The sweetener market has a perfect mix of multinational corporations, regional leaders, startups, and niche brands. The Sweetener market is dominated by companies such as Cargill, Tate & Lyle, and Archer Daniels Midland Company, which accounts for around 55% of the market.

These companies depend on their long supply chains, powerful R&D capabilities, and diversified product portfolios to capture the market in North America, Europe, and Asia-Pacific. Regional players, like Südzucker AG in Germany and Meiji in Japan, comprise about 25% of the market share, mainly through culturally customized products and regional distribution networks.

The niche brands and start-ups, PureCircle and GLG Life Tech Corporation, take around 15% of the market share by emphasizing innovation in natural and organic Sweetener. Private labels contribute the remaining 5%, offering cost-effective sweetening solutions under supermarket brands such as Walmart's Great Value and Tesco's Finest. This market implies a moderately consolidated industry leaving space for minor players to innovate and expand.

Global Market Share by Key Players

| Global Market Share, 2025 | Industry Share% |

|---|---|

| Top Multinationals (Cargill, Archer Daniels Midland, Tate & Lyle) | 40% |

| Rest of Top 5 (Südzucker AG, Ajinomoto Co., Inc.) | 15% |

| Regional Leaders (Meiji, Lotte Confectionery, Tereos S.A.) | 25% |

| Startups and Niche Brands (PureCircle, GLG Life Tech Corporation, Cumberland Packing) | 15% |

| Private Labels (Walmart (Great Value), Tesco (Finest)) | 5% |

The global market for Sweetener reflects moderate consolidation, often due to the international major’s dominance in high volume categories while small startup companies and niche brands enhance innovation.

The conventional segment holds a close to 70% market share, as major usage can be traced across most of the mass-market applications comprising soft drinks and processed food. The dominance of high-fructose corn syrup and artificial Sweetener such as aspartame is in this segment. Ajinomoto and Südzucker top the list of manufacturers.

Organic Sweetener, 30% of this market, are increasing in popularity with consumers seeking clean-label and sustainable options. Robust growth of this segment, especially in North America and Europe, can be attributed to products like PureCircle's organic stevia and Tate & Lyle's plant-based Sweetener. This part of the organics also draws advantages from a connection with premium food and beverage houses that are dealing with healthy goods.

Beverages account for 45% where Sweetener go hand in hand with carbonated drinks, energy beverages, as well as juices. Companies like PepsiCo and Coca-Cola are significant takers, who highly depend on firms like Cargill for innovative alternatives. Bakery and confectionery account for 30%, due to the increased demand for low calorie and sugar free products.

Functional products, like ADM’s Sweetener, support reduced-calorie formulations in this segment. The dairy products industry accounts for 25%, with its growth being mainly on sweetened yogurts, flavored milk, and desserts. The regional developments and innovations in Meiji about Sweetener in dairy point towards the diversification in this application area.

The big players in the global Sweetener market have been highly innovative, sustainable, and expanded in 2024. Multinationals have been opening green production sites while product portfolios were diversified with added plant-based and natural alternatives. Regional leaders have utilized cultural differences in preference and applied local ingredients to offer non-alternative products, mainly across Asia and Europe.

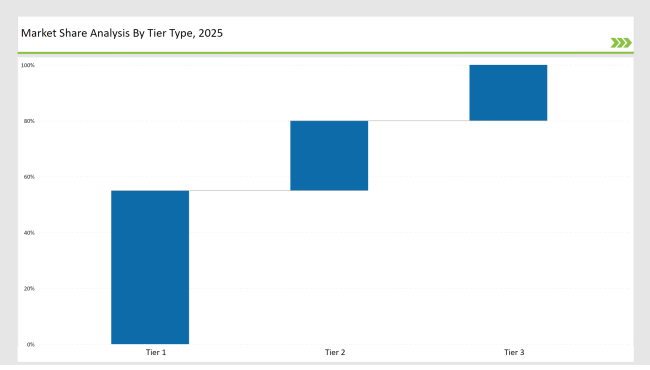

| By Tier Type | Tier 1 |

|---|---|

| Market Share % | 55% |

| Example of Key Players | Cargill, ADM, Tate & Lyle |

| By Tier Type | Tier 2 |

|---|---|

| Market Share % | 25% |

| Example of Key Players | Südzucker AG, Meiji, Lotte Confectionery |

| By Tier Type | Tier 3 |

|---|---|

| Market Share % | 20% |

| Example of Key Players | PureCircle, GLG Life Tech, Cumberland Packing |

| Brand | Key Focus |

|---|---|

| ADM | Enhanced supply chain transparency for its natural Sweetener. |

| Südzucker AG | Developed low-calorie sugar products for bakery applications. |

| Cargill | Expanded “ ViaTech” stevia line with improved taste modulation for beverages. |

| Tate & Lyle | Partnered with startups to explore alternative plant-based Sweetener. |

| Ajinomoto Co., Inc. | Conducted awareness campaigns for safe artificial sweetener consumption. |

| Meiji | Focused on expanding sweetener offerings in the functional foods segment. |

| GLG Life Tech | Launched a carbon-neutral facility for stevia extraction. |

| Cumberland Packing Corporation | Partnered with health influencers to promote its low-calorie sweetener range. |

| PureCircle | Collaborated with beverage brands to create customized stevia blends. |

| Lotte Confectionery | Introduced sustainable Sweetener in eco-friendly packaging. |

Stevia is a natural, zero-calorie sweetener that has gained significant attention lately because consumers are trying to reduce their sugar intake. The trend is being exploited by manufacturers in terms of an increased range of products containing stevia as a sweetener, like stevia-sweetened sodas, juices, and baked goods.

Stevia has gained mainstream status in Asia-Pacific regions like China and Japan, whereas the growth in Europe is primarily because of increasing health consciousness among consumers, leading to the demand for natural Sweetener.

E-commerce sites also offer more sales opportunities for specialty and premium Sweetener like monk fruit sweetener and organic honey. With an e-commerce website, the producers can expand the customer base from health-conscious buyers to others that may live too far away to shop in the specialty food store. Thus, online selling can help people conveniently and effectively locate and purchase those niche sweetener products that boost the market for natural Sweetener.

These novel extraction and processing techniques have helped improve the flavor and functionality of natural Sweetener. As an example, new extraction and purification techniques developed for Stevia have allowed the production of refined, less bitter-tasting Sweetener that make them more desirable for a greater variety of food and beverage uses.

Similar advances in the processing of monk fruit have enabled the manufacture of monk fruit Sweetener that are more soluble and sweeter, thus suitable for use in many different formulations, including beverages and baked goods.

Cargill, Tate & Lyle, and ADM collectively hold a significant share, with a combined market dominance of approximately 40%.

Regional players, such as Südzucker AG and Meiji, account for around 25% of the global sweeteners market.

Startups and niche brands like Pure Circle contribute 15%, focusing on innovation in natural and organic sweeteners.

Sustainability initiatives, including eco-friendly packaging and carbon-neutral production, are becoming critical competitive factors.

Private labels account for 5% of the market, offering affordable sweeteners under brands like Walmart’s Great Value.

Beverages and bakery products remain the most lucrative, driven by innovation in low-calorie and functional sweeteners.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Sweetener Market Analysis – Size, Share, and Forecast Outlook 2025 to 2035

United Kingdom Sweetener Market Trends – Size, Demand & Forecast 2025–2035

USA Sweetener Market Report – Trends, Demand & Industry Forecast 2025–2035

Analysis and Growth Projections for Dry Sweeteners Market

Corn Sweeteners Market Outlook - Growth, Demand & Forecast 2025 to 2035

ASEAN Sweetener Market Growth – Trends, Demand & Innovations 2025–2035

Novel Sweeteners Market Analysis by Product Type, End Use, Application and Region from 2025 to 2035

Polyol Sweeteners Market Analysis - Size, Share, & Forecast Outlook 2025 to 2035

Europe Sweetener Market Outlook – Share, Growth & Forecast 2025–2035

Nutritive Sweetener Market Size and Share Forecast Outlook 2025 to 2035

Australia Sweetener Market Analysis – Size, Share & Forecast 2025–2035

Intensive Sweeteners Market Analysis by Nature, Type, Application, Sales Channel and Region through 2035

Fermented Sweeteners Market

Analysis and Growth Projections for Artificial Sweetener Business

Low-calorie Sweeteners Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Animal Feed Sweetener Market – Growth, Innovations & Market Demand

Natural Malt Sweeteners Market

Peptide-based Sweetener Size and Share Forecast Outlook 2025 to 2035

Low Intensity Sweeteners Market Size and Share Forecast Outlook 2025 to 2035

Latin America Sweetener Market Trends – Growth, Demand & Forecast 2025–2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA