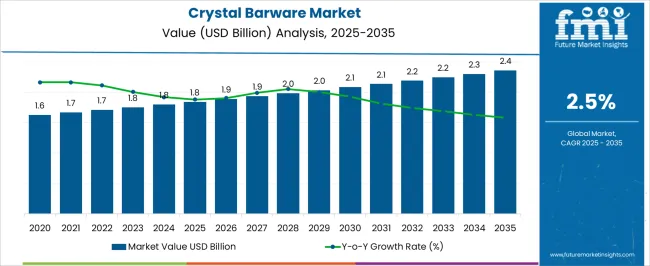

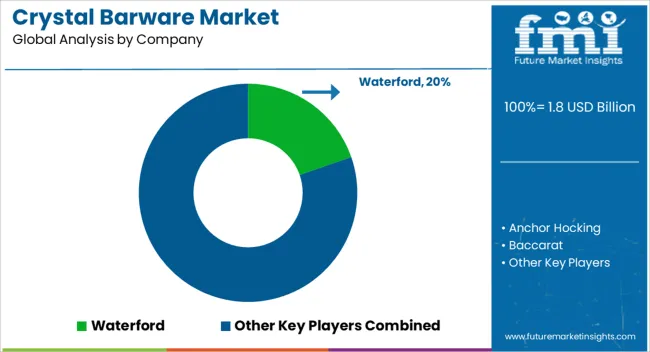

The Crystal Barware Market is estimated to be valued at USD 1.8 billion in 2025 and is projected to reach USD 2.4 billion by 2035, registering a compound annual growth rate (CAGR) of 2.5% over the forecast period. Between 2024 and 2029, the market grows from USD 1.6 billion to USD 1.8 billion, supported by rising consumer interest in premium dining and gifting experiences, as well as strong demand from the hospitality sector for luxury drinkware collections. This stage is characterized by heightened focus on handcrafted crystal pieces, often associated with exclusivity and cultural heritage, which appeal strongly in both Western and Asian luxury markets.

From 2030 to 2034, the market advances from USD 1.9 billion to USD 2.2 billion, adding USD 0.3 billion in value. Growth during this period is underpinned by the blending of traditional craftsmanship with modern aesthetics, appealing to younger demographics that seek both elegance and functionality in barware. Collaborations between luxury brands and designers further fuel the trend, while rising online luxury retail channels create broader accessibility for niche and heritage brands.

Between 2035 and 2039, the market increases from USD 2.3 billion to USD 2.4 billion, as growth stabilizes in mature economies while affluent households in emerging regions continue to drive incremental demand. The phase also benefits from a growing culture of mixology and home-based entertaining, which keeps interest in specialized crystal barware sustained. The crystal barware market demonstrates measured but continuous growth, fueled by heritage value, evolving lifestyle choices, and the premiumization of dining experiences.

| Metric | Value |

|---|---|

| Crystal Barware Market Estimated Value in (2025 E) | USD 1.8 billion |

| Crystal Barware Market Forecast Value in (2035 F) | USD 2.4 billion |

| Forecast CAGR (2025 to 2035) | 2.5% |

The crystal barware market is experiencing steady growth driven by rising consumer demand for premium and luxury home entertainment products. Increasing interest in sophisticated dining and cocktail experiences has fueled the popularity of elegant glassware collections. Industry trends indicate a strong preference for high-quality materials and craftsmanship that elevate the drinking experience.

Consumers are drawn to products that combine aesthetic appeal with durability and clarity. Additionally, growth in the luxury real estate and hospitality sectors has boosted demand for upscale barware. Retail channels continue to expand offerings that cater to discerning buyers seeking exclusive and artisanal designs.

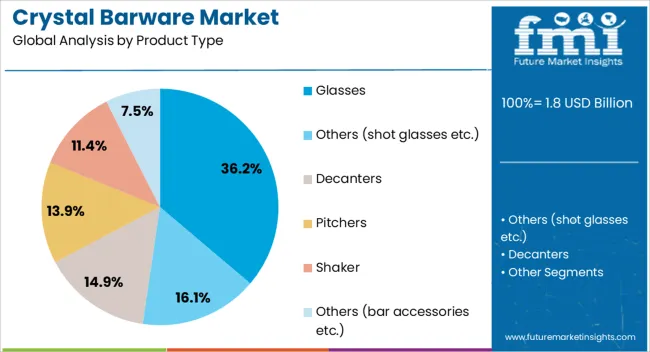

Innovation in design and customization options are expected to sustain consumer interest. Segment growth is being led by the Glasses product type, Lead Crystal material, and High/Luxury price range, reflecting preferences for premium quality and sophisticated style.

The crystal barware market is segmented by product type, material, price, end use, distribution channel, and geographic regions. By product type, the crystal barware market is divided into Glasses, Others (including shot glasses), Decanters, Pitchers, shakers, and Other Items (such as bar accessories). In terms of material, the crystal barware market is classified into Lead crystal and lead-free crystal. Based on price, the crystal barware market is segmented into High/luxury, Low, and Medium. The end use of the crystal barware market is segmented into Residential, Commercial, Bars and lounges, Restaurants, Hotels, and Others (caterers, etc.). By distribution channel, the crystal barware market is segmented into Offline, Supermarket/hypermarket, Specialty store, Others (department stores, etc.), Online, Company websites, and E-commerce. Regionally, the crystal barware industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The Glasses segment is projected to account for 36.2% of the crystal barware market revenue in 2025, remaining the most popular product type. This segment benefits from widespread consumer preference for individual glassware pieces that serve various drinks such as whiskey, cocktails, and wine.

Glasses provide both functional use and decorative appeal, making them versatile for personal and professional settings. Advances in manufacturing have enabled intricate designs and enhanced clarity, which attract collectors and everyday users alike.

The rise in at-home mixology trends has also increased the demand for high-quality glasses, encouraging repeat purchases and brand loyalty.

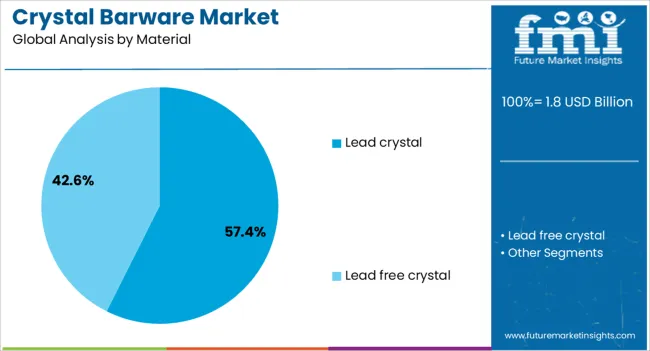

The Lead Crystal segment is expected to hold 57.4% of the crystal barware market revenue in 2025, securing its position as the preferred material. Lead crystal is valued for its brilliance, weight, and ability to be finely cut and polished, creating a luxurious and elegant appearance.

Consumers often associate lead crystal with premium craftsmanship and long-lasting quality. Despite growing environmental concerns around lead content, lead crystal remains favored for special occasions and gifting due to its aesthetic qualities.

Manufacturers continue to refine lead crystal production techniques to enhance clarity and reduce impurities, sustaining its market demand.

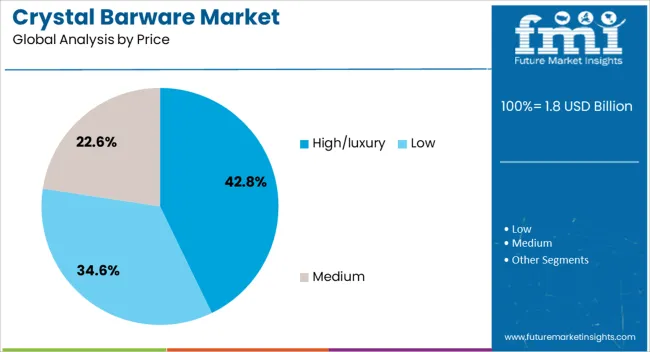

The High/Luxury price segment is projected to represent 42.8% of the crystal barware market revenue in 2025, reflecting strong consumer willingness to invest in premium barware products. This segment growth is supported by affluent buyers who seek exclusive designs and exceptional quality for personal collections or gifts.

Luxury pricing is often justified by the craftsmanship, material purity, and brand heritage associated with these products. The segment also benefits from gifting occasions such as weddings and anniversaries, where consumers are inclined to purchase high-end barware.

As consumer preference for upscale home entertaining rises, the High/Luxury segment is expected to sustain its market prominence.

Crystal barware is gaining ground through luxury dining culture, gifting appeal, and e-commerce expansion, though cost and production challenges persist. Its positioning as both functional and decorative ensures sustained demand across global markets.

Consumer inclination toward luxury dining and social entertaining has boosted the prominence of crystal barware, as households and hospitality venues increasingly seek items that elevate presentation and aesthetics. The growing trend of hosting gatherings and curated experiences has made crystal barware an aspirational choice, reinforcing its presence in both retail and commercial spaces. Strong marketing through design-led collaborations and limited-edition launches has enhanced brand desirability. High-end restaurants and hotels integrate crystal barware as a marker of exclusivity, stimulating further demand. This behavior not only widens consumer reach but also builds a perception of refinement, making crystal drinkware a symbol of prestige.

The role of crystal barware in the global gifting and collectible category remains significant, as consumers associate crystal with timeless elegance and heirloom value. Seasonal demand during weddings, festivals, and corporate events continues to support growth across various regions. Collectors view handcrafted designs and limited runs as valuable investments, which in turn drives niche sales. Brands have leveraged this sentiment by creating signature lines tailored for gifting occasions, strengthening distribution across boutiques and luxury outlets. While other barware alternatives exist, crystal retains a premium status, often chosen for its uniqueness and long-term appeal.

E-commerce platforms have reshaped the distribution of crystal barware, offering broader visibility and enabling brands to connect with younger consumers who value convenience and digital engagement. Premium retailers are increasingly relying on curated online storefronts that highlight craftsmanship, heritage, and storytelling to influence purchasing decisions. Virtual showrooms, digital catalogs, and social media campaigns provide additional touchpoints, ensuring consumer access beyond traditional luxury boutiques. Direct-to-consumer strategies empower manufacturers to control pricing, design narratives, and limited-edition drops more effectively. This online momentum not only supports wider reach but also creates loyalty by integrating interactive experiences that showcase value beyond functionality.

Crystal barware manufacturers face ongoing challenges related to production complexity, high input costs, and dependency on skilled artisans. Energy-intensive processes, fragility during shipping, and limited availability of raw materials elevate both cost and operational risks. These factors often make it difficult for brands to scale production without compromising quality. Economic fluctuations further impact consumer spending on luxury homeware, creating demand variability. In response, companies are focusing on efficiency improvements, localizing production capabilities, and diversifying sourcing networks. Despite constraints, resilience is maintained through consumer perception of crystal as a status symbol, ensuring continued relevance in the high-value barware segment.

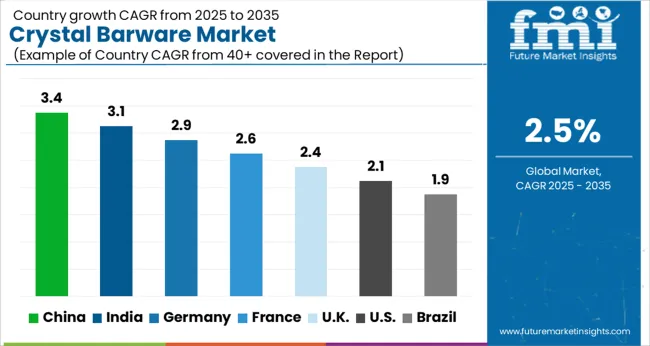

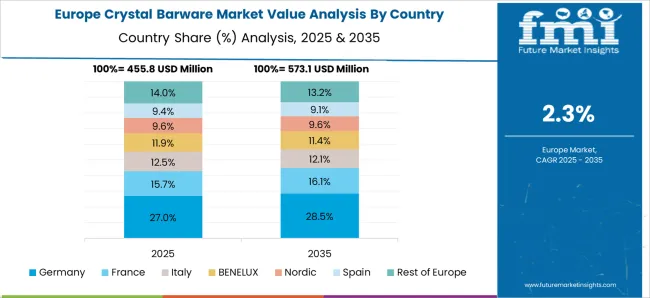

The crystal barware segment is projected to expand globally at a CAGR of 2.5% from 2025 to 2035, supported by rising demand for premium dining, gifting traditions, and broader adoption across hospitality venues. China leads with a CAGR of 3.4%, backed by strong luxury consumption, expanding hospitality investments, and a high gifting culture that embraces premium drinkware. India follows at 3.1%, driven by a growing middle-class consumer base, rising wedding expenditures, and increasing appreciation for luxury collectibles. France records 2.6%, influenced by cultural associations with fine dining, boutique retail presence, and integration of crystal in gifting categories. The United Kingdom shows 2.4%, supported by demand from hospitality chains, online retail penetration, and adoption among young professionals. The United States reports 2.1%, reflecting gradual uptake through luxury retailers, premium gifting segments, and upscale hospitality demand. The analysis covers more than 40 countries, with these leading regions shaping design preferences, consumer trends, and supplier positioning in the evolving crystal barware landscape.

The CAGR of the China crystal barware market averaged 2.8% during 2020–2024 and is expected to accelerate to 3.1% in 2025–2035, outpacing most mature markets. Early growth was shaped by strong demand for banquet dining and gift-giving traditions, supported by rapid expansion of luxury malls in major cities. In the next few years, higher CAGR is projected as international and domestic crystalware brands target middle-class consumers through omni-channel distribution. The shift toward premium dining culture and luxury home décor also expands the role of barware as a lifestyle symbol. Rising exposure to Western dining aesthetics and gifting traditions fuels consistent market adoption in tier I and tier II urban centers.

India’s crystal barware market recorded a CAGR of 2.6% between 2020 and 2024 and is projected to climb to 3.0% in 2025–2035. The earlier phase saw limited but steady demand from affluent urban households and luxury hotels. Going forward, higher CAGR is supported by expanding premium hospitality, growing gifting culture in weddings, and rising penetration of international crystal brands in metropolitan retail stores. Rising preference for branded tableware in tier I cities further complements growth. Domestic players explore niche categories with customized and decorative barware, while imported products gain traction among aspirational buyers. The widening luxury retail footprint is likely to strengthen market share for premium crystal.

The CAGR of the France crystal barware market averaged 2.2% during 2020–2024 and is expected to accelerate slightly to 2.4% in 2025–2035. Initial momentum stemmed from a long-standing heritage of fine dining, supported by strong retail presence of luxury crystal brands. Over the coming years, modest growth is driven by tourist purchases, heritage-focused marketing, and the integration of barware into upscale hospitality projects. Crystalware maintains its position as a key gifting category in premium segments, though everyday consumption remains steady. Domestic manufacturers benefit from reputation and craftsmanship, while international brands increasingly capture niche collectors. Online luxury channels strengthen access for younger demographics seeking timeless tableware.

The CAGR of the United Kingdom crystal barware market averaged 2.3% during 2020–2024 and is expected to accelerate to 2.4% in 2025–2035, moving in line with the global growth rate of 2.5%. Early progress was shaped by steady sales in premium dining and gifting channels, supported by heritage-driven consumption and modest demand from luxury retailers. During the next phase, the marginal increase is underpinned by stronger positioning of artisanal brands, rising appeal of premium glassware in high-end hospitality, and continued expansion of e-commerce platforms that cater to luxury kitchenware. The shift toward collectible and statement barware also creates a steady consumer pull in developed retail markets.

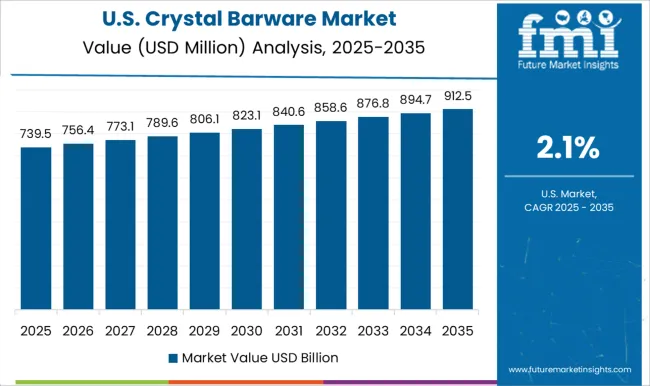

The CAGR of the United States crystal barware market averaged 2.4% during 2020–2024 and is expected to accelerate to 2.6% in 2025–2035. Early sales were shaped by demand from department stores, luxury retail, and high-end dining establishments. Over the next few years, incremental growth is projected as lifestyle-driven purchases and experiential dining trends strengthen the market. Collectible barware finds a strong base among affluent consumers, while e-commerce penetration accelerates sales in gifting categories. Demand for heritage-inspired designs combined with contemporary styles ensures steady adoption across household and hospitality sectors. Domestic brands collaborate with interior design and lifestyle influencers, strengthening cultural positioning of premium crystalware.

The competitive dynamics of the crystal glassware industry are defined by the interplay of heritage, luxury positioning, and strategic diversification among leading players. Waterford maintains global recognition through its Irish craftsmanship and premium home décor offerings, while French maisons Baccarat and Saint-Louis leverage artisanal mastery and bespoke collections to strengthen exclusivity and appeal to luxury hospitality clients. Lalique and Lladro diversify with art-inspired glass sculptures and lifestyle collections, targeting collectors and high-net-worth consumers, whereas Swarovski drives innovation across fashion accessories, home décor, and collaborations with luxury brands to enhance global brand resonance. Functional design and performance-oriented segments are led by Riedel, Schott Zwiesel, and Ravenscroft Crystal, focusing on sommelier-approved glassware and wine applications.

Volume-driven and affordability-focused players such as Bormioli Rocco, Dartington Crystal, and Anchor Hocking exploit high-production capacities and retail partnerships to capture broader consumer segments. Regional champions, including Crystal Bohemia and Lucaris, capitalize on Central European and Asian manufacturing expertise, reinforcing export competitiveness. Orrefors emphasizes Nordic minimalism and a balance of decorative and functional products. Across the industry, strategies center on luxury collaborations, e-commerce expansion, artisanal heritage reinforcement, and selective innovation, enabling both prestige and mass-market players to differentiate in a fragmented yet high-value landscape, while sustaining brand equity and global reach.

| Item | Value |

|---|---|

| Quantitative Units | USD 1.8 Billion |

| Product Type | Glasses, Others (shot glasses etc.), Decanters, Pitchers, Shaker, and Others (bar accessories etc.) |

| Material | Lead crystal and Lead free crystal |

| Price | High/luxury, Low, and Medium |

| End Use | Residential, Commercial, Bars and lounges, Restaurants, Hotels, and Others (caterers etc.) |

| Distribution Channel | Offline, Supermarket/hypermarket, Specialty store, Others (department stores etc.), Online, Company websites, and E-commerce |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | Waterford, Anchor Hocking, Baccarat, Bormioli Rocco, Crystal Bohemia, Dartington Crystal, Lalique, Lladro, Lucaris, Orrefors, Ravenscroft Crystal, Riedel, Saint-Louis, Schott Zwiesel, and Swarovski |

| Additional Attributes | Dollar sales, share, pricing trends, consumer preferences, regional demand shifts, distribution channel performance, competitor strategies, premiumization drivers, and emerging gifting occasions. |

The global crystal barware market is estimated to be valued at USD 1.8 billion in 2025.

The market size for the crystal barware market is projected to reach USD 2.4 billion by 2035.

The crystal barware market is expected to grow at a 2.5% CAGR between 2025 and 2035.

The key product types in crystal barware market are glasses, _whiskey glasses, _tumblers, _cocktail glasses, others (shot glasses etc.), decanters, pitchers, shaker and others (bar accessories etc.).

In terms of material, lead crystal segment to command 57.4% share in the crystal barware market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Crystal Malt Market Size and Share Forecast Outlook 2025 to 2035

Crystallization Equipment Market Size and Share Forecast Outlook 2025 to 2035

Crystal Products Market Size and Share Forecast Outlook 2025 to 2035

Crystal Oscillator Market Analysis - Size, Share, and Forecast 2025 to 2035

Crystalline Fructose Market Growth - Trends & Forecast through 2034

Nanocrystalline cellulose Market Size and Share Forecast Outlook 2025 to 2035

Monocrystalline Solar Cell Market Size and Share Forecast Outlook 2025 to 2035

Nanocrystal Packaging Coating Market Analysis - Size, Share, and Forecast 2025 to 2035

Polycrystalline Silicon Market Growth 2025 to 2035

Microcrystalline Cellulose Market Size and Share Forecast Outlook 2025 to 2035

Anti Crystallizing Agents Market

Microcrystalline Wax Market

Liquid Crystal Polymers Market Size and Share Forecast Outlook 2025 to 2035

Liquid Crystal Polymer (LCP) Market Size and Share Forecast Outlook 2025 to 2035

Protein Crystallization and Crystallography Market Analysis - Growth & Forecast 2025 to 2035

Photonic Crystal Displays Market Size and Share Forecast Outlook 2025 to 2035

Industrial Crystallizer Market Growth – Trends & Forecast 2024-2034

Cellulose Nanocrystals and Nanofibers Market Size and Share Forecast Outlook 2025 to 2035

Solar Grade Monocrystalline Silicon Rods Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Optical Grade LiTaO3 Crystal Substrate Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA