The USA sweetener market is projected to reach a value of USD 3.7 Billion in 2025, growing at a CAGR of 5.4% over the next decade to an estimated value of USD 5.9 Billion by 2035. This significant growth is driven by evolving consumer preferences for healthier alternatives, rising awareness of the health impacts of sugar, and advancements in sweetener technology.

Food and drink producers depend on various alternative sugars for their formulations, which can be used in beverages, baked items, dairy, and confectionery. Fruit and plant ingredients are developed as more and more people pay attention to the foods they consume with full sugars and be more fit and ready for certain diets or sugar restrictions.

The demand for minimally processed and clean-label ingredients has been due to the ongoing clean-label trend, expected for the USA sweetener market to show a consistent growth rate.

The market for this product is gaining ground rapidly with the introduction of new formulas by companies that want to achieve the best possible balance between flavor, price, and usability. The major factors are the increasing cases of diabetes and obesity, which tend to make people seek low-calorie and diabetic-friendly choices. The positive predictions of the market growth lead to the offering of a wider product range and to the market entry of new product categories.

| Attributes | Description |

|---|---|

| Estimated USA Sweetener Industry Size (2025E) | USD 3.7 billion |

| Projected USA Sweetener Industry Value (2035F) | USD 5.9 billion |

| Value-based CAGR (2025 to 2035) | 5.4% |

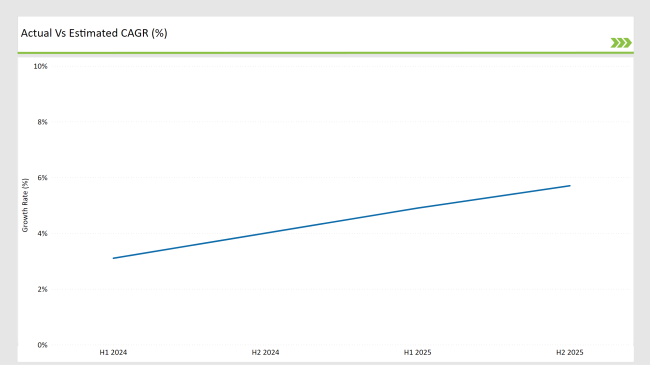

The table below highlights the semi-annual growth trends in the USA sweetener market, revealing a steady increase in CAGR from 2025 to 2035, driven by rising consumer demand for clean-label and functional sweeteners, particularly in beverages and confections, attributed to ongoing research and a shift toward natural alternatives.

H1 signifies period from January to June, H2 Signifies period from July to December

| Date | Development/M&A Activity & Details |

|---|---|

| January 2024 | Idahoan Foods : Launched a new line of sweetener-enhanced potato products aimed at health-conscious consumers looking for lower-calorie options. |

| March 2024 | Cargill : Announced the expansion of its stevia extraction facility to increase production capacity for natural sweeteners in response to growing demand. |

| May 2024 | ADM : Acquired a specialty sweetener company to enhance its portfolio of sugar alternatives and expand its market presence in the health and wellness sector. |

| July 2024 | Ingredion Incorporated : Introduced a new range of clean-label sweeteners derived from natural sources, targeting the growing demand for transparency in food ingredients. |

| September 2024 | Tate & Lyle : Partnered with a major beverage manufacturer to develop innovative low-calorie sweetener solutions for new product lines. |

Demand for Natural Sweeteners Drives Innovation in the Food Industry

The increasing demand for natural sweeteners such as stevia, monk fruit, and agave syrup is driven by health-conscious consumers. The low or zero-caloric content of the said options makes them increasingly popular in the context of the clean-label trend. Stevia, which can be related to plant-based origin, is appropriate for diabetics and leads the segment by acquiring substantial market penetration.

The regularity for natural sweeteners exceeds 45% in the 2025 market projections. Baked goods and beverages alongside health supplements now use natural sweeteners which industry analysts believe will remain central to this market growth. Consumer scepticism against artificial food additives has propelled this market forward while driving the industry toward a permanent transition toward natural sweeteners.

Blended Formulations and Artificial Sweetener Innovations Expand Market Potential

Natural sweeteners currently lead consumer choices but artificial sweeteners maintain their central position because of their economic advantage and durability’s across different applications. The market has experienced an opportunity boost because of blended sweetener solutions that fuse artificial and natural sweetener types. Trials that combine sucralose with stevia create advanced products that maintain strong flavor perception in beverages and processed foods due to their improved stability.

The innovation-driven approach of the industry becomes apparent through advancements in future artificial sweeteners such as all lose development. Their focus goes toward developing ingredients that provide better tastes along with reduced aftertaste effects and suitable use in multiple product formulations.

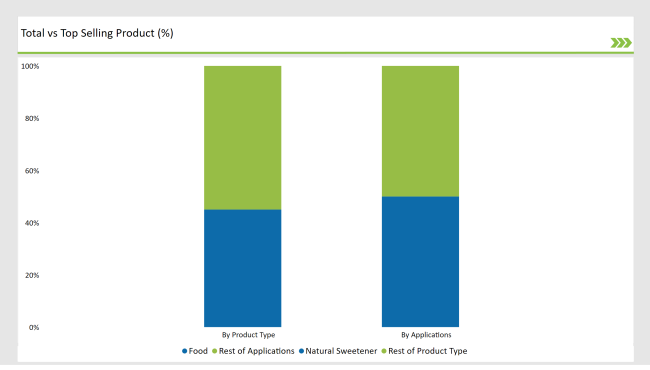

% share of Individual categories by Product Type and Application in 2025

During 2025, Food will maintain the strongest market position with a 50% revenue share because these sweeteners are used conspicuously throughout this sector. The market leadership position Erritor has built is based on beverage customers seeking products without added sugar and calories. Manufacturers of flavored water and soft drinks along with energy drinks use popular artificial sweeteners erythritol, stevia, and monk fruit to create optimal Flavor profiles.

The market continues thriving because consumers increasingly seek drinks with health benefits. The market fulfills consumer expectations regarding sweetness levels using reduced-calorie sweeteners that appeal to health-conscious customers. The growth of this segment can be attributed to innovative beverage initiatives that unite natural sweeteners together with artificial choices through hybrid drink development. Ongoing health and wellness momentum will keep the beverages segment as a dominant force driving the American sweetener market.

The natural sweetener Stevia dominates the market with a projected 45% market share for 2025. The tasteless profile of stevia combined with its wide compatibility in food and beverage products makes it a growing popular choice across the industry. The plant-based source of stevia matches the rising market need for ingredients that bear clean-label certifications. The sweetener finds extensive applications throughout beverages and bakery products, along with dairy items and confectioneries.

STEM processes for stevia production have improved its taste characteristics while eliminating its unpleasant aftertaste to boost customer adoption. Stevia-based formulations attract increasing investment from manufacturers, which solidifies its position as a leading brand in the sweetener market. The ability of this ingredient to adapt to consumer demands combined with its health-weighted advantages makes it a viable ingredient for continued market application.

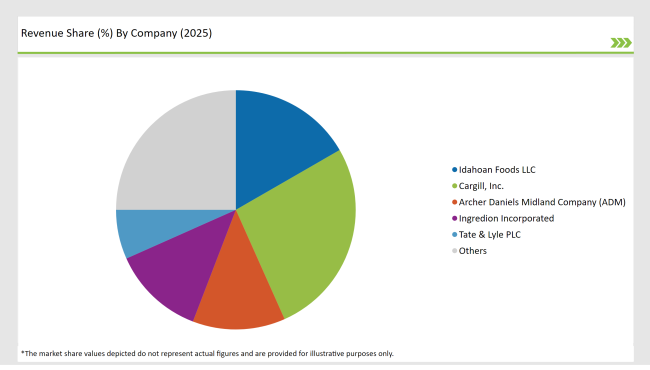

2025 Market share of USA Sweetener suppliers

Large manufacturers in the USA sweetener market rule through extensive product range development alongside research expertise and vast international distribution channels. Through continuous innovation combined with technological improvements, manufacturers establish industry standards that secure their competitive position. Their capability to serve multiple consumer needs through multiple applications leads to their sustained market position.

The market leadership of regional manufacturers comes from their focus on niche markets alongside specialized product production. The capacity of medium-sized companies lets them immediately respond to regional demands by delivering customized organic and non-GMO sweetening products. Their fast response to regional needs supports both market flexibility and its potential development.

Local competitors sustain competitive market dynamics because they serve unique community requirements and innovative price solutions. Local business operators focus on delivering customized solutions that enable them to build sustained relationships throughout their market area. The industry relies heavily on small manufacturers because their innovations combined with specialized products increase market competition and drive economic development.

By Function the industry has been categorized into sweetening agents, flavor enhancers, and preservatives.

By Nature, the industry has been categorized into organic and conventional.

By Application, the industry has been categorized into beverages, bakery and confectionery, and dairy products.

By functionality, the industry has been categorized into low-calorie, zero-calorie, and high-intensity options.

The USA market is expected to grow at a CAGR of 5.4% throughout the forecast period.

By 2035, the sales value is expected to be worth USD 5.9 billion.

Growing consumer preference for healthier options which in turn is driving up demand for natural ingredients.

Some of the key players in manufacturing include Cargill, Inc., Archer Daniels Midland Company (ADM), Ingredion Incorporated, Tate & Lyle PLC, Pure Circle Ltd., and more.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

USA Medical Coding Market Size and Share Forecast Outlook 2025 to 2035

USA Labels Market Size and Share Forecast Outlook 2025 to 2035

USA Plant-based Creamers Market Size and Share Forecast Outlook 2025 to 2035

USA Barrier Coated Paper Market Size and Share Forecast Outlook 2025 to 2035

USA Electronic Health Records (EHR) Market Size and Share Forecast Outlook 2025 to 2035

USA Animal Model Market Size and Share Forecast Outlook 2025 to 2035

USA and Canada Packer Bottle Market Size and Share Forecast Outlook 2025 to 2035

USA Stretch Hood Films Market Size and Share Forecast Outlook 2025 to 2035

USA and Canada Fence Screen Market Size and Share Forecast Outlook 2025 to 2035

USA Lubricant Contaminated HDPE Container Waste Market Size and Share Forecast Outlook 2025 to 2035

USA Commercial Walk-In Refrigeration Market Size and Share Forecast Outlook 2025 to 2035

USA & Canada Pre-painted Steel Roofing and Cladding Market Size and Share Forecast Outlook 2025 to 2035

USA Residential Cotton Candy Maker Market Size and Share Forecast Outlook 2025 to 2035

USA Faith Based Tourism Market Size and Share Forecast Outlook 2025 to 2035

United States NFC Lemon Juice Market Analysis - Size, Growth and Forecast 2025 to 2035

USA and Canada Copper Market Insights - Demand, Size & Industry Trends 2025 to 2035

USA Ground and Precipitated Calcium Carbonate Market Growth by Product Type, Application, End-Use, and Region in 2025 to 2035

United States Animal Feed Additives Market Report – Trends, Growth & Forecast 2025–2035

United States Wild Rice Market Outlook – Size, Demand & Forecast 2025–2035

United States Wood Vinegar Market Analysis – Trends, Growth & Forecast 2025–2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA