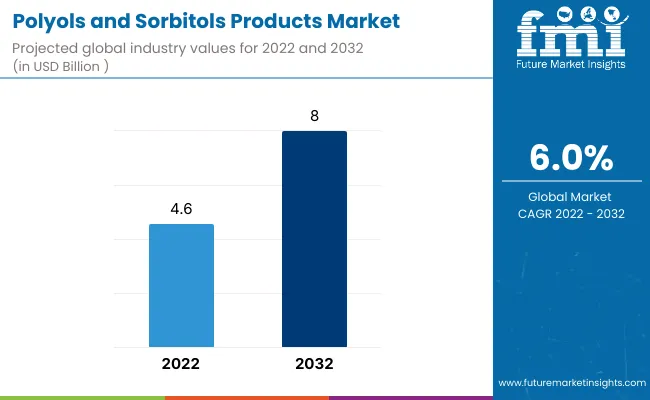

The sales in the global polyols and sorbitols products market are anticipated to total US$ 4.6 Bn by the end of 2022, showcasing growth at a CAGR of nearly 5% to 6% during the forecast period from 2022 to 2032.

Driven by the growing usage across the food & beverages and dietary pharmaceutical industries, the demand for polyols and sorbitols products is estimated to surpass a valuation of US$ 8 Bn by the end of 2032, in comparison to the US$ 4.3 Bn registered in 2021.

| Report Attribute | Details |

| Polyols And Sorbitols Products Market Registered Base Value (2021) | US$ 4.3 Billion |

| Polyols And Sorbitols Products Market Expected Value (2022) | US$ 4.6 Billion |

| Polyols And Sorbitols Products Market Anticipated Value (2032) | US$ 8 Billion |

| Polyols And Sorbitols Products Market Projected Growth Rate (2022-2032) | 5% to 6% CAGR |

Polyols are sugar alcohol molecules that possess two or more alcohol groups. It is also known as a sugar-free sweetener. Polyols and sorbitols are generally extracted from natural foods such as peaches, apples, pears, and others and from corn syrup.

In the past few years, there is a significant rise in incidence of lifestyle diseases such as diabetes, obesity, and others across the globe, due to the growing adoption of unhealthy eating habits and increasing fast-paced lifestyles.

For instance, according to a study by the International Diabetes Federation, nearly 537 million adults from the age of 20 to 79 years were reported to be suffering from diabetes worldwide in 2020 and the number is estimated to reach 643 million by 2030.

As sugar-free sweeteners are extensively used by diabetic patients for adding flavor & sweetness to numerous food products, growing prevalence of diabetes is projected to create lucrative growth opportunities in the global market over the coming years.

Excess consumption of polyols and sorbitols products results in causing gastrointestinal ailments such as bloating, laxative effects, flatulence, and abdominal discomfort among others.

In addition, a number of regulatory organizations such as the Food and Drugs Administration (FDA) are implementing regulations, mandating the laxative warning on products that contain over 10% of sugar alcohol. Hence, increasing awareness regarding these adverse health effects related to these sugar-free sweeteners is hindering the sales of polyols and sorbitols products in the market.

North America is estimated to emerge as a highly remunerative market for polyols and sorbitols products from 2022 to 2032, reveals Future Market Insights.

Due to the growing customer inclination towards healthy living and increasing adoption of low-calorie food products, there is a swift rise in demand for sugar-free products. Hence, leading companies are emphasizing on introducing novel sugar-free products to capitalize on the increasing demand.

For instance, in 2020, Ingredion, an American multinational sweetener and ingredient provider announced introducing its first polyols sweetener, ERYSTA Erythritol with reduced calorie content for applications in desserts, bakery products, and others. A slew of such new product launches is estimated to bolster the sales in the North America market.

As per a study by FMI, South Asia is anticipated to account for a significant share in the global polyols and sorbitols products market from 2022 to 2032.

With increasing burden of diseases such as cholesterol-related ailments, diabetes, and obesity, demand for fat-free, low calorie, organic and natural products is rapidly increasing across Asia Pacific, creating growth prospects for polyols and sorbitols products.

Also, Polyols and sorbitols are increasingly finding applications in milkshakes, juices, protein shakes, energy drinks, soups, and syrups as flavoring agents and sweeteners. This is further projected to accelerate the demand in the South Asia market.

Some of the leading players in the polyols and sorbitols products market are Royal Dutch Shell PLC., Tereos Starch & Sweeteners, Gulshan Polyols Ltd., Roquette Freres, China National Bluestar Co, Ltd., Merck, Cargill, Ecogreen Oleochemicals, BASF SE, Sorini, Sigma-Aldrich, American International foods, Spi Pharma, Polyols & Polymers Pvt. Ltd., and others.

Key manufacturers are aiming at launching new products and expanding their production capacity to strengthen their foothold in the highly competitive polyols and sorbitols products market.

| Report Attribute | Details |

| Growth Rate | CAGR of 5% to 6% from 2022 to 2032 |

| Base Year for Estimation | 2021 |

| Historical Data | 2015-2020 |

| Forecast Period | 2022-2032 |

| Quantitative Units | Revenue in USD Billion, Volume in Kilotons and CAGR from 2022-2032 |

| Report Coverage | Revenue Forecast, Volume Forecast, Company Ranking, Competitive Landscape, Growth Factors, Trends and Pricing Analysis |

| Segments Covered |

|

| Countries Covered |

|

| Key Companies Profiled |

|

| Customization | Available Upon Request |

FMI projects the sales of polyols and sorbitols products in the market is expected to rise at 5% to 6% value CAGR by 2032.

The global polyols and sorbitols products market is expected to be dominated by South Asia over the forecast period 2022-2032.

Royal Dutch Shell PLC., Tereos Starch & Sweeteners, Gulshan Polyols Ltd., Roquette Freres, China National Bluestar Co, Ltd., Merck, Cargill, Ecogreen Oleochemicals, BASF SE, Sorini, Sigma-Aldrich, American International foods, Spi Pharma, Polyols & Polymers Pvt. Ltd, and others are some of the leading players in the prominent polyols and sorbitols products market.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Polyols Market Growth - Innovations & Industrial Applications

Natural Oil Polyols NOP Market Size and Share Forecast Outlook 2025 to 2035

Android Automotive OS (AAOS) Market Size and Share Forecast Outlook 2025 to 2035

Anderson Cascade Impactor Market Size and Share Forecast Outlook 2025 to 2035

Andersen-Tawil Syndrome Treatment Market Trends - Growth & Future Prospects 2025 to 2035

Andro Supplements Market

Candle Filter Cartridges Market Size and Share Forecast Outlook 2025 to 2035

Handheld Electrostatic Meter Market Size and Share Forecast Outlook 2025 to 2035

Hand Towel Automatic Folding Machine Market Size and Share Forecast Outlook 2025 to 2035

Handheld Ultrasound Scanner Market Size and Share Forecast Outlook 2025 to 2035

Handheld Tagging Gun Market Forecast and Outlook 2025 to 2035

Handheld Imaging Systems Market Size and Share Forecast Outlook 2025 to 2035

Sandwich Panel System Market Size and Share Forecast Outlook 2025 to 2035

Hand Tools Market Size and Share Forecast Outlook 2025 to 2035

Land Survey Equipment Market Size and Share Forecast Outlook 2025 to 2035

Handloom Product Market Size and Share Forecast Outlook 2025 to 2035

Band File Sander Belts Market Size and Share Forecast Outlook 2025 to 2035

Handheld XRF Analyzers Market Size and Share Forecast Outlook 2025 to 2035

Sand Abrasion Tester Market Size and Share Forecast Outlook 2025 to 2035

Sand Testing Equipments Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA