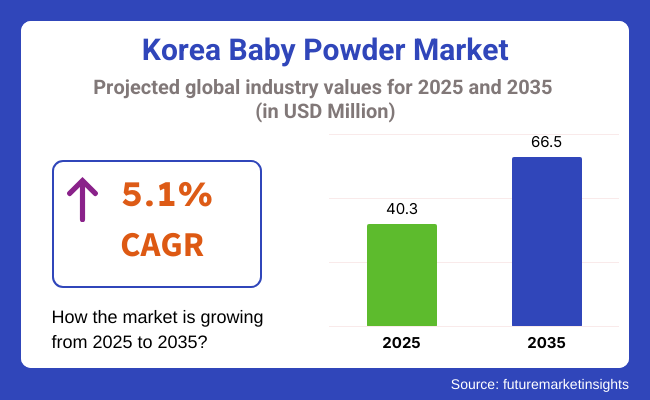

The Korea baby powder market is poised to register a valuation of USD 40.3 million in 2025. The industry is slated to grow at 5.1% CAGR from 2025 to 2035, witnessing USD 66.5 million by 2035. The market is on a steady rise as a result of a combination of cultural, demographic, and lifestyle changes that are influencing consumer behavior.

Among the primary drivers is increased awareness among parents regarding infant skin care, as there is greater preference for hypoallergenic, chemical-free products that are gentle on skin. Korean consumers, who are used to prioritizing skincare and hygiene, are now applying the same standards to baby care, creating increased demand for premium, dermatologically-tested powders.

South Korea's birth rate, although one of the lowest in the world, is experiencing policy-facilitated support for having children and being a parent, including government subsidies and longer parental leave. All this is causing new parents to spend more on high-quality baby products, treating them as necessities rather than luxuries.

Combined with this is the growth in dual-income households, which has resulted in greater disposable income for families to spend on reliable, safe baby care brands.Parents tend to seek peer opinions, parenting communities, and influencer suggestions, which largely drive purchasing choices.

Product innovation at the local level, with companies launching powders based on natural or organic contents, has also solidified consumer faith and interest. Additionally, increased fears regarding skin issues such as diaper rash and eczema have established baby powder as a household favorite.

The growth can be attributed to e-commerce expansion, convenience, and expanded product availability, especially for special or natural baby powder products. All these variables combined - the health-focused nature of parenting, enhanced affordability, online influence, and product innovations - are promoting the Korea market growth, even against a low-birthrate scenario.

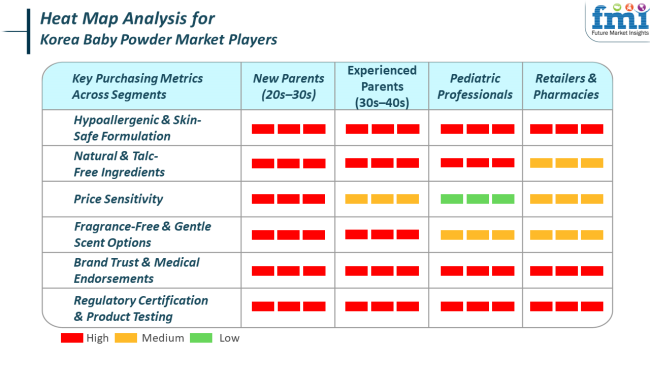

In Korea's market, purchasing trends vary by end-use segment, responding to specific needs and preferences. Among consumers who are household members, including parents and caregivers, there is a strong preference for safety, skin sensitivity, and ingredient transparency.

Korean parents are very well-informed and tend to read product labels carefully for toxic chemicals such as talc, parabens, and artificial scents. Demand for natural, hypoallergenic, and dermatologically tested powders is increasing due to a wider cultural emphasis on skincare and health. Parents also increasingly use online reviews, parenting forums, and social media influencers to inform their choices, so brand reputation and online presence are key.

In maternity clinics and hospitals, medical safety and functionality are paramount. These facilities look for products with high standards of hygiene and clinical requirements. Baby powders utilized in these institutions should be gentle, non-irritating, and approved for newborn or sensitive skin.

Branding and packaging are not as important in this case; rather, emphasis is placed on whether the product is sterile, easy to apply, and without allergens. Since a lot of new parents get introduced to baby care products during hospital visits, the products employed in these institutions have the potential to make lasting impressions on future consumer behavior.

Nurseries and childcare centers, however, work with a combination of practicality and safety. These institutions deal with multiple children at a time, so they need baby powders that work well, are within budget, and effective for regular use. Although cost is a larger factor in this segment, rising parental expectations mean that caregivers are increasingly choosing quality products that offer minimum safety and quality features. There is also increased awareness among caregivers about using non-toxic and mild products, particularly for sensitive-skinned or allergic children.

Between 2020 and 2024, the Korean market experienced significant changes fueled by shifting consumer consciousness, regulatory pressures, and changing lifestyles. Perhaps the most dramatic change was the trend away from talc-based powders because of international safety concerns and increasing skepticism over potentially unsafe ingredients.

Korean parents, who are already very particular about skincare, started looking for clean-label options-products with natural, plant-based, and hypoallergenic ingredients. This decade also witnessed the emergence of organic and dermatologist-approved baby powders, with companies competing to win the trust of consumers with openness and safety certification.

From 2025 to 2035, the market is anticipated to develop further along the lines of personalization, sustainability, and scientific advancement. With sustained low birth rates, the market will tend to focus on quality rather than quantity-parents will spend more on high-end, niche products that address specific skin concerns like eczema, sensitivity, or even fragrance preferences. Emergence of functional powders with added probiotics, herbal extracts, or skin barrier-enhancing ingredients is also expected.

Comparative Industry Shift Analysis (2020 to 2024 vs. 2025 to 2035)

| 2020 to 2024 | 2025 to 2035 |

|---|---|

| As global safety issues surrounding talc grew, Korean parents quickly shifted towards talc-free powders with clean and low-level ingredient statements. | The future holds a shift towards baby powders that not only guard skin but also perform particular functions-such as soothing inflamed skin, promoting skin microbiome health, or preventing eczema flare-ups. |

| Parents moved strongly towards e-commerce, particularly during the pandemic. Product discovery, comparison, and reviews were predominantly conducted via parenting blogs, social media, and influencer posts. | Purchase decisions will be increasingly technology-led, with tailored product recommendations based on a baby's skin type, age, or known allergies. AI-driven mobile apps, virtual consultations, and machine learning-powered product filters will lead parents to the best products quickly and assuredly. |

| Customers started to look for brands to disclose completely everything that goes into their baby care items. | Packaging will not only safeguard products. With QR codes and intelligent labels, parents will be able to see real-time information about sourcing, usage instructions, sustainability initiatives, and e ven batch-level quality control. |

| COVID-19 raised the level of hygiene awareness, compelling parents to seek powders that were protective against skin irritation while having a clean, sanitary reputation. | The market will shift from basic hygiene to a more general wellness focus. Baby powders will be viewed as a component of everyday skincare regimens that promote long-term skin health, comfort, and emotional well-being-combining traditional care with holistic benefits. |

The Korea baby powder market, though experiencing consistent growth, is confronted with a number of underlying threats that may impact its long-term stability and growth. Perhaps the most immediate challenge is the nation's chronically low birth rate. As the number of births keeps falling each year, the very foundation consumer base for baby care products is progressively diminishing.

Another major threat is the changing regulatory landscape. With increased focus on ingredient safety, particularly around talc and artificial additives, the industry needs to keep pace with revised safety standards and consumer protection legislation at all times.

Any adverse publicity or litigation over baby powder ingredients-like those experienced worldwide-could quickly undermine consumer confidence and brand reputation, even if the products themselves are safe according to local standards. This renders proactive compliance, transparency, and third-party testing necessary but possibly expensive for manufacturers.

Over the past few years, corn-starch-based powders have become the first choice among Korean parents and caregivers, slowly replacing traditional talc-based products. This is primarily due to increasing concerns regarding the safety and long-term health effects of talc, particularly following international controversies and lawsuits that associated the use of talc with respiratory problems and, in certain international instances, even cancer.

Powders made from corn starch are viewed as safer, softer, and more natural. Coming from a well-known plant source, corn starch provides the same moisture-drawing and calming qualities of talc but without the same degree of perceived risk.

Korean consumers, already highly committed to clean and transparent beauty and skincare standards, are drawn to those same values even in the category of baby care. The growth of "clean baby care" follows adult skincare trends, with a focus on hypoallergenic, dermatologically tested, and chemical-free products, which powders based on corn starch often meet.

Among the different channels of sales, online stores have become the leading and most sought-after platform for buying baby powders in South Korea. The trend has been gaining momentum in recent years with the e-commerce industry witnessing massive growth, propelled by heightened digital activity and the extensive use of online shopping across all age groups. Online stores lead the market because of their convenience, affordability, and availability of a large variety of products.

The growth in e-commerce has been especially steep in the baby care category, where parents tend to favor research, comparison of products, and reviews before purchasing. E-commerce sites like Coupang, Gmarket, and 11st provide detailed product descriptions, customer reviews, and convenient price comparisons, which assist in making well-informed buying decisions. In addition, the ease of home delivery and the convenience of being able to quickly see product availability make online stores a good choice for busy parents who might not want to go to stores.

The Korean market is defined by a mix of international consumer brands and specialty players in baby care, each offering unique capabilities to address Korea's increasingly health- and ingredient-aware parenting segment.

Global behemoths like Johnson & Johnson, Kimberly-Clark Corp, and Oriflame Holding AG provide mass-market brand trust and extensive distribution, whereas emerging and niche brands like Mamaearth, MeeMee, and Mann & Schröder GmbH meet increasing demand for organic, talc-free, and natural formulations.

Key Company Share Analysis

| Company Name | Estimated Industry Share (%) |

|---|---|

| Johnson & Johnson | 10-12% |

| Kimberly-Clark Corp | 8-10% |

| Oriflame Holding AG | 6-8% |

| Mamaearth | 5-7% |

| Lion Corporation | 5-7% |

| Mann & Schröder GmbH | 4-6% |

| Mee Mee | 3-5% |

| Mothercare | 3-5% |

| Libero | 2-4% |

| Osotspa Company Limited | 2-4% |

| Company Name | Key Offerings & Activities |

|---|---|

| Johnson & Johnson | A leading player with far-reaching brand trust, manufacturing talc-free and cornstarch -based baby powders. Highly used in Korean homes and maternity hospitals due to its gentle formulations. |

| Kimberly-Clark Corp | Renowned for its baby care product lines under the Huggies brand, it provides complementary baby skincare such as powders. Robust retail alliances and extensive distribution channels in Korea. |

| Oriflame Holding AG | A Swedish brand selling natural ingredient-based baby powders, commonly sold through direct selling and online platforms. Targets health-aware parents looking for plant-based products. |

| Mamaearth | An Indian-origin clean beauty and baby care brand, popular in Korea for its toxin-free, cornstarch -based baby powders infused with herbs. High digital presence and eco-branding. |

| Lion Corporation | A Japanese brand with a presence in Korea, famous for safe and efficient personal care products, such as baby powder for sensitive skin. Quality is well known for being consistent. |

| Mann & Schröder GmbH | German producer selling high-quality baby care products under brands such as Sanosan. Specializes in dermatologically tested, talc-free baby powders popular in Korean hospitals and nurseries. |

| Mee Mee | An Indian brand found in Korea via specialty baby shops and e-commerce sites. Provides affordable cornstarch -based powders suitable for frequent household use. |

| Mothercare | A British baby store brand with expertly selected products of baby powders from reliable, safe sources. Its brand strength is the bundling of products for new parents via retail and online packs. |

| Libero | More famous for its nappies, Libero also distributes baby care products such as powder. Its gentle care and skin-friendly approach appeals to environmentally conscious Korean parents. |

| Osotspa Company Limited | A Thai company famous for its traditional baby powder brands in Southeast Asia. In Korea, it caters to niche markets and ethnic groups familiar with its traditional formulas. |

The Korea baby powder industry is getting more segmented as foreign and local players vie to meet changing consumer demands that revolve around safety, skin sensitivity, and eco-friendliness. The anchor brands such as Johnson & Johnson and Kimberly-Clark gain leverage from countrywide retail chains, but new players such as Mamaearth and Mann & Schröder GmbH are growing with clean-label promotion, natural positioning, and large-scale digital presence.

With the increase in low birth rates, businesses are shifting their attention towards high-end offerings instead of high-volume sales. There is also an increasing demand for sustainability, reflected in packaging and ingredient sourcing. Growth in the future will most likely be fueled by those businesses that integrate science-supported skin benefits, green brand positioning, and innovative delivery models (e.g., online subscriptions, curated baby care kits).

With respect to ingredient, the market is classified into talc-based and corn-starch-based.

In terms of price, the industry is bifurcated into mass and premium.

Based on nature, the industry is classified into organic and conventional.

In terms of sales channel, the industry is divided into direct sales, modern trade, convenience stores, departmental stores, specialty stores, mono brand stores, online retailers, drug stores, and other sales channels.

Regionally, the industry is divided into South Gyeongsang, North Jeolla, South Jeolla, Jeju, and the rest of Korea.

The industry is expected to reach USD 40.3 million in 2025.

The industry is projected to witness USD 66.5 million by 2035.

The industry is slated to grow at 5.1% CAGR during the study period.

Online stores are widely preferred.

Leading companies include Johnson & Johnson, Kimberly-Clark Corp, Libero, Lion Corporation, Mamaearth, Mann & Schröder GmbH, Mee Mee, Mothercare, Oriflame Holding AG, and Osotspa Company Limited.

Table 1: Industry Analysis and Outlook Value (US$ Million) Forecast by Region, 2019 to 2034

Table 2: Industry Analysis and Outlook Volume (Units) Forecast by Region, 2019 to 2034

Table 3: Industry Analysis and Outlook Value (US$ Million) Forecast by Ingredient, 2019 to 2034

Table 4: Industry Analysis and Outlook Volume (Units) Forecast by Ingredient, 2019 to 2034

Table 5: Industry Analysis and Outlook Value (US$ Million) Forecast by Price, 2019 to 2034

Table 6: Industry Analysis and Outlook Volume (Units) Forecast by Price, 2019 to 2034

Table 7: Industry Analysis and Outlook Value (US$ Million) Forecast by Nature, 2019 to 2034

Table 8: Industry Analysis and Outlook Volume (Units) Forecast by Nature, 2019 to 2034

Table 9: Industry Analysis and Outlook Value (US$ Million) Forecast by Sales Channel, 2019 to 2034

Table 10: Industry Analysis and Outlook Volume (Units) Forecast by Sales Channel, 2019 to 2034

Table 11: South Gyeongsang Industry Analysis and Outlook Value (US$ Million) Forecast by Ingredient, 2019 to 2034

Table 12: South Gyeongsang Industry Analysis and Outlook Volume (Units) Forecast by Ingredient, 2019 to 2034

Table 13: South Gyeongsang Industry Analysis and Outlook Value (US$ Million) Forecast by Price, 2019 to 2034

Table 14: South Gyeongsang Industry Analysis and Outlook Volume (Units) Forecast by Price, 2019 to 2034

Table 15: South Gyeongsang Industry Analysis and Outlook Value (US$ Million) Forecast by Nature, 2019 to 2034

Table 16: South Gyeongsang Industry Analysis and Outlook Volume (Units) Forecast by Nature, 2019 to 2034

Table 17: South Gyeongsang Industry Analysis and Outlook Value (US$ Million) Forecast by Sales Channel, 2019 to 2034

Table 18: South Gyeongsang Industry Analysis and Outlook Volume (Units) Forecast by Sales Channel, 2019 to 2034

Table 19: North Jeolla Industry Analysis and Outlook Value (US$ Million) Forecast by Ingredient, 2019 to 2034

Table 20: North Jeolla Industry Analysis and Outlook Volume (Units) Forecast by Ingredient, 2019 to 2034

Table 21: North Jeolla Industry Analysis and Outlook Value (US$ Million) Forecast by Price, 2019 to 2034

Table 22: North Jeolla Industry Analysis and Outlook Volume (Units) Forecast by Price, 2019 to 2034

Table 23: North Jeolla Industry Analysis and Outlook Value (US$ Million) Forecast by Nature, 2019 to 2034

Table 24: North Jeolla Industry Analysis and Outlook Volume (Units) Forecast by Nature, 2019 to 2034

Table 25: North Jeolla Industry Analysis and Outlook Value (US$ Million) Forecast by Sales Channel, 2019 to 2034

Table 26: North Jeolla Industry Analysis and Outlook Volume (Units) Forecast by Sales Channel, 2019 to 2034

Table 27: South Jeolla Industry Analysis and Outlook Value (US$ Million) Forecast by Ingredient, 2019 to 2034

Table 28: South Jeolla Industry Analysis and Outlook Volume (Units) Forecast by Ingredient, 2019 to 2034

Table 29: South Jeolla Industry Analysis and Outlook Value (US$ Million) Forecast by Price, 2019 to 2034

Table 30: South Jeolla Industry Analysis and Outlook Volume (Units) Forecast by Price, 2019 to 2034

Table 31: South Jeolla Industry Analysis and Outlook Value (US$ Million) Forecast by Nature, 2019 to 2034

Table 32: South Jeolla Industry Analysis and Outlook Volume (Units) Forecast by Nature, 2019 to 2034

Table 33: South Jeolla Industry Analysis and Outlook Value (US$ Million) Forecast by Sales Channel, 2019 to 2034

Table 34: South Jeolla Industry Analysis and Outlook Volume (Units) Forecast by Sales Channel, 2019 to 2034

Table 35: Jeju Industry Analysis and Outlook Value (US$ Million) Forecast by Ingredient, 2019 to 2034

Table 36: Jeju Industry Analysis and Outlook Volume (Units) Forecast by Ingredient, 2019 to 2034

Table 37: Jeju Industry Analysis and Outlook Value (US$ Million) Forecast by Price, 2019 to 2034

Table 38: Jeju Industry Analysis and Outlook Volume (Units) Forecast by Price, 2019 to 2034

Table 39: Jeju Industry Analysis and Outlook Value (US$ Million) Forecast by Nature, 2019 to 2034

Table 40: Jeju Industry Analysis and Outlook Volume (Units) Forecast by Nature, 2019 to 2034

Table 41: Jeju Industry Analysis and Outlook Value (US$ Million) Forecast by Sales Channel, 2019 to 2034

Table 42: Jeju Industry Analysis and Outlook Volume (Units) Forecast by Sales Channel, 2019 to 2034

Table 43: Rest of Industry Analysis and Outlook Value (US$ Million) Forecast by Ingredient, 2019 to 2034

Table 44: Rest of Industry Analysis and Outlook Volume (Units) Forecast by Ingredient, 2019 to 2034

Table 45: Rest of Industry Analysis and Outlook Value (US$ Million) Forecast by Price, 2019 to 2034

Table 46: Rest of Industry Analysis and Outlook Volume (Units) Forecast by Price, 2019 to 2034

Table 47: Rest of Industry Analysis and Outlook Value (US$ Million) Forecast by Nature, 2019 to 2034

Table 48: Rest of Industry Analysis and Outlook Volume (Units) Forecast by Nature, 2019 to 2034

Table 49: Rest of Industry Analysis and Outlook Value (US$ Million) Forecast by Sales Channel, 2019 to 2034

Table 50: Rest of Industry Analysis and Outlook Volume (Units) Forecast by Sales Channel, 2019 to 2034

Figure 1: Industry Analysis and Outlook Value (US$ Million) by Ingredient, 2024 to 2034

Figure 2: Industry Analysis and Outlook Value (US$ Million) by Price, 2024 to 2034

Figure 3: Industry Analysis and Outlook Value (US$ Million) by Nature, 2024 to 2034

Figure 4: Industry Analysis and Outlook Value (US$ Million) by Sales Channel, 2024 to 2034

Figure 5: Industry Analysis and Outlook Value (US$ Million) by Region, 2024 to 2034

Figure 6: Industry Analysis and Outlook Value (US$ Million) Analysis by Region, 2019 to 2034

Figure 7: Industry Analysis and Outlook Volume (Units) Analysis by Region, 2019 to 2034

Figure 8: Industry Analysis and Outlook Value Share (%) and BPS Analysis by Region, 2024 to 2034

Figure 9: Industry Analysis and Outlook Y-o-Y Growth (%) Projections by Region, 2024 to 2034

Figure 10: Industry Analysis and Outlook Value (US$ Million) Analysis by Ingredient, 2019 to 2034

Figure 11: Industry Analysis and Outlook Volume (Units) Analysis by Ingredient, 2019 to 2034

Figure 12: Industry Analysis and Outlook Value Share (%) and BPS Analysis by Ingredient, 2024 to 2034

Figure 13: Industry Analysis and Outlook Y-o-Y Growth (%) Projections by Ingredient, 2024 to 2034

Figure 14: Industry Analysis and Outlook Value (US$ Million) Analysis by Price, 2019 to 2034

Figure 15: Industry Analysis and Outlook Volume (Units) Analysis by Price, 2019 to 2034

Figure 16: Industry Analysis and Outlook Value Share (%) and BPS Analysis by Price, 2024 to 2034

Figure 17: Industry Analysis and Outlook Y-o-Y Growth (%) Projections by Price, 2024 to 2034

Figure 18: Industry Analysis and Outlook Value (US$ Million) Analysis by Nature, 2019 to 2034

Figure 19: Industry Analysis and Outlook Volume (Units) Analysis by Nature, 2019 to 2034

Figure 20: Industry Analysis and Outlook Value Share (%) and BPS Analysis by Nature, 2024 to 2034

Figure 21: Industry Analysis and Outlook Y-o-Y Growth (%) Projections by Nature, 2024 to 2034

Figure 22: Industry Analysis and Outlook Value (US$ Million) Analysis by Sales Channel, 2019 to 2034

Figure 23: Industry Analysis and Outlook Volume (Units) Analysis by Sales Channel, 2019 to 2034

Figure 24: Industry Analysis and Outlook Value Share (%) and BPS Analysis by Sales Channel, 2024 to 2034

Figure 25: Industry Analysis and Outlook Y-o-Y Growth (%) Projections by Sales Channel, 2024 to 2034

Figure 26: Industry Analysis and Outlook Attractiveness by Ingredient, 2024 to 2034

Figure 27: Industry Analysis and Outlook Attractiveness by Price, 2024 to 2034

Figure 28: Industry Analysis and Outlook Attractiveness by Nature, 2024 to 2034

Figure 29: Industry Analysis and Outlook Attractiveness by Sales Channel, 2024 to 2034

Figure 30: Industry Analysis and Outlook Attractiveness by Region, 2024 to 2034

Figure 31: South Gyeongsang Industry Analysis and Outlook Value (US$ Million) by Ingredient, 2024 to 2034

Figure 32: South Gyeongsang Industry Analysis and Outlook Value (US$ Million) by Price, 2024 to 2034

Figure 33: South Gyeongsang Industry Analysis and Outlook Value (US$ Million) by Nature, 2024 to 2034

Figure 34: South Gyeongsang Industry Analysis and Outlook Value (US$ Million) by Sales Channel, 2024 to 2034

Figure 35: South Gyeongsang Industry Analysis and Outlook Value (US$ Million) Analysis by Ingredient, 2019 to 2034

Figure 36: South Gyeongsang Industry Analysis and Outlook Volume (Units) Analysis by Ingredient, 2019 to 2034

Figure 37: South Gyeongsang Industry Analysis and Outlook Value Share (%) and BPS Analysis by Ingredient, 2024 to 2034

Figure 38: South Gyeongsang Industry Analysis and Outlook Y-o-Y Growth (%) Projections by Ingredient, 2024 to 2034

Figure 39: South Gyeongsang Industry Analysis and Outlook Value (US$ Million) Analysis by Price, 2019 to 2034

Figure 40: South Gyeongsang Industry Analysis and Outlook Volume (Units) Analysis by Price, 2019 to 2034

Figure 41: South Gyeongsang Industry Analysis and Outlook Value Share (%) and BPS Analysis by Price, 2024 to 2034

Figure 42: South Gyeongsang Industry Analysis and Outlook Y-o-Y Growth (%) Projections by Price, 2024 to 2034

Figure 43: South Gyeongsang Industry Analysis and Outlook Value (US$ Million) Analysis by Nature, 2019 to 2034

Figure 44: South Gyeongsang Industry Analysis and Outlook Volume (Units) Analysis by Nature, 2019 to 2034

Figure 45: South Gyeongsang Industry Analysis and Outlook Value Share (%) and BPS Analysis by Nature, 2024 to 2034

Figure 46: South Gyeongsang Industry Analysis and Outlook Y-o-Y Growth (%) Projections by Nature, 2024 to 2034

Figure 47: South Gyeongsang Industry Analysis and Outlook Value (US$ Million) Analysis by Sales Channel, 2019 to 2034

Figure 48: South Gyeongsang Industry Analysis and Outlook Volume (Units) Analysis by Sales Channel, 2019 to 2034

Figure 49: South Gyeongsang Industry Analysis and Outlook Value Share (%) and BPS Analysis by Sales Channel, 2024 to 2034

Figure 50: South Gyeongsang Industry Analysis and Outlook Y-o-Y Growth (%) Projections by Sales Channel, 2024 to 2034

Figure 51: South Gyeongsang Industry Analysis and Outlook Attractiveness by Ingredient, 2024 to 2034

Figure 52: South Gyeongsang Industry Analysis and Outlook Attractiveness by Price, 2024 to 2034

Figure 53: South Gyeongsang Industry Analysis and Outlook Attractiveness by Nature, 2024 to 2034

Figure 54: South Gyeongsang Industry Analysis and Outlook Attractiveness by Sales Channel, 2024 to 2034

Figure 55: North Jeolla Industry Analysis and Outlook Value (US$ Million) by Ingredient, 2024 to 2034

Figure 56: North Jeolla Industry Analysis and Outlook Value (US$ Million) by Price, 2024 to 2034

Figure 57: North Jeolla Industry Analysis and Outlook Value (US$ Million) by Nature, 2024 to 2034

Figure 58: North Jeolla Industry Analysis and Outlook Value (US$ Million) by Sales Channel, 2024 to 2034

Figure 59: North Jeolla Industry Analysis and Outlook Value (US$ Million) Analysis by Ingredient, 2019 to 2034

Figure 60: North Jeolla Industry Analysis and Outlook Volume (Units) Analysis by Ingredient, 2019 to 2034

Figure 61: North Jeolla Industry Analysis and Outlook Value Share (%) and BPS Analysis by Ingredient, 2024 to 2034

Figure 62: North Jeolla Industry Analysis and Outlook Y-o-Y Growth (%) Projections by Ingredient, 2024 to 2034

Figure 63: North Jeolla Industry Analysis and Outlook Value (US$ Million) Analysis by Price, 2019 to 2034

Figure 64: North Jeolla Industry Analysis and Outlook Volume (Units) Analysis by Price, 2019 to 2034

Figure 65: North Jeolla Industry Analysis and Outlook Value Share (%) and BPS Analysis by Price, 2024 to 2034

Figure 66: North Jeolla Industry Analysis and Outlook Y-o-Y Growth (%) Projections by Price, 2024 to 2034

Figure 67: North Jeolla Industry Analysis and Outlook Value (US$ Million) Analysis by Nature, 2019 to 2034

Figure 68: North Jeolla Industry Analysis and Outlook Volume (Units) Analysis by Nature, 2019 to 2034

Figure 69: North Jeolla Industry Analysis and Outlook Value Share (%) and BPS Analysis by Nature, 2024 to 2034

Figure 70: North Jeolla Industry Analysis and Outlook Y-o-Y Growth (%) Projections by Nature, 2024 to 2034

Figure 71: North Jeolla Industry Analysis and Outlook Value (US$ Million) Analysis by Sales Channel, 2019 to 2034

Figure 72: North Jeolla Industry Analysis and Outlook Volume (Units) Analysis by Sales Channel, 2019 to 2034

Figure 73: North Jeolla Industry Analysis and Outlook Value Share (%) and BPS Analysis by Sales Channel, 2024 to 2034

Figure 74: North Jeolla Industry Analysis and Outlook Y-o-Y Growth (%) Projections by Sales Channel, 2024 to 2034

Figure 75: North Jeolla Industry Analysis and Outlook Attractiveness by Ingredient, 2024 to 2034

Figure 76: North Jeolla Industry Analysis and Outlook Attractiveness by Price, 2024 to 2034

Figure 77: North Jeolla Industry Analysis and Outlook Attractiveness by Nature, 2024 to 2034

Figure 78: North Jeolla Industry Analysis and Outlook Attractiveness by Sales Channel, 2024 to 2034

Figure 79: South Jeolla Industry Analysis and Outlook Value (US$ Million) by Ingredient, 2024 to 2034

Figure 80: South Jeolla Industry Analysis and Outlook Value (US$ Million) by Price, 2024 to 2034

Figure 81: South Jeolla Industry Analysis and Outlook Value (US$ Million) by Nature, 2024 to 2034

Figure 82: South Jeolla Industry Analysis and Outlook Value (US$ Million) by Sales Channel, 2024 to 2034

Figure 83: South Jeolla Industry Analysis and Outlook Value (US$ Million) Analysis by Ingredient, 2019 to 2034

Figure 84: South Jeolla Industry Analysis and Outlook Volume (Units) Analysis by Ingredient, 2019 to 2034

Figure 85: South Jeolla Industry Analysis and Outlook Value Share (%) and BPS Analysis by Ingredient, 2024 to 2034

Figure 86: South Jeolla Industry Analysis and Outlook Y-o-Y Growth (%) Projections by Ingredient, 2024 to 2034

Figure 87: South Jeolla Industry Analysis and Outlook Value (US$ Million) Analysis by Price, 2019 to 2034

Figure 88: South Jeolla Industry Analysis and Outlook Volume (Units) Analysis by Price, 2019 to 2034

Figure 89: South Jeolla Industry Analysis and Outlook Value Share (%) and BPS Analysis by Price, 2024 to 2034

Figure 90: South Jeolla Industry Analysis and Outlook Y-o-Y Growth (%) Projections by Price, 2024 to 2034

Figure 91: South Jeolla Industry Analysis and Outlook Value (US$ Million) Analysis by Nature, 2019 to 2034

Figure 92: South Jeolla Industry Analysis and Outlook Volume (Units) Analysis by Nature, 2019 to 2034

Figure 93: South Jeolla Industry Analysis and Outlook Value Share (%) and BPS Analysis by Nature, 2024 to 2034

Figure 94: South Jeolla Industry Analysis and Outlook Y-o-Y Growth (%) Projections by Nature, 2024 to 2034

Figure 95: South Jeolla Industry Analysis and Outlook Value (US$ Million) Analysis by Sales Channel, 2019 to 2034

Figure 96: South Jeolla Industry Analysis and Outlook Volume (Units) Analysis by Sales Channel, 2019 to 2034

Figure 97: South Jeolla Industry Analysis and Outlook Value Share (%) and BPS Analysis by Sales Channel, 2024 to 2034

Figure 98: South Jeolla Industry Analysis and Outlook Y-o-Y Growth (%) Projections by Sales Channel, 2024 to 2034

Figure 99: South Jeolla Industry Analysis and Outlook Attractiveness by Ingredient, 2024 to 2034

Figure 100: South Jeolla Industry Analysis and Outlook Attractiveness by Price, 2024 to 2034

Figure 101: South Jeolla Industry Analysis and Outlook Attractiveness by Nature, 2024 to 2034

Figure 102: South Jeolla Industry Analysis and Outlook Attractiveness by Sales Channel, 2024 to 2034

Figure 103: Jeju Industry Analysis and Outlook Value (US$ Million) by Ingredient, 2024 to 2034

Figure 104: Jeju Industry Analysis and Outlook Value (US$ Million) by Price, 2024 to 2034

Figure 105: Jeju Industry Analysis and Outlook Value (US$ Million) by Nature, 2024 to 2034

Figure 106: Jeju Industry Analysis and Outlook Value (US$ Million) by Sales Channel, 2024 to 2034

Figure 107: Jeju Industry Analysis and Outlook Value (US$ Million) Analysis by Ingredient, 2019 to 2034

Figure 108: Jeju Industry Analysis and Outlook Volume (Units) Analysis by Ingredient, 2019 to 2034

Figure 109: Jeju Industry Analysis and Outlook Value Share (%) and BPS Analysis by Ingredient, 2024 to 2034

Figure 110: Jeju Industry Analysis and Outlook Y-o-Y Growth (%) Projections by Ingredient, 2024 to 2034

Figure 111: Jeju Industry Analysis and Outlook Value (US$ Million) Analysis by Price, 2019 to 2034

Figure 112: Jeju Industry Analysis and Outlook Volume (Units) Analysis by Price, 2019 to 2034

Figure 113: Jeju Industry Analysis and Outlook Value Share (%) and BPS Analysis by Price, 2024 to 2034

Figure 114: Jeju Industry Analysis and Outlook Y-o-Y Growth (%) Projections by Price, 2024 to 2034

Figure 115: Jeju Industry Analysis and Outlook Value (US$ Million) Analysis by Nature, 2019 to 2034

Figure 116: Jeju Industry Analysis and Outlook Volume (Units) Analysis by Nature, 2019 to 2034

Figure 117: Jeju Industry Analysis and Outlook Value Share (%) and BPS Analysis by Nature, 2024 to 2034

Figure 118: Jeju Industry Analysis and Outlook Y-o-Y Growth (%) Projections by Nature, 2024 to 2034

Figure 119: Jeju Industry Analysis and Outlook Value (US$ Million) Analysis by Sales Channel, 2019 to 2034

Figure 120: Jeju Industry Analysis and Outlook Volume (Units) Analysis by Sales Channel, 2019 to 2034

Figure 121: Jeju Industry Analysis and Outlook Value Share (%) and BPS Analysis by Sales Channel, 2024 to 2034

Figure 122: Jeju Industry Analysis and Outlook Y-o-Y Growth (%) Projections by Sales Channel, 2024 to 2034

Figure 123: Jeju Industry Analysis and Outlook Attractiveness by Ingredient, 2024 to 2034

Figure 124: Jeju Industry Analysis and Outlook Attractiveness by Price, 2024 to 2034

Figure 125: Jeju Industry Analysis and Outlook Attractiveness by Nature, 2024 to 2034

Figure 126: Jeju Industry Analysis and Outlook Attractiveness by Sales Channel, 2024 to 2034

Figure 127: Rest of Industry Analysis and Outlook Value (US$ Million) by Ingredient, 2024 to 2034

Figure 128: Rest of Industry Analysis and Outlook Value (US$ Million) by Price, 2024 to 2034

Figure 129: Rest of Industry Analysis and Outlook Value (US$ Million) by Nature, 2024 to 2034

Figure 130: Rest of Industry Analysis and Outlook Value (US$ Million) by Sales Channel, 2024 to 2034

Figure 131: Rest of Industry Analysis and Outlook Value (US$ Million) Analysis by Ingredient, 2019 to 2034

Figure 132: Rest of Industry Analysis and Outlook Volume (Units) Analysis by Ingredient, 2019 to 2034

Figure 133: Rest of Industry Analysis and Outlook Value Share (%) and BPS Analysis by Ingredient, 2024 to 2034

Figure 134: Rest of Industry Analysis and Outlook Y-o-Y Growth (%) Projections by Ingredient, 2024 to 2034

Figure 135: Rest of Industry Analysis and Outlook Value (US$ Million) Analysis by Price, 2019 to 2034

Figure 136: Rest of Industry Analysis and Outlook Volume (Units) Analysis by Price, 2019 to 2034

Figure 137: Rest of Industry Analysis and Outlook Value Share (%) and BPS Analysis by Price, 2024 to 2034

Figure 138: Rest of Industry Analysis and Outlook Y-o-Y Growth (%) Projections by Price, 2024 to 2034

Figure 139: Rest of Industry Analysis and Outlook Value (US$ Million) Analysis by Nature, 2019 to 2034

Figure 140: Rest of Industry Analysis and Outlook Volume (Units) Analysis by Nature, 2019 to 2034

Figure 141: Rest of Industry Analysis and Outlook Value Share (%) and BPS Analysis by Nature, 2024 to 2034

Figure 142: Rest of Industry Analysis and Outlook Y-o-Y Growth (%) Projections by Nature, 2024 to 2034

Figure 143: Rest of Industry Analysis and Outlook Value (US$ Million) Analysis by Sales Channel, 2019 to 2034

Figure 144: Rest of Industry Analysis and Outlook Volume (Units) Analysis by Sales Channel, 2019 to 2034

Figure 145: Rest of Industry Analysis and Outlook Value Share (%) and BPS Analysis by Sales Channel, 2024 to 2034

Figure 146: Rest of Industry Analysis and Outlook Y-o-Y Growth (%) Projections by Sales Channel, 2024 to 2034

Figure 147: Rest of Industry Analysis and Outlook Attractiveness by Ingredient, 2024 to 2034

Figure 148: Rest of Industry Analysis and Outlook Attractiveness by Price, 2024 to 2034

Figure 149: Rest of Industry Analysis and Outlook Attractiveness by Nature, 2024 to 2034

Figure 150: Rest of Industry Analysis and Outlook Attractiveness by Sales Channel, 2024 to 2034

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Korea Automotive Performance Tuning and Engine Remapping Service Industry Size and Share Forecast Outlook 2025 to 2035

Korea Smart Home Security Camera Market Size and Share Forecast Outlook 2025 to 2035

Korea Automated People Mover Industry Size and Share Forecast Outlook 2025 to 2035

Korea Bicycle Component Aftermarket Analysis Size and Share Forecast Outlook 2025 to 2035

Korea Isomalt Industry – Market Trends & Industry Growth 2025 to 2035

Korea Probiotic Supplement Industry – Industry Insights & Demand 2025 to 2035

Korea Calcium Supplement Market is segmented by form,end-use, application and province through 2025 to 2035.

The Korea Non-Dairy Creamer Market in Korea is segmented by form, nature, flavor, type, base, end-use, packaging, distribution channel, and province through 2025 to 2035.

Korea Women’s Intimate Care Market Analysis - Size, Share & Trends 2025 to 2035

Korea Conference Room Solution Market Growth – Trends & Forecast 2025 to 2035

Korea Visitor Management System Market Growth – Trends & Forecast 2025 to 2035

Korea fiber optic gyroscope market Growth – Trends & Forecast 2025 to 2035

Korea Event Management Software Market Insights – Demand & Growth Forecast 2025 to 2035

Korea Submarine Cable Market Insights – Demand & Forecast 2025 to 2035

Last-mile Delivery Software Market in Korea – Trends & Forecast through 2035

Korea HVDC Transmission System Market Trends & Forecast 2025 to 2035

Korea Base Station Antenna Market Growth – Trends & Forecast 2025 to 2035

Smart Space Market Analysis in Korea-Demand & Growth 2025 to 2035

Korea Banking-as-a-Service (BaaS) Platform Market Growth – Trends & Forecast 2025 to 2035

Korea I2C Bus Market Trends & Forecast 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA