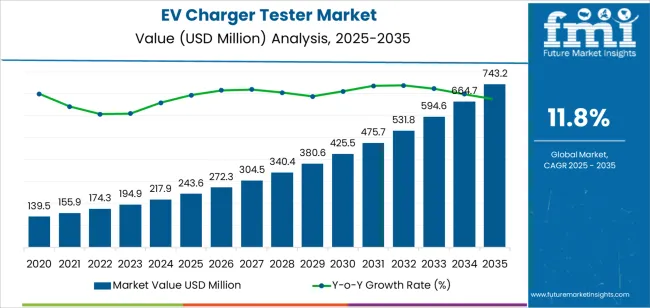

The EV charger tester market is expected to grow from USD 243.6 million in 2025 to USD 743.2 million by 2035, reflecting a robust CAGR of 11.8%. This growth is driven by the increasing adoption of electric vehicles (EVs) globally, along with the expansion of EV charging infrastructure to meet the rising demand for cleaner and more sustainable transportation options. As the number of EVs on the road increases, the need for reliable testing equipment to ensure the proper functioning of charging stations and EV chargers becomes essential. The market is further supported by technological advancements in charging technology, including fast charging and ultra-fast charging systems, which require specialized testing equipment.

As governments and private sector investments continue to expand the EV infrastructure, the demand for EV charger testers will continue to grow. The rising focus on energy efficiency and safety standards for charging stations, along with regulatory compliance requirements, will create additional opportunities for the market. Furthermore, the ongoing shift towards smart charging systems and the integration of IoT in charging solutions will drive innovation in testing technologies, making them more efficient, precise, and adaptable to various EV models.

The Growth Rate Volatility Index (GRVI) for the EV charger tester market measures the variability of the market’s growth rates over the forecast period from 2025 to 2035, identifying any periods of significant acceleration or deceleration in growth.

The market shows a steady upward trend over the forecast period, but the GRVI indicates that the growth rate will likely experience some fluctuations throughout the decade. In the early phase, from 2025 to 2030, the market will experience moderate fluctuations in growth as investments in EV infrastructure ramp up and charging technologies become more advanced. However, with increasing EV adoption and regulatory support, the market will see consistent growth, and the volatility in annual growth rates will be moderate, with growth rates ranging from 10% to 12%.

Between 2030 and 2035, the market may experience higher stability in growth, as the charging infrastructure reaches more mature stages, and demand for advanced testing equipment stabilizes. The GRVI indicates less volatility during this phase, with growth rates likely to remain more consistent, ranging between 11% and 12%, as the focus shifts towards smart charging solutions and standardization of testing equipment. The market is expected to maintain a steady, predictable growth trajectory during this phase, driven by widespread EV adoption and the continued expansion of charging stations worldwide.

| Metric | Value |

|---|---|

| Market Value (2025) | USD 243.6 million |

| Market Forecast Value (2035) | USD 743.2 million |

| Forecast CAGR (2025-2035) | 11.8% |

The EV charger tester market is growing as electric vehicles (EVs) and associated charging infrastructure expand worldwide. As public and private charging points proliferate, operators need dependable testing equipment to verify performance, safety, and regulatory compliance. The increasing deployment of fast charging systems and networked charging stations raises the demand for specialised testers capable of evaluating parameters such as output voltage, current stability, connector integrity and communication protocol compliance.

Another key driver is regulatory and industry emphasis on charger reliability and safety standards. As consumers and fleet operators expect consistent charging performance, testing equipment helps ensure that chargers meet functions such as correct interaction with EVs, proper earthing and insulation resistance, and correct handling of dynamic load conditions. Technological advances in charger design and smart features also mean that tester equipment must evolve to support new protocols and diagnostics. At the same time, factors such as the initial cost of advanced testers, lack of standardised testing protocols across regions, and slower adoption in emerging markets may moderate growth.

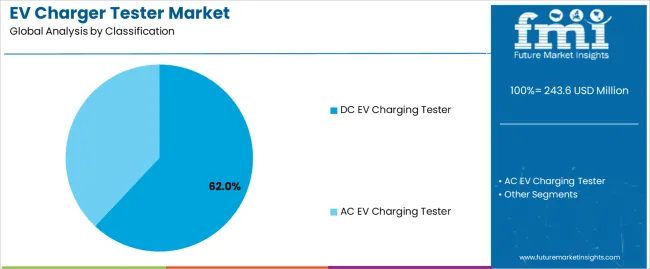

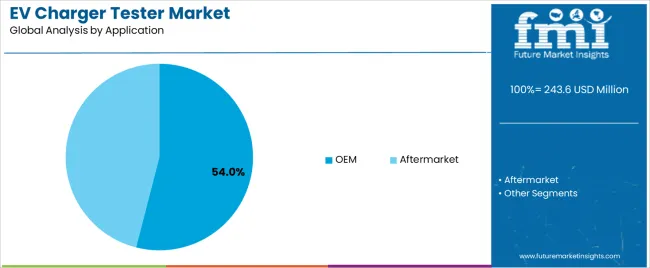

The EV charger tester market is segmented by classification and application. The leading classification segment is the DC EV charging tester, which holds 62% of the market share, while the OEM (Original Equipment Manufacturer) application segment dominates, accounting for 54% of the market. These segments are crucial in the market's growth, driven by the increasing adoption of electric vehicles (EVs) and the growing demand for reliable testing equipment to ensure the proper functioning of EV charging infrastructure.

The DC EV charging tester segment leads the EV charger tester market, commanding 62% of the market share. DC fast chargers are essential for providing high-speed charging to electric vehicles, and testing these chargers is critical to ensure their efficiency, safety, and reliability. DC EV charging testers are designed to simulate the behavior of electric vehicles when connected to charging stations, allowing manufacturers and service providers to verify that chargers operate correctly under various conditions. This includes checking voltage, current, and communication protocols between the charger and the EV.

The increasing adoption of DC fast chargers, which are essential for reducing charging time, particularly in public and commercial charging stations, contributes to the dominance of DC EV charging testers in the market. As the demand for fast charging infrastructure grows, especially with the expansion of EV adoption worldwide, the need for reliable and accurate testing equipment will continue to drive the market for DC EV charging testers. Their ability to ensure that DC fast charging stations meet industry standards and provide quick, safe charging solutions is a key factor in their market leadership.

The OEM (Original Equipment Manufacturer) application segment leads the EV charger tester market, holding a 54% market share. OEMs play a pivotal role in the manufacturing and production of EV chargers, and ensuring that their products meet regulatory standards and quality expectations is essential. OEMs require reliable and precise testing equipment to validate the performance and safety of their EV chargers before they are sold to consumers or deployed in public and commercial charging stations. This involves the use of both AC and DC testing equipment to verify that the chargers are fully functional and comply with industry regulations.

The strong presence of OEMs in the market is further fueled by the expansion of the electric vehicle market, which continues to grow as governments, businesses, and consumers increasingly turn to EVs as a sustainable alternative to traditional vehicles. The demand for OEM testing equipment is expected to rise as manufacturers continue to scale production and improve the efficiency and performance of EV chargers. Given that OEMs are responsible for the design and production of most charging equipment, their significant share in the market will continue to drive the demand for advanced EV charger testers.

The EV charger tester market is gaining traction as electric vehicle (EV) adoption accelerates and charging infrastructure expands worldwide. The segment is projected to grow significantly due to the increasing deployment of public fast-charging stations, home chargers, fleet charging systems, and OEM charger testing requirements. The growing regulatory standards and safety certifications for EV charging systems also drive demand for tester equipment. Additionally, innovations in tester functionality, such as support for multiple protocols, diagnostics, and smart connectivity, are shaping the competitive landscape.

What Are The Primary Growth Drivers For the EV Charger Tester Market?

Key drivers for the EV charger tester market include the widespread rollout of EV charging infrastructure across residential, commercial, and public segments. As governments and private operators invest in chargers, the need for rigorous testing to ensure safety, performance, and compliance intensifies. Charging station operators and OEMs require testers to validate adherence to international standards and detect faults early. Technological advancements—such as support for DC fast chargers, multi-protocol compatibility, and remote diagnostics—further boost the market. Additionally, the rise in fleet electrification and commercial charging networks heightens the need for ongoing maintenance and verification tools.

What Are The Key Restraints In the EV Charger Tester Market?

Despite favourable conditions, the EV charger tester market faces challenges. The cost of advanced testing equipment, especially tools capable of handling high-power DC fast chargers or multiple communication protocols, can limit adoption, particularly among smaller installers or operators in emerging markets. Integration challenges arise because charger testers must support evolving standards and a variety of connector types and communication protocols. Additionally, fragmented regulatory environments across regions impose varying certification requirements, which can delay deployment and add complexity for manufacturers of testing equipment. These factors may slow growth in some segments or regions.

What Are The Emerging Trends In the EV Charger Tester Market?

Emerging trends in this market include increasing demand for multifunctional tester platforms that validate charger performance, communication protocols, grid-compatibility, and safety compliance in one device. The shift toward smart diagnostics and remote monitoring in tester equipment is also growing, enabling predictive maintenance and reducing downtime for charging infrastructure. Another trend is the development of multifunction testing tools designed for high-power DC fast-charging systems, given the growth in ultra-rapid chargers. Additionally, as EV charging networks become more global, there is a push for standardization of testing requirements and protocols, simplifying equipment design and accelerating global adoption of tester solutions.

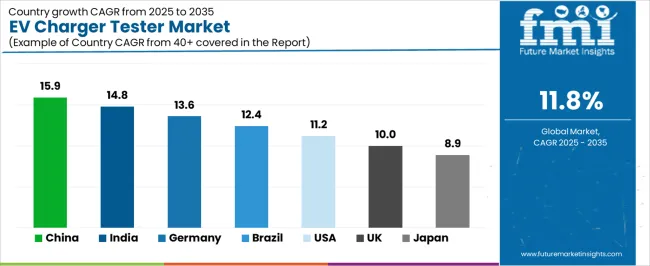

The EV charger tester market is growing rapidly, driven by the global adoption of electric vehicles (EVs) and the increasing need for reliable, efficient charging infrastructure. EV charger testers are essential tools for ensuring that EV charging stations are functioning correctly, safely, and efficiently. As the number of electric vehicles on the road continues to rise, the demand for EV chargers and the need for accurate testing solutions also increase. Emerging markets like China and India are witnessing strong growth in this sector, while developed markets like Germany, the USA, and the UK continue to invest heavily in expanding their charging infrastructure. This analysis provides insights into the key factors driving the growth of the EV charger tester market across various countries.

| Country | CAGR (2025-2035) |

|---|---|

| China | 15.9% |

| India | 14.8% |

| Germany | 13.6% |

| Brazil | 12.4% |

| USA | 11.2% |

| United Kingdom | 10% |

| Japan | 8.9% |

China is leading the EV charger tester market with a significant CAGR of 15.9%. As the largest market for electric vehicles globally, China is rapidly expanding its EV infrastructure, including charging stations, to support the growing number of electric vehicles. The Chinese government’s policies to promote green energy, along with incentives for electric vehicle adoption, have led to a massive increase in EV production and sales.

The rise in the number of EVs on the road directly correlates with the demand for reliable charging infrastructure, which in turn drives the need for efficient testing solutions to ensure that chargers are functioning correctly. As China continues to invest in expanding its EV infrastructure and ensuring high-quality charging experiences for consumers, the market for EV charger testers is expected to continue growing at a fast pace.

India’s EV charger tester market is growing at a robust CAGR of 14.8%. India is witnessing a significant shift toward electric mobility, driven by government initiatives, incentives for EV adoption, and a growing awareness of environmental concerns. With the Indian government’s push toward achieving cleaner transportation, there has been a marked increase in the installation of EV charging stations across urban and rural areas.

The growing demand for EVs and the expansion of the country’s charging network is propelling the need for EV charger testers to ensure safe and effective charging infrastructure. India’s rapid urbanization and expanding automotive sector, combined with investments in sustainable energy solutions, will continue to drive the demand for charging stations and, consequently, the market for EV charger testers.

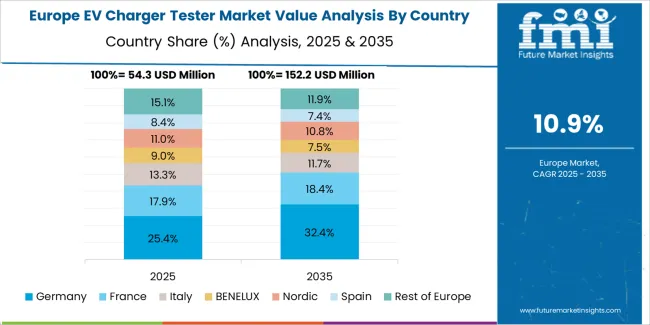

Germany’s EV charger tester market is projected to grow at a CAGR of 13.6%. As a leader in the automotive industry and a strong proponent of electric mobility, Germany is at the forefront of the transition to electric vehicles. The country has set ambitious targets for EV adoption, and there has been a significant increase in the number of EV charging stations, particularly in urban areas.

Germany’s strong focus on sustainability and renewable energy has further fueled the growth of EV infrastructure, making the demand for efficient testing solutions more critical. With a growing number of electric vehicles on the road and expanding charging networks, the market for EV charger testers in Germany is expected to continue expanding as the country strives to meet its climate goals and improve its electric mobility ecosystem.

Brazil’s EV charger tester market is expected to grow at a CAGR of 12.4%. The adoption of electric vehicles in Brazil is still in its early stages, but the government’s initiatives to promote sustainable mobility, alongside a growing demand for environmentally friendly transportation, are driving the need for EV charging infrastructure. With more automakers introducing EV models to the Brazilian market, the demand for charging stations and reliable charging infrastructure is increasing.

Brazil’s focus on reducing carbon emissions and promoting clean energy is leading to the expansion of the country’s EV infrastructure. As more EVs hit the road, there is an increased need for EV charger testers to ensure that charging stations are functioning safely and efficiently. This growth will be further supported by Brazil’s increasing awareness of green technologies and sustainable transportation solutions.

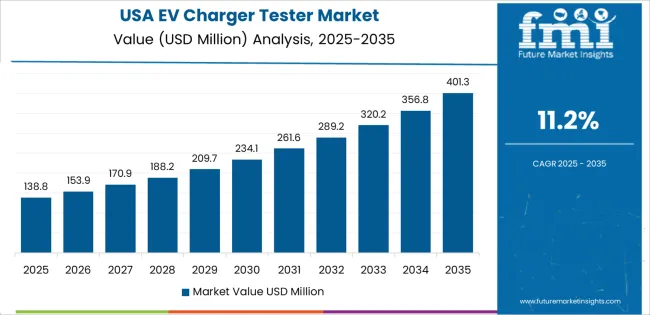

The United States has a projected CAGR of 11.2% for the EV charger tester market. As one of the largest markets for electric vehicles, the USA has seen a rapid increase in the adoption of EVs, driven by government incentives, technological advancements, and an increasing focus on sustainability. The expansion of the charging network to accommodate a growing number of EVs has fueled the need for testing solutions to ensure safe and effective charging operations.

The rollout of national and regional EV charging infrastructure initiatives, combined with the growing number of electric vehicles on the road, creates a strong demand for EV charger testers. As the USA continues to lead in electric vehicle adoption and infrastructure development, the market for EV charger testers is expected to see steady growth.

The United Kingdom’s EV charger tester market is projected to grow at a CAGR of 10.0%. The UK is investing heavily in electric mobility and has set ambitious goals for phasing out internal combustion engine vehicles. The UK government’s focus on increasing the number of charging stations and promoting EV adoption is driving the demand for reliable testing solutions to ensure the safety and performance of chargers.

With the continued expansion of the UK’s EV infrastructure and the growing number of electric vehicles, the need for EV charger testers is expected to rise. The UK’s commitment to achieving net-zero emissions and improving the quality of its charging infrastructure will further support the demand for these testing solutions.

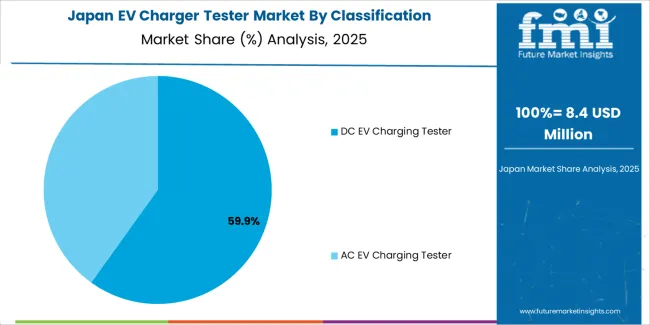

Japan’s EV charger tester market is expected to grow at a CAGR of 8.9%. As one of the leading countries in electric mobility, Japan has seen a steady increase in the adoption of electric vehicles. The government’s strong focus on reducing greenhouse gas emissions and promoting electric mobility is driving the growth of EV infrastructure across the country.

The expanding network of charging stations, along with the increasing number of electric vehicles, creates a growing need for EV charger testers to ensure that charging stations are operating safely and efficiently. Japan’s technological expertise and commitment to clean energy solutions will continue to drive the market for EV charger testers in the coming years. However, the market growth in Japan is expected to be more moderate compared to emerging markets like China and India.

In the EV charger tester market, companies such as Comemso (holding about 14% share), ITECH, GMC Instruments, Fluke Corporation, Keysight Technologies, HT Instruments, Triplett Test Equipment, ZERA GmbH, Megger Group, Seaward Electronic Ltd., and others are vying for position. The market is growing as electric vehicle adoption increases and charging infrastructure expands. The EV charging tester market is projected to grow significantly in the coming years, driven by the need for testing equipment that ensures safety, performance compliance, and rapid deployment of charging stations.

The companies’ competitive strategies vary. Some firms emphasise high precision measurement, compliance with emerging EVSE (electric vehicle supply equipment) standards, and support for high voltage DC testing. Others prioritise modular tester platforms, ease of integration into service fleets or maintenance workflows, and global service support. Some focus on partnerships with charging station manufacturers or network operators to secure long term testing contracts. Brochures of such testers typically highlight parameters such as voltage and current rating, waveform simulation, connector compatibility (AC and DC), software analytics for fault detection, and portability for field use. Firms with strong brand reputation and international service networks (e.g., Keysight, Fluke) attempt to leverage this into heightened trust in emerging markets. Meanwhile, smaller specialised vendors (like Comemso) position themselves around niche capabilities such as EV charger simulation or rapid compliance testing. The result is a market where both broad based capability and tailored specialisation matter for achieving share in the EV charger tester space.

| Items | Details |

|---|---|

| Quantitative Units | USD Million |

| Regions Covered | Asia Pacific, Europe, North America, Latin America, Middle East & Africa |

| Classification | DC EV Charging Tester, AC EV Charging Tester |

| Application | OEM, Aftermarket |

| Key Companies Profiled | Comemso, ITECH, GMC INSTRUMENTS, Fluke Corporation, Keysight Technologies, HT Instruments, Triplett Test Equipment, ZERA GmbH, Megger Group, Seaward Electronic Ltd., Chauvin Arnoux, Sonel S.A., Kewtech Corporation, DEKRA, dSPACE GmbH, Benning Elektrotechnik, Gossen Metrawatt, Hioki E.E. Corporation, Guangzhou ZHIYUAN Electronics Co., Ltd., Ningbo Iuxpower Electronic Technology Co., Ltd., Jishili Electronics (Suzhou) Co., Ltd., Shenzhen Skonda Electronic Co., Ltd. |

| Additional Attributes | The market analysis includes dollar sales by classification and application categories. It also covers regional adoption trends across major markets such as Asia Pacific, Europe, and North America. The competitive landscape focuses on key manufacturers in the EV charger tester market, with innovations in DC and AC EV charging testing technologies. Trends in the growing demand for EV chargers in OEM and aftermarket applications are explored, along with advancements in electrical testing equipment for electric vehicle infrastructure. |

The global EV charger tester market is estimated to be valued at USD 243.6 million in 2025.

The market size for the EV charger tester market is projected to reach USD 743.2 million by 2035.

The EV charger tester market is expected to grow at a 11.8% CAGR between 2025 and 2035.

The key product types in EV charger tester market are dc EV charging tester and ac EV charging tester.

In terms of application, oem segment to command 54.0% share in the EV charger tester market in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

EV Transmission System Market Size and Share Forecast Outlook 2025 to 2035

EV Charging Panelboard Market Forecast Outlook 2025 to 2035

Evacuated Miniature Crystal Oscillator (EMXO) Market Forecast and Outlook 2025 to 2035

Evaporative Air Cooler Market Size and Share Forecast Outlook 2025 to 2035

EV Charging Cable Market Size and Share Forecast Outlook 2025 to 2035

EVOH Encapsulation Film Market Size and Share Forecast Outlook 2025 to 2035

eVTOL Charging Facilities Market Size and Share Forecast Outlook 2025 to 2035

Event Tourism Market Size and Share Forecast Outlook 2025 to 2035

EV Telematics Control Systems Market Size and Share Forecast Outlook 2025 to 2035

Evidence Collection Tubes Market Size and Share Forecast Outlook 2025 to 2035

EV Battery Recycling and Black Mass Processing Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

EVA Coated Film Market Size and Share Forecast Outlook 2025 to 2035

EV Charging Management Software Platform Market Size and Share Forecast Outlook 2025 to 2035

EV EMC Battery Filter Market Size and Share Forecast Outlook 2025 to 2035

EV Traction Inverter Market Size and Share Forecast Outlook 2025 to 2035

EV Plant Construction Market Size and Share Forecast Outlook 2025 to 2035

EV Battery Heating System Market Size and Share Forecast Outlook 2025 to 2035

EV Charging Station Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Event Logistics Market Size and Share Forecast Outlook 2025 to 2035

Evaporated Filled Milk Market Size, Growth, and Forecast for 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA