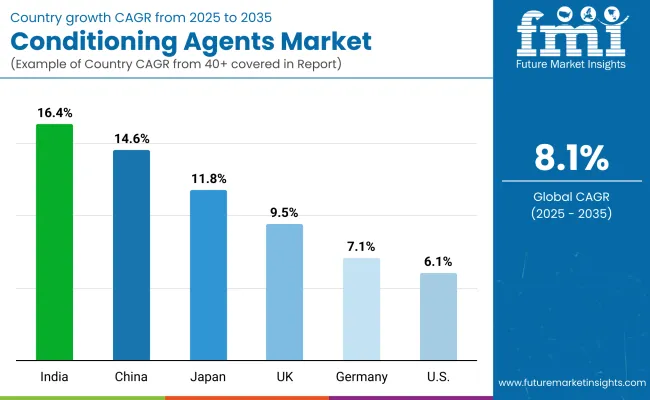

The Conditioning Agents Market is expected to record a valuation of USD 4,403.6 million in 2025 and USD 9,602.4 million in 2035, with an increase of USD 5,198.8 million, which equals a growth of 118% over the decade. The overall expansion represents a CAGR of 8.1% and a 2.2X increase in market size.

Conditioning Agents Market Key Takeaways

| Metric | Value |

|---|---|

| Conditioning Agents Market Estimated Value in (2025E) | USD 4,403.6 million |

| Conditioning Agents Market Forecast Value in (2035F) | USD 9,602.4 million |

| Forecast CAGR (2025 to 2035) | 8.1% |

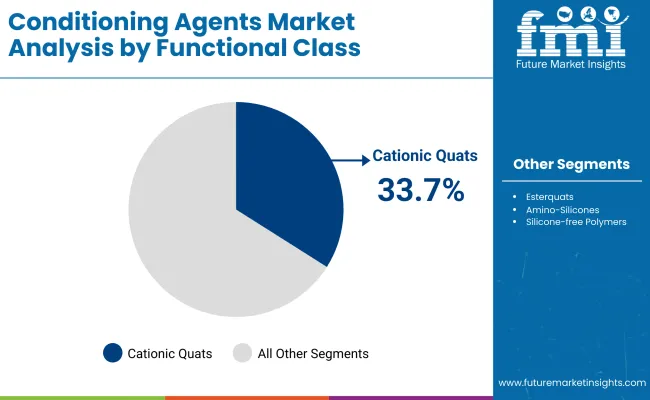

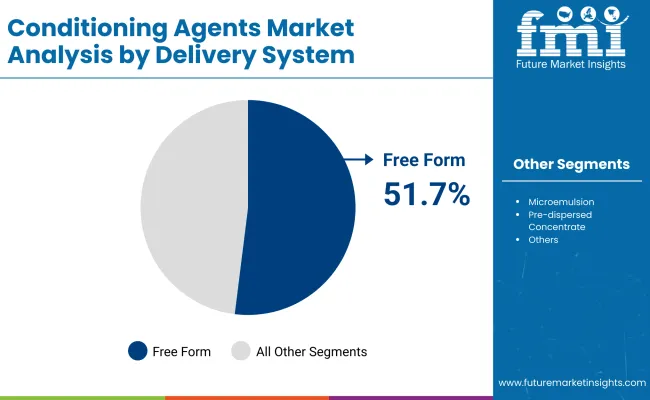

During the first five-year period from 2025 to 2030, the market increases from USD 4,403.6 million to USD 6,015.0 million, adding USD 1,611.4 million, which accounts for 31% of the total decade growth. This phase records steady adoption in haircare and skincare formulations, driven by demand for cationic quats and free-form delivery systems, which dominate with 33.7% and 51.7% market shares in 2025, respectively.

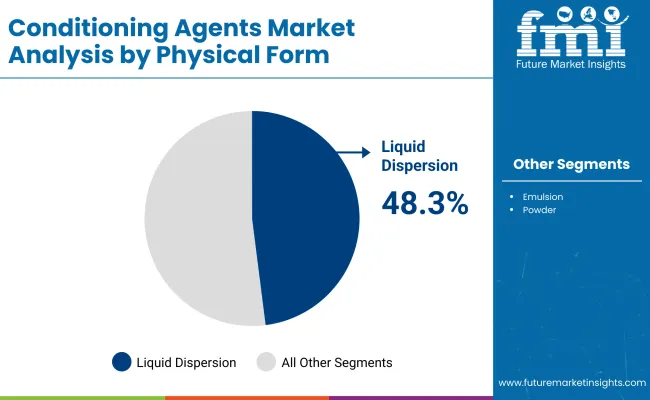

The second half from 2030 to 2035 contributes USD 3,587.4 million, equal to 69% of total growth, as the market jumps from USD 6,015.0 million to USD 9,602.4 million. This acceleration is powered by widespread adoption of amino-silicones, silicone-free polymers, and multifunctional esters across men’s grooming and professional salon applications. Liquid dispersions continue to account for the largest physical form segment, while Asia-Pacificespecially China and Indiadrives double-digit CAGRs of 14.6% and 16.4%, respectively, pushing regional dominance. Leading suppliers such as Evonik, Croda, and BASF capture significant value through innovation in bio-based conditioning systems and sustainable formulations.

From 2020 to 2024, the Conditioning Agents Market grew steadily, driven by demand for haircare and skincare formulations that relied heavily on cationic quats, esterquats, and amino-silicones. During this period, the competitive landscape was dominated by chemical manufacturers controlling nearly all revenue, with leaders such as BASF, Evonik, and Croda focusing on formulation efficiency, conditioning performance, and stability across rinse-off and leave-in conditioners.

Competitive differentiation relied on conditioning efficacy, safety, and compatibility with diverse formulations, while sustainability was still an emerging theme. Service-based or digital models had minimal traction, contributing less than 5% of the total market value.

Demand for Conditioning Agents will expand to USD 4,403.6 million in 2025, and the revenue mix will shift as bio-based and silicone-free polymers grow to capture a higher share. Traditional chemical leaders face rising competition from specialty ingredient innovators offering clean-label, vegan-certified, and multifunctional conditioning systems. Major incumbents are pivoting to sustainable portfolios, green chemistry processes, and biodegradable conditioning systems to retain relevance.

Emerging entrants specializing in natural conditioning actives, AR/VR-enabled product testing, and AI-driven formulation design are gaining share. The competitive advantage is moving away from commodity-based conditioning agents alone to portfolio breadth, sustainability credentials, and ecosystem-driven innovation.

The Conditioning Agents Market is growing as consumer preference for advanced haircare, skincare, and men’s grooming products accelerates. Conditioning agents such as cationic quats and amino-silicones are integral to enhancing texture, detangling, and providing moisture retention. Expanding middle-class populations in Asia-Pacific, particularly in China and India, are fueling higher consumption of shampoos, conditioners, and lotions, while premium formulations are gaining share in mature markets like the USA and Europe.

Growth is also driven by the industry’s pivot to sustainable, silicone-free, and bio-based conditioning polymers that align with clean-label and eco-friendly trends. Consumers increasingly seek multifunctional productssuch as 2-in-1 shampoos and skin conditioning lotionsthat deliver both performance and sustainability. This shift is prompting companies like Evonik, BASF, and Croda to innovate in green chemistry, biodegradable actives, and renewable feedstock-based agents, creating new revenue opportunities and strengthening adoption across both mass-market and professional salon channels.

The Conditioning Agents Market is segmented by functional class, delivery system, physical form, application, end use, and geography. By functional class, the market includes cationic quats, esterquats, amino-silicones, silicone-free polymers, and betaines & amphoterics, reflecting the diverse chemistries used to deliver conditioning performance.

Delivery system segmentation covers free form, microemulsion, and pre-dispersed concentrates, catering to different formulation requirements. Based on physical form, the market spans liquid dispersions, emulsions, and powders, supporting varied end-product applications.

In terms of application, the categories include rinse-off conditioners, leave-in conditioners, 2-in-1 shampoos, and skin conditioning lotions. End-use segmentation highlights adoption across haircare, skincare, men’s grooming, and professional salon products, underpinned by evolving consumer preferences for multifunctional and sustainable solutions.

Regionally, the scope extends across North America, Europe, East Asia, South Asia & Pacific, Latin America, and the Middle East & Africa, with high-growth opportunities particularly in China, India, and Japan, where double-digit CAGRs are driving the global expansion.

| Functional Class | Value Share % 2025 |

|---|---|

| Cationic quats | 33.7% |

| Others | 66.3% |

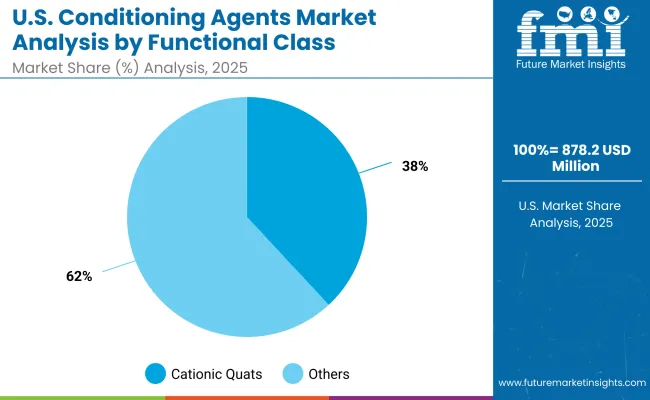

The cationic quats segment is projected to contribute 33.7% of the Conditioning Agents Market revenue in 2025, maintaining its lead as the dominant functional class. This is driven by their strong conditioning performance, compatibility with rinse-off and leave-in formulations, and cost-effectiveness in large-scale haircare products. Demand is also supported by their proven efficacy in detangling, smoothing, and reducing static, making them a staple in mainstream and premium product lines.

The segment’s growth is further supported by ongoing innovation in esterquat derivatives that improve biodegradability and reduce environmental impact. As clean-label and eco-friendly preferences rise, formulators are adapting cationic quats into hybrid systems with silicone-free and bio-based polymers to enhance sustainability without sacrificing performance. This positions cationic quats as the backbone of conditioning agent formulations globally, while other classes such as amino-silicones and betaines gain traction in niche and premium applications.

| Physical Form | Value Share % 2025 |

|---|---|

| Liquid dispersion | 48.3% |

| Others | 51.7% |

The liquid dispersion segment is forecasted to hold 48.3% of the Conditioning Agents Market share in 2025, led by its widespread use in haircare and skincare formulations. Liquid dispersions are favored for their ease of blending with emulsions, shampoos, and conditioners, as well as their superior delivery of conditioning benefits such as detangling, softness, and smooth feel. This makes them the preferred choice for both rinse-off and leave-in applications.

Their stability and compatibility with multiple conditioning activesincluding cationic quats, esterquats, and betaineshave facilitated widespread adoption across personal care product manufacturing. The segment’s growth is bolstered by innovation in bio-based dispersions that improve biodegradability while maintaining performance. As consumer demand for sustainable and multifunctional products rises, liquid dispersion conditioning agents are expected to continue dominating the market, particularly in mass-market and professional salon segments.

| Delivery System | Value Share % 2025 |

|---|---|

| Free form | 51.7% |

| Others | 48.3% |

The free form delivery system is projected to account for 51.7% of the Conditioning Agents Market revenue in 2025, establishing it as the leading segment. Free form conditioning agents are preferred by formulators for their versatility, ease of incorporation into diverse product bases, and ability to deliver consistent performance across shampoos, conditioners, and skincare formulations.

Their suitability for a wide range of applications, from rinse-off to leave-in products, has made them especially popular in mainstream haircare. Recent developments in bio-based and silicone-free free forms have enhanced sustainability credentials while maintaining conditioning efficacy, improving consumer acceptance. Given their balance of performance, cost-effectiveness, and formulation flexibility, free form delivery systems are expected to maintain their leading role in the Conditioning Agents Market.

Expanding demand in personal care and grooming

The Conditioning Agents Market is experiencing strong growth as consumer spending on haircare, skincare, and men’s grooming accelerates globally. Rising awareness about personal appearance, coupled with the increasing influence of social media and beauty standards, is fueling demand for conditioners, serums, and multifunctional products.

Conditioning agents such as cationic quats and esterquats remain essential in delivering softness, shine, and manageability, especially in shampoos and leave-in products. This widespread adoption across both premium and mass-market categories ensures steady volume expansion, making personal care the most significant growth driver.

Shift toward sustainable and bio-based formulationsSustainability is a major driver in the Conditioning Agents Market, as consumers and regulators push for silicone-free, biodegradable, and bio-based conditioning systems. Leading companies like Evonik, BASF, and Croda are actively investing in green chemistry, plant-derived actives, and renewable feedstock to align with clean-label and eco-friendly product trends.

This shift has opened opportunities for innovative polymers and hybrid conditioning systems that balance environmental impact with performance. The move toward sustainability is not only boosting consumer acceptance but also strengthening brand equity for manufacturers who can deliver ethical and high-performing conditioning agents.

Regulatory and safety compliance challengesDespite the growth potential, the Conditioning Agents Market faces challenges related toregulatory scrutiny and safety compliance. Concerns about toxicity, skin sensitivity, and environmental impact of traditional conditioning agentsespecially quaternary ammonium compounds and siliconesare leading to stricter global regulations.

The need for extensive testing, certification, and compliance with regional standards increases costs and slows down product launches. Furthermore, consumer skepticism toward synthetic ingredients forces companies to reformulate at higher expenses. These compliance barriers create complexity in global supply chains, potentially restraining the pace of adoption for conventional conditioning agents.

Rising adoption of multifunctional and hybrid productsA key trend shaping the Conditioning Agents Market is the surge in demand for multifunctional and hybrid products that combine conditioning with added benefits such as anti-frizz, UV protection, or scalp care. Consumers, especially in Asia-Pacific and Europe, are increasingly drawn to products that save time while delivering holistic results.

This trend is driving the growth of 2-in-1 shampoos, leave-in sprays, and skincare lotions enriched with advanced conditioning polymers. Brands are responding with hybrid formulations that integrate bio-based actives, silicone alternatives, and smart delivery systems, reflecting the industry’s pivot toward innovation-led product development.

| Country | Estimated CAGR (2025 to 2035) |

|---|---|

| China | 14.6% |

| USA | 6.1% |

| India | 16.4% |

| UK | 9.5% |

| Germany | 7.1% |

| Japan | 11.8% |

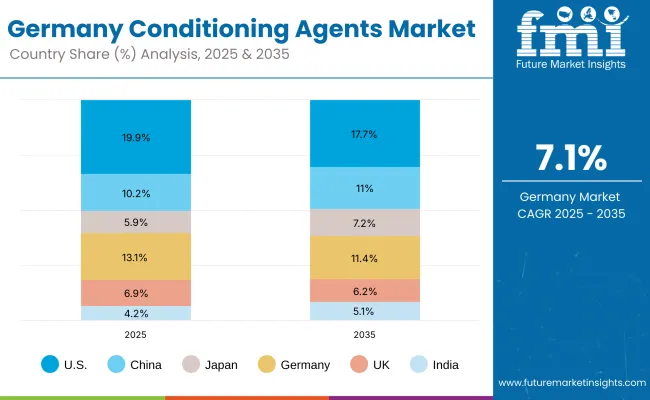

The global Conditioning Agents Market shows a pronounced regional disparity in adoption speed, strongly influenced by consumer grooming habits, premiumization trends, and sustainability mandates.

Asia-Pacific emerges as the fastest-growing region, anchored by India at 16.4% CAGR and China at 14.6% CAGR. Growth is driven by large, youthful populations, rising disposable incomes, and expanding penetration of haircare and skincare products. India’s trajectory reflects rising demand for men’s grooming and professional salon products, while China is experiencing strong adoption of silicone-free and multifunctional conditioning systems supported by clean beauty and regulatory frameworks encouraging natural formulations.

Europe maintains a strong growth profile, led by the UK at 9.5% CAGR and Germany at 7.1% CAGR, supported by stringent cosmetic safety standards and a consumer shift toward vegan and bio-based conditioners. The region benefits from advanced formulation R&D hubs and significant demand for sustainable, premium personal care brands.

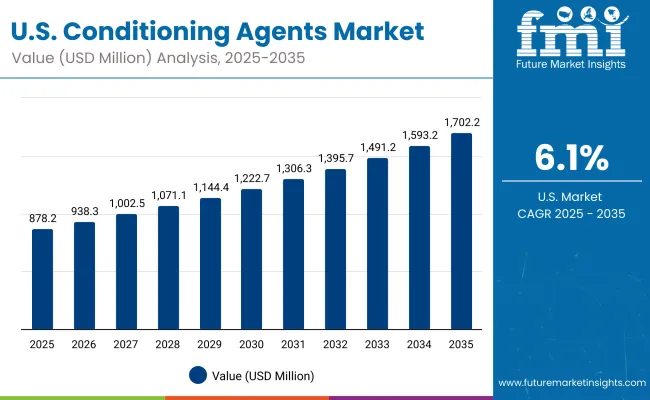

North America shows moderate expansion, with the USA at 6.1% CAGR, reflecting maturity in core haircare categories. Growth is driven by the premiumization of skincare and leave-in conditioners, as well as the rising influence of multicultural beauty markets. Japan grows at a robust 11.8% CAGR, supported by dermocosmetic innovation, multifunctional hybrid products, and consumer preference for premium hair-smoothing formulations. Its advanced R&D ecosystem further strengthens market expansion across East Asia.

| Year | USA Conditioning Agents Market (USD Million) |

|---|---|

| 2025 | 878.24 |

| 2026 | 938.33 |

| 2027 | 1002.53 |

| 2028 | 1071.12 |

| 2029 | 1144.41 |

| 2030 | 1222.71 |

| 2031 | 1306.36 |

| 2032 | 1395.75 |

| 2033 | 1491.24 |

| 2034 | 1593.27 |

| 2035 | 1702.28 |

The Conditioning Agents Market in the United States is projected to grow at a CAGR of 6.1% from 2025 to 2035, driven by rising demand across haircare, skincare, and men’s grooming segments. Growth is underpinned by strong consumer preference for premium leave-in conditioners and multifunctional 2-in-1 shampoos, supported by innovation in bio-based and silicone-free polymers. Professional salon adoption is increasing as stylist-driven brands integrate amino-silicones and esterquats for advanced smoothening and shine effects. Skincare applications, particularly conditioning lotions, are also gaining momentum as part of hybrid beauty trends.

The Conditioning Agents Market in the United Kingdom is expected to grow at a CAGR of 9.5% from 2025 to 2035, supported by rising demand in haircare, skincare, and men’s grooming applications. Consumers are increasingly shifting toward vegan, silicone-free, and bio-based conditioning agents, aligning with the region’s strong clean beauty and sustainability trends.

Premium haircare brands and professional salon chains are leading adopters of advanced formulations, particularly in leave-in conditioners and 2-in-1 shampoos. Skincare product launches with multifunctional conditioning benefits are also gaining traction, supported by innovation in hybrid cosmetic formulations.

India is witnessing rapid growth in the Conditioning Agents Market, which is forecast to expand at a CAGR of 16.4% through 2035. A sharp increase in adoption is being driven by rising disposable incomes, expansion of modern retail, and growing awareness in tier-2 and tier-3 cities. Haircare remains the dominant segment, with strong demand for rinse-off conditioners and 2-in-1 shampoos, while men’s grooming and professional salon services are expanding rapidly. Local and international brands are also introducing affordable, multifunctional, and silicone-free formulations to cater to price-sensitive but quality-conscious consumers.

The Conditioning Agents Market in China is expected to grow at a CAGR of 14.6%, the highest among leading economies. This momentum is driven by the country’s large consumer base, growing middle-class population, and strong demand for premium and multifunctional haircare and skincare products. Domestic and international brands are expanding portfolios with silicone-free, bio-based, and multifunctional conditioning agents, aligning with the government’s push for clean and sustainable beauty. E-commerce platforms are accelerating product penetration, while local innovation is fostering competitive pricing and wider availability across urban and tier-2 cities.

| Country | 2025 Share (%) |

|---|---|

| USA | 19.9% |

| China | 10.2% |

| Japan | 5.9% |

| Germany | 13.1% |

| UK | 6.9% |

| India | 4.2% |

| Country | 2035 Share (%) |

|---|---|

| USA | 17.7% |

| China | 11.0% |

| Japan | 7.2% |

| Germany | 11.4% |

| UK | 6.2% |

| India | 5.1% |

The Conditioning Agents Market in Germany is projected to grow at a CAGR of 7.1%, underpinned by its leadership in premium haircare, skincare innovation, and sustainability-driven cosmetics manufacturing. German consumers show high affinity for vegan, silicone-free, and bio-based formulations, pushing brands to accelerate R&D in esterquats, betaines, and amino-silicone alternatives.

Professional salon adoption is also strong, with advanced formulations tailored to anti-frizz, shine, and scalp-care benefits. Compliance with stringent EU cosmetic safety standards and increasing consumer scrutiny of ingredient sourcing further influence product development. Germany remains a hub for green chemistry innovation, supplying both domestic and export markets.

| USA By Functional Class | Value Share % 2025 |

|---|---|

| Cationic quats | 38.1% |

| Others | 61.9% |

The Conditioning Agents Market in the United States is projected at USD 878.2 million in 2025, expanding steadily at a CAGR of 6.1% through 2035. Cationic quats dominate with 38.1% share, reflecting their widespread use in rinse-off conditioners and 2-in-1 shampoos. However, market value is gradually transitioning toward bio-based and silicone-free polymers, supported by clean-label trends and consumer preference for sustainable products.

Growth is catalyzed by rising demand for leave-in conditioners, men’s grooming lines, and professional salon applications, where advanced esterquats and amino-silicones provide premium performance. Regulatory compliance with USA FDA cosmetic standards and increasing multicultural beauty demand further shape innovation in formulations. The USA market is also seeing strong adoption of hybrid conditioning systems combining moisturizing, anti-frizz, and scalp-care functions.

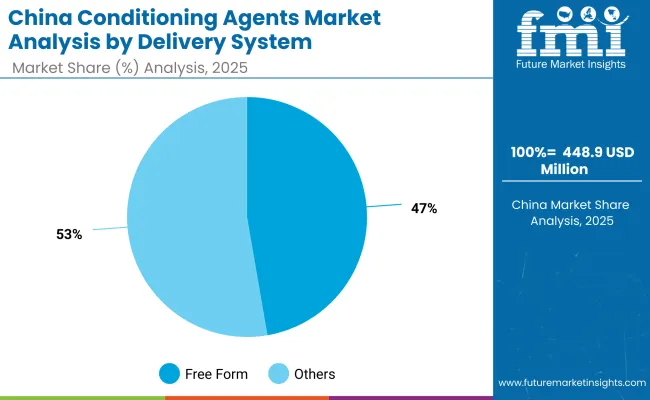

| China By Delivery System | Value Share % 2025 |

|---|---|

| Free form | 47.3% |

| Others | 52.7% |

The Conditioning Agents Market in China is valued at USD 448.9 million in 2025, with the free form delivery system accounting for 47.3% share. The dominance of this segment stems from its versatility in mass-market shampoos, conditioners, and skincare formulations, which continue to see strong adoption in China’s expanding urban middle class. Affordable free-form formulations enable manufacturers to scale production efficiently while catering to growing demand in tier-2 and tier-3 cities.

This advantage positions free-form delivery systems as essential in addressing China’s fast-moving consumer goods sector, where cost-effectiveness, adaptability, and scalability are critical. Emulsion and pre-dispersed formats are gradually gaining share in premium segments, especially in men’s grooming and high-end salon treatments. As e-commerce platforms accelerate distribution and consumer preference shifts toward eco-friendly, multifunctional, and clean-label products, the free form system will continue to drive growth opportunities for both local and international players.

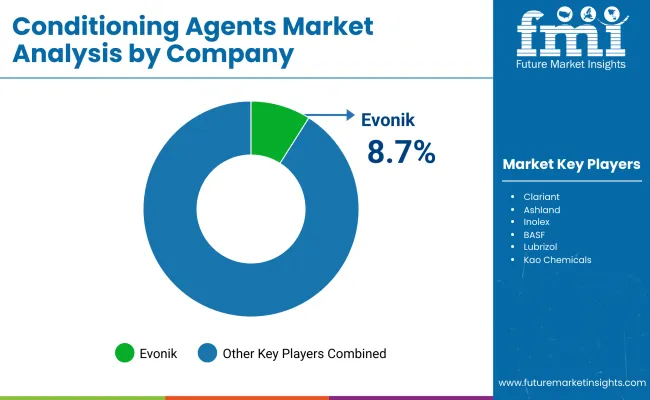

| Company | Global Value Share 2025 |

|---|---|

| Evonik | 8.7% |

| Others | 91.3% |

The Conditioning Agents Market is moderately fragmented, with global chemical leaders, specialty ingredient suppliers, and niche-focused innovators competing across diverse application areas. Global leaders such as Evonik, Croda, BASF, and Lubrizol hold significant market share, driven by broad conditioning agent portfolios including cationic quats, esterquats, and amino-silicones. Their strategies emphasize sustainability, bio-based innovations, and multifunctional conditioning systems for haircare and skincare.

Established mid-sized players, including Solvay, Clariant, and Ashland, focus on silicone-free polymers, betaines, and amphoteric conditioning agents, catering to clean-label and eco-conscious product formulations. These companies are accelerating adoption through value-added blends, biodegradable actives, and partnerships with beauty brands, making them highly relevant for premium and mass-market personal care applications.

Specialized providers such as Inolex and Kao Chemicals differentiate by offering application-specific solutions in men’s grooming, professional salon products, and hybrid skincare-haircare categories. Their strength lies in customization, innovation in niche formulations, and regional adaptability rather than global scale.

Competitive differentiation is shifting away from commodity-based ingredients toward integrated portfolios that highlight sustainability credentials, multifunctional performance, and regulatory compliance. Players with strong R&D pipelines in bio-based conditioning agents and green chemistry are expected to gain long-term advantage.

Key Developments in Conditioning Agents Market

| Item | Value |

|---|---|

| Quantitative Units | USD 4,403.6 Million |

| Functional Class | Cationic quats , Esterquats , Amino-silicones, Silicone-free polymers, Betaines & amphoterics |

| Delivery System | Free form, Microemulsion , Pre-dispersed concentrate, Others |

| Physical Form | Liquid dispersion, Emulsion, Powder |

| Application | Rinse-off conditioners, Leave-in conditioners, 2-in-1 shampoos, Skin conditioning lotions |

| End Use | Haircare, Skincare, Men’s grooming, Professional salon |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | Evonik , Croda , BASF, Lubrizol, Dow, Solvay, Clariant , Ashland, Inolex , Kao Chemicals |

| Additional Attributes | Dollar sales by functional class and end-use application, adoption trends in rinse-off and leave-in conditioners, rising demand for silicone-free and bio-based polymers, sector-specific growth in haircare, skincare, men’s grooming, and professional salons, revenue segmentation by delivery system (free form, emulsions, dispersions), integration with clean-label and vegan-certified formulations, regional trends influenced by sustainability initiatives, and innovations in esterquats , amino-silicones, and multifunctional hybrid conditioning agents. |

The global Conditioning Agents Market is estimated to be valued at USD 4,403.6 million in 2025.

The market size for the Conditioning Agents Market is projected to reach USD 9,602.4 million by 2035.

The Conditioning Agents Market is expected to grow at a 8.1% CAGR between 2025 and 2035.

The key Functional Class types in the Conditioning Agents Market are cationic quats, esterquats, amino-silicones, silicone-free polymers, and betaines & amphoterics.

In terms of delivery system, the free form segment is projected to command the largest share at 51.7% in 2025, driven by its versatility and wide use in mass-market haircare and skincare formulations.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Conditioning Hair Treatments Market Analysis - Size and Share Forecast Outlook 2025 to 2035

Air Conditioning Compressor Market Size and Share Forecast Outlook 2025 to 2035

Air Conditioning System Market Size and Share Forecast Outlook 2025 to 2035

Power Conditioning Services Market Trends - Growth & Forecast 2025 to 2035

Signal Conditioning Modules Market Size and Share Forecast Outlook 2025 to 2035

Solar Air Conditioning System Market Insights – Size, Share & Industry Trends 2025-2035

Railway Air Conditioning System Market Size and Share Forecast Outlook 2025 to 2035

Aircraft air conditioning units Market Size and Share Forecast Outlook 2025 to 2035

Nonwoven Air Conditioning Filter Market Size and Share Forecast Outlook 2025 to 2035

Water Surface Conditioning Equipment Market Size and Share Forecast Outlook 2025 to 2035

Refrigeration and Air Conditioning Compressors Market Size and Share Forecast Outlook 2025 to 2035

Key Players & Market Share in Refrigeration and Air Conditioning Compressors

Matting Agents Market Size and Share Forecast Outlook 2025 to 2035

Healing Agents Market (Skin Repair & Soothing Actives) Market Size and Share Forecast Outlook 2025 to 2035

Foaming Agents Market Size and Share Forecast Outlook 2025 to 2035

Firming Agents Botox-Like Market Size and Share Forecast Outlook 2025 to 2035

Heating Agents Market Size and Share Forecast Outlook 2025 to 2035

Cooling Agents Market Size and Share Forecast Outlook 2025 to 2035

Firming Agents Market Growth – Product Innovations & Applications from 2025 to 2035

Raising Agents Market Trends – Growth & Industry Forecast 2024 to 2034

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA