The Automotive Lightweight Materials Market is estimated to be valued at USD 296.7 billion in 2025 and is projected to reach USD 652.5 billion by 2035, registering a compound annual growth rate (CAGR) of 8.2% over the forecast period. The automotive lightweight materials market is projected to experience consistent growth from USD 200.1 billion in 2024 to approximately USD 652.5 billion by 2039, reflecting a remarkable increase of USD 452.4 billion over the 16-year period and a compound annual growth rate (CAGR) of about 7.9%.

During the initial phase from 2024 to 2029, the market value rises steadily from USD 200.1 billion to USD 321.0 billion, accounting for roughly 27% of the total anticipated growth. This early expansion is driven by escalating demand for fuel-efficient vehicles, stringent emissions regulations across major automotive markets, and increasing adoption of lightweight composites and alloys aimed at reducing vehicle weight without compromising safety.

Technological advancements in materials science and manufacturing processes further facilitate the integration of these lightweight materials in conventional and electric vehicles. Between 2030 and 2034, market growth accelerates from USD 347.3 billion to USD 515.1 billion, supported by increased investments in electric vehicle production, growing consumer preference for sustainable mobility, and enhanced performance requirements for structural components.

| Metric | Value |

|---|---|

| Automotive Lightweight Materials Market Estimated Value in (2025 E) | USD 296.7 billion |

| Automotive Lightweight Materials Market Forecast Value in (2035 F) | USD 652.5 billion |

| Forecast CAGR (2025 to 2035) | 8.2% |

The automotive lightweight materials market is experiencing significant transformation as automakers intensify their shift toward fuel efficiency, electrification, and sustainability. The increasing focus on reducing vehicle emissions has compelled manufacturers to invest in lightweight solutions that do not compromise structural integrity or passenger safety. This transition is being shaped by the tightening of global fuel economy standards and carbon emission mandates, especially across North America, Europe, and Asia.

Lightweight materials have gained traction as they enable reduced vehicle mass, improved acceleration, extended electric vehicle range, and enhanced crash performance. Advanced materials are now being integrated into traditional internal combustion engines as well as next-generation electric and hybrid vehicle platforms.

Collaborations between OEMs and material science innovators are strengthening the development of scalable lightweighting strategies, supported by continuous improvements in joining technologies and formability. As OEMs face rising pressure to meet corporate average fuel economy targets and battery performance expectations, the market for lightweight materials is expected to expand consistently over the next decade.

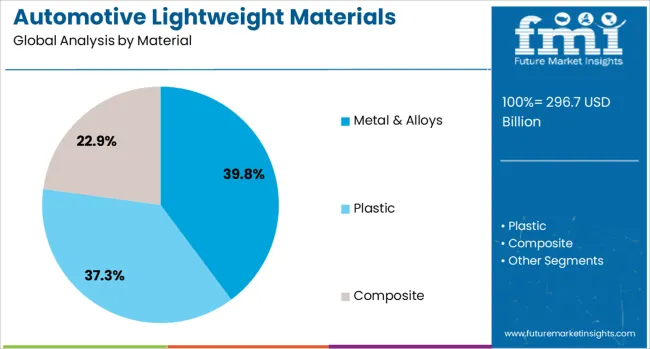

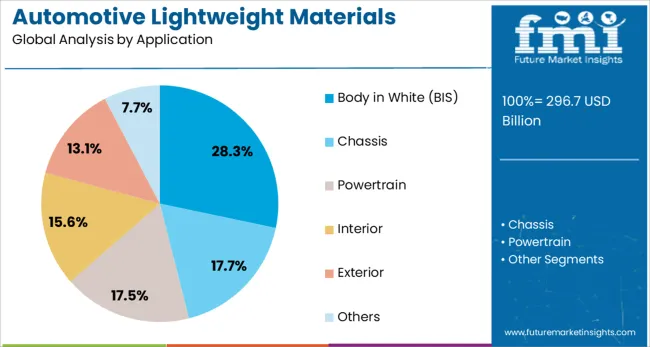

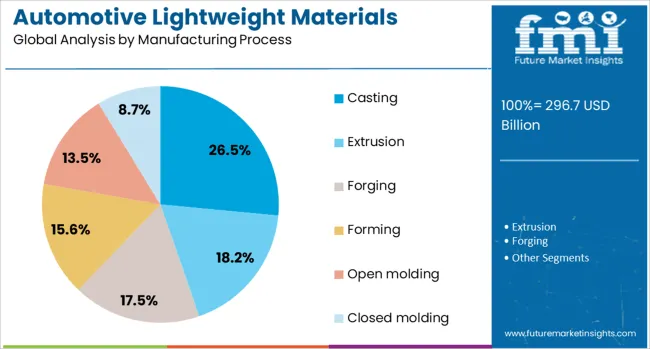

The automotive lightweight materials market is segmented by material, application, manufacturing process, vehicle, and geographic region. By material, the automotive lightweight materials market is divided into metal and alloys, and plastic and composites. In terms of application, the automotive lightweight materials market is classified into Body in White (BIS), Chassis, Powertrain, Interior, Exterior, and Others. Based on manufacturing process, the automotive lightweight materials market is segmented into Casting, Extrusion, Forging, Forming, Open molding, and closed molding.

By vehicle, the automotive lightweight materials market is segmented into Internal Combustion Engine Vehicle (ICEV), BEVHEV. Regionally, the automotive lightweight materials industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

Metal and alloys are projected to account for 39.8% of the total revenue share in the automotive lightweight materials market in 2025, maintaining their lead among all material types. This growth has been driven by the structural versatility and mechanical strength offered by lightweight metals such as aluminum and magnesium alloys, which are increasingly replacing traditional steel in automotive frames and components.

The cost-effectiveness of high-strength alloys, along with their established manufacturing infrastructure and recyclability, has facilitated widespread adoption. Moreover, the compatibility of these metals with existing production lines and their support for forming complex geometries under high stress conditions have contributed to their dominance.

In both internal combustion engines and electric vehicles, these materials have been preferred due to their thermal performance and crash resistance. Their ability to be adapted to lightweight multi-material architectures while maintaining crashworthiness and stiffness has further established them as a cornerstone of lightweighting strategies in the automotive sector.

Body in white applications are expected to represent 28.3% of the automotive lightweight materials market revenue share in 2025, emerging as the leading application area. The prominence of this segment is a result of manufacturers' efforts to reduce vehicle mass at the earliest stage of the production lifecycle. Structural weight reduction at the body in white stage significantly improves fuel economy, acceleration, and emissions, making it a priority focus for OEMs.

The integration of lightweight materials into body shells, pillars, roof rails, and subframes has become increasingly common due to advancements in hot stamping, adhesive bonding, and laser welding. These processes enable precise assembly of multi-material combinations while maintaining high safety standards.

Additionally, growing adoption of electric vehicles has increased the demand for optimized body structures that compensate for the added weight of batteries. The application of lightweight solutions in the body in white stage is expected to continue expanding, supported by innovation in joining technologies and high-strength material formulations.

Casting is forecast to hold 26.5% of the total market share in the manufacturing process segment of automotive lightweight materials by 2025, positioning it as a key contributor to material adoption. This growth has been fueled by the ability of casting to produce complex, near-net-shape components with reduced machining requirements, enhancing material utilization and production efficiency.

Lightweight metals such as aluminum and magnesium are widely employed in casting to manufacture engine blocks, transmission cases, and structural mounts, especially in mass production environments. The scalability of casting, along with its adaptability to high-pressure and low-pressure techniques, has reinforced its application in both conventional and electric vehicle architectures.

Furthermore, continuous development in precision casting methods and die life extension technologies has made it possible to meet the strict tolerances and quality benchmarks required by OEMs. The rising demand for high-performance lightweight components in powertrain and chassis systems is expected to sustain the growth of casting in this market.

Automotive lightweight materials are central to meeting performance, efficiency, and emissions goals. EV growth, process improvements, and OEM–supplier collaborations are driving adoption despite cost and supply chain challenges.

The automotive lightweight materials market is experiencing growth as automakers seek to improve fuel economy and reduce emissions without sacrificing performance. Lightweight materials such as aluminum, magnesium, and high-strength steel are replacing traditional steel in body structures, chassis components, and closures. This substitution helps reduce overall vehicle mass, leading to better acceleration, braking, and fuel efficiency. Consumer demand for vehicles with lower operating costs and compliance with global fuel standards are reinforcing this shift. OEMs are adopting multi-material strategies, combining metals, composites, and polymers to achieve optimal weight reduction. This trend is evident across passenger cars, SUVs, and commercial vehicles, making lightweight materials a vital component in modern automotive manufacturing.

Electric vehicle production is significantly influencing the demand for lightweight materials, as reducing weight directly improves driving range and energy efficiency. Automakers are incorporating carbon fiber composites, aluminum alloys, and engineered plastics into EV platforms for battery enclosures, frames, and body panels. Weight savings contribute to better battery performance and reduce the need for larger, heavier power packs. With more EV models entering the market, suppliers are expanding material portfolios to meet diverse OEM requirements. The shift toward electric mobility is accelerating investments in forming and joining techniques suited for lightweight materials, ensuring structural integrity and crash performance without compromising design flexibility.

The development of improved forming, molding, and bonding methods is enabling broader use of lightweight materials in mass production. Processes such as hot stamping, resin transfer molding, and laser welding allow precise shaping and joining of aluminum, magnesium, and composite components. These advancements enhance material strength, corrosion resistance, and surface finish, making them more viable for exterior and load-bearing applications. Integration of mixed materials in a single structure requires sophisticated engineering to manage thermal expansion and structural compatibility. Tier suppliers are collaborating closely with OEMs to develop modular designs that can be adapted across multiple vehicle platforms, reducing manufacturing complexity and cost.

While the benefits of lightweight materials are clear, high production costs, specialized equipment needs, and supply chain constraints remain challenges. Advanced materials such as carbon fiber and certain high-strength alloys are still expensive to source and process, impacting vehicle pricing. Fluctuating raw material prices and limited supplier capacity can also affect production schedules. OEMs are addressing these issues through long-term supplier agreements, recycling initiatives, and localized production facilities to reduce lead times. Collaboration between manufacturers and material producers is focused on optimizing yield, reducing waste, and improving scalability. Overcoming these barriers will be crucial to expanding lightweight material use beyond premium and high-performance segments.

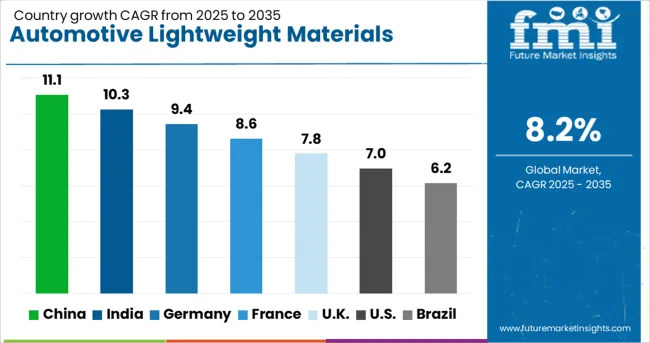

| Country | CAGR |

|---|---|

| China | 11.1% |

| India | 10.3% |

| Germany | 9.4% |

| France | 8.6% |

| UK | 7.8% |

| USA | 7.0% |

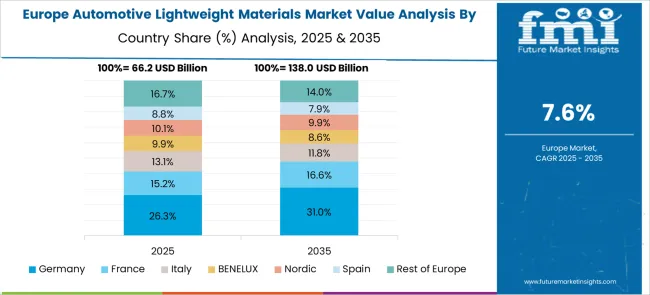

| Brazil | 6.2% |

The automotive lightweight materials market is projected to grow globally at a CAGR of 8.2% between 2025 and 2035, supported by rising demand for fuel efficiency, improved vehicle handling, and compliance with stringent emission standards. China leads with a CAGR of 11.1%, driven by large-scale automotive production, rapid EV adoption, and strong investment in aluminum, magnesium, and composite manufacturing. India follows at 10.3%, fueled by expanding vehicle manufacturing, export growth, and localization of lightweight material supply chains. France records 8.6%, supported by its premium and performance vehicle segments alongside active R&D in advanced composites. The United Kingdom grows at 7.8%, benefiting from lightweight component integration in luxury, sports, and electric models. The United States posts 7.0%, with demand influenced by high pickup and SUV production and weight-reduction initiatives in electric and hybrid platforms. The analysis underscores Asia-Pacific’s dominance in scaling lightweight material adoption, while Europe and North America continue to focus on premium vehicle innovation, high-performance applications, and supply chain optimization.

China is forecasted to achieve a CAGR of 11.1% during 2025–2035, rising from approximately 9.6% in 2020–2024, maintaining its lead above the global 8.2% average. This growth increase stems from rapid expansion in electric vehicle production, where aluminum, magnesium alloys, and composites are prioritized to extend driving range and improve performance. Government mandates on fuel economy and emissions are accelerating OEM adoption of lightweight body structures, battery enclosures, and chassis components. Tier suppliers are scaling up advanced forming and joining technologies to meet demand across mass-market and premium segments. Strong integration between material producers and automakers supports cost optimization and shortens product development cycles.

India is projected to post a CAGR of 10.3% during 2025–2035, up from about 8.9% in 2020–2024, reflecting robust demand supported by rising vehicle exports, growing SUV production, and regulatory pressure for fuel efficiency. Localization of lightweight material manufacturing, including aluminum sheet rolling and high-strength steel processing, is reducing import dependency and improving affordability. Export-oriented automotive platforms are increasingly using lightweight designs to meet overseas market standards. OEM investment in forming and molding capabilities enables higher integration of composite and polymer-based parts. Shared mobility fleets and commercial vehicle operators are also adopting lightweight solutions to improve operational efficiency and payload capacity.

France is expected to record a CAGR of 8.6% during 2025–2035, rising from an estimated 7.5% in 2020–2024, aided by the country’s strong premium and performance automotive segment. Demand is driven by the use of carbon fiber composites, aluminum extrusions, and advanced polymers in high-value models. Lightweighting initiatives are closely tied to European Union emissions regulations, prompting faster adoption in both ICE and EV platforms. Domestic R&D efforts are refining hybrid material solutions to balance weight reduction with crash safety performance. Tier suppliers are diversifying their offerings to serve both domestic production and export-focused OEMs. This positions France as a competitive hub for lightweight innovation in Europe.

The United Kingdom is projected to post a CAGR of 7.8% during 2025–2035, up from roughly 6.6% in 2020–2024, reflecting recovery in premium vehicle manufacturing and increased investment in lightweight engineering. The earlier period saw slower adoption due to reduced model launches and supply chain disruptions affecting advanced material sourcing. The rise in CAGR is supported by renewed demand for luxury, sports, and EV platforms that incorporate aluminum-intensive bodies and composite panels. Motorsport technology transfer is boosting structural design efficiency and weight savings. Tier suppliers are enhancing capacity for small-batch, high-precision components suited to the UK’s niche automotive segments.

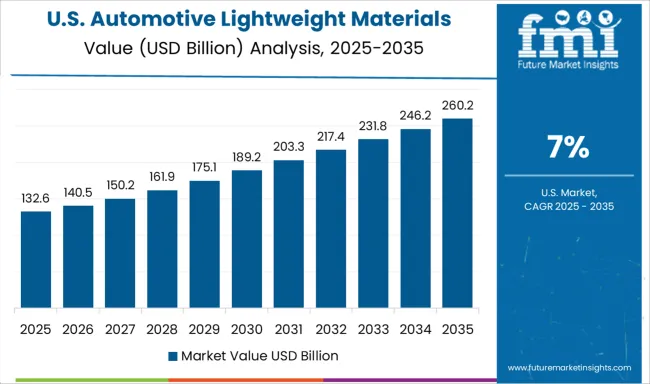

The United States is forecasted to post a CAGR of 7.0% during 2025–2035, improving from about 6.1% in 2020–2024, driven by weight-reduction initiatives in pickups, SUVs, and EVs. OEMs are expanding aluminum and high-strength steel usage in frames, closures, and chassis to improve fuel economy and meet emissions targets. Growth in EV manufacturing is prompting adoption of composite battery enclosures and lightweight suspension components. The aftermarket segment also sees rising demand for performance-oriented weight reduction kits. Regional suppliers are investing in automation and digital inspection systems to increase production consistency while lowering costs for high-volume applications.

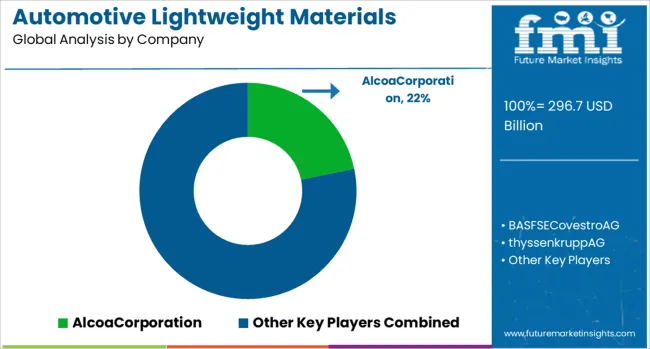

Alcoa Corporation, BASF SE, Covestro AG, thyssenkrupp AG, LyondellBasell, and ArcelorMittal dominate through the provision of high-strength aluminum alloys, engineered plastics, composite solutions, advanced steels, and lightweight polymers. Historical strategies have focused on R&D for enhanced material properties, development of hybrid and multi-material components, and establishing strong OEM partnerships to secure design-in approvals. Regional expansion into Asia-Pacific, North America, and Europe has been prioritized to support automaker localization and meet rising EV production demands.

Differentiation levers include superior strength-to-weight ratios, corrosion resistance, formability, thermal and chemical stability, and recyclability. Market challenges revolve around scaling advanced materials for mass production, managing high raw material costs, and aligning product offerings with diverse OEM specifications while meeting regulatory emissions and safety standards. Forecast strategies indicate continued investment in multi-material integration, cost optimization for large-scale EV adoption, and development of circular material solutions to enhance sustainability credentials. Emerging opportunities lie in lightweight solutions tailored for electric and autonomous vehicles, where weight reduction directly influences energy efficiency and battery range. Companies demonstrating agility in R&D, localized manufacturing, and innovative material solutions are positioned to capture long-term growth in the global automotive lightweight materials segment.

| Item | Value |

|---|---|

| Quantitative Units | USD 296.7 Billion |

| Material | Metal & Alloys, Plastic, and Composite |

| Application | Body in White (BIS), Chassis, Powertrain, Interior, Exterior, and Others |

| Manufacturing Process | Casting, Extrusion, Forging, Forming, Open molding, and Closed molding |

| Vehicle | Internal Combustion Engine Vehicle (ICEV), BEV, and HEV |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | AlcoaCorporation, BASFSECovestroAG, thyssenkruppAG, LyondellBasell, and ArcelorMittal |

| Additional Attributes | Dollar sales, share by material type and application, regional adoption trends, OEM procurement strategies, competitive benchmarking, pricing analysis, EV lightweighting demand, and growth opportunities in multi-material integration. |

The global automotive lightweight materials market is estimated to be valued at USD 296.7 billion in 2025.

The market size for the automotive lightweight materials market is projected to reach USD 652.5 billion by 2035.

The automotive lightweight materials market is expected to grow at a 8.2% CAGR between 2025 and 2035.

The key product types in automotive lightweight materials market are metal & alloys, _high strength steel, _aluminum, _magnesium, plastic, _polypropylene, _polyurethane, _polyvinyl chloride, _abs, _polycarbonate, composite, _glass fiber composite and _carbon fiber composite.

In terms of application, body in white (bis) segment to command 28.3% share in the automotive lightweight materials market in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Lightweight Automotive Body Panels Market Size and Share Forecast Outlook 2025 to 2035

Automotive NVH Materials Market Size and Share Forecast Outlook 2025 to 2035

Advanced Automotive Materials Market Growth - Trends & Forecast 2025 to 2035

Automotive Soft Trim Interior Materials Market Growth - Trends & Forecast 2025 to 2035

Aerospace Lightweight Materials Market 2025 to 2035

Industry Analysis of Automotive Lightweight Body Panel in the United States Size and Share Forecast Outlook 2025 to 2035

Automotive Direct Liquid Cooling IGBT Module Market Size and Share Forecast Outlook 2025 to 2035

Automotive Hoses and Assemblies Market Size and Share Forecast Outlook 2025 to 2035

Automotive Network Testing Market Size and Share Forecast Outlook 2025 to 2035

Automotive Performance Part Market Size and Share Forecast Outlook 2025 to 2035

Automotive Carbon Ceramic Brake Market Size and Share Forecast Outlook 2025 to 2035

Automotive Camshaft Market Size and Share Forecast Outlook 2025 to 2035

Automotive Stamping Industry Analysis in India Size and Share Forecast Outlook 2025 to 2035

Automotive Cylinder Liner Market Size and Share Forecast Outlook 2025 to 2035

Automotive Microcontroller Market Size and Share Forecast Outlook 2025 to 2035

Automotive Roof Rails Market Size and Share Forecast Outlook 2025 to 2035

Automotive Active Safety System Market Size and Share Forecast Outlook 2025 to 2035

Automotive Diagnostic Scan Tool Market Size and Share Forecast Outlook 2025 to 2035

Automotive Test Equipment Market Size and Share Forecast Outlook 2025 to 2035

Automotive Dynamic Map Data Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA