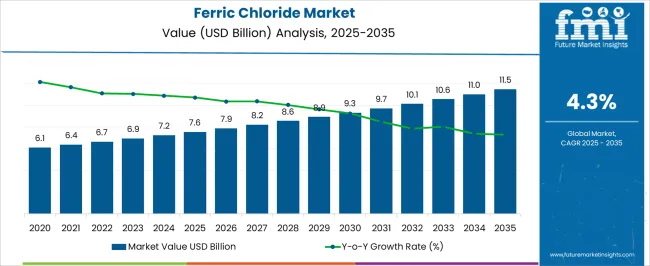

The Ferric Chloride Market is estimated to be valued at USD 7.6 billion in 2025 and is projected to reach USD 11.5 billion by 2035, registering a compound annual growth rate (CAGR) of 4.3% over the forecast period. The chart illustrates a consistent upward trend, reflecting its critical use in water treatment, chemical processing, and electronics etching. Between 2020 and 2025, the market advances steadily from USD 6.1 billion to USD 7.6 billion, supported by increasing municipal wastewater treatment and stricter environmental regulations.

From 2026 to 2030, the curve shows moderate acceleration, climbing from USD 7.9 billion to USD 9.3 billion. This phase aligns with heightened industrial adoption in metallurgy, printed circuit board manufacturing, and dye production. Post-2030, the market enters a more mature growth stage, with expansion continuing at a slower pace, reaching USD 11.5 billion by 2035. The YoY growth rate line highlights this transition, displaying a gradual decline after 2028, consistent with market stabilization.

| Metric | Value |

|---|---|

| Ferric Chloride Market Estimated Value in (2025 E) | USD 7.6 billion |

| Ferric Chloride Market Forecast Value in (2035 F) | USD 11.5 billion |

| Forecast CAGR (2025 to 2035) | 4.3% |

The ferric chloride market is experiencing strong growth, driven by the increasing emphasis on water quality management and stringent environmental compliance. As urbanization accelerates and freshwater resources face mounting stress, ferric chloride has gained prominence as a key coagulant in water and wastewater treatment processes. The compound’s high efficacy in removing suspended particles, organic matter, and phosphates has led to its broad use across municipal, industrial, and commercial utilities.

Advancements in liquid dosing technologies, automation in treatment plants, and the rising need for cost-effective chemical solutions have further enhanced the appeal of ferric chloride. In emerging markets, the expansion of sanitation infrastructure and stricter discharge regulations are also contributing to increased consumption.

Developed regions continue to modernize existing treatment facilities with chemicals that offer operational stability and higher purification performance. With water scarcity and pollution challenges intensifying globally, ferric chloride is expected to remain integral to wastewater treatment frameworks, especially in decentralized and smart water management systems.

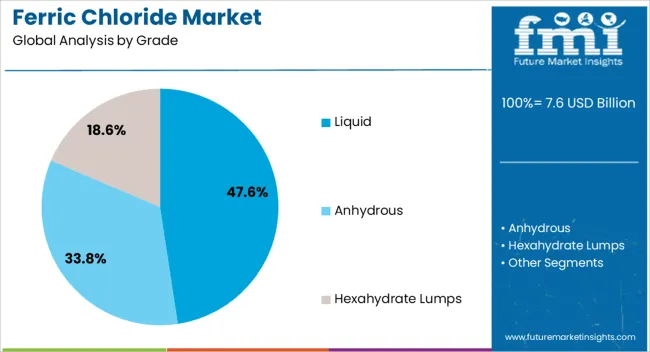

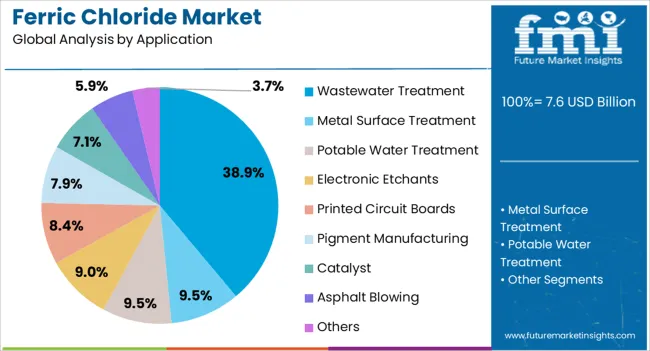

The ferric chloride market is segmented by grade, application, end-use industry, and geographic regions. By grade, the ferric chloride market is divided into Liquid, Anhydrous, and Hexahydrate Lumps. In terms of application, the ferric chloride market is classified into Wastewater Treatment, Metal Surface Treatment, Potable Water Treatment, Electronic Etchants, Printed Circuit Boards, Pigment Manufacturing, Catalyst, Asphalt Blowing, and Others.

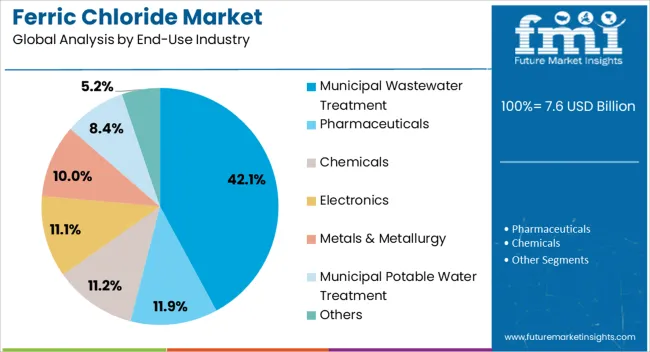

Based on end-use industry, the ferric chloride market is segmented into Municipal Wastewater Treatment, Pharmaceuticals, Chemicals, Electronics, Metals & Metallurgy, Municipal Potable Water Treatment, and Others. Regionally, the ferric chloride industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The liquid grade segment is projected to hold 47.6% of the total revenue share in the ferric chloride market in 2025. This leading position is attributed to the segment’s superior handling characteristics, cost-efficiency, and compatibility with automated dosing systems. Liquid ferric chloride is widely preferred in water treatment plants due to its consistent concentration, ease of transportation, and fast dissolution in water.

Its use minimizes dust exposure and allows for more accurate dosing, making it suitable for continuous large-scale operations. The ability to be stored in bulk containers and delivered via tanker systems has also contributed to reduced logistical costs and safer material handling.

Increasing investments in automated and remote-controlled treatment infrastructure have further supported the use of liquid formulations, especially in municipal and industrial settings. The reduced need for on-site preparation and its stable shelf life have positioned liquid ferric chloride as the preferred grade among utility operators and environmental service providers.

The wastewater treatment application segment is anticipated to account for 38.9% of the ferric chloride market’s revenue share in 2025, making it the dominant application area. This leadership is driven by the compound’s proven effectiveness in coagulating and precipitating contaminants, particularly phosphates and heavy metals.

Ferric chloride is widely used in both primary and secondary treatment stages to enhance sedimentation and improve sludge dewatering. Growing population densities, industrial expansion, and tightening water discharge norms have increased reliance on chemical treatments for efficient wastewater management.

The compound’s compatibility with a variety of treatment systems and its ability to reduce odor and corrosion in sewer networks have further strengthened its role in municipal and industrial wastewater operations The growing trend toward circular water use and resource recovery has also favored the use of ferric chloride, as it supports advanced treatment processes like phosphorus recovery and biosolid stabilization.

The municipal wastewater treatment end-use industry segment is expected to contribute 42.1% of the overall revenue share in the ferric chloride market in 2025. This leading share is being supported by expanding urban infrastructure, increasing investments in public sanitation, and stricter environmental regulations across both developed and developing countries.

Municipal facilities are heavily reliant on cost-effective and efficient coagulants to manage large volumes of sewage and stormwater, where ferric chloride has consistently demonstrated superior performance. Its role in minimizing biochemical oxygen demand and facilitating the removal of suspended solids has been instrumental in helping municipalities meet discharge limits and maintain compliance with water quality standards.

Government-funded upgrades of wastewater treatment plants and the growing implementation of decentralized systems have further driven demand in this segment. Additionally, the compound’s low toxicity, availability in liquid form, and minimal residuals have positioned it as a reliable and sustainable solution for public water utilities focused on long-term operational efficiency and environmental stewardship.

The ferric chloride market is expanding due to its widespread use in water treatment, industrial applications, and as a key component in various chemical processes. Ferric chloride is primarily used for water purification, where it acts as a coagulant to remove impurities and contaminants. The growing need for clean water and wastewater treatment solutions is driving the demand for ferric chloride in municipal and industrial water treatment plants. Additionally, its application in electronics, metal surface treatment, and pigment manufacturing is contributing to market growth. The market is also witnessing increased demand in emerging economies, driven by infrastructure development and industrial expansion.

The ferric chloride market is primarily driven by the rising demand for water treatment and wastewater management. As global concerns about water pollution and the need for effective water purification systems increase, ferric chloride plays a crucial role in municipal and industrial water treatment plants. It helps remove suspended particles and impurities, making it an essential component in improving water quality. The growth in urban populations and industrial activities, especially in emerging markets, is further driving the need for efficient water and wastewater treatment solutions, contributing to the demand for ferric chloride in various applications.

Despite its widespread use, the ferric chloride market faces challenges related to fluctuating raw material prices and environmental concerns. The production of ferric chloride involves the use of iron ore and hydrochloric acid, and the price of these raw materials can fluctuate based on global supply and demand, affecting production costs. While ferric chloride is effective for water treatment, its disposal, particularly in large quantities, can have environmental implications. The chemical's potential for generating hazardous waste and its impact on ecosystems if not properly managed can lead to stricter regulatory requirements, creating barriers for manufacturers and limiting market growth.

The ferric chloride market presents significant opportunities, particularly with the growth in water treatment and emerging applications in industries such as electronics and pigments. As the global focus on clean water intensifies, ferric chloride’s role in municipal and industrial water treatment processes continues to expand. Furthermore, its use in the electronics industry, where it is used for etching printed circuit boards, and in the production of pigments for paints and coatings is opening new growth avenues. As industries continue to require high-quality water treatment solutions and advanced chemical applications, ferric chloride’s demand is expected to rise, particularly in developing countries where industrialization and infrastructure development are increasing.

A key trend in the ferric chloride market is the increasing use of ferric chloride in the electronics and recycling industries. Ferric chloride is used in the production of printed circuit boards (PCBs), which are essential components in electronic devices. The growing demand for electronics and the rise of technological advancements, including consumer electronics, automotive, and telecommunications, is driving the need for ferric chloride in this sector.AS the recycling industry grows, particularly in terms of e-waste recycling, ferric chloride is increasingly used to recover valuable metals like gold, silver, and copper from electronic waste, opening up new opportunities in the recycling market. This trend is expected to drive demand for ferric chloride in the coming years.

| Countries | CAGR |

|---|---|

| China | 5.8% |

| India | 5.4% |

| Germany | 4.9% |

| France | 4.5% |

| UK | 4.1% |

| USA | 3.7% |

| Brazil | 3.2% |

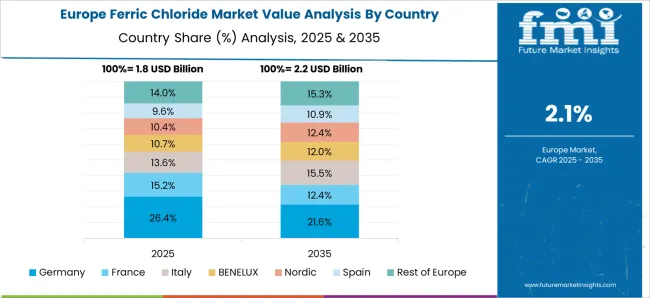

The global ferric chloride market is projected to grow at a CAGR of 4.3% from 2025 to 2035, driven by rising demand across water treatment, wastewater management, and chemical manufacturing sectors. China leads with 5.8% growth, fueled by industrial and urban expansion. India follows at 5.4%, supported by increased water infrastructure projects and industrial growth. Germany, the UK, and the USA also experience steady growth, driven by government initiatives, industrial demand, and water quality regulations. The analysis includes over 40+ countries, with the leading markets detailed below.

The ferric chloride market in China is projected to grow at a CAGR of 5.8% through 2035. The demand for ferric chloride is driven by its widespread use in water treatment, chemicals, and electronics industries. With rapid industrialization and a growing need for water treatment solutions in urban areas, China is increasing its consumption of ferric chloride. The expansion of the semiconductor and electronics sectors also contributes to the market’s growth, as ferric chloride is essential in etching and manufacturing processes. Additionally, government investments in infrastructure and industrial activities further support the demand for ferric chloride.

Demand for ferric chloride in India is expected to grow at a CAGR of 5.4% through 2035. The country’s expanding water treatment sector, driven by rising urbanization and industrialization, is a major factor fueling the demand for ferric chloride. As India seeks solutions for clean water and waste management, ferric chloride plays a crucial role in water purification and sewage treatment. The growth in the chemical manufacturing and textile industries, where ferric chloride is used in various processes, further supports the market expansion. Additionally, increased government initiatives to improve water infrastructure contribute to rising consumption.

Sale of ferric chloride in Germany is projected to grow at a CAGR of 4.9% through 2035. The country’s demand for ferric chloride is driven by its use in water treatment, wastewater treatment, and chemical manufacturing processes. With stringent regulations on water quality and waste management, Germany’s focus on efficient water treatment solutions increases the need for ferric chloride. The market is also supported by the growth of the chemical sector, where ferric chloride is used in various processes such as etching and as a catalyst. Additionally, the country’s industrial development and urbanization contribute to the rising consumption of ferric chloride.

The ferric chloride market in the United Kingdom is projected to grow at a CAGR of 4.1% through 2035. The demand for ferric chloride is largely driven by its use in water treatment, particularly in municipal water systems and industrial applications. As the UK focuses on improving its water infrastructure, the demand for ferric chloride for sewage and wastewater treatment is increasing. Additionally, ferric chloride is used in the chemical industry for various processes, such as etching and as a catalyst, supporting its market growth in the country. The UK’s growing industrial and manufacturing sectors contribute to the continued demand for ferric chloride.

The USA ferric chloride market is projected to grow at a CAGR of 3.7% through 2035. The growth of the water treatment industry, particularly for municipal and industrial wastewater treatment, is a major driver for the market. Ferric chloride is widely used for its high efficiency in removing contaminants from water, making it essential for meeting water quality standards. The chemical industry’s reliance on ferric chloride in various processes, including etching and waste treatment, further supports market demand. Government regulations and increased investments in water infrastructure further drive the adoption of ferric chloride in the USA

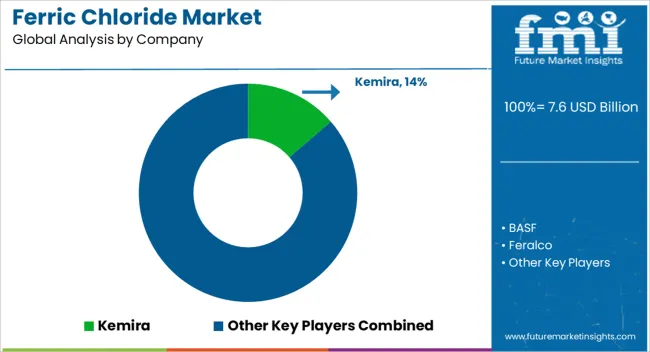

The ferric chloride market is driven by leading chemical manufacturers providing high-quality products used in water treatment, wastewater treatment, industrial applications, and chemical processing. Kemira is a significant player, offering ferric chloride solutions widely used in water purification and industrial applications, with a strong focus on sustainability and efficient processing.

BASF is a global leader in the production of ferric chloride, delivering high-quality products for water treatment, chemical processes, and waste management, emphasizing reliability and performance. Feralco provides ferric chloride solutions primarily for water treatment and waste management, known for its effective purification properties and environmental focus. PVS Chemicals manufactures ferric chloride used in various industrial applications, including water and wastewater treatment, with a focus on consistent quality and customer satisfaction. Kem One produces ferric chloride products used in water treatment, with an emphasis on meeting environmental standards and providing cost-effective solutions for industrial applications. Gulbrandsen offers ferric chloride for water treatment and chemical processing, emphasizing high performance and cost efficiency. Malay-Sino Chemicals supplies ferric chloride primarily for industrial applications, including chemical processes and metal etching, focusing on reliable products. Tessenderlo Group manufactures ferric chloride solutions for water treatment, offering products that ensure safe and efficient operations for municipal and industrial customers. Feracid specializes in ferric chloride products used in water and wastewater treatment, offering high-purity and reliable solutions. BorsodChem, SGB SMIT, and ICL Group contribute significantly to the market with advanced ferric chloride products for various industries. Ravensdown, Haifa Group, and Bunge Limited are also involved in the production of ferric chloride, offering effective water treatment solutions for diverse applications, including industrial and municipal use.

| Item | Value |

|---|---|

| Quantitative Units | USD 7.6 Billion |

| Grade | Liquid, Anhydrous, and Hexahydrate Lumps |

| Application | Wastewater Treatment, Metal Surface Treatment, Potable Water Treatment, Electronic Etchants, Printed Circuit Boards, Pigment Manufacturing, Catalyst, Asphalt Blowing, and Others |

| End-Use Industry | Municipal Wastewater Treatment, Pharmaceuticals, Chemicals, Electronics, Metals & Metallurgy, Municipal Potable Water Treatment, and Others |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | Kemira, BASF, Feralco, PVS Chemicals, Kem One, Gulbrandsen, Malay-Sino Chemicals, Tessenderlo Group, Feracid, BorsodChem, BPS Products, Asia Chemicals, Sidra Wasserchemie, Chemifloc, Akzo Nobel Industrial Chemicals, and National Biochemicals |

| Additional Attributes | Dollar sales by product type (liquid ferric chloride, solid ferric chloride) and end-use segments (water treatment, industrial processes, chemical applications). Demand dynamics are driven by increasing regulations on wastewater treatment, the growing need for efficient industrial processes, and expanding infrastructure development. Regional trends show strong growth in North America, Europe, and Asia-Pacific, with innovations in water treatment technologies, environmental regulations, and industrial applications contributing to market expansion. |

The global ferric chloride market is estimated to be valued at USD 7.6 billion in 2025.

The market size for the ferric chloride market is projected to reach USD 11.5 billion by 2035.

The ferric chloride market is expected to grow at a 4.3% CAGR between 2025 and 2035.

The key product types in ferric chloride market are liquid, anhydrous and hexahydrate lumps.

In terms of application, wastewater treatment segment to command 38.9% share in the ferric chloride market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Ferric Sulfate Market Growth - Trends & Forecast 2025 to 2035

Ferric Sulfate & Polyferric Sulfate Market 2024-2034

Ferric Phosphate Market

UK Ferric Sulfate Market Trends – Size, Share & Industry Growth 2025-2035

USA Ferric Sulfate Market Analysis – Demand, Growth & Forecast 2025-2035

Polyferric Sulfate Market

Japan Ferric Sulfate Market Report – Demand, Trends & Industry Forecast 2025-2035

ASEAN Ferric Sulfate Market Trends – Size, Share & Growth 2025-2035

Germany Ferric Sulfate Market Analysis – Size, Share & Forecast 2025-2035

Zinc Chloride Market Analysis - Size, Share, and Forecast 2025 to 2035

Acid Chlorides Market Size and Share Forecast Outlook 2025 to 2035

Allyl Chloride Market Size and Share Forecast Outlook 2025 to 2035

Barium Chloride Market Size and Share Forecast Outlook 2025 to 2035

Sodium Chloride Market Size and Share Forecast Outlook 2025 to 2035

Industry Share Analysis for Cupric Chloride Companies

Calcium Chloride Market Size and Share Forecast Outlook 2025 to 2035

Choline Chloride Market Size and Share Forecast Outlook 2025 to 2035

Thionyl Chloride Market Size and Share Forecast Outlook 2025 to 2035

Valeryl Chloride Market Size and Share Forecast Outlook 2025 to 2035

Aluminum Chloride Hexahydrate Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA