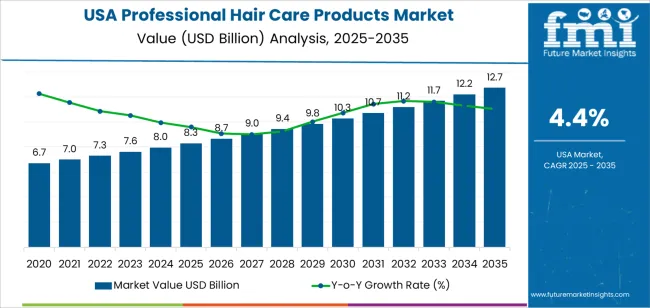

The USA professional hair care products demand is valued at USD 8.3 billion in 2025 and is forecasted to reach USD 12.7 billion by 2035, recording a CAGR of 4.4%. Demand is influenced by steady salon activity, expanded distribution of professional-grade formulations, and continued consumer interest in specialised hair treatments. The category is supported by persistent service volumes across colouring, styling, and conditioning applications, alongside wider retail placement of salon-linked product lines. Growth is also shaped by increased use of targeted formulations designed for texture management, scalp care, and chemical-treatment support.

Hair coloring represents the leading product type, reflecting its central role in salon services and its stable usage among consumers seeking predictable shade performance. Formulations in this segment include oxidative dyes, ammonia-free alternatives, and toning solutions that support colour retention and post-treatment care. Ongoing development of pigment technologies, bonding additives, and scalp-comfort formulations contributes to sustained purchasing by salons and professional distributors.

Demand is strongest in the West, South, and Northeast, where salon density, professional training networks, and retail–salon hybrid formats support continuous product turnover. Key suppliers include Aveda Corporation (Estée Lauder), KAO Corporation, Henkel, Procter & Gamble (P&G), Revlon Inc., and L’Oréal Group. These suppliers maintain extensive portfolios of salon-focused formulations and structured distribution channels that serve professional stylists and retail partners.

Saturation point analysis shows the segment operating well below saturation during the early period from 2025 to 2029. Growth will be supported by steady demand from salons, continued interest in bond-repair systems, colour-protection treatments, and premium scalp-care formulations. Expanded stylist education programs and wider distribution of professional-grade home-care products will reinforce this phase. Product rotation cycles within salons remain frequent, keeping early-period saturation limited.

From 2030 to 2035, the segment begins moving toward a soft saturation band as usage patterns mature and professional users stabilise their preferred product portfolios. Growth continues but moderates as salon services reach stable throughput and consumers adopt routine care habits with limited variation. Incremental gains will come from improved ingredient systems, targeted scalp-health solutions, and specialised colour-maintenance lines rather than broad category expansion. The saturation trajectory overall reflects a mature, service-linked segment shaped by steady professional adoption, consistent consumer routines, and long-running formulation updates across the USA professional hair-care landscape.

| Metric | Value |

|---|---|

| USA Professional Hair Care Products Sales Value (2025) | USD 8.3 billion |

| USA Professional Hair Care Products Forecast Value (2035) | USD 12.7 billion |

| USA Professional Hair Care Products Forecast CAGR (2025-2035) | 4.4% |

Demand for professional hair care products in the USA is increasing because salons and stylists seek high-performance formulations that deliver visible results and support premium services. Professional-grade brands offer stronger actives, advanced textures and targeted solutions that appeal to consumers willing to upgrade their hair-care routines. The growth of social media and influencer-driven beauty culture also elevates expectations for salon-quality outcomes at home and in professional settings. Rising demand for natural, clean-label and salon-exclusive products drives investment in professional lines that command higher price points.

Salons and spas leveraging digital engagement and e-commerce tools extend their retail business beyond services, further boosting product turnover. Segmentation of hair concerns, such as textured hair, scalp health, male grooming and colour-treated hair, supports specialised professional product launches. Constraints include higher cost of professional-grade products compared with mass-market items, limited access-to-consumer channels in some store formats and the need for salon-expert training to properly position and sell these products. Some consumers may remain loyal to existing mass-market brands, which moderates rapid growth in the professional channel.

Demand for professional hair-care products in the United States reflects usage across at-home routines and professional salon environments, shaped by style preferences, hair-treatment needs, and product-performance expectations. Product-type distribution aligns with colouring demand, styling requirements, and chemical-treatment usage. End-user patterns reflect how consumers and salons allocate spending across specialised and daily-use formulations. Sales-channel distribution shows the combined influence of retail availability, salon-based recommendations, and online purchasing.

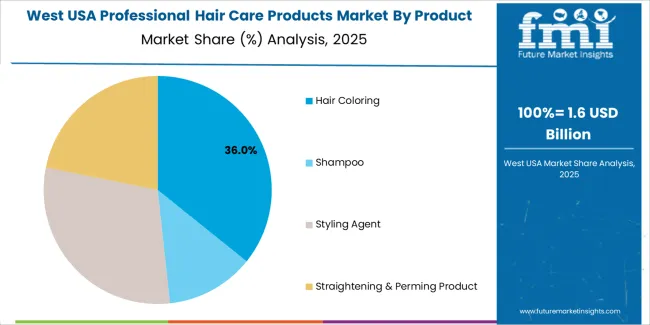

Hair colouring products hold 35.3% of national demand and form the leading product category. Their use spans permanent dyes, demi-permanent shades, toners, and corrective formulations applied across salons and home routines. Colouring supports wide tone variation and cosmetic enhancement, making it central to professional service menus. Styling agents represent 30.1%, covering sprays, gels, mousses, and creams used to shape, hold, or texture hair across daily and event-based applications. Straightening and perming products account for 22.0%, serving users seeking long-lasting structural changes. Shampoo holds 12.6%, focusing on cleansing and treatment support. Product-type distribution reflects consumer emphasis on colour maintenance, styling versatility, and chemical-treatment durability.

Key drivers and attributes:

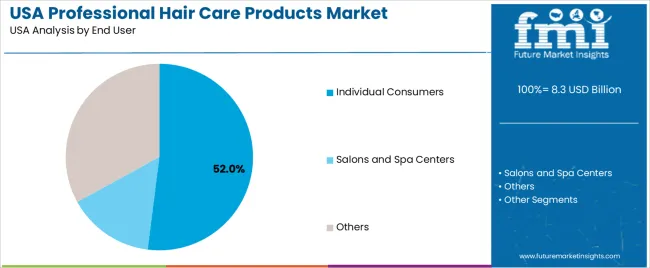

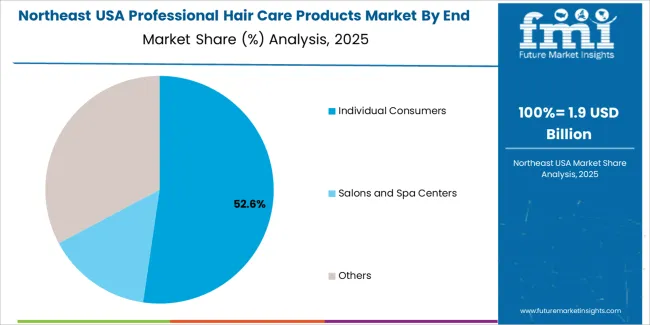

Individual consumers represent 52.0% of U.S. demand and form the largest end-user group. Users purchase professional-grade products for home colouring, styling, and maintenance due to consistent performance and wider shade options. Salons and spa centres hold 15.0%, applying specialised formulations for controlled treatments, corrective work, and customised styling. The remaining 33.0% includes professional stylists operating independently, small service outlets, and institutional users such as training academies. End-user distribution reflects how professional products move across both retail and service environments as consumers balance salon visits with home-care routines, while salons focus on chemical services, colour application, and treatment-focused usage.

Key drivers and attributes:

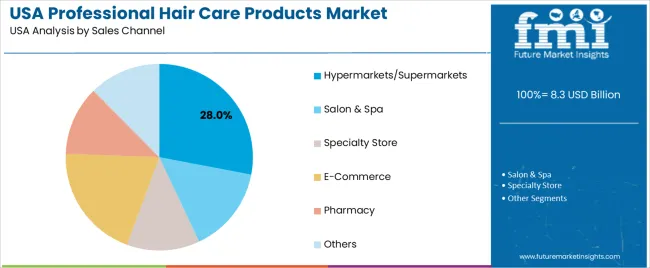

Hypermarkets and supermarkets hold 28.0% of national demand and represent the primary sales channel. Their wide assortment, frequent restocking, and accessibility support routine purchasing of professional-grade shampoos, colouring kits, and styling products. E-commerce accounts for 20.0%, driven by convenience, broader brand availability, and subscription-based delivery. Salons and spas represent 15.0%, offering professional-only lines and treatment-linked products. Specialty stores hold 12.6%, serving users seeking curated selections. Pharmacies account for 12.0%, offering treatment-focused formulations. The remaining 12.4% includes independent retailers and small-format outlets. Sales-channel distribution reflects combined consumer reliance on mass retail, structured salon recommendations, and expanding online product access.

Key drivers and attributes:

Growing demand for premium salon-grade products, increased salon visits and emphasis on hair and scalp health are driving growth.

In the United States, demand for professional hair care products those developed for salon use or advanced at-home application is rising as consumers seek higher quality results and trust’ brand formulas that stylists endorse. The increase in salon services such as colour, keratin smoothing, bonding treatments and scalp therapy drives salon stocking and retail of these professional-grade lines. Rising awareness of scalp health, hair damage repair, clean-label and vegan formulations encourages uptake of advanced treatment shampoos, serums and styling systems. Retail channels (including salon-retail, specialised beauty stores and online professional portals) are expanding access beyond traditional salon-only distribution.

High price point, dependency on salon-channel distribution and competition from premium consumer brands restrain broader adoption.

Professional hair care products typically cost more than mass-market items, which may limit usage among price-sensitive consumers and restrict growth in the broader retail segment. These products often rely on salon-channel placement, meaning that decreases in salon footfall or slower salon-retail growth influence demand. Some premium consumer-grade brands are narrowing the performance gap and offering similar benefits at lower cost, which can reduce the unique advantage of strictly professional lines.

Expansion of multi-channel distribution, shift toward at-home professional-quality systems and increased focus on inclusivity & texture-specific products define key trends.

Manufacturers and salon brands are increasingly distributing professional hair care lines via e-commerce and subscription models, enabling consumers to purchase salon-quality products without direct salon visits. There is growth in professional-quality treatment systems designed for home use, such as bond-builders and keratin treatments, which blur the line between salon-exclusive and retail. Inclusivity in hair care especially for textured, curly and coily hair is gaining traction, with professionals and brands developing formulas specific to these needs. These trends support continued demand growth for professional hair care products in the U.S. industry.

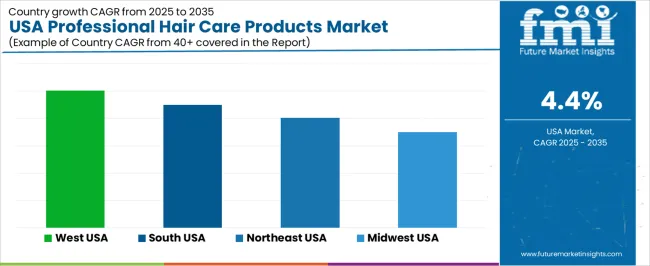

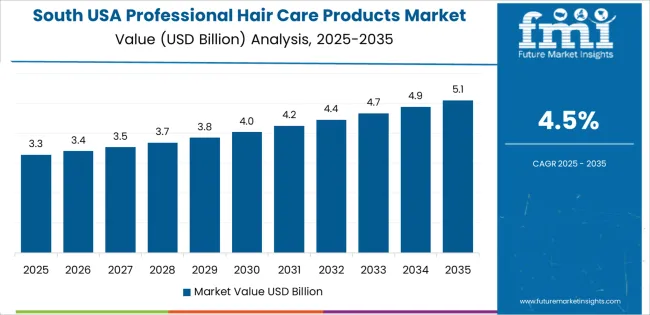

Demand for professional hair care products in the USA is increasing through 2035 as salons, barbershops, dermatology practices, and premium retail channels expand their use of high-performance formulations for cleansing, repair, styling, and scalp care. Growth is driven by rising interest in ingredient-focused products, increased service personalization, and wider access to salon-grade items through e-commerce and specialty stores. Manufacturers supply targeted solutions for color protection, texture management, scalp balance, and chemical-treatment recovery. Regional demand varies according to salon density, consumer income levels, and distributor networks supplying professional outlets. The West leads with a 5.0% CAGR, followed by the South (4.5%), the Northeast (4.0%), and the Midwest (3.5%).

| Region | CAGR (2025-2035) |

|---|---|

| West | 5.0% |

| South | 4.5% |

| Northeast | 4.0% |

| Midwest | 3.5% |

The West grows at 5.0% CAGR, supported by dense salon networks and high consumer adoption of premium hair-care routines across California, Washington, and Colorado. Salons use professional shampoos, conditioners, bond-repair treatments, and color-care systems for clients seeking targeted solutions for heat damage, chemical processing, or environmental exposure. Dermatology and scalp-care clinics add professional formulations to treatment plans for clients requiring structured regimens. Retailers maintain broad assortments of salon-grade products, supported by strong interest in clean-label and ingredient-specific formulations. E-commerce platforms record high turnover due to recurring purchases from urban consumers. Consistent service demand across metropolitan industries reinforces long-term product usage.

The South grows at 4.5% CAGR, supported by expanding salon activity and rising demand for texture-management and moisture-focused products across Texas, Florida, Georgia, and surrounding states. Salons use professional treatments for smoothing, curl definition, color protection, and humidity control. Retailers expand assortments of salon-grade products aligned with regional preferences for hydration-rich formulations. Beauty-supply distributors support widespread salon access to treatment systems, styling concentrates, and post-chemical-care products. E-commerce contributes additional volume through routine replenishment. Although conventional hair-care items remain strong, premium professional products gain traction due to increased brand awareness and rising interest in personalized service routines.

The Northeast grows at 4.0% CAGR, supported by concentrated urban salon activity and steady interest in high-performance formulations across New York, Massachusetts, and Pennsylvania. Salons adopt targeted treatments for chemical-color recovery, scalp balance, and advanced conditioning. Professional brands maintain strong distribution through beauty-supply outlets and premium retailers. Consumers in metropolitan areas purchase salon-grade products for at-home care routines aligned with ingredient transparency and performance claims. Specialty hair studios rely on concentrated repair systems and styling products for complex techniques, including balayage and textured-hair treatments. Established salon culture reinforces consistent regional demand.

The Midwest grows at 3.5% CAGR, supported by stable salon activity and moderate but consistent consumer interest in premium hair-care routines across Illinois, Minnesota, Wisconsin, and Ohio. Salons use professional bond-repair systems, salon-grade conditioners, and styling products suited for varied hair textures and seasonal weather shifts. Retailers expand access to professional lines through beauty-supply stores and online channels. Consumers adopt salon-recommended products for at-home maintenance following chemical services. Although growth is slower than in coastal regions, strong salon presence in suburban communities ensures continued use of core professional formulations.

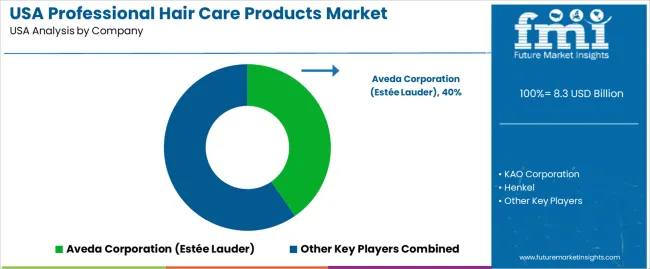

Demand for professional hair-care products in the USA is shaped by a concentrated group of global beauty and personal-care companies supplying salons, professional stylists, and premium retail channels. Aveda Corporation (Estée Lauder) holds the leading position with an estimated 40.4% share, supported by its controlled botanical-based formulations, stable product performance, and strong placement within salon networks and prestige retail environments. Its position is reinforced by consistent ingredient verification and dependable supply across colour-care, repair treatments, and styling ranges.

KAO Corporation and Henkel follow as significant participants, offering professional brands that provide reliable conditioning, colour-support, and smoothing systems used in salon services. Their strengths include established R&D frameworks, predictable product behaviour under salon conditions, and strong relationships with stylist education programmes. Procter & Gamble (P&G) maintains a notable presence through professional product lines that emphasize controlled moisture balance, heat-protection performance, and broad compatibility with textured and colour-treated hair.

Revlon Inc. contributes additional capability with salon-focused colour and care ranges positioned for consistent results across diverse hair types, while L’Oréal Group supports demand through its extensive salon portfolio that offers targeted treatment, colouring, and damage-repair solutions used widely by professional stylists.

Competition across this segment centers on treatment effectiveness, colour-care longevity, ingredient safety, salon-level performance, and education support for professionals. Demand remains strong due to stable salon service activity, continued interest in high-performance treatments, and reliance on predictable, stylist-trusted formulations that meet the requirements of professional application and client expectations in the USA.

| Items | Values |

|---|---|

| Quantitative Units | USD billion |

| Product Type | Hair Coloring, Shampoo, Styling Agent, Straightening & Perming Product |

| End User | Individual Consumers, Salons and Spa Centers, Others |

| Sales Channel | Hypermarkets/Supermarkets, Salon & Spa, Specialty Store, E-Commerce, Pharmacy, Others |

| Regions Covered | West, Midwest, South, Northeast |

| Key Companies Profiled | Aveda Corporation (Estée Lauder), KAO Corporation, Henkel, Procter & Gamble (P&G), Revlon Inc., L'Oréal Group |

| Additional Attributes | Dollar sales by product type, end-user, and sales channel categories; regional adoption trends across West, Midwest, South, and Northeast; competitive landscape of professional hair care brands; advancements in scalp-focused products, ammonia-free hair color, bond-building technology, and clean-formulation shampoos; integration with salon services, professional stylist networks, and premium retail distribution across the USA. |

The global demand for professional hair care products in USA is estimated to be valued at USD 8.3 billion in 2025.

The market size for the demand for professional hair care products in USA is projected to reach USD 12.7 billion by 2035.

The demand for professional hair care products in USA is expected to grow at a 4.4% CAGR between 2025 and 2035.

The key product types in demand for professional hair care products in USA are hair coloring, shampoo, styling agent and straightening & perming product.

In terms of end user, individual consumers segment to command 52.0% share in the demand for professional hair care products in USA in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Professional Hair Care Market Insights & Forecast 2025 to 2035

Demand for Professional Hair Care Products in Japan Size and Share Forecast Outlook 2025 to 2035

USA and Canada Pet Care Products Market Analysis – Size, Share and Forecast 2025 to 2035

Anti-Static Hair Care Products Market Analysis - Size and Share Forecast Outlook 2025 to 2035

Haircare Supplement Market - Size, Share, and Forecast Outlook 2025 to 2035

USA Products from Food Waste Market Growth – Trends, Demand & Outlook 2025-2035

USA Hair Dryer Market Outlook – Size, Trends & Growth 2025-2035

Hair Care Market Size and Share Forecast Outlook 2025 to 2035

Hair Care Packaging Market Growth and Trends 2025 to 2035

USA Home Care Services Market Trends – Growth, Demand & Analysis 2025-2035

Suncare Products Market Size and Share Forecast Outlook 2025 to 2035

Skincare Products Market Size and Share Forecast Outlook 2025 to 2035

Sun Care Products Market Analysis – Growth, Applications & Outlook 2025–2035

Car Care Products Market Trends - Growth, Demand & Analysis 2025 to 2035

Hair Styling Products Market Analysis - Trends, Growth & Forecast 2025 to 2035

Professional Hair Clipper Market Trends & Forecast 2024-2034

Nail Care Products Market Growth, Trends and Forecast from 2025 to 2035

Hair Lightening Products Market Size and Share Forecast Outlook 2025 to 2035

Facial Care Products Market Size and Share Forecast Outlook 2025 to 2035

Dental Care Products Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA