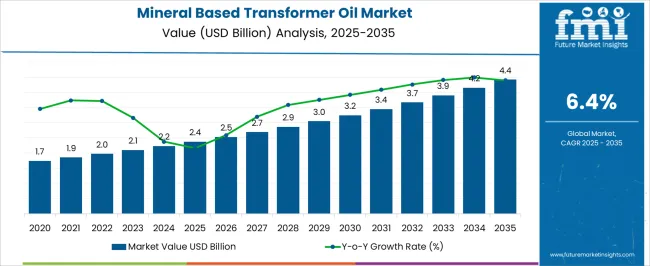

The mineral-based transformer oil market is projected to reach USD 2.4 billion in 2025 and USD 4.4 billion by 2035, expanding at a CAGR of 6.4%. Anticipated growth patterns suggest that the sector is moving toward a gradual saturation point as demand shifts from expansion to replacement cycles. In the early years, adoption will be supported by rising investments in transmission and distribution networks, grid modernization efforts, and industrial electrification, particularly in the Asia-Pacific and the Middle East. However, as the decade progresses, demand will transition from rapid adoption toward steady replacement of aged equipment and retrofitting in developed economies.

This deceleration pattern reflects a market maturing under efficiency standards, environmental regulations, and the push for alternative insulating fluids like bio-based and synthetic oils. The saturation point is likely to emerge in regions where power infrastructure is already stable, such as Europe and North America, leading to slower incremental growth. Yet, emerging regions will continue to drive absolute demand with new installations. In my opinion, this dual dynamic, rapid capacity additions in developing markets alongside replacement-focused growth in mature regions, defines the unique saturation trajectory of this market, where revenue opportunities persist but growth premiums narrow over time.

| Metric | Value |

|---|---|

| Mineral Based Transformer Oil Market Estimated Value in (2025 E) | USD 2.4 billion |

| Mineral Based Transformer Oil Market Forecast Value in (2035 F) | USD 4.4 billion |

| Forecast CAGR (2025 to 2035) | 6.4% |

The mineral-based transformer oil market is shaped by several interconnected parent markets, each influencing demand and growth in distinct ways. The power transmission and distribution sector holds the largest share at 42%, as transformer oil is essential for insulation, cooling, and efficient operation of high-voltage equipment in substations and grid networks. The industrial machinery and manufacturing sector contributes 23%, driven by the use of transformer oil in heavy-duty equipment, processing plants, and industrial power systems where reliability and heat management are critical. The renewable energy segment accounts for 15%, supported by the integration of wind and solar power installations requiring transformers with mineral oil-based insulation to stabilize grid performance.

The transportation and railway electrification market holds 12%, using transformer oil in traction systems, locomotives, and metro infrastructure to ensure durability and operational safety. Finally, the commercial and institutional infrastructure segment represents 8%, where transformer oils support uninterrupted energy supply in commercial complexes, hospitals, and data centers. Collectively, power transmission, industrial, and renewable energy applications represent 80% of global demand, underscoring the importance of operational reliability, safety standards, and energy infrastructure development as the primary growth drivers, while transportation and commercial infrastructure offer complementary expansion opportunities worldwide.

The current market landscape reflects ongoing demand fueled by the expansion of power infrastructure globally, particularly in developing regions where grid modernization and capacity enhancements are prioritized.

The inherent properties of mineral-based oils, such as high dielectric strength, thermal stability, and cost-effectiveness, support their continued preference. Moreover, rising investments in renewable energy projects and electrification are creating additional opportunities for transformer oil demand.

Environmental regulations and a shift toward higher-performance insulating materials are shaping the future outlook, encouraging innovation in oil formulations to enhance fire safety and biodegradability. The market is expected to grow steadily as aging electrical infrastructure necessitates maintenance and replacement, and as new installations integrate mineral-based oils for reliable transformer operation.

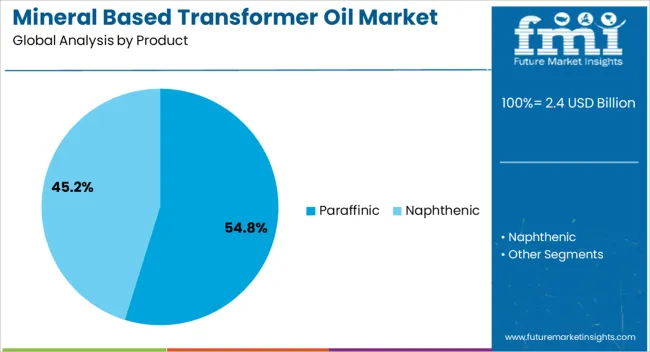

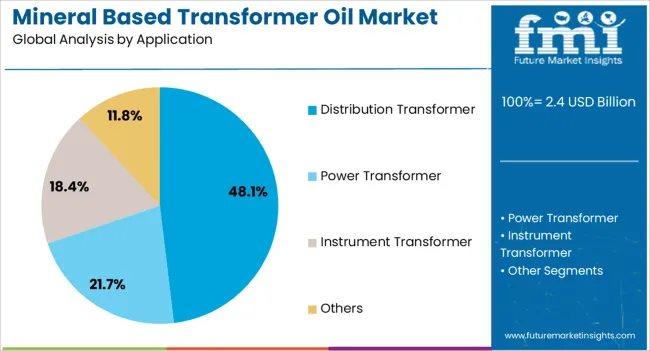

The mineral based transformer oil market is segmented by product, application, and geographic regions. By product, mineral based transformer oil market is divided into Paraffinic and Naphthenic. In terms of application, mineral based transformer oil market is classified into Distribution Transformer, Power Transformer, Instrument Transformer, and Others. Regionally, the mineral based transformer oil industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The Paraffinic product segment is projected to hold 54.8% of the Mineral Based Transformer Oil market revenue share in 2025, making it the leading product type. This predominance is attributed to paraffinic oils’ superior oxidative stability and high viscosity index, which enhance transformer efficiency and longevity.

Their excellent low-temperature properties and compatibility with a wide range of transformer materials have led to widespread adoption. Additionally, paraffinic oils provide enhanced thermal conductivity, improving heat dissipation and reducing transformer overheating risks.

The balance of performance and cost-effectiveness inherent in paraffinic oils supports their preference by manufacturers and utilities. Continuous improvements in refining processes have further increased the quality and reliability of paraffinic oils, solidifying their dominant market position.

The Distribution Transformer application segment is expected to account for 48.1% of the market revenue share in 2025, emerging as the largest application area. This leadership position is driven by the extensive use of mineral-based transformer oil in distribution transformers due to its effective insulating and cooling properties.

The growing electrification of residential, commercial, and industrial sectors has accelerated the deployment of distribution transformers worldwide, sustaining demand for transformer oils tailored to these units. Distribution transformers require oils that maintain dielectric strength under varying load and environmental conditions, which mineral-based oils reliably provide.

Furthermore, infrastructure upgrades and replacement of aging transformers in expanding power grids contribute to the steady growth of this segment. The ability of mineral-based oils to support transformer safety and performance in diverse climatic conditions reinforces their sustained application dominance.

The mineral-based transformer oil market is advancing through power transmission, industrial, renewable, and transportation applications. Its role in reliable insulation, cost-effectiveness, and infrastructure adaptability ensures consistent long-term demand.

The mineral-based transformer oil market is experiencing strong momentum due to extensive investments in power transmission and distribution projects across developed and emerging economies. Utilities are focusing on reliable insulation and cooling mediums for transformers, where mineral oil has remained a preferred choice because of its cost-effectiveness and operational reliability. Grid modernization, substation expansions, and rural electrification programs are further driving large-scale adoption. Government-backed initiatives targeting energy access in remote regions add to this demand, ensuring consistent usage across multiple voltage levels. Manufacturers are responding with improved oil formulations that meet international standards for oxidation stability, thermal resistance, and dielectric performance, ensuring product suitability for diverse climates and load conditions worldwide.

Industrial demand for mineral-based transformer oil is growing as manufacturing, processing plants, and heavy machinery facilities prioritize uninterrupted operations. Transformer oil plays a critical role in maintaining efficiency and preventing equipment overheating, especially in industries such as steel, chemicals, and petrochemicals. Rapid industrialization in Asia and Middle East markets is driving large orders for transformers and related insulation oil. Private players are also increasing investments in power-intensive manufacturing units, further fueling demand. Product suppliers are emphasizing high-purity oils with enhanced performance characteristics to meet the stringent operational requirements of heavy-duty machinery.

The integration of renewable energy projects, particularly wind and solar, has created a significant new avenue for the mineral-based transformer oil market. Renewable installations require efficient grid connectivity through step-up and step-down transformers, where insulation and cooling fluids are indispensable. Transformer oils are used in compact designs for onshore and offshore wind projects, as well as solar farms that require stable grid feeding. Renewable energy developers and grid operators prefer mineral-based oils for cost control, ensuring both reliability and affordability in project deployment. The market has also witnessed increased contracts in hybrid renewable projects, where mineral oils are utilized in central inverters and substations. This segment provides a consistent growth premium across multiple geographies.

Transport electrification, metro rail projects, and commercial infrastructure are further supporting demand for mineral-based transformer oil. Railways and metros rely on transformer oils for traction power and electrification networks, ensuring efficient insulation and load performance. At the same time, commercial complexes, hospitals, and data centers require backup transformers where mineral oil acts as a trusted insulating medium. Infrastructure growth across urban and semi-urban areas has increased the need for efficient energy distribution systems. Market participants are diversifying offerings with oils designed for compact transformers suitable for confined spaces in these projects. This diversification strengthens product adaptability while addressing a wide array of infrastructure-driven energy requirements globally.

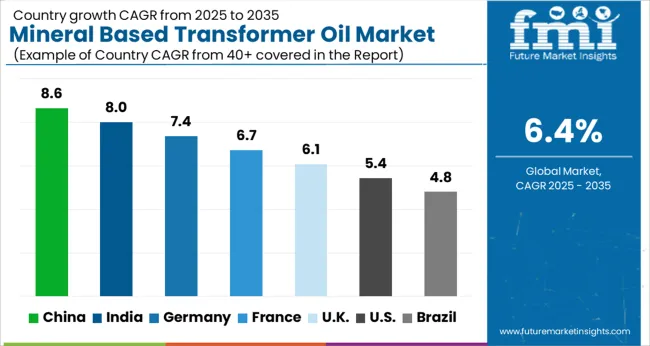

| Country | CAGR |

|---|---|

| China | 8.6% |

| India | 8.0% |

| Germany | 7.4% |

| France | 6.7% |

| UK | 6.1% |

| USA | 5.4% |

| Brazil | 4.8% |

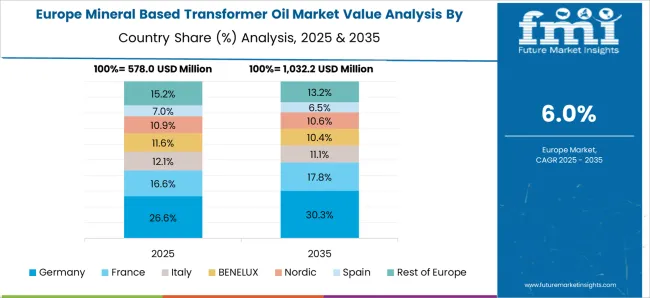

The global mineral-based transformer oil market is projected to grow at a CAGR of 6.4% from 2025 to 2035. China leads at 8.6%, followed by India at 8.0%, Germany at 7.4%, France at 6.7%, the UK at 6.1%, and the USA at 5.4%. Growth is driven by large-scale power transmission projects, industrial expansion, and grid modernization programs that depend heavily on reliable insulating and cooling fluids for transformers. Asia, particularly China and India, demonstrates accelerated adoption due to rapid industrial growth, rural electrification initiatives, and strong investment in renewable integration. Europe focuses on premium-grade transformer oils with enhanced dielectric strength and oxidation stability, catering to long-life and safety-driven applications. North America emphasizes replacement demand, infrastructure modernization, and cost-effective adoption, supported by strong supplier networks. Dollar sales, share, and regional adoption underline the importance of grid expansion, industrial reliability, and diversified infrastructure needs as the primary forces behind this growth trajectory. The analysis spans over 40+ countries, with the leading markets highlighted above.

The mineral-based transformer oil market in China is projected to grow at a CAGR of 8.6% from 2025 to 2035, supported by extensive power grid development, industrial growth, and investment in transmission and distribution infrastructure. With expanding electrification projects and integration of renewable energy into the grid, demand for reliable insulating oils is accelerating. Domestic manufacturers are scaling production to provide high-purity oils with superior dielectric strength and oxidation stability. Strategic partnerships with global suppliers improve quality assurance and ensure compliance with international standards. Expansion of smart grid initiatives and replacement of aging transformers further increase oil consumption. Dollar sales, share, and industrial demand reflect the dominant role of China as a key producer and consumer in the transformer oil market.

The mineral-based transformer oil market in India is expected to expand at a CAGR of 8.0% from 2025 to 2035, driven by government-backed electrification programs, renewable integration, and large-scale industrialization. Transmission and distribution utilities are investing in transformer upgrades to meet rising electricity demand across rural and urban regions. Domestic producers are enhancing capacity while focusing on cost-effective, high-performance grades to compete with global suppliers. Demand is reinforced by expanding metro projects, industrial clusters, and renewable energy parks requiring reliable insulation solutions. Regulatory standards ensure safety and quality, while collaborations with international companies strengthen supply chains. Dollar sales and share indicate strong growth across both public utilities and private sector industrial installations.

The mineral-based transformer oil market in Germany is projected to grow at a CAGR of 7.4% from 2025 to 2035, supported by modernization of transmission infrastructure and increasing focus on energy reliability. Demand is concentrated in utility-scale projects, industrial facilities, and renewable energy networks that require efficient insulating fluids. German producers emphasize premium oils with high oxidation resistance and extended service life. Grid operators are investing heavily in replacing older transformers, which is generating steady oil consumption. Partnerships between equipment manufacturers and oil suppliers enhance compatibility and efficiency. Dollar sales and share data highlight strong reliance on premium-grade oils suited for advanced grid systems and compliance with stringent EU standards.

The mineral-based transformer oil market in the UK is anticipated to grow at a CAGR of 6.1% from 2025 to 2035, influenced by investments in renewable integration, utility-scale grid projects, and infrastructure upgrades. Transformer oil demand is rising in offshore wind, urban electrification, and rail networks, where high-performance fluids ensure operational safety and reliability. Domestic suppliers are competing with global firms by focusing on cost-effective, compliant formulations. The replacement of legacy transformers with modern, efficient systems further strengthens oil consumption trends. Dollar sales and share analyses indicate utilities, industrial operators, and infrastructure projects as the main contributors. Compliance with strict safety and environmental standards ensures long-term stability in oil demand across applications.

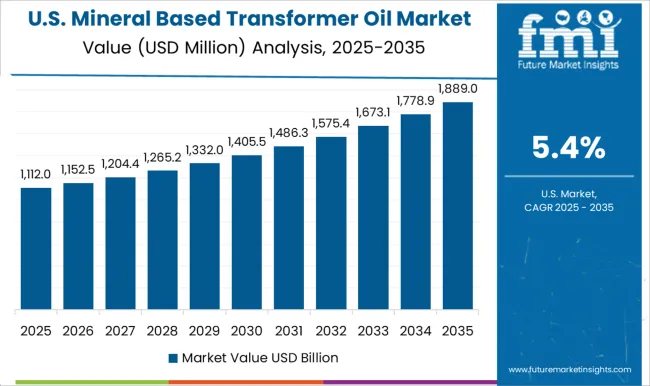

The mineral-based transformer oil market in the USA is forecasted to grow at a CAGR of 5.4% from 2025 to 2035, shaped by grid modernization, industrial upgrades, and expanding energy consumption. Transformer oil adoption is being driven by replacement demand in aging infrastructure and growing investments in renewable integration projects. Domestic producers emphasize compliance with IEEE and ASTM standards, while global suppliers strengthen competition with advanced formulations. Demand is rising in utilities, manufacturing, and large-scale energy facilities that require reliable and long-life insulating oils. Dollar sales, share data highlight steady growth with emphasis on replacement and modernization rather than new grid expansion. Partnerships between utilities and suppliers ensure stable long-term contracts.

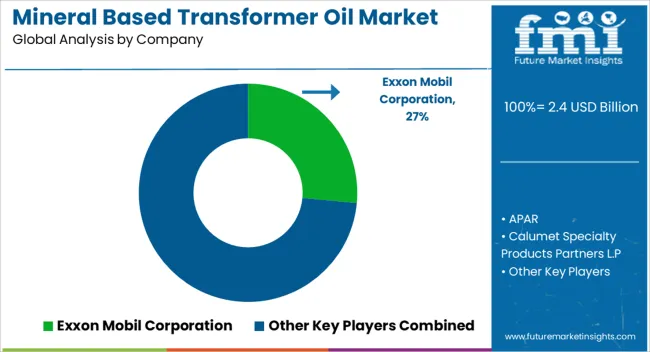

Competition in the mineral-based transformer oil market is influenced by product reliability, dielectric strength, oxidation stability, and compliance with global standards. Exxon Mobil Corporation and Chevron Corporation lead with large-scale production, advanced refining capabilities, and long-standing supply relationships with utilities and equipment manufacturers. Castrol Limited and Phillips 66 Company emphasize tailored formulations for high-performance insulation, offering extended transformer life and reduced maintenance requirements. Calumet Specialty Products Partners L.P. and Ergon Inc differentiate by supplying specialty, high-purity grades catering to specific utility, industrial, and renewable applications.

Regional leaders such as APAR and Gandhar Oil Refinery (India) Limited play a critical role in the Asian market, supported by competitive pricing, local supply chains, and strong relationships with domestic utilities. Hydrodec Group plc and HCS Group focus on recycled and specialty transformer oils, positioning themselves as key players for customers prioritizing circular economy practices and re-refined solutions. China Petroleum & Chemical Corporation (Sinopec) dominates regional demand with vertically integrated production and distribution networks, ensuring supply stability. NYNAS AB and Mineral Oil Corporation strengthen competition with their focus on environmentally compliant and high-performance insulating fluids. Sunoco Lubricants supports niche demand in industrial applications with tailored oil blends.

| Item | Value |

|---|---|

| Quantitative Units | USD 2.4 Billion |

| Product | Paraffinic and Naphthenic |

| Application | Distribution Transformer, Power Transformer, Instrument Transformer, and Others |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | Exxon Mobil Corporation, APAR, Calumet Specialty Products Partners L.P, CASTROL LIMITED, HCS Group, Ergon Inc, Gandhar Oil Refinery (India) Limited, Hydrodec Group plc, China Petroleum & Chemical Corporation, Phillips 66 Company, Sunoco Lubricants, Mineral Oil Corporation, NYNAS AB, and Chevron Corporation |

| Additional Attributes | Dollar sales, share by grade and application, regional demand trends, pricing outlook, competitive benchmarking, regulatory compliance, and future growth opportunities across utility and industrial sectors. |

The global mineral based transformer oil market is estimated to be valued at USD 2.4 billion in 2025.

The market size for the mineral based transformer oil market is projected to reach USD 4.4 billion by 2035.

The mineral based transformer oil market is expected to grow at a 6.4% CAGR between 2025 and 2035.

The key product types in mineral based transformer oil market are paraffinic and naphthenic.

In terms of application, distribution transformer segment to command 48.1% share in the mineral based transformer oil market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Mineral Enrichment Ingredients Market Size and Share Forecast Outlook 2025 to 2035

Mineral Scanner Market Size and Share Forecast Outlook 2025 to 2035

Mineral Processing Equipment Market Size and Share Forecast Outlook 2025 to 2035

Mineral Sunscreen Market Size and Share Forecast Outlook 2025 to 2035

Mineral Wool Material Market Size and Share Forecast Outlook 2025 to 2035

Mineral Insulated Cables Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Mineral Premix Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Mineral Yeast Market Analysis by Calcium Yeast, Selenium Yeast, Zinc Yeast, and Other Fortified Yeast Types Through 2035

Mineral Wool Market by Type & Application from 2025 to 2035

Key Companies & Market Share in the Mineral Wool Sector

Mineral Feed Market Analysis - Growth, Demand & Livestock Nutrition

Mineral Fortification Market Insights – Nutrient-Rich Foods & Industry Growth 2024 to 2034

Mineral Adsorbent Market

Demineralized Whey Powder Market Size, Growth, and Forecast for 2025 to 2035

Hair Mineral Analyzer Market Size and Share Forecast Outlook 2025 to 2035

Food Minerals Market Size and Share Forecast Outlook 2025 to 2035

Milk Mineral Concentrate Market Trends-Demand, Innovations & Forecast 2025 to 2035

Boron Minerals and Chemicals Market Size and Share Forecast Outlook 2025 to 2035

Trace Minerals in Feed Market Analysis by Type, Livestock, Chelate Type, Form and Region through 2025 to 2035

White Mineral Oil Market Analysis by Food, Pharmaceutical, Technical Through 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA