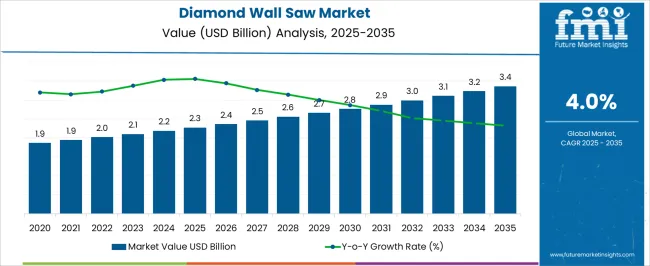

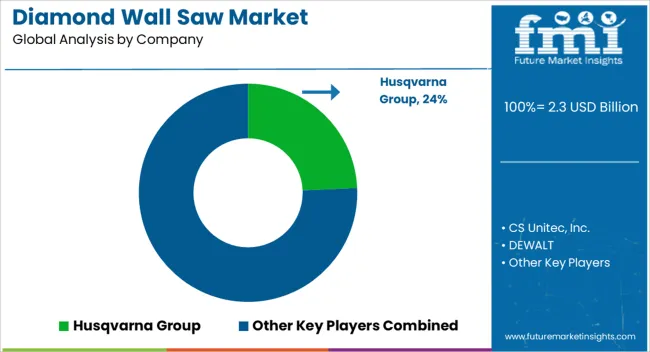

The diamond wall saw market is expected to grow from USD 2.3 billion in 2025 to USD 3.4 billion by 2035, registering a 4.0% CAGR and generating an absolute dollar opportunity of USD 1.1 billion. Growth is driven by increasing construction and demolition activities, particularly in urban infrastructure projects, tunneling, and industrial renovations. Diamond wall saws are preferred for their precision, efficiency, and ability to cut through concrete, masonry, and reinforced structures with minimal structural damage, making them indispensable in modern construction and renovation projects.

Peak-to-trough analysis highlights the cyclical patterns in market performance over the forecast period. Peak demand periods are observed during phases of high construction and renovation activity, when new infrastructure projects, urban redevelopment initiatives, and industrial expansions drive increased adoption of advanced cutting solutions. Conversely, troughs occur during slower construction periods, economic downturns, or seasonal variations in construction activity, leading to temporary reductions in equipment deployment. Regional variations also influence market cycles, with North America and Europe showing moderate peaks due to steady but mature construction activity, while Asia Pacific exhibits pronounced peaks linked to rapid urbanization and industrial expansion. Overall, the market demonstrates resilience, with peaks balancing troughs to maintain a steady upward trajectory. The USD 1.1 billion absolute opportunity reflects both new installations and replacement demand, underscoring consistent growth across regions from 2025 to 2035.

| Metric | Value |

|---|---|

| Diamond Wall Saw Market Estimated Value in (2025 E) | USD 2.3 billion |

| Diamond Wall Saw Market Forecast Value in (2035 F) | USD 3.4 billion |

| Forecast CAGR (2025 to 2035) | 4.0% |

The diamond wall saw market is largely influenced by the construction and demolition sector, which contributes approximately 40% of the market share due to its use in cutting reinforced concrete, masonry, and stone structures. The mining and quarrying industry accounts for around 25%, employing wall saws for precise extraction of stone and mineral blocks. Infrastructure projects, including roads and bridges, represent close to 15%, where wall saws are essential for modifications and expansions. The industrial manufacturing sector contributes roughly 10%, using wall saws for material shaping and processing. The remaining 10% comes from specialty renovation and retrofitting projects, which require controlled and accurate cutting solutions. The diamond wall saw market is advancing with innovations in blade materials, motor efficiency, and automation. High-performance diamond segments and reinforced blades are improving cutting speed and precision for hard and dense materials. Portable and lightweight wall saw models are gaining popularity, allowing easier handling on-site. Integration with computerized control systems enables automated cutting and enhanced safety. Manufacturers are focusing on energy-efficient motors and water recycling systems to reduce operational costs and environmental impact. Strategic collaborations with construction and demolition firms are expanding product reach. There is also growing adoption in niche applications, including heritage building renovations and specialized industrial cutting projects.

The market outlook remains positive, driven by rising investments in urban redevelopment and industrial expansion. The growing preference for high-precision cutting equipment that reduces structural damage and enhances worksite efficiency is contributing to the adoption of diamond wall saws. Technological improvements in blade composition and saw control systems are enabling greater operational flexibility and safety.

Additionally, the shift toward mechanized and automated cutting tools in civil engineering and building renovation is reinforcing market expansion. As infrastructure modernization efforts intensify globally and end users seek solutions that minimize labor while improving output, the market for diamond wall saws is expected to maintain upward momentum, with future opportunities centered around integration with digital controls and enhanced durability.

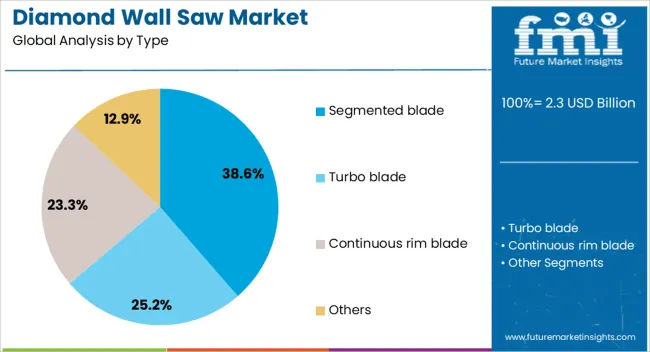

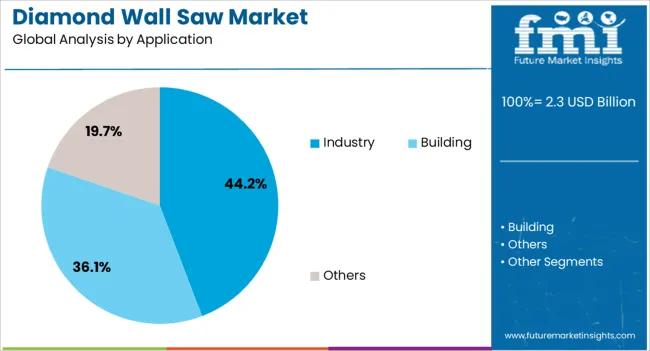

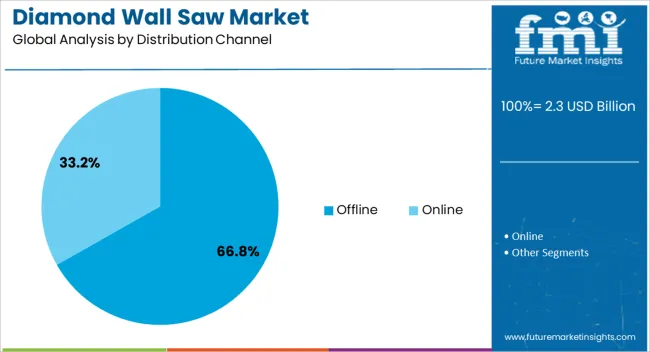

The diamond wall saw market is segmented by type, application, distribution channel, and geographic regions. By type, diamond wall saw market is divided into Segmented blade, Turbo blade, Continuous rim blade, and Others. In terms of application, diamond wall saw market is classified into Industry, Building, and Others. Based on distribution channel, diamond wall saw market is segmented into Offline and Online. Regionally, the diamond wall saw industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The segmented blade type is projected to hold 38.6% of the Diamond Wall Saw Market revenue share in 2025, making it the leading segment in terms of blade type. This leadership is being supported by the blade’s superior ability to manage heat and reduce friction during high-intensity cutting tasks.

Segmented blades are widely utilized in concrete and reinforced material applications where cooling and debris removal are critical for efficiency and blade longevity. Their structural design enables faster cutting speeds and a longer service life, making them suitable for large-scale projects that require reliability and consistency.

The adoption of segmented blades has been further strengthened by their compatibility with advanced saw models and the demand for reduced downtime on industrial worksites As end users continue to prioritize cutting tools that offer durability and operational cost savings, the segmented blade segment is expected to remain dominant within the market.

The industry application segment is expected to account for 44.2% of the Diamond Wall Saw Market revenue share in 2025, establishing it as the leading application area. Growth in this segment is being attributed to the increasing use of wall saws in factories, production facilities, and heavy construction projects where high-strength materials require precise cutting.

The ability of diamond wall saws to deliver accurate and controlled cuts in thick concrete and steel-reinforced walls has made them essential in industrial environments. The segment’s growth is also being reinforced by ongoing infrastructure development and the modernization of manufacturing plants that demand efficient structural modifications.

The preference for automated and high-powered cutting tools that improve safety and reduce manual intervention has contributed significantly to the expansion of this segment As industries continue to invest in machinery that enhances productivity and adheres to evolving safety standards, the use of diamond wall saws in industrial settings is expected to grow further.

The offline distribution channel is projected to capture 66.8% of the Diamond Wall Saw Market revenue share in 2025, making it the dominant channel. This strong position is being maintained due to the technical nature of the product, where customers prefer physical demonstrations, direct consultations, and after-sales support.

Offline channels allow buyers to evaluate machinery performance, material compatibility, and custom installation requirements before making high-investment purchases. The trust established through distributor relationships and the availability of on-site services have continued to favor brick-and-mortar outlets.

Additionally, the role of regional dealers in managing maintenance, training, and warranty services has played a vital role in sustaining this channel’s dominance Despite the gradual emergence of digital sales platforms, the offline segment remains critical in meeting the specific needs of professional contractors and industrial users, particularly in regions where hands-on purchasing processes are valued.

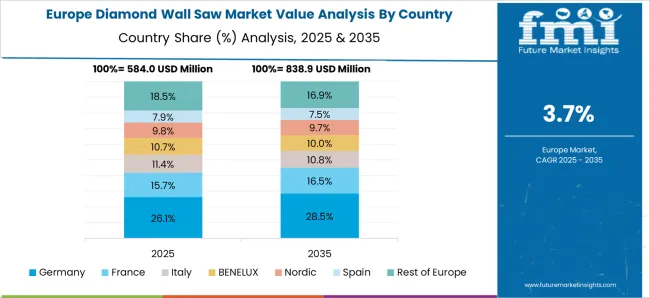

The diamond wall saw market is expanding due to rising demand in construction, mining, and renovation projects. Global revenue crossed USD 1.5 billion in 2024, with North America accounting for 35% due to extensive commercial and residential construction activities. Europe contributes 30%, led by Germany, UK, and France with high adoption for industrial cutting and renovation projects. Asia Pacific represents 28%, led by China, India, and Japan, driven by infrastructure expansion and urban development. Diamond wall saws, including handheld and track-mounted models, are preferred for concrete, masonry, and stone cutting due to precision, speed, and reduced labor requirements. Increasing construction investments continue to strengthen global adoption.

Construction and industrial cutting applications account for over 60% of global diamond wall saw adoption. Residential and commercial building projects represent 35%, while infrastructure and industrial renovations contribute 25%. North America leads with 35% share due to growing demand for concrete and reinforced wall cutting. Europe contributes 30%, emphasizing precision cutting in industrial plants and renovation projects. Asia Pacific is growing at a CAGR of 6.1%, driven by urban housing and industrial construction in China and India. Track-mounted wall saws dominate with 55% of sales due to high efficiency, while handheld models account for 45%. Rising demand for fast, accurate, and safe cutting solutions supports market expansion worldwide.

Technological innovations in blade materials, motor efficiency, and track systems are improving performance and durability of diamond wall saws. Segmented diamond blades enhance cutting speed by 15–20% and reduce vibration, while reinforced motors extend operational lifespan by 10–15%. Track-mounted systems with automated feed mechanisms ensure uniform cuts in large-scale projects. North America emphasizes high-capacity, low-vibration units for commercial projects, while Europe focuses on precision and safety features for industrial sites. Asia Pacific is adopting cost-efficient, durable saws for urban development projects. Technological progress ensures accurate cutting, reduced labor effort, and lower material wastage, increasing adoption across construction and industrial applications globally.

Diamond wall saws are increasingly adopted in renovation, mining, and infrastructure sectors. Renovation and demolition projects account for 40% of global demand, while industrial and mining applications contribute 20% and 15%, respectively. North America leads with 35% share due to large-scale commercial renovations. Europe contributes 30%, emphasizing industrial plant upgrades. Asia Pacific, led by China and India, is growing at a CAGR of 6.1% due to expanding urban infrastructure. Specialized saws for stone, concrete, and reinforced walls ensure high precision. Rising construction, mining, and renovation activities globally continue to drive adoption across residential, commercial, and industrial projects.

Diamond wall saws face challenges due to high initial investment and maintenance costs. Track-mounted systems range between USD 25,000–75,000 per unit, limiting affordability for small contractors. Blade replacement, motor servicing, and track maintenance increase operational costs by 12–15% annually. Availability of skilled operators is crucial for precision cutting and safety compliance. Supply chain dependencies for high-quality diamond segments and reinforced motors affect production timelines. Manufacturers address these challenges through modular designs, extended blade lifespan, and operator training programs. Despite advantages in precision, speed, and durability, high costs, maintenance requirements, and skilled labor dependency remain key constraints for global market adoption.

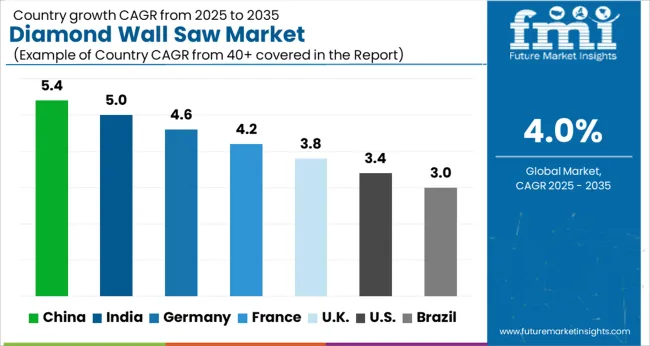

| Country | CAGR |

|---|---|

| China | 5.4% |

| India | 5.0% |

| Germany | 4.6% |

| France | 4.2% |

| UK | 3.8% |

| USA | 3.4% |

| Brazil | 3.0% |

The diamond wall saw market is projected to grow at a global CAGR of 4% through 2035, driven by increasing demand in construction, demolition, mining, and infrastructure projects. China leads at 5.4%, 35% above the global benchmark, supported by BRICS-driven expansion in construction, large-scale infrastructure projects, and industrial mining activities. India follows at 5.0%, 25% above the global average, reflecting growing adoption in building construction, urban infrastructure development, and industrial applications. Germany records 4.6%, 15% above the benchmark, shaped by OECD-driven innovation in high-performance cutting technologies, specialized construction projects, and industrial applications. The United Kingdom posts 3.8%, 5% below the global rate, influenced by selective use in construction, renovation, and niche industrial projects. The United States stands at 3.4%, 15% below the benchmark, with steady demand in commercial construction, infrastructure maintenance, and specialized industrial applications. BRICS economies drive overall volume growth, OECD countries emphasize precision, efficiency, and technological advancement, while ASEAN nations contribute through expanding construction and industrial sectors.

The diamond wall saw market in China is projected to grow at a CAGR of 5.4%, above the global CAGR of 4%, supported by large-scale construction and renovation projects across residential, commercial, and infrastructure sectors. In 2024, sales of wall saw systems increased by 12%, with strong adoption in cities such as Shanghai, Beijing, and Shenzhen. Domestic manufacturers including Sany, XCMG, and Zhuzhou Diamond Tool supplied high-capacity, precision saws, while global brands like Hilti and Husqvarna expanded local distribution networks. Rising demand for precision cutting of concrete, reinforced structures, and stone materials is driving market growth, especially in high-rise construction projects.

India’s diamond wall saw market is expected to expand at a CAGR of 5.0%, above the global CAGR of 4%, due to growing infrastructure development, metro rail projects, and high-rise building construction. In 2024, sales volumes increased by 10% in Mumbai, Delhi, and Bengaluru. Domestic suppliers such as Bharat Diamond Tools and global manufacturers like Hilti and Husqvarna focused on providing compact, high-performance wall saw systems suitable for urban construction. Adoption is being driven by contractors seeking precision cutting for reinforced concrete and masonry structures while optimizing operational safety.

Germany’s diamond wall saw market is projected to grow at a CAGR of 4.6%, above the global CAGR of 4%, supported by demand in industrial construction, renovation, and heritage building restoration. In 2024, installations increased by 9%, with strong adoption in Berlin, Munich, and Hamburg. Manufacturers including Hilti, Husqvarna, and domestic players delivered high-precision saws with enhanced safety and cutting efficiency. Adoption is focused on masonry and reinforced concrete applications in commercial and industrial projects, complemented by advanced operator training programs.

The diamond wall saw market in the United Kingdom is forecast to grow at a CAGR of 3.8%, slightly below the global CAGR of 4%, with steady demand from commercial construction and renovation projects. In 2024, sales increased by 7%, concentrated in London, Manchester, and Birmingham. Suppliers such as Hilti UK, Husqvarna, and local distributors offered portable and mid-range wall saw systems for contractors and renovation firms. Growth is influenced by safety regulations and the need for precise cutting in high-rise and heritage buildings.

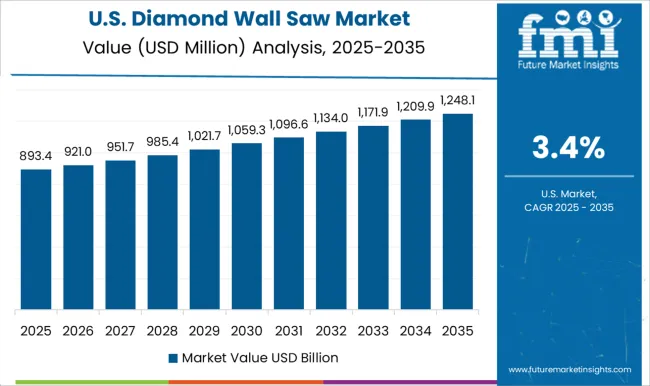

The diamond wall saw market in the United States is projected to grow at a CAGR of 3.4%, below the global CAGR of 4%, reflecting a mature construction sector with steady replacement and retrofit demand. In 2024, installations rose by 6%, driven by demand in high-rise commercial buildings and infrastructure renovation. Companies such as Husqvarna, Hilti, and Tyrolit supplied compact and high-precision saws suitable for reinforced concrete and masonry applications. Market growth is supported by contractors seeking efficiency, safety, and compliance with OSHA standards.

Competition in the diamond wall saw market is being influenced by cutting precision, durability, and adaptability to concrete, masonry, and stone applications. Market presence is being maintained through certified tools, technical support, and distribution networks that ensure availability for construction, demolition, and industrial projects. Husqvarna Group is being represented with wall saws engineered for accurate vertical and horizontal cutting, while CS Unitec, Inc. is being promoted with compact, portable systems designed for tight spaces. DEWALT is being applied with electric-powered saws optimized for heavy-duty concrete cutting. Diamond Products Limited is being showcased with modular wall saws structured for cutting thickness and depth versatility. Diamond Tech International is being recognized with equipment engineered for precision and operational safety. Diamond Vantage Inc. is being advanced with high-performance saws designed for industrial and commercial applications. Hilti Corporation is being promoted with battery- and electric-powered saws optimized for efficiency and user ergonomics. KERN-DEUDIAM Diamantwerkzeuge und Maschinen GmbH is being applied with customizable wall saw solutions for specialized construction tasks. Makita Corporation is being represented with portable and robust saws designed for concrete, masonry, and block cutting. Norton Abrasives (Saint-Gobain) is being showcased with diamond cutting systems engineered for durability and performance. Pentruder (Atlas Copco) is being advanced with hydraulic and electric saws structured for high-precision cuts. Robert Bosch GmbH is being promoted with wall saws designed for professional construction environments. STIHL Group is being applied with portable diamond saws optimized for reliability and ease of use. TYROLIT Group is being represented with high-precision cutting systems designed for demanding wall and slab applications. Wacker Neuson SE is being highlighted with compact, mobile saws structured for construction and demolition projects. Strategies among these companies are being centered on product innovation, tool reliability, and expansion of technical support services. Research and development efforts are being allocated to enhance blade durability, cutting speed, dust suppression, and user ergonomics. Product brochures are being structured with specifications covering motor type, cutting depth, blade diameter, power supply, and material compatibility. Features such as portability, safety mechanisms, modularity, and maintenance ease are being emphasized to guide procurement and operational decisions. Each brochure is being arranged to highlight certification compliance, application suitability, and service support. Technical information is being presented in a clear, evaluation-ready format to assist contractors, engineers, and purchasing teams in selecting diamond wall saws that meet performance, reliability, and operational requirements.

| Item | Value |

|---|---|

| Quantitative Units | USD 2.3 Billion |

| Type | Segmented blade, Turbo blade, Continuous rim blade, and Others |

| Application | Industry, Building, and Others |

| Distribution Channel | Offline and Online |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | Husqvarna Group, CS Unitec, Inc., DEWALT, Diamond Products Limited, Diamond Tech International, Diamond Vantage Inc., Hilti Corporation, KERN-DEUDIAM Diamantwerkzeuge und Maschinen GmbH, Makita Corporation, Norton Abrasives (Saint-Gobain), Pentruder (Atlas Copco), Robert Bosch GmbH, STIHL Group, TYROLIT Group, and Wacker Neuson SE |

| Additional Attributes | Dollar sales by saw type and end use, demand dynamics across construction, demolition, and mining, regional trends in infrastructure development, innovation in blade durability and cutting precision, environmental impact of dust and material waste, and emerging use cases in retrofitting, renovation, and precision concrete cutting. |

The global diamond wall saw market is estimated to be valued at USD 2.3 billion in 2025.

The market size for the diamond wall saw market is projected to reach USD 3.4 billion by 2035.

The diamond wall saw market is expected to grow at a 4.0% CAGR between 2025 and 2035.

The key product types in diamond wall saw market are segmented blade, turbo blade, continuous rim blade and others.

In terms of application, industry segment to command 44.2% share in the diamond wall saw market in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Wall Mounted Manifolds Market Size and Share Forecast Outlook 2025 to 2035

Diamond and CBN Micron Powder Market Size and Share Forecast Outlook 2025 to 2035

Wall Covering Product Market Forecast and Outlook 2025 to 2035

SAW Filter Market Size and Share Forecast Outlook 2025 to 2035

Diamond Tool Grinding Machine Market Size and Share Forecast Outlook 2025 to 2035

Wall Blower Market Size and Share Forecast Outlook 2025 to 2035

Diamond-like Carbon Coatings market Size and Share Forecast Outlook 2025 to 2035

Wall Repair Roller Paint Market Size and Share Forecast Outlook 2025 to 2035

Diamond Like Carbon (DLC) Coating Market Size and Share Forecast Outlook 2025 to 2035

Diamond Jewelry Market Analysis - Size, Share, & Forecast Outlook 2025 to 2035

Wallets & Little Cases Market Size and Share Forecast Outlook 2025 to 2035

Diamond Core Drilling Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Saw Blades Market Size, Share, and Forecast 2025 to 2035

Wall Art Market Analysis by Growth, Trends and Forecast from 2025 to 2035

Sawing and Cutting Tools Market Growth, Trends and Forecast from 2025 to 2035

Wall Mounted Paper Napkin Dispensers Market Growth - Demand & Forecast 2025 to 2035

Diamond Wire Market Size & Outlook 2025 to 2035

Saw Palmetto Market Analysis by Powder, Whole and others Forms Through 2035

Diamond-Blackfan Anemia (DBA) Syndrome Therapeutics Market - Growth & Innovations 2025 to 2035

Wall Decor Market Insights – Growth & Demand 2025–2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA