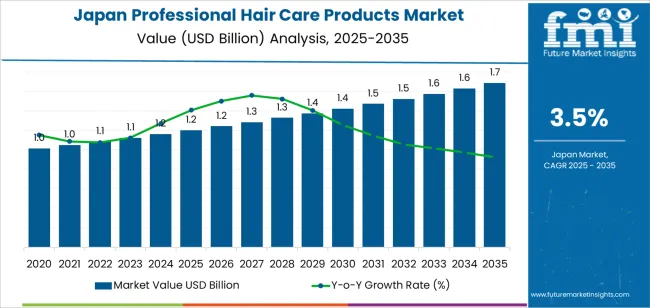

The demand for professional hair care products in Japan is expected to grow from USD 1.2 billion in 2025 to USD 1.7 billion by 2035, reflecting a CAGR of 3.5%. As consumers continue to prioritize hair health and beauty, the desire for high-quality, salon-grade products is increasing. This trend is fueled by growing awareness of the benefits of professional-grade hair care solutions, which offer superior performance compared to mass-market alternatives. Products that cater to specific hair concerns, such as anti-aging, color protection, and damage repair, are gaining popularity.

Innovations in product formulations, particularly those that focus on enhancing the health of hair, are driving demand for more effective professional hair care products. The availability of these products through online retail and e-commerce platforms has made them more accessible to a broader audience, further boosting their adoption. The growth is also supported by increasing consumer interest in personal grooming and self-care, particularly among younger demographics who seek premium solutions for their hair care needs.

Technological advancements in the development of more specialized and customized products will also contribute to industry growth. As professional hair care brands continue to evolve their offerings to meet consumer demand for innovative, effective solutions, the industry will maintain its positive trajectory. This sustained growth will be driven by ongoing trends in hair health, self-care, and the increasing preference for salon-quality products, ensuring strong demand throughout the forecast period.

From 2025 to 2030, the demand for professional hair care products in Japan is expected to grow from USD 1.2 billion to USD 1.3 billion, adding USD 0.1 billion in value. This phase will see moderate growth driven by consumers' increasing preference for premium products that provide superior hair care solutions. The rise in personalized and functional products designed to address specific consumer needs, such as color protection, damage repair, and anti-aging, will also support this growth. The expanding availability of professional hair care products through retail outlets and online platforms will make them more accessible, encouraging wider adoption.

From 2030 to 2035, the industry will grow from USD 1.3 billion to USD 1.7 billion, contributing USD 0.4 billion in value. While growth will continue, it will be at a slower pace as the industry matures. During this period, the focus will shift from rapid expansion to optimizing existing products and increasing brand loyalty. Manufacturers will concentrate on refining product formulations to enhance their functionality and effectiveness, rather than introducing entirely new products. Despite the slower growth rate, the demand for professional-grade hair care products will remain strong, supported by ongoing trends in personal grooming and consumers' continued interest in high-quality, specialized hair care solutions.

| Metric | Value |

|---|---|

| Demand for Professional Hair Care Products in Japan Value (2025) | USD 1.2 billion |

| Demand for Professional Hair Care Products in Japan Forecast Value (2035) | USD 1.7 billion |

| Demand for Professional Hair Care Products in Japan Forecast CAGR (2025 to 2035) | 3.5% |

Demand for professional hair care products in Japan is rising as more consumers seek salon‑grade treatments and specialised formulas for hair styling and repair. With the number of professional salons and beauty studios remaining strong, usage of products designed for salon application such as intense treatment masks, colour protection systems and styling‑finish formulas has increased. Consumers are showing stronger willingness to invest in higher‑performance hair care that offers visible results.

The shift in consumer behaviour toward premium hair services and customised treatments supports this trend. Hair salons in Japan are offering more advanced services, such as scalp analysis, damage repair, and hair‐sculpting work that rely on professional‑only products. These services encourage repeat purchase of specialist products by consumers seeking the salon experience at home or via follow‑up care.

Advances in product innovation and distribution are also driving growth. Manufacturers are introducing new formulations that address specific needs like environmental damage, thinning hair and ageing‑related concerns, tailored to the Japanese haircare consumer. Online platforms and salon‑direct sales are growing channels for these products, allowing brands to reach consumers ready for professional‑level solutions. As the appetite for specialised hair care continues, demand for professional hair care products in Japan is expected to grow steadily.

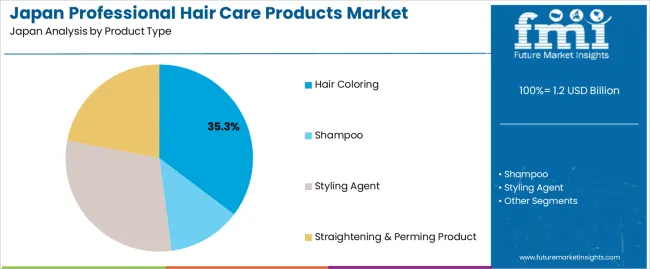

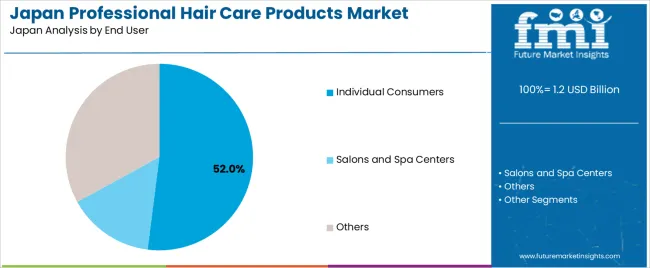

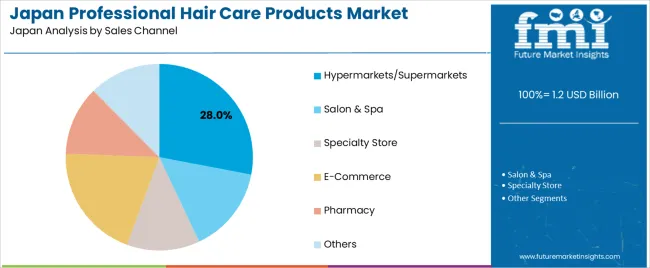

Demand for professional hair care products in Japan is segmented by product type, end user, and sales channel. By product type, demand is divided into hair coloring, shampoo, styling agent, and straightening & perming products, with hair coloring holding the largest share. In terms of end user, the industry is categorized into individual consumers, salons and spa centers, and others, with individual consumers accounting for the largest share. The industry is also segmented by sales channel, including hypermarkets/supermarkets, salon & spa, specialty stores, e-commerce, pharmacy, and others, with hypermarkets/supermarkets leading the demand. Regionally, demand is divided into Kanto, Kinki, Chubu, Kyushu & Okinawa, Tohoku, and the Rest of Japan.

Hair coloring accounts for 35% of the demand for professional hair care products in Japan. Hair coloring products are in high demand due to the growing trend of personal grooming and beauty treatments, with many individuals seeking salon-quality results at home. The increasing popularity of hair dyeing, as a way to enhance personal appearance or cover grays, drives the continued growth of this segment.

The demand for hair coloring products is further driven by innovations in formulations, including ammonia-free options, long-lasting colors, and products designed to nourish and protect hair during the coloring process. As Japanese consumers become more conscious of hair health and quality, the demand for professional hair coloring products that offer both color and care has surged. With the increasing trend of at-home hair coloring, professional-grade products are also being marketed for individual consumer use, contributing to the segment's leadership in the industry.

Individual consumers account for 52% of the demand for professional hair care products in Japan. The rise of self-care and beauty trends, combined with growing awareness of the importance of high-quality hair care, has made professional-grade hair care products highly sought after by individual consumers. These consumers are increasingly looking for salon-quality products that they can use at home to maintain their hair health, styling, and coloring.

The demand from individual consumers is driven by their growing interest in hair care products that offer personalized benefits, such as color protection, hair strengthening, and hydration. With the increasing availability of professional hair care products in retail and online channels, individual consumers are increasingly opting for premium hair care solutions, leading to a rise in sales. The trend of DIY beauty treatments and at-home hair care routines further contributes to the dominance of individual consumers in the industry, as they seek high-quality, effective products for personal use.

Hypermarkets/supermarkets account for 28% of the demand for professional hair care products in Japan. These sales channels offer a wide variety of hair care products at competitive prices, making them a popular shopping destination for individual consumers seeking convenience and variety. Hypermarkets and supermarkets are preferred for purchasing everyday hair care products, as they offer easy access to a broad selection of brands and products, from hair coloring to shampoos and styling agents.

The demand for professional hair care products in hypermarkets/supermarkets is driven by the increasing preference for one-stop shopping, where consumers can find both essential items and premium beauty products in a single location. These retail channels also cater to the growing trend of value-driven purchases, where consumers can buy professional products at affordable prices. As the beauty and personal care industry continues to expand in Japan, hypermarkets/supermarkets will remain key players in the distribution of professional hair care products, offering both accessibility and variety to the consumer base.

Key drivers include the rise of premiumisation in beauty services, growing focus on scalp care and anti‑thinning solutions driven by Japan’s ageing population, and the willingness of consumers to pay for salon‑grade products at home or via online channels. The growth of male grooming, salon brands extending into consumer lines, and digital commerce for professional lines further support uptake. Restraints include modest growth in salon openings in some regions, competition from mass‑market and DIY product ranges, regulatory and ingredient safety constraints, and pricing sensitivity in certain segments which may limit adoption of high‑end professional SKUs.

In Japan, demand is increasing because salons and professional hair care brands are meeting evolving consumer expectations around hair health, styling effectiveness and brand prestige. Consumers increasingly expect personalised hair‑care solutions, higher performance from treatments and ingredient sophistication (e.g., bond‑repair, scalp‑therapy, botanical actives). The extension of salon brands into home‑use professional‑grade products allows consumers to continue the salon experience at home, further boosting demand. Online channels and specialty retail are making professional lines more accessible outside just the salon environment, widening reach and driving growth for professional hair‑care in Japan.

Technological innovations are enabling growth in Japan’s professional hair‑care segment through advanced formulations and salon‑to‑consumer transitions. Examples include bond‑repair technologies (to repair cut‑hair structure), scalp‑therapeutic treatments (for thinning hair, dandruff, ageing scalp), and enriched styling agents that balance Japanese hair types (fine, straight) with modern fashion demands. Packaging innovations, salon professional‑grade refill formats, and elevated branding support premium positioning. Also, digital engagement (salon tutorials, online consultation, virtual hair‑analysis) helps professional brands engage consumers beyond the chair and drive at‑home usage of professional products. These innovations increase differentiation and push willingness to pay, supporting stronger demand.

Professional‑grade products typically carry a premium over mass retail brands, which may limit volume growth among more price‑sensitive consumers. Another issue is the highly competitive market with many premium and salon‑brands vying for attention, which can erode margins and require heavy marketing investment. Salon product adoption depends on professional endorsement and retail linkages if salons favour proprietary lines or consumers lack access outside the salon, growth can be constrained. Regulatory or ingredient safety shifts (especially in Japan, where cosmetic/medical regulations are strict) can increase development costs and slow product launches.

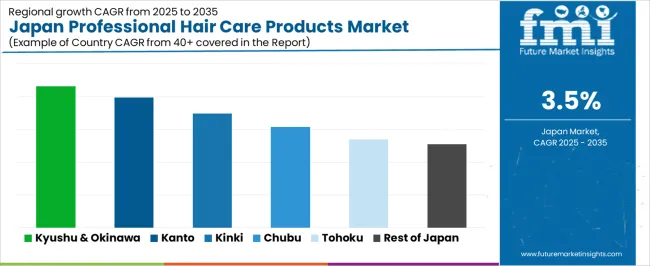

| Region | CAGR (%) |

|---|---|

| Kyushu & Okinawa | 4.3% |

| Kanto | 4.0% |

| Kinki | 3.5% |

| Chubu | 3.1% |

| Tohoku | 2.7% |

| Rest of Japan | 2.6% |

The demand for professional hair care products in Japan is growing across all regions, with Kyushu & Okinawa leading at a 4.3% CAGR. This growth is driven by increasing consumer focus on high-quality, salon-grade products and rising beauty standards. Kanto follows closely at 4.0%, supported by strong demand in metropolitan areas like Tokyo. Kinki shows a 3.5% CAGR, driven by a robust beauty industry. Chubu experiences a 3.1% CAGR, with steady demand for professional products. Tohoku and the Rest of Japan show more moderate growth at 2.7% and 2.6%, respectively, with increasing adoption in smaller towns and rural areas.

Kyushu & Okinawa is experiencing the highest demand for professional hair care products in Japan, with a 4.3% CAGR. The region is seeing a shift in consumer preferences towards high-end, salon-quality hair care solutions. There is a growing focus on beauty and wellness, with consumers increasingly willing to invest in professional products to enhance their hair care routines. The region's vibrant tourism industry also contributes to the rising demand for professional-grade products, as international visitors seek premium hair care options.

Kyushu & Okinawa’s strong local beauty industry and the rise of specialty beauty salons are driving demand for professional hair care products. Consumers are more inclined to visit salons offering high-quality treatments and products, creating a sustainable demand for premium hair care products. With an increasing number of beauty-conscious consumers and a focus on personal care, Kyushu & Okinawa will continue to lead growth in the professional hair care sector.

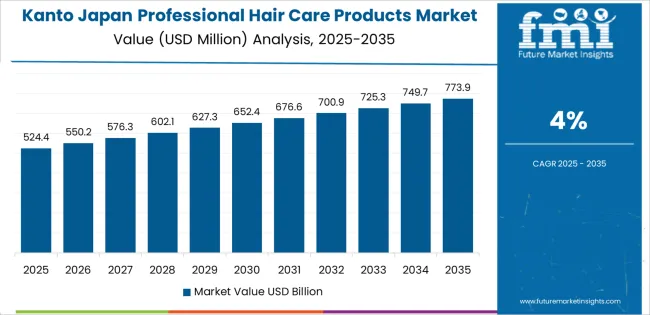

Kanto is experiencing strong demand for professional hair care products, with a 4.0% CAGR. The region, particularly Tokyo, is a hub for beauty and fashion trends, contributing to a high demand for salon-quality hair care products. As the largest consumer industry in Japan, Kanto benefits from a large number of beauty salons, spas, and cosmetic stores that offer professional-grade products. The region’s consumers are also more willing to invest in premium products for hair health and styling.

The growing interest in personalized hair care routines and the rise of beauty influencers are contributing to the demand for high-quality hair care solutions in Kanto. As beauty standards continue to evolve and consumers prioritize quality over price, the demand for professional hair care products is expected to grow steadily. With a strong focus on innovation and trends in beauty, Kanto remains a key region for growth in the professional hair care industry.

Kinki is experiencing steady demand for professional hair care products, with a 3.5% CAGR. The region, which includes Osaka and Kyoto, is home to a well-established beauty and cosmetics industry. The increasing number of beauty-conscious consumers and the growing popularity of high-quality hair care products contribute to the demand in Kinki. As personal grooming continues to gain importance, the use of salon-grade products for hair health and styling is becoming more widespread.

The region’s diverse population and cultural influences also play a role in the growing demand for professional hair care. As consumers in Kinki adopt more sophisticated beauty routines, the demand for professional-grade hair care products, such as shampoos, conditioners, and styling treatments, is on the rise. With the region’s strong fashion and beauty sectors, Kinki is poised to continue experiencing steady growth in the demand for professional hair care products.

Chubu is seeing moderate growth in demand for professional hair care products, with a 3.1% CAGR. The region is known for its manufacturing and industrial sectors, but the beauty industry is also expanding, particularly in cities like Nagoya. As consumers in Chubu become more interested in high-quality, salon-style hair care solutions, the demand for professional products is steadily increasing. The rise of personal care awareness and growing salon cultures are contributing factors to the sector’s growth in the region.

Chubu’s demand for professional hair care products is also supported by a growing number of beauty salons and an expanding retail industry for hair care products. Consumers are increasingly prioritizing hair health and styling, leading to higher sales of premium hair care products. As the region continues to embrace modern beauty trends and products, the demand for professional-grade hair care solutions is expected to rise in the coming years.

Tohoku is seeing moderate growth in demand for professional hair care products, with a 2.7% CAGR. The region has fewer major urban centers compared to other parts of Japan, but there is an increasing interest in personal grooming and beauty care, particularly in smaller towns and rural areas. As consumers in Tohoku become more aware of beauty trends and access to salon-grade products, the adoption of professional hair care solutions is steadily rising.

The growth is also being fueled by the expansion of beauty salons in the region, which offer professional hair treatments and services. As more consumers seek high-quality hair care products and services to enhance their grooming routines, demand for premium solutions is expected to increase. With a growing awareness of the benefits of professional hair care, the region will continue to see steady growth in product adoption, though it will likely remain slower compared to more metropolitan regions like Kanto and Kyushu & Okinawa.

The Rest of Japan is also seeing moderate growth in demand for professional hair care products, with a 2.6% CAGR. Like Tohoku, this region is characterized by smaller towns and rural areas, where the beauty and personal grooming culture is gradually gaining momentum. As consumers in the Rest of Japan become more familiar with global beauty trends, there is an increasing interest in using salon-quality hair care products, which has led to a steady rise in demand.

The growth is also supported by the expanding presence of beauty salons in these areas, which cater to consumers seeking professional hair treatments and products. With a growing appreciation for high-quality, effective hair care solutions, the Rest of Japan is expected to continue experiencing growth in this sector, although at a slower pace compared to urban areas like Kanto. As awareness of premium hair care products grows, the demand for such products in the Rest of Japan will keep increasing.

The demand for professional hair care products in Japan is driven by an array of factors within its mature beauty industry. With Japanese consumers placing increasing emphasis on scalp health, hair strength, and premium salon‑grade treatments, manufacturers and salons are responding with advanced formulations tailored to high‑end needs. The industry continues to benefit from urbanization, higher disposable income in metropolitan areas, and a culture of frequent salon visits that supports demand for professional‑quality hair care.

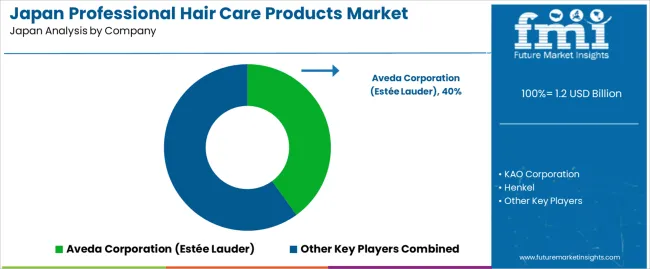

Within Japan’s professional hair care segment, Aveda Corporation (Estée Lauder) holds an estimated 40.0% share, reflecting its strong presence as a premium brand in salon networks and high‑end distribution channels. Other significant players include KAO Corporation, Henkel, Procter & Gamble (P&G), Revlon Inc., and L’Oréal Group, each delivering specialized formulations, salon‑exclusive lines or global names adapted to Japanese consumer expectations in textures, fragrance, and performance.

Key growth drivers in Japan include the rising prevalence of hair concerns like thinning, graying and scalp sensitivity due to aging demographics; the willingness of Japanese consumers to pay for premium experiences and ingredients; and the trend of professional salons expanding services such as treatments, bonding systems, and personalized hair care regimens. The growth of online‑to‑offline and travel retail channels boosts access to professional hair‑care brands. Challenges remain in terms of stiff competition from domestic brands, regulatory considerations around cosmetic ingredients, and evolving consumer preferences for cleaner labels or multifunctional products.

| Items | Values |

|---|---|

| Quantitative Unit | USD billion |

| Product Type | Hair Coloring, Shampoo, Styling Agent, Straightening & Perming Product |

| End User | Individual Consumers, Salons and Spa Centers, Others |

| Sales Channel | Hypermarkets/Supermarkets, Salon & Spa, Specialty Store, E-Commerce, Pharmacy, Others |

| Regions Covered | Kyushu & Okinawa, Kanto, Kinki, Chubu, Tohoku, Rest of Japan |

| Key Players Profiled | Aveda Corporation (Estée Lauder), KAO Corporation, Henkel, Procter & Gamble (P&G), Revlon Inc., L'Oréal Group |

| Additional Attributes | Dollar sales by product type, end user, sales channel, and regional trends, focusing on salon usage, e-commerce growth, and increased consumer interest in premium professional hair care solutions. |

The demand for professional hair care products in Japan is estimated to be valued at USD 1.2 billion in 2025.

The market size for the professional hair care products in Japan is projected to reach USD 1.7 billion by 2035.

The demand for professional hair care products in Japan is expected to grow at a 3.5% CAGR between 2025 and 2035.

The key product types in professional hair care products in Japan are hair coloring, shampoo, styling agent and straightening & perming product.

In terms of end user, individual consumers segment is expected to command 52.0% share in the professional hair care products in Japan in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Demand Signal Repository Solutions Market Size and Share Forecast Outlook 2025 to 2035

Demand Side Management Market Size and Share Forecast Outlook 2025 to 2035

Demand Response Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

North America Shipping Supplies Market Trends – Innovations & Growth 2024-2034

Demand of Kozani Saffron in Greece Analysis - Size, Share & Forecast 2025 to 2035

Demand of No-acid Whey Strained Dairy Processing Concepts in European Union Size and Share Forecast Outlook 2025 to 2035

Demand for Bronte Pistachio in Italy Analysis - Size, Share & Forecast 2025 to 2035

Demand and Trend Analysis of Gaming Monitor in Western Europe Size and Share Forecast Outlook 2025 to 2035

Demand and Trend Analysis of Gaming Monitor in Korea Size and Share Forecast Outlook 2025 to 2035

Demand and Trend Analysis of Gaming Monitor in Japan Size and Share Forecast Outlook 2025 to 2035

Glycine Soja (Soybean) Seed Extract Market Size and Share Forecast Outlook 2025 to 2035

Demand and Trend Analysis of Yeast in Japan - Size, Share, and Forecast Outlook 2025 to 2035

Demand of Pistachio-based desserts & ingredients in France Analysis - Size, Share & Forecast 2025 to 2035

Demand and Trends Analysis of Stevia in Japan Size and Share Forecast Outlook 2025 to 2035

Demand and Trend Analysis of Fabric Stain Remover in Korea Size and Share Forecast Outlook 2025 to 2035

Demand and Sales Analysis of Paper Cup in Korea Size and Share Forecast Outlook 2025 to 2035

Demand and Sales Analysis of Paper Cup in Western Europe Size and Share Forecast Outlook 2025 to 2035

Demand of MFGM-enriched Powders & RTDs in European Union Size and Share Forecast Outlook 2025 to 2035

Demand and Sales Analysis of Paper Cup in Japan Size and Share Forecast Outlook 2025 to 2035

Demand and Trend Analysis of Avocado Oil in Western europe Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA