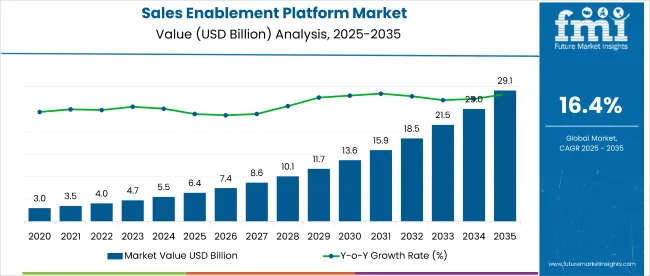

The market for sales enablement platforms is expected to increase in value from USD 6.38 billion in 2025 to approximately USD 29.18 billion by 2035, registering a 16.4% CAGR over the forecast period. This expansion is being fueled by growing enterprise reliance on intelligent tools that optimize seller efficiency and align marketing operations.

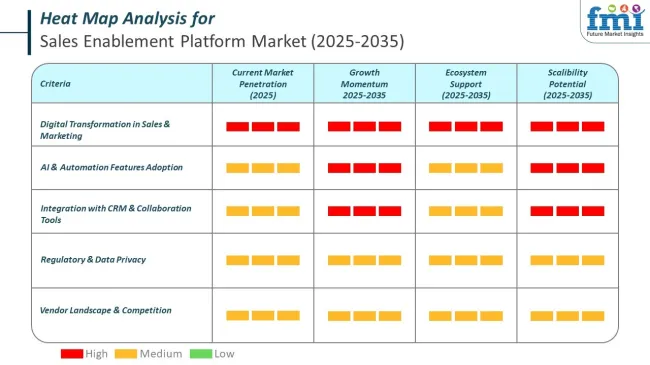

During 2024 and early 2025, digital transformation was accelerated across B2B sales functions, resulting in a pivot from conventional CRMs to AI-powered enablement ecosystems. Automation in coaching, data-led performance tracking, and dynamic content workflows has been adopted widely to streamline sales cycles and improve overall team productivity.

Advanced capabilities such as AI-curated content, contextual playbooks, and embedded microlearning have been increasingly deployed. Most enterprise platforms have been integrated into existing workflows using tools like Salesforce, Slack, or Microsoft Teams.

Seamless user experience is being prioritized, and vendors like Highspot, Seismic, and Showpad have been expanding CMS and LMS integrations. In leading deployments, usage heatmaps and seller analytics are being applied to reduce prep time and support conversion strategies. In 2024, more than 70% of top-performing sales organizations were reported to be leveraging enablement platforms as core to their revenue strategy, a trend projected to continue through 2035.

Across the industry, key trends are being observed. AI-driven personalization is being used to suggest real-time actions, surface relevant content, and optimize engagement timing. Micro-coaching features are being deployed at scale to support onboarding, especially in regulated sectors such as healthcare and banking.

Moreover, sales enablement is being unified with marketing and customer success through API-first architecture. Connections between CRMs, CDPs, and enablement tools are being standardized to ensure a single source of insight. These shifts are being driven by measurable efficiency gains, improved training outcomes, and clearer attribution from sales content to closed deals.

Regionally, adoption has been led by North America, where demand for insight-rich, mobile-optimized platforms remains strong. In Europe, momentum is being supported by GDPR-aligned frameworks and regulatory compliance needs. Asia Pacific is witnessing rapid adoption, fueled by localization, mobile-first UX, and mid-market digitization in India and Southeast Asia.

Latin America is being shaped by open-source platform deployments tailored for SMBs. As investments are redirected from legacy systems to intelligent, connected enablement environments, the market is expected to remain on a sustained growth path, reinforced by enterprise digitization and the pursuit of predictable, scalable sales outcomes.

The sales enablement platform market is growing rapidly across the top five global economies, fueled by the integration of emerging technologies like AI, machine learning, and cloud-based solutions. These technologies are enhancing productivity, customer engagement, and efficiency. Key players such as Seismic, Highspot, and Salesforce are leading this transformation, according to SkyQuest Technology.

The sales enablement platform market is facing a complex regulatory environment with varying data privacy laws across the top five economies. Ensuring compliance with regional regulations is critical as businesses adopt these platforms. Data protection frameworks in the USA., China, Japan, Germany, and India are evolving, with a focus on transparency, consent, and data security. The integration of AI and analytics in these platforms raises concerns around automated decision-making and profiling, requiring careful attention to compliance.

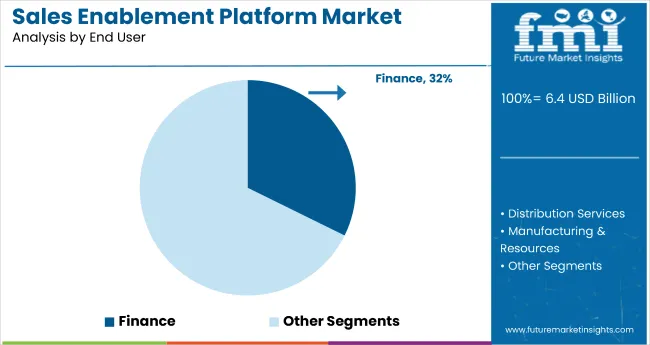

In 2025, the finance sector is projected to retain a dominant position in the sales enablement platform market, accounting for a 32.3% market share. This leadership is being driven by the industry's high demand for compliant, relationship-based, and data-intensive sales workflows.

Sales teams in banking, insurance, and wealth management are being increasingly equipped with digital tools that manage regulatory content, track performance metrics, and personalize customer engagement. AI-powered insights, document automation, and real-time content delivery are being integrated to address regulatory complexity and streamline lead management processes.

Financial service providers such as JPMorgan Chase, AXA, and American Express are adopting platforms that enhance client engagement through tailored experiences and automate sales training. The ongoing digitization of financial services and frequent updates to compliance frameworks are being addressed through embedded educational modules and automated workflow systems.

The use of CRM-integrated enablement tools is also ensuring better tracking of customer journeys. As decision-making continues to be driven by data and regulatory adherence, the finance segment is expected to remain the largest contributor to growth within the sales enablement platform industry.

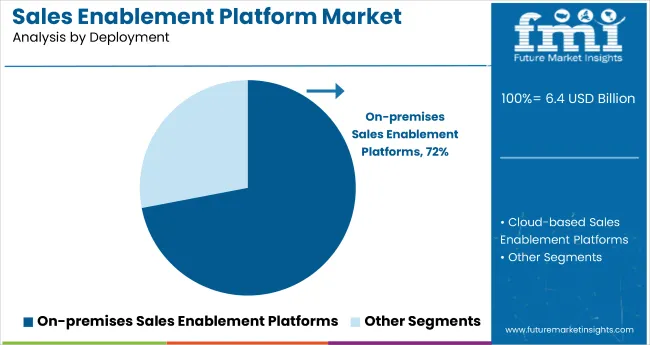

Cloud-based sales enablement platforms are forecasted to grow at the highest CAGR of 16.9% from 2025 to 2035. This growth is being propelled by the shift to remote and hybrid work environments, which has emphasized the need for accessible, real-time collaboration tools for distributed sales teams. Cloud-native platforms are being chosen for their scalability, ease of deployment, and reduced reliance on physical IT infrastructure.

Enterprises are increasingly adopting solutions from vendors like Seismic, Showpad, and Highspot that offer integration with CRM systems, marketing automation platforms, and AI-driven recommendation engines. These platforms are being favored for enabling on-demand training, sales content access, and performance analytics across devices and locations.

Organizations are also turning to the cloud to manage global sales operations without incurring significant infrastructure costs. Improvements in cybersecurity and compliance with data protection standards such as GDPR and SOC 2 are further enhancing adoption confidence. As organizations prioritize agility, cost control, and scalability in their sales processes, cloud-based deployments are expected to be at the forefront of technological transformation across industries.

| Company | Allego and LXA |

|---|---|

| Contract/Release Details | Allego, an AI-powered revenue enablement suite provider, partnered with LXA to release "The 2025 State of Sales Enablement Report," offering key insights into AI-driven sales enablement adoption and challenges in advancing sales strategies. |

| Date | February 25, 2025 |

| Contract Value (USD million) | Approximately USD 8 - USD 12 |

| Renewal Period | NA |

| Company | Seismic |

|---|---|

| Contract/Release Details | Seismic, a leading sales enablement platform, enhanced its content management and analytics capabilities by integrating AI-driven insights to help sales teams track content performance and optimize strategies.. |

| Date | January 15, 2025 |

| Contract Value (USD million) | Approximately USD 15 - USD 20 |

| Renewal Period | 3 - 5 years |

| Company | Gong.io |

|---|---|

| Contract/Release Details | Gong.io, a revenue intelligence platform, introduced AI-driven features to enhance team productivity and decision-making through insights derived from customer interactions, transforming sales success in 2025. |

| Date | December 10, 2024 |

| Contract Value (USD million) | Approximately USD 18 - USD 25 |

| Renewal Period | 4 - 6 years |

| Company | Consensus |

|---|---|

| Contract/Release Details | Copy.ai released a guide titled "Achieving AI Content Efficiency in Go-to-Market Efforts 2024," showcasing how AI-powered to ols help organizations create more effective sales content and personalized outreach at scale. |

| Date | November 20, 2024 |

| Contract Value (USD million) | Approximately USD 10 - USD 15 |

| Renewal Period | 3 - 5years |

| Company | Copy.ai |

|---|---|

| Contract/Release Details | Copy.ai released a guide titled "Achieving AI Content Efficiency in Go-to-Market Efforts 2024," showcasing how AI-powered to ols help organizations create more effective sales content and personalized outreach at scale. |

| Date | November 20, 2024 |

| Contract Value (USD million) | Approximately USD 5 - USD 8 |

| Renewal Period | NA |

The market for AI-driven sales enablement saw considerable progress in 2024 and early 2025, characterized by both strategic partnerships and software launches. The partnership builds on Allego's focus on how AI is becoming built into the DNA of to day's sophisticated sales strategy, in most all use cases. Meanwhile, Seismic, Gong. io, and Consensus drives sales content management, team productivity, and personalized buyer engagement with AI-smartened solutions. These moves correspond to a wider trend across industries, to ward AI-driven automation and data-centric decision-making, driving sales effectiveness across industries.

One of the major factors for the growth of Sales Enablement Platform Market is the growing usage of artificial intelligence (AI) and predictive analytics. AI platforms are empowering sales teams with real-time insights, automating lead scoring, and facilitating data-driven recommendations, contributing to higher degrees of personalization in customer interactions. Identifies high-conversion opportunities, enhances forecasting accuracy, and lowers sales cycle time With the ability to recommend content more effectively and optimize outreach strategies, these technologies enrich productivity. As the modern business focus shifts to ward data-driven decisions, AI-powered sales enablement to ols are becoming a key caveat for remaining competitive. Continued advances in AI practices & algorithms for automation in sales, including virtual sales assistants, chatbots, etc., are additional factors driving market growth, enabling sales teams to concentrate on high-volume or high-value customer interactions and closing accounts and strategic deals.

The transition to remote work and digital-first sales is driving higher demand for sales enablement platforms. The need of the hour for sales teams is cloud-based, collaborative to ols that allow access to sales content, training materials, and customer insights from a single location with virtual selling on the rise. Video integration, digital playbooks, and AI-based coaching improves effectiveness when selling virtually. Hence, businesses are now utilizing digital to ols that will allow cross-office communication, real-time collaboration and uniform messaging despite teams being split across physical locations. ” This phenomenon runs especially deep across industries including technology, healthcare and financial services, where remote engagement has become the norm. The evolution of hybrid and remote work models is only going to fuel market growth as the demand for robust, cloud-native sales enablement solutions also increases.

Many organizations are now focusing on Sales and Marketing alignment to make their lead conversion journey more efficient. Sales enablement platforms help ensure the right display of information through the marketing and sales funnel by providing marketing and sales workflows with a seamless way to collaborate and incorporate marketing content. They offer analytics on how content performs, enabling marketing teams to fine-tune strategies driven by actual engagement statistics in the real world. It empowers sales teams with the ability to track customer interactions across various points of contact, allowing for a more personalized approach that can boost conversion rates and drive better ROI. The growing need for integrated sales-marketing solutions stems from companies' drive to improve the conversion of new leads into revenue. When businesses are leveraging these platforms, they are bringing operational parity, ensuring consistency, and providing a better customer journey through the complete spectrum of the sales funnel.

There is a growing concern on data security and regulatory compliance which is one of the key challenges as well in the Sales Enablement Platform Market. Sales enablement solutions capture and process huge amounts of customer data - which may include sensitive financial and personal information. Compliance with stringent data-centric regulations like GDPR, CCPA, and many industry-specific regulations is a growing headache for both vendors and enterprises. Business continuity and customer trust are threatened by unauthorized access, data breaches, and cyber threats. Moreover, with enterprises embracing AI on analytics, and cloud-enabled deployments, issues of data sovereignty and third-party control on data become priorities. According to XS, organizations need to spend on solid cybersecurity protection, encryption and compliance frameworks to hedge the risks. Compliance with changing global regulations is a complicated process that could delay adoption in certain sectors, especially in highly regulated businesses such as healthcare and finance.

| Market Shift | 2020 to 2024 |

|---|---|

| Adoption of AI in Sales Enablement | Early adoption phase with companies integrating AI for CRM automation, lead scoring, and chatbots. AI-enhanced recommendations began improving sales conversions. |

| AI-Driven Content Personalization | AI-assisted content recommendation engines improved sales materials based on customer preferences and historical interactions. |

| Conversational AI & Virtual Sales Assistants | Chatbots and AI-driven assistants provided pre-programmed responses to FAQs and basic lead nurturing. Adoption was limited to large enterprises. |

| Predictive Sales Analytics | AI-assisted forecasting models helped improve sales pipeline visibility, but accuracy was limited due to reliance on historical data. |

| Automation of Sales Processes | Robotic Process Automation (RPA) automated repetitive tasks like email follow-ups and meeting scheduling. |

| AI in Sales Training & Coaching | AI-driven coaching to ols provided performance analytics and sales training based on predefined KPIs. Adoption was limited to tech-savvy enterprises. |

| Regulatory Compliance & AI Ethics | Initial regulatory frameworks for AI in sales were under development, with a focus on data privacy (GDPR, CCPA). |

| Enterprise AI Adoption & Market Expansion | Early-stage AI adoption was concentrated in large enterprises and tech-driven industries. AI’s impact was incremental rather than transformational. |

| Integration with Other Enterprise Systems | AI to ols were primarily integrated with CRM platforms like Salesforce and HubSpot but had limited interoperability with other enterprise applications. |

| Customer Experience & AI-Driven Engagement | AI-assisted engagement improved customer interactions, but personalization remained limited due to data silos. |

| Market Shift | 2025 to 2035 |

|---|---|

| Adoption of AI in Sales Enablement | AI becomes a core driver of sales strategies. Hyper-personalized sales engagement powered by generative AI, autonomous sales assistants, and real-time behavioral analytics transform sales execution. |

| AI-Driven Content Personalization | Generative AI creates hyper-personalized sales content in real-time. AI automatically adapts messaging for individual customers based on behavioral signals, industry trends, and competitor analysis. |

| Conversational AI & Virtual Sales Assistants | AI-powered autonomous sales assistants handle full-cycle sales conversations. Natural Language Processing (NLP) and sentiment analysis enable AI to negotiate deals, handle objections, and improve customer retention strategies. |

| Predictive Sales Analytics | AI-powered predictive analytics provide real-time insights by integrating macroeconomic data, competitor movements, and customer sentiment. Businesses achieve near-accurate demand forecasting and dynamic pricing adjustments. |

| Automation of Sales Processes | AI-driven autonomous sales workflows eliminate manual intervention. Intelligent process automation streamlines contract management, compliance checks, and proposal generation. |

| AI in Sales Training & Coaching | Real-time AI coaching delivers personalized training sessions. AI identifies skill gaps, provides instant feedback, and dynamically adjusts training programs based on sales performance trends. |

| Regulatory Compliance & AI Ethics | AI governance policies become stringent. Regulations mandate ethical AI usage, data protection, and transparency in AI-driven sales decisions. Companies invest in AI ethics compliance and bias detection to ols. |

| Enterprise AI Adoption & Market Expansion | AI becomes a mainstream technology in sales enablement. SMEs and non-tech industries embrace AI-driven sales strategies, democratizing access to advanced AI to ols across all sectors. |

| Integration with Other Enterprise Systems | AI seamlessly integrates with ERP, supply chain management, and customer service platforms. Unified AI-driven ecosystems enhance cross-functional collaboration and decision-making. |

| Customer Experience & AI-Driven Engagement | AI delivers an omnichannel, predictive, and highly personalized customer experience. AI understands customer intent in real time and adapts sales strategies accordingly. |

Comprises dominant brands in sales enablement solutions that are widely recognised for both innovation and global sales reach. Others-such as Seismic, Highspot, Showpad, and Brainshark-have pioneered best-of- breed platforms that combine content management, analytics, training, and customer engagement to ols. Their extensive product catalogs, expansive customer reach, and ongoing technological innovation have allowed them to achieve solid revenue growth and pivot for changing market demands.

These companies are focused on scalability, advanced analytics and integration with existing CRM and marketing platforms. With their well-demonstrated track record, alliances and market presence, these companies have emerged as the preferred choice of global enterprises looking to improve sales productivity and revenue performance in organizations across industries. Innovation driven by their leadership and continuous market advancement

Tier 2 players provide a middle ground in the sales enablement market, providing focused solutions, with just enough functionality without the enterprise price tag. Allego, ClearSlide, and MindTickle provide powerful content management, sales coaching, and performance analytics platforms, respectively.

They are known for being agile, configurable, and able to implement quickly and thus are attractive to mid-sized companies and certain industry verticals. These vendors constantly extend their capabilities via ties to CRM systems and new technologies. While they don't have as wide at the reach as Tier 1 frontrunners, their innovative features and a focus on customer optimization ensure they win a slice of the market. By offering competitive pricing and flexible deployment models, they have garnered interest from businesses seeking to enhance both sales efficiency and operational performance, thus fostering innovation in the market.

Tier 3 companies comprise new entrants that offer unique, highly specific solutions and are quickly scaling in the sales enablement market. Mediafly, SalesLoft and Outreach have been utilizing advanced technology to boost engagement and productivity of their sales teams.

These tend to focus on ease of use, mobile compatibility, and ability to integrate with a wide range of enterprise systems, so are favored by startups and SMEs. Their offerings often include advanced analytics, real-time coaching, and interactive content delivery methods that outpace bigger and long-established competitors. Despite being relatively young, Agile systems have been able to capture an increasingly interested market due to their focus on responsive development with the customer in mind. They are agile to changing process and that makes them strong players to capture the future market.

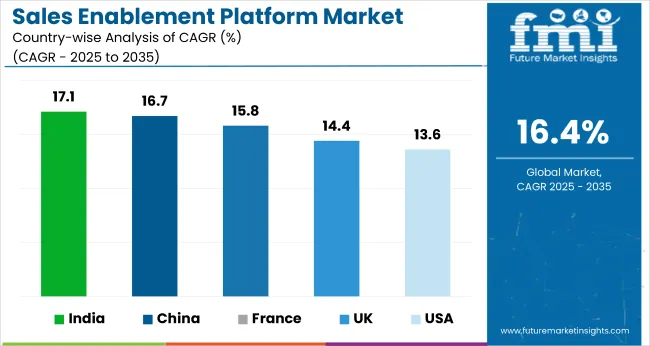

The section below covers the industry analysis for the Sales Enablement Platform market for different countries. The market demand analysis on key countries in several countries of the globe, including USA, France, UK, China and India are provided.

| Country | Value CAGR (2025 to 2035) |

|---|---|

| USA | 13.6% |

| France | 15.8% |

| UK | 14.4% |

| China | 16.7% |

| India | 17.1% |

US Sales enablement platform market account for the largest share owing to the higher adoption of enterprise tech, significant investment in AI-based sales solution and matured digital sales ecosystem. Many large enterprises in IT, BFSI, healthcare, etc. are leveraging AI-powered sales enablement to ols to engage customers, streamline workflows, and boost sales productivity. The major vendors (Seismic, Highspot, and SalesLoft) stimulate innovation and competition in the market. The USA's digital-first business environment and focus on data-led decision-making also drives growth.

The USA leads the world as the most matured and high growth market for Sales Enablement platforms due to the exodus of CRM systems, and widespread adoption of cloud computing, as well as advanced analytics solutions ensuring seamless integration of these sales enablement to ols.

The French Market in the Sales Enablement Platform is growing significantly with the rampant digitization across industries and the requirement of better sales efficiency. French firms (especially those in the finance, automotive, and manufacturing sectors) are investing in technologies, dubbed sales enablement, that allow them to better engage, and be more efficient when reaching their customers. Demand for secure regulatory-compliant platforms which not only protect data but also bolster sales performance is driven by regulatory frameworks such as GDPR.

The country’s emphasis on automation using artificial intelligence (AI) and solutions offered in the cloud have led to faster adoption rates as companies to use predictive analytics and intelligent coaching for optimizing their sales strategies. Furthermore, growing startup ecosystem and government initiatives encouraging the digitalisation of the country are driving the growth of the market. France is consequently one of the key European hubs for the adoption of sales enablement technologies, as companies continue to prioritize sales-marketing alignment and personalized engagement.

The key factors contributing to the growth of sales enablement platforms in India are rapid digitalization, increasing adoption of cloud-based solutions, and rising investments from small and medium businesses (SMBs). A burgeoning e-commerce and fintech environment is spurring the kind of automation, analytics and customer engagement to ols needed to drive AI-based sales processes. Across India, likewise, businesses are deploying to sales enablement solutions integrated with CRM systems that further the enablement of services to lead conversion, sales and productivity optimization.

Moreover, the shift to wards remote and hybrid work arrangements has created a demand for solutions that enable sales teams to collaborate effectively in virtual settings. The market growth is additionally fueled by government initiatives encouraging digital transformation as well as an increasing startup ecosystem. The India sales enablement platform market is expected to witness a momentous growth rate in the coming years, thanks to businesses looking for cost-effective and scalable solutions.

The Major Players Operating in the Sales Enablement Platform Market are: to p competitors in the market that offer an end-to-end solution include Seismic, Highspot, Showpad, and Brainshark, all enterprise-grade firms that are offering an advanced set of features from analytics to content management and AI-driven sales coaching.

Mid-tier companies such as Allego, ClearSlide and MindTickle address specific industry or function needs with agile, customizable platforms. Newer companies including Mediafly, SalesLoft and Outreach have entered the marketplace with specialized, easy-to-use solutions that focus on automation and real-time collaboration.

These companies are looking for strategic partnerships, acquisitions, and investment opportunities to secure their competitive edge in AI-drive automation. The Move to ward Cloud Delivers User-Friendly, Mobile First Solutions, and Increases Competition in the Market Aligned with the trend of businesses focusing on data-driven sales strategies, vendors are setting themselves apart with personalized user experiences, easier integrations and added security features to stay relevant in the market.

| Report Attributes | Details |

|---|---|

| Current Total Market Size (2025) | USD 6.38 billion |

| Projected Market Size (2035) | USD 29.18 billion |

| CAGR (2025 to 2035) | 16.4% |

| Base Year for Estimation | 2024 |

| Historical Period | 2020 to 2024 |

| Projections Period | 2025 to 2035 |

| Quantitative Units | USD billion for value |

| Deployment Types Analyzed (Segment 1) | On-premises Sales Enablement Platforms, Cloud-based Sales Enablement Platforms |

| End Users Covered (Segment 2) | Finance, Distribution Services, Manufacturing & Resources, Services, Public Sector, Infrastructure |

| Technologies & Features Analyzed (Segment 3) | AI-powered analytics, content management, real-time coaching, predictive sales engagement |

| Regions Covered | North America; Latin America; Western Europe; Eastern Europe; South Asia & Pacific; East Asia; Middle East & Africa |

| Countries Covered | United States, France, United Kingdom, China, India |

| Key Players Influencing the Market | Seismic, Highspot, Showpad, Brainshark, Allego, ClearSlide, MindTickle, Mediafly, SalesLoft, Outreach |

| Additional Attributes | Dollar sales by deployment and end user, AI & automation trends, cloud adoption, sales-marketing alignment, data security challenges |

| Customization and Pricing | Customization and Pricing Available on Request |

In terms of Deployment, the segment is categorized into On-premises Sales Enablement Platforms and Cloud-based Sales Enablement Platforms.

In terms of End User, the segment is classified into Finance, Distribution Services, Manufacturing & Resources, Services, Public Sector, and Infrastructure.

Key countries of North America, Latin America, Western Europe, Eastern Europe, East Asia, South Asia & pacific, Middle East and Africa (MEA) have been covered in the report.

The global Sales Enablement Platform industry is projected to witness CAGR of 16.4% between 2025 and 2035.

The global Sales Enablement Platform industry stood at USD 6.38 billion in 2025.

The global Sales Enablement Platform industry is anticipated to reach USD 29.18 billion by 2035 end.

South Asia & Pacific is set to record the highest CAGR of 17.3% in the assessment period.

The key players operating in the global Sales Enablement Platform industry include Seismic, Highspot, Showpad, Brainshark, Allego and others.

Table 1: Global Market Value (US$ Million) Forecast by Region, 2019 to 2034

Table 2: Global Market Value (US$ Million) Forecast by Component, 2019 to 2034

Table 3: Global Market Value (US$ Million) Forecast by Deployment Model, 2019 to 2034

Table 4: Global Market Value (US$ Million) Forecast by Industry Vertical, 2019 to 2034

Table 5: North America Market Value (US$ Million) Forecast by Country, 2019 to 2034

Table 6: North America Market Value (US$ Million) Forecast by Component, 2019 to 2034

Table 7: North America Market Value (US$ Million) Forecast by Deployment Model, 2019 to 2034

Table 8: North America Market Value (US$ Million) Forecast by Industry Vertical, 2019 to 2034

Table 9: Latin America Market Value (US$ Million) Forecast by Country, 2019 to 2034

Table 10: Latin America Market Value (US$ Million) Forecast by Component, 2019 to 2034

Table 11: Latin America Market Value (US$ Million) Forecast by Deployment Model, 2019 to 2034

Table 12: Latin America Market Value (US$ Million) Forecast by Industry Vertical, 2019 to 2034

Table 13: Western Europe Market Value (US$ Million) Forecast by Country, 2019 to 2034

Table 14: Western Europe Market Value (US$ Million) Forecast by Component, 2019 to 2034

Table 15: Western Europe Market Value (US$ Million) Forecast by Deployment Model, 2019 to 2034

Table 16: Western Europe Market Value (US$ Million) Forecast by Industry Vertical, 2019 to 2034

Table 17: Eastern Europe Market Value (US$ Million) Forecast by Country, 2019 to 2034

Table 18: Eastern Europe Market Value (US$ Million) Forecast by Component, 2019 to 2034

Table 19: Eastern Europe Market Value (US$ Million) Forecast by Deployment Model, 2019 to 2034

Table 20: Eastern Europe Market Value (US$ Million) Forecast by Industry Vertical, 2019 to 2034

Table 21: South Asia and Pacific Market Value (US$ Million) Forecast by Country, 2019 to 2034

Table 22: South Asia and Pacific Market Value (US$ Million) Forecast by Component, 2019 to 2034

Table 23: South Asia and Pacific Market Value (US$ Million) Forecast by Deployment Model, 2019 to 2034

Table 24: South Asia and Pacific Market Value (US$ Million) Forecast by Industry Vertical, 2019 to 2034

Table 25: East Asia Market Value (US$ Million) Forecast by Country, 2019 to 2034

Table 26: East Asia Market Value (US$ Million) Forecast by Component, 2019 to 2034

Table 27: East Asia Market Value (US$ Million) Forecast by Deployment Model, 2019 to 2034

Table 28: East Asia Market Value (US$ Million) Forecast by Industry Vertical, 2019 to 2034

Table 29: Middle East and Africa Market Value (US$ Million) Forecast by Country, 2019 to 2034

Table 30: Middle East and Africa Market Value (US$ Million) Forecast by Component, 2019 to 2034

Table 31: Middle East and Africa Market Value (US$ Million) Forecast by Deployment Model, 2019 to 2034

Table 32: Middle East and Africa Market Value (US$ Million) Forecast by Industry Vertical, 2019 to 2034

Figure 1: Global Market Value (US$ Million) by Component, 2024 to 2034

Figure 2: Global Market Value (US$ Million) by Deployment Model, 2024 to 2034

Figure 3: Global Market Value (US$ Million) by Industry Vertical, 2024 to 2034

Figure 4: Global Market Value (US$ Million) by Region, 2024 to 2034

Figure 5: Global Market Value (US$ Million) Analysis by Region, 2019 to 2034

Figure 6: Global Market Value Share (%) and BPS Analysis by Region, 2024 to 2034

Figure 7: Global Market Y-o-Y Growth (%) Projections by Region, 2024 to 2034

Figure 8: Global Market Value (US$ Million) Analysis by Component, 2019 to 2034

Figure 9: Global Market Value Share (%) and BPS Analysis by Component, 2024 to 2034

Figure 10: Global Market Y-o-Y Growth (%) Projections by Component, 2024 to 2034

Figure 11: Global Market Value (US$ Million) Analysis by Deployment Model, 2019 to 2034

Figure 12: Global Market Value Share (%) and BPS Analysis by Deployment Model, 2024 to 2034

Figure 13: Global Market Y-o-Y Growth (%) Projections by Deployment Model, 2024 to 2034

Figure 14: Global Market Value (US$ Million) Analysis by Industry Vertical, 2019 to 2034

Figure 15: Global Market Value Share (%) and BPS Analysis by Industry Vertical, 2024 to 2034

Figure 16: Global Market Y-o-Y Growth (%) Projections by Industry Vertical, 2024 to 2034

Figure 17: Global Market Attractiveness by Component, 2024 to 2034

Figure 18: Global Market Attractiveness by Deployment Model, 2024 to 2034

Figure 19: Global Market Attractiveness by Industry Vertical, 2024 to 2034

Figure 20: Global Market Attractiveness by Region, 2024 to 2034

Figure 21: North America Market Value (US$ Million) by Component, 2024 to 2034

Figure 22: North America Market Value (US$ Million) by Deployment Model, 2024 to 2034

Figure 23: North America Market Value (US$ Million) by Industry Vertical, 2024 to 2034

Figure 24: North America Market Value (US$ Million) by Country, 2024 to 2034

Figure 25: North America Market Value (US$ Million) Analysis by Country, 2019 to 2034

Figure 26: North America Market Value Share (%) and BPS Analysis by Country, 2024 to 2034

Figure 27: North America Market Y-o-Y Growth (%) Projections by Country, 2024 to 2034

Figure 28: North America Market Value (US$ Million) Analysis by Component, 2019 to 2034

Figure 29: North America Market Value Share (%) and BPS Analysis by Component, 2024 to 2034

Figure 30: North America Market Y-o-Y Growth (%) Projections by Component, 2024 to 2034

Figure 31: North America Market Value (US$ Million) Analysis by Deployment Model, 2019 to 2034

Figure 32: North America Market Value Share (%) and BPS Analysis by Deployment Model, 2024 to 2034

Figure 33: North America Market Y-o-Y Growth (%) Projections by Deployment Model, 2024 to 2034

Figure 34: North America Market Value (US$ Million) Analysis by Industry Vertical, 2019 to 2034

Figure 35: North America Market Value Share (%) and BPS Analysis by Industry Vertical, 2024 to 2034

Figure 36: North America Market Y-o-Y Growth (%) Projections by Industry Vertical, 2024 to 2034

Figure 37: North America Market Attractiveness by Component, 2024 to 2034

Figure 38: North America Market Attractiveness by Deployment Model, 2024 to 2034

Figure 39: North America Market Attractiveness by Industry Vertical, 2024 to 2034

Figure 40: North America Market Attractiveness by Country, 2024 to 2034

Figure 41: Latin America Market Value (US$ Million) by Component, 2024 to 2034

Figure 42: Latin America Market Value (US$ Million) by Deployment Model, 2024 to 2034

Figure 43: Latin America Market Value (US$ Million) by Industry Vertical, 2024 to 2034

Figure 44: Latin America Market Value (US$ Million) by Country, 2024 to 2034

Figure 45: Latin America Market Value (US$ Million) Analysis by Country, 2019 to 2034

Figure 46: Latin America Market Value Share (%) and BPS Analysis by Country, 2024 to 2034

Figure 47: Latin America Market Y-o-Y Growth (%) Projections by Country, 2024 to 2034

Figure 48: Latin America Market Value (US$ Million) Analysis by Component, 2019 to 2034

Figure 49: Latin America Market Value Share (%) and BPS Analysis by Component, 2024 to 2034

Figure 50: Latin America Market Y-o-Y Growth (%) Projections by Component, 2024 to 2034

Figure 51: Latin America Market Value (US$ Million) Analysis by Deployment Model, 2019 to 2034

Figure 52: Latin America Market Value Share (%) and BPS Analysis by Deployment Model, 2024 to 2034

Figure 53: Latin America Market Y-o-Y Growth (%) Projections by Deployment Model, 2024 to 2034

Figure 54: Latin America Market Value (US$ Million) Analysis by Industry Vertical, 2019 to 2034

Figure 55: Latin America Market Value Share (%) and BPS Analysis by Industry Vertical, 2024 to 2034

Figure 56: Latin America Market Y-o-Y Growth (%) Projections by Industry Vertical, 2024 to 2034

Figure 57: Latin America Market Attractiveness by Component, 2024 to 2034

Figure 58: Latin America Market Attractiveness by Deployment Model, 2024 to 2034

Figure 59: Latin America Market Attractiveness by Industry Vertical, 2024 to 2034

Figure 60: Latin America Market Attractiveness by Country, 2024 to 2034

Figure 61: Western Europe Market Value (US$ Million) by Component, 2024 to 2034

Figure 62: Western Europe Market Value (US$ Million) by Deployment Model, 2024 to 2034

Figure 63: Western Europe Market Value (US$ Million) by Industry Vertical, 2024 to 2034

Figure 64: Western Europe Market Value (US$ Million) by Country, 2024 to 2034

Figure 65: Western Europe Market Value (US$ Million) Analysis by Country, 2019 to 2034

Figure 66: Western Europe Market Value Share (%) and BPS Analysis by Country, 2024 to 2034

Figure 67: Western Europe Market Y-o-Y Growth (%) Projections by Country, 2024 to 2034

Figure 68: Western Europe Market Value (US$ Million) Analysis by Component, 2019 to 2034

Figure 69: Western Europe Market Value Share (%) and BPS Analysis by Component, 2024 to 2034

Figure 70: Western Europe Market Y-o-Y Growth (%) Projections by Component, 2024 to 2034

Figure 71: Western Europe Market Value (US$ Million) Analysis by Deployment Model, 2019 to 2034

Figure 72: Western Europe Market Value Share (%) and BPS Analysis by Deployment Model, 2024 to 2034

Figure 73: Western Europe Market Y-o-Y Growth (%) Projections by Deployment Model, 2024 to 2034

Figure 74: Western Europe Market Value (US$ Million) Analysis by Industry Vertical, 2019 to 2034

Figure 75: Western Europe Market Value Share (%) and BPS Analysis by Industry Vertical, 2024 to 2034

Figure 76: Western Europe Market Y-o-Y Growth (%) Projections by Industry Vertical, 2024 to 2034

Figure 77: Western Europe Market Attractiveness by Component, 2024 to 2034

Figure 78: Western Europe Market Attractiveness by Deployment Model, 2024 to 2034

Figure 79: Western Europe Market Attractiveness by Industry Vertical, 2024 to 2034

Figure 80: Western Europe Market Attractiveness by Country, 2024 to 2034

Figure 81: Eastern Europe Market Value (US$ Million) by Component, 2024 to 2034

Figure 82: Eastern Europe Market Value (US$ Million) by Deployment Model, 2024 to 2034

Figure 83: Eastern Europe Market Value (US$ Million) by Industry Vertical, 2024 to 2034

Figure 84: Eastern Europe Market Value (US$ Million) by Country, 2024 to 2034

Figure 85: Eastern Europe Market Value (US$ Million) Analysis by Country, 2019 to 2034

Figure 86: Eastern Europe Market Value Share (%) and BPS Analysis by Country, 2024 to 2034

Figure 87: Eastern Europe Market Y-o-Y Growth (%) Projections by Country, 2024 to 2034

Figure 88: Eastern Europe Market Value (US$ Million) Analysis by Component, 2019 to 2034

Figure 89: Eastern Europe Market Value Share (%) and BPS Analysis by Component, 2024 to 2034

Figure 90: Eastern Europe Market Y-o-Y Growth (%) Projections by Component, 2024 to 2034

Figure 91: Eastern Europe Market Value (US$ Million) Analysis by Deployment Model, 2019 to 2034

Figure 92: Eastern Europe Market Value Share (%) and BPS Analysis by Deployment Model, 2024 to 2034

Figure 93: Eastern Europe Market Y-o-Y Growth (%) Projections by Deployment Model, 2024 to 2034

Figure 94: Eastern Europe Market Value (US$ Million) Analysis by Industry Vertical, 2019 to 2034

Figure 95: Eastern Europe Market Value Share (%) and BPS Analysis by Industry Vertical, 2024 to 2034

Figure 96: Eastern Europe Market Y-o-Y Growth (%) Projections by Industry Vertical, 2024 to 2034

Figure 97: Eastern Europe Market Attractiveness by Component, 2024 to 2034

Figure 98: Eastern Europe Market Attractiveness by Deployment Model, 2024 to 2034

Figure 99: Eastern Europe Market Attractiveness by Industry Vertical, 2024 to 2034

Figure 100: Eastern Europe Market Attractiveness by Country, 2024 to 2034

Figure 101: South Asia and Pacific Market Value (US$ Million) by Component, 2024 to 2034

Figure 102: South Asia and Pacific Market Value (US$ Million) by Deployment Model, 2024 to 2034

Figure 103: South Asia and Pacific Market Value (US$ Million) by Industry Vertical, 2024 to 2034

Figure 104: South Asia and Pacific Market Value (US$ Million) by Country, 2024 to 2034

Figure 105: South Asia and Pacific Market Value (US$ Million) Analysis by Country, 2019 to 2034

Figure 106: South Asia and Pacific Market Value Share (%) and BPS Analysis by Country, 2024 to 2034

Figure 107: South Asia and Pacific Market Y-o-Y Growth (%) Projections by Country, 2024 to 2034

Figure 108: South Asia and Pacific Market Value (US$ Million) Analysis by Component, 2019 to 2034

Figure 109: South Asia and Pacific Market Value Share (%) and BPS Analysis by Component, 2024 to 2034

Figure 110: South Asia and Pacific Market Y-o-Y Growth (%) Projections by Component, 2024 to 2034

Figure 111: South Asia and Pacific Market Value (US$ Million) Analysis by Deployment Model, 2019 to 2034

Figure 112: South Asia and Pacific Market Value Share (%) and BPS Analysis by Deployment Model, 2024 to 2034

Figure 113: South Asia and Pacific Market Y-o-Y Growth (%) Projections by Deployment Model, 2024 to 2034

Figure 114: South Asia and Pacific Market Value (US$ Million) Analysis by Industry Vertical, 2019 to 2034

Figure 115: South Asia and Pacific Market Value Share (%) and BPS Analysis by Industry Vertical, 2024 to 2034

Figure 116: South Asia and Pacific Market Y-o-Y Growth (%) Projections by Industry Vertical, 2024 to 2034

Figure 117: South Asia and Pacific Market Attractiveness by Component, 2024 to 2034

Figure 118: South Asia and Pacific Market Attractiveness by Deployment Model, 2024 to 2034

Figure 119: South Asia and Pacific Market Attractiveness by Industry Vertical, 2024 to 2034

Figure 120: South Asia and Pacific Market Attractiveness by Country, 2024 to 2034

Figure 121: East Asia Market Value (US$ Million) by Component, 2024 to 2034

Figure 122: East Asia Market Value (US$ Million) by Deployment Model, 2024 to 2034

Figure 123: East Asia Market Value (US$ Million) by Industry Vertical, 2024 to 2034

Figure 124: East Asia Market Value (US$ Million) by Country, 2024 to 2034

Figure 125: East Asia Market Value (US$ Million) Analysis by Country, 2019 to 2034

Figure 126: East Asia Market Value Share (%) and BPS Analysis by Country, 2024 to 2034

Figure 127: East Asia Market Y-o-Y Growth (%) Projections by Country, 2024 to 2034

Figure 128: East Asia Market Value (US$ Million) Analysis by Component, 2019 to 2034

Figure 129: East Asia Market Value Share (%) and BPS Analysis by Component, 2024 to 2034

Figure 130: East Asia Market Y-o-Y Growth (%) Projections by Component, 2024 to 2034

Figure 131: East Asia Market Value (US$ Million) Analysis by Deployment Model, 2019 to 2034

Figure 132: East Asia Market Value Share (%) and BPS Analysis by Deployment Model, 2024 to 2034

Figure 133: East Asia Market Y-o-Y Growth (%) Projections by Deployment Model, 2024 to 2034

Figure 134: East Asia Market Value (US$ Million) Analysis by Industry Vertical, 2019 to 2034

Figure 135: East Asia Market Value Share (%) and BPS Analysis by Industry Vertical, 2024 to 2034

Figure 136: East Asia Market Y-o-Y Growth (%) Projections by Industry Vertical, 2024 to 2034

Figure 137: East Asia Market Attractiveness by Component, 2024 to 2034

Figure 138: East Asia Market Attractiveness by Deployment Model, 2024 to 2034

Figure 139: East Asia Market Attractiveness by Industry Vertical, 2024 to 2034

Figure 140: East Asia Market Attractiveness by Country, 2024 to 2034

Figure 141: Middle East and Africa Market Value (US$ Million) by Component, 2024 to 2034

Figure 142: Middle East and Africa Market Value (US$ Million) by Deployment Model, 2024 to 2034

Figure 143: Middle East and Africa Market Value (US$ Million) by Industry Vertical, 2024 to 2034

Figure 144: Middle East and Africa Market Value (US$ Million) by Country, 2024 to 2034

Figure 145: Middle East and Africa Market Value (US$ Million) Analysis by Country, 2019 to 2034

Figure 146: Middle East and Africa Market Value Share (%) and BPS Analysis by Country, 2024 to 2034

Figure 147: Middle East and Africa Market Y-o-Y Growth (%) Projections by Country, 2024 to 2034

Figure 148: Middle East and Africa Market Value (US$ Million) Analysis by Component, 2019 to 2034

Figure 149: Middle East and Africa Market Value Share (%) and BPS Analysis by Component, 2024 to 2034

Figure 150: Middle East and Africa Market Y-o-Y Growth (%) Projections by Component, 2024 to 2034

Figure 151: Middle East and Africa Market Value (US$ Million) Analysis by Deployment Model, 2019 to 2034

Figure 152: Middle East and Africa Market Value Share (%) and BPS Analysis by Deployment Model, 2024 to 2034

Figure 153: Middle East and Africa Market Y-o-Y Growth (%) Projections by Deployment Model, 2024 to 2034

Figure 154: Middle East and Africa Market Value (US$ Million) Analysis by Industry Vertical, 2019 to 2034

Figure 155: Middle East and Africa Market Value Share (%) and BPS Analysis by Industry Vertical, 2024 to 2034

Figure 156: Middle East and Africa Market Y-o-Y Growth (%) Projections by Industry Vertical, 2024 to 2034

Figure 157: Middle East and Africa Market Attractiveness by Component, 2024 to 2034

Figure 158: Middle East and Africa Market Attractiveness by Deployment Model, 2024 to 2034

Figure 159: Middle East and Africa Market Attractiveness by Industry Vertical, 2024 to 2034

Figure 160: Middle East and Africa Market Attractiveness by Country, 2024 to 2034

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Salesforce Services Market Size and Share Forecast Outlook 2025 to 2035

Sales Analysis of Tourism Industry in the Middle East Size and Share Forecast Outlook 2025 to 2035

Sales Compensation Software Market Size and Share Forecast Outlook 2025 to 2035

Sales Performance Management (SPM) Software Market Size and Share Forecast Outlook 2025 to 2035

Sales Coaching Software Market Size and Share Forecast Outlook 2025 to 2035

Salesforce CRM Document Generation Software Market Size and Share Forecast Outlook 2025 to 2035

Sales Training and Onboarding Software Market Size and Share Forecast Outlook 2025 to 2035

Sales Intelligence Software Market Size and Share Forecast Outlook 2025 to 2035

Sales of Sports Nutrition Products in Latin America Analysis Size and Share Forecast Outlook 2025 to 2035

Sales of Plant‑based Ready Meals in US Analysis - Size, Share & Forecast 2025 to 2035

Sales Intelligence Market Size and Share Forecast Outlook 2025 to 2035

Sales of Used Bikes through Bike Marketplaces Market- Growth & Demand 2025 to 2035

Sales Platforms Software Market Size and Share Forecast Outlook 2025 to 2035

Retail Sales of Legume Snacks in the UK Analysis - Size, Share & Forecast 2025 to 2035

Retail Sales of Kvass in Russia and CIS countries Analysis - Size, Share & Forecast 2025 to 2035

Retail Sales of Layered Verrine‑Style Desserts in France Analysis - Size, Share & Forecast 2025 to 2035

US Convenience Confectionery Retail Sales Analysis - Size, Share & Forecast 2025 to 2035

Retail Sales of Bergamot from Calabria in Italy Analysis - Size, Share & Forecast 2025 to 2035

Generator Sales Market Size and Share Forecast Outlook 2025 to 2035

Demand and Sales Analysis of Paper Cup in Japan Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA