The Europe sweetener market is set to grow from an estimated USD 3,921.0 million in 2025 to USD 5,373.0 million by 2035, with a compound annual growth rate (CAGR) of 3.2% during the forecast period from 2025 to 2035.

| Metric | Value |

|---|---|

| Estimated Europe Industry Size (2025E) | USD 3,921.0 million |

| Projected Europe Value (2035F) | USD 5,373.0 million |

| Value-based CAGR (2025 to 2035) | 3.2% |

The onset of health and wellness awareness in Europe has in fact successfully influenced the consumption of alternative sweeteners, triggered by a demand for knowledge/fact and practice on natural and plant-based sweeteners.

The same trend; food and drink, health, and personal care all show evidence of this movement. The progress in natural sweetener production and research, especially on stevia and monk fruit, coupled with sugar alcohols such as erythritol and xylitol, embody poles of sustainability and health. Besides, the EU regulatory framework that advocates reduced sugar intake is a further force behind the uptake of sweeteners with alternatives.

The expected date will set the mark of completion at 2025 and the market will be of significant value with the main growth driven by the application in functional foods and beverages. Sweeteners are thus gaining the tendency to be used more oftentimes with the intent to displace the original normal sugar.

The environmental advantages of plant-based sweeteners and the coming of more clean-label products would substantially boost the demand for these products in the market. Furthermore, the market is likely to reap the benefits from the ongoing development in production methods that enhance both the taste and the efficiency of sweeteners.

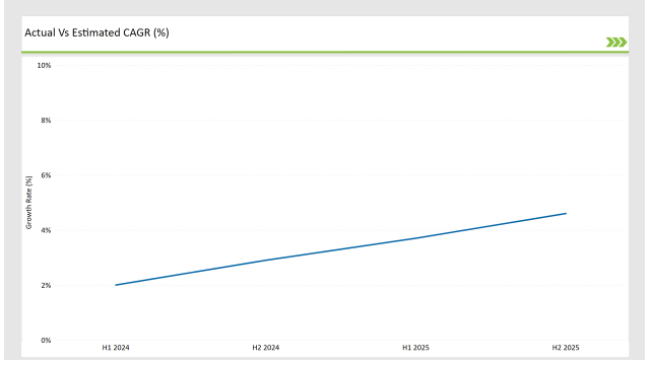

The table below provides a detailed comparative assessment of the changes in the compound annual growth rate (CAGR) over six months for the base year (2024) and the current year (2025) specifically for the European sweetener market.

This semi-annual analysis highlights crucial shifts in market dynamics and outlines revenue realization patterns, providing stakeholders with a more precise understanding of the growth trajectory within the year. The first half of the year, H1, covers January to June, while the second half, H2, spans July to December.

| Particular | Value CAGR |

|---|---|

| H1 (2024 to 2034) | 2.0% |

| H2 (2023 to 2034) | 2.9% |

| H1 (2025 to 2035) | 3.7% |

| H2 (2025 to 2035) | 4.6% |

H1 signifies period from January to June, H2 Signifies period from July to December

For the European sweetener market, the sector is predicted to grow at a CAGR of 2.0% during the first half of 2024, with an increase to 2.9% in the second half of the same year. In 2025, the growth rate is anticipated to slightly decrease to 3.7% in H1 but is expected to rise to 4.6% in H2.

This pattern reveals a decrease of 20 basis points from the first half of 2024 to the first half of 2025, followed by an increase of 20 basis points in the second half of 2025 compared to the second half of 2024.

| Date | Development/M&A Activity & Details |

|---|---|

| 24- March | Expans ion of Manufacturing Facilities: Cargill expanded its sweetener production facility in Belgium to meet the growing demand for natural sweeteners across Europe. The facility now focuses on stevia-based sweeteners and sugar alcohols. |

Growing demand for natural and low-calorie sweeteners in Europe

While healthy consumers and governmental efforts are still fighting against obesity and diabetes, the European market is experiencing a considerable shift to natural and low-calorie sweeteners. Sweeteners such as stevia, erythritol, and monk fruit have been picked due to the similarity of sweetness and non-addition of calories to sugar thereby ideal for use in beverages, baked foods, and snacks.

The curbing of sugar intake by regulatory measures from the European Union has helped further encourage food and beverage companies to introduce these alternatives into their products. Some alternative natural sweeteners are favoured because they are compatible with clean-label trends, where consumers demand transparency about sourcing and health benefits.

The increasing popularity of functional foods and beverages has further led to increased consumption of sweeteners. In addition, products enriched with natural and low-calorie sweeteners are being launched as healthier alternatives and cater to the demand of diabetic and weight-conscious consumers. Additionally, improvements in the technology of sweeteners have increased the taste and texture of these products, thereby making them acceptable to consumers.

Innovation in Functional Sweeteners for Food and Beverage Applications

The focus is always on research about the development of sweeteners with improved functionality, enhanced heat stability, and better solubility properties. These approaches are especially gaining importance within the emergent markets of low-sugar beverages and functional snack applications. As the demand for healthier food increases, manufacturers are using state-of-the-art technology to create sweeteners that not only replace sugar but also contribute to additional health benefits.

For example, fortified sweeteners introduced with added vitamins and minerals are also presented to increase product appeal. The increasing focus on functionality and health will lead Europe even further in the adaptation of sweeteners.

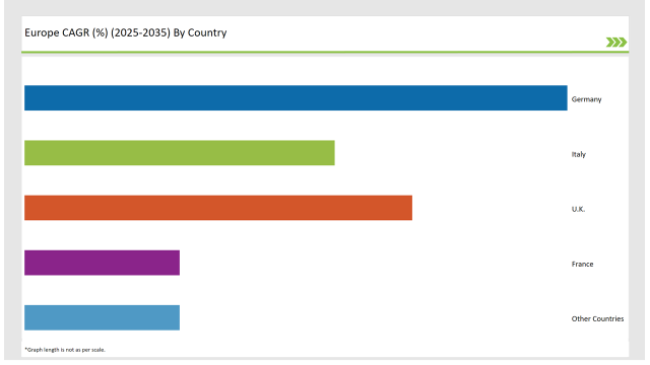

The following table shows the estimated growth rates of the top four markets. These countries are set to exhibit high consumption, recording high CAGRs through 2035.

| Countries | Market Share (%) |

|---|---|

| Germany | 24% |

| Italy | 15% |

| UK | 20% |

| France | 12% |

| Other Countries | 29% |

Germany is leading the way for sweetener adoption, with the strength of its industrial base coupled with a focus on innovation, driven by consumer demand. Food and beverage manufacturing units have become the testing ground for advanced formulations of natural and alternative sweeteners, including novel blends of stevia and monk fruit designed to be used in baked goods and beverages.

Many regulatory bodies encourage innovation, and companies such as BASF and Nordzucker have spent heavy investments on improving the taste and functionality of their sweeteners to be within the preference ranges of consumers for clean-label and high-quality products.

Local manufacturers have taken a significant market share in the niche markets, organic confectionery, and low-calorie dairy products. Technological innovation in the German extraction and production companies of natural sweeteners has resulted in higher quality assurance and more sustainable methods of production.

The sweetener market in the UK has been particularly remarkable because of its policy orientation which was the main driving force behind the growth. The primary force for this market is the introduction of the sugar tax which forced many manufacturers to reformulate their products and use natural and low-calorie sweeteners.

Unlike Germany where the innovation-driven approach is given priority, the policy-driven growth here is the centre of attention and it works through the implementation of strict health regulations as a means to reach the goal of extensive usage of sugar alternatives.

Further, partnerships between local manufacturers and global players like Tate & Lyle have improved the ability to gain access to premium-quality sweeteners in the region. If backed by their policies, the UK is very well to sustain its growth pace in the biotic adoption of innovative sweeteners.

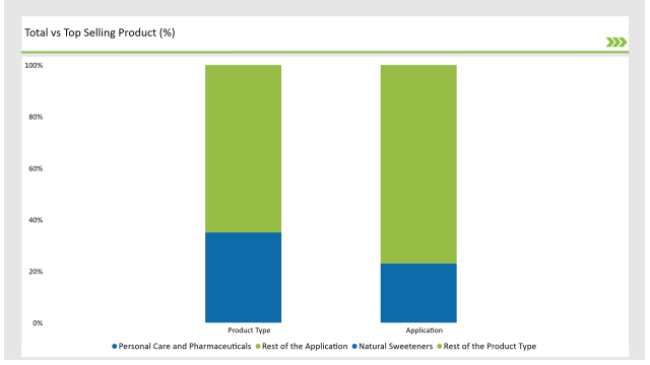

% share of Individual categories by Product Type and Applications in 2025

| Main Segment | Market Share (%) |

|---|---|

| Product Type (Natural Sweeteners) | 35% |

| Remaining segments | 65% |

Food and beverage is the leading segment of sweeteners in Europe, with applications ranging from low-sugar soft drinks to baked goods and confectionery. Functional beverages in particular are a growth area because manufacturers are starting to use natural sweeteners, such as stevia and monk fruit, for healthier alternatives on demand by consumers.

This segment includes plant-based yogurts and protein bars as well, for which sweeteners boost flavour while also maintaining a clean-label appeal. Sugar replacement technologies have also innovated ways to improve the taste and texture of products, which meet consumer expectations.

| Main Segment | Market Share (%) |

|---|---|

| Application (Personal Care and Pharmaceuticals) | 23% |

| Remaining segments | 77% |

The pharmaceutical and personal care segments are rapidly surfacing as major growth areas for sweeteners, especially in Europe. Pharmaceuticals find extensive usage of sweeteners such as xylitol and sorbitol in chewable tablets, syrups, and oral rehydration solutions to enhance palatability. For formulations that are sugar-free or diabetic-friendly, the demand is even higher.

Meanwhile, the toothpaste and mouthwash personal care application of xylitol added moisture-retaining and anti-cavity properties to these products, whose use was growing because consumers were becoming increasingly aware of health and wellness issues. Growth in these segments has been supported by research aimed at identifying new formulations that utilize sweeteners in novel applications.

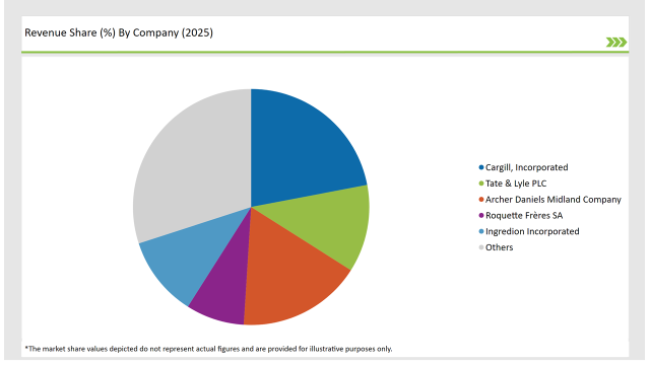

2025 Market share of Europe Sweetener manufacturers

| Manufacturer | Market Share (%) |

|---|---|

| Cargill, Incorporated | 22% |

| Tate & Lyle PLC | 12% |

| Archer Daniels Midland Company | 17% |

| Roquette Frères SA | 8% |

| Ingredion Incorporated | 11% |

| Others | 30% |

The European market for sweeteners is moderately concentrated and has significant players like Cargill, Tate & Lyle, and Roquette in terms of holding major shares. The grip over market business operations is maintained by such companies through significant distribution networks, robust research expertise, and strategic tie-ups.

Local and regional players like Nordzucker and Tereos also gain ground as they focus on niche markets, offering innovative, sustainable sweeteners. Cargill and Tate & Lyle, among others, are concentrating on building their capacities of production to capture the increasing demand for natural and low-calorie sweeteners. Research and development into their products is also being done to have enhanced functionality and taste.

Regional players are also getting on board through strategies that include the production of organic and non-GMO sweeteners that can meet particular consumer needs.

As per Product Type, the industry has been categorized into Natural sweeteners (Stevia, Palm Sugar, Coconut Sugar, Honey, Maple Syrup, Monk Fruit Sugar, Agave Syrup, Lucuma Fruit Sugar, Molasses, Other Natural Sweeteners), Artificial sweeteners(Acesulfame Potassium, Aspartame, Neotame, Advantame, Saccharin, Sucralose, Other Artificial Sweeteners), Sucrose, Noval, Sweetners, Sugar Alcohol.

As per Nature, the industry has been categorized into Organic, and Conventional.

As per Application, the industry has been categorized into Food (Bakery Goods, Sweet Spreads, Confectionery and Chewing Gums, Dairy Products, Others), Beverages(Carbonated Drinks, Fruit Drinks & Juice, Sports & Energy Drinks, Powdered Drinks and Mixes, Others), Pharmaceuticals, and Personal Care.

As per Application, the industry has been categorized into Hypermarkets / Supermarkets, Convenience Stores, Specialty Retail Stores, Traditional Grocery Retailers, Online Retailers, and Other Channels.

As per category, the industry has been divided into High Intensity Sweetener, and Low Intensity Sweetener.

Industry analysis has been carried out in key countries of Germany, UK, France, Italy, Spain, Belgium, Netherlands, Nordic, Hungary, Poland, Czech Republic and Rest of Europe.

The Europe sweetener market is projected to grow at a CAGR of 3.2% from 2025 to 2035.

By 2035, the market is expected to reach an estimated value of USD 5,373.0 million.

Key factors driving the European sweetener market include increasing health consciousness and demand for natural alternatives, alongside regulatory changes and consumer preferences for low-calorie options. Additionally, trends in the food and beverage industry and sustainability concerns are influencing market dynamics.

Germany, the UK, and France, are key countries with high consumption rates in the European sweetener market.

Leading manufacturers include Cargill, Incorporated, Tate & Lyle PLC, and Archer Daniels Midland Company, known for their innovative and sustainable production techniques and a variety of product lines.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Europe Radiotherapy Patient Positioning Market Size and Share Forecast Outlook 2025 to 2035

Europe Polyvinyl Alcohol Industry Analysis Size and Share Forecast Outlook 2025 to 2035

Europe Cruise Market Forecast and Outlook 2025 to 2035

Europe Massage Therapy Service Market Size and Share Forecast Outlook 2025 to 2035

Europe Cement Market Analysis Size and Share Forecast Outlook 2025 to 2035

European Union Tourism Industry Size and Share Forecast Outlook 2025 to 2035

Europe Injection Molding Machines Market Size and Share Forecast Outlook 2025 to 2035

Europe Injection Moulders Market Size and Share Forecast Outlook 2025 to 2035

Europe and MENA Generic Oncology Drug Market Size and Share Forecast Outlook 2025 to 2035

Europe Masking Tapes Market Size and Share Forecast Outlook 2025 to 2035

Europe Liners Market Size and Share Forecast Outlook 2025 to 2035

Europe Dermal Fillers Market Size and Share Forecast Outlook 2025 to 2035

Europe Trolley Bus Market Size and Share Forecast Outlook 2025 to 2035

Europe Protease Market Size and Share Forecast Outlook 2025 to 2035

Europe Luxury Packaging Market Size and Share Forecast Outlook 2025 to 2035

Europe & USA Consumer Electronics Packaging Market Size and Share Forecast Outlook 2025 to 2035

Europe Plant-Based Meal Kit Market Size and Share Forecast Outlook 2025 to 2035

Europe Temperature Controlled Packaging Solutions Market Size and Share Forecast Outlook 2025 to 2035

Europe Rubber Derived Unrefined Pyrolysis Oil Market Size and Share Forecast Outlook 2025 to 2035

Europe Pet Food Market Analysis by Nature, Product Type, Source, Pet Type, Packaging, Distribution Channel, and Country - Growth, Trends, and Forecast through 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA