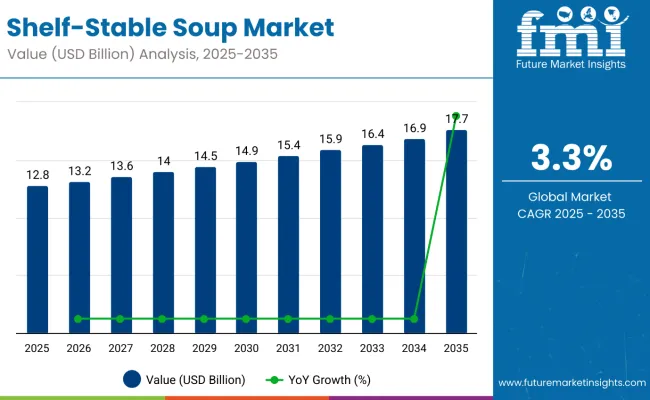

The shelf-stable soup market is estimated to be valued at USD 12.8 billion in 2025 and is projected to reach USD 17.7 billion by 2035, registering a compound annual growth rate CAGR of 3.3% over the forecast period.

| Metric | Value |

|---|---|

| Estimated Value in (2025E) | USD 12.8 billion |

| Forecast Value in (2035F) | USD 17.7 billion |

| Forecast CAGR (2025 to 2035) | 3.3% |

The market is projected to add an absolute dollar opportunity of USD 5.0 billion over the forecast period. This reflects a 1.39 times growth at a compound annual growth rate of 3.3%. The market evolution is expected to be shaped by rising demand for convenient meal solutions, health-conscious food choices, and extended shelf-life products, particularly where nutritional value and storage convenience are required.

By 2030, the market is likely to reach USD 15.3 billion, accounting for USD 2.3 billion in incremental value over the first half of the decade. The remaining USD 2.7 billion is expected during the second half, suggesting a moderately back-loaded growth pattern. Product innovation in plant-based formulations and clean-label ingredients is gaining traction due to the favorable nutritional advantages and convenience properties of shelf-stable soup.

Companies such as Kraft Heinz and Tabatchnick Fine Foods are advancing their competitive positions through investment in advanced preservation technologies and scalable production systems. Health-conscious procurement models are supporting expansion into organic segments, premium formulations, and international flavor applications. Market performance will remain anchored in nutritional efficacy, flavor innovation, and clean-label compliance benchmarks.

The market holds a strong position across its parent industries, reflecting its superior convenience, extended shelf life, and suitability for various distribution channels. Within the ready-to-eat meal solutions category, shelf-stable soup contributes significantly, with its share estimated at around 38%, driven by its nutritional profile and suitability as a meal replacement. In the convenience food ingredients market, it accounts for nearly 32%, supporting applications that require extended shelf life and quick preparation. Within the emergency food supplies segment, its contribution stands close to 28%, where long-lasting soups are vital for disaster preparedness and food security. In the clean-label soup market, shelf-stable variants hold about 25%, underscoring their appeal for natural and minimally processed formulations.

The market is being driven by rising demand for nutritious, convenient, and long-lasting food products. Advanced preservation technologies using thermal processing, aseptic packaging, and natural preservation have enhanced nutritional profiles, flavor retention, and shelf stability, making shelf-stable soups viable alternatives to fresh soup options. Manufacturers are introducing specialized formulations and customized flavor profiles tailored for specific consumer preferences, expanding their role beyond basic meal solutions. Strategic collaborations between soup manufacturers and food retailers have accelerated adoption in emergency preparedness and convenience food segments

Shelf-stable soup's superior convenience, extended shelf life, and nutritional value make it an attractive option for health-conscious consumers and busy households seeking quick meal solutions with consistent quality and storage benefits.

Growing awareness of meal planning and emergency preparedness is further propelling adoption, especially in urban households, workplace environments, and food service sectors. Government initiatives promoting food security, along with innovations in preservation technology, are also enhancing product quality and flavor profiles.

As convenience and wellness trends accelerate across demographics and clean-label preferences become critical, the shelf-stable soup market outlook remains favorable. With consumers and manufacturers prioritizing convenience, nutritional density, and shelf stability, shelf-stable soups are well-positioned to expand across various retail, food service, and institutional applications.

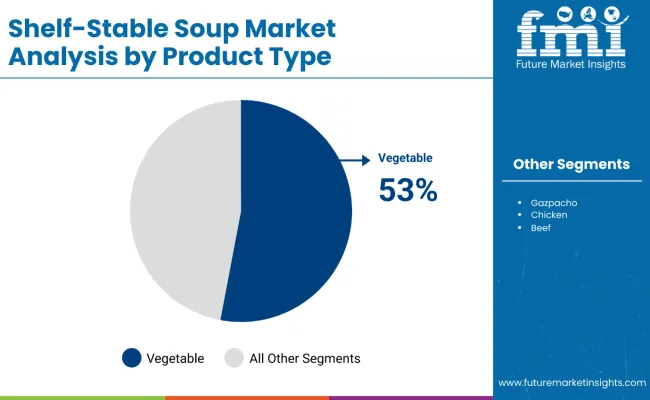

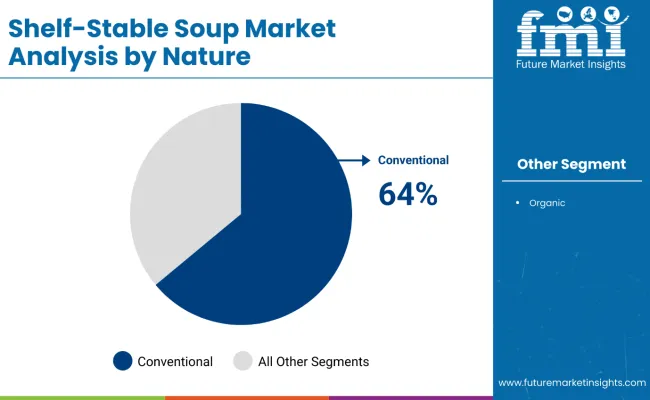

The market is segmented by product type, nature, and region. By product type, the market is divided into gazpacho, vegetable, chicken, beef, and other. By nature, the market is bifurcated into conventional and organic. Regionally, the market spans across North America, Europe, Asia-Pacific, Latin America, and the Middle East & Africa.

The vegetable segment holds a dominant position with 53% of the market share in the product type category, owing to its broad appeal among health-conscious consumers, dietary restrictions accommodation, and plant-based diet trends. Vegetable-based shelf-stable soups are widely adopted across demographic segments, including vegetarians, vegans, and flexitarians, due to their nutritional density and flavor versatility.

They enable manufacturers to deliver concentrated nutrition while maintaining production efficiency and controlling ingredient costs in final products. As demand for plant-based, clean-label, and nutrient-dense meal options grows, the vegetable segment continues to gain preference in both retail and food service applications.

Manufacturers are investing in advanced vegetable processing technologies, flavor enhancement, and nutritional fortification to improve taste profiles, texture, and bioavailability. The segment is poised to expand further as global health trends favor plant-forward, sustainable, and nutritionally complete soup formats.

Conventional remains a core nature segment with 64% of the market share in 2025, as traditional shelf-stable soups provide accessibility, affordability, and familiar flavor profiles for mainstream consumers across diverse income segments. Their widespread availability supports market penetration in both developed and emerging markets.

Conventional shelf-stable soups also offer production scalability and cost efficiency in manufacturing environments, while providing consistent quality without premium pricing constraints. This makes them indispensable in mass market retail environments.

Ongoing demand for affordable nutrition and the broad consumer base of conventional food products are key trends driving the sustained relevance of conventional shelf-stable soups in this nature segment.

In 2024, global shelf-stable soup consumption grew by 12% year-on-year, with North America taking a 42% share. Applications include convenient meal solutions, emergency food supplies, and workplace nutrition programs. Manufacturers are introducing advanced preservation ratios and multi-functional soup blends that deliver superior nutritional density and flavor retention. Clean-label formulations now support transparent ingredient positioning. Health-conscious consumption trends and convenience efficacy support consumer confidence. Technology providers increasingly supply ready-to-serve soup solutions with integrated nutritional profiles to reduce preparation complexity.

Convenience and Nutrition Trends Drive Shelf-Stable Soup Adoption

Food manufacturers and retail companies are choosing shelf-stable soup products to achieve superior convenience, extend storage capabilities, and meet consumer demand for quick meal solutions. In nutritional testing, premium shelf-stable soups deliver up to 75% vegetable content compared to traditional canned soups at 45-55%. Products enhanced with shelf-stable formulations maintain nutritional stability throughout extended storage cycles. In ready-to-eat formats, nutrient-enhanced soups help reduce preparation time while maintaining nutritional density by up to 55%. Shelf-stable soup applications are now being deployed for emergency preparedness positioning, increasing adoption in sectors demanding long-term food storage. These advantages explain the rising adoption of shelf-stable soups across North America and Europe.

Raw Material Volatility, Preservation Complexity and Packaging Constraints Restrict Expansion

Growth faces constraints due to raw material price fluctuations, complex preservation requirements, and specialized packaging infrastructure needs. Vegetable ingredient costs can vary from $2 to $4 per pound, depending on seasonal factors and regional supply conditions, impacting soup pricing and leading to procurement delays of up to 8% in manufacturing applications. Preservation processing technology requirements and quality control standards add 3 to 5 weeks to product development cycles. Specialized packaging and storage conditions in retail environments extend distribution costs by 12-15% compared to conventional packaged foods. Limited availability among preservation-capable processing facilities restricts scalable production, especially for custom formulation projects. These constraints make shelf-stable soup adoption challenging in price-sensitive markets despite growing convenience benefits and commercial interest.

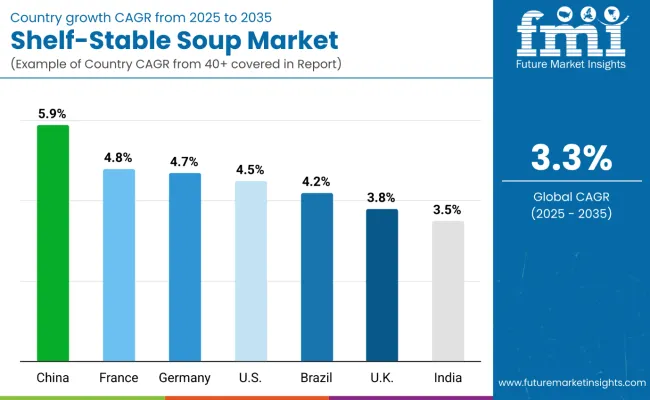

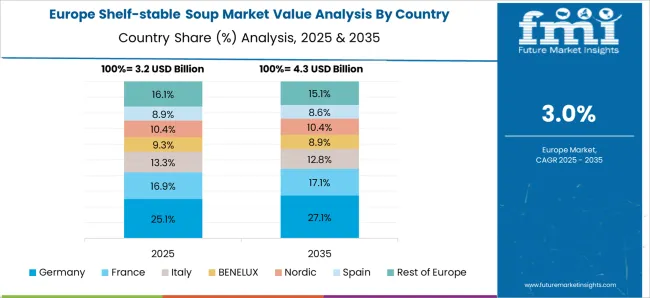

| Countries | CAGR (2025 to 2035) |

|---|---|

| China | 5.9% |

| France | 4.8% |

| Germany | 4.7% |

| USA | 4.5% |

| Brazil | 4.2% |

| UK | 3.8% |

| India | 3.5% |

The market shows varied growth trajectories across the top seven countries. China leads with the highest projected CAGR of 5.9% from 2025 to 2035, driven by robust urbanization and convenience food adoption. France follows closely with a CAGR of 4.8%, supported by premium product innovations and health-conscious consumption. Germany is next at 4.7%, benefiting from organic food integration and quality standards. The USA shows moderate growth at 4.5%, supported by established convenience food infrastructure but constrained by market maturity. Brazil, with a CAGR of 4.2%, experiences steady expansion fueled by economic development and changing dietary patterns, reflecting a regional pivot toward convenient and nutritious meal solutions.

The report covers an in-depth analysis of 40+ countries; seven top-performing OECD countries are highlighted below.

Revenue from shelf-stable soup in China is projected to grow at a CAGR of 5.9% from 2025 to 2035, driven by demand for convenient meal solutions in urban markets across major cities such as Beijing, Shanghai, and Guangzhou. Chinese food processors are investing in advanced preservation technologies and flavor localization to improve quality and consumer acceptance. Strong domestic demand and rising urbanization patterns are reinforcing the role of shelf-stable soups in the national food distribution system.

Key Statistics

The shelf-stable soup market in France is expected to expand at a CAGR of 4.8% from 2025 to 2035, due to premium product innovation and gourmet soup applications in the Paris, Lyon, and Marseille regions. Advanced preservation technologies and premium ingredient sourcing are being deployed for artisanal, organic, and specialty soup applications. Shelf-stable soup partnerships between French food companies and European ingredient suppliers have expanded significantly. EU food safety standards and French culinary traditions support practical shelf-stable soup development.

Key Statistics

Sales of shelf-stable soup in Germany are expected to grow at a CAGR of 4.7% from 2025 to 2035, driven by the increasing need for health-focused applications and premium soup production in the Munich, Hamburg, and Berlin regions. Shelf-stable soup adoption is shifting from basic convenience toward specialized nutrition and gourmet meal enhancement. Custom preservation services and specialized processing capabilities lead commercial shelf-stable soup deployment. EU regulatory framework compliance and German food quality standards have improved shelf-stable soup accessibility in premium food and nutrition applications.

Key Statistics

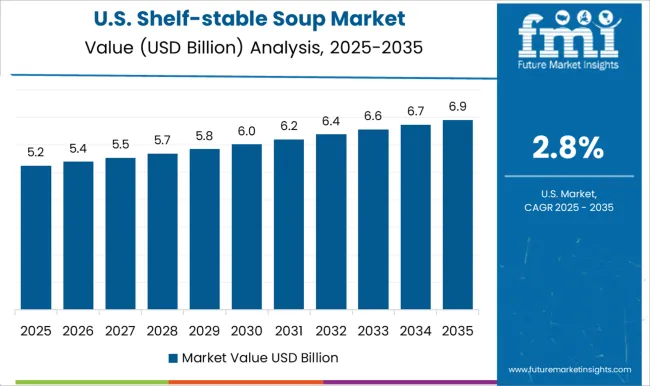

Demand for shelf-stable soup in the USA is expected to expand at a CAGR of 4.5% from 2025 to 2035, driven by convenience food growth and emergency preparedness trends in major metropolitan areas, including New York, Los Angeles, and Chicago. Retail chains and food service operators are increasingly adopting shelf-stable soups for inventory management and consumer convenience. Government nutrition guidelines have helped promote convenient meal solutions, although commercial shelf-stable soup adoption is progressing steadily across diverse consumer segments.

Key Statistics

The shelf-stable soup market in Brazil is projected to grow at a CAGR of 4.2% from 2025 to 2035, supported by strong demand for affordable nutrition and convenient meal solutions. Urban markets like São Paulo, Rio de Janeiro, and Brasília are experiencing a shift toward preserved foods, family meal solutions, and accessible nutrition products. Domestic food companies are leveraging local ingredients and international preservation technologies to meet quality expectations for affordable and nutritionally complete meal options.

Key Statistics

Revenue from shelf-stable soup in the UK is projected to grow at a CAGR of 3.8% from 2025 to 2035, supported by rising adoption of convenient meal formats in metropolitan hubs such as London, Manchester, and Birmingham. British food manufacturers are advancing clean-label formulations and low-sodium recipes to enhance consumer trust and nutritional positioning. Collaborations between national retailers and ingredient suppliers are strengthening the supply chain, while premium shelf-stable soup varieties are increasingly marketed as part of balanced meal solutions in retail outlets.

Key Statistics

Revenue from shelf-stable soup in India is projected to grow at a CAGR of 3.5% from 2025 to 2035, driven by adoption in metro markets including Delhi, Mumbai, and Bengaluru. Indian food companies are strengthening production capabilities through cold-chain expansion and government-backed food processing schemes, enabling broader penetration of packaged soups. Increased consumer inclination toward quick meals and rising participation of organized retail are encouraging higher visibility for shelf-stable soup offerings. Domestic processors are collaborating with international suppliers to incorporate organic vegetables and fortified formulations into premium segments.

Key Statistics

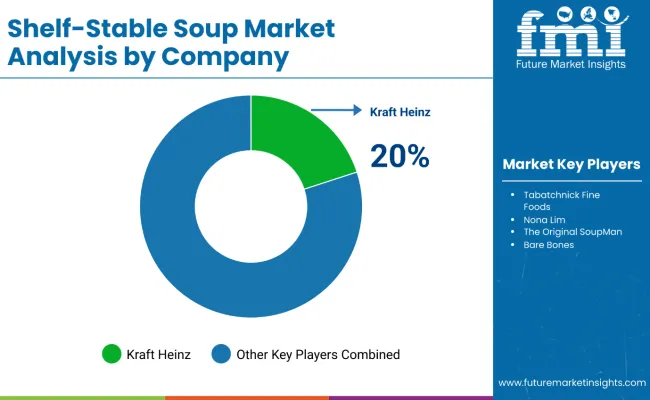

The market is moderately consolidated, featuring a mix of global food giants, specialized soup manufacturers, and regional processors with varying degrees of preservation technology, product innovation, and distribution expertise. Kraft Heinz and Tabatchnick Fine Foods lead the shelf-stable soup segment, supplying advanced preserved soup products for retail, food service, and institutional applications. Their strength lies in comprehensive food processing capabilities, global distribution networks, and established relationships with major retail chains.

Nona Lim and The Original SoupMan differentiate through specialized preservation technologies, premium formulation services, and application-specific solutions that cater to health-conscious consumers and gourmet food applications. Bare Bones and Pacific Foods focus on premium soup production, addressing growing demand for organic, clean-label, and nutritionally enhanced soup applications.

Regional specialists such as Swanson Health Products, Ragozzino Foods, and FAWEN emphasize processing innovation, ingredient sourcing, and sustainable food production, creating value in specialty soup markets and health-focused nutrition applications.

Entry barriers remain significant, driven by challenges in advanced preservation technology, food supply chain integration, and compliance with food safety and nutritional standards across multiple distribution categories. Competitiveness increasingly depends on preservation efficiency, flavor customization capabilities, and product development expertise for diverse retail and food service environments.

| Items | Values |

|---|---|

| Quantitative Units (2025) | USD 12.8 Billion |

| Product Type | Gazpacho, Vegetable, Chicken, Beef, and Other |

| Nature | Conventional and Organic |

| Regions Covered | North America, Latin America, Europe, East Asia, South Asia, Oceania, and the Middle East & Africa |

| Country Covered | United States, Canada, United Kingdom, Germany, France, China, Japan, South Korea, Brazil, Australia, and 40+ countries |

| Key Companies Profiled | Tabatchnick Fine Foods, Nona Lim, The Original SoupMan, Bare Bones, Pacific Foods, Swanson Health Products, Ragozzino Foods, FAWEN, and Kraft Heinz |

| Additional Attributes | Dollar sales by product type and nature, regional consumption trends, competitive landscape, consumer preferences for traditional versus health-focused soups, innovations in fortified and ready-to-heat formulations, and quality and safety standardization across diverse distribution channels |

The global shelf-stable soup market is estimated to be valued at USD 12.8 billion in 2025.

The market size for the shelf-stable soup market is projected to reach USD 17.7 billion by 2035.

The shelf-stable soup market is expected to grow at a 3.3% CAGR between 2025 and 2035.

The key product types in shelf-stable soup market are gazpacho, vegetable, chicken, beef and other.

In terms of nature, conventional segment to command 62.3% share in the shelf-stable soup market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Soup Containers Market

Fish Soup Market Analysis by Form, Format, Packaging and Sales Channel Through 2035

Dried Soup Market Size, Growth, and Forecast for 2025 to 2035

Potato Soup Market Size and Share Forecast Outlook 2025 to 2035

Canned Soup Market Size and Share Forecast Outlook 2025 to 2035

Understanding Potato Soup Market Share & Market Trends

Chilled Soup Market Analysis by Packaging Type and Distribution Channels Through 2035

UK Potato Soup Market Growth – Trends, Demand & Forecast 2025-2035

USA Potato Soup Market Trends – Growth, Demand & Innovations 2025-2035

Gluten-Free Soup Market Insights - Specialty Diets & Consumer Demand 2025 to 2035

Europe Potato Market Analysis Through Fresh, Frozen, Canned and Other Packaging Formats

Rundown of Growth Factors Elevating the Asia Pacific Potato Soup Sales.

Analysis and Growth Projections for Refrigerated and Frozen Soup Market

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA