The Latin America Sweetener Market sales is set to grow from an estimated USD 1,248.0 million in 2025 to USD 1,847.0 million by 2035, with a compound annual growth rate (CAGR) of 5.9% during the forecast period from 2025 to 2035.

| Metric | Value |

|---|---|

| Estimated Latin America Industry Size (2025E) | USD 1,248.0 million |

| Projected Latin America Value (2035F) | USD 1,847.0 million |

| Value-based CAGR (2025 to 2035) | 5.9% |

The Latin American sweetener sales are forecasted for steady growth due to of health concerns, introduction of regulatory policies, and the move of consumers towards less sugar or no sugar at all products. The shift has taken place from synthetic to natural and low-calorie sweeteners as consumers began to be more concerned about obesity, diabetes, and other ailments. Plant-based monosaccharides such as stevia, honey, agave syrup, and monk fruit extract are becoming more and more popular.

At the same time, other products like aspartame, sucralose, and acesulfame K are also previalant in sugar-free soft drinks and processed foods. To go further, other sugar alcohols in these formulations, such as xylitol, erythritol, sorbitol, and maltitol are becoming more and more popular in the diabetic-friendly and keto-friendly formulations. New products like allulose and blends among sweeteners are also available since consumers demand different taste and label ingredients.

The application segments for sweeteners in Latin America are beverages, bakery and confectionery, dairy and frozen desserts, pharmaceuticals, and personal care products. The beverage sector is comprising of soft drinks, juices, energy drinks, and functional drinks, is now moving towards low-calorie and sugar-free alternatives at a fast pace. In the case of the demand for sugar substitutes in baked items, chocolates, and candies, it is climbing up since people are looking for healthier choices.

The sweeteners are also used in ice creams and zests that are reduced in sugars, soy foods, and stds, and the pharmaceutical segment that comes into picture is cough syrups, swallowable tablets, and medicated losanges. Sugar is used as a substitute along with the xylitol in the oral range of the personal care sector which makes therapeutic products more effective like the use of xylitol in toothpaste, chewing gum, and mouthwashes.

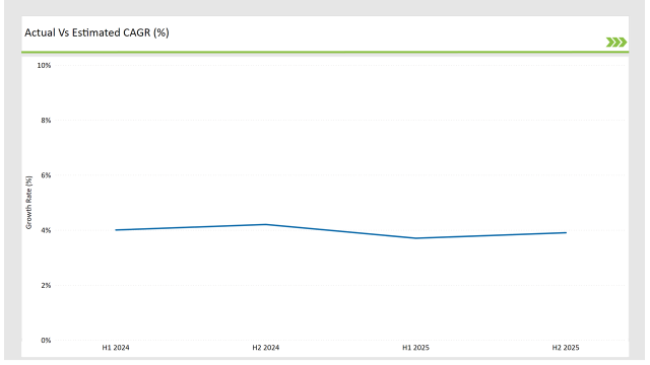

This table illustrates the values for the changes in the compound annual growth rate (CAGR) for the base year (2024) and the current year (2025) of the Latin American sweetener market, over six months, along with a detailed comparative assessment of these changes. The first half of the year, H1, covers January to June, while the second half, H2, spans July to December.

| Particular | Value CAGR |

|---|---|

| H1 (2024 to 2034) | 4.0% |

| H2 (2024 to 2034) | 4.2% |

| H1 (2025 to 2035) | 3.7% |

| H2 (2025 to 2035) | 3.9% |

H1 signifies period from January to June, H2 Signifies period from July to December

On the Latin American sweetener market, the sector is expected to have a 4.0% CAGR in the first half of 2024, with an increase to 4.2% in the second half of the same year. 2025 is projected to have a small decrease in growth rates of 3.7% in H1, yet in H2 it is expected to be more beneficial and get up to 3.9%.

Trends in Health and Wellness

Boosting the health consciousness of Latinos is one of the prominent factors penetrating the sweetener market. As people become more and more aware of the adverse effects of sugar, including obesity, diabetes, and heart disease, they are becoming more and more interested in healthy choices. The natural low-calorie sweetener market is a large one and is getting more significant, especially concerning the need for stevia, monk fruit, and agave syrup.

These plant-origin sweeteners also relate to the clean-label, sustainability, and functional food trend's strength. This shift is not merely confined to entities in the beverage sector but is also extending to packaged foods, dairy products, and even confectioneries.

Traditional food producers and multinationals that are addressing these alterations in the consumer behavior are inventive with the formulas by introducing these natural alternatives. Furthermore, because of the expansion of the interest in diets such as keto, low carb, and diabetes living in places like Mexico and Brazil, the sale of these substitutes has increased and hence the overall market has ranged.

Government Regulations and Sugar Taxes

The Mexican government is intervening in multiple ways to diminish public health crisis of obesity and diabetes, hence reshaping the market for sweeteners in the Latin America region. There are sugar taxes and labeling nutrition laws in many countries that have been in force; Mexico is still the first in passing them. These rules have made a space where sugar reduction is getting to be a priority for food and beverage makers.

The implementation of a sugar tax in Mexico has affected consumers' choices a lot, which led to listing the demand for the low-sugar and sugar-free products that have undergone significant reformulation. In Brazil, along with the governmental push for front-of-pack labels to indicate high sugar content in some products, the manufacturers have had to readjust their products.

Thus, sweetener suppliers have to sucralose and stevia to meet the consumers' different needs alongside the companies' compliance with government orders. These measures have not only lead companies to create healthier products but have also set a right example among earlier adopters of these changes that will be the first to benefit from the competition.

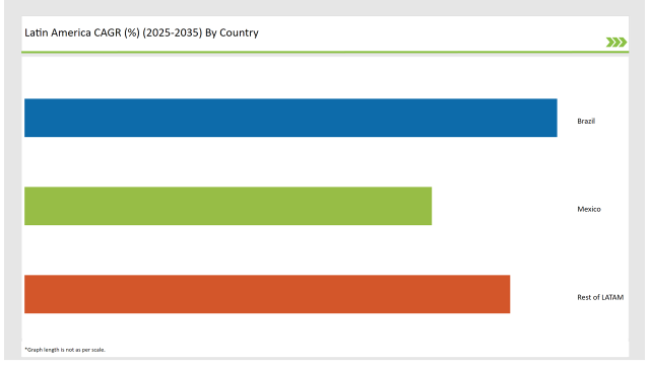

The following table shows the estimated growth rates of the top four markets. These countries are set to exhibit high consumption, recording high CAGRs through 2035.

| Countries | Market Share (%) |

|---|---|

| Brazil | 34% |

| Mexico | 26% |

| Rest of LATAM | 31% |

Brazil's dominant position in the Latin American sweetener market stems from its 34% share, which is driven primarily by the country's increasing demand for healthy products. People have developed a better insight into the impacts of an excessive sugar regime thus, people are shifting to natural and low-calorie sweeteners.

This is a very clear trend especially in Brazil, where the adoption of wellness products is mainly responsible for the shift to organic food and drink., Companies in Brazil are focusing on sweetener options like stevia, agave syrup, and sugar alcohols for health-conscious consumers that want alternatives to traditional sugar. The diversified food industry in Brazil, which covers beverages to packaged snacks and dairy, is the bedrock of the sweeteners market and thus boosts natural sweeteners.

The agriculture strengthens the food industry and gives Brazil the potential to create a legacy of far-reaching market share, regardless of {seekers looking to land} and environment problems, As a result, Brazil is facing a larger market share both for local production and as an export country.

Mexico holds a 26% share of the sweetener market in Latin America, driven in part by government regulations and sugar tax policies. The introduction of a sugar tax in Mexico has significantly influenced consumer behavior, making low-calorie and sugar-free products more attractive to both manufacturers and consumers.

The tax has led food and beverage companies to reformulate their products, incorporating sugar substitutes like stevia and sucralose to comply with the new regulations while maintaining product appeal. As the country continues to tackle rising obesity rates, regulatory measures are expected to further drive the demand for non-sugar sweeteners.

Furthermore, Mexico's large consumer base, particularly in urban areas, is increasingly adopting healthier eating habits, which positions the market for growth in the coming years. As manufacturers seek to avoid the high costs of sugary products, sweeteners that offer a healthier alternative are seeing expanded use in everything from beverages to snacks.

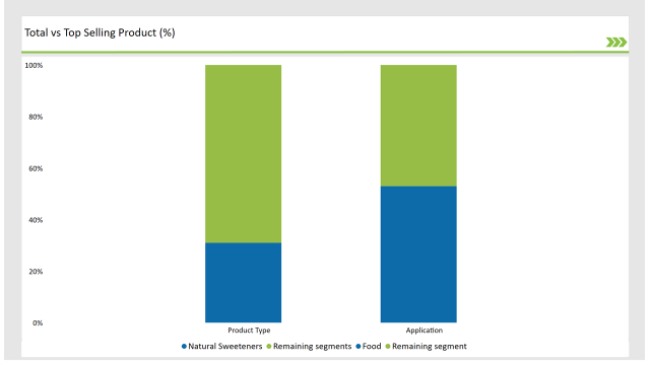

% share of Individual categories by Product Type and Applications in 2025

| Main Segment | Market Share (%) |

|---|---|

| Product Type (Natural Sweeteners) | 31% |

| Remaining segments | 69% |

It is projected that natural sweeteners will occupy a sizable part of the total Latin American sweetener market in 2025 which is 31%. This is all due to the moves of the consumers to healthier, clean-label alternatives to traditional sugars and artificial sweeteners. Natural sweeteners, such as stevia, agave syrup, monk fruit, and coconut sugar are becoming more and more popular and bestow a sense of health and nutritional well-being to their users.

The knowledge of the adverse effects of synthetic sweeteners and refined sugars is motivating people to use plant-based sweeteners, which have a lower glycemic index and fewer calories. Among the natural sugary substances that are now being applied right in the markets of Brazil and Mexico the ones that accompany diabetes diets such as keto and low-carb diet stand out.

Inventors of the beverages, snacks, and desserts lines in LATAM countries have started to explore more this path, thus extending their market gains.

| Main Segment | Market Share (%) |

|---|---|

| Application ( Food ) | 53% |

| Remaining segments | 47% |

Food remains the largest area for sweeteners in Latin America, having a sizeable 53% of the market in 2025. This is largely due to the constant need for sugar substitutes in food products such as baked goods, dairy, confectionery, and processed foods, which is what is driving it. As Latin American citizens are becoming more health-conscious, the speed of innovation for reduced sugar and sugar substitutes items has dramatically increased.

For that matter, cakes, cookies, and candies are being manufactured more and more with ingredient changes such as sweeteners like stevia and sugar alcohols that fulfill people's sexual needs with respect to healthy and widely accepted alternatives. The popularity of low-carםb, keto, and diabetic-friendly products as functional foods also contributes to this process.

On the other hand, the food sector's emphasis on clean-label products, which preach about the inclusion of natural, minimally processed substances, has been a crucible of the incidence of natural sweeteners in food applications. The combination of policies such as sugar taxes and the trend toward eating better also makes the food sector a major driver of the sweetener market in Latin America.

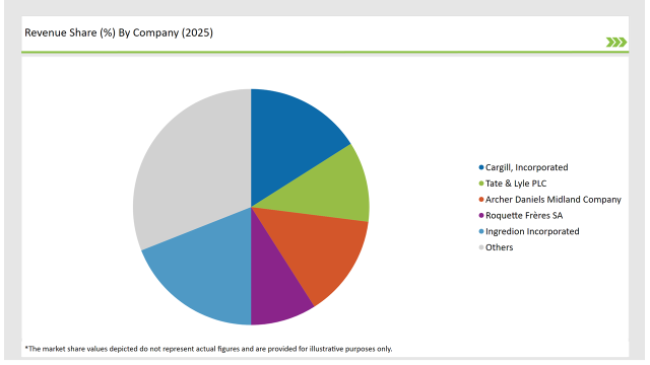

2025 Market share of Latin America Sweetener manufacturers

| Manufacturer | Market Share (%) |

|---|---|

| Cargill, Incorporated | 16% |

| Tate & Lyle PLC | 11% |

| Archer Daniels Midland Company | 14% |

| Roquette Frères SA | 9% |

| Ingredion Incorporated | 19% |

| Others | 31% |

Latin America is a market place with a moderate to high concentration level that is ruled by key players especially in the natural sweeteners production sector. Even though multinationals like Cargill, Tate & Lyle, and Ingredion are investing hugely in their sugar business, regional actors are carving their own niches with the sweeteners that are more relevant to their community like the agave syrup and stevia.

In emerging markets such as Brazil and Mexico, local manufacturers have been taking the fights with agricultural resources such as agave syrup and stevia thanks to the high technology of the region at competitive prices. This has opened the door for smaller companies, especially in the natural and organic categories, to occupy a larger market share. However, the bigger companies succeeded in the distribution and supply chain infrastructure.

To sum it up, the market is still fragmented and demonstrates some tendencies for oligopolistic behavior as a few of the global companies dominate the overall sales, especially in artificial sweeteners and food and beverage operations. Nevertheless, with the common preference for natural, plant-based sweeteners, smaller producers in Brazil, Mexico, and other key players have newfound possibilities for expansion and presence.

As per Product Type, the industry has been categorized into Natural sweeteners (Stevia, Palm Sugar, Coconut Sugar, Honey, Maple Syrup, Monk Fruit Sugar, Agave Syrup, Lucuma Fruit Sugar, Molasses, Other Natural Sweeteners), Artificial sweeteners (Acesulfame Potassium, Aspartame, Neotame, Advantame, Saccharin, Sucralose, Other Artificial Sweeteners), Sucrose, Noval, Sweetners, Sugar Alcohol.

As per Nature, the industry has been categorized into Organic, and Conventional.

As per Application, the industry has been categorized into Food (Bakery Goods, Sweet Spreads, Confectionery and Chewing Gums, Dairy Products, Others), Beverages (Carbonated Drinks, Fruit Drinks & Juice, Sports & Energy Drinks, Powdered Drinks and Mixes, Others), Pharmaceuticals, and Personal Care.

As per Application, the industry has been categorized into Hypermarkets / Supermarkets, Convenience Stores, Specialty Retail Stores, Traditional Grocery Retailers, Online Retailers, and Other Channels.

As per category, the industry has been divided into High Intensity Sweetener, and Low Intensity Sweetener.

Industry analysis has been carried out in key countries of Brazil, Mexico and Rest of Latin America.

The Latin America Sweetener market is projected to grow at a CAGR of 5.9% from 2025 to 2035.

By 2035, the market is expected to reach an estimated value of USD 1,847.0 million.

The Latin American sweetener market is driven by increasing health-consciousness, with consumers seeking low-calorie and natural alternatives to sugar, such as stevia and monk fruit. Government regulations, including sugar taxes and nutritional labeling laws, are pushing manufacturers to adopt healthier formulations. Additionally, the rising prevalence of lifestyle diseases like obesity and diabetes is driving demand for sugar-free and sugar-reduced products across food and beverages.

Leading manufacturers include Cargill, Incorporated, Tate & Lyle PLC, and Archer Daniels Midland Company, known for their innovative and sustainable production techniques and a variety of product lines.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Latin America Joint Compound Industry Analysis Size and Share Forecast Outlook 2025 to 2035

Latin America In-mold Labels Market Size and Share Forecast Outlook 2025 to 2035

Latin America Rigid Industrial Packaging Market Size and Share Forecast Outlook 2025 to 2035

Latin America Hand Sanitizer Market Size and Share Forecast Outlook 2025 to 2035

Latin America Hand Soap Market Size and Share Forecast Outlook 2025 to 2035

Latin America Hydraulic Filtration Market Size and Share Forecast Outlook 2025 to 2035

Latin America Automotive HVAC Market Size and Share Forecast Outlook 2025 to 2035

Latin America Frozen Ready Meals Market Insights – Demand & Forecast 2025–2035

Latin America Fish Protein Market Trends – Size, Growth & Forecast 2025–2035

Latin America Aqua Feed Additives Market Trends – Growth & Forecast 2025–2035

Latin America Collagen Peptide Market Report – Trends, Size & Forecast 2025–2035

Latin America Bubble Tea Market Outlook – Growth, Trends & Forecast 2025–2035

Latin America Shrimp Market Report – Trends, Growth & Forecast 2025–2035

Latin America Animal Feed Alternative Protein Market Analysis – Growth & Forecast 2025–2035

Latin America Cultured Wheat Market Outlook – Growth, Demand & Forecast 2025–2035

Latin America Fructo-Oligosaccharides Market Report – Trends & Forecast 2025–2035

Latin America Starch Derivatives Market Outlook – Growth, Demand & Forecast 2025–2035

Latin America Sports Drink Market Analysis – Demand, Size & Forecast 2025–2035

Latin America Calf Milk Replacer Market Insights – Size, Growth & Forecast 2025–2035

Latin America Non-Alcoholic Malt Beverages Market Trends – Growth & Forecast 2025–2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA