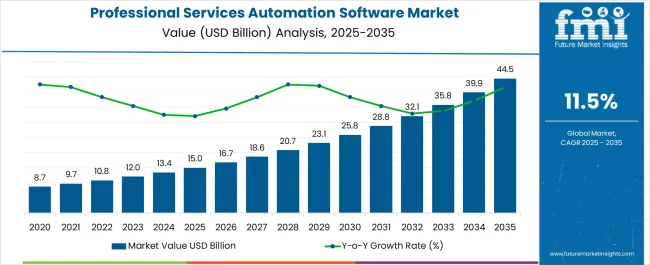

The professional services automation software market is estimated to be valued at USD 15.0 billion in 2025 and is projected to reach USD 44.5 billion by 2035, registering a compound annual growth rate (CAGR) of 11.5% over the forecast period.

Practice leaders evaluate software capabilities based on proposal generation speed, utilization rate visibility, and margin analysis granularity when replacing legacy systems that fragment operational data across multiple platforms and manual processes. Technology decisions involve assessing API connectivity with existing accounting systems, CRM integration depth, and mobile time capture reliability while considering user adoption complexity, change management requirements, and training investment necessary for successful organizational transformation.

Budget approvals depend on demonstrable return calculations including reduced proposal preparation time, improved project margin visibility, and accelerated cash collection cycles that justify subscription expenses against measurable productivity improvements.

Deployment operations require careful data cleansing from legacy systems, workflow redesign coordination, and permission structure establishment that accommodate partnership hierarchies, client confidentiality requirements, and regulatory compliance obligations throughout diverse professional service environments.

Technical integration involves synchronizing employee directories, client contact databases, and historical project information while maintaining audit trails and access controls that satisfy professional liability insurance requirements and industry regulatory standards. Performance validation addresses system response times, data accuracy maintenance, and backup reliability that ensure business continuity while supporting daily operational demands across multiple office locations and client sites.

Implementation coordination involves IT administrators, operations managers, and practice group leaders working together to customize dashboards that provide relevant metrics without overwhelming users while accommodating different information needs between senior partners, project managers, and administrative staff.

Rollout planning encompasses pilot group selection, feedback incorporation, and gradual expansion while managing resistance from established practitioners comfortable with existing processes and concerned about technology learning curves. Support systems address troubleshooting protocols, user helpdesk availability, and ongoing training resources that maintain system adoption momentum throughout organizational change periods.

Platform evolution emphasizes predictive resource planning, automated proposal assembly, and intelligent project risk assessment that transform reactive management into proactive business optimization while reducing manual administrative burden throughout service delivery cycles.

Development priorities include machine learning application for project scope prediction, natural language processing for contract analysis, and robotic process automation for routine administrative tasks that eliminate repetitive work while improving accuracy and consistency. Advanced features encompass client sentiment analysis, competitive intelligence integration, and market opportunity identification that extend platform value beyond operational efficiency toward strategic business development support.

| Metric | Value |

|---|---|

| Professional Services Automation Software Market Estimated Value in (2025 E) | USD 15.0 billion |

| Professional Services Automation Software Market Forecast Value in (2035 F) | USD 44.5 billion |

| Forecast CAGR (2025 to 2035) | 11.5% |

The professional services automation software market is witnessing strong expansion as enterprises increasingly adopt digital solutions to streamline workflows, optimize resource utilization, and improve project profitability. Rising demand for real time analytics, automated time tracking, and integrated billing systems is driving adoption across consulting, IT services, and other knowledge driven sectors.

The shift toward hybrid and remote work models has accelerated the need for cloud based platforms that support collaboration, scalability, and data security. Organizations are prioritizing automation to reduce operational inefficiencies and strengthen client delivery capabilities.

Furthermore, continuous advancements in AI enabled analytics and workflow automation are positioning professional services automation software as a central tool in service delivery optimization. The outlook remains positive as enterprises continue to integrate automation platforms to enhance productivity, ensure compliance, and support long term scalability.

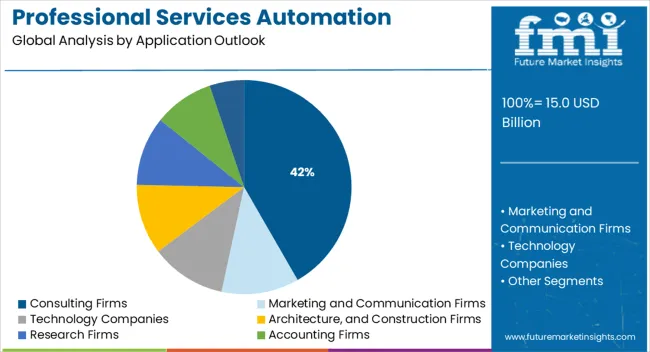

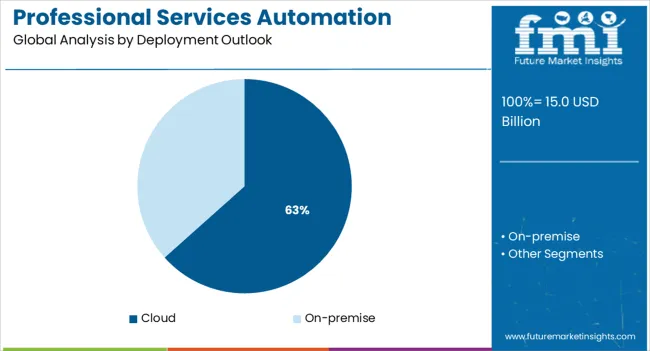

The market is segmented by Application Outlook and Deployment Outlook and region. By Application Outlook, the market is divided into Consulting Firms, Marketing and Communication Firms, Technology Companies, Architecture, and Construction Firms, Research Firms, Accounting Firms, and Others. In terms of Deployment Outlook, the market is classified into Cloud and On-premise. Regionally, the market is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The consulting firms segment is expected to hold 41.70% of total market revenue by 2025 within the application category, positioning it as the leading segment. This growth is attributed to the extensive reliance of consulting organizations on tools that enhance project visibility, improve time management, and ensure accurate billing.

The increasing complexity of client projects has heightened the demand for platforms that provide resource allocation, progress tracking, and performance reporting in real time. Consulting firms are also adopting automation software to standardize processes and improve profitability across multiple engagements.

These factors have reinforced the dominance of consulting firms as the largest application segment in the professional services automation software market.

The cloud deployment segment is projected to account for 63.40% of market revenue by 2025 within the deployment category, making it the dominant segment. This is driven by its scalability, cost efficiency, and ease of integration with other enterprise systems.

Cloud based platforms enable service providers to offer flexible access, real time collaboration, and secure data management across geographies. The preference for cloud solutions has been further strengthened by the rise of remote and hybrid work, where accessibility and reliability are critical.

Regular updates, lower upfront costs, and enhanced security frameworks have positioned cloud deployment as the preferred choice among organizations. As businesses continue to prioritize agility and digital transformation, the cloud segment maintains its leadership within the professional services automation software market.

The global professional services automation software market recorded a CAGR of 12.1% CAGR over the past 10 years. The market is expected to record a CAGR of 11.5% over the forthcoming decade. A surge in remote working practices and hybrid projects resulted from the pandemic, which positively impacted professional services automation software.

In the face of the pandemic, companies adopted PSA software across their business models to balance integrated project delivery with increased profitability and efficient resource utilization. Invoice and expense management, automated billing, and resource allocation are the fundamental functions of professional services automation software.

The increased demand for efficient project management and resource allocation solutions, along with the growing trend of cloud-based technology adoption, is expected to drive the market. The market may see increased competition among vendors, with the introduction of new, advanced solutions, and increased emphasis on Artificial Intelligence and Machine Learning.

| Historical CAGR (2020 to 2025) | 12.1% |

|---|---|

| Historical Market Value (2025) | USD 10,797 million |

| Forecast CAGR | 11.5% |

Increased Demand for Efficiency and Productivity

The demand for Professional Services Automation (PSA) software is driven by the need for organizations to streamline and automate their operations, improve efficiency, and increase productivity. For instance, PSA software can be used to automate time tracking, resource management, project management, and billing processes, reducing the time and cost of managing services and improving customer satisfaction.

Growing Adoption of Cloud Technology

The shift towards cloud-based solutions has led to an increase in the adoption of professional services automation software, which is accessible from anywhere, making it easier for remote teams to collaborate. Cloud-based PSA software allows companies to access data in real time, eliminating the need for clunky manual processes and enabling organizations to better scale their operations.

Need for Real-time Data and Reporting

The need for real-time data and reporting to make informed business decisions is driving the demand for professional services automation software. PSA software can provide insights into the number of projects in progress, staff billable and non-billable hours, and project profitability that can help organizations make more informed decisions.

Growing Competition and the Need for Differentiation

Organizations are looking to differentiate themselves from their competitors through better service offerings and customer experience, and professional services automation software can help achieve these goals. For instance, by leveraging professional services automation software, an organization can automate and streamline many of its service operations, like service ticketing, invoicing, and asset management. This can improve customer satisfaction and response times.

Compliance and Regulatory Requirements

The need to comply with various regulations and standards is also driving the demand for professional services automation software, as it helps organizations maintain proper record-keeping and tracking. For example, in the healthcare sector, organizations must adhere to the Health Insurance Portability and Accountability Act (HIPAA), which requires the secure storage and transmission of medical records. PSA software can help companies maintain compliance with these regulations.

Governments are digitizing their economic operations, so professional services automation software is expected to have robust market opportunities. To accelerate economic growth, various governments, including Canada, India, Germany, and Saudi Arabia, support regional market players.

The government of Canada, for instance, provided USD 15 billion to the Canada Digital Adoption Program (CDAP) in March 2025 to support the adoption of digital technologies by small and medium-sized enterprises (SMEs).

As part of this program, SMEs may receive USD 2,1500 microgrants for social media advertising, website development, and other automated web actions related to their e-commerce business. Global implementation of professional services automation software encourages industry participants to invest in Research and Development activities to create innovation and increase brand value.

High Initial Cost and Limited Customization

Professional Services Automation (PSA) software can be expensive, especially for small businesses or startups that may not have the budget to invest in such technology. Some PSA software solutions may have limited customization options, making it difficult to adapt to the unique needs and requirements of an organization. PSA software requires ongoing maintenance and support, which can be an added cost and resource burden for organizations.

Resistance to Change & User Adoption

PSA software can be disruptive to the existing processes and workflows of an organization, which can lead to resistance from employees who may be comfortable with their current ways of working. Integrating PSA software with existing systems can be challenging and time-consuming, requiring technical expertise and resources. Getting employees to use PSA software can be a challenge, as they may require training and support to become proficient at using the updated technology.

During 2025, the technology segment acquired a significant market share, valued at USD 5,018.22 million. Technology solution providers use PSA solutions to shorten their solution's time to market and improve transparency.

To target a wider potential audience, various PSA solution providers for technology companies are emphasizing mergers and collaborations. For instance, in 2025 DXC Technology announced the formation of a new DXC ServiceNow Strategic Business Group, making DXC one of the significant ServiceNow globally.

By 2035, the marketing and communication segment is expected to record a CAGR of 12.8%. This segment is expected to expand at a considerable rate through 2035. PSA solution developers are launching their new PSA innovations in the market for various communication & marketing applications, which may drive the segment's growth.

For example, Adobe recently launched its new Web Experience Management (WEM) platform, providing a comprehensive suite of tools for digital marketers to manage their customer experience. Other PSA solution providers, such as Salesforce and Microsoft, are also launching their WEM platforms, offering features such as AI-driven insights, personalization, and automated customer segmentation.

On-premise PSA software deployments are expected to account for a significant share of the market in 2025, representing around 51%. On-premise PSA solutions are more secure & private and less susceptible to digital threats, leading to strong growth in this segment.

PSA solutions that are deployed on-premises can also perform their work and provide safe access to data even when the internet connection is interrupted since their local storage systems store the data securely. To improve their brand identity, market players participate in various exhibitions to advertise their on-premise PSA solutions.

For example, Oracle recently participated in ServiceNow’s Knowledge20 Digital Experience, where it showcased its latest on-premise PSA solutions. Oracle also highlighted its Oracle Field Service Cloud, which can be used to automatically assign technicians and materials to jobs, analyze and optimize routes, and track technician performance.

Between 2025 and 2035, the cloud-based PSA market is expected to grow by 14.7%. Cloud-based PSA solutions offer several advantages. This includes quick deployment, remote work management, unlimited storage capacity, and reduced Total Cost of Ownership (TCO) and CapEx costs, driving the segment's growth. To improve their cloud-based professional services automation software portfolio, industry participants such as Kimble Applications, Projector PSA, and SAP SE emphasize strategic partnerships. For instance, Kimble Applications has partnered with Google Cloud to provide their customers with end-to-end cloud-based professional services automation software on the Google Cloud Platform.

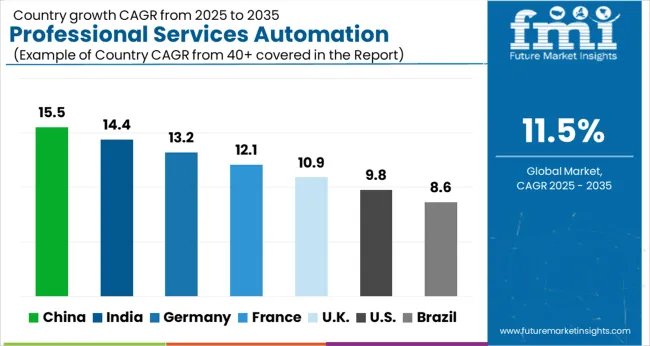

In 2025, North America held a significant market share of USD 4,897 million, or 43.5% of the market. New solutions introduced by market players and the integration of advanced technologies, such as Artificial Intelligence (AI) and Machine Learning (ML), are creating positive traction for PSA solutions.

Several established market players, including Appirio, Salesforce, Oracle Corporation, Upland Software, and NetSuite OpenAir, Inc., are also in the market. Market players are launching their latest products in this potential region to boost profitability and build their customer base thus, driving the market growth. For example, Appirio recently introduced a suite of solutions called Cloud Management Platform to help organizations manage their cloud investments.

Currently, the United States holds a significant share of the professional services automation market in terms of revenues. This market growth is mostly due to the early adoption of core technologies, including cloud computing and machine learning.

This growth has also been attributed to substantial investments by IT companies in developing and deploying cloud-based solutions for PSA software. To boost their revenue growth, service providers in this market are focusing on partnerships and acquisitions.

For instance, the professional services market in the United States posted a 9.4% growth rate from 2020 to 2024 (Services Performance Insight, LLC), and it is believed that the growth may be driven by the increasing demand for the Professional Services Automation (PSA) software market.

According to forecasts, Germany may expand at a CAGR of 5.3% in the next five years. This is due to factors such as a rise in IT spending supported by government initiatives in emerging economies such as Germany. For example, the federal government in Germany has committed to spending more than USD 3.93 billion on its ‘AI Made in Germany’ initiative over the next seven years.

The Asia Pacific professional services automation software market is dominated by India with a market share of 54.0% and is expected to record a CAGR of 14.0% through 2035. This is attributed to increasing digitalization and the emergence of creative professional services automation startups in the region.

Cloud integrations and online service delivery play a key role in increasing industry growth. Regional key players are enhancing their research and development operations and expanding their professional services and automation solutions portfolio.

For example, in March 2025, Nividous Software Solutions collaborated with Damco Solutions to streamline the core and non-core business processes of various industries using intelligent automation processes.

Emerging start-ups and SMEs are focusing on establishing strategic partnerships with significant market players for the adoption of professional services automation software.

There are many start-ups in the professional services automation software market. Some of the popular ones include Workfront, Replicon, Mavenlink, Wrike, Celoxis, Paymo, Accelo, Clarizen, Projectmates, Hive, and others. These start-ups offer various features like project management, time tracking, resource management, invoicing, and more, to help professional services organizations streamline their operations and increase efficiency.

Since there are many players in the professional services automation software market, it is moderately fragmented, because players are introducing innovative products and implementing technological advancements to gain a competitive advantage. In the coming years, the market's growth capacity is likely to be supported by irreplaceable value propositions in product offerings.

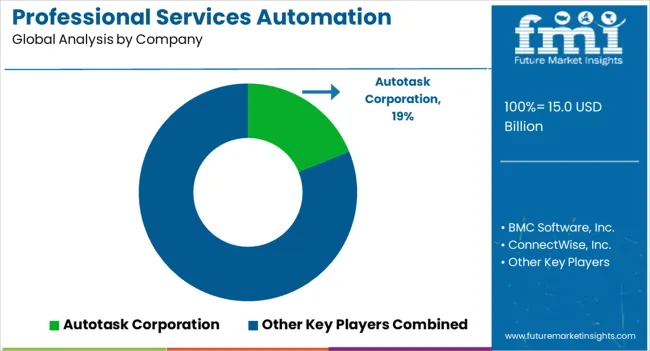

The professional services automation (PSA) software market is highly competitive, driven by the need for efficient project management, resource allocation, and billing processes in service-based industries. Autotask Corporation (now part of Datto, Inc.) and ConnectWise Inc. lead the market with comprehensive PSA platforms designed to streamline operations for managed service providers (MSPs). Their software solutions offer integrated tools for ticketing, project management, and customer relationship management (CRM), enhancing service delivery and operational efficiency.

BMC Software Inc., Deltek Inc., and Planview Inc. are significant players, offering enterprise-grade PSA solutions that cater to larger organizations with complex project portfolios. Their platforms integrate project planning, time tracking, and financial management to help firms deliver services on time and within budget.

FinancialForce (now Certinia Inc.) and Kimble Applications (now part of Mavenlink under Kantata) provide cloud-based PSA solutions that focus on driving growth, profitability, and customer satisfaction by offering real-time insights and analytics for professional services firms.

Microsoft Corporation and Oracle Corporation further strengthen competition with their integrated PSA solutions within broader enterprise resource planning (ERP) systems, allowing organizations to unify project, resource, and financial management across functions. NetSuite OpenAir Inc. (Oracle NetSuite) focuses on delivering specialized PSA tools for project-based businesses, while NetSuite remains a dominant force with its end-to-end service management platform.

| Attribute | Details |

|---|---|

| Forecast Period | 2025 to 2035 |

| Historical Data Available for | 2020 to 2025 |

| Market Analysis | USD million for Value and MT for Volume |

| Key Regions Covered | North America; Latin America; Europe; The Middle East and Africa; East Asia |

| Key Countries Covered | United States, Canada, Brazil, Mexico, Chile, Peru, Germany, United Kingdom, Spain, Italy, France, Russia, Poland, China, India, Japan, Australia, New Zealand, GCC Countries, North Africa, South Africa, and Türkiye |

| Key Segments Covered | Application, Deployment, Region |

| Key Companies Profiled |

Autotask Corporation (now part of Datto, Inc.), BMC Software Inc., ConnectWise Inc., Deltek Inc., FinancialForce (now Certinia Inc.), Kimble Applications (now part of Mavenlink under Kantata), Microsoft Corporation, NetSuite OpenAir Inc. (Oracle NetSuite), Oracle Corporation, Planview Inc. |

| Report Coverage | Market Forecast, Company Share Analysis, Competition Intelligence, DROT Analysis, Market Dynamics and Challenges, and Strategic Growth Initiatives |

| Customization & Pricing | Available upon Request |

The global professional services automation software market is estimated to be valued at USD 15.0 billion in 2025.

The market size for the professional services automation software market is projected to reach USD 44.5 billion by 2035.

The professional services automation software market is expected to grow at a 11.5% CAGR between 2025 and 2035.

The key product types in professional services automation software market are consulting firms, marketing and communication firms, technology companies, architecture, and construction firms, research firms, accounting firms and others.

In terms of deployment outlook, cloud segment to command 63.4% share in the professional services automation software market in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Form Automation Software Market – Digitizing Workflows

Cloud Professional Services Market Size and Share Forecast Outlook 2025 to 2035

Recruiting Automation Software Market Size and Share Forecast Outlook 2025 to 2035

Russian IT Software & Services Market Report – Growth & Forecast 2014-2020

Software-Defined Wide Area Network Market Size and Share Forecast Outlook 2025 to 2035

Software Defined Vehicle Market Size and Share Forecast Outlook 2025 to 2035

Software Defined Networking (SDN) And Network Function Virtualization (NFV) Market Size and Share Forecast Outlook 2025 to 2035

Software Defined Perimeter (SDP) Market Size and Share Forecast Outlook 2025 to 2035

Software-Defined Wide Area Network SD-WAN Market Size and Share Forecast Outlook 2025 to 2035

Professional Potting Soil Market Size and Share Forecast Outlook 2025 to 2035

Software Defined Radio (SDR) Market Size and Share Forecast Outlook 2025 to 2035

Software License Management (SLM) Market Size and Share Forecast Outlook 2025 to 2035

Professional Cleaning Products Market Size and Share Forecast Outlook 2025 to 2035

Software-Defined Networking SDN Market Size and Share Forecast Outlook 2025 to 2035

Automation Testing Market Size and Share Forecast Outlook 2025 to 2035

Software-Defined Anything (SDx) Market Size and Share Forecast Outlook 2025 to 2035

Software-Defined Data Center Market Size and Share Forecast Outlook 2025 to 2035

Software Containers Market Size and Share Forecast Outlook 2025 to 2035

Software Defined Application And Infrastructure Market Size and Share Forecast Outlook 2025 to 2035

Software Defined Networking Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA