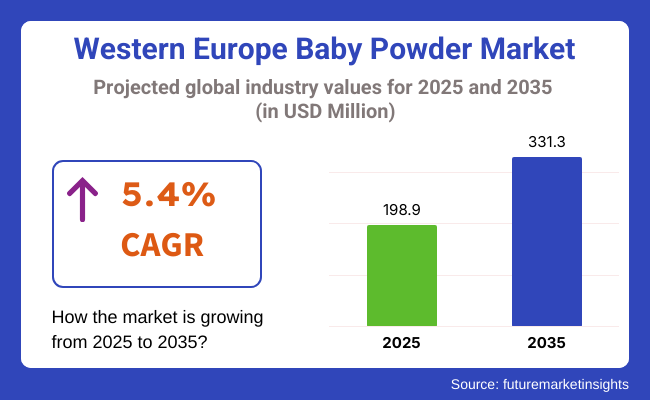

The Western Europe baby powder market is poised to register a valuation of USD 198.9 million in 2025. The industry is slated to grow at 5.4% CAGR from 2025 to 2035, witnessing USD 331.3 million by 2035. The expansion of the market is being fueled by the convergence of changing consumer attitudes, demographic factors, and rising awareness of baby hygiene.

One of the main drivers is the increased demand for natural and organic personal care products for babies. With parents becoming increasingly aware of what goes into personal care products, there has been a clear shift towards talc-free, hypoallergenic, and plant-based powders. This trend is part of a larger movement toward clean beauty and wellness, where consumers are prioritizing transparency, safety and sustainability in the products they use for their children.

Furthermore, Western Europe's stable birth rate and tradition of baby care and parental expenditures favor sustained demand in the category. Though population growth rate is slow, high disposable incomes and investment in premium baby care products keep the market going. Parents are ready to pay extra for products that offer better skin protection, less irritation, and being dermatologically tested - all essential features marketed in contemporary powders.

Product diversification and innovation are also another reason for market growth. Companies are increasing product lines to cover powders with calming ingredients such as chamomile, calendula, or oat extracts for babies with sensitive skin.

Additionally, wider distribution through both online and offline retail channels has increased the availability of these products. E-commerce, in particular, is increasingly contributing, providing parents with convenience, greater variety of products, and detailed reviews that drive purchase decisions.

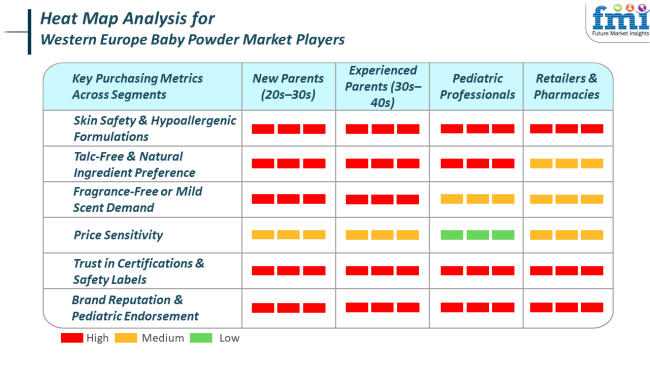

Western Europe's market caters to a diverse range of end-use segments, namely infants, toddlers, and increasingly adult consumers. Within these segments, buying behavior is increasingly influenced by a demand for natural, safe, and dermatologically tested products. For infants, safety is the key-parents prefer talc-free, hypoallergenic, and fragrance-free products with natural ingredients such as cornstarch or oat flour.

There's a widening movement towards eco-certified and organic products with clean-label trends ongoing in driving consumer decisions. In the toddlers segment, convenience and functionality rule. Parents want powders that provide friction, sweat, and irritation management, and prefer simple packaging and multiple benefits like deodorizing or soothing properties.

With adults, baby powder increasingly finds application in personal care and skin care, widening the market from its conventional base. Consumers in this segment prioritize texture, fragrance, and skin-calming ingredients, favoring light, non-clumping formulas with supplemental aloe vera or zinc oxide.

Ethical shopping criteria such as cruelty-free status, sustainable packaging, and transparency also guide purchasing decisions. Even though consumer preferences vary between age groups, universal trends like ingredient safety, skin-friendliness, and functional usability continue to be key to consumer values, driving product innovation as well as marketing messages in the market.

During 2020 to 2024, the Western European market experienced significant changes driven by health consciousness, regulatory pressure, and changing consumer values. The most important among these changes was the general shift away from talc-based powders in favor of alternatives amid concerns over possible health hazards, which pushed manufacturers to reformulate products and also boosted demand for talc-free ones.

Concurrently, the COVID-19 pandemic amplified customer emphasis on cleanliness, safety, and ingredient openness, fueling demand for organic and hypoallergenic baby care products. Brands responded in large part by introducing cleaner, dermatologically tested, and plant-based products, riding the larger clean beauty trend.

Growth of the market in the future will be steady, fueled by innovation, sustainability, and diversification of customer demographics. Between 2025 and 2035, focus on natural ingredients, with even tighter consumer vigilance on safety certification and eco-labels is expected.

Sustainability will be an increasing differentiator-recyclable packaging, refillable packaging, and carbon-neutral production will increase in importance for brand allegiance and purchasing choices. Additionally, tailored skincare for babies, enabled by advances in dermatological research and digital diagnosis, could be a niche area for growth.

Comparative Industry Shift Analysis (2020 to 2024 vs. 2025 to 2035)

| 2020 to 2024 | 2025 to 2035 |

|---|---|

| The market for talc-free, pl ant-based powders grew as a result of concerns about the health effects of talcum powder. Parents became more ingredient-aware and switched to safer products. | Customized baby care will be on the rise. Brands will provide skin-sensitive, climate-adjusted powders specific to the baby's requirements, potentially using AI skin analysis for skin-sensitive babies. |

| During the COVID-19 outbreak, home stay resulted in growth in baby care buying. Hygiene and routine care were at the top of parents' priority lists, which saw increased baby powder usage for comfort and skin rash prevention. | Environmental sustainability will be a dominant force in influencing buying behavior. Biodegradable packaging, jars that can be refilled, and zero-waste processes will be the rage as green parenting goes mainstream. |

| Natural, organic, and dermatologist-tested powders gained popularity as parents turned their attention to clean label products. Ethical sourcing and cruelty-free ingredients began to gain traction. | Baby powder will be considered part of a larger baby wellness regimen. The products will be promoted not only for comfort but also for skin health, calming, and preventive treatments. |

The Western European market is exposed to a number of risks arising from changing consumer trends, regulations, and rising competition from incumbent and new brands. Among the most pronounced risks is the increasing consumer anxiety related to the safety of talc-based powders. In recent years, health concerns surrounding talc, including its possible connections to ovarian cancer, have put health regulators and consumers under heightened scrutiny.

As a result, consumers have turned towards alternatives that do not use talc, with some established brands facing reputation loss and legal action. For those companies where talc-based formulae constitute a high percentage of their business, this is a significant threat to brand reputation and market share.

Regulatory threats are also on the rise in the market, especially with greater European health and safety regulators scrutinizing the sector. Regulations about ingredients used for baby care products, such as baby powders, are becoming more stringent.

The European Union has strict laws regarding product labeling and safety, which could mean that companies would have to change their products or packaging to fit new requirements. These regulatory hurdles can drive up the cost of operations and make it difficult for new brands to enter the market.

Talc powders have been historically the most popular in the Western European baby powder market. Talc, a mineral composed mostly of magnesium, silicon, and oxygen, has been highly valued for centuries for its moisture-absorbing, friction-reducing, and drying qualities to the skin, and it has been used ever since as a key ingredient in baby powders.

Talc powders are also smooth to touch and soft on the skin, which is why they have become popular for use on infants. Companies like Johnson & Johnson have long been the market leaders with talc-based products, due to their well-documented effectiveness and established track record of calming skin irritations and avoiding rashes.

Nonetheless, the application of talc in baby powders has come under pressure in recent years as consumers and health authorities have questioned potential health hazards. Research establishing links between talc and ovarian cancer and respiratory problems, especially when the powder is inhaled, prompted alarm among consumers as well as health regulators. In spite of continued controversies regarding the scientific evidence, some Western European companies have begun to shift away from talc-formulated products to more secure substitutes.

Conventional baby powders, commonly made with chemicals like talc or cornstarch, have been around for generations. Their mass marketing, low cost, and established presence in the marketplace account for their popularity. Large, long-standing brands like Johnson's Baby Powder enjoy widespread acceptance among parents, having established good reputations over the years.

These companies have large marketing budgets and high brand recognition, which provides them with a great marketing advantage in the competitive market. Moreover, conventional powders tend to be cheaper, and price becomes a key consideration for parents with purchasing decisions, especially in an area where most families seek affordable products.

Alternatively, organic baby powders, formulated from natural plant-based ingredients such as cornstarch or arrowroot powder, are increasing in popularity. They are of appeal mainly to parents who are concerned about the potential health consequences of chemicals in standard products.

As more people become aware of the safety of ingredients such as talc, parents are increasingly opting for organic alternatives, which tend to be labeled as being free from harsh chemicals and fragrances. There is also growing demand for products that are sustainable and environmentally friendly, and organic baby powders tend to meet this demand by using environmentally friendly packaging and sourcing.

The Western European baby powder sector is intensely competitive, with established multinational firms in addition to a number of niche brands. While large corporations persistently rule the market with safe products appealing to a large community of parents, smaller eco-brands are steadily gaining popularity on the strength of sustainability, organics, and transparency. As consumers become more inclined towards natural, safe options, large corporations and new brands alike are shifting to meet the demand for chemical-free and environmentally friendly products.

| Company Name | Estimated Industry Share (%) |

|---|---|

| Johnson & Johnson | 20-25% |

| Kimberly-Clark Corp | 15-18% |

| Artsana Group | 10-12% |

| Asahi Group Foods Ltd | 7-9% |

| The Burt's Bees | 5-7% |

| California Baby | 4-6% |

| Chattem , Inc. | 3-5% |

| Free | 2-4% |

| Lion Corporation | 3-5% |

| Mamaearth | 3-5% |

| Company Name | Key Company Offerings and Activities |

|---|---|

| Johnson & Johnson | A leading player with its best-known brand Baby Powder, making a range of talc-free and sensitive skin versions available. Emphasizing product safety and compliance with regulation, it has been at the forefront of meeting increased consumer fears regarding talc. |

| Kimberly-Clark Corp | One of its most famous brands, Kimberly-Clark's Huggies line is known for baby powders that are sensitive-skin-friendly and dermatologically tested. The company excels at making its products affordable and accessible, both in retail and online. |

| Artsana Group | The umbrella company of Chicco , Artsana specializes in natural baby powders that emphasize safe, gentle formulations. Its products appeal to health-aware parents who look for safe, dermatologist-approved baby care products. |

| Asahi Group Foods Ltd | With a reputation for its health-oriented products, Asahi is extending its baby care business in Western Europe. Asahi focuses on mild, non-irritant formulations that suit babies with delicate skin. |

| The Burt's Bees | This eco-friendly skincare range has extended into baby care in the form of baby powders that are not only free of synthetic fragrances and parabens but are also marketed as eco-friendly, organic, and cruelty-free. |

| California Baby | Specializing in organic baby care products, California Baby features a range of talc-free powders. Its focus is on mild, plant-derived ingredients that are gentle on babies with sensitive skin. |

| Chattem , Inc. | With its Gold Bond brand, Chattem makes baby powders that center on calming and safeguarding baby skin. The company is famous for its powerful formulas that treat rashes and skin irritations. |

| Free | This Swedish brand offers hypoallergenic and gentle baby care products, including powders. With a focus on eco-friendly packaging, Libero caters to environmentally conscious consumers in Western Europe. |

| Lion Corporation | A major player in personal care, Lion Corporation offers baby powders that are both gentle and safe, catering to sensitive skin. The company focuses on affordable pricing and strong brand recognition. |

| Mamaearth | One of the fast-growing natural brands, Mamaearth provides baby powders that do not contain dangerous chemicals. The brand has gained attention due to its use of eco-friendly packaging and plant-based ingredients. |

The Western European baby powder market keeps on changing, with growing consumer demand for natural, safe, and eco-friendly products. Classic leaders such as Johnson & Johnson and Kimberly-Clark remain dominant with a product safety focus, while new entrants such as Mamaearth and The Burt's Bees are capitalizing on the eco-friendly segment by providing organic, clean-label options.

The future of the market will be characterized by a further integration of sustainability, with increased pressure for biodegradable packaging, reusable containers, and ingredients that are kind to baby skin as well as the environment. Furthermore, advances in technology and increasing awareness of ingredient transparency are likely to continue to influence the industry.

In terms of ingredient, the industry is classified into talc-based and corn-starch-based.

With respect to price, the market is divided into mass and premium.

Based on nature, the industry is bifurcated into organic and conventional.

In terms of sales channel, the industry is divided into direct sales, modern trade, convenience stores, departmental stores, specialty stores, mono brand stores, online retailers, drug stores, and other sales channels.

By country, the industry is segregated into the UK, Germany, Italy, France, Spain, and the rest of Europe.

The industry is expected to reach USD 198.9 million in 2025.

The market is projected to witness USD 331.3 million by 2035.

The industry is slated to capture 5.4% CAGR during the study period.

Conventional products are widely used.

Leading companies include Artsana Group, Asahi Group Foods Ltd, The Burt's Bees, California Baby, Chattem, Inc., Johnson & Johnson, Kimberly-Clark Corp, Libero, Lion Corporation, and Mamaearth.

Table 1: Industry Analysis and outlook Value (US$ Million) Forecast by Country, 2019 to 2034

Table 2: Industry Analysis and outlook Volume (Units) Forecast by Country, 2019 to 2034

Table 3: Industry Analysis and outlook Value (US$ Million) Forecast by Ingredient, 2019 to 2034

Table 4: Industry Analysis and outlook Volume (Units) Forecast by Ingredient, 2019 to 2034

Table 5: Industry Analysis and outlook Value (US$ Million) Forecast by Price, 2019 to 2034

Table 6: Industry Analysis and outlook Volume (Units) Forecast by Price, 2019 to 2034

Table 7: Industry Analysis and outlook Value (US$ Million) Forecast by Nature, 2019 to 2034

Table 8: Industry Analysis and outlook Volume (Units) Forecast by Nature, 2019 to 2034

Table 9: Industry Analysis and outlook Value (US$ Million) Forecast by Sales Channel, 2019 to 2034

Table 10: Industry Analysis and outlook Volume (Units) Forecast by Sales Channel, 2019 to 2034

Table 11: UK Industry Analysis and outlook Value (US$ Million) Forecast By Region, 2019 to 2034

Table 12: UK Industry Analysis and outlook Volume (Units) Forecast By Region, 2019 to 2034

Table 13: UK Industry Analysis and outlook Value (US$ Million) Forecast by Ingredient, 2019 to 2034

Table 14: UK Industry Analysis and outlook Volume (Units) Forecast by Ingredient, 2019 to 2034

Table 15: UK Industry Analysis and outlook Value (US$ Million) Forecast by Price, 2019 to 2034

Table 16: UK Industry Analysis and outlook Volume (Units) Forecast by Price, 2019 to 2034

Table 17: UK Industry Analysis and outlook Value (US$ Million) Forecast by Nature, 2019 to 2034

Table 18: UK Industry Analysis and outlook Volume (Units) Forecast by Nature, 2019 to 2034

Table 19: UK Industry Analysis and outlook Value (US$ Million) Forecast by Sales Channel, 2019 to 2034

Table 20: UK Industry Analysis and outlook Volume (Units) Forecast by Sales Channel, 2019 to 2034

Table 21: Germany Industry Analysis and outlook Value (US$ Million) Forecast By Region, 2019 to 2034

Table 22: Germany Industry Analysis and outlook Volume (Units) Forecast By Region, 2019 to 2034

Table 23: Germany Industry Analysis and outlook Value (US$ Million) Forecast by Ingredient, 2019 to 2034

Table 24: Germany Industry Analysis and outlook Volume (Units) Forecast by Ingredient, 2019 to 2034

Table 25: Germany Industry Analysis and outlook Value (US$ Million) Forecast by Price, 2019 to 2034

Table 26: Germany Industry Analysis and outlook Volume (Units) Forecast by Price, 2019 to 2034

Table 27: Germany Industry Analysis and outlook Value (US$ Million) Forecast by Nature, 2019 to 2034

Table 28: Germany Industry Analysis and outlook Volume (Units) Forecast by Nature, 2019 to 2034

Table 29: Germany Industry Analysis and outlook Value (US$ Million) Forecast by Sales Channel, 2019 to 2034

Table 30: Germany Industry Analysis and outlook Volume (Units) Forecast by Sales Channel, 2019 to 2034

Table 31: Italy Industry Analysis and outlook Value (US$ Million) Forecast By Region, 2019 to 2034

Table 32: Italy Industry Analysis and outlook Volume (Units) Forecast By Region, 2019 to 2034

Table 33: Italy Industry Analysis and outlook Value (US$ Million) Forecast by Ingredient, 2019 to 2034

Table 34: Italy Industry Analysis and outlook Volume (Units) Forecast by Ingredient, 2019 to 2034

Table 35: Italy Industry Analysis and outlook Value (US$ Million) Forecast by Price, 2019 to 2034

Table 36: Italy Industry Analysis and outlook Volume (Units) Forecast by Price, 2019 to 2034

Table 37: Italy Industry Analysis and outlook Value (US$ Million) Forecast by Nature, 2019 to 2034

Table 38: Italy Industry Analysis and outlook Volume (Units) Forecast by Nature, 2019 to 2034

Table 39: Italy Industry Analysis and outlook Value (US$ Million) Forecast by Sales Channel, 2019 to 2034

Table 40: Italy Industry Analysis and outlook Volume (Units) Forecast by Sales Channel, 2019 to 2034

Table 41: France Industry Analysis and outlook Value (US$ Million) Forecast By Region, 2019 to 2034

Table 42: France Industry Analysis and outlook Volume (Units) Forecast By Region, 2019 to 2034

Table 43: France Industry Analysis and outlook Value (US$ Million) Forecast by Ingredient, 2019 to 2034

Table 44: France Industry Analysis and outlook Volume (Units) Forecast by Ingredient, 2019 to 2034

Table 45: France Industry Analysis and outlook Value (US$ Million) Forecast by Price, 2019 to 2034

Table 46: France Industry Analysis and outlook Volume (Units) Forecast by Price, 2019 to 2034

Table 47: France Industry Analysis and outlook Value (US$ Million) Forecast by Nature, 2019 to 2034

Table 48: France Industry Analysis and outlook Volume (Units) Forecast by Nature, 2019 to 2034

Table 49: France Industry Analysis and outlook Value (US$ Million) Forecast by Sales Channel, 2019 to 2034

Table 50: France Industry Analysis and outlook Volume (Units) Forecast by Sales Channel, 2019 to 2034

Table 51: Spain Industry Analysis and outlook Value (US$ Million) Forecast By Region, 2019 to 2034

Table 52: Spain Industry Analysis and outlook Volume (Units) Forecast By Region, 2019 to 2034

Table 53: Spain Industry Analysis and outlook Value (US$ Million) Forecast by Ingredient, 2019 to 2034

Table 54: Spain Industry Analysis and outlook Volume (Units) Forecast by Ingredient, 2019 to 2034

Table 55: Spain Industry Analysis and outlook Value (US$ Million) Forecast by Price, 2019 to 2034

Table 56: Spain Industry Analysis and outlook Volume (Units) Forecast by Price, 2019 to 2034

Table 57: Spain Industry Analysis and outlook Value (US$ Million) Forecast by Nature, 2019 to 2034

Table 58: Spain Industry Analysis and outlook Volume (Units) Forecast by Nature, 2019 to 2034

Table 59: Spain Industry Analysis and outlook Value (US$ Million) Forecast by Sales Channel, 2019 to 2034

Table 60: Spain Industry Analysis and outlook Volume (Units) Forecast by Sales Channel, 2019 to 2034

Table 61: Rest of Industry Analysis and outlook Value (US$ Million) Forecast by Ingredient, 2019 to 2034

Table 62: Rest of Industry Analysis and outlook Volume (Units) Forecast by Ingredient, 2019 to 2034

Table 63: Rest of Industry Analysis and outlook Value (US$ Million) Forecast by Price, 2019 to 2034

Table 64: Rest of Industry Analysis and outlook Volume (Units) Forecast by Price, 2019 to 2034

Table 65: Rest of Industry Analysis and outlook Value (US$ Million) Forecast by Nature, 2019 to 2034

Table 66: Rest of Industry Analysis and outlook Volume (Units) Forecast by Nature, 2019 to 2034

Table 67: Rest of Industry Analysis and outlook Value (US$ Million) Forecast by Sales Channel, 2019 to 2034

Table 68: Rest of Industry Analysis and outlook Volume (Units) Forecast by Sales Channel, 2019 to 2034

Figure 1: Industry Analysis and outlook Value (US$ Million) by Ingredient, 2024 to 2034

Figure 2: Industry Analysis and outlook Value (US$ Million) by Price, 2024 to 2034

Figure 3: Industry Analysis and outlook Value (US$ Million) by Nature, 2024 to 2034

Figure 4: Industry Analysis and outlook Value (US$ Million) by Sales Channel, 2024 to 2034

Figure 5: Industry Analysis and outlook Value (US$ Million) by Country, 2024 to 2034

Figure 6: Industry Analysis and outlook Value (US$ Million) Analysis by Country, 2019 to 2034

Figure 7: Industry Analysis and outlook Volume (Units) Analysis by Country, 2019 to 2034

Figure 8: Industry Analysis and outlook Value Share (%) and BPS Analysis by Country, 2024 to 2034

Figure 9: Industry Analysis and outlook Y-o-Y Growth (%) Projections by Country, 2024 to 2034

Figure 10: Industry Analysis and outlook Value (US$ Million) Analysis by Ingredient, 2019 to 2034

Figure 11: Industry Analysis and outlook Volume (Units) Analysis by Ingredient, 2019 to 2034

Figure 12: Industry Analysis and outlook Value Share (%) and BPS Analysis by Ingredient, 2024 to 2034

Figure 13: Industry Analysis and outlook Y-o-Y Growth (%) Projections by Ingredient, 2024 to 2034

Figure 14: Industry Analysis and outlook Value (US$ Million) Analysis by Price, 2019 to 2034

Figure 15: Industry Analysis and outlook Volume (Units) Analysis by Price, 2019 to 2034

Figure 16: Industry Analysis and outlook Value Share (%) and BPS Analysis by Price, 2024 to 2034

Figure 17: Industry Analysis and outlook Y-o-Y Growth (%) Projections by Price, 2024 to 2034

Figure 18: Industry Analysis and outlook Value (US$ Million) Analysis by Nature, 2019 to 2034

Figure 19: Industry Analysis and outlook Volume (Units) Analysis by Nature, 2019 to 2034

Figure 20: Industry Analysis and outlook Value Share (%) and BPS Analysis by Nature, 2024 to 2034

Figure 21: Industry Analysis and outlook Y-o-Y Growth (%) Projections by Nature, 2024 to 2034

Figure 22: Industry Analysis and outlook Value (US$ Million) Analysis by Sales Channel, 2019 to 2034

Figure 23: Industry Analysis and outlook Volume (Units) Analysis by Sales Channel, 2019 to 2034

Figure 24: Industry Analysis and outlook Value Share (%) and BPS Analysis by Sales Channel, 2024 to 2034

Figure 25: Industry Analysis and outlook Y-o-Y Growth (%) Projections by Sales Channel, 2024 to 2034

Figure 26: Industry Analysis and outlook Attractiveness by Ingredient, 2024 to 2034

Figure 27: Industry Analysis and outlook Attractiveness by Price, 2024 to 2034

Figure 28: Industry Analysis and outlook Attractiveness by Nature, 2024 to 2034

Figure 29: Industry Analysis and outlook Attractiveness by Sales Channel, 2024 to 2034

Figure 30: Industry Analysis and outlook Attractiveness by Region, 2024 to 2034

Figure 31: UK Industry Analysis and outlook Value (US$ Million) by Ingredient, 2024 to 2034

Figure 32: UK Industry Analysis and outlook Value (US$ Million) by Price, 2024 to 2034

Figure 33: UK Industry Analysis and outlook Value (US$ Million) by Nature, 2024 to 2034

Figure 34: UK Industry Analysis and outlook Value (US$ Million) by Sales Channel, 2024 to 2034

Figure 35: UK Industry Analysis and outlook Value (US$ Million) By Region, 2024 to 2034

Figure 36: UK Industry Analysis and outlook Value (US$ Million) Analysis By Region, 2019 to 2034

Figure 37: UK Industry Analysis and outlook Volume (Units) Analysis By Region, 2019 to 2034

Figure 38: UK Industry Analysis and outlook Value Share (%) and BPS Analysis By Region, 2024 to 2034

Figure 39: UK Industry Analysis and outlook Y-o-Y Growth (%) Projections By Region, 2024 to 2034

Figure 40: UK Industry Analysis and outlook Value (US$ Million) Analysis by Ingredient, 2019 to 2034

Figure 41: UK Industry Analysis and outlook Volume (Units) Analysis by Ingredient, 2019 to 2034

Figure 42: UK Industry Analysis and outlook Value Share (%) and BPS Analysis by Ingredient, 2024 to 2034

Figure 43: UK Industry Analysis and outlook Y-o-Y Growth (%) Projections by Ingredient, 2024 to 2034

Figure 44: UK Industry Analysis and outlook Value (US$ Million) Analysis by Price, 2019 to 2034

Figure 45: UK Industry Analysis and outlook Volume (Units) Analysis by Price, 2019 to 2034

Figure 46: UK Industry Analysis and outlook Value Share (%) and BPS Analysis by Price, 2024 to 2034

Figure 47: UK Industry Analysis and outlook Y-o-Y Growth (%) Projections by Price, 2024 to 2034

Figure 48: UK Industry Analysis and outlook Value (US$ Million) Analysis by Nature, 2019 to 2034

Figure 49: UK Industry Analysis and outlook Volume (Units) Analysis by Nature, 2019 to 2034

Figure 50: UK Industry Analysis and outlook Value Share (%) and BPS Analysis by Nature, 2024 to 2034

Figure 51: UK Industry Analysis and outlook Y-o-Y Growth (%) Projections by Nature, 2024 to 2034

Figure 52: UK Industry Analysis and outlook Value (US$ Million) Analysis by Sales Channel, 2019 to 2034

Figure 53: UK Industry Analysis and outlook Volume (Units) Analysis by Sales Channel, 2019 to 2034

Figure 54: UK Industry Analysis and outlook Value Share (%) and BPS Analysis by Sales Channel, 2024 to 2034

Figure 55: UK Industry Analysis and outlook Y-o-Y Growth (%) Projections by Sales Channel, 2024 to 2034

Figure 56: UK Industry Analysis and outlook Attractiveness by Ingredient, 2024 to 2034

Figure 57: UK Industry Analysis and outlook Attractiveness by Price, 2024 to 2034

Figure 58: UK Industry Analysis and outlook Attractiveness by Nature, 2024 to 2034

Figure 59: UK Industry Analysis and outlook Attractiveness by Sales Channel, 2024 to 2034

Figure 60: UK Industry Analysis and outlook Attractiveness By Region, 2024 to 2034

Figure 61: Germany Industry Analysis and outlook Value (US$ Million) by Ingredient, 2024 to 2034

Figure 62: Germany Industry Analysis and outlook Value (US$ Million) by Price, 2024 to 2034

Figure 63: Germany Industry Analysis and outlook Value (US$ Million) by Nature, 2024 to 2034

Figure 64: Germany Industry Analysis and outlook Value (US$ Million) by Sales Channel, 2024 to 2034

Figure 65: Germany Industry Analysis and outlook Value (US$ Million) By Region, 2024 to 2034

Figure 66: Germany Industry Analysis and outlook Value (US$ Million) Analysis By Region, 2019 to 2034

Figure 67: Germany Industry Analysis and outlook Volume (Units) Analysis By Region, 2019 to 2034

Figure 68: Germany Industry Analysis and outlook Value Share (%) and BPS Analysis By Region, 2024 to 2034

Figure 69: Germany Industry Analysis and outlook Y-o-Y Growth (%) Projections By Region, 2024 to 2034

Figure 70: Germany Industry Analysis and outlook Value (US$ Million) Analysis by Ingredient, 2019 to 2034

Figure 71: Germany Industry Analysis and outlook Volume (Units) Analysis by Ingredient, 2019 to 2034

Figure 72: Germany Industry Analysis and outlook Value Share (%) and BPS Analysis by Ingredient, 2024 to 2034

Figure 73: Germany Industry Analysis and outlook Y-o-Y Growth (%) Projections by Ingredient, 2024 to 2034

Figure 74: Germany Industry Analysis and outlook Value (US$ Million) Analysis by Price, 2019 to 2034

Figure 75: Germany Industry Analysis and outlook Volume (Units) Analysis by Price, 2019 to 2034

Figure 76: Germany Industry Analysis and outlook Value Share (%) and BPS Analysis by Price, 2024 to 2034

Figure 77: Germany Industry Analysis and outlook Y-o-Y Growth (%) Projections by Price, 2024 to 2034

Figure 78: Germany Industry Analysis and outlook Value (US$ Million) Analysis by Nature, 2019 to 2034

Figure 79: Germany Industry Analysis and outlook Volume (Units) Analysis by Nature, 2019 to 2034

Figure 80: Germany Industry Analysis and outlook Value Share (%) and BPS Analysis by Nature, 2024 to 2034

Figure 81: Germany Industry Analysis and outlook Y-o-Y Growth (%) Projections by Nature, 2024 to 2034

Figure 82: Germany Industry Analysis and outlook Value (US$ Million) Analysis by Sales Channel, 2019 to 2034

Figure 83: Germany Industry Analysis and outlook Volume (Units) Analysis by Sales Channel, 2019 to 2034

Figure 84: Germany Industry Analysis and outlook Value Share (%) and BPS Analysis by Sales Channel, 2024 to 2034

Figure 85: Germany Industry Analysis and outlook Y-o-Y Growth (%) Projections by Sales Channel, 2024 to 2034

Figure 86: Germany Industry Analysis and outlook Attractiveness by Ingredient, 2024 to 2034

Figure 87: Germany Industry Analysis and outlook Attractiveness by Price, 2024 to 2034

Figure 88: Germany Industry Analysis and outlook Attractiveness by Nature, 2024 to 2034

Figure 89: Germany Industry Analysis and outlook Attractiveness by Sales Channel, 2024 to 2034

Figure 90: Germany Industry Analysis and outlook Attractiveness By Region, 2024 to 2034

Figure 91: Italy Industry Analysis and outlook Value (US$ Million) by Ingredient, 2024 to 2034

Figure 92: Italy Industry Analysis and outlook Value (US$ Million) by Price, 2024 to 2034

Figure 93: Italy Industry Analysis and outlook Value (US$ Million) by Nature, 2024 to 2034

Figure 94: Italy Industry Analysis and outlook Value (US$ Million) by Sales Channel, 2024 to 2034

Figure 95: Italy Industry Analysis and outlook Value (US$ Million) By Region, 2024 to 2034

Figure 96: Italy Industry Analysis and outlook Value (US$ Million) Analysis By Region, 2019 to 2034

Figure 97: Italy Industry Analysis and outlook Volume (Units) Analysis By Region, 2019 to 2034

Figure 98: Italy Industry Analysis and outlook Value Share (%) and BPS Analysis By Region, 2024 to 2034

Figure 99: Italy Industry Analysis and outlook Y-o-Y Growth (%) Projections By Region, 2024 to 2034

Figure 100: Italy Industry Analysis and outlook Value (US$ Million) Analysis by Ingredient, 2019 to 2034

Figure 101: Italy Industry Analysis and outlook Volume (Units) Analysis by Ingredient, 2019 to 2034

Figure 102: Italy Industry Analysis and outlook Value Share (%) and BPS Analysis by Ingredient, 2024 to 2034

Figure 103: Italy Industry Analysis and outlook Y-o-Y Growth (%) Projections by Ingredient, 2024 to 2034

Figure 104: Italy Industry Analysis and outlook Value (US$ Million) Analysis by Price, 2019 to 2034

Figure 105: Italy Industry Analysis and outlook Volume (Units) Analysis by Price, 2019 to 2034

Figure 106: Italy Industry Analysis and outlook Value Share (%) and BPS Analysis by Price, 2024 to 2034

Figure 107: Italy Industry Analysis and outlook Y-o-Y Growth (%) Projections by Price, 2024 to 2034

Figure 108: Italy Industry Analysis and outlook Value (US$ Million) Analysis by Nature, 2019 to 2034

Figure 109: Italy Industry Analysis and outlook Volume (Units) Analysis by Nature, 2019 to 2034

Figure 110: Italy Industry Analysis and outlook Value Share (%) and BPS Analysis by Nature, 2024 to 2034

Figure 111: Italy Industry Analysis and outlook Y-o-Y Growth (%) Projections by Nature, 2024 to 2034

Figure 112: Italy Industry Analysis and outlook Value (US$ Million) Analysis by Sales Channel, 2019 to 2034

Figure 113: Italy Industry Analysis and outlook Volume (Units) Analysis by Sales Channel, 2019 to 2034

Figure 114: Italy Industry Analysis and outlook Value Share (%) and BPS Analysis by Sales Channel, 2024 to 2034

Figure 115: Italy Industry Analysis and outlook Y-o-Y Growth (%) Projections by Sales Channel, 2024 to 2034

Figure 116: Italy Industry Analysis and outlook Attractiveness by Ingredient, 2024 to 2034

Figure 117: Italy Industry Analysis and outlook Attractiveness by Price, 2024 to 2034

Figure 118: Italy Industry Analysis and outlook Attractiveness by Nature, 2024 to 2034

Figure 119: Italy Industry Analysis and outlook Attractiveness by Sales Channel, 2024 to 2034

Figure 120: Italy Industry Analysis and outlook Attractiveness By Region, 2024 to 2034

Figure 121: France Industry Analysis and outlook Value (US$ Million) by Ingredient, 2024 to 2034

Figure 122: France Industry Analysis and outlook Value (US$ Million) by Price, 2024 to 2034

Figure 123: France Industry Analysis and outlook Value (US$ Million) by Nature, 2024 to 2034

Figure 124: France Industry Analysis and outlook Value (US$ Million) by Sales Channel, 2024 to 2034

Figure 125: France Industry Analysis and outlook Value (US$ Million) By Region, 2024 to 2034

Figure 126: France Industry Analysis and outlook Value (US$ Million) Analysis By Region, 2019 to 2034

Figure 127: France Industry Analysis and outlook Volume (Units) Analysis By Region, 2019 to 2034

Figure 128: France Industry Analysis and outlook Value Share (%) and BPS Analysis By Region, 2024 to 2034

Figure 129: France Industry Analysis and outlook Y-o-Y Growth (%) Projections By Region, 2024 to 2034

Figure 130: France Industry Analysis and outlook Value (US$ Million) Analysis by Ingredient, 2019 to 2034

Figure 131: France Industry Analysis and outlook Volume (Units) Analysis by Ingredient, 2019 to 2034

Figure 132: France Industry Analysis and outlook Value Share (%) and BPS Analysis by Ingredient, 2024 to 2034

Figure 133: France Industry Analysis and outlook Y-o-Y Growth (%) Projections by Ingredient, 2024 to 2034

Figure 134: France Industry Analysis and outlook Value (US$ Million) Analysis by Price, 2019 to 2034

Figure 135: France Industry Analysis and outlook Volume (Units) Analysis by Price, 2019 to 2034

Figure 136: France Industry Analysis and outlook Value Share (%) and BPS Analysis by Price, 2024 to 2034

Figure 137: France Industry Analysis and outlook Y-o-Y Growth (%) Projections by Price, 2024 to 2034

Figure 138: France Industry Analysis and outlook Value (US$ Million) Analysis by Nature, 2019 to 2034

Figure 139: France Industry Analysis and outlook Volume (Units) Analysis by Nature, 2019 to 2034

Figure 140: France Industry Analysis and outlook Value Share (%) and BPS Analysis by Nature, 2024 to 2034

Figure 141: France Industry Analysis and outlook Y-o-Y Growth (%) Projections by Nature, 2024 to 2034

Figure 142: France Industry Analysis and outlook Value (US$ Million) Analysis by Sales Channel, 2019 to 2034

Figure 143: France Industry Analysis and outlook Volume (Units) Analysis by Sales Channel, 2019 to 2034

Figure 144: France Industry Analysis and outlook Value Share (%) and BPS Analysis by Sales Channel, 2024 to 2034

Figure 145: France Industry Analysis and outlook Y-o-Y Growth (%) Projections by Sales Channel, 2024 to 2034

Figure 146: France Industry Analysis and outlook Attractiveness by Ingredient, 2024 to 2034

Figure 147: France Industry Analysis and outlook Attractiveness by Price, 2024 to 2034

Figure 148: France Industry Analysis and outlook Attractiveness by Nature, 2024 to 2034

Figure 149: France Industry Analysis and outlook Attractiveness by Sales Channel, 2024 to 2034

Figure 150: France Industry Analysis and outlook Attractiveness By Region, 2024 to 2034

Figure 151: Spain Industry Analysis and outlook Value (US$ Million) by Ingredient, 2024 to 2034

Figure 152: Spain Industry Analysis and outlook Value (US$ Million) by Price, 2024 to 2034

Figure 153: Spain Industry Analysis and outlook Value (US$ Million) by Nature, 2024 to 2034

Figure 154: Spain Industry Analysis and outlook Value (US$ Million) by Sales Channel, 2024 to 2034

Figure 155: Spain Industry Analysis and outlook Value (US$ Million) By Region, 2024 to 2034

Figure 156: Spain Industry Analysis and outlook Value (US$ Million) Analysis By Region, 2019 to 2034

Figure 157: Spain Industry Analysis and outlook Volume (Units) Analysis By Region, 2019 to 2034

Figure 158: Spain Industry Analysis and outlook Value Share (%) and BPS Analysis By Region, 2024 to 2034

Figure 159: Spain Industry Analysis and outlook Y-o-Y Growth (%) Projections By Region, 2024 to 2034

Figure 160: Spain Industry Analysis and outlook Value (US$ Million) Analysis by Ingredient, 2019 to 2034

Figure 161: Spain Industry Analysis and outlook Volume (Units) Analysis by Ingredient, 2019 to 2034

Figure 162: Spain Industry Analysis and outlook Value Share (%) and BPS Analysis by Ingredient, 2024 to 2034

Figure 163: Spain Industry Analysis and outlook Y-o-Y Growth (%) Projections by Ingredient, 2024 to 2034

Figure 164: Spain Industry Analysis and outlook Value (US$ Million) Analysis by Price, 2019 to 2034

Figure 165: Spain Industry Analysis and outlook Volume (Units) Analysis by Price, 2019 to 2034

Figure 166: Spain Industry Analysis and outlook Value Share (%) and BPS Analysis by Price, 2024 to 2034

Figure 167: Spain Industry Analysis and outlook Y-o-Y Growth (%) Projections by Price, 2024 to 2034

Figure 168: Spain Industry Analysis and outlook Value (US$ Million) Analysis by Nature, 2019 to 2034

Figure 169: Spain Industry Analysis and outlook Volume (Units) Analysis by Nature, 2019 to 2034

Figure 170: Spain Industry Analysis and outlook Value Share (%) and BPS Analysis by Nature, 2024 to 2034

Figure 171: Spain Industry Analysis and outlook Y-o-Y Growth (%) Projections by Nature, 2024 to 2034

Figure 172: Spain Industry Analysis and outlook Value (US$ Million) Analysis by Sales Channel, 2019 to 2034

Figure 173: Spain Industry Analysis and outlook Volume (Units) Analysis by Sales Channel, 2019 to 2034

Figure 174: Spain Industry Analysis and outlook Value Share (%) and BPS Analysis by Sales Channel, 2024 to 2034

Figure 175: Spain Industry Analysis and outlook Y-o-Y Growth (%) Projections by Sales Channel, 2024 to 2034

Figure 176: Spain Industry Analysis and outlook Attractiveness by Ingredient, 2024 to 2034

Figure 177: Spain Industry Analysis and outlook Attractiveness by Price, 2024 to 2034

Figure 178: Spain Industry Analysis and outlook Attractiveness by Nature, 2024 to 2034

Figure 179: Spain Industry Analysis and outlook Attractiveness by Sales Channel, 2024 to 2034

Figure 180: Spain Industry Analysis and outlook Attractiveness By Region, 2024 to 2034

Figure 181: Rest of Industry Analysis and outlook Value (US$ Million) by Ingredient, 2024 to 2034

Figure 182: Rest of Industry Analysis and outlook Value (US$ Million) by Price, 2024 to 2034

Figure 183: Rest of Industry Analysis and outlook Value (US$ Million) by Nature, 2024 to 2034

Figure 184: Rest of Industry Analysis and outlook Value (US$ Million) by Sales Channel, 2024 to 2034

Figure 185: Rest of Industry Analysis and outlook Value (US$ Million) Analysis by Ingredient, 2019 to 2034

Figure 186: Rest of Industry Analysis and outlook Volume (Units) Analysis by Ingredient, 2019 to 2034

Figure 187: Rest of Industry Analysis and outlook Value Share (%) and BPS Analysis by Ingredient, 2024 to 2034

Figure 188: Rest of Industry Analysis and outlook Y-o-Y Growth (%) Projections by Ingredient, 2024 to 2034

Figure 189: Rest of Industry Analysis and outlook Value (US$ Million) Analysis by Price, 2019 to 2034

Figure 190: Rest of Industry Analysis and outlook Volume (Units) Analysis by Price, 2019 to 2034

Figure 191: Rest of Industry Analysis and outlook Value Share (%) and BPS Analysis by Price, 2024 to 2034

Figure 192: Rest of Industry Analysis and outlook Y-o-Y Growth (%) Projections by Price, 2024 to 2034

Figure 193: Rest of Industry Analysis and outlook Value (US$ Million) Analysis by Nature, 2019 to 2034

Figure 194: Rest of Industry Analysis and outlook Volume (Units) Analysis by Nature, 2019 to 2034

Figure 195: Rest of Industry Analysis and outlook Value Share (%) and BPS Analysis by Nature, 2024 to 2034

Figure 196: Rest of Industry Analysis and outlook Y-o-Y Growth (%) Projections by Nature, 2024 to 2034

Figure 197: Rest of Industry Analysis and outlook Value (US$ Million) Analysis by Sales Channel, 2019 to 2034

Figure 198: Rest of Industry Analysis and outlook Volume (Units) Analysis by Sales Channel, 2019 to 2034

Figure 199: Rest of Industry Analysis and outlook Value Share (%) and BPS Analysis by Sales Channel, 2024 to 2034

Figure 200: Rest of Industry Analysis and outlook Y-o-Y Growth (%) Projections by Sales Channel, 2024 to 2034

Figure 201: Rest of Industry Analysis and outlook Attractiveness by Ingredient, 2024 to 2034

Figure 202: Rest of Industry Analysis and outlook Attractiveness by Price, 2024 to 2034

Figure 203: Rest of Industry Analysis and outlook Attractiveness by Nature, 2024 to 2034

Figure 204: Rest of Industry Analysis and outlook Attractiveness by Sales Channel, 2024 to 2034

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Western Blotting Processors Market Trends and Forecast 2025 to 2035

Western Blotting Market is segmented by product, application and end user from 2025 to 2035

Western Europe Automotive Performance Tuning & Engine Remapping Market Size and Share Forecast Outlook 2025 to 2035

Western Europe Valve Seat Insert Market Size and Share Forecast Outlook 2025 to 2035

Western Europe Automated People Mover Industry Size and Share Forecast Outlook 2025 to 2035

Western Europe Bicycle Component Aftermarket Analysis Size and Share Forecast Outlook 2025 to 2035

Western Europe Automotive Load Floor IndustryAnalysis in Western Europe Forecast & Analysis 2025 to 2035

Western Europe Probiotic Supplement Market Analysis in – Growth & Market Trends from 2025 to 2035

Western Europe Women’s Intimate Care Market Analysis – Size, Share & Trends 2025 to 2035

Western Europe Non-Dairy Creamer Market Analysis by Growth, Trends and Forecast from 2025 to 2035

Western Europe Last-mile Delivery Software Market – Growth & Outlook through 2035

Western Europe Inkjet Printer Market – Growth & Forecast 2025 to 2035

Western Europe HVDC Transmission System Market – Growth & Forecast 2025 to 2035

Conference Room Solution Market Growth – Trends & Forecast 2025 to 2035

Western Europe Intelligent Enterprise Data Capture Software Market - Growth & Forecast 2025-2035

Communications Platform as a Service (CPaaS) Market Growth - Trends & Forecast 2025 to 2035

Visitor Management System Industry Analysis in Western Europe - Market Outlook 2025 to 2035

Western Europe Base Station Antenna Market - Growth & Demand 2025 to 2035

Western Europe Banking-as-a-Service (BaaS) Platform Market - Growth & Demand 2025 to 2035

Western Europe Event Management Software Market Trends – Growth & Forecast 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA