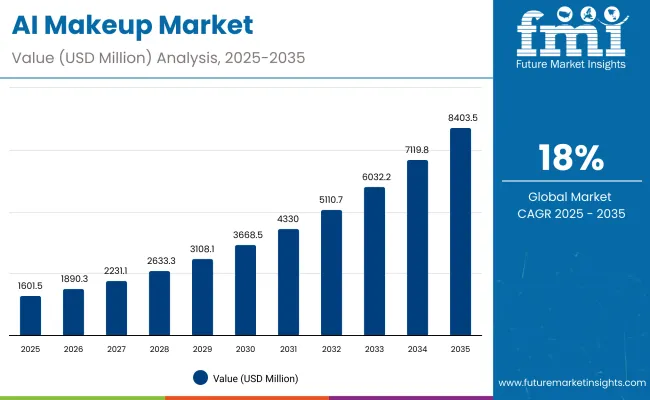

The AI Makeup Market is expected to record a valuation of USD 1,601.5 Million in 2025 and USD 8,403.5 Million in 2035, with an increase of USD 6,802.0 Million, which equals a growth of 425% over the decade. The overall expansion represents a CAGR of 18.0% and a 5.25X increase in market size.

AI Makeup Market Key Takeaways

| Metric | Value |

|---|---|

| Market Estimated Value in (2025E) | USD 1,601.5 Million |

| Market Forecast Value in (2035F) | USD 8,403.5 Million |

| Forecast CAGR (2025 to 2035) | 18.0% |

During the first five-year period from 2025 to 2030, the market increases from USD 1,601.5 Million to USD 3,668.5 Million, adding USD 2,067.0 Million, which accounts for 30.4% of the total decade growth. This phase records steady adoption in mobile-based virtual try-on (VTO), consumer-facing AR filters, and personalized recommendation engines, driven by the need for interactive beauty experiences. Virtual Try-On Simulation dominates this period as it caters to over 40% of applications requiring real-time engagement and accuracy.

The second half from 2030 to 2035 contributes USD 4,735.0 Million, equal to 69.6% of total growth, as the market jumps from USD 3,668.5 Million to USD 8,403.5 Million. This acceleration is powered by widespread deployment of AI-driven personalization, brand-owned AI platforms, and in-store AR/AI kiosks integrated with e-commerce. Mobile applications and AR-based technologies together capture a larger share above 70% by the end of the decade. Software-led SaaS licensing and cloud-based analytics add recurring revenue, increasing the software share beyond 42% in total value.

From 2020 to 2024, the AI Makeup Market grew steadily from experimental pilots into mainstream adoption, driven by mobile AR filters, influencer-led campaigns, and initial virtual try-on solutions. During this period, the competitive landscape was dominated by AI tech vendors and camera app platforms, controlling nearly 60% of revenue, with leaders such as Perfect Corp., ModiFace, and YouCam shaping precision AR and AI tools for consumers and retailers. Competitive differentiation relied on realism, ease of integration, and user engagement metrics, while direct monetization models were limited. Service-based and SaaS platforms had minimal traction, contributing less than 15% of the total market value.

Demand for AI Makeup will expand to USD 1,601.5 Million in 2025, and the revenue mix will shift as SaaS licensing and brand-owned AI platforms grow to over 42% share. Traditional leaders face rising competition from digital-first startups offering AI-powered skin analysis, personalized beauty recommendations, and subscription-based AR experiences. Major players are pivoting to hybrid models, integrating cloud analytics, omnichannel retail workflows, and AR/VR-based immersive shopping to retain relevance. Emerging entrants specializing in AI personalization, AR commerce, and social-media-native platforms are gaining share. The competitive advantage is moving away from standalone apps to ecosystem strength, scalability, and recurring revenue streams.

The AI Makeup Market is expanding as beauty brands move beyond static online catalogs to interactive, try-before-you-buy experiences. Virtual try-on tools, powered by AR and computer vision, allow customers to test products instantly across mobile apps, e-commerce sites, and social platforms. This not only reduces product return rates but also increases consumer confidence and average basket size, making AI-powered beauty solutions an essential revenue driver for retailers and cosmetic manufacturers alike.

Growth is also driven by the integration of AI personalization engines that analyze skin tone, facial features, and past purchasing behavior to provide hyper-targeted product recommendations. Unlike generic marketing, these algorithms create a unique consumer profile, enabling brands to launch tailored campaigns and limited-edition products. This level of precision drives higher engagement, loyalty, and cross-selling opportunities, making personalization a competitive differentiator that accelerates adoption of AI technologies across both consumer-facing and B2B segments in the beauty ecosystem.

The AI Makeup Market is segmented by offering, functionality, end user, deployment, product type, company type, business model, consumer type, technology, and region. Offerings include platforms, consumer apps, embedded retail tools, and AI development solutions, while functionalities span virtual try-ons, skin tone analysis, recommendation engines, personalization, and in-store AR tools. End users range from consumers and retailers to manufacturers and tech providers, adopting through mobile apps, web platforms, kiosks, or APIs. Product categories cover face, eye, lip, nail, hair, and skincare, supported by AI vendors, beauty retailers, and social platforms. Business models involve SaaS, white-label, D2C apps, and brand-owned AI tools, catering to Gen Z, influencers, professionals, and new users. Core technologies include AR, computer vision, ML, and NLP, with North America and Asia-Pacific leading regional growth.

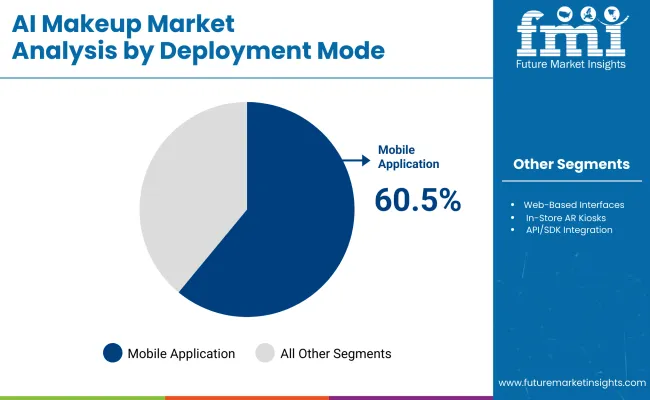

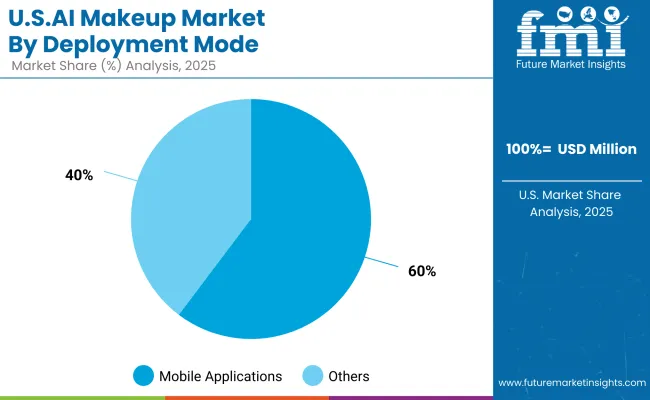

| Deployment Mode | Value Share% 2025 |

|---|---|

| Mobile Applications | 60.5% |

| Others | 39.5% |

The mobile applications segment is projected to contribute 60.5% of the AI Makeup Market revenue in 2025, making it the dominant deployment category. This leadership is fueled by the widespread adoption of AR-powered try-on apps and integration of AI tools within e-commerce platforms and social media channels. Mobile-first strategies are resonating with Gen Z and millennial consumers who prefer real-time, on-the-go personalization.

Growth is further supported by the rising penetration of beauty apps in China and the USA, along with the use of AI-driven recommendations within retail shopping experiences. As AR and AI technologies mature, mobile platforms are increasingly serving as the primary channel for virtual makeup, skincare diagnostics, and tailored beauty solutions, cementing their role as the backbone of AI beauty adoption.

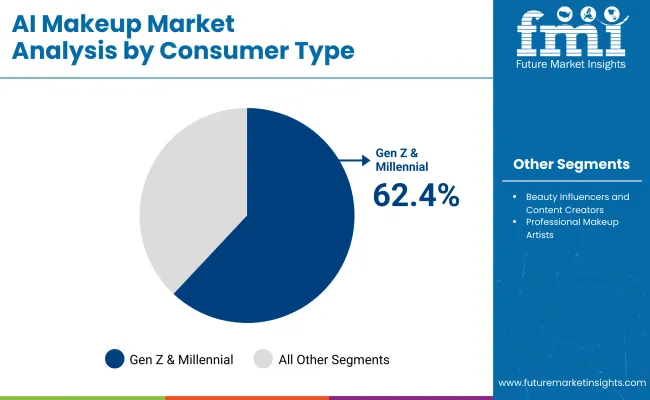

| Consumer Type | Value Share% 2025 |

|---|---|

| Gen Z & Millennials | 62.4% |

| Others | 37.6% |

The Gen Z & Millennial segment is forecasted to hold 62.4% of the AI Makeup Market share in 2025, driven by their digital-first beauty behaviors and reliance on AI-powered try-on tools. This group actively engages with social media filters, AR applications, and personalized AI beauty recommendations, making them the largest adopters of virtual makeup solutions.

Their preference for personalized, on-demand experiences is accelerating the integration of AI into beauty platforms, especially within mobile-first ecosystems like TikTok, Instagram, and Tmall apps. The segment’s dominance is further strengthened by high smartphone penetration, openness to tech-driven experimentation, and sustainability-driven shopping choices. As brands continue to target these demographics with immersive AI experiences, Gen Z & Millennials are expected to remain the core growth driver of the AI Makeup Market.

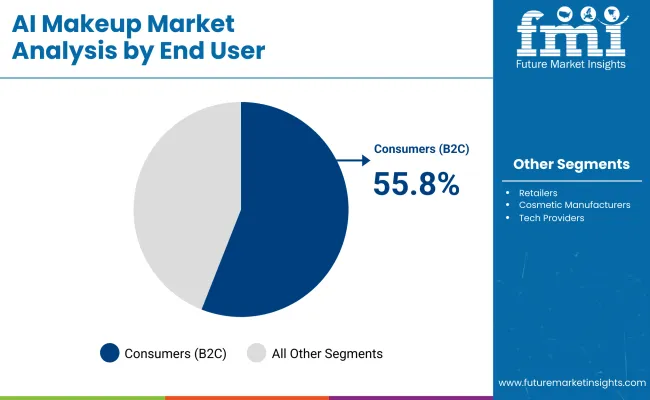

| End User | Value Share% 2025 |

|---|---|

| Consumers (B2C) | 55.8% |

| Others | 44.2% |

The laser triangulation technology segment is projected to account for 55.8% of the AI Makeup Market revenue in The consumer (B2C) segment is projected to account for 55.8% of the AI Makeup Market revenue in 2025, positioning it as the leading end-user group. This dominance is fueled by the rising use of AI-driven virtual try-on applications, personalized shade-matching tools, and AR-enabled shopping experiences. Consumers increasingly demand customized beauty solutions, where AI algorithms analyze facial features, skin tone, and texture to recommend tailored products.

This segment’s growth is further amplified by mobile-first adoption, integration of AI tools on e-commerce and social media platforms, and the popularity of immersive beauty apps that merge convenience with engagement. As personalization and digital interactivity become central to consumer decision-making, the B2C segment is expected to retain its leadership throughout the forecast period.

Personalization Through AI Algorithms

The AI makeup market is primarily fueled by the growing demand for hyper-personalized beauty experiences. Advanced algorithms can analyze facial features, skin tone, undertones, and even lifestyle habits to provide precise makeup recommendations tailored to each individual. This level of personalization increases consumer trust, reduces product mismatches, and enhances satisfaction, driving repeat purchases. It also allows brands to differentiate themselves by offering unique experiences that cannot be achieved through traditional retail interactions, making AI-powered tools a core driver of growth in the beauty industry.

Integration with E-commerce & Social Media

The rapid expansion of online beauty retail is further accelerated by AI-powered virtual try-on solutions embedded in e-commerce platforms and social media. Consumers can instantly experiment with different shades and looks through AR filters on platforms like Instagram, TikTok, and online brand stores, making the shopping experience engaging and interactive. This real-time product visualization not only improves conversion rates but also reduces product return rates. For beauty brands, this integration bridges the gap between physical and digital retail, fueling adoption of AI makeup solutions globally.

Data Privacy Concerns in Facial Recognition

Despite its benefits, one of the major restraints in the AI makeup market is the heightened concern over data privacy and security. AI makeup applications often rely on facial recognition and image-based scanning, raising fears about how biometric data is collected, stored, and used. With increasing global scrutiny through regulations such as GDPR in Europe or China’s strict data protection laws, companies face challenges in ensuring compliance. Consumer hesitation to share sensitive personal information remains a significant barrier that could slow adoption, particularly in regions with strong data protection frameworks.

Rise of AI-Enabled Sustainable Beauty

A defining trend shaping the AI makeup market is the convergence of personalization with sustainability. AI technologies are increasingly being leveraged to help consumers choose the right product on the first try, reducing the need for excessive physical sampling and minimizing waste in packaging and returns. Some platforms even simulate eco-friendly product packaging in AR experiences, enhancing consumer awareness about sustainability. This resonates strongly with Gen Z and millennial consumers who prioritize ethical and sustainable consumption. The trend is encouraging brands to align AI-powered beauty solutions with eco-conscious strategies, strengthening their appeal in a competitive market.

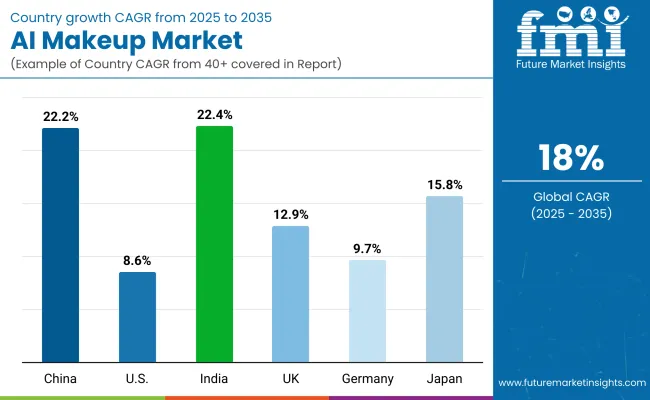

| Countries | CAGR (2025 to 2035) |

|---|---|

| China | 22.2% |

| USA | 8.6% |

| India | 22.4% |

| UK | 12.9% |

| Germany | 9.7% |

| Japan | 15.8% |

The global AI Makeup Market reveals significant regional variations in adoption, shaped by digital beauty penetration, consumer tech adoption, and brand-led innovation. Asia-Pacific leads the growth curve, with China at 22.2% CAGR and India at 22.4% CAGR, supported by the popularity of mobile-first beauty apps, rapid e-commerce expansion, and strong engagement of Gen Z and millennial consumers. China’s beauty-tech ecosystem is driven by domestic giants integrating AI makeup into super-apps, while India’s surge reflects affordable smartphone access, influencer-led adoption, and growing demand for personalized beauty experiences.

Europe maintains a strong presence, with the UK at 12.9% CAGR and Germany at 9.7% CAGR, propelled by premium beauty brands embedding AI-driven try-on features to comply with sustainability goals and reduce physical testers. Consumer focus on ethical beauty and digital-first retail channels drives regional adoption. Japan, with a 15.8% CAGR, highlights the region’s tech-forward consumer base and integration of AI beauty tools into daily self-care routines, supported by collaborations between cosmetics giants and technology firms.

In contrast, North America shows steady but moderate expansion, with the USA at 8.6% CAGR, reflecting a relatively mature beauty retail ecosystem. Growth here is fueled more by AR/VR-based beauty consultations, AI-powered dermatology integrations, and hybrid in-store-online experiences rather than sheer consumer adoption.

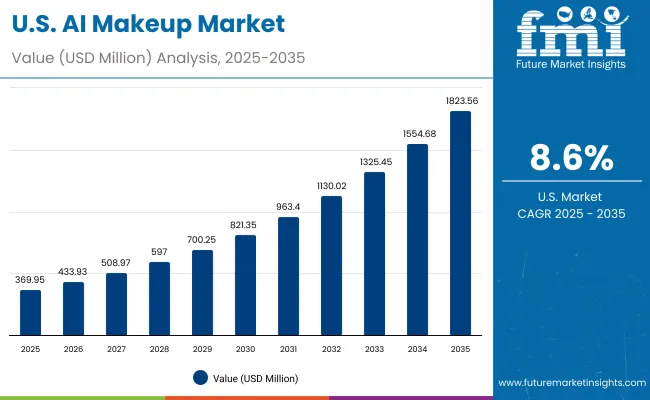

| Year | USA AI Makeup Market (USD Million) |

|---|---|

| 2025 | 369.95 |

| 2026 | 433.93 |

| 2027 | 508.97 |

| 2028 | 597.00 |

| 2029 | 700.25 |

| 2030 | 821.35 |

| 2031 | 963.40 |

| 2032 | 1,130.02 |

| 2033 | 1,325.45 |

| 2034 | 1,554.68 |

| 2035 | 1,823.56 |

The USA AI Makeup Market is expected to expand at a strong CAGR of 8.6% (2025-2035), supported by high digital adoption among beauty consumers and increasing integration of AI-driven try-on tools by leading cosmetics brands. Mobile-first experiences and AR-powered virtual try-ons are becoming mainstream in both e-commerce and physical retail, enabling brands to reduce product returns and drive customer engagement. Growth is further strengthened by partnerships between tech providers and beauty brands offering cloud-based personalization, virtual skin analysis, and AI-driven product recommendations.

The AI Makeup Market in the United Kingdom is projected to expand at a CAGR of 12.9%, fueled by strong adoption of virtual try-on tools in beauty retail and luxury cosmetics. Premium department stores and e-commerce platforms are integrating AI-powered recommendation engines to elevate customer experiences. Heritage beauty brands are collaborating with tech startups to develop AR-enabled makeup mirrors and skin analysis solutions, catering to Gen Z and millennial shoppers who value personalization. Government support for digital innovation in retail and partnerships with universities in AI research further accelerate market penetration.

India is expected to be one of the fastest-growing markets, expanding at a CAGR of 22.4% through 2035. Rising smartphone penetration and social commerce platforms are boosting awareness of AI-driven beauty solutions. Affordable AI makeup apps are attracting younger consumers in tier-2 and tier-3 cities, while established cosmetic players are rolling out localized AR-based shade-matching tools. EdTech and vocational institutes are introducing AI-powered beauty courses, training professionals in digital makeup consultancy. Public-private initiatives are encouraging homegrown AI startups to develop indigenous solutions that address diverse Indian skin tones and regional beauty preferences.

The AI Makeup Market in China is forecast to grow at a CAGR of 22.2%, the highest globally. Rapid adoption is supported by a booming e-commerce sector, government-driven digital retail programs, and tech giants integrating AI into beauty platforms. Livestreaming commerce is a major growth driver, where AI filters and AR-based try-ons enhance customer engagement. Affordable AI solutions from domestic players are democratizing access to smart beauty tools across both luxury and mass-market segments. Beauty-tech collaborations are further fueled by the country’s strong AI R&D ecosystem.

| Market Share | 2025 |

|---|---|

| China | 23.1% |

| USA | 12.6% |

| India | 7.6% |

| UK | 17.2% |

| Germany | 9.7% |

| Japan | 6.0% |

| Market Share | 2035 |

|---|---|

| China | 21.7% |

| USA | 14.1% |

| India | 10.3% |

| UK | 15.8% |

| Germany | 7.7% |

| Japan | 6.5% |

The AI Makeup Market in Germany is projected to grow at a CAGR of 9.7%, supported by its strong cosmetics retail presence and digital adoption among Gen Z and millennials. Beauty retailers are integrating AI try-on mirrors in stores to enhance personalized shopping experiences. German skincare brands are also embedding AI-driven shade-matching and ingredient recommendations into e-commerce platforms. Regulatory emphasis on sustainability and cruelty-free testing aligns with AI systems that simulate results digitally, reducing the need for physical product trials.

| USA By Deployment Mode | Value Share% 2025 |

|---|---|

| Mobile Applications | 60.3% |

| Others | 39.7% |

The AI Makeup Market in the USA is set to expand at a CAGR of 12.6%, driven by the dominance of mobile-first shopping behaviors. Major players like Sephora and Ulta are enhancing their apps with AI virtual try-ons, AR shade matching, and skin analysis tools. Social media platforms such as TikTok and Instagram are integrating AI-powered filters that influence product discovery and brand engagement. Premium beauty brands are leveraging personalized recommendations and subscription models powered by AI analytics.

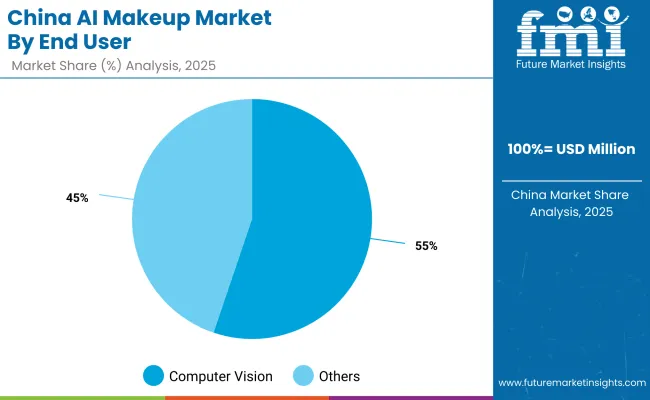

| China By End User | Value Share% 2025 |

|---|---|

| Computer Vision | 55.2% |

| Others | 44.8% |

The AI Makeup Market in China is growing rapidly, expected to lead globally by 2035. With 55.2% share in e-commerce and social platforms, adoption is being accelerated by super-app ecosystems like Alibaba, JD.com, and Douyin. Chinese beauty consumers are highly responsive to AI live-streaming sales, virtual makeup influencers, and AR try-on tools. Local beauty-tech startups are launching low-cost AI solutions integrated with mini-programs on WeChat. This environment positions China as the fastest-scaling AI makeup hub, supported by government-driven digital retail policies.

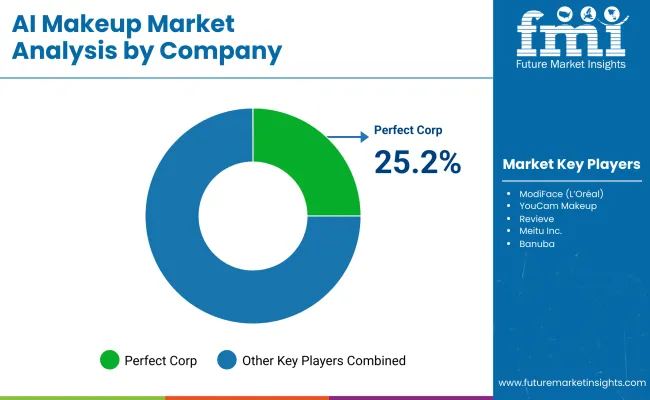

The AI Makeup Market is moderately fragmented, with global beauty-tech leaders, mid-sized innovators, and niche-focused startups competing across retail, e-commerce, and social commerce applications. Perfect Corp dominates with its YouCam Makeup platform, holding 25.2% market share, owing to strong partnerships with global cosmetic brands and deep integration of AI shade-matching, AR try-on, and skin analysis tools across both online and offline channels.

Mid-sized innovators such as ModiFace (L’Oréal-owned), Revieve, and Banuba are driving growth through B2B SaaS beauty-tech platforms, offering white-label AR try-on solutions for retailers and direct-to-consumer brands. These players emphasize cloud-based personalization engines and AI-driven skin diagnostics, making them critical enablers for digital transformation in beauty retail.

Specialized startups like Youthforia AI, Haut.AI, and MirrorMe focus on hyper-personalized makeup recommendations, sustainability-driven AI solutions, and niche AR applications for smaller brands and indie retailers. Their strength lies in agility, fast deployment, and regional customization, making them highly adaptable to emerging beauty trends and consumer demands.

Competitive differentiation is shifting from basic AR try-ons toward integrated beauty ecosystems that combine predictive AI for skin health, AR/VR-based immersive retail, metaverse beauty avatars, and subscription-based AI beauty services. This signals a strong move toward holistic, data-driven consumer experiences rather than standalone virtual try-on tools.

Key Developments in AI Makeup Market

| Item | Value |

|---|---|

| Quantitative Units | USD 1,601.5 Million |

| Type of Offering | Platform-as-a-Service (PaaS), Consumer-Facing Applications, Embedded Retail Technology, AI-Based Product Development Tools |

| Functionality / Use Case | Virtual Try-On Simulation, Skin Tone and Face Shape Analysis, Makeup Recommendation Engine, Makeup Filter and Enhancement Tools, Personalization Algorithms, Retail Integration Tools |

| End User | Consumers (B2C), Retailers (B2B2C), Cosmetic Manufacturers, Tech Providers |

| Deployment Mode | Mobile Applications, Web-Based Interfaces, In-Store AR Kiosks, API/SDK Integration |

| Product Type | Face Products, Eye Products, Lip Products, Nail Products, Hair Simulation, Skincare/Base Products |

| Company Type | AI Tech Vendors, Beauty Retailers, Social Media & Camera Apps, E-commerce Platforms |

| Business Model | SaaS Licensing, White-label Apps, Direct-to-Consumer Apps, Brand-Owned AI Solutions |

| Consumer Type | Gen Z and Millennials, Beauty Influencers and Content Creators, Professional Makeup Artists, First-Time Makeup Users |

| Technology Type: | Augmented Reality (AR), Facial Recognition and Landmark Detection, Machine Learning Algorithms, Computer Vision, Natural Language Processing (NLP), Big Data Personalization Engines |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | Perfect Corp., ModiFace (L’Oréal), YouCam Makeup, Revieve, Meitu Inc., Banuba, Ulta Beauty, Sephora, Taaz Inc., Poplar Studio |

| Additional Attributes | Dollar sales by product category and deployment mode, adoption trends in AR-powered virtual try-on and personalized makeup recommendations, rising demand for mobile and in-store AI beauty applications, sector-specific growth across retail, e-commerce, and professional salons, software and subscription-based revenue segmentation, integration with AR/VR and social commerce platforms, regional trends influenced by beauty-tech adoption and digital consumer engagement, and innovations in computer vision, facial recognition, and machine learning-driven personalization engines. |

The global AI Makeup Market is estimated to be valued at USD 1,601.5 Million in 2025, driven by strong adoption of mobile applications and AR-powered try-on solutions.

The AI Makeup Market is projected to reach USD 8,403.5 Million by 2035, supported by continued integration into e-commerce, retail platforms, and personalized beauty services.

The AI Makeup Market is expected to grow at a 18.0% CAGR between 2025 and 2035, fueled by demand for hyper-personalized beauty experiences, AR/VR innovations, and machine learning–driven product recommendations.

The key product types in the AI Makeup Market are face products, eye products, lip products, nail products, hair simulation, and skincare/base products.

In terms of deployment, the mobile applications segment is expected to command a significant share of the AI Makeup Market in 2025, owing to widespread use among Gen Z and Millennials through social media and beauty retail platforms.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Airport Ground Transportation Market Forecast and Outlook 2025 to 2035

AI Waste Sorting Robots Market Forecast and Outlook 2025 to 2035

AI Image Editor Market Forecast and Outlook 2025 to 2035

Airless Sprayer Accessories Market Size and Share Forecast Outlook 2025 to 2035

Air Purge Valve Market Size and Share Forecast Outlook 2025 to 2035

AI Demand Forecasting Software Market Size and Share Forecast Outlook 2025 to 2035

Air Flow Sensors Market Size and Share Forecast Outlook 2025 to 2035

Air Separation Plant Market Size and Share Forecast Outlook 2025 to 2035

Air Cooled Turbo Generators Market Size and Share Forecast Outlook 2025 to 2035

Aircraft Cooling Turbines Market Size and Share Forecast Outlook 2025 to 2035

Air Conditioning Compressor Market Size and Share Forecast Outlook 2025 to 2035

Air Measuring Equipment Market Size and Share Forecast Outlook 2025 to 2035

Aircraft Smoke Detection and Fire Extinguishing System Market Size and Share Forecast Outlook 2025 to 2035

Aircraft Hose Fittings Market Size and Share Forecast Outlook 2025 to 2035

Aircraft Cabin Interior Market Size and Share Forecast Outlook 2025 to 2035

Aircraft Galley Systems Market Size and Share Forecast Outlook 2025 to 2035

Aircraft Interior Lighting Market Size and Share Forecast Outlook 2025 to 2035

Aircraft Battery Market Size and Share Forecast Outlook 2025 to 2035

Aircraft Floor Panels Market Size and Share Forecast Outlook 2025 to 2035

Aircraft Fuel Systems Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA