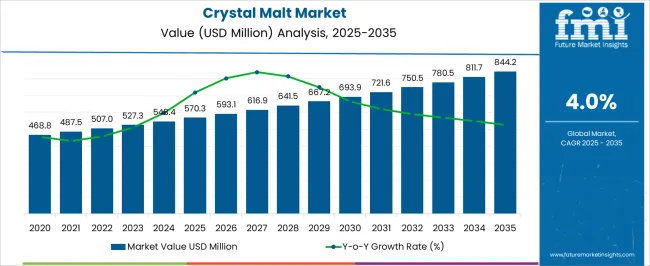

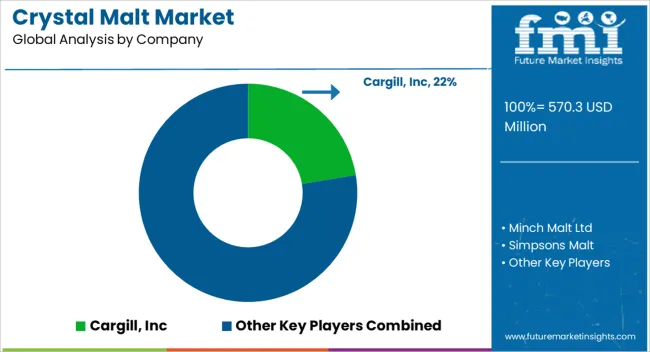

The Crystal Malt Market is estimated to be valued at USD 570.3 million in 2025 and is projected to reach USD 844.2 million by 2035, registering a compound annual growth rate (CAGR) of 4.0% over the forecast period.

| Metric | Value |

|---|---|

| Crystal Malt Market Estimated Value in (2025 E) | USD 570.3 million |

| Crystal Malt Market Forecast Value in (2035 F) | USD 844.2 million |

| Forecast CAGR (2025 to 2035) | 4.0% |

The Crystal Malt market is witnessing steady growth driven by the rising global demand for specialty malts in beverage production, particularly beer brewing. Current market conditions reflect a preference for malt varieties that enhance flavor, color, and aroma while providing consistency in brewing applications. The market is supported by increasing investments in craft and industrial breweries and a growing consumer inclination toward premium and flavored beer products.

Factors such as ease of integration into existing brewing processes and the ability to produce distinctive sensory profiles are enabling broader adoption. Additionally, the trend of experimenting with innovative brewing techniques and specialty malt blends is contributing to the expansion of the market.

The emphasis on quality ingredients, coupled with the increasing awareness of product origin and production methods, is encouraging breweries to adopt high-quality crystal malts Moving forward, opportunities are expected in the development of new malt varieties, enhanced flavor profiles, and sustainable sourcing methods, which will support long-term growth across both established and emerging beer markets.

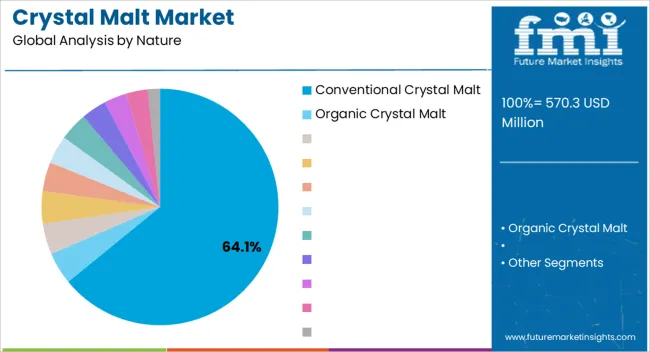

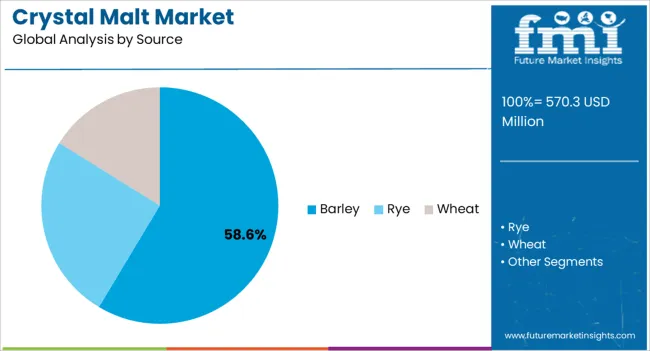

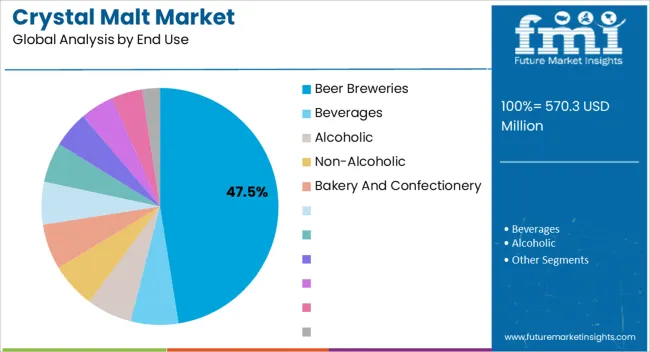

The crystal malt market is segmented by nature, source, end use, and geographic regions. By nature, crystal malt market is divided into Conventional Crystal Malt and Organic Crystal Malt. In terms of source, crystal malt market is classified into Barley, Rye, and Wheat. Based on end use, crystal malt market is segmented into Beer Breweries, Beverages, Alcoholic, Non-Alcoholic, and Bakery And Confectionery. Regionally, the crystal malt industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The Conventional Crystal Malt segment is projected to hold 64.10% of the overall Crystal Malt market revenue share in 2025, establishing it as the leading type within the market. This dominance is being driven by its consistent performance in enhancing beer flavor, aroma, and color, which aligns with the brewing requirements of large-scale and craft breweries.

Adoption has been accelerated by the malt’s ability to produce predictable results in fermentation, supporting scalability and quality control. Furthermore, its widespread availability and standardized production processes have ensured reliable supply chains, reducing operational risk for brewers.

The segment has benefited from increased consumer preference for beers with rich, balanced flavors, as well as from breweries seeking versatile malt that can be combined with other specialty malts to create differentiated products Future growth is expected to be supported by continuous innovation in brewing techniques and increasing demand for premium and flavored beers, which require high-quality crystal malts capable of delivering consistent sensory attributes.

Barley is expected to account for 58.60% of the Crystal Malt market revenue share in 2025, making it the dominant source for malt production. The segment’s growth is being driven by barley’s superior malting properties, including high enzyme activity, favorable protein content, and predictable gelatinization characteristics, which contribute to consistent brewing performance.

Barley-based malts are preferred for their ability to deliver uniform flavor, aroma, and color, making them the choice for large-scale industrial breweries as well as craft beer producers. The reliability of barley supply, supported by established agricultural practices and global cultivation networks, has further strengthened this segment.

Additionally, barley’s versatility allows it to be adapted into various malt types, providing brewers with flexibility in developing diverse beer profiles With breweries increasingly focusing on quality, efficiency, and flavor consistency, the barley source segment is expected to maintain its leadership and continue supporting the expansion of the Crystal Malt market.

The Beer Breweries end-use segment is anticipated to hold 47.50% of the total Crystal Malt market revenue in 2025, establishing it as the largest consuming industry for crystal malt. This leading position is being driven by the consistent demand for specialty malts that enhance flavor, color, and aroma while maintaining stability during fermentation.

Breweries are increasingly relying on crystal malts to create distinct beer profiles that cater to both mainstream and craft markets, reflecting a growing consumer preference for premium and artisanal beer products. The segment has benefited from the expansion of commercial and craft brewing operations, along with the rising adoption of innovative brewing techniques that require high-quality malt inputs.

Additionally, the integration of crystal malt into standardized brewing recipes has improved operational efficiency and product consistency, further reinforcing its adoption With the ongoing global growth of the beer industry and increasing focus on flavor differentiation, the beer breweries segment is expected to continue its dominance, driving long-term demand for crystal malts.

Malt is produced from grains through a process known as malting, which comprises partial germination, to adjust or change the grains' natural food substances. Malt is mostly prepared from barley, while corn, rice wheat, and rye are utilized less as often as possible.

The primary use of malt is in fermenting/brewing beer and in preparing other alcoholic and non-alcoholic beverages. Besides, the malt is widely used in confectioneries and baked goods. The extensive use of malt in beers, alcohol, other drinks, and food products make it a go-to product for food and beverage industry.

Crystal malt is a category of malt made from specialty grains and is used to incorporate and manipulate the flavour and colour of any brew. Crystal malt is a conventional British colour malt next to chocolate, amber, brown, and black malts, and is used to provide the desired colour to any beer and other beverages. Crystal malts are valued conferring to their colour depth, which is usually expressed in degrees Lovibond (°L). Crystal malts range from 20° L to around 200° L with the most common crystals in the range of 30° to 40°. Crystal malt is prepared from steeped and germinated barley grains.

The germinated grains are then stewed followed by a process called as kilning. Addition of crystal malt is a common way to add a sweet essence to beer. The saccharinity of crystal malt has distinctive caramel tone, and thus the crystal malts are occasionally called as caramel malts. Crystal malt sweetness is the main characteristic of numerous styles of beer.

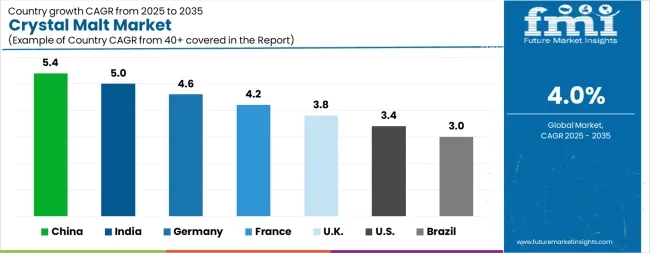

| Country | CAGR |

|---|---|

| China | 5.4% |

| India | 5.0% |

| Germany | 4.6% |

| France | 4.2% |

| UK | 3.8% |

| USA | 3.4% |

| Brazil | 3.0% |

The Crystal Malt Market is expected to register a CAGR of 4.0% during the forecast period, exhibiting varied country level momentum. China leads with the highest CAGR of 5.4%, followed by India at 5.0%. Developed markets such as Germany, France, and the UK continue to expand steadily, while the USA is likely to grow at consistent rates. Brazil posts the lowest CAGR at 3.0%, yet still underscores a broadly positive trajectory for the global Crystal Malt Market. In 2024, Germany held a dominant revenue in the Western Europe market and is expected to grow with a CAGR of 4.6%. The USA Crystal Malt Market is estimated to be valued at USD 215.4 million in 2025 and is anticipated to reach a valuation of USD 300.9 million by 2035. Sales are projected to rise at a CAGR of 3.4% over the forecast period between 2025 and 2035. While Japan and South Korea markets are estimated to be valued at USD 27.8 million and USD 14.5 million respectively in 2025.

| Item | Value |

|---|---|

| Quantitative Units | USD 570.3 Million |

| Nature | Conventional Crystal Malt and Organic Crystal Malt |

| Source | Barley, Rye, and Wheat |

| End Use | Beer Breweries, Beverages, Alcoholic, Non-Alcoholic, and Bakery And Confectionery |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | Cargill, Inc, Minch Malt Ltd, Simpsons Malt, Great Western Malting, Crisp Malting Group Ltd, BSG CraftBrewing, and Proximity Malt |

The global crystal malt market is estimated to be valued at USD 570.3 million in 2025.

The market size for the crystal malt market is projected to reach USD 844.2 million by 2035.

The crystal malt market is expected to grow at a 4.0% CAGR between 2025 and 2035.

The key product types in crystal malt market are conventional crystal malt and organic crystal malt.

In terms of source, barley segment to command 58.6% share in the crystal malt market in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Malt Sprouts Market Size and Share Forecast Outlook 2025 to 2035

Malted Rye Flour Market Size and Share Forecast Outlook 2025 to 2035

Crystallization Equipment Market Size and Share Forecast Outlook 2025 to 2035

Malted barley flour Market Size and Share Forecast Outlook 2025 to 2035

Crystal Products Market Size and Share Forecast Outlook 2025 to 2035

Crystal Oscillator Market Analysis - Size, Share, and Forecast 2025 to 2035

Crystal Barware Market Size and Share Forecast Outlook 2025 to 2035

Malt Beverage Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Malted Milk Market Size and Share Forecast Outlook 2025 to 2035

Malt Ingredients Market Analysis by Raw Material, Product Type, Grade, End-use, and Region through 2035

Malt Market Trends and Forecast 2025 to 2035

Analysis and Growth Projections for Maltodextrin Business

Maltitol Market Analysis by form, end use industry and by region – Growth, trends and forecast from 2025 to 2035

Malted Milk Powder Market Trends - Growth & Industry Forecast 2025 to 2035

Crystalline Fructose Market Growth - Trends & Forecast through 2034

Malted Wheat Flour Market

Isomalt Market Analysis - Size, Share, and Forecast 2025 to 2035

Isomalt Industry in Japan – Growth & Industry Trends 2025 to 2035

Isomalt Industry Analysis in Western Europe – Size, Share & Forecast 2025 to 2035

Isomaltulose Market Growth - Size, Trends & Forecast 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA