The decision intelligence market is expanding rapidly, driven by the convergence of artificial intelligence, analytics, and business intelligence technologies aimed at enhancing strategic decision-making. Organizations are leveraging decision intelligence solutions to convert large data volumes into actionable insights that improve operational efficiency and competitiveness.

The growing emphasis on real-time analytics and data-driven strategies across industries such as finance, healthcare, and retail has accelerated adoption. Cloud-based deployment models and AI-enabled decision platforms are providing scalability, integration, and predictive accuracy, supporting digital transformation initiatives.

As enterprises focus on reducing uncertainty and optimizing resource allocation, the market is expected to achieve strong growth momentum, reinforced by advancements in machine learning and automation.

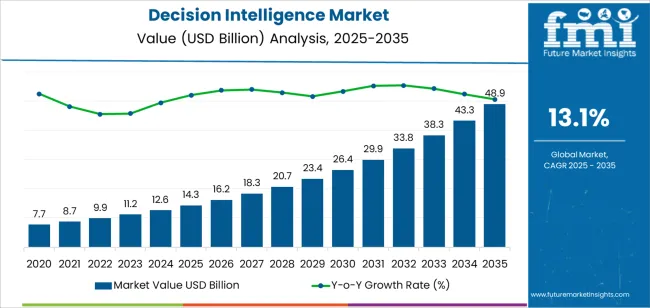

| Metric | Value |

|---|---|

| Decision Intelligence Market Estimated Value in (2025 E) | USD 14.3 billion |

| Decision Intelligence Market Forecast Value in (2035 F) | USD 48.9 billion |

| Forecast CAGR (2025 to 2035) | 13.1% |

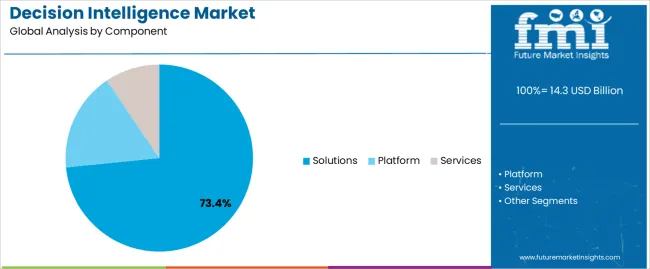

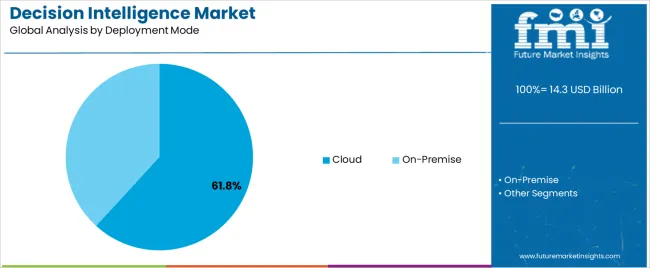

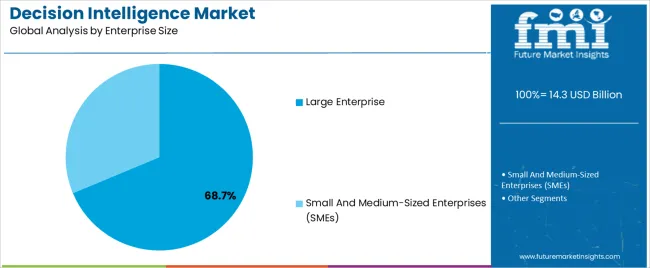

The market is segmented by Component, Deployment Mode, Enterprise Size, and Industry Vertical and region. By Component, the market is divided into Solutions, Platform, and Services. In terms of Deployment Mode, the market is classified into Cloud and On-Premise. Based on Enterprise Size, the market is segmented into Large Enterprise and Small And Medium-Sized Enterprises (SMEs). By Industry Vertical, the market is divided into IT And Telecom, BFSI, Government, Healthcare, Manufacturing, Retail And Consumer Goods, and Others. Regionally, the market is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The solutions segment leads the component category with approximately 73.4% share, driven by the growing need for integrated platforms that combine data modeling, visualization, and predictive analytics. Businesses are increasingly adopting comprehensive decision intelligence systems to streamline workflows and enhance situational awareness.

The segment benefits from the shift toward customized, domain-specific applications capable of supporting both strategic and operational decision-making. Continuous advancements in AI algorithms and cognitive analytics have improved the accuracy and adaptability of solutions.

With organizations prioritizing automation and intelligent forecasting, solution-based offerings are expected to dominate as the foundation of decision intelligence frameworks.

The cloud segment accounts for approximately 61.8% share of the deployment mode category, reflecting the industry’s shift toward scalable and cost-efficient data infrastructure. Cloud-based deployment offers real-time data access, reduced infrastructure costs, and improved collaboration across distributed teams.

The segment’s expansion is further supported by enterprises adopting hybrid and multi-cloud strategies to ensure flexibility and data security. Vendors are enhancing cloud-native platforms with AI-driven decision layers to support rapid deployment and continuous model optimization.

As data volumes continue to grow exponentially, cloud deployment will remain the preferred mode for decision intelligence systems, enabling agile and responsive business environments.

The large enterprise segment holds approximately 68.7% share within the enterprise size category, owing to the significant data complexity and decision-making requirements of large organizations. These enterprises are prioritizing decision intelligence systems to manage cross-functional processes, forecast trends, and optimize strategic initiatives.

The segment benefits from substantial budgets for digital transformation and advanced analytics deployment. Adoption is particularly strong in sectors such as banking, telecommunications, and manufacturing, where predictive insights deliver measurable performance advantages.

With increasing emphasis on data-driven corporate governance and risk management, large enterprises are expected to remain the primary users of decision intelligence technologies.

This section highlights the expected developments in the market while providing a detailed analysis of the sector over the last five years. The market grew at a 22.8% CAGR during the historical period. The market is predicted to develop at a constant rate of 18.1% CAGR until 2035.

| Historical CAGR | 22.8% |

|---|---|

| Forecasted CAGR | 18.1% |

The field of decision intelligence is restricted by low data quality, improper integration, and privacy concerns, which hinder its adoption. Crucial factors that are anticipated to restrict the demand for decision intelligence over the forecast period are:

Convergence of AI and BI Hit the Roof in the Decision Intelligence Sector

The convergence of artificial intelligence (AI) with business intelligence (BI) tools is anticipated to gain considerable traction and is being increasingly adopted by organizations of all sizes.

This amalgamation has bestowed many advantages on businesses, as the integration of AI with BI tools provides more profound insights and analyses, empowering decision-makers to make well-informed and precise decisions.

This, in turn, results in increased efficiency, profitability, and a competitive advantage for the business. The global decision intelligence market is anticipated to witness significant growth in the forthcoming decade as more companies embrace AI-powered BI solutions to stay ahead of the curve.

Expansion of Predictive Analytics Drives the Demand for Decision Intelligence

Predictive analytics models are being used by organizations progressively for scenario planning and forecasting to keep ahead of the fast-paced commercial landscape.

These predictive models help firms foresee risks, take advantage of opportunities, and make well-informed decisions through data analysis and machine learning algorithms.

Predictive analytics model sensation depends on creating a strict structure for the decision intelligence industry. This framework should include promising practices and procedures for gathering, processing, and analyzing data and plans to incorporate the knowledge from predictive analytics into regular business operations.

By putting the proper framework in place, organizations may use predictive analytics to enhance their decision-making skills and obtain a competitive advantage in the decision intelligence sector.

Rise of AI-driven Decision Making

Explainability is becoming increasingly necessary as AI-driven decision-making processes proliferate to maintain transparency and build consumer confidence. This has prompted the creation of decision intelligence, which offers more thorough justifications of AI-generated conclusions by fusing various artificial intelligence technologies with human analysis.

Because of the increased vulnerability, users are now able to assess and challenge the system's outputs and comprehend the reasoning behind the decisions. Decision intelligence is rising in importance because global marketplaces require more reliable and trustworthy decision-making procedures.

Comprehensive evaluations of certain decision intelligence market areas are provided in this section. The platform component segment and the on-premise deployment segment are the two primary foci of the research.

Through a thorough analysis, this section aims to offer readers a deeper understanding of these areas and their significance within the broader market.

| Attributes | Details |

|---|---|

| Top Component | Platform |

| CAGR from 2025 to 2035 | 17.8% |

The platform component segment is expected to dominate the decision intelligence market, exhibiting a significant CAGR of 17.8% from 2025 to 2035. However, it is noteworthy that the CAGR for the platform segment was 22.6% during the historical period. The development of platforms for decision intelligence can be attributed to several factors:

| Attributes | Details |

|---|---|

| Top Deployment Mode | On-premise |

| CAGR from 2025 to 2035 | 17.6% |

The on-premise deployment segment is expected to rise at a CAGR of 17.6% from 2025 to 2035. The following factors drive the development of the on-premise segment:

The United States, China, Japan, South Korea, and the United Kingdom are some of the most predominant nations flourishing in the decision intelligence sector.

| Countries | CAGR (2025 to 2035) |

|---|---|

| United States | 18.4% |

| United Kingdom | 19.3% |

| China | 19.1% |

| Japan | 18.9% |

| South Korea | 19.6% |

The decision intelligence sector in the United States is predicted to develop gradually at a CAGR of 18.4% until 2035. The sector is expected to achieve a value of USD 48.9 billion by 2035. The need for decision intelligence is being driven by the following factors, which drive the industry's growth:

The decision management systems sector in the United Kingdom is expected to grow substantially over the coming years at a CAGR of 19.3% until 2035. The market is projected to be valued at USD 2.6 billion, indicating a vast potential for growth and investment in this sector. Here are a few of the major trends:

The need for decision intelligence in China is expected to grow at a CAGR of 19.1% through 2035. The industry is likely to be valued at USD 10.6 billion by 2035. The primary trends are:

The demand for decision intelligence in Japan is soaring dramatically; the data-driven decision making industry is anticipated to grow at a CAGR of 18.9% through 2035. Among the main motivators are:

Decision intelligence is expected to expand rapidly in South Korea, with a potential CAGR of 19.6% through 2035. This market is likely to reach a valuation of USD 4.4 billion by 2035. The following are some of the main trends:

As organizations employ innovations and strategic efforts to reshape the way activities appear in the future, the global decision intelligence sector is undergoing an unprecedented shift.

Technological firms' research and development centers are at the forefront of developing innovative platforms, operational procedures, and technological improvements.

Technological advancements are expedited when industry participants, academic institutions, and governmental bodies collaborate to create a dynamic ecosystem.

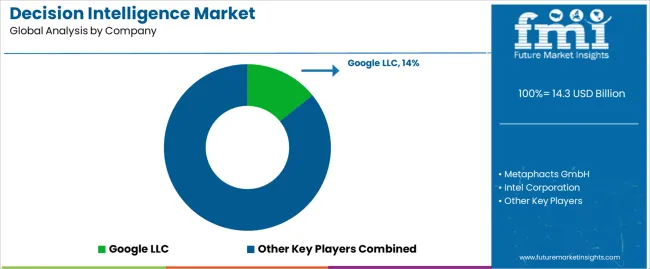

With their respective competence areas, Google, IBM Corp., and Intel drive the cognitive computing business. Google aggressively develops artificial intelligence (AI) for decision-making technologies, emphasizing scalability and efficiency gains.

Leading enterprise-wide business intelligence efforts, IBM specializes in creating intelligent technology for rapidly expanding business goals. Intel's expertise in decision management systems technology impacts software management advances, which is closely related to decision intelligence.

Their combined influence promotes creativity, effectiveness, and scalability in decision intelligence products. It is essential to developing the decision intelligence sector toward broad acceptance and the assembly of intelligent technology platforms.

These industry participants help to form the global decision intelligence market's general outlook for the upcoming ten years by encouraging innovation, market expansion, and technological advancements.

Recent Developments in the Decision Intelligence Industry

The global decision intelligence market is estimated to be valued at USD 14.3 billion in 2025.

The market size for the decision intelligence market is projected to reach USD 48.9 billion by 2035.

The decision intelligence market is expected to grow at a 13.1% CAGR between 2025 and 2035.

The key product types in decision intelligence market are solutions, platform and services.

In terms of deployment mode, cloud segment to command 61.8% share in the decision intelligence market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Decision Management Applications Market Size and Share Forecast Outlook 2025 to 2035

Clinical Decision Support Systems Market Size and Share Forecast Outlook 2025 to 2035

Clinical Decision Support App Market – AI-Powered Insights 2034

General Intelligent Decision-Making Service Market Size and Share Forecast Outlook 2025 to 2035

Intelligence Surveillance Reconnaissance (ISR) Market Size and Share Forecast Outlook 2025 to 2035

Lead Intelligence Software Market Size and Share Forecast Outlook 2025 to 2035

Sales Intelligence Software Market Size and Share Forecast Outlook 2025 to 2035

Sales Intelligence Market Size and Share Forecast Outlook 2025 to 2035

Energy Intelligence Solution Market - Growth & Forecast 2025 to 2035

Threat Intelligence Market Trends – Growth & Forecast 2024-2034

Signals Intelligence (SIGINT) Market Size and Share Forecast Outlook 2025 to 2035

Content Intelligence – AI-Powered Insights for Marketers

Business Intelligence Market Size and Share Forecast Outlook 2025 to 2035

Location Intelligence Market Size and Share Forecast Outlook 2025 to 2035

Audience Intelligence Platform Market – Insights & Trends 2034

Embedded Intelligence Market Growth – Trends & Industry Forecast 2023-2033

Artificial Intelligence (chipset) Market Forecast and Outlook 2025 to 2035

Artificial Intelligence in Construction Market Size and Share Forecast Outlook 2025 to 2035

Artificial Intelligence in Telecommunication Market Size and Share Forecast Outlook 2025 to 2035

Artificial Intelligence in Retail Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA