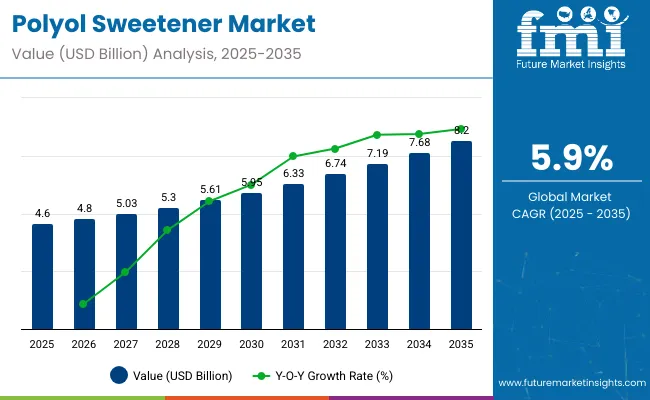

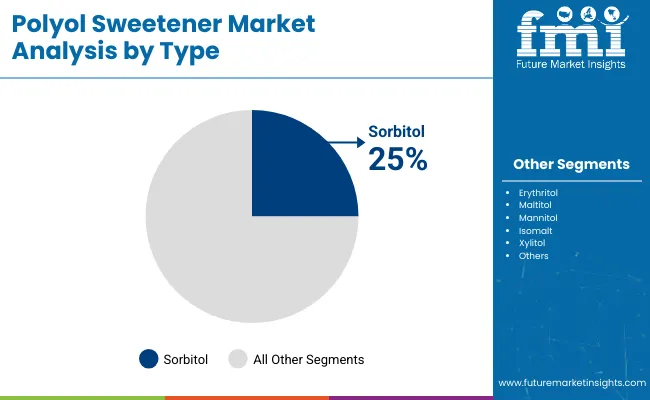

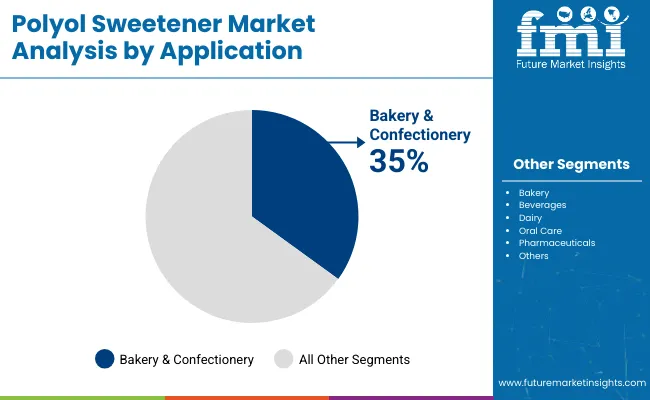

The polyol sweeteners market is valued at USD 4.6 billion in 2025 and is slated to reach USD 8.2 billion by 2035. The market is poised to grow at 5.9% CAGR during the study period. Growth is being underpinned by sorbitol’s sustained dominance, with the ingredient projected to command roughly 25% of global revenue, while confectionery applications are forecast to absorb close to 35% of overall demand as brands reformulate candy, gum, and chocolate for calorie-conscious consumers.

Regulatory support for sugar reduction, combined with steady capacity expansions and process innovations, is anticipated to keep competition active and broaden uptake in pharmaceuticals and personal-care products.

| Attributes | Key Statistics |

|---|---|

| Base Year Value (2025) | USD 4.6 billion |

| Expected Forecast Value (2035) | USD 8.2 billion |

| Estimated Growth (2025 to 2035) | 5.9% |

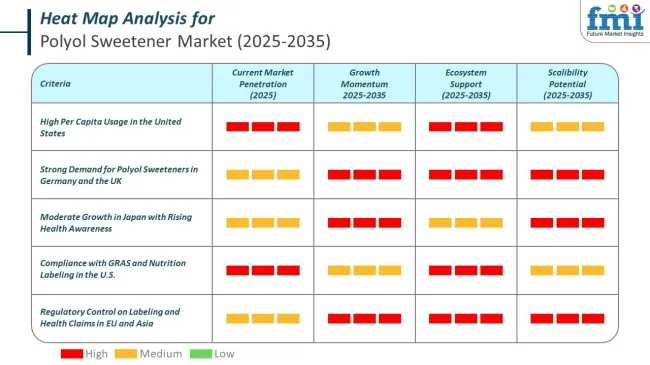

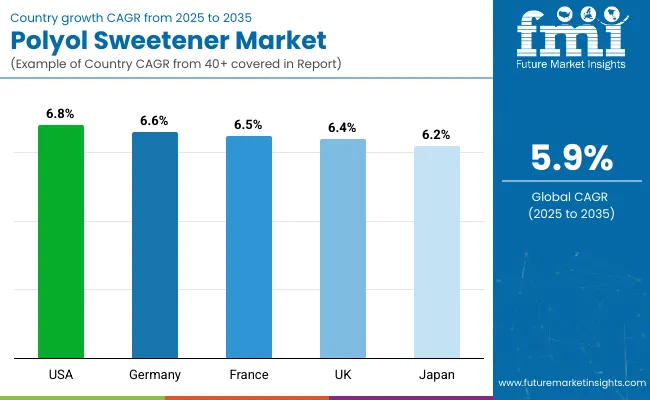

The United States is projected to retain roughly 29% of global polyol sweetener revenue through 2035, so it is viewed as the largest single market, while China is expected to log the quickest absolute gains at about 5.4% CAGR as sugar-reduction mandates are adopted nationwide.

Japan is anticipated to expand steadily on the back of an ageing, diabetic-prone population, and Australia, despite holding just over 2% share, is forecast to post the sharpest relative growth. Across these leading countries, sorbitol is predicted to remain the primary product, and confectionery applications are likely to keep their position as the top demand centre, prompting suppliers to scale capacity and release cleaner-label formulations that match evolving calorie-conscious preferences.

The polyol sweetener market is expanding in key economies where sugar reduction initiatives and demand for clean-label, reduced-calorie products remain priorities. While precise per capita figures are unavailable, the maturity of health-conscious consumer bases and ingredient substitution trends provide a clear proxy for estimating consumption patterns.

The polyol sweetener market operates within tightly defined regulatory frameworks across major economies. In the United States, polyols are classified as GRAS and require mandatory listing under “Total Carbohydrates” with certain products allowed to claim dental health benefits. The European Union mandates clear warnings on excessive intake and imposes restrictions on use in beverages.

In Asia’s leading markets, polyol sweeteners must comply with national additive standards and labeling rules tied to health positioning. Japan maintains a neutral stance on terminology and prohibits phrases like “artificial” or “synthetic.” China regulates polyols through its Food Safety Law with specific product labeling obligations.

The global polyol sweeteners market is experiencing significant growth, driven by consumer demand for low-calorie options. Sorbitol, with a 25% market share, is a key driver, valued for its ability to enhance freshness and retain moisture. Its use is expanding across pharmaceuticals and cosmetics. The confectionery industry, holding a 35% share, also heavily adopts polyols for their low-calorie and bulking benefits, addressing the rising preference for healthier treats.

The global polyol sweeteners market is experiencing robust growth, primarily fueled by a surging consumer demand for low-calorie and sugar-free alternatives in various food and beverage products. Sorbitol, a key player in this market with an estimated 25% share, is at the forefront of this expansion. Its versatility stems from its ability to extend product freshness, prevent decay, and maintain moisture content, particularly crucial in bakery items. For instance, sorbitol is commonly used in cakes and pastries to keep them soft and fresh for longer periods.

Derived from the catalytic hydrogenation of d-glucose, sorbitol serves as a multifaceted ingredient, functioning as a bulking agent, sequestrant, thickener, sweetener, and humectant. Beyond food applications, sorbitol's demand is escalating in the pharmaceutical sector, where it acts as a vital stabilizer and excipient in drug formulation and the synthesis of synthetic vitamin C.

The confectionery industry represents a significant segment within the polyol sweeteners market, holding a substantial 35% market share. This dominance is driven by a global shift towards healthier, low-calorie confectionery items. Polyol sweeteners offer a competitive advantage over traditional sugar, as they can be used in comparable amounts while providing fewer calories.

For example, in sugar-free chocolates, polyols replace sugar directly, maintaining the texture and sweetness without the added calories. Unlike high-intensity sweeteners, which are used sparingly due to their extreme sweetness, polyols also act as effective bulking agents, contributing to the desired texture and mouthfeel of candies and beverages.

Sugar-free chewing gum often utilizes polyols like sorbitol to provide bulk and a sustained sweet taste without contributing to tooth decay, which is a major benefit for consumers. This functional duality makes them highly appealing to manufacturers striving to create appealing and health-conscious products.

The global market for polyol sweeteners witnessed a substantial growth rate of 6.90% between 2020 and 2024, resulting in a valuation of USD 4,100 million. The market is expected to maintain its growth momentum in the upcoming years and is anticipated to register a CAGR of 5.9% between 2025 and 2035.

| Attributes | Key Statistics |

|---|---|

| Market Value (2024) | USD 4,317.3 million |

| Market Share (2025) | USD 4.6 billion |

| Estimated Growth (2020 to 2024) | 6.90% |

The United States market is projected to advance at a 6.8% CAGR between 2025 and 2035. Expansion is being propelled by stringent “added-sugar” labelling rules, soda-tax schemes in several states, and the country’s growing diabetic population.

Although sucrose prices remain favourable, brand owners have been compelled to reformulate flagship lines and adopt polyols that offer bulk without spiking glycaemic response. Reliable sorbitol and maltitol supply is ensured by large Midwestern corn-wet-milling complexes, while new fermentation facilities in the Gulf region are scaling up zero-calorie erythritol. Market concentration remains high, yet regional confectioners continue to sign long-term offtake contracts with ingredient majors.

Sales of polyol sweeteners in United Kingdom are expected to grow at a 6.4% CAGR from 2025 to 2035. Momentum is being provided by the Soft Drinks Industry Levy, Public Health England’s sugar-reduction targets, and heightened consumer awareness of glycaemic control.

Beverage manufacturers have been reformulating with erythritol and monk-fruit combinations to remain below taxable thresholds, while confectioners are releasing “no added sugar” chocolate using maltitol or isomalt. Domestic start-ups are piloting fermentation-based production in Teesside and Norfolk, which will widen local supply. Despite inflationary pressure on raw materials, retailer commitment to healthier store-brand lines is maintaining volume growth across grocery and e-commerce channels.

Demand for polyol sweeteners in France is forecast to register a 6.5% CAGR during 2025 to 2035, underpinned by the Nutri-Score labelling scheme and the country’s sophisticated functional-foods sector. Food manufacturers have been urged to improve Nutri-Score grades, so sucrose is being replaced with maltitol, lactitol, and erythritol to lower calorie density.

Dairy-dessert producers employ lactitol to preserve mouthfeel, while gummy-candy makers use isomalt to combat moisture migration. The French Syndicate for Oral Health continues to endorse xylitol chewing gum, reinforcing consumer confidence. Roquette’s Lestrem complex is undergoing expansion that will raise crystalline maltitol capacity by 20 %, ensuring secure regional supply through the next decade.

Germany’s polyol sweeteners market is anticipated to expand at a 6.6% CAGR to 2035, driven by federal sugar-reduction targets and a strong nutraceutical culture. Large confectionery houses in Cologne and Aachen are accelerating trials that blend maltitol with high-intensity sweeteners for calorie-efficient chocolate.

Pharmaceutical demand for sorbitol and xylitol in chewable tablets and syrups remains firm, aided by stringent excipient quality standards. The German Confectionery Association has published technical dossiers demonstrating polyol processing advantages, facilitating wider adoption. New high-purity erythritol plants in Saxony-Anhalt will enhance EU supply security and reduce freight emissions tied to Asian imports.

Japan is projected to grow at a 6.2% CAGR through 2035, supported by the country’s healthy-ageing agenda and the well-established FOSHU framework. Xylitol chewing gum, carrying dental-health claims approved by consumer-affairs authorities, continues to dominate the functional-confectionery aisle.

Beverage formulators are blending stevia with maltitol syrups to achieve authentic sweetness while qualifying for reduced-calorie labelling. Ageing demographics have heightened interest in low-glycaemic snacks featuring erythritol, and vending-machine operators are adding such products nationwide. Domestic corn-starch suppliers cooperate with universities on enzymatic efficiency upgrades to lower production costs and secure long-term competitiveness against imported polyols.

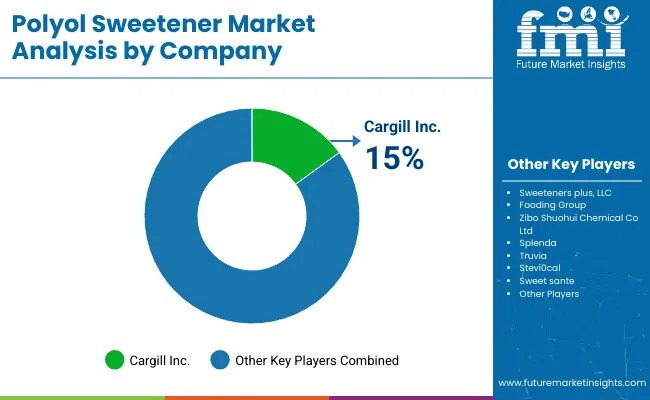

The polyol sweeteners industry is characterised by a clear two-tier structure. Tier 1 suppliers comprise integrated agribusiness and ingredient firms with global footprints, extensive corn-wet-milling or cane-processing assets, and in-house application laboratories. Cargill, Archer Daniels Midland, Ingredion, Roquette, and Tereos fall into this category.

Their broad portfolios cover sorbitol, maltitol, erythritol, and xylitol, and their distribution is handled through long-term agreements with logistics specialists such as Brenntag and IMCD. These leading companies are investing in new crystallisation towers, enzymatic conversion routes, and fermentation reactors to shorten lead times and improve cost positions. Advisory teams are being deployed to co-develop reduced-sugar recipes with multinational confectioners and beverage bottlers, locking in multi-year supply contracts.

Tier 2 producers operate regionally or focus on high-purity niches. Firms such as Matsutani Chemical (Japan), Jungbunzlauer (Austria), HYET Sweet (Netherlands), Sukhjit Starch (India), and Shandong Biete (China) specialise in single-polyol lines or pharmaceutical grades. Their competitive edge is maintained through flexible batch sizes, rapid customisation, and strict compliance with pharmacopeial standards.

Many are adopting membrane-filtration upgrades and energy-efficient evaporators to meet tightening cost targets. Collaboration with contract manufacturers in Southeast Asia is widening geographic reach without heavy capital expenditure.

The overall supplier landscape remains partnership-driven. Formulation support centres are being opened near cluster hubs in Illinois, Picardy, and Shandong so that customers can trial polyol blends under real-plant conditions. Raw-material hedging strategies are being expanded to shield downstream clients from corn-price swings. Certification against FSSC 22000 and IPEC-PQG guidelines is viewed as a passport to premium excipient tenders in Europe and North America.

| Report Attribute | Details |

|---|---|

| Market Size (2025) | USD 4.6 billion |

| Projected Market Size (2035) | USD 8.2 billion |

| CAGR (2025 to 2035) | 5.9% |

| Base Year for Estimation | 2024 |

| Historical Period | 2019 to 2024 |

| Projection Period | 2025 to 2035 |

| Quantitative Units | USD billion (value) and kilotons (volume) |

| Product Types Analysed | Sorbitol, Xylitol, Maltitol, Erythritol, Mannitol, Isomalt, Lactitol |

| Form Types Analysed | Powder / Crystal, Liquid Syrup |

| Application Segments Analysed | Confectionery, Bakery, Dairy, Beverages, Pharmaceuticals, Personal Care |

| Feed-stock Sources Analysed | Corn-derived, Sugar-beet / Sugar-cane based |

| End-use Channels Covered | B2B Ingredient Supply, Contract Manufacturing, Private-label Brands |

| Distribution Channels Covered | Direct Sales, Specialty Distributors, E-commerce Ingredient Portals |

| Regions Covered | North America, Europe, Asia Pacific, Latin America, Middle East & Africa |

| Countries Covered | United States, Canada, United Kingdom, France, Germany, Italy, Spain, Japan, China, South Korea, India, Brazil, Mexico, Australia, GCC |

| Key Players Influencing the Market | Cargill, Archer Daniels Midland, Ingredion, Roquette, Tereos, Matsutani Chemical, Jungbunzlauer, HYET Sweet, Sukhjit Starch, Shandong Biete |

| Additional Attributes | Dollar-sales growth by product type, regional demand trends, price-trend analysis, cost-structure breakdown, supply–demand balance, regulatory landscape review, formulation benchmarking, competitive intensity mapping |

The polyol sweeteners market was valued at USD 4.6 billion in 2025.

The market is projected to reach USD 8.2 billion by 2035.

Sorbitol is expected to remain the leading product type, holding roughly 25% share.

A CAGR of about 5.95% is anticipated for the 2025 to 2035 period.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Polyolefin Pipe Market Size and Share Forecast Outlook 2025 to 2035

Polyolefin Catalyst Market Size and Share Forecast Outlook 2025 to 2035

Sweetener Market Analysis – Size, Share, and Forecast Outlook 2025 to 2035

Assessing Sweetener Market Share & Industry Dynamics

Polyols Market Growth - Innovations & Industrial Applications

Polyols and Sorbitols Products Market

Polyolefin Powder Market

Polyolefin Films Market

Polyolefin Resin Paints Market

United Kingdom Sweetener Market Trends – Size, Demand & Forecast 2025–2035

USA Sweetener Market Report – Trends, Demand & Industry Forecast 2025–2035

Analysis and Growth Projections for Dry Sweeteners Market

Corn Sweeteners Market Outlook - Growth, Demand & Forecast 2025 to 2035

ASEAN Sweetener Market Growth – Trends, Demand & Innovations 2025–2035

Novel Sweeteners Market Analysis by Product Type, End Use, Application and Region from 2025 to 2035

Cyclic Polyolefin Market Size and Share Forecast Outlook 2025 to 2035

Europe Sweetener Market Outlook – Share, Growth & Forecast 2025–2035

Nutritive Sweetener Market Size and Share Forecast Outlook 2025 to 2035

Polyester Polyol Market Size and Share Forecast Outlook 2025 to 2035

Australia Sweetener Market Analysis – Size, Share & Forecast 2025–2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA