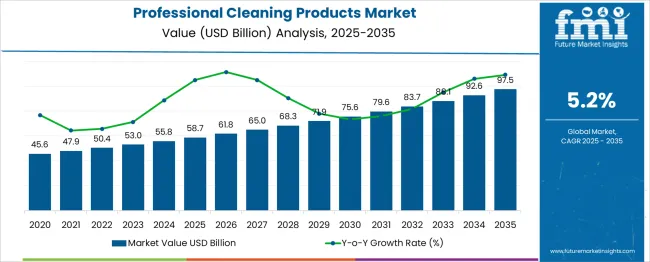

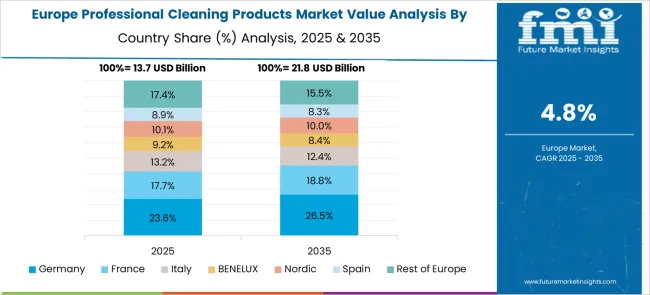

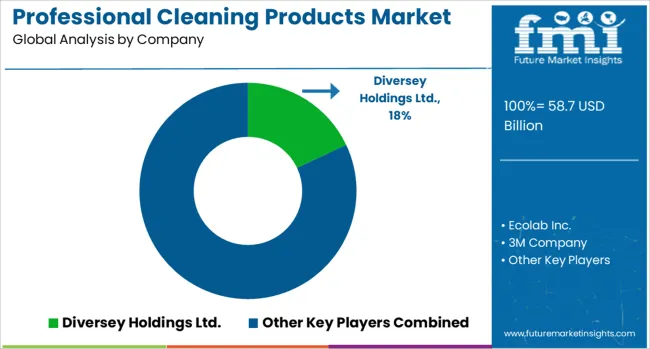

The Professional Cleaning Products Market is estimated to be valued at USD 58.7 billion in 2025 and is projected to reach USD 97.5 billion by 2035, registering a compound annual growth rate (CAGR) of 5.2% over the forecast period. Regional growth patterns exhibit notable imbalances, influenced by economic development, industrial activity, and regulatory frameworks. Asia-Pacific is expected to demonstrate the fastest expansion due to rising commercial infrastructure, increased healthcare facilities, and a growing hospitality sector. Yearly incremental growth in the region supports higher adoption of advanced cleaning formulations and automated dispensing systems, contributing significantly to the overall market increment. Europe, while mature, shows steady but comparatively moderate growth.

Regulatory emphasis on hygiene standards, environmental compliance, and chemical safety drives adoption of professional cleaning solutions, yet the base market size limits exponential increases. North America maintains a stable growth trajectory with industrial and institutional demand continuing to expand. Investments in green cleaning products and technologically advanced formulations sustain market relevance, though the rate of growth is more aligned with overall GDP expansion rather than rapid industrial scaling. The imbalance across regions indicates that Asia-Pacific will account for a disproportionately large share of the absolute dollar opportunity from 2025 to 2035, while Europe and North America experience incremental but consistent growth. These regional differences are expected to persist throughout the decade, reflecting economic maturity, regulatory environments, and the adoption of innovative cleaning technologies. The 5.2% CAGR underscores a uniform upward trend globally, but regional contributions will vary significantly.

| Metric | Value |

|---|---|

| Professional Cleaning Products Market Estimated Value in (2025 E) | USD 58.7 billion |

| Professional Cleaning Products Market Forecast Value in (2035 F) | USD 97.5 billion |

| Forecast CAGR (2025 to 2035) | 5.2% |

The Professional Cleaning Products market is experiencing consistent growth, primarily influenced by heightened hygiene standards and the enforcement of stricter sanitation protocols across commercial and institutional sectors. Demand has been amplified by the continued prioritization of cleanliness in high-traffic public areas, especially in healthcare, food service, and corporate environments. Rising awareness regarding infection control and public safety has led to increased consumption of surface cleaning solutions and disinfectants designed for professional use.

The market outlook remains favorable as businesses adopt more frequent and intensive cleaning routines to meet regulatory compliance and customer expectations. Technological advancements in cleaning formulations, such as eco-friendly and fast-acting disinfectants, are further driving market expansion.

Additionally, the global shift toward sustainability is encouraging the use of biodegradable products that align with environmental standards. Strategic distribution partnerships and growing investment in janitorial service infrastructure are also expected to support sustained market penetration and long-term revenue growth..

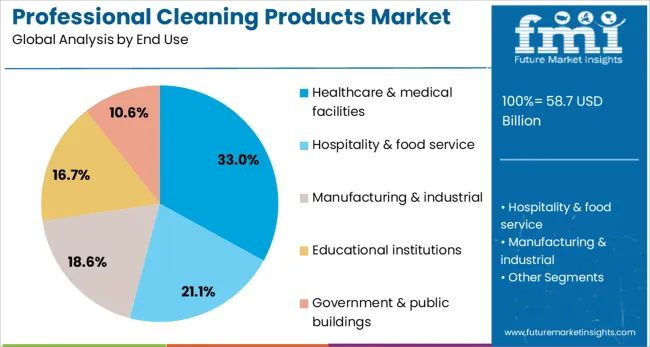

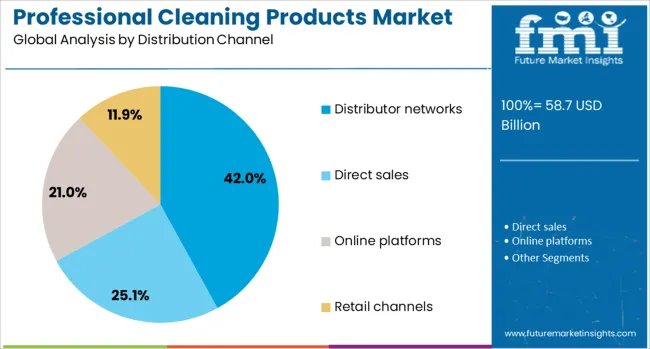

The professional cleaning products market is segmented by product type, end-use distribution channel, and geographic regions. The professional cleaning products market is divided into Surface cleaners & disinfectants, Floor care products, Specialized cleaning chemicals, Instrument cleaning chemistries, Laundry and textile care products, and Kitchen and food service cleaners. In terms of end use, the professional cleaning products market is classified into Healthcare & medical facilities, Hospitality & food service, Manufacturing & industrial, Educational institutions, Government & public buildings. The distribution channel of the professional cleaning products market is segmented into Distributor networks, Direct sales, Online platforms, and Retail channels. Regionally, the professional cleaning products industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The surface cleaners and disinfectants segment is projected to account for 41% of the Professional Cleaning Products market revenue share in 2025, making it the leading product type. This leadership position has been established due to the critical role these products play in maintaining hygiene and preventing the spread of infectious agents across high-touch surfaces.

Institutions and commercial facilities have prioritized the use of disinfectants with broad-spectrum efficacy, especially in environments that demand stringent cleanliness standards. The segment has benefited from increased health awareness and regulatory mandates requiring frequent surface sanitization in industries such as hospitality, transportation, and food processing.

Surface cleaners that are compatible with various materials and fast-drying have been preferred, ensuring operational efficiency without compromising hygiene. Continued innovations in antimicrobial formulations and growing demand for hospital-grade products have further strengthened this segment’s position in the market..

The healthcare and medical facilities segment is expected to contribute 33% of the total revenue share in the Professional Cleaning Products market in 2025, making it the leading end-use industry. This segment’s dominance has been driven by the critical need for contamination control in medical environments, where sanitation directly impacts patient safety and treatment outcomes.

Hospitals, clinics, and diagnostic centers have continued to invest in high-performance cleaning agents to maintain sterile conditions and reduce the risk of healthcare-associated infections. The demand for professional-grade products that meet stringent disinfection criteria has remained consistently high in this segment.

Additionally, compliance with infection prevention regulations and accreditation requirements has reinforced the ongoing use of certified cleaning solutions. The increased focus on operational hygiene in long-term care facilities and surgical centers has also played a vital role in maintaining this segment’s leadership position within the overall market..

The distributor networks segment is projected to hold 42% of the revenue share in the Professional Cleaning Products market in 2025, making it the most dominant distribution channel. This prominence has been attributed to the widespread reach and logistical advantages offered by established distributor partnerships. Professional end-users have continued to rely on distributors for timely delivery, product guidance, and inventory management support.

Distributors have played a critical role in bridging manufacturers with healthcare institutions, corporate facilities, and cleaning service providers. The segment’s growth has also been driven by its ability to manage diverse product portfolios and ensure compliance with procurement standards.

As cleaning requirements evolve, distributor networks have been essential in introducing new formulations and training personnel on best practices. The capacity to provide tailored solutions and after-sales service has solidified the role of distributors as preferred intermediaries in the professional cleaning ecosystem..

The market has been expanding due to increasing hygiene awareness, rising health and safety standards, and the growth of commercial establishments. Products such as disinfectants, surface cleaners, floor care solutions, and specialized detergents have been widely adopted in hotels, hospitals, offices, and industrial facilities. Demand has been driven by regulatory requirements for sanitation, outbreaks of infectious diseases, and the need for operational efficiency in cleaning services. Technological innovations in formulation, eco-friendly ingredients, and automation of cleaning systems have further strengthened market growth.

Healthcare facilities and hospitality establishments have been primary drivers of the professional cleaning products market. Hospitals, clinics, and nursing homes require high-performance disinfectants and surface cleaning solutions to maintain infection control and patient safety standards. Similarly, hotels, resorts, and restaurants have relied on professional cleaning chemicals for maintaining hygiene, guest satisfaction, and compliance with sanitation regulations. The adoption of specialized floor care and odor control products has enhanced operational efficiency and ensured workplace safety. Cleaning service providers have increasingly implemented standardized protocols, utilizing professional products to achieve consistent results. Furthermore, demand for high-quality, non-toxic, and residue-free solutions has risen in both sectors to minimize health risks to staff and occupants. This continuous emphasis on cleanliness and sanitation has sustained steady growth in the use of professional cleaning products across global markets.

Innovations in chemical formulations have significantly influenced the professional cleaning products market. Concentrated solutions, ready-to-use sprays, and multi-surface cleaners have improved efficiency and reduced labor and storage costs. Formulations incorporating environmentally friendly ingredients, biodegradable surfactants, and low-VOC compounds have met regulatory requirements while appealing to sustainability-focused clients. Automation and integration with cleaning equipment, such as scrubbers, dispensers, and foggers, have enhanced precision and minimized product waste. Antimicrobial and antiviral enhancements in disinfectants have further strengthened performance against pathogenic microorganisms. Research in fragrance technology and user-friendly packaging has also improved adoption by professional cleaning teams. These technological developments have expanded the scope of applications in healthcare, food processing, hospitality, and commercial facilities, ensuring that professional cleaning products remain effective, efficient, and compliant with industry standards.

Regulatory frameworks and heightened hygiene awareness have strongly shaped the demand for professional cleaning products. Safety regulations, such as occupational health standards and infection control guidelines, have mandated the use of certified cleaning agents in hospitals, laboratories, and food processing units. Government initiatives promoting workplace sanitation and public health campaigns have driven adoption in commercial and industrial spaces. Furthermore, audits and inspections by health authorities have reinforced the need for reliable cleaning solutions that comply with environmental and safety standards. Consumer awareness regarding germ prevention, especially following global health crises, has encouraged institutions to prioritize professional-grade products over household alternatives. As compliance with strict sanitation requirements remains critical, the market for professional cleaning chemicals has continued to expand across diverse sectors, influencing both production and distribution strategies.

Emerging economies have presented significant opportunities for the professional cleaning products market due to rapid urbanization, growth of commercial infrastructure, and increasing institutional cleaning requirements. Small and medium enterprises, hotels, and hospitals in these regions have been adopting professional cleaning chemicals to meet global hygiene standards. Simultaneously, sustainability trends have encouraged the development of green cleaning products that are biodegradable, low in chemical residue, and safe for operators and the environment. Adoption of automated dispensing systems and eco-friendly concentrated formulations has enabled cost savings and reduced chemical wastage. Strategic partnerships between manufacturers, distributors, and service providers have facilitated market penetration and ensured product availability in remote areas. The convergence of regulatory compliance, sustainability initiatives, and infrastructure growth continues to offer long-term expansion prospects for professional cleaning products globally.

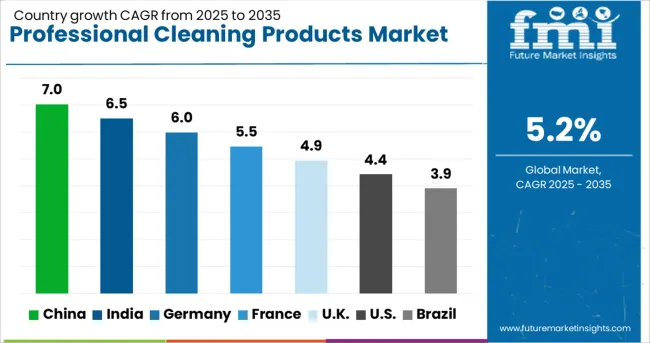

| Country | CAGR |

|---|---|

| China | 7.0% |

| India | 6.5% |

| Germany | 6.0% |

| France | 5.5% |

| UK | 4.9% |

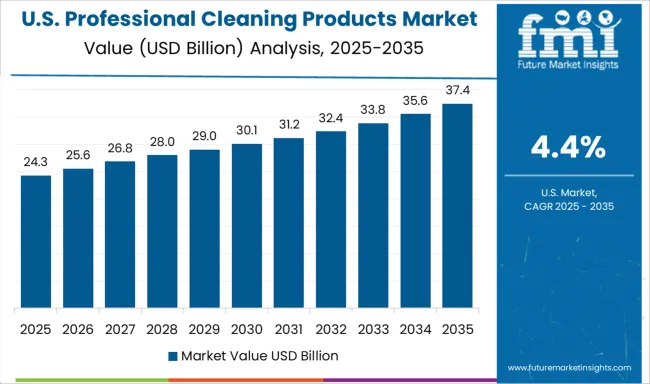

| USA | 4.4% |

| Brazil | 3.9% |

The market is projected to expand at a CAGR of 5.2% between 2025 and 2035, driven by rising hygiene standards in commercial, healthcare, and institutional facilities. China is expected to lead with a 7.0% CAGR, supported by rapid industrial growth and increasing institutional demand. India follows at 6.5%, fueled by growing adoption of commercial cleaning solutions and regulatory hygiene mandates. Germany, at 6.0%, benefits from stringent sanitation standards and technological advancements in cleaning products. The UK, with a 4.9% CAGR, experiences steady growth through commercial and healthcare sector demand. The USA, at 4.4%, maintains expansion due to widespread implementation of professional hygiene practices. This report includes insights on 40+ countries; the top markets are shown here for reference.

The professional cleaning products industry in China is projected to grow at a CAGR of 7.0% from 2025 to 2035, supported by increasing adoption in hospitality, healthcare, and commercial sectors. Manufacturers are emphasizing eco-friendly formulations and automated dispensing solutions to enhance operational efficiency. Leading companies such as SC Johnson and Diversey have expanded production lines in Tier 1 and Tier 2 cities to meet institutional demand. Growth in hotel chains, hospitals, and large office complexes has accelerated procurement, while regulatory standards for hygiene and safety continue to guide product development. Increasing awareness of workplace sanitation and integration of smart cleaning technologies has strengthened the overall market outlook.

The industry in India is expected to expand at a CAGR of 6.5% from 2025 to 2035, fueled by rising commercial infrastructure and awareness of hygiene standards. Companies such as Godrej and Diversey have introduced water-efficient and biodegradable cleaning solutions. Demand is primarily driven by hospitality, hospitals, and industrial facilities seeking standardized cleaning protocols. Regional distribution networks have been strengthened to ensure timely delivery to urban and semi-urban centers. Adoption of multi-purpose cleaning systems and automated dispensing units is becoming widespread, while government-led sanitation campaigns further stimulate market uptake.

Germany is forecast to witness a CAGR of 6.0% between 2025 and 2035 in professional cleaning products, supported by stringent workplace hygiene regulations and sustainability policies. Major manufacturers including Ecolab and Diversey are investing in concentrated formulations and automated systems for healthcare, industrial, and hospitality facilities. Technological advancements in touchless cleaning devices and eco-friendly chemicals are driving adoption. Demand for standardized cleaning protocols in hospitals and laboratories continues to expand, while long-term maintenance contracts contribute to market stability.

The United Kingdom professional cleaning products industry is projected to grow at a CAGR of 4.9% over 2025 to 2035, driven by healthcare, commercial offices, and public sector cleaning contracts. Companies have introduced concentrated and refillable solutions to reduce operational costs and waste. Adoption of robotic cleaning devices and standardized sanitation protocols is accelerating in educational institutions and corporate campuses. Government regulations for occupational hygiene and increasing attention to facility cleanliness further strengthen market expansion prospects.

In the United States, the professional cleaning products industry is expected to advance at a CAGR of 4.4% from 2025 to 2035, driven by commercial real estate, healthcare, and institutional demand. Major players like Ecolab and 3M have focused on multi-purpose concentrated formulations and automated dispensing systems. Expansion of corporate offices, hospitals, and logistics centers supports market growth, while raising awareness of occupational hygiene and regulatory compliance reinforces adoption. Implementation of smart cleaning solutions and integration of green chemicals has strengthened competitiveness in both urban and regional markets.

The market features a combination of established global chemical corporations and specialized hygiene solution providers. Diversey Holdings Ltd. maintains a strong position through its comprehensive range of commercial cleaning chemicals, floor care systems, and hygiene solutions designed for hospitality, healthcare, and industrial facilities. Ecolab Inc. leverages its extensive research and development capabilities to offer sanitation, disinfection, and water treatment solutions, emphasizing efficiency and compliance with regulatory standards. 3M Company integrates innovative surface cleaning technologies with its broader portfolio of industrial and safety products, targeting sectors that require precise and effective cleaning performance.

Reckitt Benckiser Group focuses on antimicrobial solutions, disinfectants, and specialized cleaning chemicals, often pairing product launches with awareness campaigns to meet evolving hygiene requirements. SC Johnson Professional delivers customized facility cleaning solutions, combining durable equipment with chemical formulations suitable for large-scale commercial applications. Henkel AG & Co. KGaA emphasizes concentrated cleaning products, eco-efficient solutions, and specialized formulations for industrial and institutional clients. The market remains highly competitive, with emerging players introducing niche products such as enzymatic cleaners, surface sanitizers, and low-chemical-footprint formulations. Entry barriers include the need for regulatory approvals, quality certifications, and substantial investment in R&D to meet the performance and safety demands of professional environments. Innovation in dispensing systems, concentrated formulas, and automated cleaning solutions continues to influence market positioning.

| Item | Value |

|---|---|

| Quantitative Units | USD 58.7 Billion |

| Product Type | Surface cleaners & disinfectants, Floor care products, Specialized cleaning chemicals, Instrument cleaning chemistries, Laundry and textile care products, and Kitchen and food service cleaners |

| End Use | Healthcare & medical facilities, Hospitality & food service, Manufacturing & industrial, Educational institutions, and Government & public buildings |

| Distribution Channel | Distributor networks, Direct sales, Online platforms, and Retail channels |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | Diversey Holdings Ltd., Ecolab Inc., 3M Company, Reckitt Benckiser Group, SC Johnson Professional, and Henkel AG & Co. KGaA |

| Additional Attributes | Dollar sales by product type and end-use sector, demand dynamics across healthcare facilities, hospitality, industrial sites, and commercial offices, regional trends in adoption across North America, Europe, and Asia-Pacific, innovation in eco-friendly formulations, antimicrobial technologies, and automated dispensing systems, environmental impact of chemical usage, packaging waste, and wastewater treatment, and emerging use cases in high-touch surface disinfection, sustainable cleaning programs, and integrated facility hygiene solutions. |

The global professional cleaning products market is estimated to be valued at USD 58.7 billion in 2025.

The market size for the professional cleaning products market is projected to reach USD 97.5 billion by 2035.

The professional cleaning products market is expected to grow at a 5.2% CAGR between 2025 and 2035.

The key product types in professional cleaning products market are surface cleaners & disinfectants, _multi-surface cleaners, _sanitizers, _disinfectants, floor care products, _floor cleaner, _polishes, _maintenance chemicals, specialized cleaning chemicals, _degreasers, _descalers, _industrial-grade formulations, instrument cleaning chemistries, laundry and textile care products and kitchen and food service cleaners.

In terms of end use, healthcare & medical facilities segment to command 33.0% share in the professional cleaning products market in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Professional Hair Care Market Insights & Forecast 2025 to 2035

Interdental Cleaning Products Market Trends - Growth & Forecast 2025 to 2035

Demand for Professional Hair Care Products in USA Size and Share Forecast Outlook 2025 to 2035

Demand for Professional Hair Care Products in Japan Size and Share Forecast Outlook 2025 to 2035

Demand for Industrial & Institutional Cleaning Products in EU Size and Share Forecast Outlook 2025 to 2035

Cleaning Robot Market Size and Share Forecast Outlook 2025 to 2035

Professional Potting Soil Market Size and Share Forecast Outlook 2025 to 2035

Professional Services Automation Software Market Size and Share Forecast Outlook 2025 to 2035

Products from Food Waste Industry Analysis in Korea Size, Share and Forecast Outlook 2025 to 2035

Products from Food Waste in Japan - Size, Share, and Forecast Outlook 2025 to 2035

Products from Food Waste Market Analysis - Size, Growth, and Forecast 2025 to 2035

Cleaning In Place Market Growth - Trends & Forecast 2025 to 2035

Professional Gear Bags Market - Trends, Growth & Forecast 2025 to 2035

Professional Hair Clipper Market Trends & Forecast 2024-2034

Cleaning and Hygiene Product Market Report – Demand & Trends 2024-2034

Wet Cleaning Ozone Water System Market Size and Share Forecast Outlook 2025 to 2035

Dry Cleaning Solvents Market Size and Share Forecast Outlook 2025 to 2035

GMP Cleaning Services Market Analysis Size and Share Forecast Outlook 2025 to 2035

Dry-Cleaning and Laundry Services Market Growth, Trends and Forecast from 2025 to 2035

USA Products from Food Waste Market Growth – Trends, Demand & Outlook 2025-2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA