The polymer surge arrester market, estimated at USD 1.0 billion in 2025 and forecasted to reach USD 1.6 billion by 2035 with a CAGR of 5.4%, illustrates a steady but moderate expansion trajectory that signals a movement toward maturity. The adoption lifecycle reflects a gradual penetration of polymer-based arresters in place of porcelain-based counterparts, driven by advantages such as lightweight design, superior insulation, and resistance to environmental degradation.

The incremental year-on-year growth seen in the data suggests that the market is progressing along the growth stage, but is gradually approaching the maturity curve by the end of the forecast period. Early adoption has been largely concentrated in utility modernization projects and regions prioritizing grid resilience. As polymer surge arresters prove long-term operational efficiency, wider adoption is being observed across transmission and distribution systems.

The moderate CAGR indicates that future adoption will not be driven by rapid technological disruption but rather by replacement demand, regulatory compliance, and incremental upgrades. By 2030, the market is expected to enter the late growth phase, where adoption will stabilize as utilities standardize these solutions. The lifecycle trend, therefore, positions the market toward a plateau beyond 2035, where innovation will center on performance optimization, cost reduction, and integration with smart grid monitoring systems.

| Metric | Value |

|---|---|

| Polymer Surge Arrester Market Estimated Value in (2025 E) | USD 1.0 billion |

| Polymer Surge Arrester Market Forecast Value in (2035 F) | USD 1.6 billion |

| Forecast CAGR (2025 to 2035) | 5.4% |

The polymer surge arrester market forms an essential segment within the global electrical protection equipment industry, highlighting its role in safeguarding power systems from voltage surges. Within the broader surge protection device market, it accounts for about 7.2%, reflecting increasing adoption across transmission and distribution networks. In the global power transmission infrastructure sector, it secures 5.8%, driven by investments in grid modernization and expansion.

Across the medium and high voltage equipment market, the share is estimated at 6.5%, showing its relevance in both utility and industrial applications. Within the electrical insulation materials and polymer composites sector, it represents 4.6%, underlining the shift toward lightweight and durable designs. In the renewable energy integration equipment category, the market stands at 3.9%, linked to rising grid-connected solar and wind installations. Recent developments in this market emphasize material innovation, performance reliability, and integration with smart grid systems. Manufacturers are introducing advanced silicone rubber housings and hydrophobic polymer coatings to enhance weather resistance and reduce maintenance needs. Compact and lightweight designs are being developed to ease installation in constrained urban and industrial environments.

Smart monitoring technologies with sensors are increasingly being integrated, enabling predictive maintenance and real-time fault detection. Investments in eco-friendly materials and recycling approaches are also gaining traction to address sustainability requirements. Collaborations between utilities, manufacturers, and research institutions are shaping product advancements, ensuring surge protection solutions align with evolving energy infrastructure demands.

The polymer surge arrester market is experiencing steady growth, driven by increasing investments in power transmission and distribution infrastructure and the rising need for reliable protection against voltage surges. Industry publications and utility reports have highlighted a growing preference for polymer-based designs over traditional porcelain units, owing to their superior mechanical strength, lighter weight, and resistance to pollution and moisture.

Grid modernization initiatives, expansion of renewable energy integration, and urban electrification projects are further boosting demand for advanced surge protection equipment. In addition, regulatory frameworks mandating the adoption of surge protection devices to improve system reliability and prevent costly outages are influencing procurement patterns.

Technological innovations, including improved polymer housing materials and enhanced gapless designs, have extended product life cycles and reduced maintenance requirements. Market momentum is expected to be led by medium-voltage applications in distribution networks and utilities, reflecting both replacement demand in mature markets and new installations in emerging economies.

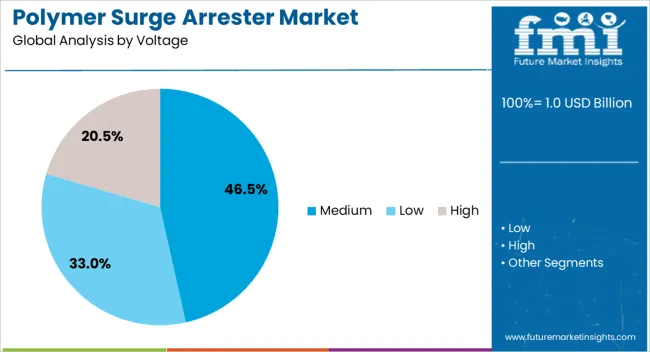

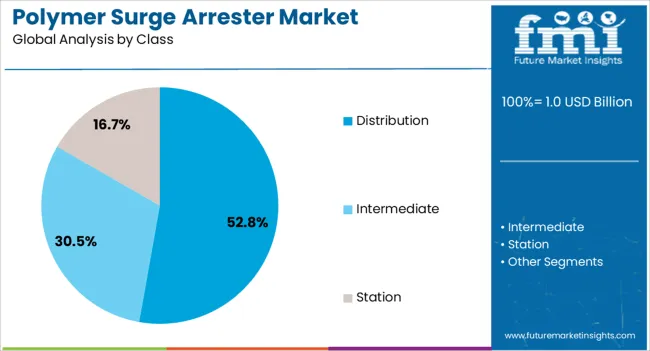

The polymer surge arrester market is segmented by voltage, class, application, and geographic regions. By voltage, polymer surge arrester market is divided into Medium, Low, and High. In terms of class, polymer surge arrester market is classified into Distribution, Intermediate, and Station.

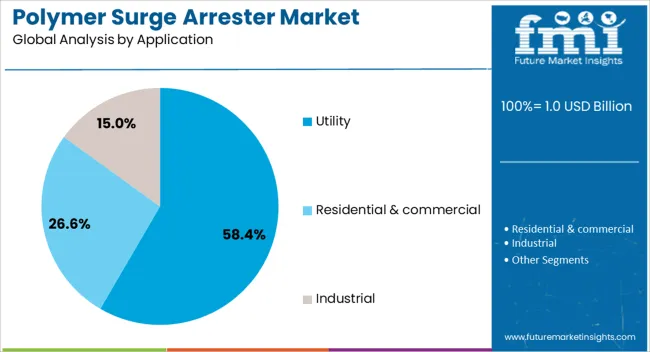

Based on application, polymer surge arrester market is segmented into Utility, Residential & commercial, and Industrial. Regionally, the polymer surge arrester industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The medium voltage segment is projected to account for 46.5% of the polymer surge arrester market revenue in 2025, maintaining its leading position due to its widespread use in distribution networks and industrial facilities. Growth in this segment has been supported by the rising demand for stable electricity supply in urban and semi-urban areas, where medium voltage lines dominate the network.

Utilities and industrial operators have increasingly adopted polymer surge arresters in this range for their ability to provide dependable protection against switching and lightning surges while offering lightweight installation and reduced maintenance needs.

Additionally, the global expansion of renewable energy projects, particularly wind and solar farms, has increased the need for medium-voltage surge protection to safeguard grid-connected equipment. The segment’s adoption is further reinforced by cost-effective installation and compatibility with modern distribution infrastructure, ensuring its sustained market leadership.

The distribution class segment is projected to contribute 52.8% of the polymer surge arrester market revenue in 2025, reflecting its extensive deployment in power distribution systems. This segment’s growth has been driven by the rising demand for robust surge protection at the distribution level, where outages and equipment failures can have significant economic and operational impacts.

Distribution class polymer surge arresters are valued for their ability to protect transformers, circuit breakers, and other distribution equipment from transient overvoltages. Utilities have increasingly standardized these arresters in grid expansion and refurbishment projects due to their superior performance in polluted or coastal environments.

Moreover, the lighter weight and vandalism-resistant features of polymer designs have enhanced field handling and durability. As urbanization and industrial expansion continue to place higher demands on distribution networks, this segment is expected to remain a critical area of investment for utilities worldwide.

The utility segment is projected to hold 58.4% of the polymer surge arrester market revenue in 2025, retaining its dominant share due to the sector’s critical need for reliable and efficient surge protection across transmission and distribution networks. Growth in this segment has been supported by large-scale grid modernization projects, expansion of rural electrification programs, and the integration of variable renewable energy sources, all of which require enhanced surge mitigation solutions.

Utility operators have prioritized polymer surge arresters for their long service life, low maintenance requirements, and resilience in diverse environmental conditions.

Additionally, polymer designs have facilitated quicker and safer installation, reducing downtime during maintenance or upgrades. With utilities facing increasing pressure to improve grid reliability and minimize outage-related losses, the adoption of polymer surge arresters in utility applications is expected to remain strong, bolstered by continuous infrastructure investment and regulatory compliance requirements.

The market has gained momentum as modern power transmission and distribution networks expand to meet growing electricity demand. Polymer-based arresters are designed to protect electrical systems from overvoltage events caused by lightning strikes, switching operations, or faults. Their lightweight design, superior insulation performance, and resistance to environmental stress have driven adoption over traditional porcelain arresters.

Utilities and industries rely on these arresters to ensure grid reliability and reduce maintenance downtime. Rising investments in renewable power projects, urban power distribution, and cross-border transmission lines have supported demand.

Grid modernization initiatives have been instrumental in driving the adoption of polymer surge arresters. Many utilities are upgrading old infrastructure to withstand higher transmission capacities and intermittent renewable power integration. Polymer arresters offer advantages such as low weight, shatter resistance, and excellent hydrophobic properties, making them suitable for high-voltage substations and overhead lines. The deployment of smart grids and distributed energy networks has increased the vulnerability of equipment to transient surges, necessitating reliable protection devices. Large-scale electrification programs in developing economies have also accelerated installations, particularly in rural transmission projects. Compared to traditional porcelain-based alternatives, polymer surge arresters require lower installation and maintenance costs. Their compatibility with compact switchgear and modern substations ensures that they remain essential for reliable electricity distribution across evolving power networks.

Advancements in materials and manufacturing technologies have improved the performance of polymer surge arresters, reinforcing their market appeal. The use of advanced silicone rubber, epoxy composites, and hydrophobic polymers has enhanced resistance to weathering, pollution, and UV exposure. Zinc oxide varistors integrated into polymer arresters provide better non-linear resistance characteristics, enabling fast and efficient absorption of surge energy. Lightweight polymer housings have reduced installation complexity while increasing mechanical strength under severe climatic conditions. Modern testing standards ensure higher reliability, particularly in extra high voltage and ultra-high voltage networks. Utilities benefit from extended operational lifespans and reduced service interruptions due to superior tracking and erosion resistance. Continuous innovation has positioned polymer surge arresters as the preferred solution in regions with extreme weather conditions and high levels of industrial activity.

Despite their benefits, the market faces challenges from counterfeit products and cost pressures. Low-quality polymer arresters circulating in developing markets pose risks to grid reliability and increase the chances of failure under surge conditions. Price-sensitive markets often favor cheaper alternatives, leading to higher maintenance costs over time. Standardization issues across regions complicate procurement, as testing and certification processes differ between countries. Utilities face budget constraints in large-scale electrification projects, which can delay procurement of advanced polymer surge arresters. The raw material price fluctuations in polymers and zinc oxide affect overall production costs. Addressing these challenges requires stricter enforcement of quality standards, collaboration between regulatory bodies, and investment in awareness programs that highlight the long-term benefits of reliable polymer surge arrester deployment.

The growing share of renewable power generation has fueled demand for polymer surge arresters, particularly in solar and wind power installations. These energy sources often require extensive transmission infrastructure to connect to national grids, increasing exposure to transient surges. Polymer arresters are well-suited for such applications due to their durability and low maintenance requirements in remote locations. Offshore wind farms, in particular, rely heavily on surge protection equipment to safeguard submarine cables and associated substations. Solar parks spread across desert and semi-arid regions also benefit from polymer arresters’ hydrophobic and pollution-resistant properties. With renewable energy capacity additions expected to dominate future grid expansion, polymer surge arresters are projected to play an essential role in ensuring uninterrupted power flow. Their deployment in hybrid and microgrid systems further strengthens long-term demand growth.

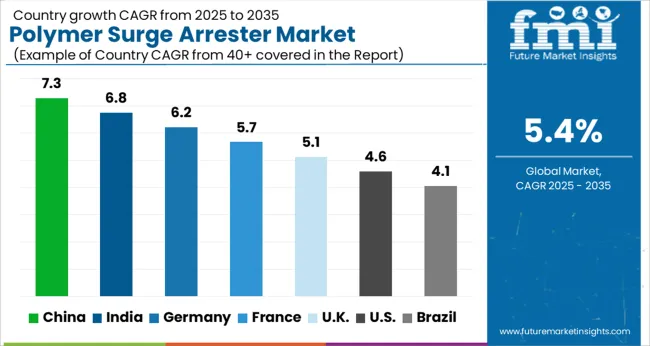

| Country | CAGR |

|---|---|

| China | 7.3% |

| India | 6.8% |

| Germany | 6.2% |

| France | 5.7% |

| UK | 5.1% |

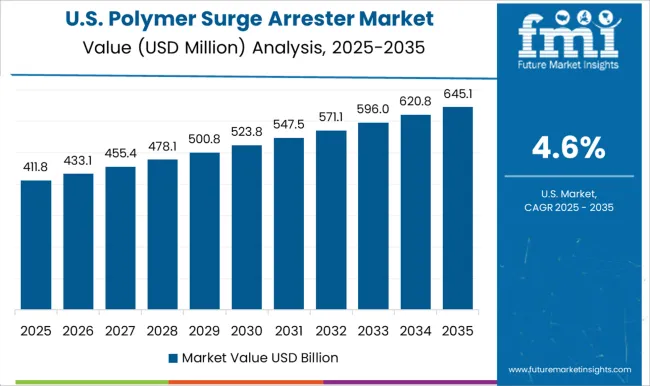

| USA | 4.6% |

| Brazil | 4.1% |

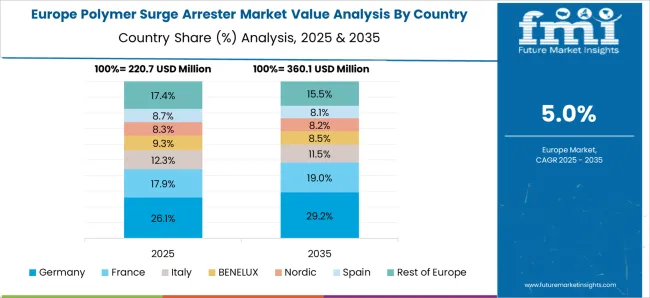

China leads the market with a projected growth rate of 7.3%, driven by rising electricity demand and continued grid modernization initiatives. India follows at 6.8%, where investments in power transmission and distribution networks are accelerating deployment. Germany records 6.2% growth, supported by its focus on strengthening renewable energy integration and grid stability. The United Kingdom achieves 5.1%, with steady adoption across residential and industrial applications. The United States shows a 4.6% growth rate, influenced by efforts to enhance power reliability and mitigate risks from voltage surges. Collectively, these countries emphasize the strategic importance of polymer surge arresters in ensuring efficient and reliable power systems across diverse geographies. This report includes insights on 40+ countries; the top markets are shown here for reference.

The market in China is projected to grow at a CAGR of 7.3%, supported by rapid expansion of transmission and distribution infrastructure. The shift toward polymer-based arresters is being favored due to lightweight design, better performance under pollution, and ease of installation compared to porcelain alternatives. Increasing electricity consumption and expansion of renewable energy projects are further accelerating the adoption of advanced surge protection solutions. With continued investments in smart grid technologies, the demand for polymer surge arresters in China is expected to remain robust in the long term.

India is anticipated to expand at a CAGR of 6.8%, driven by investments in electrification programs and grid modernization. Increased adoption of renewable power sources is generating the need for enhanced surge protection equipment across substations and transmission lines. Favorable government policies for strengthening power reliability are reinforcing demand for polymer surge arresters. Additionally, the focus on minimizing outages and ensuring long-term grid stability is leading utilities to increasingly adopt polymer technology. This market is expected to benefit from rapid infrastructure upgrades in both urban and rural areas.

Germany is forecasted to grow at a CAGR of 6.2%, supported by the transition toward renewable energy and the need for grid reinforcement. The country’s emphasis on integrating wind and solar power into the grid is driving demand for effective surge protection solutions. Polymer arresters are being increasingly deployed due to their superior resistance to environmental conditions and lower maintenance requirements. Growth in cross-border electricity exchange within Europe is also amplifying the importance of resilient transmission infrastructure. The German market is positioned as a frontrunner in adopting innovative polymer surge protection technologies.

The market in the United Kingdom is expected to record a CAGR of 5.1%, influenced by ongoing modernization of the country’s electrical grid. With increasing adoption of offshore wind projects and distributed energy resources, the need for surge protection across substations and transmission lines is rising. Utilities are shifting toward polymer arresters for their reliability and lightweight structure, which aids in easier installation and replacement. Rising emphasis on grid resilience and outage reduction is likely to remain a critical driver of this market in the United Kingdom.

The market in the United States is projected to grow at a CAGR of 4.6%, shaped by modernization of transmission systems and the push for renewable energy integration. Investments in strengthening aging grid infrastructure are encouraging utilities to adopt reliable surge protection devices. Increasing use of distributed power generation and microgrids is also creating demand for polymer-based arresters. Adoption of smart grid technologies and the move toward digital substations are reinforcing the role of advanced surge arresters in ensuring network stability.

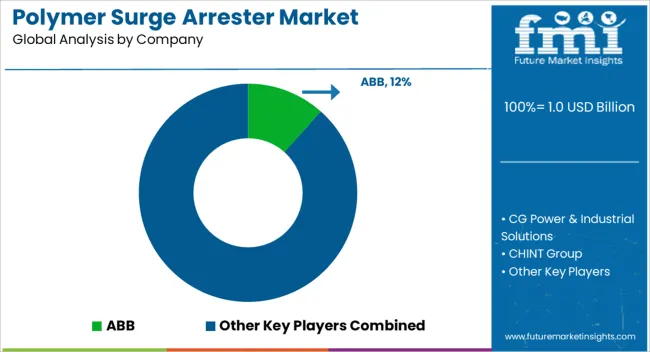

The market is influenced by the presence of leading multinational corporations and specialized regional manufacturers addressing the growing demand for reliable grid protection. ABB, Siemens Energy, and General Electric remain at the forefront with advanced surge protection technologies designed for high-voltage applications. Eaton and Toshiba Energy Systems & Solutions extend their portfolios with polymer-based solutions that emphasize durability and reduced maintenance. CG Power & Industrial Solutions and CHINT Group maintain a strong position across developing markets by offering cost-effective alternatives. Regional specialists such as Compaq International, Elpro, and Rashtriya Electrical and Engineering Corporation cater to domestic and export markets through tailored solutions for utilities and industrial facilities.

European companies like DEHN SE, Ensto, INAEL, and Izoelektro focus on integrating smart grid compatibility and safety standards into their products. Asian manufacturers, including Hangzhou Yongde Electric Appliances, Zhejiang Ruili Electric, and Zhejiang Volcano Electrical Technology, are strengthening global competitiveness with price-efficient surge arresters that meet international certifications. Hubbell, TE Connectivity, and Surgetek add further diversity by focusing on innovation, modularity, and integration with grid monitoring systems. These players are driving advancements in polymer surge arresters that support network resilience, operational safety, and long-term grid efficiency.

| Item | Value |

|---|---|

| Quantitative Units | USD 1.0 Billion |

| Voltage | Medium, Low, and High |

| Class | Distribution, Intermediate, and Station |

| Application | Utility, Residential & commercial, and Industrial |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | ABB, CG Power & Industrial Solutions, CHINT Group, Compaq International, DEHN SE, Eaton, Electric Powertek, Elpro, Ensto, General Electric, Hangzhou Yongde Electric Appliances, Hubbell, INAEL, Izoelektro, Rashtriya Electrical and Engineering Corporation, Siemens Energy, Surgetek, TE Connectivity, Toshiba Energy Systems & Solutions, Zhejiang Ruili Electric, and Zhejiang Volcano Electrical Technology |

| Additional Attributes | Dollar sales by arrester type and voltage class, demand dynamics across transmission, distribution, and industrial networks, regional trends in polymer-based insulation adoption, innovation in lightweight design, hydrophobic performance, and reliability, environmental impact of material use and end-of-life disposal, and emerging use cases in renewable energy grids, smart substations, and urban power infrastructure. |

The global polymer surge arrester market is estimated to be valued at USD 1.0 billion in 2025.

The market size for the polymer surge arrester market is projected to reach USD 1.6 billion by 2035.

The polymer surge arrester market is expected to grow at a 5.4% CAGR between 2025 and 2035.

The key product types in polymer surge arrester market are medium, low and high.

In terms of class, distribution segment to command 52.8% share in the polymer surge arrester market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Polymeric Brominated Flame Retardants Market Size and Share Forecast Outlook 2025 to 2035

Polymer-based Prefilled Syringe Market Size and Share Forecast Outlook 2025 to 2035

Polymer Modified Bitumen Market Forecast and Outlook 2025 to 2035

Polymer Stabilizers Market Size and Share Forecast Outlook 2025 to 2035

Polymeric Adsorbents Market Size and Share Forecast Outlook 2025 to 2035

Polymerization Initiator Market Size and Share Forecast Outlook 2025 to 2035

Polymer Processing Aid (PPA) Market Size and Share Forecast Outlook 2025 to 2035

Polymer Feed System Market Size and Share Forecast Outlook 2025 to 2035

Polymer Bearings Market Size and Share Forecast Outlook 2025 to 2035

Polymer Nanomembrane Market Size and Share Forecast Outlook 2025 to 2035

Polymeric Sand Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Polymer Binders Market Size and Share Forecast Outlook 2025 to 2035

Polymer Emulsions Market Size and Share Forecast Outlook 2025 to 2035

Polymer Memory Market Size and Share Forecast Outlook 2025 to 2035

Polymer Gel Market Size and Share Forecast Outlook 2025 to 2035

Polymeric Microcapsules Market Size and Share Forecast Outlook 2025 to 2035

Polymer Fillers Market Analysis - Size, Share, and Forecast 2025 to 2035

Polymer Coated Fabrics Market Trends 2025 to 2035

Polymer Emulsion Market Growth - Trends & Forecast 2025 to 2035

Polymeric Membrane Market Growth - Trends & Forecast 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA