The Air Conditioning System Market is estimated to be valued at USD 138.0 billion in 2025 and is projected to reach USD 251.8 billion by 2035, registering a compound annual growth rate (CAGR) of 6.2% over the forecast period.

| Metric | Value |

|---|---|

| Air Conditioning System Market Estimated Value in (2025 E) | USD 138.0 billion |

| Air Conditioning System Market Forecast Value in (2035 F) | USD 251.8 billion |

| Forecast CAGR (2025 to 2035) | 6.2% |

The air conditioning system market is experiencing steady growth driven by the rising demand for energy-efficient cooling solutions across residential, commercial, and industrial sectors. Increasing global temperatures, urbanization, and higher disposable incomes are contributing to widespread adoption of advanced air conditioning systems. Technological advancements, including the development of automatic and smart control systems, are enhancing energy efficiency, user convenience, and system reliability.

Growing investments in residential and commercial building infrastructure, combined with government initiatives to promote energy-saving appliances, are supporting market expansion. The integration of environmentally friendly refrigerants and compliance with energy regulations is further shaping market dynamics. Rising awareness among consumers about energy savings, indoor air quality, and smart home integration is influencing purchasing decisions.

As demand for comfortable and efficient living spaces continues to grow, the air conditioning system market is expected to witness sustained expansion Manufacturers are increasingly focusing on innovation, modularity, and customization to cater to diverse applications and technological preferences, creating opportunities for long-term market growth.

The air conditioning system market is segmented by type, technology, application, and geographic regions. By type, air conditioning system market is divided into Residential, Industrial, Commercial, and Automotive. In terms of technology, air conditioning system market is classified into Automatic, Manual, and Semi-automatic. Based on application, air conditioning system market is segmented into Split Air, Room Air, Packaged Air, Mini Split Air, Ductless Air, Terminal Air, Central Air, Portable Air, and Packaged Central Air. Regionally, the air conditioning system industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The residential segment is projected to hold 29.6% of the air conditioning system market revenue share in 2025, establishing itself as the leading type. This segment is being driven by the growing adoption of air conditioning systems in individual homes, apartments, and urban residential complexes. Rising disposable income, increasing construction of residential properties, and consumer preference for comfortable indoor environments are key factors supporting this growth.

Energy efficiency and affordability are critical considerations, with many homeowners opting for systems that reduce operational costs while providing reliable cooling performance. The segment benefits from the availability of a variety of air conditioning solutions that are tailored for residential use, including split, window, and portable units.

In addition, the growing penetration of smart and connected home technologies has encouraged the integration of automatic controls, sensors, and remote monitoring, enhancing user convenience As urbanization continues and climate conditions drive the need for indoor climate management, the residential segment is expected to maintain its leadership position in the global air conditioning market.

The automatic technology segment is anticipated to account for 52.3% of the air conditioning system market revenue share in 2025, making it the leading technology category. This leadership is being reinforced by the convenience and efficiency offered by systems capable of adjusting temperature, airflow, and operation modes without manual intervention. Automatic systems reduce energy consumption and enhance comfort by optimizing performance based on room conditions, occupancy, and external climate factors.

Their integration with smart thermostats and IoT-enabled home devices has further increased adoption, allowing users to monitor and control systems remotely. Regulatory incentives promoting energy-efficient appliances have encouraged consumers to choose automatic systems over conventional manual systems.

The segment’s growth is also supported by widespread awareness of sustainability and the financial benefits of reduced energy bills As consumers increasingly prioritize comfort, efficiency, and advanced functionality in cooling solutions, the automatic technology segment is expected to continue dominating the market through 2025 and beyond.

The split air segment is projected to hold 28.2% of the air conditioning system market revenue share in 2025, establishing it as the leading application category. Its dominance is being driven by the system’s ability to provide efficient and flexible cooling for individual rooms or zones, making it suitable for both residential and small commercial spaces. Split air systems are favored for their quiet operation, easy installation, and precise temperature control.

The segment benefits from growing urbanization and increasing demand for retrofitting in existing structures, where split systems offer a practical solution without major renovations. Rising awareness of energy efficiency, coupled with technological improvements such as inverter-based compressors and automatic control functions, has further supported adoption.

Split air systems provide the advantage of modular installation, allowing consumers to choose units based on room size and cooling requirements As demand for comfortable indoor environments continues to increase, the split air segment is expected to maintain its leading position in terms of revenue share in the global air conditioning system market.

The air conditioning system market size is estimated at USD 129.9 billion by 2025. The market value is expected to reach USD 237.1 billion, with a steady CAGR of 6.2%.

Technological advancements have made modern air conditioning system more efficient and attractive to businesses. Innovations in industrial consumption of air conditioning system such as smart controls, improved refrigerants, and energy-saving designs help companies reduce costs and improve sustainability. These advancements drive the adoption of new system.Health and comfort are crucial considerations for businesses. Employees perform better in well-cooled environments, and customers are more likely to stay longer in comfortable spaces. The proper use of air conditioning improves air quality, benefiting health and enhancing the overall experience for both employees and customers.

Regulatory requirements also play a role in the increasing demand. Governments are imposing stricter energy efficiency standards, and businesses need to comply. Modern commercial air conditioning system are designed to meet these standards, making them a necessary investment for companies looking to stay compliant.

Smart thermostats and IoT (Internet of Things) connectivity are increasingly integrated into air conditioning system. These technologies allow users to remotely control and monitor their HVAC system via smartphones or other devices, optimizing energy use and enhancing user comfort.

There is growing awareness of the importance of indoor air quality (IAQ). Air conditioning system now often include features such as advanced filtration system, UV lights to kill pathogens, and humidity control options to improve IAQ and support respiratory health.

VRF system are gaining popularity, especially in commercial buildings and large residential complexes. VRF technology allows for simultaneous heating and cooling in different zones, providing greater flexibility, energy efficiency, and individualized comfort control.

There is a shift towards environmentally friendly refrigerants with lower Global Warming Potential (GWP) compared to traditional refrigerants like R-410A. Examples include R-32 and R-290 (propane), which have better environmental profiles and comply with international regulations.

Modular air conditioning system are becoming more prevalent, particularly in commercial applications. These system allow for easier installation, maintenance, and scalability, accommodating changes in building layouts or usage without major disruptions.

Manufacturers are focusing on reducing operational noise levels of air conditioning units, especially for residential applications. Quieter operation enhances user comfort and reduces disturbances, making air conditioning system more appealing to consumers.

Hybrid system that combine traditional HVAC technologies with renewable energy sources (e.g., solar panels or geothermal heat pumps) are emerging. These system offer energy savings and environmental benefits while ensuring reliable indoor comfort.

Advanced control algorithms are being implemented to optimize HVAC system performance based on real-time data and predictive analytics. These technologies anticipate changes in weather, occupancy patterns, and building usage to maximize efficiency and comfort.

The United States experiences a robust demand for air conditioning system due to its diverse climate zones, where many regions face extremely hot summers. This necessitates effective cooling solutions in both residential and commercial buildings.

The industry is characterized by a high rate of system replacements as older units are phased out in favor of more energy-efficient and technologically advanced models.

Innovations in smart home technology, allowing users to control their air conditioning system remotely, have also contributed to the rising demand. Consumers increasingly prioritize energy efficiency and cost savings, which drives the market toward advanced, eco-friendly solutions.

Office buildings, retail spaces, and industrial facilities require robust and reliable HVAC solutions to maintain optimal working conditions and protect equipment.

Government regulations and incentives promoting energy efficiency further stimulate market growth. The United States market also sees significant activity in the development of sustainable and renewable energy-powered air conditioning system, reflecting broader trends towards environmental responsibility and sustainability.

Modernization of infrastructure in the United Kingdom has increased demand for air conditioning. As new buildings are constructed and older ones are retrofitted, there is a growing emphasis on incorporating advanced HVAC system that offer both heating and cooling capabilities.

This dual functionality is particularly appealing in a climate that requires both types of temperature control throughout the year. Awareness of climate change and its potential impact on future weather patterns encourages both the public and private sectors to invest in reliable air conditioning solutions.

The United Kingdom government has also played a role in shaping the air conditioning market through building regulations and environmental policies.

Efforts to reduce carbon footprints and improve energy efficiency are reflected in the push for air conditioning system that comply with stringent standards. Incentives and subsidies for energy-efficient technologies further encourage businesses and homeowners to upgrade or install new system.

As public awareness of climate change and sustainability grows, there is a noticeable shift towards choosing air conditioning solutions that offer minimal environmental impact while providing effective temperature control.

The increasing affordability of air conditioning units makes them accessible to a broader segment of the population. In large cities, high-rise apartment buildings and modern housing complexes often come with built-in air conditioning, reflecting the growing standardization of these system in urban planning.

Rising living standards and the growing middle-class fuel the demand for modern air conditioning units. Government policies promoting energy efficiency and the reduction of carbon emissions are pivotal in shaping market trends and encouraging the adoption of advanced, environmentally friendly technologies.

The Chinese market is also characterized by a high rate of technological adoption, with consumers and businesses increasingly preferring smart air conditioning system that offer remote control and automation features. This shift is part of a broader trend towards smart home and smart city initiatives.

The construction of new urban centers and the retrofitting of existing infrastructure provide substantial opportunities for the HVAC industry. China's manufacturing capacity enables the production of a wide range of air conditioning system, from basic units to highly advanced models, catering to diverse consumer needs and preferences.

Automatic technologies enable air conditioning system to operate more efficiently. Smart thermostats and sensors adjust the cooling output based on real-time occupancy and ambient conditions. This reduces energy wastage and lowers utility bills, making these system attractive to both residential and commercial customers who are keen to reduce operational costs.

Automatic technologies facilitate the integration of air conditioning system with other smart home or building management system. This creates a cohesive environment where the AC system works in tandem with lighting, security, and other utilities.

Such integration enhances overall efficiency and user experience, making these system an essential part of modern smart homes and buildings.

Urbanization is on the rise, leading to the construction of more buildings, including offices, malls, hotels, and hospitals. As these structures go up, the need for reliable air conditioning grows, making it an essential component of modern urban development.

With temperatures rising and summers becoming hotter, businesses require efficient cooling system to maintain comfortable environments. In many places, air conditioning is no longer a luxury but a necessity for maintaining productivity and comfort.

Projects like airports, convention centers, and public buildings require large-scale cooling solutions, driving demand for commercial system. Similarly, renovations and upgrades of old buildings lead to the replacement of outdated, less efficient models with modern air conditioning system.

Energy efficiency concerns are prompting businesses to seek ways to cut expenses. As energy costs rise, energy-efficient AC system become an attractive investment. Businesses are increasingly aware of the importance of indoor environmental quality, leading them to invest in advanced air conditioning system to ensure a pleasant and healthy indoor atmosphere.

Commercial air conditioning system are thus becoming indispensable in modern commercial spaces. They address the needs of expanding urban centers, adapt to changing climates, support economic growth, and adhere to evolving regulations, all while ensuring comfort, health, and efficiency.

Key players in the air conditioning system industry are collaborating with tech companies to develop integrated smart home solutions. Forming joint ventures with local companies in emerging markets to leverage local expertise and distribution networks. Partnering with research institutions and universities to drive innovation and stay ahead of regulatory changes and market demands.

| Country | CAGR |

|---|---|

| China | 8.4% |

| India | 7.8% |

| Germany | 7.1% |

| France | 6.5% |

| UK | 5.9% |

| USA | 5.3% |

| Brazil | 4.7% |

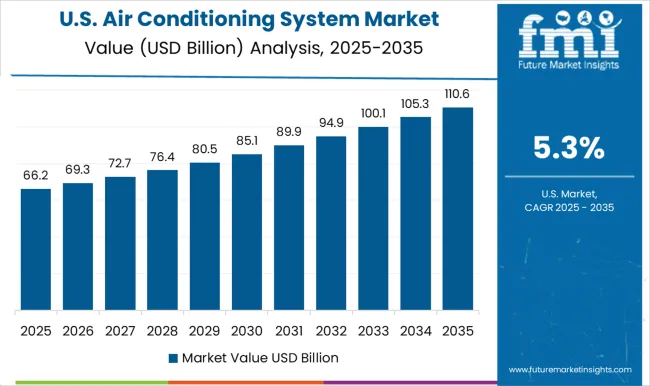

The Air Conditioning System Market is expected to register a CAGR of 6.2% during the forecast period, exhibiting varied country level momentum. China leads with the highest CAGR of 8.4%, followed by India at 7.8%. Developed markets such as Germany, France, and the UK continue to expand steadily, while the USA is likely to grow at consistent rates. Brazil posts the lowest CAGR at 4.7%, yet still underscores a broadly positive trajectory for the global Air Conditioning System Market. In 2024, Germany held a dominant revenue in the Western Europe market and is expected to grow with a CAGR of 7.1%. The USA Air Conditioning System Market is estimated to be valued at USD 48.4 billion in 2025 and is anticipated to reach a valuation of USD 80.8 billion by 2035. Sales are projected to rise at a CAGR of 5.3% over the forecast period between 2025 and 2035. While Japan and South Korea markets are estimated to be valued at USD 6.6 billion and USD 4.7 billion respectively in 2025.

| Item | Value |

|---|---|

| Quantitative Units | USD 138.0 Billion |

| Type | Residential, Industrial, Commercial, and Automotive |

| Technology | Automatic, Manual, and Semi-automatic |

| Application | Split Air, Room Air, Packaged Air, Mini Split Air, Ductless Air, Terminal Air, Central Air, Portable Air, and Packaged Central Air |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | DAIKIN INDUSTRIES, Ltd., Carrier., Haier Group, Johnson Controls - Hitachi Air Conditioning Company, Lennox International Inc., LG Electronics., Midea., Mitsubishi Electric India Pvt. Ltd., Panasonic Corporation, Samsung Electronics Co. Ltd., ALFA LAVAL, Electrolux, Trane Technologies plc, Whirlpool, and Voltas, Inc. |

The global air conditioning system market is estimated to be valued at USD 138.0 billion in 2025.

The market size for the air conditioning system market is projected to reach USD 251.8 billion by 2035.

The air conditioning system market is expected to grow at a 6.2% CAGR between 2025 and 2035.

The key product types in air conditioning system market are residential, industrial, commercial and automotive.

In terms of technology, automatic segment to command 52.3% share in the air conditioning system market in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Solar Air Conditioning System Market Insights – Size, Share & Industry Trends 2025-2035

Railway Air Conditioning System Market Size and Share Forecast Outlook 2025 to 2035

Air Fryer Paper Liners Market Size and Share Forecast Outlook 2025 to 2035

Air Struts Market Size and Share Forecast Outlook 2025 to 2035

Airborne Molecular Contamination Control Services Market Forecast and Outlook 2025 to 2035

Airflow Balancer Market Size and Share Forecast Outlook 2025 to 2035

Aircraft Cabin Environment Sensor Market Forecast and Outlook 2025 to 2035

Airborne Radar Market Size and Share Forecast Outlook 2025 to 2035

Aircraft Electric Motor Market Forecast Outlook 2025 to 2035

Airport Ground Transportation Market Forecast and Outlook 2025 to 2035

Airless Sprayer Accessories Market Size and Share Forecast Outlook 2025 to 2035

Air Purge Valve Market Size and Share Forecast Outlook 2025 to 2035

Air Flow Sensors Market Size and Share Forecast Outlook 2025 to 2035

Air Separation Plant Market Size and Share Forecast Outlook 2025 to 2035

Air Cooled Turbo Generators Market Size and Share Forecast Outlook 2025 to 2035

Aircraft Cooling Turbines Market Size and Share Forecast Outlook 2025 to 2035

Air Measuring Equipment Market Size and Share Forecast Outlook 2025 to 2035

Aircraft Hose Fittings Market Size and Share Forecast Outlook 2025 to 2035

Aircraft Cabin Interior Market Size and Share Forecast Outlook 2025 to 2035

Aircraft Interior Lighting Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA