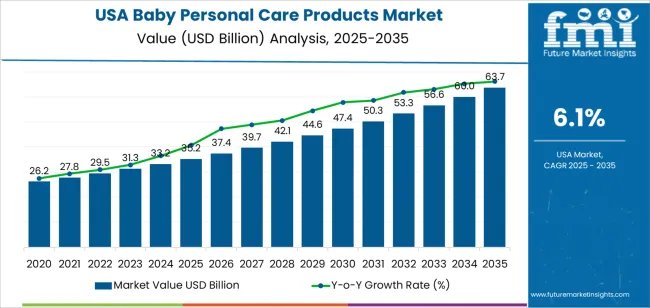

The demand for baby personal care products in the USA is expected to grow from USD 35.2 billion in 2025 to USD 63.6 billion by 2035, reflecting a CAGR of 6.1%. The rising awareness among parents about the importance of safe and gentle products for babies is a major driver of this growth. The increasing focus on organic and hypoallergenic ingredients in baby personal care products is attracting health-conscious consumers. The growth of the parenting demographic, combined with rising disposable incomes, also contributes to the demand for premium, high-quality baby care items. Parents are becoming more discerning, seeking products that prioritize both effectiveness and safety, leading to an increase in the use of baby skin care, diapering, and bathing products.

The baby personal care sector in the USA is benefitting from innovations in formulation technologies, with an emphasis on products that are free from harsh chemicals. These innovations are aimed at addressing concerns related to allergies, rashes, and sensitivities, which are common among infants. In addition, the availability of baby personal care products in convenient packaging and multi-functional formats has contributed to the growing popularity of such products. Retailers and online platforms are also expanding their offerings to meet the evolving demands of parents, making these products more accessible.

From 2025 to 2030, the sector is expected to grow from USD 35.2 billion to USD 50.2 billion, adding USD 15.0 billion in value. This period is anticipated to contribute significantly to the overall expansion, driven by increasing awareness of the importance of safe and effective baby care. Parents' growing preference for premium, organic, and hypoallergenic products will boost demand, alongside the rising awareness of skin conditions such as eczema that require specialized products. The increasing number of working parents and the greater emphasis on quality baby care products will further fuel demand during this phase. Advancements in product formulations and packaging will continue to capture consumer interest, promoting increased adoption of baby personal care products.

From 2030 to 2035, the demand for baby personal care products is expected to grow from USD 50.2 billion to USD 63.6 billion, contributing USD 13.4 billion in value. Growth will continue, albeit at a slower pace compared to the earlier phase, as the sector matures. Demand will remain strong due to ongoing trends in health-conscious and eco-friendly parenting. Product innovation, such as the development of more personalized baby care lines, will ensure steady growth. The gradual industry saturation will result in a more stable growth trajectory, with key players focusing on refining their offerings and enhancing customer loyalty.

| Metric | Value |

|---|---|

| Demand for Baby Personal Care Products in USA Value (2025) | USD 35.2 billion |

| Demand for Baby Personal Care Products in USA Forecast Value (2035) | USD 63.6 billion |

| Demand for Baby Personal Care Products in USA Forecast CAGR (2025-2035) | 6.1% |

The demand for baby personal care products in the USA is growing due to the increasing focus on the health, safety, and well-being of infants. As parents and caregivers become more conscientious about the ingredients in the products they use for their babies, there is a rising preference for natural, organic, and hypoallergenic personal care products. This includes baby lotions, shampoos, wipes, diapers, and other skin care items that are gentle on sensitive skin and free from harmful chemicals.

A key driver of this growth is the rising awareness among parents about the importance of using safe, non-toxic products on their babies’ skin. With the growing trend toward clean-label and sustainable products, parents are more likely to choose baby personal care items that are eco-friendly, dermatologically tested, and free from artificial additives. This is particularly significant as concerns about skin irritation, allergies, and long-term health effects continue to influence purchasing decisions.

The increasing number of births and growing disposable income in the USA are contributing factors to the demand for premium baby personal care products. Parents are more willing to invest in higher-quality products that promote their babies' health and comfort. As the demand for safe, gentle, and eco-conscious baby care products continues to rise, the industry for these products in the USA is expected to grow steadily through 2035.

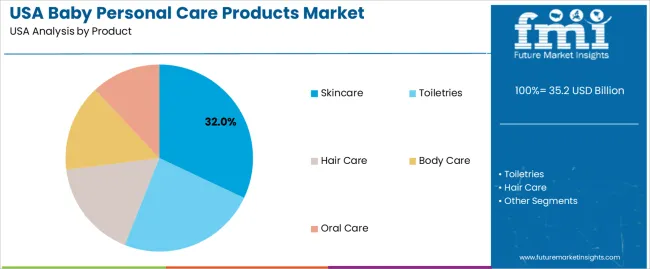

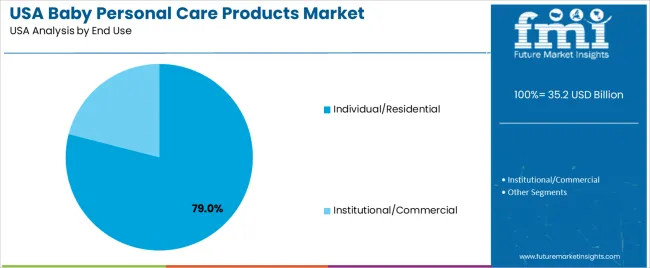

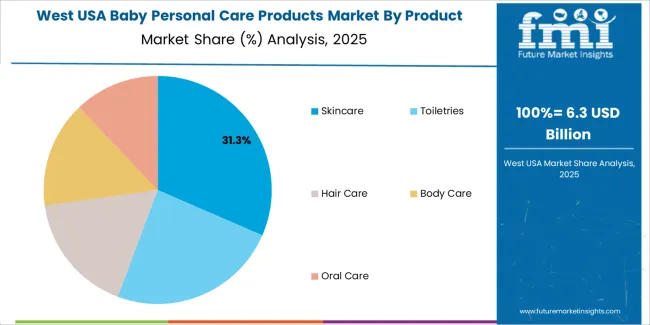

Demand for baby personal care products in the USA is segmented by product type, end use, nature, price, and region. By product type, demand is divided into skincare, toiletries, hair care, body care, and oral care, with skincare holding the largest share at 32%. The end-use segmentation includes individual/residential and institutional/commercial, with individual/residential leading at 79%. The products are also divided by nature into conventional and organic options. In terms of price, demand is segmented into mass and premium categories. Regionally, demand is distributed across West USA, South USA, Northeast USA, and Midwest USA.

Skincare accounts for 32% of the demand for baby personal care products in the USA. This high demand is driven by parents' increasing focus on the delicate and sensitive nature of a baby’s skin. Baby skincare products, such as lotions, creams, and oils, are essential for preventing and soothing skin issues like dryness, diaper rash, and irritation. With babies’ skin being more susceptible to environmental factors, parents often seek out gentle, hypoallergenic products to protect their child’s skin. Moreover, the growing awareness of the harmful effects of chemicals in conventional skincare products has led to a rise in demand for organic and natural baby skincare products. The increased availability of baby-specific skincare brands and the growing emphasis on safe, non-toxic ingredients have further contributed to the rise in popularity of skincare products within the baby personal care category.

The individual/residential segment leads the demand for baby personal care products in the USA, with 79% of the share. This is primarily due to the large number of parents seeking personal care products for their babies at home. Parents place a high priority on providing their babies with safe, effective products for everyday use, from skincare to hair care. Baby personal care products are essential for maintaining hygiene, comfort, and health, which drives their consistent demand in residential settings. The convenience of purchasing baby care products online and in stores, along with the growing awareness of the importance of proper care from birth, ensures steady growth in the individual/residential industry. As the number of new parents continues to rise, this segment remains the dominant driver of demand for baby personal care products in the USA.

Demand for baby personal care products in USA is growing as more parents prioritise gentle skincare and hygiene for infants. These products, including baby lotions, shampoos, wipes, soaps, and skincare treatments, are increasingly used to protect sensitive infant skin, maintain hygiene, and address conditions like rashes or dryness. Rising parental awareness about baby skin sensitivity, hygiene, and the desire for safe, mild formulations fuels demand. Growing preference for organic and hypoallergenic baby care items supports this trend. Despite growth, challenges such as concerns over chemical exposure, stringent safety regulations, and the relatively high cost of premium products remain barriers for some buyers.

Why is Demand for Baby Personal Care Products Growing in USA?

Demand for baby personal care products in the USA is growing as parents increasingly recognise the importance of specialised care for infants’ sensitive skin. With concerns about allergies, irritations, and dermatological health, parents are turning to products that are hypoallergenic, natural, or organic. As disposable incomes rise and parenting styles shift towards wellness and preventive care, the adoption of higher quality baby products continues to expand. The increasing emphasis on health and safety for babies drives parents to seek trusted and gentle options. The rise of e‑commerce provides easy access to a wide range of brands, enabling parents to compare, review, and purchase products that best suit their needs, contributing to the demand growth.

How are Technological & Industry Innovations Driving Baby Personal Care Demand in USA?

Technological and industry innovations are significantly driving the demand for baby personal care products in the USA. Manufacturers are increasingly focusing on creating safe, chemical‑free, and plant‑based formulations that cater to infants’ delicate skin. Products like fragrance‑free lotions, organic washes, and dermatologist‑tested soaps are becoming more common, offering safer alternatives to traditional products. In addition, clean‑label, hypoallergenic options are gaining popularity among parents seeking the best for their babies. Innovations in packaging, such as eco-friendly designs and convenient dispensing methods, further contribute to the appeal. The expansion of online retail, including subscription-based models, has also made these products more accessible, enhancing convenience and boosting demand for baby care items.

What are the Key Challenges and Risks That Could Limit Baby Personal Care Demand in USA?

Despite strong growth, challenges are limiting the demand for baby personal care products in the USA. The high price points for premium or organic products may make them unaffordable for price-sensitive parents, which could restrict their widespread adoption. Concerns about product safety, such as chemical ingredients, fragrances, and preservatives, might deter some buyers or push them toward minimalistic or all-natural alternatives. Stringent regulatory standards for baby products can increase manufacturing costs and limit the available ingredient options, impacting product variety. Furthermore, the slowing birth rates in the USA may affect long-term growth potential, as fewer babies reduce the demand for baby-specific products in the industry.

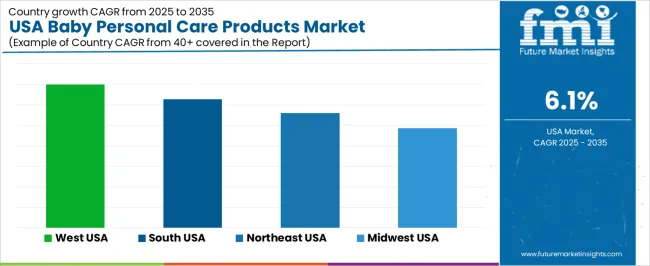

| Region | CAGR (%) |

|---|---|

| West USA | 7.0% |

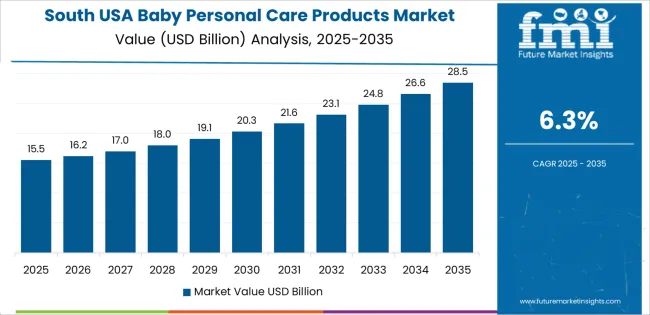

| South USA | 6.3% |

| Northeast USA | 5.6% |

| Midwest USA | 4.9% |

Demand for baby personal care products in the USA is growing steadily, with West USA leading at a 7.0% CAGR, driven by a large population of young families and a strong preference for natural, organic, and eco-friendly products. South USA follows with a 6.3% CAGR, supported by the region’s growing number of young families and the increasing awareness of safe, gentle ingredients. Northeast USA shows a 5.6% CAGR, fueled by the region’s focus on health-conscious living and premium, dermatologically tested baby care solutions. Midwest USA experiences a 4.9% CAGR, with steady demand driven by the region’s practical needs for baby care products. As parents across the country continue to prioritize safety, health, and quality, the demand for baby personal care products is expected to rise consistently, particularly in regions focused on sustainability and wellness.

West USA leads the demand for baby personal care products, growing at a 7.0% CAGR. The region's large population of young families and strong preference for high-quality, natural, and organic products is driving this growth. States like California are known for their focus on eco-friendly, non-toxic baby care solutions, and this trend extends to baby personal care products such as lotions, shampoos, and wipes. The increasing awareness of baby skin sensitivity and the demand for safe and gentle products further boost the industry. The West’s active lifestyle and wellness-focused culture also contribute to the demand for premium baby care products. As parents continue to prioritize health, sustainability, and quality, West USA remains the largest industry for baby personal care products.

South USA is experiencing strong demand for baby personal care products, with a 6.3% CAGR. The region’s large population and growing number of young families create a steady demand for baby care items, including diapers, baby lotions, shampoos, and wipes. Parents in South USA are increasingly seeking out gentle, safe, and natural products for their children, fueling demand for premium personal care items. The region’s warm climate also drives the need for baby care products that provide hydration and sun protection. As the industry for baby personal care continues to expand, parents are becoming more aware of the ingredients in the products they use, contributing to a rise in demand for organic and non-toxic baby care solutions. With the region’s growing population and focus on child health, the demand for baby personal care products in South USA is expected to remain strong.

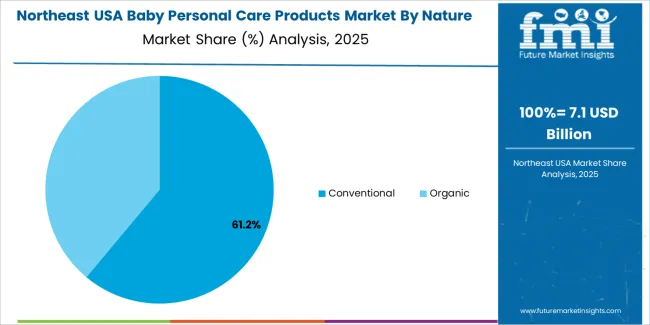

Northeast USA shows steady growth in demand for baby personal care products, with a 5.6% CAGR. The region’s focus on health-conscious living and premium products contributes to this demand, as parents seek the best care for their children. Baby personal care products such as natural lotions, shampoos, and diaper creams are in high demand, driven by a growing interest in organic, safe, and gentle ingredients. The large urban population, particularly in areas like New York and Massachusetts, has a strong preference for high-quality, dermatologically tested products that meet the specific needs of sensitive baby skin. As parents in the Northeast become more aware of product safety and ingredients, the demand for natural baby care solutions continues to rise. The region’s focus on family health, combined with the increasing availability of high-quality products, ensures steady demand for baby personal care items.

Midwest USA is experiencing steady demand for baby personal care products, with a 4.9% CAGR. The region’s growing number of young families and emphasis on practical, affordable baby care solutions contribute to this steady growth. Baby products, including diapers, lotions, and shampoos, are essential in Midwest households, where parents prioritize functional, high-quality options. The region’s strong focus on family-friendly products ensures consistent demand for baby personal care items that provide safe and gentle care for children. As more families focus on health and wellness, the interest in natural and organic baby products is increasing. While growth is more moderate compared to other regions, Midwest USA remains a stable industry, with demand driven by practical needs and the growing awareness of the importance of safe, gentle ingredients in baby care products.

The demand for baby personal care products in the USA is growing steadily, driven by the increasing awareness of the importance of safe, gentle, and effective products for infant skin care. With the rising number of health-conscious parents and growing concerns over the ingredients used in baby care items, there is a strong industry focus on natural, hypoallergenic, and dermatologically tested products. Baby personal care products, including diapers, lotions, shampoos, and wipes, are essential for the everyday care of infants, and the demand is further driven by the growing middle-class population and increasing spending on premium and organic baby care items.

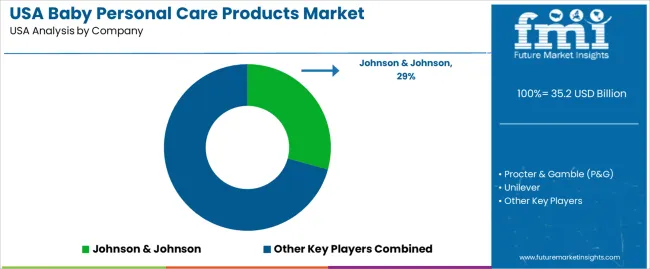

Leading companies in the baby personal care products industry in the USA include Johnson & Johnson, Procter & Gamble (P&G), Unilever, Kimberly-Clark Corporation, and The Himalaya Drug Company. Johnson & Johnson holds the largest industry share of 29.3%, with its extensive range of baby care products such as baby lotions, oils, shampoos, and wipes, known for their gentle formulations. Procter & Gamble (P&G), with its Pampers brand, is a significant player, providing high-quality baby care products, especially diapers and wipes. Unilever offers trusted brands like Dove Baby and Baby Soft, while Kimberly-Clark Corporation provides Huggies and other baby personal care items. The Himalaya Drug Company is a leading provider of natural and herbal baby care products, catering to the growing demand for organic and plant-based options.

Competition in the baby personal care products industry is driven by factors such as product safety, innovation, and growing consumer preference for natural and organic ingredients. Companies compete by offering products that are gentle on sensitive baby skin, free from harmful chemicals, and clinically tested. The demand for sustainable packaging and eco-friendly products is also influencing competition, with parents seeking brands that align with their environmental values.

| Items | Values |

|---|---|

| Quantitative Units (2025) | USD billion |

| Product | Skincare, Toiletries, Hair Care, Body Care, Oral Care |

| Nature | Conventional, Organic |

| End Use | Individual/Residential, Institutional/Commercial |

| Price | Mass, Premium |

| Gender | Unisex, Boys, Girls |

| Region | West USA, South USA, Northeast USA, Midwest USA |

| Countries Covered | USA |

| Key Companies Profiled | Johnson & Johnson, Procter & Gamble (P&G), Unilever, Kimberly-Clark Corporation, The Himalaya Drug Company |

| Additional Attributes | Dollar sales by product, nature, end use, price, and gender; regional CAGR and adoption trends; demand trends in baby personal care products; growth in individual, institutional, and commercial sectors; technology adoption in organic and conventional product formulations; vendor offerings including mass and premium baby care products; regulatory influences and industry standards |

The demand for baby personal care products in USA is estimated to be valued at USD 35.2 billion in 2025.

The market size for the baby personal care products in USA is projected to reach USD 63.7 billion by 2035.

The demand for baby personal care products in USA is expected to grow at a 6.1% CAGR between 2025 and 2035.

The key product types in baby personal care products in USA are skincare, toiletries, hair care, body care and oral care.

In terms of nature, conventional segment is expected to command 61.0% share in the baby personal care products in USA in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Baby Personal Care Products Market Analysis - Size & Growth 2025 to 2035

Baby Personal Care Market Analysis by Product Type, Nature, Age Group, Sales, and Region

Personal Care Products Filling System Market Size and Share Forecast Outlook 2025 to 2035

Baby Teeth Care Products Market Size and Share Forecast Outlook 2025 to 2035

USA Beauty and Personal Care (BPC) Retail Vending Machine Market Outlook 2025 to 2035

USA and Canada Pet Care Products Market Analysis – Size, Share and Forecast 2025 to 2035

Herbal Personal Care Products Market Size and Share Forecast Outlook 2025 to 2035

Fragranced Personal Care Products Market Analysis - Size and Share Forecast Outlook 2025 to 2035

Anti-Foaming Personal Care Products Market Analysis - Size and Share Forecast Outlook 2025 to 2035

Hyaluronic Acid Personal Care Products Market Overview - Growth & Forecast 2025 to 2035

Demand for Professional Hair Care Products in USA Size and Share Forecast Outlook 2025 to 2035

USA Products from Food Waste Market Growth – Trends, Demand & Outlook 2025-2035

Personal Care Ingredient Market Size and Share Forecast Outlook 2025 to 2035

Personal Care Appliances Market Size and Share Forecast Outlook 2025 to 2035

Personal Care Wipes Market Size and Share Forecast Outlook 2025 to 2035

Personal Care and Cosmetics Microalgae Market - Beauty & Skincare Trends 2025 to 2035

Personal Care Packaging Market Analysis by Application, Packaging Format, Capacity, and Region Forecast Through 2035

USA Home Care Services Market Trends – Growth, Demand & Analysis 2025-2035

Personal Care Aid Market Growth – Industry Trends & Forecast 2024-2034

Baby Oral Care Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA