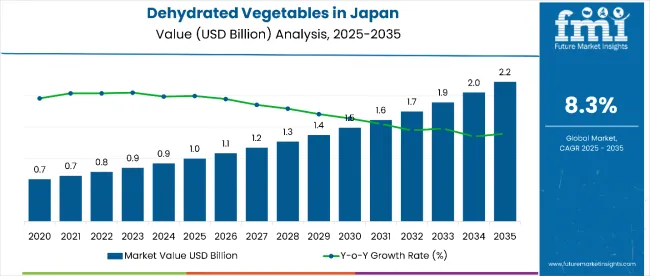

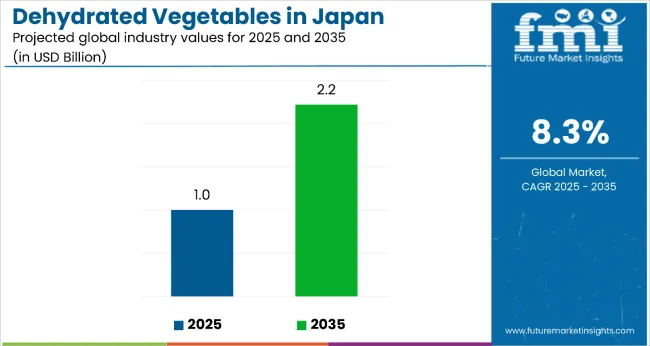

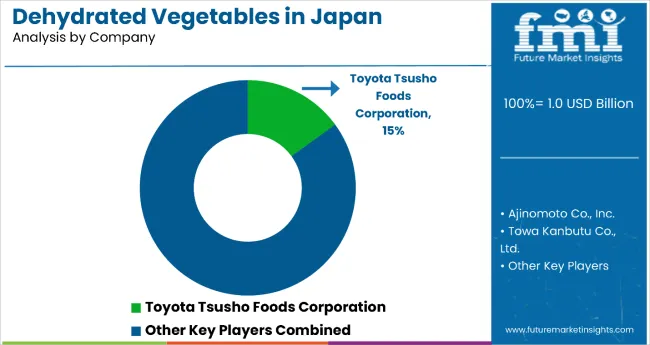

Sales of dehydrated vegetables in Japan are estimated at USD 1 billion in 2025 and are projected to reach USD 2.2 billion by 2035, reflecting a CAGR of approximately 8.3%.

| Metric | Value |

|---|---|

| Estimated Size (2025E) | USD 1 billion |

| Projected Value (2035F) | USD 2.2 billion |

| CAGR (2025 to 2035) | 8.3% |

This growth is attributed to rising consumer demand for convenience foods and higher per capita consumption across diverse age groups. The rise in demand is linked to health consciousness trends, emergency preparedness culture, and evolving culinary preferences.

By 2025, per capita consumption in leading Japanese regions such as Kanto, Chubu, and Kinki average between 2.1 and 2.8 kilograms, with projections reaching 4.5 and 6.2 kilograms by 2035. Kanto leads among areas, expected to generate USD 795.4 million in dehydrated vegetable sales by 2035, followed by Chubu (USD 567.1 million), Kinki (USD 476.2 million), Kyushu & Okinawa (USD 272.4 million), and Tohoku (USD 155.7 million).

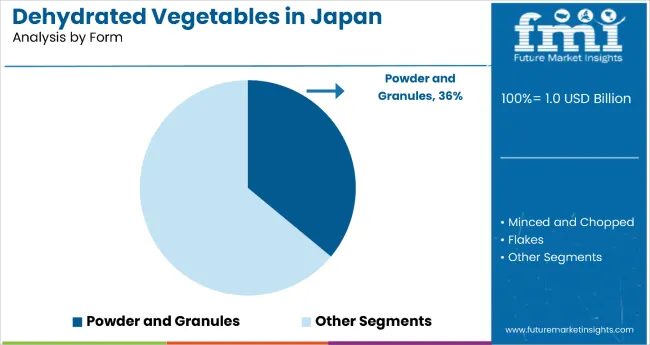

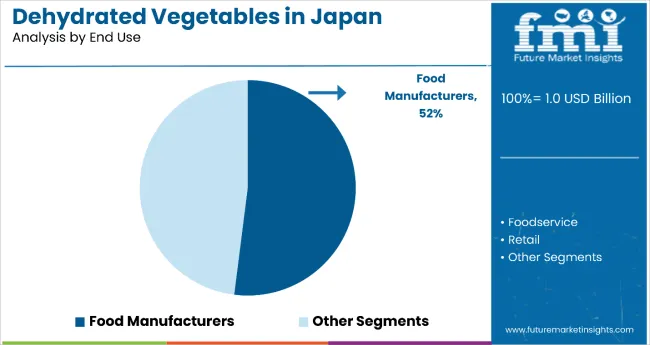

The largest contribution to demand continues to come from powder and granule forms, which are expected to account for 36% of total sales in 2025, owing to ease of storage, extended shelf life, and versatile culinary applications. By end use, food manufacturers represent the dominant consumption segment, responsible for 52% of all sales, while retail and food service segments are expanding rapidly.

Consumer adoption is particularly concentrated among health-conscious urban families and households that prioritize emergency preparedness, with convenience and nutritional value emerging as significant drivers of demand. By 2025, the average cost of dehydrated vegetables is approximately 25-30% higher than fresh vegetables, representing a narrowing price gap compared to previous years. Continued improvements in processing technology and supply chain efficiency are expected to accelerate accessibility across middle-income households. Regional disparities persist, but per capita demand in emerging regions is narrowing the gap with traditionally strong metropolitan areas.

The dehydrated vegetable segment in Japan is classified into multiple categories. By product type, key classifications include carrots, onions, potatoes, broccoli, beans, peas, cabbage, mushrooms, and tomatoes. By form, the segment spans minced & chopped, powder & granules, flakes, slices & cubes, and other specialized formats. By nature, formulations include organic and conventional. By end use, the segment covers food manufacturers (snacks & savory products, infant foods, soups, salads, dressings & sauces), food service operations, and retail channels.

Based on technology, processing methods include air drying, spray drying, freeze drying, drum drying, vacuum drying, and other techniques. By distribution channel, the segment encompasses direct sales and indirect channels, including store-based retailing and online retail platforms. By region, areas such as Kanto, Chubu, Kinki, Kyushu & Okinawa, Tohoku, and the Rest of Japan are analyzed comprehensively.

Dehydrated vegetable processing forms in Japan cater to diverse application requirements and consumer preferences. Powder and granules dominate due to convenience, storage efficiency, and culinary versatility, while other forms serve specific consumer niches.

Dehydrated vegetable end-use applications in Japan span commercial food production, food service operations, and retail consumption. Food manufacturers dominate consumption patterns, while food service and retail segments show strong growth potential.

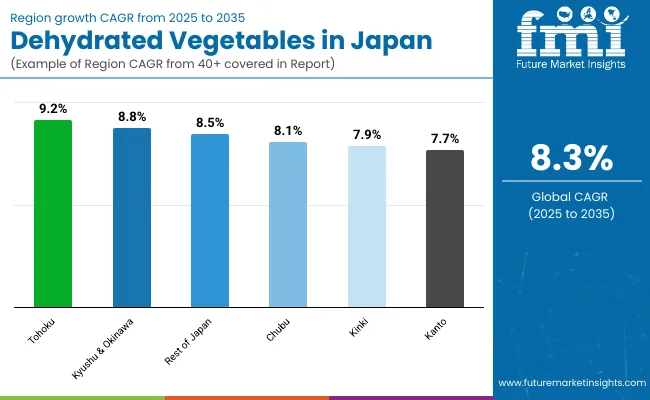

| Regions | CAGR (2025 to 2035) |

|---|---|

| Tohoku | 9.2% |

| Kyushu & Okinawa | 8.8% |

| Rest of Japan | 8.5% |

| Chubu | 8.1% |

| Kinki | 7.9% |

| Kanto | 7.7% |

Regional growth patterns will demonstrate significant variation across Japanese territories. Emerging regions benefit from lower baseline consumption and rapid lifestyle changes, while established areas expand steadily from higher consumption bases. The table below shows the compound annual growth rate (CAGR) each region is expected to record between 2025 and 2035.

Between 2025 and 2035, demand for dehydrated vegetables is projected to expand across all major Japanese regions. Still, growth rates will vary based on baseline consumption levels, urbanization trends, and lifestyle modernization patterns. Among the areas analyzed, Tohoku and Kyushu & Okinawa are expected to register the fastest compound annual growth rates of 9.2% and 8.8% respectively, outpacing more mature consumption areas.

This acceleration stems from several factors such as fast-paced regional development, changing food preparation habits, and increasing integration of convenient food solutions into traditional cooking practices. In Tohoku, per capita consumption is projected to rise from 1.8 kg in 2025 to 4.1 kg by 2035, while Kyushu & Okinawa are expected to increase from 2.1 kg to 4.6 kg over the same period.

Chubu and Kinki regions are forecast to grow at CAGRs of 8.1% and 7.9% respectively, supported by strong manufacturing presence and established food culture diversity. Both regions maintain strong retail infrastructure and commercial demand patterns.Kanto region, while maintaining the highest absolute consumption volumes, is projected to grow at a CAGR of 7.7%. The area exhibits mature consumption patterns with established retail ecosystems and widespread product availability. Growth is expected to come mainly from increased per capita consumption and premium product adoption, with less emphasis on new customer acquisition.

Dehydrated vegetable demand across Japanese regions varies based on population density, culinary traditions, and economic development levels. Kanto dominates absolute consumption while emerging regions demonstrate higher growth rates driven by increasing urbanization and changing food preparation habits.

Kanto Regional Analysis: Kanto represents the largest dehydrated vegetable consumption region, driven by high population density, diverse food service infrastructure, and strong retail presence. Urban lifestyle demands for convenience foods support sustained growth across all product categories.

Chubu Regional Sales Outlook: The Chubu region demonstrates strong growth potential driven by industrial food manufacturing presence and traditional cooking culture integration, supporting both commercial and household demand segments.

Kinki Regional Demand Patterns: Kinki region shows steady growth supported by cultural food preferences and strong retail infrastructure, particularly in Osaka and Kyoto metropolitan areas, where culinary diversity drives product experimentation.

Kyushu & Okinawa Sales Analysis: Kyushu and Okinawa regions demonstrate emerging growth potential through agricultural diversification and tourism-driven food innovation, leveraging regional specialties and unique flavor profiles.

Tohoku Regional Demand Outlook: The Tohoku region shows strong growth potential through agricultural modernization and increasing urbanization, supporting both production capabilities and consumption demand.

The competitive environment is characterized by a mix of established food processing companies and specialized ingredient suppliers. Processing capability and distribution reach remain decisive success factors, with leading suppliers maintaining extensive manufacturing facilities and comprehensive distribution networks across Japan.TOMIZ serves as a prominent participant in the Japanese dehydrated vegetable segment, offering diverse product ranges with emphasis on quality consistency and culinary application support. The company maintains strong relationships with professional chefs and home cooking enthusiasts through educational content and recipe development.

MIKASA leverages processing technology expertise to produce high-quality dehydrated vegetables for both commercial and retail applications, focusing on nutritional retention and flavor preservation through advanced processing methods.OYAOYA emphasizes organic and premium dehydrated vegetable products, targeting health-conscious consumers and specialty food applications with sustainable sourcing practices and premium packaging presentations.

Osawa maintains a strong position in traditional and natural food segments, offering dehydrated vegetables that align with traditional Japanese cooking methods while meeting modern convenience requirements.Kirishima Natural Foods focuses on regional specialties and volcanic soil-grown vegetables, providing unique flavor profiles and premium positioning in the dehydrated vegetable segment.

International players, including Juye Foods and Daihoku, contribute processing capabilities and supply chain efficiency, serving large-scale commercial customers requiring consistent quality and reliable delivery schedules.Toyota Tsusho Foods Corporation applies supply chain expertise and quality management systems to dehydrated vegetable distribution, serving both domestic and export applications.

Key Developments

| Items | Values |

|---|---|

| Quantitative Units (2025) | USD 1 Billion |

| Product Type | Carrot, Onions, Potatoes, Broccoli, Beans, Peas, Cabbage, Mushrooms, Tomatoes |

| Form | Minced and Chopped, Powder and Granules, Flakes, Slices and Cubes, Others |

| Nature | Organic, Conventional |

| End Use | Food Manufacturers, Foodservice, Retail |

| Technology | Air Drying, Spray Drying, Freeze Drying, Drum Drying, Vacuum Drying |

| Distribution Channel | Store-based retailing, Hypermarkets/Supermarkets, Convenience Stores, Food and Drink Specialty Stores, Online retail |

| Regions Covered | Kanto, Chubu, Kinki, Kyushu and Okinawa, Tohoku, Rest of Japan |

| Key Companies Profiled | TOMIZ, KUNMING LILIANGXIN SHANGMAO YOUXIAN GONGSI, MIKASA, OYAOYA, Osawa, Kirishima Natural Foods, Juye Foods, Daihoku, TOYOTA TSUSHO FOODS CORPORATION |

| Additional Attributes | Dollar sales by product type, form, and nature; regional consumption trends; seasonal demand shifts; competitive landscape; consumer preferences; sustainable sourcing practices; technological innovations in dehydration; and adoption trends across food manufacturing, food service, and retail channels |

In 2025 the total sales of dehydrated vegetables in Japan will be valued at USD 1 billion.

By 2035, the sales of dehydrated vegetables in Japan are forecasted to reach USD 2.2 billion reflecting a CAGR of 8.3%.

Powder and granules lead with a 36% share in 2025.

Tohoku is anticipated to grow at the fastest rate with a CAGR of 9.2% from 2025 to 2035.

Food manufacturers are projected to lead the end-use segment with a 52% share.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Demand Signal Repository Solutions Market Size and Share Forecast Outlook 2025 to 2035

Demand Side Management Market Size and Share Forecast Outlook 2025 to 2035

Demand Response Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Demand for Industrial Chocolate in EU Size and Share Forecast Outlook 2025 to 2035

Demand for Industrial & Institutional Cleaning Products in EU Size and Share Forecast Outlook 2025 to 2035

Demand for Joint Compound in EU Size and Share Forecast Outlook 2025 to 2035

Demand for Taurine in EU Size and Share Forecast Outlook 2025 to 2035

Demand for Kaolin in India Size and Share Forecast Outlook 2025 to 2035

Demand for DMPA in EU Size and Share Forecast Outlook 2025 to 2035

Demand for 3D Printing Materials in Middle East Size and Share Forecast Outlook 2025 to 2035

Demand for Protein-rich Shelf-stable UHT Oat Drinks in Latin America Size and Share Forecast Outlook 2025 to 2035

Demand for Yeast in EU Size and Share Forecast Outlook 2025 to 2035

Demand for Oat Drink in EU Size and Share Forecast Outlook 2025 to 2035

Demand for Vanillin in EU Size and Share Forecast Outlook 2025 to 2035

Demand for Spirulina Extract in EU Size and Share Forecast Outlook 2025 to 2035

Demand for Pulse Ingredients in EU Size and Share Forecast Outlook 2025 to 2035

Demand for Gypsum in EU Size and Share Forecast Outlook 2025 to 2035

Demand for Barite in EU Size and Share Forecast Outlook 2025 to 2035

Demand for Shrimp in the EU Size and Share Forecast Outlook 2025 to 2035

Demand for Mezcal in EU Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA