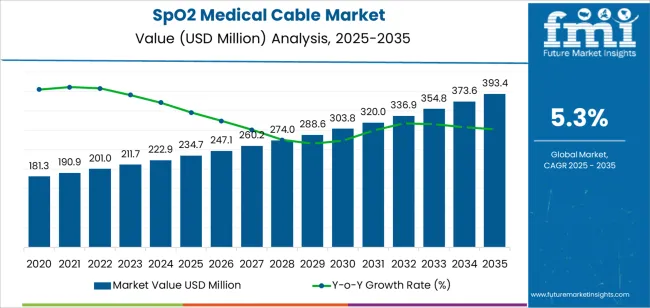

The global SpO2 medical cable market is projected to grow from USD 234.7 million in 2025 to approximately USD 393.3 million by 2035, recording an absolute increase of USD 158.6 million over the forecast period. This translates into a total growth of 67.6%, with the market forecast to expand at a CAGR of 5.3% between 2025 and 2035. The market size is expected to grow by nearly 1.7 times during the same period, supported by increasing adoption of pulse oximetry monitoring systems across healthcare facilities, growing prevalence of respiratory disorders requiring continuous oxygen saturation monitoring, and rising integration of advanced sensor technologies in patient monitoring equipment.

The market expansion reflects fundamental shifts in healthcare delivery models focusing continuous patient monitoring and early intervention capabilities. Healthcare facilities are investing in comprehensive vital signs monitoring infrastructure that supports both acute care and remote patient management applications. SpO2 cables represent critical interface components connecting pulse oximetry sensors to monitoring systems, with performance reliability directly impacting clinical decision-making accuracy. Manufacturing standards are evolving to address diverse clinical environments ranging from intensive care units to home healthcare settings, driving demand for cables that combine durability, biocompatibility, and signal integrity across extended operational periods.

Technological advancement in cable design is enabling miniaturization and enhanced flexibility while maintaining electromagnetic interference shielding and mechanical durability requirements. The integration of reusable and disposable cable options addresses infection control protocols and cost management strategies across different healthcare settings. Regional variations in healthcare infrastructure investment and reimbursement frameworks create differentiated growth trajectories, with developed markets focusing on replacement cycles and technology upgrades while emerging markets emphasize initial infrastructure deployment and capacity expansion.

| Metric | Value |

|---|---|

| Market Value (2025) | USD 234.7 million |

| Market Forecast Value (2035) | USD 393.3 million |

| Forecast CAGR (2025 to 2035) | 5.3% |

| HEALTHCARE INFRASTRUCTURE EXPANSION | CLINICAL MONITORING REQUIREMENTS | TECHNOLOGY & REGULATORY STANDARDS |

|---|---|---|

| Global Healthcare Capacity Growth Patient monitoring infrastructure expansion across established and emerging healthcare markets driving demand for reliable connectivity solutions. | Comprehensive Monitoring Protocols Modern clinical standards requiring continuous oxygen saturation monitoring across diverse patient populations and care settings. | Medical Device Compliance Standards Regulatory requirements establishing performance benchmarks favoring certified biocompatible connectivity components. |

| Respiratory Disease Prevalence Growing incidence of chronic obstructive pulmonary disease and sleep apnea creating steady demand for pulse oximetry monitoring capabilities. | Critical Care Integration Demands Intensive care units investing in integrated monitoring systems offering consistent signal transmission and clinical data accuracy. | Infection Control Requirements Healthcare facility protocols requiring disposable and sterilization-compatible cable solutions supporting contamination prevention strategies. |

| Home Healthcare Development Expansion of remote patient monitoring programs requiring durable and user-friendly cable systems supporting non-institutional care environments. | Signal Quality Standards Clinical applications demanding electromagnetic interference resistance and consistent signal integrity across extended monitoring periods. | Biocompatibility Certification Quality standards requiring hypoallergenic materials and validated safety profiles supporting patient contact applications. |

| Category | Segments Covered |

|---|---|

| By Usability Type | Reusable, Disposable |

| By Application | Hospital, Clinic, Other |

| By Region | North America, Europe, Asia Pacific, Latin America, Middle East & Africa |

| Segment | 2025 to 2035 Outlook |

|---|---|

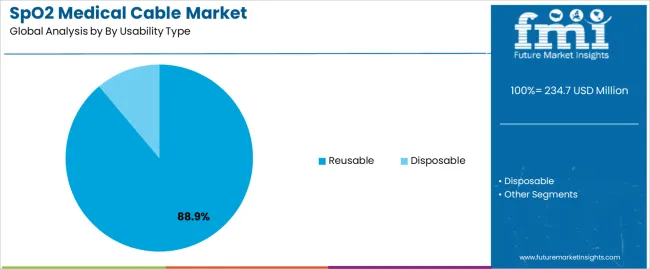

| Reusable | Dominant segment in 2025 with 88.9% market share; projected to maintain leadership through 2035. Cost-effectiveness for high-volume facilities, established sterilization protocols, durable construction supporting multiple patient uses. Momentum: steady growth driven by hospital procurement optimization and quality validation programs. Watchouts: infection control scrutiny, material degradation concerns, competition from single-use alternatives in contamination-sensitive applications. |

| Disposable | Growing segment capturing 11.1% share in 2025, driven by infection prevention protocols and single-patient use requirements. Eliminates cross-contamination risks, simplifies inventory management, supports epidemic response capacity. Momentum: rising adoption in emergency departments and isolation units. Watchouts: higher per-use costs, environmental concerns regarding medical waste, supply chain continuity during demand surges. |

| Segment | 2025 to 2035 Outlook |

|---|---|

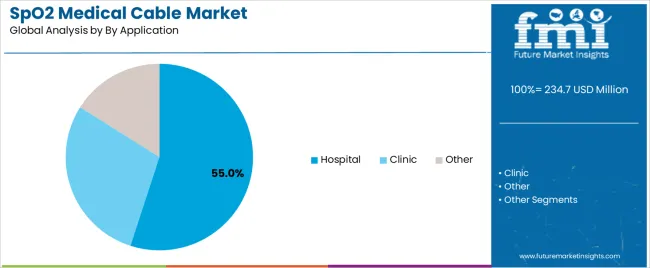

| Hospital | Largest application segment commanding 55.0% market share in 2025 with comprehensive monitoring requirements across emergency departments, intensive care units, surgical theaters, and general wards. Established procurement relationships, standardized equipment specifications, volume-based purchasing power. Momentum: steady growth driven by bed capacity expansion and equipment replacement cycles. Watchouts: budget constraints affecting non-critical upgrades, centralized procurement extending sales cycles. |

| Clinic | Moderate share in 2025 serving outpatient facilities, specialty practices, diagnostic centers, and ambulatory surgery centers. Cost-conscious procurement, preference for versatile equipment, smaller volume requirements compared to hospitals. Momentum: moderate growth via primary care expansion and specialized monitoring services. Watchouts: price sensitivity limiting premium product adoption, fragmented purchasing decisions across independent practices. |

| Other | Encompasses home healthcare, long-term care facilities, emergency medical services, and research institutions. Diverse requirements ranging from portability to extended durability, varied regulatory environments across settings. Momentum: selective growth in remote patient monitoring and mobile healthcare applications. Innovation-dependent with focus on ease-of-use and connectivity features supporting non-traditional care environments. |

| DRIVERS | RESTRAINTS | KEY TRENDS |

|---|---|---|

| Healthcare Infrastructure Investment Continuing expansion of patient monitoring capabilities across established and emerging healthcare systems driving demand for reliable cable connectivity. | Cost Containment Pressures Healthcare facility budget constraints affecting discretionary equipment purchases and upgrade timelines for non-critical components. | Miniaturization Advancement Integration of compact connector designs and flexible cable materials enabling improved patient comfort and clinical workflow efficiency. |

| Chronic Disease Prevalence Increasing recognition of continuous oxygen saturation monitoring importance in managing respiratory conditions and cardiovascular complications. | Supply Chain Complexity Component sourcing dependencies and manufacturing concentration risks affecting availability consistency during demand fluctuations. | Smart Monitoring Integration Enhanced compatibility with wireless transmission systems, real-time quality monitoring capabilities, and predictive maintenance features compared to conventional cables. |

| Regulatory Compliance Focus Growing focus on biocompatible materials and validated performance specifications supporting patient safety and clinical accuracy standards. | Technology Transition Challenges Equipment standardization concerns and connector compatibility variations influencing replacement decisions and inventory management. | Ecofriendly Materials Development Development of recyclable cable components and reduced environmental impact manufacturing processes providing differentiation opportunities while addressing healthcare green initiatives. |

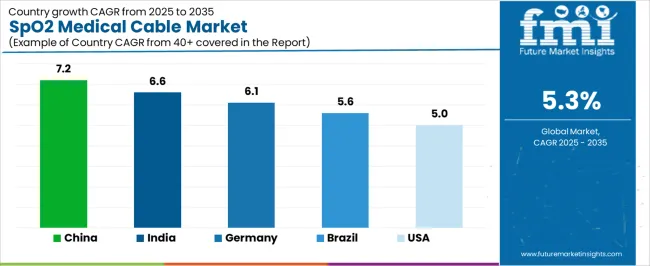

| Country | CAGR (2025-2035) |

|---|---|

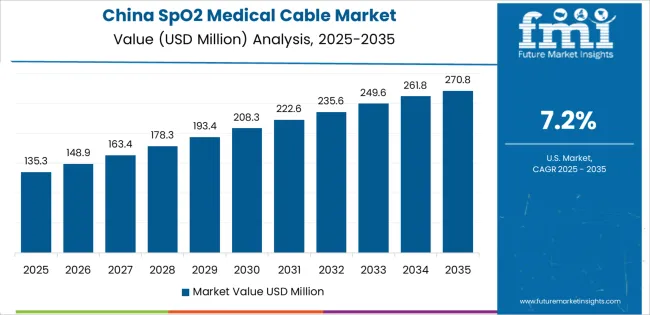

| China | 7.2% |

| India | 6.6% |

| Germany | 6.1% |

| Brazil | 5.6% |

| USA | 5.0% |

China is projected to exhibit strong growth with substantial market value by 2035, driven by expanding healthcare infrastructure and comprehensive patient monitoring system adoption creating opportunities for medical device suppliers across hospital facilities, primary care centers, and specialized treatment institutions. The country's ambitious healthcare capacity development and growing chronic disease management requirements are creating significant demand for both reusable and disposable monitoring cable solutions. Major medical equipment manufacturers and healthcare facility operators are establishing comprehensive local procurement networks to support large-scale deployment operations and meet growing demand for reliable pulse oximetry connectivity.

India is expanding substantially by 2035, supported by extensive healthcare infrastructure development and comprehensive primary care network expansion creating steady demand for affordable monitoring connectivity across diverse healthcare categories and regional facility segments. The country's expanding healthcare coverage programs and growing medical tourism sector are driving demand for cable solutions that provide reliable clinical performance while supporting budget-conscious procurement requirements. Medical device distributors and healthcare facility operators are investing in local supply chains to support growing deployment operations and equipment standardization initiatives.

Demand for SpO2 medical cables in Germany is projected to reach substantial value by 2035, supported by the country's leadership in healthcare quality standards and advanced medical device technologies requiring sophisticated cable systems for hospital applications and specialized monitoring requirements. German healthcare facilities are implementing high-quality connectivity systems that support signal integrity, biocompatibility compliance, and comprehensive quality protocols. The market is characterized by focus on clinical excellence, patient safety, and compliance with stringent medical device and infection control standards.

Revenue from SpO2 medical cables in United States is growing to reach substantial value by 2035, driven by comprehensive patient monitoring system integration programs and increasing remote care adoption creating opportunities for cable suppliers serving both acute care facilities and home healthcare service providers. The country's extensive healthcare infrastructure and expanding telehealth capabilities are creating demand for cable solutions that support diverse monitoring applications while maintaining clinical performance standards. Medical device manufacturers and healthcare facility procurement departments are developing standardized specifications to support operational efficiency and regulatory compliance.

Demand for SpO2 medical cables in Brazil is projected to reach meaningful value by 2035, driven by healthcare infrastructure modernization and public health system capacity expansion supporting hospital development and comprehensive primary care applications. The country's expanding healthcare coverage programs and growing private healthcare sector are creating demand for cost-effective cable solutions that support clinical performance and reliability standards. Medical device distributors and healthcare facility operators are maintaining comprehensive supply capabilities to support diverse procurement requirements.

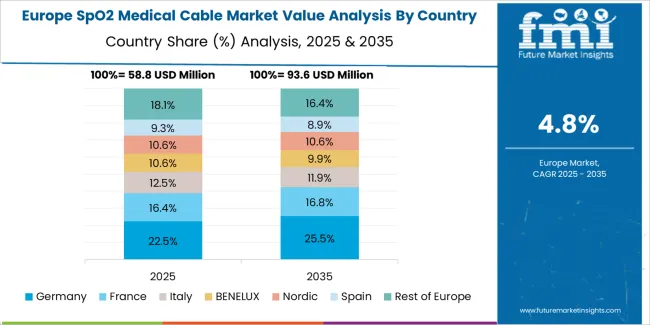

The SpO2 medical cable market in Europe is projected to grow from USD 88.9 million in 2025 to USD 154.3 million by 2035, registering a CAGR of 5.7% over the forecast period. Germany is expected to maintain its leadership position with a 28.4% market share in 2025, declining slightly to 27.8% by 2035, supported by its advanced healthcare infrastructure and stringent medical device quality standards.

France follows with a 19.6% share in 2025, projected to reach 20.1% by 2035, driven by comprehensive hospital modernization programs and integrated patient monitoring system adoption. The United Kingdom holds a 16.8% share in 2025, expected to decrease to 16.2% by 2035 due to healthcare budget optimization initiatives. Italy commands a 14.7% share, while Spain accounts for 11.3% in 2025. The Rest of Europe region is anticipated to gain momentum, expanding its collective share from 9.2% to 10.4% by 2035, attributed to increasing monitoring equipment adoption in Nordic healthcare systems and emerging Eastern European facilities implementing clinical standardization programs.

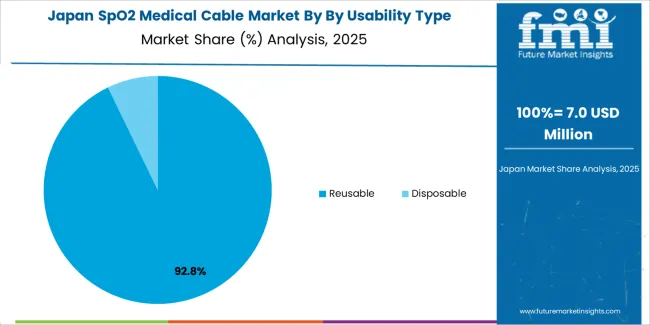

Japanese SpO2 medical cable operations reflect the country's exacting quality standards and comprehensive regulatory oversight. Major medical device manufacturers including Nihon Kohden, Terumo, and Fukuda Denshi maintain rigorous supplier qualification processes that require extensive biocompatibility testing, electromagnetic compatibility validation, and facility certifications often exceeding international standards. This creates high barriers for new suppliers but ensures consistent quality supporting clinical reliability requirements.

The Japanese market demonstrates unique application preferences, with significant focus on compact connector designs and flexible cable materials tailored to space-constrained clinical environments. Healthcare facilities require specific cable lengths and connector configurations that accommodate Japanese hospital room layouts and equipment positioning standards, driving demand for customized product specifications.

Regulatory oversight through the Pharmaceuticals and Medical Devices Agency emphasizes comprehensive safety documentation and post-market surveillance requirements. The medical device classification system requires detailed technical files and clinical performance data, creating advantages for suppliers with established regulatory compliance capabilities and quality management systems.

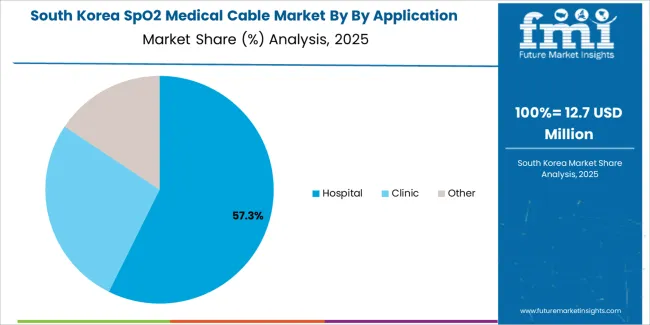

South Korean SpO2 medical cable operations reflect the country's advanced healthcare technology sector and integrated medical device manufacturing capabilities. Major hospital chains including Samsung Medical Center, Asan Medical Center, and Severance Hospital drive sophisticated procurement strategies, establishing quality standards that influence regional market specifications.

The Korean market demonstrates particular strength in integrating monitoring cables with digital health platforms and electronic medical record systems. Healthcare facilities emphasize interoperability and data integration capabilities, creating demand for cable solutions that support standardized communication protocols and system compatibility requirements.

Regulatory frameworks through the Ministry of Food and Drug Safety emphasize safety validation and performance consistency, with certification requirements that align with international standards while incorporating specific Korean testing protocols. This regulatory environment supports market entry for qualified suppliers while maintaining clinical quality expectations.

Profit pools are consolidating around OEM partnerships and specialized application expertise, with value migrating from commodity cable manufacturing to engineered solutions offering signal integrity validation, biocompatibility certification, and compatibility assurance across monitoring platforms. Several competitive archetypes dominate market positioning: established medical device OEMs leveraging integrated equipment sales and service relationships; specialized cable manufacturers focusing on regulatory compliance and custom engineering capabilities; regional distributors providing localized technical support and inventory management; and emerging suppliers targeting cost-sensitive segments through streamlined manufacturing approaches.

Switching costs remain substantial due to equipment compatibility requirements, regulatory validation protocols, and clinical staff familiarity with existing connector configurations, stabilizing incumbent positions while limiting rapid market share shifts. Technology transitions toward wireless monitoring and standardized connector designs create periodic windows for competitive repositioning. Supply chain reliability and responsive technical support differentiate premium suppliers, particularly during equipment upgrade cycles and capacity expansion projects.

Market consolidation continues as larger medical device companies acquire specialized cable manufacturers to secure supply chains and capture component margins. Digital procurement platforms are gaining traction for standardized product grades, while custom applications and OEM partnerships remain relationship-driven. Strategic priorities center on locking long-term supply agreements with hospital networks and equipment manufacturers through validated performance specifications and comprehensive quality documentation. Diversification across reusable and disposable product lines addresses varying infection control protocols and cost management strategies. Future positioning requires balancing manufacturing efficiency with customization capabilities and maintaining regulatory compliance across multiple jurisdictions while adapting to evolving clinical monitoring technologies.

| Items | Values |

|---|---|

| Quantitative Units | USD 234.7 million |

| Product | Reusable, Disposable |

| Application | Hospital, Clinic, Other |

| Regions Covered | North America, Latin America, Europe, Asia Pacific, Middle East & Africa |

| Country Covered | United States, Germany, China, India, Brazil, and other 40+ countries |

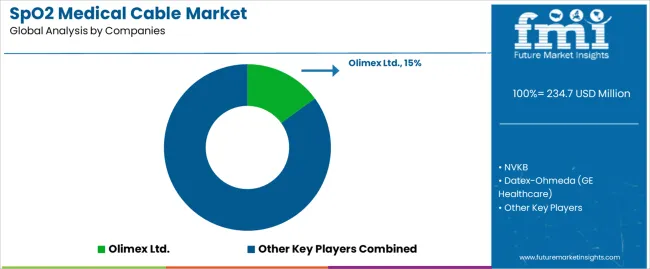

| Key Companies Profiled | Olimex Ltd., NVKB, Datex-Ohmeda (GE Healthcare), BizLink Group, Dräger, Shandong Sanyuan Biotechnology Co., Ltd., ZOLL, Masimo, Nellcor - Covidien, Philips Healthcare, SunTech Medical, Welch Allyn, Criticare, Biolight, Lub Dub, Shenzhen Sino-K Medical Technology Co., Ltd. |

| Additional Attributes | Dollar sales by usability type/application, regional demand (NA, EU, APAC), competitive landscape, reusable vs. disposable adoption, biocompatibility standards, and signal integrity innovations driving clinical reliability, infection control compliance, and monitoring system integration |

The global spo2 medical cable market is estimated to be valued at USD 234.7 million in 2025.

The market size for the spo2 medical cable market is projected to reach USD 393.4 million by 2035.

The spo2 medical cable market is expected to grow at a 5.3% CAGR between 2025 and 2035.

The key product types in spo2 medical cable market are reusable and disposable.

In terms of by application, hospital segment to command 55.0% share in the spo2 medical cable market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Medical Eye Shield Film Market Size and Share Forecast Outlook 2025 to 2035

Medical Far Infrared Therapy Device Market Size and Share Forecast Outlook 2025 to 2035

Medical Latex Protective Suit Market Size and Share Forecast Outlook 2025 to 2035

Medical Activated Carbon Dressing Market Size and Share Forecast Outlook 2025 to 2035

Medical Coated Roll Stock Market Size and Share Forecast Outlook 2025 to 2035

Medical Billing Outsourcing Market Size and Share Forecast Outlook 2025 to 2035

Medical Pressure Mapping System Market Size and Share Forecast Outlook 2025 to 2035

Medical Chairs Market Size and Share Forecast Outlook 2025 to 2035

Medical Exoskeleton Market Forecast Outlook 2025 to 2035

Medical Display Market Forecast and Outlook 2025 to 2035

Medical Spa Market Size and Share Forecast Outlook 2025 to 2035

Medical Face Shield Market Forecast and Outlook 2025 to 2035

Medical Robot Market Size and Share Forecast Outlook 2025 to 2035

Medical Nutrition Market Forecast and Outlook 2025 to 2035

Medical Wax Market Size and Share Forecast Outlook 2025 to 2035

Medical Specialty Bag Market Size and Share Forecast Outlook 2025 to 2035

Medical Plastics Market Size and Share Forecast Outlook 2025 to 2035

Medical Device Tester Market Size and Share Forecast Outlook 2025 to 2035

Medical Device Trays Market Size and Share Forecast Outlook 2025 to 2035

Medical Adhesives Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA