The Latin America food testing services market is expected to reach USD 2,400.9 million by 2025, growing to USD 5,251.0 million by 2035, with a compound annual growth rate (CAGR) of 8.1% for next decade.

| Attributes | Value |

|---|---|

| Estimated Latin America Industry Size (2025E) | USD 2,400.9 million |

| Projected Latin America Value (2035F) | USD 5,251.0 million |

| Value-based CAGR (2025 to 2035) | 8.1% |

The industry will experience growth during the period from 2025 to 2035, driven by growing consumer awareness about food safety, transparency, and compliance. Latin America's rapid urbanization and growth are mandating demand for quality food products. The obligatory testing services, which are ensuring food safety, quality, and compliance across the supply chain, are gaining priority.

Additionally, growing knowledge about food-borne diseases, potential food contamination threats, and health and organic foods is propelling the demand for sophisticated food testing solutions. Activities in this direction have also been facilitated by improvements in technology in the form of quick tests and automated lab procedures, furthering efficiency and accuracy.

It offers the possibility of extending the applications of food testing from soft drink testing to meat testing in order to cater to both domestic and international markets.

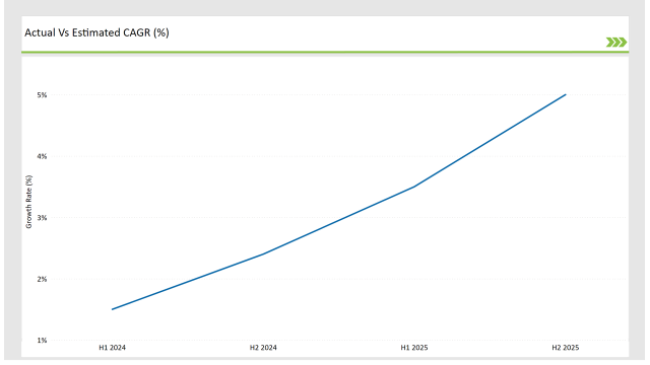

The following table shows a detailed comparison assessment for the foregone six months' changes in CAGR from the base year 2024 and the current year 2025 concerning Latin American food testing services.

This semi-annual edition maps critical changes in the market dynamics while also directing revenue realization patterns, thus furnishing the stakeholders with a much-needed sharpened outlook on the year growth trajectory. H1 stands for January to June, while H2 stands for July to December.

| Particular | Value CAGR |

|---|---|

| H1 (2024 to 2034) | 1.5% |

| H2 (2024 to 2034) | 2.4% |

| H1 (2025 to 2035) | 3.5% |

| H2 (2025 to 2035) | 5.0% |

H1 signifies period from January to June, H2 Signifies period from July to December

The industry is predicted to grow at a CAGR of 1.5% during the first half of 2024, with an increase to 2.4% in the second half in same year. In 2025, growth rate is anticipated to slightly decrease to 3.5% in H1 but is expected to rise to 5.0% in H2.

| Date | Development/M&A Activity & Details |

|---|---|

| 2024 | SGS Brazil received ISO 17025 and AOAC International accreditation for its newly established laboratory, placing its fast and secure testing services all over Brazil. The investment is broadening the portfolio of SGS, from food labeling to risk management, regulatory compliance and market intelligence solutions, in an effort to cope with local as well as foreign demands. Expansion addresses local and export market demand. |

| 2024 | To meet expanding demand for food testing services, a number of food testing providers are making more investments in local expansion. New labs are being opened, specifically in Argentina, Brazil, and Mexico, which are some of largest markets in Latin America. These expansions are aimed at expanding testing capabilities for wider array of food products, from beverages and dairy, meat and seafood. |

Uptake of Food Safety Regulations And Compliance

Increased sophistication of food safety legislation across Latin America is one major drivers fueling expansion in food testing services sector. The standardization of food is growing both at local and global levels and firms within the region, be they large or small, have spent significantly on food testing services to meet health and safety legislation.

In addition, government authorities have enacted high food safety regulations with consumers at the forefront, mandating that producers and manufacturers engage with accredited laboratories for independent testing services. The increasing number of food recalls due to contamination and consumer safety are adding to the demand for independent testing laboratories.

As food industry emphasizes traceability, safety certification, and supply chain transparency, there is a growing demand for technical test solutions to analyze types of contaminants, allergens, and pathogens in food products. These regulatory activities present tremendous opportunities for testing providers.

Growth in Consumer Demand for Quality and Organic Food

The other major driver of the Latin America food testing services market is the rise in consumer demand for quality, organic, and sustainable food products. As Latin American consumers become more health-conscious, they prefer food products that provide a decrease in artificial additives, preservatives, and pesticides.

This shift in behavior is leading to an increased focus by food companies on applying quality control and transparency measures. Testing services offer peace of mind to the consumer to confirm claims like organic, gluten-free, and non-GMO (genetically modified organisms) that are increasingly significant to consumers than ever before.

The growth of e-commerce and increased focus on health-focused food products also drives testing to ensure food products meet quality and nutritional expectations. The growth in ethical sourcing awareness increases the need for testing across food categories.

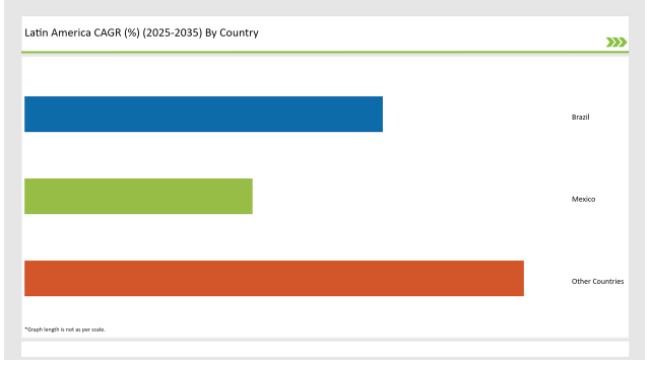

The following table shows the estimated growth rates of the key markets. These countries are set to exhibit high consumption, recording high CAGRs from 2025 to 2035.

| Countries | Market Share (%) |

|---|---|

| Brazil | 33% |

| Mexico | 21% |

| Other Countries | 46% |

Brazil is a key player in the Latin America food testing services market since the country has a huge and diverse food production sector. The high demand for food safety and regulatory compliance is a reflection of Brazil's stringent food safety standards which not only demand frequent testing to be able to comply with local regulations but also with international market rules.

Brazil, being a major producer of foodstuffs, meat, and drinks, is consequently bringing innovations in food testing to track safety, quality, and traceability of products. Expansion of Brazilian food items in the European and North American food markets necessitates the use of accredited food testing services to validate conformity with global food safety standards.

The Mexican food testing services market is on the rise driven by rising public interest in food health and quality. The Mexican food industry is increasingly going organic and non-GMO with food makers demanding testing services, to not only authenticate product claims but also comply with health laws and meet consumer demands locally and overseas.

The government has also moved to amend food safety regulations which indirectly, create demand for food testing services to be provided. In addition, Mexico's central role in the North American trading environment necessitates the need for reliable food testing approaches and, therefore, the expansion of food testing service providers.

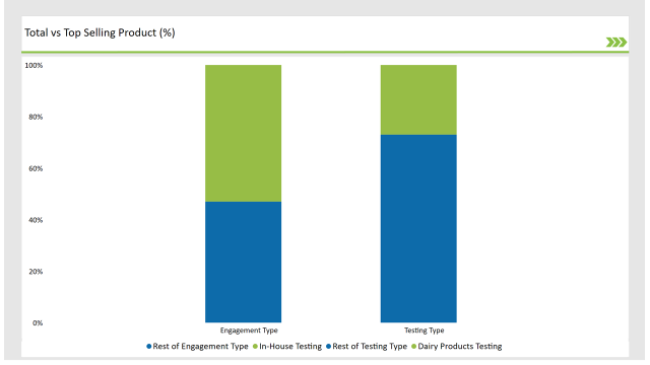

% share of Individual Categories Testing Method and Engagement Type in 2025

| Main Segment | Market Share (%) |

|---|---|

| Testing Method ( Dairy Products Testing ) | 27% |

| Remaining segments | 73% |

The dairy products testing segment in Latin America secures the highest market share owing to rising demand for top quality and safe dairy products and the focus on a balanced diet. Dairy products constitute a significant port of the diet in the region, hence the significance of safety and quality has risen as the primary point.

Analysis of microbes, pesticide contamination, adulterants, and nutritional value are the most important ones is thus increasing in demand. Similarly, the launch of a new range of products such as probiotic, lactose-free, and others has increased the demand for extensive testing services. Food traceability is also gaining immense traction with rising import export activities from USA and Europe.

| Main Segment | Market Share (%) |

|---|---|

| Engagement Type ( In-House Testing ) | 53% |

| Remaining segments | 47% |

The key market share of in-house testing in the food testing services industry in Latin America is because of the necessity for higher automation, efficiency, and focus on food safety procedures. Organizations are opting for in-house testing approaches now because of the visibility of real-time monitoring, minimizing the test time, and the simplification of manufacturing.

This assists companies in easily detecting contamination, adulteration, or quality issues, thereby ensuring that the products meet local and global standards. Furthermore, in-house testing maintains confidentiality and prevents delays compared to outsourcing. In-house testing service providers are now focusing on technology and automation specifically for the quality assurance of meat, dairy, and beverages.

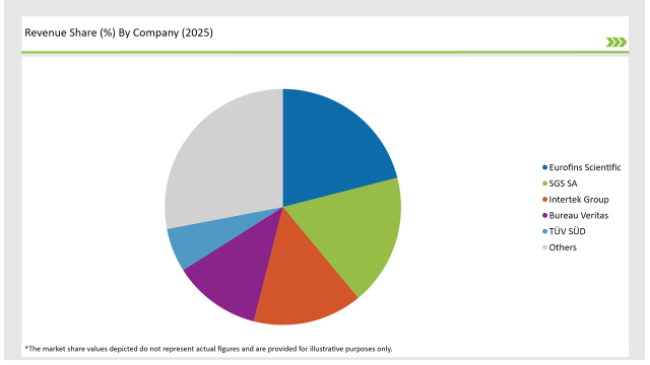

2025 Market share of Latin America Food Testing Services manufacturers

The Latin America food testing services market is concentrated, with major international and regional players controlling industry. Major players such as SGS, Intertek, Eurofins Scientific, and Bureau Veritas control a major portion of the market, taking advantage of their strong reputation, wide range of services offered, and large regional networks.

These big companies invest in sophisticated technologies, cutting-edge laboratories, and international certifications, making them extremely competitive in fulfilling the sophisticated food safety and regulatory requirements across various food industries like dairy, meat, beverages, and agriculture. The industry is not entirely monopolized.

There is space for local and niche players, particularly in nations such as Brazil, Mexico, Argentina, and Chile, where smaller, specialized testing firms have been able to carve out a niche by concentrating on specific food groups or providing services in a particular geographic area. These firms tend to focus on individualized customer service, affordability, and flexibility in addressing local demands.

In spite of the presence of a number of major players, overall market dynamics continue to be changing, with continuous developments in food safety legislation, improvements in testing technology, and others. Moreover, regional companies are focusing on expanding and developing their portfolios. With the region witnessing strong growth in the food production and export industries, demand for trusted, accredited testing services keeps increasing, offering opportunities to both leading firms and new entrants.

The competition is based on technological innovation, global compliance with certification, and specialization in services, while the smaller firms use their regional familiarity and customized approaches to address specific regional needs.

With respect to testing method, the industry is categorized into dairy products testing, dietary supplements testing, meat testing analysis, plant based, and novel food testing methods, and animal feed testing methods.

As per engagement type, the industry is categorized into in house/ captive testing and analytics services and 3rd party/ independent testing and analytics service providers.

Industry analysis has been carried out in key countries, such as Brazil, Mexico, and the rest of Latin America.

By 2035, the market is expected to reach an estimated value of USD 5,251.0 million.

The industry is poised to reach USD 2,400.9 million in 2025.

Brazil, poised to capture 33% share in 2025, is anticipated to depict highest share.

Dairy products testing is widely used.

In-house testing is majorly preferred.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Latin America Joint Compound Industry Analysis Size and Share Forecast Outlook 2025 to 2035

Latin America In-mold Labels Market Size and Share Forecast Outlook 2025 to 2035

Latin America Rigid Industrial Packaging Market Size and Share Forecast Outlook 2025 to 2035

Latin America Hand Sanitizer Market Size and Share Forecast Outlook 2025 to 2035

Latin America Hand Soap Market Size and Share Forecast Outlook 2025 to 2035

Latin America Hydraulic Filtration Market Size and Share Forecast Outlook 2025 to 2035

Latin America Automotive HVAC Market Size and Share Forecast Outlook 2025 to 2035

Latin America Frozen Ready Meals Market Insights – Demand & Forecast 2025–2035

Latin America Fish Protein Market Trends – Size, Growth & Forecast 2025–2035

Latin America Aqua Feed Additives Market Trends – Growth & Forecast 2025–2035

Latin America Collagen Peptide Market Report – Trends, Size & Forecast 2025–2035

Latin America Bubble Tea Market Outlook – Growth, Trends & Forecast 2025–2035

Latin America Shrimp Market Report – Trends, Growth & Forecast 2025–2035

Latin America Animal Feed Alternative Protein Market Analysis – Growth & Forecast 2025–2035

Latin America Cultured Wheat Market Outlook – Growth, Demand & Forecast 2025–2035

Latin America Fructo-Oligosaccharides Market Report – Trends & Forecast 2025–2035

Latin America Starch Derivatives Market Outlook – Growth, Demand & Forecast 2025–2035

Latin America Sports Drink Market Analysis – Demand, Size & Forecast 2025–2035

Latin America Calf Milk Replacer Market Insights – Size, Growth & Forecast 2025–2035

Latin America Non-Alcoholic Malt Beverages Market Trends – Growth & Forecast 2025–2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA