The Western Europe anti-wrinkle products market is poised to register a valuation of USD 994.7 million in 2025. The industry is slated to grow at 5.6% CAGR from 2025 to 2035, witnessing USD 1,736.6 million by 2035. The expansion of the market is being propelled by a mixture of demographic changes, lifestyle trends, and growing consumer awareness. One of the key drivers is the aging population in the region.

Germany, France, Italy, and Spain are all experiencing consistent rises in median age because of declining birth rates and increasing life expectancy. With longer lives, individuals are increasingly interested in looking younger, driving demand for anti-aging and more notably anti-wrinkle skincare products.

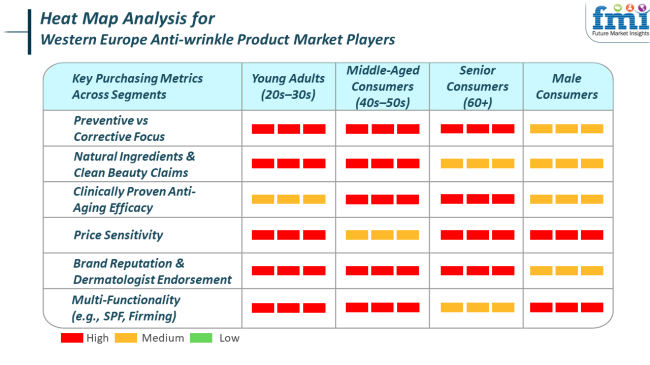

Along with aging, cultural perceptions about beauty and grooming have also undergone significant changes. There is an increasing acceptance and mainstreaming of cosmetic regimens previously deemed high-maintenance or niche. Men are also increasingly becoming active users of skincare, widening the base of consumers.

Beauty standards have further been enhanced and magnified by social media and influencer marketing, pushing consumers within both older and younger age brackets to initiate preventive skincare sooner. This has created increasing demand not just for products that correct issues but also for preventive anti-wrinkle treatments.

In addition, technological development and ingredient innovation are increasing product effectiveness, thereby enhancing consumer confidence. The application of peptides, retinoids, and natural plant compounds has rendered anti-wrinkle creams and serums more desirable, as consumers are better aware and selective regarding product ingredients. Also, environmentally friendly formulations and eco-friendly packaging are contributing, particularly from millennial and Gen Z consumers who are guided by ethical consumption.

The Western Europe anti-wrinkle product market is driven by distinct purchasing patterns and trends across different end-use categories, such as individual consumers, dermatological clinics, and beauty salons. Individual consumers, and especially consumers above 30 years, are more concerned with preventive skincare and transparency of ingredients.

They require products with validated actives such as retinol, hyaluronic acid, and peptides and appreciate clean, cruelty-free, and sustainable formulations. In social media, online reviews and influencer promotions play a decisive role in the purchase decision with most preferring a multi-functional formula that delivers hydration, sun care, and anti-aging combined.

These customers, as a norm, prefer scientific-backed cosmeceutical-grade products delivering consistent performance. Beauty salons, on the other hand, are concerned with sensorial attractiveness-texture, fragrance, and packaging-in addition to efficacy, choosing products that enhance the customer experience and facilitate aftercare retail sales. Throughout all segments, there is a distinct trend toward quick-absorbing, results-oriented formulas that are consistent with changing consumer expectations for function and simplicity.

Between 2020 and 2024, the Western European anti-wrinkle product market underwent dramatic change, driven by both global and local trends. The COVID-19 pandemic first caused supply chains to be disrupted and demand for discretionary beauty products to fall; however, it also led to a renewed emphasis on self-care and skincare regimens as consumers stayed at home.

This resulted in an increase in home treatments and a move from makeup to skin care, specifically products that nurture long-term skin health. Digitalization sped up, with investments in e-commerce, virtual consultation for skin, and customized product recommendations. In this time, consumers became ingredient-conscious, causing increased demand for science-formulated products and ingredients-free products containing no harmful additives.

Forward-looking from 2025 to 2035, the sector is predicted to continue to change in reaction to aging populations, technological advancement, and shifting consumer habits.Customized skincare will be a mainstream norm, propelled by AI, genetic screening, and microbiome profiling.

Anti-aging products will further embed biotechnology, peptides, and bio-retinol substitutes, with the goal of providing clinical-level outcomes without surgery. The boundary between skincare and wellness will become more blurred, with anti-aging products not only targeting wrinkles but also the longevity of skin, barrier health, and inflammation. Furthermore, the growth of environmentally friendly consumers will drive brands to embrace circular packaging, carbon-neutral manufacturing, and refills.

Comparative Industry Shift Analysis (2020 to 2024 vs. 2025 to 2035)

| 2020 to 2024 | 2025 to 2035 |

|---|---|

| Consumers became increasingly self-conscious about self-care during the pandemic, embracing skincare habits for health and relaxation. The emphasis was on early prevention and maintenance with affordable products. | Consumers will embrace a more proactive and educated attitude towards aging, with greater interest in skin health, longevity, and long-term consequences of lifestyle and environmental influences on the skin. |

| Preference shifted toward multifunctional, clean-label items containing well-known ingredients. Products that could accomplish more with less were becoming popular, particularly those providing hydration and wrinkle improvement in one. | Consumers will look for hyper-targeted products that target specific skin issues and aging patterns. There will be more utilization of smart delivery systems and products addressing skin biology and genetics. |

| The growth of digital beauty experiences and online shopping turned into a defining trend. Online skin consultations and diagnostic tools grew popular, especially during lockdown. | The future decade will witness integrated advanced use of AI, skin-scanning technologies, and intelligent skincare technology. Personalized product development via data analytics, DNA testing, and real-time analysis of the skin will become prevalent. |

| Goods bearing ingredients such as retinol, hyaluronic acid, niacinamide , and plant-derived elements dominated store shelves. Customers cherished familiarity and protection over innovation. | Biotechnology innovations will fuel ingredients. Peptides, stem-cell extracts, actives that communicate with the microbiome, and bio-retinol substitutes will be at the forefront, which will deliver clinically proven results with no irritation. |

The Western Europe market for anti-wrinkle products, although potentially strong in terms of growth, is not risk-free. Part of the greatest risk involves regulatory complexity and changing compliance standards in the EU. The European Union has strict laws on cosmetic ingredients, labeling, and claims advertising.

Any change in these rules-e.g., prohibitions on certain active ingredients or changes in packaging standards-can impede production and slow product introduction. For multiregional Western European brands, managing these differences layers cost and operational risk.

Another key risk is growing consumer wariness and desire for transparency. Consumers today are well-informed and frequently examine ingredients, brand morality, and sustainability procedures. Lack of transparency or being accused of greenwashing can promptly create reputation damage, particularly in a time when social media can create negative momentum. Moreover, false information or viral phenomena concerning skincare (like untested home remedies or fear of certain ingredients) may trigger abrupt changes in consumer behavior, disrupting demand for certain types of products.

In the Western European anti-wrinkle market, creams and moisturizers are the most commonly sold product type. Such products are set deep into daily skincare regimens and are frequently the initial line of defense for visible signs of aging. In this region, consumers value hydration as an essential aspect of wrinkle prevention and diminishment, and thus moisturizers containing anti-aging contents are greatly sought after.

Brands often develop these products with commonly recognized actives like hyaluronic acid, retinol, peptides, and antioxidants, which enjoy high consumer awareness and clinical validation. The convenience of use, ease of application, and widespread availability across price tiers-from mass to prestige-make creams and moisturizers the most popular.

Cleansers, although a necessity in general skincare, have a less central function in anti-wrinkle care. Yet, anti-aging cleansers are also increasing in popularity because they also provide additional benefits such as mild exfoliation, moisturizing, and incorporation of mild anti-aging agents (e.g., glycolic acid or ceramides). Sensitive or aging consumers seek non-stripping cleansers that reinforce skin barrier integrity while quietly increasing firmness or glow.

Natural and herbal anti-wrinkle products have experienced substantial growth in Western Europe and are widely adopted by consumers seeking milder, more skin-friendly alternatives. This is particularly prevalent among health-oriented consumers who regard natural ingredients as safe and associated with overall well-being.

Germany, France, and Nordics have a long history of herbal and botanical skin treatments, which lends cultural significance to the demand. They tend to include ingredients such as aloe vera, green tea, chamomile, rosehip, and plant oils, which are thought to be effective but not irritating. As sensitivity to sensitive skin and safe long-term ingredients becomes more of an issue, natural products remain the mainstream, especially in chemists and organic beauty stores.

Synthetic anti-wrinkle treatments, although having encountered some criticism, continue to enjoy a strong market share based on their clinically proven efficacy and rapid-acting effects. Treatments with lab-formulated actives like retinoids, peptides, and niacinamide are favored by consumers looking for visible enhancements in fine lines, firmness, and skin texture.

The Western European anti-wrinkle product market is extremely competitive with a combination of established international players and new niche brands targeting particular consumer inclinations. The market is dominated by the increasing demand for sustainable, natural, and performance-oriented products, with leaders such as L'Oréal S.A., Beiersdorf AG, and Unilever enjoying a strong market share.

These giants of the industry have a broad line of products at various price points, meeting varied consumer demands, from expensive anti-aging creams to bargain-price daily moisturizers. Specialized brands like ARK Skincare and Alma Secret Company are finding niches in the market by providing organic, clean beauty products appealing to eco-friendly consumers. The future of the anti-wrinkle segment will continue to be shaped by a focus on innovation, sustainability, and personalized skincare experiences.

| Company Name | Estimated Industry Share (%) |

|---|---|

| Beiersdorf AG | 10-12% |

| L'Oréal S.A | 12-15% |

| Unilever | 8-10% |

| Clarins Group | 6-8% |

| ARK Skincare | 3-5% |

| Alma Secret Company | 2-4% |

| Allergan PLC | 5-7% |

| Coty, Inc. | 4-6% |

| Colgate Palmolive Company | 5-7% |

| Mary Kay Inc. | 3-5% |

| Company Name | Key Company Offerings and Activities |

|---|---|

| Beiersdorf AG | Beiersdorf has its fame around the NIVEA brand, which has a broad line of anti-wrinkle products for both mass-market value consumers and upmarket segments, with high efficacy and long consumer loyalty. |

| L'Oréal S.A. | A top player in the anti-wrinkle category, L'Oréal has products from several brands such as Lancôme and L'Oréal Paris, focusing on sophisticated science, anti-aging benefits, and luxury formats. |

| Unilever | Unilever's brands such as Dove and Simple appeal to a wide consumer base, with low-cost anti-wrinkle creams that emphasize moisturization , skin barrier repair, and anti-aging properties with an emphasis on simplicity. |

| Clarins Group | Clarins centers on premium, high-end anti-aging skincare with luxurious ingredients that target specific concerns such as wrinkles, fine lines, and firming, with a focus on natural ingredients. |

| ARK Skincare | ARK Skincare differentiates itself with an emphasis on organic anti-aging solutions, providing products developed to combat skin aging in a gentle, sustainable manner, attracting environmentally aware consumers. |

| Alma Secret Company | Recognized for the combination of natural herbal ingredients and innovative anti-aging technologies, Alma Secret focuses on luxury anti-wrinkle solutions of high efficacy and attention to younger, radiating-looking skin. |

| Allergan PLC | A leader in both medical aesthetics and skincare, Allergan's Botox brand is deeply entrenched in anti-wrinkle procedures, complemented by topical skincare solutions for aging indications. |

| Coty, Inc. | Coty provides anti-wrinkle solutions via premium brands such as Lancôme and Rimmel , aiming at both premium and mass segments, with an emphasis on affordable yet effective anti-aging skincare. |

| Colgate Palmolive Company | Colgate Palmolive carries products under the Protex brand, which specializes in skincare and anti-aging benefits, especially in soaps and body care. The company highlights affordable skincare for aging issues. |

| Mary Kay Inc. | Famous for direct selling, Mary Kay carries a line of anti-aging skincare solutions such as serums, creams, and masks, aimed at affordable, high-performance products for wrinkle elimination. |

The Western European anti-wrinkle product market remains to be competed by both global players and new niche brands. L'Oréal S.A., Beiersdorf AG, and Unilever continue to be the leading players, leading innovation in mass-market and luxury products. These players aim to provide products that cater to a wide array of consumer needs, ranging from scientifically proven formulations to more affordable anti-aging solutions.

Nevertheless, the expansion of niche players such as ARK Skincare and Alma Secret Company is significant, with increasing consumer demand for products formulated from natural, organic, and sustainable ingredients. These niche players address eco-conscious consumers by providing luxury and ethical skincare options, emphasizing ingredient sourcing and manufacturing transparency.

In terms of product type, the industry is classified into creams & moisturizers, cleansers, and other products.

With respect to nature, the market is divided into natural/herbal, synthetic, and organic.

Based on end-user, the industry is classified into men and women.

In terms of sales channel, the market is segregated into pharmacies, specialty outlets, supermarkets/hypermarkets, convenience stores, beauty stores, e-retailers, and others.

By country, the industry is segregated into the UK, Germany, Italy, France, Spain, and the rest of Europe.

The industry is expected to reach USD 994.7 million in 2025.

The market is projected to witness USD 1,736.6 million by 2035.

The industry is slated to capture 5.6% CAGR during the study period.

Moisturizers and creams are widely used.

Leading companies include Oriflame Cosmetics AG, Natura & Co., L'Oréal S.A., Clarins Group, Unilever, Beiersdorf AG, Henkel AG, Avon Products Inc., ARK Skincare, Alma Secret Company, Allergan PLC, Coty, Inc., Colgate Palmolive Company, and Mary Kay Inc.

Table 1: Industry Analysis and Outlook Value (US$ Million) Forecast by Country, 2018 to 2033

Table 2: Industry Analysis and Outlook Volume (Unit Pack) Forecast by Country, 2018 to 2033

Table 3: Industry Analysis and Outlook Value (US$ Million) Forecast by Product Type , 2018 to 2033

Table 4: Industry Analysis and Outlook Volume (Unit Pack) Forecast by Product Type , 2018 to 2033

Table 5: Industry Analysis and Outlook Value (US$ Million) Forecast by Nature , 2018 to 2033

Table 6: Industry Analysis and Outlook Volume (Unit Pack) Forecast by Nature , 2018 to 2033

Table 7: Industry Analysis and Outlook Value (US$ Million) Forecast by End-User , 2018 to 2033

Table 8: Industry Analysis and Outlook Volume (Unit Pack) Forecast by End-User , 2018 to 2033

Table 9: Industry Analysis and Outlook Value (US$ Million) Forecast by Sales Channel , 2018 to 2033

Table 10: Industry Analysis and Outlook Volume (Unit Pack) Forecast by Sales Channel , 2018 to 2033

Table 11: UK Industry Analysis and Outlook Value (US$ Million) Forecast By Region, 2018 to 2033

Table 12: UK Industry Analysis and Outlook Volume (Unit Pack) Forecast By Region, 2018 to 2033

Table 13: UK Industry Analysis and Outlook Value (US$ Million) Forecast by Product Type , 2018 to 2033

Table 14: UK Industry Analysis and Outlook Volume (Unit Pack) Forecast by Product Type , 2018 to 2033

Table 15: UK Industry Analysis and Outlook Value (US$ Million) Forecast by Nature , 2018 to 2033

Table 16: UK Industry Analysis and Outlook Volume (Unit Pack) Forecast by Nature , 2018 to 2033

Table 17: UK Industry Analysis and Outlook Value (US$ Million) Forecast by End-User , 2018 to 2033

Table 18: UK Industry Analysis and Outlook Volume (Unit Pack) Forecast by End-User , 2018 to 2033

Table 19: UK Industry Analysis and Outlook Value (US$ Million) Forecast by Sales Channel , 2018 to 2033

Table 20: UK Industry Analysis and Outlook Volume (Unit Pack) Forecast by Sales Channel , 2018 to 2033

Table 21: Germany Industry Analysis and Outlook Value (US$ Million) Forecast By Region, 2018 to 2033

Table 22: Germany Industry Analysis and Outlook Volume (Unit Pack) Forecast By Region, 2018 to 2033

Table 23: Germany Industry Analysis and Outlook Value (US$ Million) Forecast by Product Type , 2018 to 2033

Table 24: Germany Industry Analysis and Outlook Volume (Unit Pack) Forecast by Product Type , 2018 to 2033

Table 25: Germany Industry Analysis and Outlook Value (US$ Million) Forecast by Nature , 2018 to 2033

Table 26: Germany Industry Analysis and Outlook Volume (Unit Pack) Forecast by Nature , 2018 to 2033

Table 27: Germany Industry Analysis and Outlook Value (US$ Million) Forecast by End-User , 2018 to 2033

Table 28: Germany Industry Analysis and Outlook Volume (Unit Pack) Forecast by End-User , 2018 to 2033

Table 29: Germany Industry Analysis and Outlook Value (US$ Million) Forecast by Sales Channel , 2018 to 2033

Table 30: Germany Industry Analysis and Outlook Volume (Unit Pack) Forecast by Sales Channel , 2018 to 2033

Table 31: Italy Industry Analysis and Outlook Value (US$ Million) Forecast By Region, 2018 to 2033

Table 32: Italy Industry Analysis and Outlook Volume (Unit Pack) Forecast By Region, 2018 to 2033

Table 33: Italy Industry Analysis and Outlook Value (US$ Million) Forecast by Product Type , 2018 to 2033

Table 34: Italy Industry Analysis and Outlook Volume (Unit Pack) Forecast by Product Type , 2018 to 2033

Table 35: Italy Industry Analysis and Outlook Value (US$ Million) Forecast by Nature , 2018 to 2033

Table 36: Italy Industry Analysis and Outlook Volume (Unit Pack) Forecast by Nature , 2018 to 2033

Table 37: Italy Industry Analysis and Outlook Value (US$ Million) Forecast by End-User , 2018 to 2033

Table 38: Italy Industry Analysis and Outlook Volume (Unit Pack) Forecast by End-User , 2018 to 2033

Table 39: Italy Industry Analysis and Outlook Value (US$ Million) Forecast by Sales Channel , 2018 to 2033

Table 40: Italy Industry Analysis and Outlook Volume (Unit Pack) Forecast by Sales Channel , 2018 to 2033

Table 41: France Industry Analysis and Outlook Value (US$ Million) Forecast By Region, 2018 to 2033

Table 42: France Industry Analysis and Outlook Volume (Unit Pack) Forecast By Region, 2018 to 2033

Table 43: France Industry Analysis and Outlook Value (US$ Million) Forecast by Product Type , 2018 to 2033

Table 44: France Industry Analysis and Outlook Volume (Unit Pack) Forecast by Product Type , 2018 to 2033

Table 45: France Industry Analysis and Outlook Value (US$ Million) Forecast by Nature , 2018 to 2033

Table 46: France Industry Analysis and Outlook Volume (Unit Pack) Forecast by Nature , 2018 to 2033

Table 47: France Industry Analysis and Outlook Value (US$ Million) Forecast by End-User , 2018 to 2033

Table 48: France Industry Analysis and Outlook Volume (Unit Pack) Forecast by End-User , 2018 to 2033

Table 49: France Industry Analysis and Outlook Value (US$ Million) Forecast by Sales Channel , 2018 to 2033

Table 50: France Industry Analysis and Outlook Volume (Unit Pack) Forecast by Sales Channel , 2018 to 2033

Table 51: Spain Industry Analysis and Outlook Value (US$ Million) Forecast By Region, 2018 to 2033

Table 52: Spain Industry Analysis and Outlook Volume (Unit Pack) Forecast By Region, 2018 to 2033

Table 53: Spain Industry Analysis and Outlook Value (US$ Million) Forecast by Product Type , 2018 to 2033

Table 54: Spain Industry Analysis and Outlook Volume (Unit Pack) Forecast by Product Type , 2018 to 2033

Table 55: Spain Industry Analysis and Outlook Value (US$ Million) Forecast by Nature , 2018 to 2033

Table 56: Spain Industry Analysis and Outlook Volume (Unit Pack) Forecast by Nature , 2018 to 2033

Table 57: Spain Industry Analysis and Outlook Value (US$ Million) Forecast by End-User , 2018 to 2033

Table 58: Spain Industry Analysis and Outlook Volume (Unit Pack) Forecast by End-User , 2018 to 2033

Table 59: Spain Industry Analysis and Outlook Value (US$ Million) Forecast by Sales Channel , 2018 to 2033

Table 60: Spain Industry Analysis and Outlook Volume (Unit Pack) Forecast by Sales Channel , 2018 to 2033

Table 61: Rest of Industry Analysis and Outlook Value (US$ Million) Forecast by Product Type , 2018 to 2033

Table 62: Rest of Industry Analysis and Outlook Volume (Unit Pack) Forecast by Product Type , 2018 to 2033

Table 63: Rest of Industry Analysis and Outlook Value (US$ Million) Forecast by Nature , 2018 to 2033

Table 64: Rest of Industry Analysis and Outlook Volume (Unit Pack) Forecast by Nature , 2018 to 2033

Table 65: Rest of Industry Analysis and Outlook Value (US$ Million) Forecast by End-User , 2018 to 2033

Table 66: Rest of Industry Analysis and Outlook Volume (Unit Pack) Forecast by End-User , 2018 to 2033

Table 67: Rest of Industry Analysis and Outlook Value (US$ Million) Forecast by Sales Channel , 2018 to 2033

Table 68: Rest of Industry Analysis and Outlook Volume (Unit Pack) Forecast by Sales Channel , 2018 to 2033

Figure 1: Industry Analysis and Outlook Value (US$ Million) by Product Type , 2023 to 2033

Figure 2: Industry Analysis and Outlook Value (US$ Million) by Nature , 2023 to 2033

Figure 3: Industry Analysis and Outlook Value (US$ Million) by End-User , 2023 to 2033

Figure 4: Industry Analysis and Outlook Value (US$ Million) by Sales Channel , 2023 to 2033

Figure 5: Industry Analysis and Outlook Value (US$ Million) by Country, 2023 to 2033

Figure 6: Industry Analysis and Outlook Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 7: Industry Analysis and Outlook Volume (Unit Pack) Analysis by Country, 2018 to 2033

Figure 8: Industry Analysis and Outlook Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 9: Industry Analysis and Outlook Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 10: Industry Analysis and Outlook Value (US$ Million) Analysis by Product Type , 2018 to 2033

Figure 11: Industry Analysis and Outlook Volume (Unit Pack) Analysis by Product Type , 2018 to 2033

Figure 12: Industry Analysis and Outlook Value Share (%) and BPS Analysis by Product Type , 2023 to 2033

Figure 13: Industry Analysis and Outlook Y-o-Y Growth (%) Projections by Product Type , 2023 to 2033

Figure 14: Industry Analysis and Outlook Value (US$ Million) Analysis by Nature , 2018 to 2033

Figure 15: Industry Analysis and Outlook Volume (Unit Pack) Analysis by Nature , 2018 to 2033

Figure 16: Industry Analysis and Outlook Value Share (%) and BPS Analysis by Nature , 2023 to 2033

Figure 17: Industry Analysis and Outlook Y-o-Y Growth (%) Projections by Nature , 2023 to 2033

Figure 18: Industry Analysis and Outlook Value (US$ Million) Analysis by End-User , 2018 to 2033

Figure 19: Industry Analysis and Outlook Volume (Unit Pack) Analysis by End-User , 2018 to 2033

Figure 20: Industry Analysis and Outlook Value Share (%) and BPS Analysis by End-User , 2023 to 2033

Figure 21: Industry Analysis and Outlook Y-o-Y Growth (%) Projections by End-User , 2023 to 2033

Figure 22: Industry Analysis and Outlook Value (US$ Million) Analysis by Sales Channel , 2018 to 2033

Figure 23: Industry Analysis and Outlook Volume (Unit Pack) Analysis by Sales Channel , 2018 to 2033

Figure 24: Industry Analysis and Outlook Value Share (%) and BPS Analysis by Sales Channel , 2023 to 2033

Figure 25: Industry Analysis and Outlook Y-o-Y Growth (%) Projections by Sales Channel , 2023 to 2033

Figure 26: Industry Analysis and Outlook Attractiveness by Product Type , 2023 to 2033

Figure 27: Industry Analysis and Outlook Attractiveness by Nature , 2023 to 2033

Figure 28: Industry Analysis and Outlook Attractiveness by End-User , 2023 to 2033

Figure 29: Industry Analysis and Outlook Attractiveness by Sales Channel , 2023 to 2033

Figure 30: Industry Analysis and Outlook Attractiveness by Region, 2023 to 2033

Figure 31: UK Industry Analysis and Outlook Value (US$ Million) by Product Type , 2023 to 2033

Figure 32: UK Industry Analysis and Outlook Value (US$ Million) by Nature , 2023 to 2033

Figure 33: UK Industry Analysis and Outlook Value (US$ Million) by End-User , 2023 to 2033

Figure 34: UK Industry Analysis and Outlook Value (US$ Million) by Sales Channel , 2023 to 2033

Figure 35: UK Industry Analysis and Outlook Value (US$ Million) By Region, 2023 to 2033

Figure 36: UK Industry Analysis and Outlook Value (US$ Million) Analysis By Region, 2018 to 2033

Figure 37: UK Industry Analysis and Outlook Volume (Unit Pack) Analysis By Region, 2018 to 2033

Figure 38: UK Industry Analysis and Outlook Value Share (%) and BPS Analysis By Region, 2023 to 2033

Figure 39: UK Industry Analysis and Outlook Y-o-Y Growth (%) Projections By Region, 2023 to 2033

Figure 40: UK Industry Analysis and Outlook Value (US$ Million) Analysis by Product Type , 2018 to 2033

Figure 41: UK Industry Analysis and Outlook Volume (Unit Pack) Analysis by Product Type , 2018 to 2033

Figure 42: UK Industry Analysis and Outlook Value Share (%) and BPS Analysis by Product Type , 2023 to 2033

Figure 43: UK Industry Analysis and Outlook Y-o-Y Growth (%) Projections by Product Type , 2023 to 2033

Figure 44: UK Industry Analysis and Outlook Value (US$ Million) Analysis by Nature , 2018 to 2033

Figure 45: UK Industry Analysis and Outlook Volume (Unit Pack) Analysis by Nature , 2018 to 2033

Figure 46: UK Industry Analysis and Outlook Value Share (%) and BPS Analysis by Nature , 2023 to 2033

Figure 47: UK Industry Analysis and Outlook Y-o-Y Growth (%) Projections by Nature , 2023 to 2033

Figure 48: UK Industry Analysis and Outlook Value (US$ Million) Analysis by End-User , 2018 to 2033

Figure 49: UK Industry Analysis and Outlook Volume (Unit Pack) Analysis by End-User , 2018 to 2033

Figure 50: UK Industry Analysis and Outlook Value Share (%) and BPS Analysis by End-User , 2023 to 2033

Figure 51: UK Industry Analysis and Outlook Y-o-Y Growth (%) Projections by End-User , 2023 to 2033

Figure 52: UK Industry Analysis and Outlook Value (US$ Million) Analysis by Sales Channel , 2018 to 2033

Figure 53: UK Industry Analysis and Outlook Volume (Unit Pack) Analysis by Sales Channel , 2018 to 2033

Figure 54: UK Industry Analysis and Outlook Value Share (%) and BPS Analysis by Sales Channel , 2023 to 2033

Figure 55: UK Industry Analysis and Outlook Y-o-Y Growth (%) Projections by Sales Channel , 2023 to 2033

Figure 56: UK Industry Analysis and Outlook Attractiveness by Product Type , 2023 to 2033

Figure 57: UK Industry Analysis and Outlook Attractiveness by Nature , 2023 to 2033

Figure 58: UK Industry Analysis and Outlook Attractiveness by End-User , 2023 to 2033

Figure 59: UK Industry Analysis and Outlook Attractiveness by Sales Channel , 2023 to 2033

Figure 60: UK Industry Analysis and Outlook Attractiveness By Region, 2023 to 2033

Figure 61: Germany Industry Analysis and Outlook Value (US$ Million) by Product Type , 2023 to 2033

Figure 62: Germany Industry Analysis and Outlook Value (US$ Million) by Nature , 2023 to 2033

Figure 63: Germany Industry Analysis and Outlook Value (US$ Million) by End-User , 2023 to 2033

Figure 64: Germany Industry Analysis and Outlook Value (US$ Million) by Sales Channel , 2023 to 2033

Figure 65: Germany Industry Analysis and Outlook Value (US$ Million) By Region, 2023 to 2033

Figure 66: Germany Industry Analysis and Outlook Value (US$ Million) Analysis By Region, 2018 to 2033

Figure 67: Germany Industry Analysis and Outlook Volume (Unit Pack) Analysis By Region, 2018 to 2033

Figure 68: Germany Industry Analysis and Outlook Value Share (%) and BPS Analysis By Region, 2023 to 2033

Figure 69: Germany Industry Analysis and Outlook Y-o-Y Growth (%) Projections By Region, 2023 to 2033

Figure 70: Germany Industry Analysis and Outlook Value (US$ Million) Analysis by Product Type , 2018 to 2033

Figure 71: Germany Industry Analysis and Outlook Volume (Unit Pack) Analysis by Product Type , 2018 to 2033

Figure 72: Germany Industry Analysis and Outlook Value Share (%) and BPS Analysis by Product Type , 2023 to 2033

Figure 73: Germany Industry Analysis and Outlook Y-o-Y Growth (%) Projections by Product Type , 2023 to 2033

Figure 74: Germany Industry Analysis and Outlook Value (US$ Million) Analysis by Nature , 2018 to 2033

Figure 75: Germany Industry Analysis and Outlook Volume (Unit Pack) Analysis by Nature , 2018 to 2033

Figure 76: Germany Industry Analysis and Outlook Value Share (%) and BPS Analysis by Nature , 2023 to 2033

Figure 77: Germany Industry Analysis and Outlook Y-o-Y Growth (%) Projections by Nature , 2023 to 2033

Figure 78: Germany Industry Analysis and Outlook Value (US$ Million) Analysis by End-User , 2018 to 2033

Figure 79: Germany Industry Analysis and Outlook Volume (Unit Pack) Analysis by End-User , 2018 to 2033

Figure 80: Germany Industry Analysis and Outlook Value Share (%) and BPS Analysis by End-User , 2023 to 2033

Figure 81: Germany Industry Analysis and Outlook Y-o-Y Growth (%) Projections by End-User , 2023 to 2033

Figure 82: Germany Industry Analysis and Outlook Value (US$ Million) Analysis by Sales Channel , 2018 to 2033

Figure 83: Germany Industry Analysis and Outlook Volume (Unit Pack) Analysis by Sales Channel , 2018 to 2033

Figure 84: Germany Industry Analysis and Outlook Value Share (%) and BPS Analysis by Sales Channel , 2023 to 2033

Figure 85: Germany Industry Analysis and Outlook Y-o-Y Growth (%) Projections by Sales Channel , 2023 to 2033

Figure 86: Germany Industry Analysis and Outlook Attractiveness by Product Type , 2023 to 2033

Figure 87: Germany Industry Analysis and Outlook Attractiveness by Nature , 2023 to 2033

Figure 88: Germany Industry Analysis and Outlook Attractiveness by End-User , 2023 to 2033

Figure 89: Germany Industry Analysis and Outlook Attractiveness by Sales Channel , 2023 to 2033

Figure 90: Germany Industry Analysis and Outlook Attractiveness By Region, 2023 to 2033

Figure 91: Italy Industry Analysis and Outlook Value (US$ Million) by Product Type , 2023 to 2033

Figure 92: Italy Industry Analysis and Outlook Value (US$ Million) by Nature , 2023 to 2033

Figure 93: Italy Industry Analysis and Outlook Value (US$ Million) by End-User , 2023 to 2033

Figure 94: Italy Industry Analysis and Outlook Value (US$ Million) by Sales Channel , 2023 to 2033

Figure 95: Italy Industry Analysis and Outlook Value (US$ Million) By Region, 2023 to 2033

Figure 96: Italy Industry Analysis and Outlook Value (US$ Million) Analysis By Region, 2018 to 2033

Figure 97: Italy Industry Analysis and Outlook Volume (Unit Pack) Analysis By Region, 2018 to 2033

Figure 98: Italy Industry Analysis and Outlook Value Share (%) and BPS Analysis By Region, 2023 to 2033

Figure 99: Italy Industry Analysis and Outlook Y-o-Y Growth (%) Projections By Region, 2023 to 2033

Figure 100: Italy Industry Analysis and Outlook Value (US$ Million) Analysis by Product Type , 2018 to 2033

Figure 101: Italy Industry Analysis and Outlook Volume (Unit Pack) Analysis by Product Type , 2018 to 2033

Figure 102: Italy Industry Analysis and Outlook Value Share (%) and BPS Analysis by Product Type , 2023 to 2033

Figure 103: Italy Industry Analysis and Outlook Y-o-Y Growth (%) Projections by Product Type , 2023 to 2033

Figure 104: Italy Industry Analysis and Outlook Value (US$ Million) Analysis by Nature , 2018 to 2033

Figure 105: Italy Industry Analysis and Outlook Volume (Unit Pack) Analysis by Nature , 2018 to 2033

Figure 106: Italy Industry Analysis and Outlook Value Share (%) and BPS Analysis by Nature , 2023 to 2033

Figure 107: Italy Industry Analysis and Outlook Y-o-Y Growth (%) Projections by Nature , 2023 to 2033

Figure 108: Italy Industry Analysis and Outlook Value (US$ Million) Analysis by End-User , 2018 to 2033

Figure 109: Italy Industry Analysis and Outlook Volume (Unit Pack) Analysis by End-User , 2018 to 2033

Figure 110: Italy Industry Analysis and Outlook Value Share (%) and BPS Analysis by End-User , 2023 to 2033

Figure 111: Italy Industry Analysis and Outlook Y-o-Y Growth (%) Projections by End-User , 2023 to 2033

Figure 112: Italy Industry Analysis and Outlook Value (US$ Million) Analysis by Sales Channel , 2018 to 2033

Figure 113: Italy Industry Analysis and Outlook Volume (Unit Pack) Analysis by Sales Channel , 2018 to 2033

Figure 114: Italy Industry Analysis and Outlook Value Share (%) and BPS Analysis by Sales Channel , 2023 to 2033

Figure 115: Italy Industry Analysis and Outlook Y-o-Y Growth (%) Projections by Sales Channel , 2023 to 2033

Figure 116: Italy Industry Analysis and Outlook Attractiveness by Product Type , 2023 to 2033

Figure 117: Italy Industry Analysis and Outlook Attractiveness by Nature , 2023 to 2033

Figure 118: Italy Industry Analysis and Outlook Attractiveness by End-User , 2023 to 2033

Figure 119: Italy Industry Analysis and Outlook Attractiveness by Sales Channel , 2023 to 2033

Figure 120: Italy Industry Analysis and Outlook Attractiveness By Region, 2023 to 2033

Figure 121: France Industry Analysis and Outlook Value (US$ Million) by Product Type , 2023 to 2033

Figure 122: France Industry Analysis and Outlook Value (US$ Million) by Nature , 2023 to 2033

Figure 123: France Industry Analysis and Outlook Value (US$ Million) by End-User , 2023 to 2033

Figure 124: France Industry Analysis and Outlook Value (US$ Million) by Sales Channel , 2023 to 2033

Figure 125: France Industry Analysis and Outlook Value (US$ Million) By Region, 2023 to 2033

Figure 126: France Industry Analysis and Outlook Value (US$ Million) Analysis By Region, 2018 to 2033

Figure 127: France Industry Analysis and Outlook Volume (Unit Pack) Analysis By Region, 2018 to 2033

Figure 128: France Industry Analysis and Outlook Value Share (%) and BPS Analysis By Region, 2023 to 2033

Figure 129: France Industry Analysis and Outlook Y-o-Y Growth (%) Projections By Region, 2023 to 2033

Figure 130: France Industry Analysis and Outlook Value (US$ Million) Analysis by Product Type , 2018 to 2033

Figure 131: France Industry Analysis and Outlook Volume (Unit Pack) Analysis by Product Type , 2018 to 2033

Figure 132: France Industry Analysis and Outlook Value Share (%) and BPS Analysis by Product Type , 2023 to 2033

Figure 133: France Industry Analysis and Outlook Y-o-Y Growth (%) Projections by Product Type , 2023 to 2033

Figure 134: France Industry Analysis and Outlook Value (US$ Million) Analysis by Nature , 2018 to 2033

Figure 135: France Industry Analysis and Outlook Volume (Unit Pack) Analysis by Nature , 2018 to 2033

Figure 136: France Industry Analysis and Outlook Value Share (%) and BPS Analysis by Nature , 2023 to 2033

Figure 137: France Industry Analysis and Outlook Y-o-Y Growth (%) Projections by Nature , 2023 to 2033

Figure 138: France Industry Analysis and Outlook Value (US$ Million) Analysis by End-User , 2018 to 2033

Figure 139: France Industry Analysis and Outlook Volume (Unit Pack) Analysis by End-User , 2018 to 2033

Figure 140: France Industry Analysis and Outlook Value Share (%) and BPS Analysis by End-User , 2023 to 2033

Figure 141: France Industry Analysis and Outlook Y-o-Y Growth (%) Projections by End-User , 2023 to 2033

Figure 142: France Industry Analysis and Outlook Value (US$ Million) Analysis by Sales Channel , 2018 to 2033

Figure 143: France Industry Analysis and Outlook Volume (Unit Pack) Analysis by Sales Channel , 2018 to 2033

Figure 144: France Industry Analysis and Outlook Value Share (%) and BPS Analysis by Sales Channel , 2023 to 2033

Figure 145: France Industry Analysis and Outlook Y-o-Y Growth (%) Projections by Sales Channel , 2023 to 2033

Figure 146: France Industry Analysis and Outlook Attractiveness by Product Type , 2023 to 2033

Figure 147: France Industry Analysis and Outlook Attractiveness by Nature , 2023 to 2033

Figure 148: France Industry Analysis and Outlook Attractiveness by End-User , 2023 to 2033

Figure 149: France Industry Analysis and Outlook Attractiveness by Sales Channel , 2023 to 2033

Figure 150: France Industry Analysis and Outlook Attractiveness By Region, 2023 to 2033

Figure 151: Spain Industry Analysis and Outlook Value (US$ Million) by Product Type , 2023 to 2033

Figure 152: Spain Industry Analysis and Outlook Value (US$ Million) by Nature , 2023 to 2033

Figure 153: Spain Industry Analysis and Outlook Value (US$ Million) by End-User , 2023 to 2033

Figure 154: Spain Industry Analysis and Outlook Value (US$ Million) by Sales Channel , 2023 to 2033

Figure 155: Spain Industry Analysis and Outlook Value (US$ Million) By Region, 2023 to 2033

Figure 156: Spain Industry Analysis and Outlook Value (US$ Million) Analysis By Region, 2018 to 2033

Figure 157: Spain Industry Analysis and Outlook Volume (Unit Pack) Analysis By Region, 2018 to 2033

Figure 158: Spain Industry Analysis and Outlook Value Share (%) and BPS Analysis By Region, 2023 to 2033

Figure 159: Spain Industry Analysis and Outlook Y-o-Y Growth (%) Projections By Region, 2023 to 2033

Figure 160: Spain Industry Analysis and Outlook Value (US$ Million) Analysis by Product Type , 2018 to 2033

Figure 161: Spain Industry Analysis and Outlook Volume (Unit Pack) Analysis by Product Type , 2018 to 2033

Figure 162: Spain Industry Analysis and Outlook Value Share (%) and BPS Analysis by Product Type , 2023 to 2033

Figure 163: Spain Industry Analysis and Outlook Y-o-Y Growth (%) Projections by Product Type , 2023 to 2033

Figure 164: Spain Industry Analysis and Outlook Value (US$ Million) Analysis by Nature , 2018 to 2033

Figure 165: Spain Industry Analysis and Outlook Volume (Unit Pack) Analysis by Nature , 2018 to 2033

Figure 166: Spain Industry Analysis and Outlook Value Share (%) and BPS Analysis by Nature , 2023 to 2033

Figure 167: Spain Industry Analysis and Outlook Y-o-Y Growth (%) Projections by Nature , 2023 to 2033

Figure 168: Spain Industry Analysis and Outlook Value (US$ Million) Analysis by End-User , 2018 to 2033

Figure 169: Spain Industry Analysis and Outlook Volume (Unit Pack) Analysis by End-User , 2018 to 2033

Figure 170: Spain Industry Analysis and Outlook Value Share (%) and BPS Analysis by End-User , 2023 to 2033

Figure 171: Spain Industry Analysis and Outlook Y-o-Y Growth (%) Projections by End-User , 2023 to 2033

Figure 172: Spain Industry Analysis and Outlook Value (US$ Million) Analysis by Sales Channel , 2018 to 2033

Figure 173: Spain Industry Analysis and Outlook Volume (Unit Pack) Analysis by Sales Channel , 2018 to 2033

Figure 174: Spain Industry Analysis and Outlook Value Share (%) and BPS Analysis by Sales Channel , 2023 to 2033

Figure 175: Spain Industry Analysis and Outlook Y-o-Y Growth (%) Projections by Sales Channel , 2023 to 2033

Figure 176: Spain Industry Analysis and Outlook Attractiveness by Product Type , 2023 to 2033

Figure 177: Spain Industry Analysis and Outlook Attractiveness by Nature , 2023 to 2033

Figure 178: Spain Industry Analysis and Outlook Attractiveness by End-User , 2023 to 2033

Figure 179: Spain Industry Analysis and Outlook Attractiveness by Sales Channel , 2023 to 2033

Figure 180: Spain Industry Analysis and Outlook Attractiveness By Region, 2023 to 2033

Figure 181: Rest of Industry Analysis and Outlook Value (US$ Million) by Product Type , 2023 to 2033

Figure 182: Rest of Industry Analysis and Outlook Value (US$ Million) by Nature , 2023 to 2033

Figure 183: Rest of Industry Analysis and Outlook Value (US$ Million) by End-User , 2023 to 2033

Figure 184: Rest of Industry Analysis and Outlook Value (US$ Million) by Sales Channel , 2023 to 2033

Figure 185: Rest of Industry Analysis and Outlook Value (US$ Million) Analysis by Product Type , 2018 to 2033

Figure 186: Rest of Industry Analysis and Outlook Volume (Unit Pack) Analysis by Product Type , 2018 to 2033

Figure 187: Rest of Industry Analysis and Outlook Value Share (%) and BPS Analysis by Product Type , 2023 to 2033

Figure 188: Rest of Industry Analysis and Outlook Y-o-Y Growth (%) Projections by Product Type , 2023 to 2033

Figure 189: Rest of Industry Analysis and Outlook Value (US$ Million) Analysis by Nature , 2018 to 2033

Figure 190: Rest of Industry Analysis and Outlook Volume (Unit Pack) Analysis by Nature , 2018 to 2033

Figure 191: Rest of Industry Analysis and Outlook Value Share (%) and BPS Analysis by Nature , 2023 to 2033

Figure 192: Rest of Industry Analysis and Outlook Y-o-Y Growth (%) Projections by Nature , 2023 to 2033

Figure 193: Rest of Industry Analysis and Outlook Value (US$ Million) Analysis by End-User , 2018 to 2033

Figure 194: Rest of Industry Analysis and Outlook Volume (Unit Pack) Analysis by End-User , 2018 to 2033

Figure 195: Rest of Industry Analysis and Outlook Value Share (%) and BPS Analysis by End-User , 2023 to 2033

Figure 196: Rest of Industry Analysis and Outlook Y-o-Y Growth (%) Projections by End-User , 2023 to 2033

Figure 197: Rest of Industry Analysis and Outlook Value (US$ Million) Analysis by Sales Channel , 2018 to 2033

Figure 198: Rest of Industry Analysis and Outlook Volume (Unit Pack) Analysis by Sales Channel , 2018 to 2033

Figure 199: Rest of Industry Analysis and Outlook Value Share (%) and BPS Analysis by Sales Channel , 2023 to 2033

Figure 200: Rest of Industry Analysis and Outlook Y-o-Y Growth (%) Projections by Sales Channel , 2023 to 2033

Figure 201: Rest of Industry Analysis and Outlook Attractiveness by Product Type , 2023 to 2033

Figure 202: Rest of Industry Analysis and Outlook Attractiveness by Nature , 2023 to 2033

Figure 203: Rest of Industry Analysis and Outlook Attractiveness by End-User , 2023 to 2033

Figure 204: Rest of Industry Analysis and Outlook Attractiveness by Sales Channel , 2023 to 2033

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Western Blotting Processors Market Trends and Forecast 2025 to 2035

Western Blotting Market is segmented by product, application and end user from 2025 to 2035

Western Europe Automotive Performance Tuning & Engine Remapping Market Size and Share Forecast Outlook 2025 to 2035

Western Europe Valve Seat Insert Market Size and Share Forecast Outlook 2025 to 2035

Western Europe Automated People Mover Industry Size and Share Forecast Outlook 2025 to 2035

Western Europe Bicycle Component Aftermarket Analysis Size and Share Forecast Outlook 2025 to 2035

Western Europe Automotive Load Floor IndustryAnalysis in Western Europe Forecast & Analysis 2025 to 2035

Western Europe Probiotic Supplement Market Analysis in – Growth & Market Trends from 2025 to 2035

Western Europe Women’s Intimate Care Market Analysis – Size, Share & Trends 2025 to 2035

Western Europe Non-Dairy Creamer Market Analysis by Growth, Trends and Forecast from 2025 to 2035

Western Europe Last-mile Delivery Software Market – Growth & Outlook through 2035

Western Europe Inkjet Printer Market – Growth & Forecast 2025 to 2035

Western Europe HVDC Transmission System Market – Growth & Forecast 2025 to 2035

Conference Room Solution Market Growth – Trends & Forecast 2025 to 2035

Western Europe Intelligent Enterprise Data Capture Software Market - Growth & Forecast 2025-2035

Communications Platform as a Service (CPaaS) Market Growth - Trends & Forecast 2025 to 2035

Visitor Management System Industry Analysis in Western Europe - Market Outlook 2025 to 2035

Western Europe Base Station Antenna Market - Growth & Demand 2025 to 2035

Western Europe Banking-as-a-Service (BaaS) Platform Market - Growth & Demand 2025 to 2035

Western Europe Event Management Software Market Trends – Growth & Forecast 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA