The ASEAN Sweetener market is set to grow from an estimated USD 4,644.0 million in 2025 to USD 6,363.0 million by 2035, with a compound annual growth rate (CAGR) of 3.6% during the forecast period from 2025 to 2035.

| Attributes | Value |

|---|---|

| Estimated ASEAN Industry Size (2025E) | USD 4,644.0 million |

| Projected ASEAN Value (2035F) | USD 6,363.0 million |

| Value-based CAGR (2025 to 2035) | 3.6% |

The ASEAN Sweetener Market expands at a fast pace because buyers seek modern sustainable and healthy alternative sweetener options. The market consists of an extensive range of natural sweeteners alongside artificial and novel sweeteners which operate in numerous applications across food production and beverage manufacturing and pharmaceutical and personal care industries.

A growing number of patients suffering from lifestyle conditions such as diabetes and obesity has expanded the market need for calorie alternatives that contain no sugar in the ASEAN region.

Artificial sweeteners sucralose and aspartame function as essential components in low-calorie beverage and processed food formulations because they offer sugar-free functionality. New sweetener options such as sugar alcohols and monk fruit sugar are expanding their market reach by fulfilling the needs of people following diabetic and keto-friendly diets.

The ASEAN Sweetener Market rests predominantly on the strategic development activities of Thailand Malaysia and India. The natural sweetener sector of Thailand maintains a leadership position while Malaysia reformulates food products to comply with sugar taxes and India remains strong through its impressive sugarcane yields. Carbonated drinks and both fruit juices and functional beverages together form the leading consumer segment for sweeteners in the Asian region.

Government programs that push market growth through sugar reduction regulations are promoting the use of different sweetening alternatives among manufacturers. The forthcoming years will bring sustainable growth to the ASEAN Sweetener Market because of rising food technology advancements and rising R&D investments.

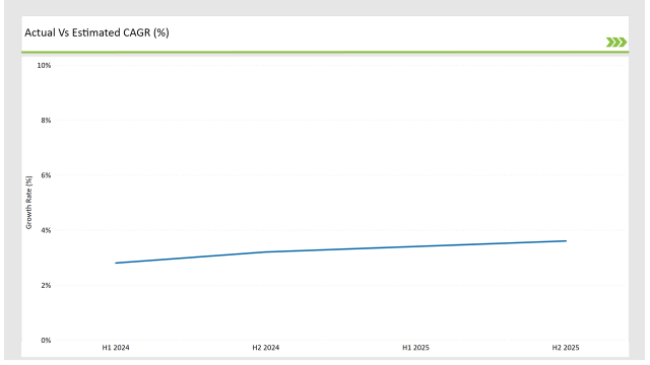

The table below provides a detailed comparative assessment of the changes in the compound annual growth rate (CAGR) over six months for the base year (2024) and the current year (2025) specifically for the ASEAN Sweetener market.

This semi-annual analysis highlights crucial shifts in market dynamics and outlines revenue realization patterns, providing stakeholders with a more precise understanding of the growth trajectory within the year. The first half of the year, H1, covers January to June, while the second half, H2, spans July to December.

H1 signifies the period from January to June, and H2 Signifies the period from July to December.

For the ASEAN Sweetener market, the sector is predicted to grow at a CAGR of 2.8% during the first half of 2024, with an increase to 3.2% in the second half of the same year. In 2024, the growth rate is anticipated to slightly decrease to 3.4% in H1 but is expected to rise to 3.6% in H2. This pattern reveals a decrease of 20 basis points from the first half of 2024 to the first half of 2025, followed by an increase of 20 basis points in the second half of 2025 compared to the second half of 2024.

| Date | Development/M&A Activity & Details |

|---|---|

| January 2024 | Sweet Green Malaysia partnered with local farmers to expand the production of sustainable palm sugar. |

| April 2024 | Stevia Co launched an improved stevia-based liquid sweetener in Thailand targeting beverage manufacturers. |

| August 2024 | Monk Fruit Global introduced monk fruit-based sweeteners for diabetic-friendly bakery products in Vietnam. |

| October 2024 | Cargill ASEAN announced an expansion of erythritol production facilities in Indonesia. |

| February 2024 | Sweet Leaf Innovations India launched a monk fruit and stevia blend tailored for functional beverages. |

Rising Popularity of Natural Sweeteners

The ASEAN market demonstrates a strong preference for natural sweeteners as stevia takes over alongside coconut sugar and honey. The modern consumer chooses healthier sugar substitutes because they want to combat weight gain along with diabetes and general wellness issues. Products derived from Stevia rebaudiana plants known as stevia now serve as the top natural sweetener because they contain zero calories and work well in products designed for diabetic and keto diets.

Natural sugar made from coconut palms and palm trees found primarily in Thailand and Indonesia is becoming more popular because of its lower glycemic response along with benefiting from minimal nutritive components. Many Southeast Asian cultural recipes embrace these natural sweeteners which today are guided into modern food products specifically targeted for health-focused buyers.

Growth of Low-Calorie Artificial Sweeteners

The low-calorie sweetener market in ASEAN relies on artificial sweeteners such as sucralose alongside aspartame and saccharin thanks to their capability to remain stable in processed foods and beverages while offering cost-effectiveness. The market growth of diet-friendly and sugar-free products depends on these sweeteners to serve urban and health-conscious consumers worldwide.

The public health policy approach of sugar tax implementation across Malaysia and Thailand created increased demand for artificial sweeteners. The reformulation of products by manufacturers focuses on carbonated drinks and powdered mixed drink products with sugar reduction protocols for maintaining product quality. This allows these applications to use sucralose and aspartame because they deliver a sugar taste similar to regular sugar which is free of calories.

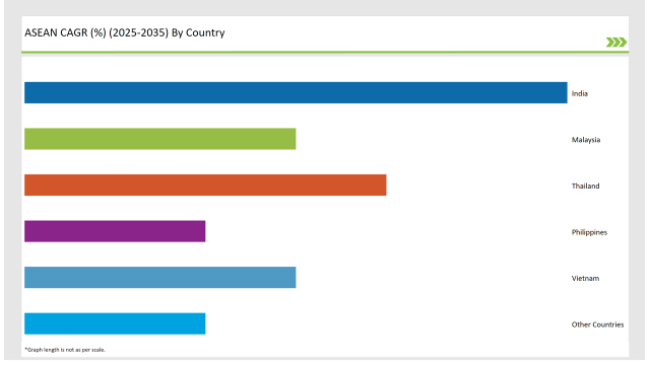

The following table shows the estimated growth rates of the top four markets. These countries are set to exhibit high consumption, recording high CAGRs through 2035.

India's growing population consuming health-oriented choices has raised demand for refined-sugar alternatives which urban residents especially seek out. Tropical natural sweeteners that include stevia jaggery and honey are becoming increasingly popular as customers seek beneficial ingredients that align with Ayurvedic standards. Lifestyle diseases such as diabetes and obesity continue to rise so stevia and monk fruit sugar gained popularity as a suitable choice for diabetic consumers when added to beverages and confectionery products.

The Indian government uses both government campaigns and regulatory reforms along with public health initiatives to boost the usage of low-calorie sweeteners within Indian society. Manufacturers now reformulate their products with sweetener blends because of the government's sugar content limits in packaged foods. Food and beverage businesses use artificial sweeteners including aspartame and sucralose to meet their reduced caloric consumption requirements.

Natural sweeteners produced by Thailand lead the market through coconut sugar and palm sugar output facilitated by the country's vast agricultural strength and industry experience. Traditional and contemporary food products throughout Thailand include these sweeteners which remain fundamental elements of Thai culture. The ASEAN market now considers Thailand one of its primary exporters due to the growing international demand for coconut and palm sugar.

The Thai consumer base shows increasing interest in natural sweeteners because of heightened health consciousness levels. Health-conscious people tend to prefer coconut sugar because of its low glycemic index and plentiful mineral components. Palm sugar attracts users with its caramel-flavored appeal and provides capabilities for organic premium food development.

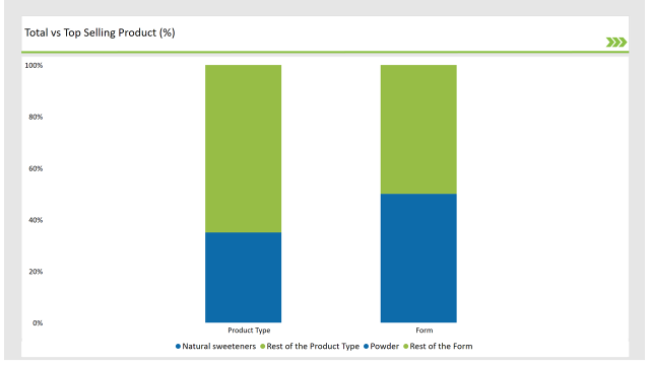

% share of Individual categories by Product Type and Form in 2025

Stevia stands as the leader among natural sweeteners which dominate the ASEAN market. Stevia adopts broad market recognition as an improved choice over regular sugar because it offers zero-calorie content derived from plant extracts. Consumer demand for sugar replacements that improve health grows as an understanding of lifestyle diseases including diabetes and obesity continues to increase among general populations.

The market for natural sweeteners is performing exceptionally well with honey coconut sugar and palm sugar showing impressive growth. The market chooses honey as a versatile sweetener that offers perceived medical advantages but prefers coconut sugar because of its low glycemic index and intense flavor. Palm sugar has maintained its position as a traditional Southeast Asian sweetener in local cuisine and markets worldwide continue to discover its merits.

Liquid sweeteners stand as the dominant sweetener type in the ASEAN territory because consumers like their versatility along with simple usability. Liquid stevia extract and honey together with agave syrup find broad application throughout beverages alongside processed foods and sauces. The liquid forms meet beverage industry requirements because they dissolve effortlessly while maintaining steady sweetness levels.

Read-to-drink beverage demands have increased the use of liquid sweeteners in products such as flavored waters iced teas and energy drinks. The food manufacturing sector selects liquid sweeteners because they mix well with product formulations while preserving both product texture and original taste profile.

Food processors are increasingly adopting liquid sweeteners into their products which is simultaneously driving their use in personal care items and medicine production. Honey and agave syrup find application in skincare formulations as humectants while they serve to improve the flavor of medicinal syrups.

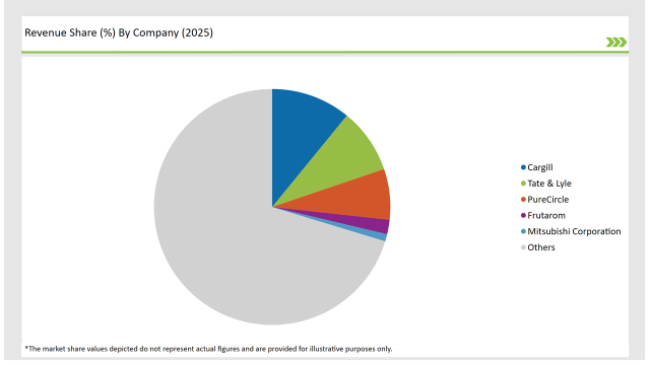

Extensive distribution channels and diverse offerings of multinational firms Cargill Tate & Lyle and Wilmar International represent the moderate to high concentration in the Asian sweetener market. The natural sweeteners market led by regional and local brands using coconut and palm sugar products continues to grow through appeal to health-conscious consumers despite dominant large players controlling major market shares.

The market is transforming due to innovations in low-calorie sweeteners and plant-based ingredients as vendors launch new product lines that respond to emerging consumer preferences. The regulatory environment works to benefit large market players who have adequate financial resources to fulfill food safety requirements besides strengthening the concentration of market leadership through acquisitions.

Business entities are currently reshaping their competitive positions while assisting consumers and adapting to regulatory elements to define Asia's upcoming sweetener market direction.

As per Product Type, the industry has been categorized into Natural Sweeteners (Stevia, Palm Sugar, Coconut Sugar, Honey, Maple Syrup, Monk Fruit Sugar, Agave Syrup, Lucuma Fruit Sugar, Molasses, and Other Natural Sweeteners. Artificial Sweeteners (Acesulfame Potassium, Aspartame, Neotame, Advantame, Saccharin, Sucralose, and Other Artificial Sweeteners), Sucrose, Novel Sweeteners, and Sugar Alcohol.

As per Form, the industry has been categorized into Powder, Liquid, and Crystals.

As per Concentration, the industry has been categorized into Organic and Conventional.

As per Category, the industry has been categorized into High-Intensity Sweetener and Low-Intensity Sweetener.

As per Sales Channel, the industry has been categorized into Hypermarkets / Supermarkets, Convenience Stores, Specialty Retail Stores, Traditional Grocery Retailers, Online Retailers, and Other Channels.

As per Application, the industry has been categorized into Food (Bakery Goods, Sweet Spreads, Confectionery and Chewing Gums, Dairy Products, and Others), Beverages (Carbonated Drinks, Fruit Drinks & Juice, Sports & Energy Drinks, Powdered Drinks and Mixes, and Others), Pharmaceuticals, Personal Care, and Other Applications.

Industry analysis has been carried out in key countries of India, Malaysia, Thailand, Philippines, Vietnam, and other ASEAN Countries.

The ASEAN Sweetener market is projected to grow at a CAGR of 3.6% from 2025 to 2035.

By 2035, the market is expected to reach an estimated value of USD 6,363.0 million.

India are key Country with high consumption rates in the ASEAN Sweetener market.

Leading manufacturers include Cargill, Tate & Lyle, Pure Circle, Frutarom, Mitsubishi Corporation, Wilmar International and others are the key players in the ASEAN market.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

ASEAN Automotive Bearings Market Size and Share Forecast Outlook 2025 to 2035

ASEAN Automotive Aftermarket Analysis - Size, Share, and Forecast Outlook 2025 to 2035

ASEAN and Gulf Countries MAP & VSP Packaging Market Size and Share Forecast Outlook 2025 to 2035

ASEAN Flexible Plastic Packaging Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

ASEAN Human Milk Oligosaccharides Market Report – Size, Demand & Growth 2025–2035

ASEAN Probiotic Ingredients Market Outlook – Growth, Size & Forecast 2025–2035

ASEAN Food Additives Market Insights – Growth, Demand & Forecast 2025–2035

ASEAN Chitin Market Analysis – Trends, Demand & Forecast 2025–2035

ASEAN Bakery Mixes Market Outlook – Size, Share & Forecast 2025–2035

ASEAN Non-Alcoholic Malt Beverages Market Trends – Demand & Forecast 2025–2035

ASEAN Animal Feed Alternative Protein Market Insights – Demand, Size & Industry Trends 2025–2035

ASEAN Chickpea Protein Market Trends – Growth, Demand & Forecast 2025–2035

ASEAN Automotive Turbocharger Market Outlook – Share, Growth & Forecast 2025–2035

ASEAN Food Testing Services Market Analysis – Size, Share & Forecast 2025–2035

ASEAN Food Emulsifier Market Report – Trends, Demand & Industry Forecast 2025–2035

ASEAN Yeast Market Report – Trends, Demand & Industry Forecast 2025–2035

ASEAN Green and Bio-based Polyol Market Growth – Trends, Demand & Innovations 2025–2035

ASEAN Natural Food Color Market Outlook – Share, Growth & Forecast 2025–2035

ASEAN Coated Fabrics Market Insights – Demand, Size & Industry Trends 2025–2035

ASEAN Barite Market Analysis – Size, Share & Forecast 2025–2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA