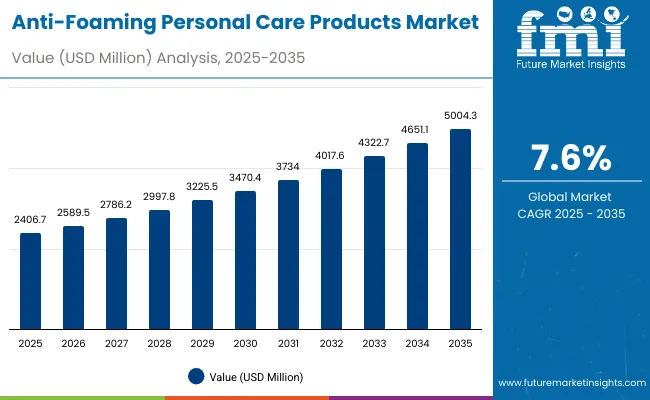

The Anti-Foaming Personal Care Products Market is expected to record a valuation of USD 2,406.7 million in 2025 and USD 5,004.3 million in 2035, with an increase of USD 2,597.6 million, which equals a growth of 193% over the decade. The overall expansion represents a CAGR of 7.6% and slightly more than a 2X increase in market size.

Anti-Foaming Personal Care Products Market Key Takeaways

| Metric | Value |

|---|---|

| Anti-Foaming Personal Care Products Market Estimated Value in (2025E) | USD 2,406.7 million |

| Anti-Foaming Personal Care Products Market Forecast Value in (2035F) | USD 5,004.3 million |

| Forecast CAGR (2025 to 2035) | 7.60% |

During the first five-year period from 2025 to 2030, the market increases from USD 2,406.7 million to USD 3,470.4 million, adding USD 1,063.7 million, which accounts for over 40% of the total decade growth. This phase records steady adoption in shampoos, conditioners, and body wash formulations, driven by the need to reduce foam build-up while enhancing rinse-off and consumer sensory experience. Silicone-based defoamers dominate this period as they cater to over 46% of industrial and personal care applications, offering superior stability in liquid-based formulations. The rising penetration of natural oil-based defoamers is also noted, especially in premium cleansers targeting eco-conscious consumers.

The second half from 2030 to 2035 contributes USD 1,533.9 million, equal to nearly 60% of total growth, as the market jumps from USD 3,470.4 million to USD 5,004.3 million. This acceleration is powered by widespread deployment of AI-formulation platforms, ingredient innovation in polymer-based defoamers, and expansion of e-commerce channels driving premium sales. Markets such as India and China experience double-digit CAGRs, leading global demand. By the end of the decade, liquid and gel formats capture an even stronger share, while cream formulations gain momentum in niche facial care segments. Digital-first distribution models, such as subscription-based platforms and specialty personal care retail chains, emerge as key growth drivers, particularly in urban markets across Asia-Pacific.

From 2020 to 2024, the Anti-Foaming Personal Care Products Market expanded steadily from an estimated USD 1,800 million to over USD 2,300 million, driven by the dominance of traditional shampoos and conditioners where defoaming agents improved texture consistency. During this period, the competitive landscape was heavily influenced by multinational FMCG leaders controlling nearly 75% of revenue, with companies such as Procter & Gamble, Unilever, and L’Oréal focusing on hardware-centric segments like rinse-off care.

Competitive differentiation relied on formulation stability, consumer sensory experience, and product affordability, while clean-label and natural active claims were still emerging as secondary drivers. Service-led or digital-first personal care models contributed minimally to overall revenue, with e-commerce penetration below 15% of total market sales.

Demand for Anti-Foaming Personal Care Products will expand to USD 2,406.7 million in 2025, and the revenue mix will shift as natural oil-based and polymer-based defoamers grow in share beyond 53% of actives. Traditional leaders face rising competition from niche digital-first beauty brands offering sulfate-free and foam-controlled cleansers tailored for sensitive skin. Major personal care vendors are pivoting to hybrid strategies, integrating AI-based ingredient recommendation systems, cloud-driven consumer personalization, and subscription-based models to sustain market dominance.

Emerging entrants specializing in vegan-certified oils, eco-friendly formulations, and AR/VR-based virtual product trials are gaining share. The competitive advantage is moving away from low-cost, mass-market foaming solutions to ecosystem-driven offerings, digital channel presence, and clean-label claims that cater to evolving consumer lifestyles.

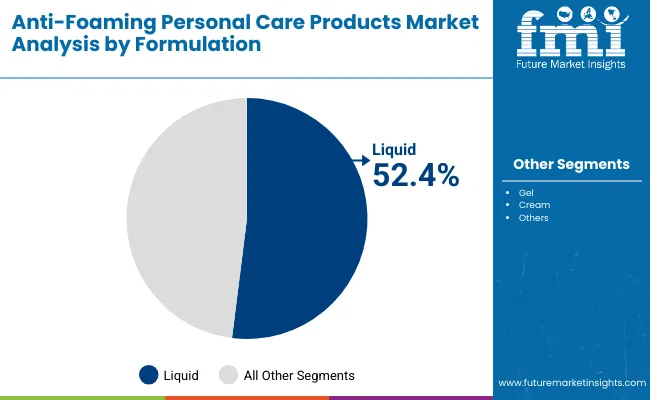

Advances in formulation technology have improved stability, texture, and foam control, allowing for smoother consumer experiences across diverse product categories. Liquid formats have gained popularity due to their suitability for daily-use shampoos, conditioners, and hand washes. The rise of silicone-based defoamers has contributed to enhanced sensory profiles and real-time foam reduction during use. Industries such as hair care, skincare, and body wash formulations are driving demand for anti-foaming solutions that integrate seamlessly into existing personal care routines.

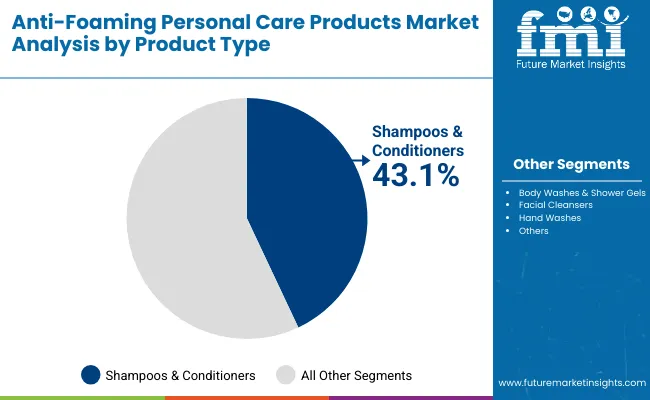

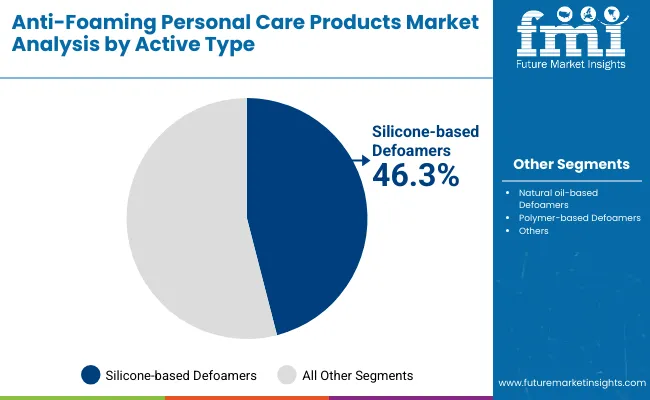

Expansion of e-commerce platforms and increased online product comparisons have fueled market growth, making niche anti-foaming formulations more visible to consumers. Innovations in natural oil-based defoamers, polymer blends, and dermatologically tested solutions are expected to open new premium application areas. Segment growth is expected to be led by shampoos & conditioners in product type, liquid formats in formulation, and silicone-based defoamers in active types due to their adaptability, proven efficacy, and ability to balance foam reduction with product sensory appeal.

The market is segmented by product type, active type, formulation, channel, end user, and geography. Product types include shampoos & conditioners, body washes & shower gels, facial cleansers, and hand washes, highlighting the largest contributors to value growth. Active types cover silicone-based defoamers, natural oil-based defoamers, and polymer-based defoamers, catering to diverse consumer and regulatory demands. Based on formulation, the market spans liquid, gel, and cream, with liquid dominating due to widespread acceptance in rinse-off formats.

Distribution channels include supermarkets & hypermarkets, e-commerce, pharmacies & drugstores, and specialty personal care retail, which reflect evolving consumer buying behavior. End users cover adults, men, women, and children, with adult women holding a major share due to higher frequency of product adoption. Regionally, the scope spans North America, Latin America, Europe, East Asia, South Asia & Pacific, and the Middle East & Africa, with India and China emerging as the fastest-growing markets, recording CAGRs above 13%.

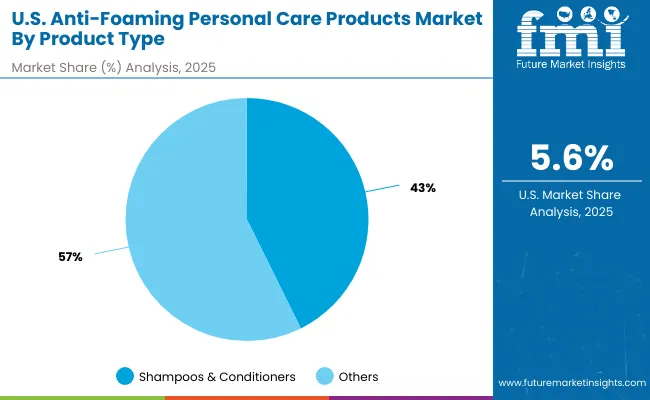

| Product Type | Value Share% 2025 |

|---|---|

| Shampoos & conditioners | 43.1% |

| Others | 56.9% |

The shampoos & conditioners segment is projected to contribute 43.1% of the Anti-Foaming Personal Care Products Market revenue in 2025, maintaining its lead as the dominant product type category. This dominance is driven by consistent consumer reliance on hair care products where foam stability and control remain critical for user experience. Anti-foaming actives are increasingly being incorporated into shampoos and conditioners to prevent excessive sud formation, improve rinse-off, and reduce scalp irritation, especially in premium and dermatologically tested formulations.

The segment’s growth is further supported by rising innovations in silicone-based and natural oil-based defoamers that enhance product feel while maintaining cleansing efficacy. Compact packaging formats, premium salon lines, and increasing adoption of sulfate-free shampoos are reinforcing demand. With consumers becoming more conscious about the quality and sensory aspects of their hair care routines, shampoos & conditioners are expected to retain their position as the backbone of this market, shaping long-term revenue growth.

| Active Type | Value Share% 2025 |

|---|---|

| Silicone-based defoamers | 46.3% |

| Others | 53.7% |

The silicone-based defoamers segment is forecasted to hold 46.3% of the market share in 2025, led by its application in shampoos, conditioners, and body washes where foam regulation is vital. These defoamers are favored for their high efficiency, chemical stability, and ability to suppress foam without impacting fragrance or formulation stability. Their compatibility with liquid and gel formats has made them essential in mass-market as well as premium product lines.

The segment’s growth is bolstered by technological advancements in silicone delivery systems that improve dispersibility and enhance long-lasting performance. Additionally, silicone-based actives are widely used in markets like the USA, Japan, and Europe where performance-driven personal care remains a priority. While natural oil-based and polymer-based alternatives are gaining ground due to sustainability preferences, silicone-based defoamers are expected to continue their dominance in the market, particularly within mainstream product categories.

| Formulation | Value Share% 2025 |

|---|---|

| Liquid | 52.4% |

| Others | 47.6% |

The liquid formulation segment is projected to account for 52.4% of the Anti-Foaming Personal Care Products Market revenue in 2025, establishing it as the leading formulation type. Liquid products are preferred due to their ease of application, wide compatibility with anti-foaming actives, and strong penetration across daily-use categories such as shampoos, conditioners, and hand washes.

The popularity of liquid formats is reinforced by their adaptability for both mass retail and e-commerce distribution, as well as their effectiveness in incorporating both silicone-based and natural oil-based defoamers. Their dominance is further strengthened by consumer trust in traditional liquid personal care products, especially in emerging markets where affordability and familiarity remain key purchase drivers. With continued innovation in natural surfactant bases and clean-label formulations, liquid formats are expected to retain leadership in the formulation segment, while gels and creams serve specialized and premium niches.

Rising Demand for Controlled-Foam Hair Care Solutions

The strongest driver for the Anti-Foaming Personal Care Products Market is the growing consumer demand for shampoos and conditioners with controlled foam levels. Excessive foam has long been associated with residue buildup, scalp irritation, and inefficient rinse-off, especially in urban markets with hard water conditions. Brands are increasingly reformulating hair care products with silicone-based and natural oil-based defoamers to provide a balanced lather that satisfies consumer expectations while minimizing side effects. The emphasis on scalp health, sulfate-free formulations, and salon-quality product experiences has made anti-foaming actives a central differentiator in premium hair care. With shampoos & conditioners already contributing 43.1% of total value in 2025, this driver will continue to reinforce the segment’s market leadership.

E-commerce Expansion Driving Premium and Niche Product Uptake

Another driver is the rapid growth of e-commerce channels, which allow smaller, niche brands to position anti-foaming personal care products directly to consumers. Platforms such as Amazon, Tmall, and specialty beauty e-commerce sites are enabling global consumers to access low-foam facial cleansers, body washes, and dermatologically tested hand washes that may not be widely available in supermarkets. Unlike mass retail shelves, online platforms encourage ingredient transparency and highlight claims such as "foam-controlled," "sensitive-skin safe," and "clean-label." This has made it easier for polymer-based and natural oil-based defoamers to gain visibility against traditional silicone-based actives. With e-commerce forecasted to be one of the fastest-growing channels over the next decade, it is a critical growth enabler for product diversification.

Consumer Misconception Linking Foam with Cleanliness

A major restraint in this market is the persistent consumer perception that more foam equates to better cleansing performance. In regions such as India and parts of Southeast Asia, foaming shampoos and body washes are considered more effective because of visible lather. This cultural association creates hesitation in adopting anti-foaming products, especially in price-sensitive segments where education and premium positioning are limited. While awareness is improving through dermatological recommendations and influencer campaigns, the barrier still slows adoption in markets that prioritize visual foam over long-term scalp or skin health benefits.

Regulatory Scrutiny on Silicone-based Formulations

Another restraint stems from tightening regulatory frameworks in Europe and Japan targeting silicones used in rinse-off products. Concerns about bioaccumulation of certain silicone compounds in water systems are leading to stricter guidelines on ingredient concentrations and disposal. This adds compliance costs for manufacturers and forces reformulation in markets where silicone-based defoamers currently dominate with 46.3% share in 2025. As clean-label and eco-friendly positioning becomes a competitive necessity, companies relying heavily on silicones face increased R&D pressure, which can slow scalability in cost-sensitive categories such as hand washes and mass-market body washes.

Shift Toward Natural Oil-Based and Polymer Alternatives

One of the most significant trends is the rising penetration of natural oil-based and polymer-based defoamers. Consumers are increasingly seeking vegan, organic-certified, and eco-friendly personal care products, leading brands to replace silicones with alternatives derived from coconut oil, sunflower oil, or biopolymer blends. These options provide defoaming benefits while aligning with sustainability and clean-label demands. Natural oil-based actives also appeal to markets such as Europe and North America, where consumers are highly ingredient-conscious. This trend is expected to reshape the market mix by 2035, with alternatives gaining share against traditional silicones, especially in facial cleansers and children’s products.

Country-Level Acceleration in India and China

Another defining trend is the rapid acceleration in India (CAGR 15.2%) and China (CAGR 13.6%), which significantly outpaces the USA and European markets. In India, rising disposable income and urbanization are pushing consumers toward premium shampoos and sulfate-free cleansers, fueling adoption of anti-foaming solutions. In China, consumer demand is more technology-driven, with growing interest in polymer-based defoamers integrated into liquid facial cleansers and gels. Together, these two markets are transforming the global growth profile, shifting industry focus from mature Western regions to Asia-Pacific as the innovation and consumption hub. This trend underscores how geographic demand will shape product development pipelines and brand strategies across the next decade.

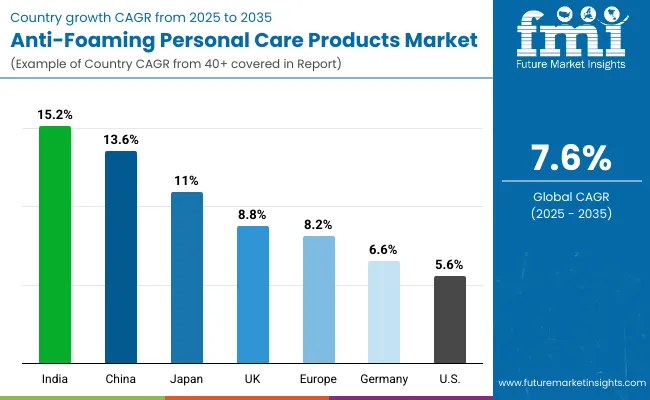

| Countries | Estimated CAGR (2025 to 2035) |

|---|---|

| China | 13.6% |

| USA | 5.6% |

| India | 15.2% |

| UK | 8.8% |

| Germany | 6.6% |

| Japan | 11.0% |

| Europe | 8.2% |

The country-wise growth outlook of the Anti-Foaming Personal Care Products Market highlights strong divergence between mature and emerging economies. India (15.2% CAGR) and China (13.6% CAGR) stand out as the fastest-growing markets, driven by rapid urbanization, increasing disposable incomes, and heightened consumer interest in premium and sulfate-free shampoos, body washes, and facial cleansers.

Indian consumers are shifting toward dermatologically tested and low-foam solutions as awareness of scalp and skin health expands, while Chinese consumers demonstrate a preference for technologically advanced formulations, particularly those incorporating polymer-based defoamers in liquid and gel formats. Japan (11.0% CAGR) also represents a high-growth market, supported by its sophisticated beauty and personal care culture where consumers are willing to invest in innovative, foam-controlled facial cleansers and skincare-driven wash products.

In contrast, Western markets such as the USA (5.6%), Germany (6.6%), and the UK (8.8%) are expanding at slower but steady rates, reflecting the maturity of their personal care industries. Growth in these regions is largely tied to innovation in clean-label and eco-friendly product claims, regulatory compliance for silicone-based actives, and the rise of e-commerce in specialty categories. Europe as a whole is projected to record 8.2% CAGR, benefiting from sustainability-led product reformulation and consumer migration toward natural oil-based defoamers. While growth rates are modest compared to Asia-Pacific, Western markets remain highly profitable due to premium positioning, brand loyalty, and established distribution channels, ensuring they retain significant global revenue share through 2035.

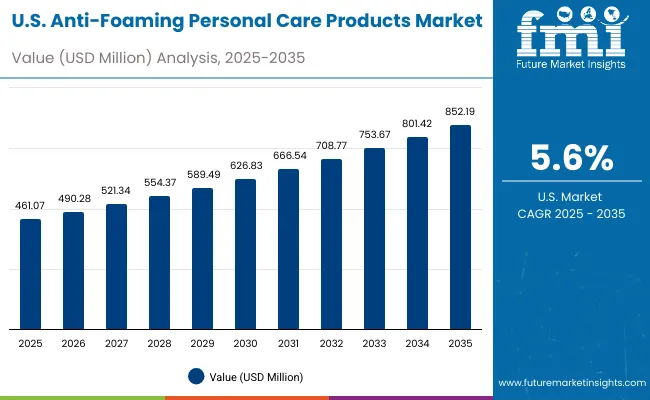

| Year | USA Anti-Foaming Personal Care Products Market (USD Million) |

|---|---|

| 2025 | 461.07 |

| 2026 | 490.28 |

| 2027 | 521.34 |

| 2028 | 554.37 |

| 2029 | 589.49 |

| 2030 | 626.83 |

| 2031 | 666.54 |

| 2032 | 708.77 |

| 2033 | 753.67 |

| 2034 | 801.42 |

| 2035 | 852.19 |

The Anti-Foaming Personal Care Products Market in the United States is projected to grow at a CAGR of 5.6%, led by steady consumer adoption across shampoos, conditioners, and body wash categories. A key factor driving this growth is heightened demand for scalp-care-focused hair products where controlled foam levels deliver both cleansing efficiency and a smoother rinse-off.

Dermatological recommendations and consumer education campaigns are encouraging the use of low-foam facial cleansers and hand washes, which are increasingly preferred by sensitive-skin consumers. The dominance of silicone-based defoamers is visible in mainstream formats, though e-commerce-driven natural oil-based alternatives are beginning to penetrate the market. Bundling of anti-foaming formulations with clean-label, sulfate-free, and premium hair care launches is shaping competitive strategies.

The Anti-Foaming Personal Care Products Market in the United Kingdom is expected to grow at a CAGR of 8.8%, supported by strong demand for premium hair and skincare products. The UK consumer base places high importance on formulation transparency, driving increased usage of natural oil-based and polymer-based defoamers in shampoos, shower gels, and cleansers. Growth is further supported by the retail channel mix, where specialty beauty retail chains and pharmacies emphasize dermatologically tested, foam-controlled formulations. Heritage-rich personal care brands are introducing cleaner, low-foam options to meet evolving sustainability and wellness preferences.

India is witnessing rapid growth in the Anti-Foaming Personal Care Products Market, which is forecast to expand at a CAGR of 15.2% through 2035, the highest globally. This acceleration is driven by urban middle-class consumers adopting premium shampoos and conditioners, especially those with sulfate-free and scalp-friendly claims. Rapid digital penetration and e-commerce expansion across tier-2 and tier-3 cities are allowing niche brands to scale quickly. Automotive-scale distribution networks of FMCG giants also play a role in bringing low-foam products to mass-market retail. Rising awareness about scalp irritation from excessive lather is further boosting demand.

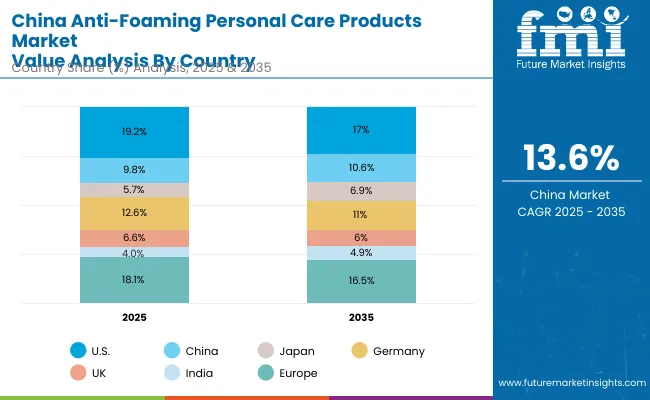

| Countries | 2025 Share (%) |

|---|---|

| USA | 19.2% |

| China | 9.8% |

| Japan | 5.7% |

| Germany | 12.6% |

| UK | 6.6% |

| India | 4.0% |

| Europe | 18.1% |

| Countries | 2035 Share (%) |

|---|---|

| USA | 17.0% |

| China | 10.6% |

| Japan | 6.9% |

| Germany | 11.0% |

| UK | 6.0% |

| India | 4.9% |

| Europe | 16.5% |

The Anti-Foaming Personal Care Products Market in China is expected to grow at a CAGR of 13.6%, among the highest worldwide. Growth momentum is driven by polymer-based and silicone-based defoamers used in facial cleansers, gels, and liquid body washes. China’s rapidly expanding premium skincare market is embracing low-foam solutions, supported by local innovation and strong digital retail ecosystems such as Tmall and JD.com. Municipal initiatives on ingredient safety and sustainability are encouraging greater adoption of natural oil-based defoamers in children’s and sensitive-skin products. Domestic companies are innovating aggressively with competitive pricing, while multinationals are focusing on premium positioning and dermatologist-backed claims.

| USA By Product Type | Value Share% 2025 |

|---|---|

| Shampoos & conditioners | 42.7% |

| Others | 57.3% |

The Anti-Foaming Personal Care Products Market in the United States is projected at USD 461.07 million in 2025, with shampoos & conditioners contributing 42.7% and other formats accounting for 57.3%. This reflects the dominance of hair care products as a key revenue stream, where foam control is central to enhancing scalp comfort and product usability. Unlike traditional high-lather products, USA consumers are shifting toward balanced foam shampoos and low-foam cleansers that reduce irritation and align with dermatologist-backed claims. This shift is closely tied to rising adoption of sulfate-free and clean-label formulations across both mass retail and premium categories.

Growth in the USA is also influenced by digital-first consumer channels where e-commerce has created space for niche, foam-controlled brands to scale quickly. The incorporation of silicone-based defoamers in mainstream haircare is supported by their proven stability and performance, but natural oil-based alternatives are gaining recognition due to sustainability preferences. Over the forecast period, bundling anti-foaming features with scalp-health claims and AI-personalized recommendations is expected to reinforce competitiveness in the USA market.

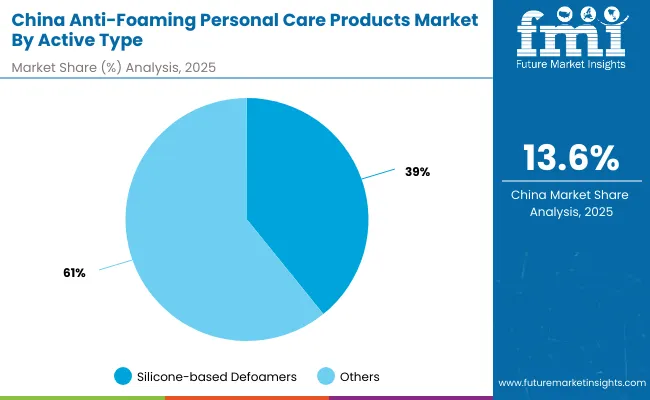

| China By Active Type | Value Share% 2025 |

|---|---|

| Silicone-based defoamers | 39.2% |

| Others | 60.8% |

The Anti-Foaming Personal Care Products Market in China is valued at approximately USD 235-240 million in 2025, with silicone-based defoamers contributing 39.2% and other actives accounting for 60.8%. The higher share of non-silicone solutions demonstrates China’s accelerating preference for natural and polymer-based defoamers, particularly in facial cleansers and body washes marketed toward sensitive-skin users. This transition reflects the country’s growing consumer sophistication, where ingredient awareness and sustainability concerns influence purchase decisions.

China’s market momentum is further supported by e-commerce ecosystems like Tmall and JD.com, which amplify the reach of premium and niche low-foam products. Competitive local players are also disrupting the market with affordable, polymer-based innovations, making anti-foaming products more accessible to middle-class consumers. As Chinese cities advance digital-first retail and ingredient-safety regulations, the market is expected to achieve double-digit CAGR of 13.6%, driven by both premium skincare adoption and cost-effective local innovation.

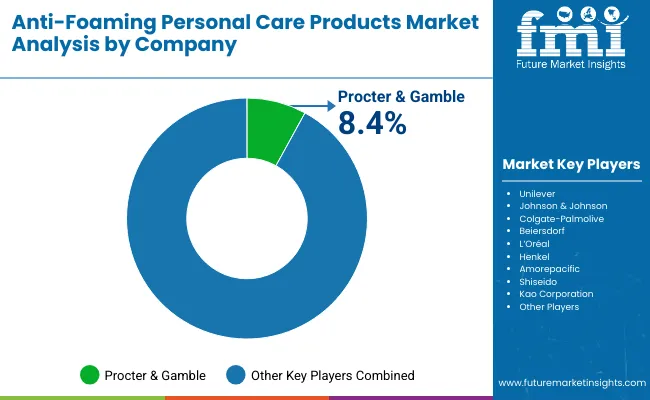

The Anti-Foaming Personal Care Products Market is moderately fragmented, with global FMCG giants, mid-sized innovators, and regional specialists competing across diverse product categories. Procter & Gamble, the global leader, holds 8.4% share in 2025, leveraging its dominance in shampoos and conditioners with sulfate-free, foam-controlled formulations. Other multinational players such as Unilever, Johnson & Johnson, Colgate-Palmolive, Beiersdorf, L’Oréal, Henkel, Amorepacific, Shiseido, and Kao Corporation collectively account for the majority of remaining global share, with strong regional portfolios. Their strategies increasingly emphasize ingredient transparency, dermatology-led claims, and digital-first product rollouts.

Mid-sized innovators are carving niches in natural oil-based and polymer-based defoamer categories, capitalizing on consumer shifts toward sustainability. Their strength lies in localized ingredient sourcing and rapid formulation turnaround, making them competitive in Asia-Pacific markets. Regional specialists in India and China are focusing on affordability and distribution expansion, particularly through pharmacies, specialty retail, and e-commerce platforms.

Competitive differentiation is shifting away from generic foaming performance toward ecosystem-driven strategies: sustainability-backed ingredient portfolios, subscription-based e-commerce models, and AI-powered personalization are now key value drivers. The competitive landscape is expected to become more dynamic as traditional leaders defend their positions against agile, clean-label entrants.

Key Developments in Anti-Foaming Personal Care Products Market

| Item | Value |

|---|---|

| Quantitative Units | USD Million |

| Product Type | Shampoos & conditioners, Body washes & shower gels, Facial cleansers, Hand washes |

| Active Type | Silicone-based defoamers, Natural oil-based defoamers, Polymer-based defoamers |

| Formulation | Liquid, Gel, Cream |

| Channel | Supermarkets & hypermarkets, E-commerce, Pharmacies & drugstores, Specialty personal care retail |

| End User | Adults, Men, Women, Children |

| Regions Covered | North America, Europe, East Asia, South Asia & Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | Procter & Gamble, Unilever, Johnson & Johnson, Colgate-Palmolive, Beiersdorf, L’Oréal, Henkel, Amorepacific, Shiseido, Kao Corporation |

| Additional Attributes | Dollar sales by product type and active type, adoption trends in shampoos & conditioners and facial cleansers, rising demand for liquid and low-foam formats, sector-specific growth in premium haircare, skincare, and hygiene products, channel expansion through e-commerce and specialty retail, software-like recurring revenue from subscription-based D2C models, integration with AI-personalized skincare tools, regional trends led by India and China, and innovations in silicone-based, polymer-based, and natural oil-based defoamer technologies. |

The Anti-Foaming Personal Care Products Market is estimated to be valued at USD 2,406.7 million in 2025.

The market size for the Anti-Foaming Personal Care Products Market is projected to reach USD 5,004.3 million by 2035.

The Anti-Foaming Personal Care Products Market is expected to grow at a 7.6% CAGR between 2025 and 2035.

The key product types in the Anti-Foaming Personal Care Products Market are shampoos & conditioners, body washes & shower gels, facial cleansers, and hand washes.

In terms of active type, silicone-based defoamers are projected to command 46.3% share in 2025 in the Anti-Foaming Personal Care Products Market.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Personal Fitness Training Software Market Size and Share Forecast Outlook 2025 to 2035

Personal Emergency Response System (PERS) Market Size and Share Forecast Outlook 2025 to 2035

Personal Protective Equipment Market Size and Share Forecast Outlook 2025 to 2035

Personality Assessment Solution Market Size and Share Forecast Outlook 2025 to 2035

Personalized Immunotherapy Market Size and Share Forecast Outlook 2025 to 2035

Personal Navigation Devices Market Size and Share Forecast Outlook 2025 to 2035

Personal Genome Testing Market Size and Share Forecast Outlook 2025 to 2035

Personal Watercraft Jet Ski Market Size and Share Forecast Outlook 2025 to 2035

Personalized Packaging Market Size and Share Forecast Outlook 2025 to 2035

Personalized Toys Market Size and Share Forecast Outlook 2025 to 2035

Personalized Nutrition Market - Size, Share, and Forecast Outlook 2025 to 2035

Personal Watercraft Market Growth - Trends & Forecast 2025 to 2035

Personal Mobility Devices Market Analysis - Trends, Growth & Forecast 2025 to 2035

Personalized Beauty Devices Market Trends - Growth & Forecast 2025 to 2035

Personal CRM Market Report - Growth & Forecast 2025 to 2035

Personalized Medicine Market is segmented by Personalized Medicine Diagnostics, Medicine Therapeutics, and Medical Care from 2025 to 2035

Personal Fitness Trainer Market - Trends, Growth & Forecast 2025 to 2035

Personalized Home Decor Market Insights & Forecast 2024-2034

Personal Protective Gloves Market

Personal Protective Equipment Packaging Market

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA