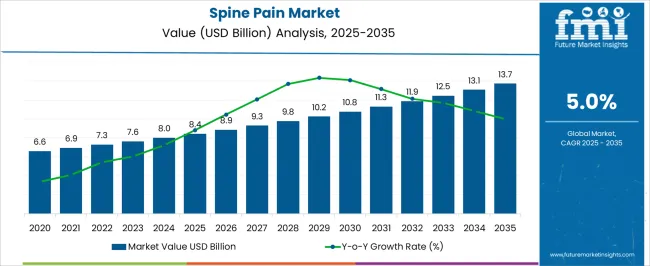

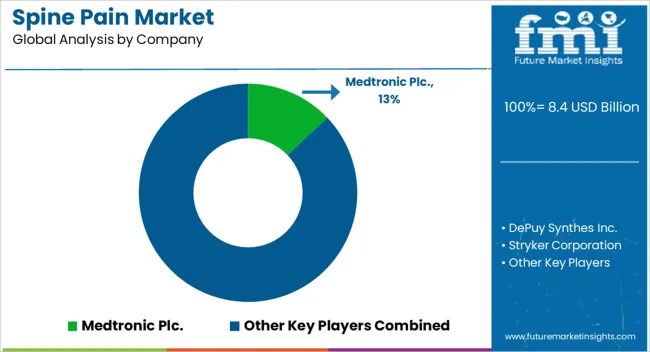

The Spine Pain Market is estimated to be valued at USD 8.4 billion in 2025 and is projected to reach USD 13.7 billion by 2035, registering a compound annual growth rate (CAGR) of 5.0% over the forecast period.

| Metric | Value |

|---|---|

| Spine Pain Market Estimated Value in (2025 E) | USD 8.4 billion |

| Spine Pain Market Forecast Value in (2035 F) | USD 13.7 billion |

| Forecast CAGR (2025 to 2035) | 5.0% |

The spine pain market is advancing steadily, supported by the growing prevalence of degenerative spinal conditions, rising incidences of trauma and injury, and an aging global population. Clinical publications and healthcare system updates have emphasized the increasing burden of lower back pain, which has become a leading cause of disability worldwide. Continuous investments in advanced medical technologies have driven innovation in both surgical and non-surgical treatment approaches, with a particular emphasis on minimally invasive techniques that reduce recovery times and improve patient outcomes.

Annual reports from medical device manufacturers have highlighted strong demand for next-generation implants and navigation-assisted procedures, reflecting a clear shift toward precision-driven solutions. Additionally, healthcare providers are prioritizing cost-effective treatment pathways to manage chronic spinal disorders, which has influenced the adoption of targeted therapies.

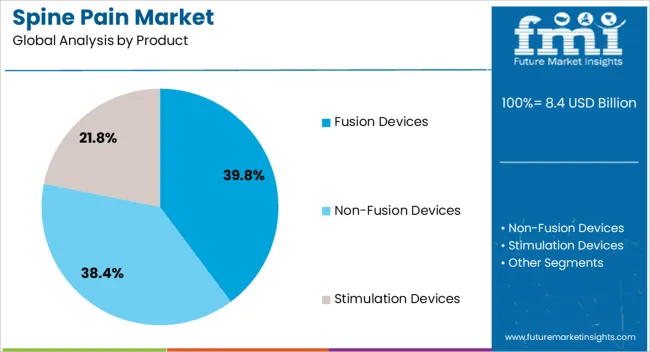

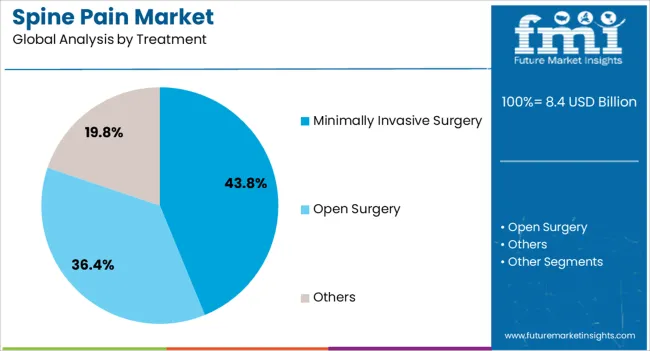

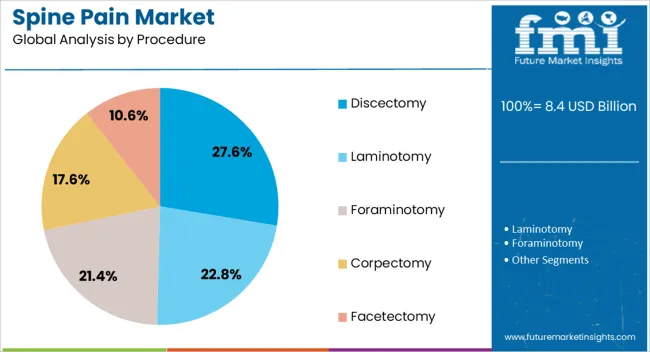

Looking ahead, the market is expected to expand further due to technological integration, rising healthcare expenditure, and broader adoption of patient-specific treatment strategies. Segmental momentum is being led by fusion devices in products, minimally invasive surgery in treatment approaches, and discectomy as the primary procedure category.

The Fusion Devices segment is projected to account for 39.8% of the spine pain market revenue in 2025, establishing itself as the leading product category. This dominance has been driven by the widespread clinical use of spinal fusion in addressing degenerative disc disease, scoliosis, and spinal instability. Clinical journals have highlighted the reliability of fusion devices in restoring spinal stability and reducing pain, leading to their consistent use in complex spinal surgeries.

Continuous advancements in biomaterials, including titanium and bioresorbable polymers, have enhanced device performance and patient safety. Furthermore, improvements in surgical techniques, such as image-guided placement, have increased the precision and effectiveness of fusion procedures.

With strong physician preference and robust clinical evidence supporting their outcomes, fusion devices are expected to maintain their leadership in the spine pain market.

The Minimally Invasive Surgery segment is projected to contribute 43.8% of the spine pain market revenue in 2025, reinforcing its role as the preferred treatment approach. Growth of this segment has been supported by the clinical advantages of smaller incisions, reduced blood loss, faster recovery, and lower infection risks compared to open surgery. Hospital systems and surgical centers have increasingly adopted minimally invasive techniques to improve patient satisfaction and optimize resource utilization.

Annual investor briefings from device manufacturers have underscored a rise in demand for specialized tools and robotic-assisted platforms tailored for minimally invasive spine procedures. Moreover, patient awareness campaigns and positive clinical outcomes have strengthened acceptance of these methods globally.

With ongoing innovations in navigation and imaging technologies, minimally invasive surgery is expected to retain its leadership as the primary treatment option for spine pain.

The Discectomy segment is projected to capture 27.6% of the spine pain market revenue in 2025, making it the leading procedure category. This growth has been attributed to the high clinical incidence of herniated discs, which frequently require surgical intervention when conservative treatments fail. Clinical studies have documented strong outcomes from discectomy in alleviating nerve compression and restoring mobility, driving its widespread adoption.

The introduction of minimally invasive discectomy techniques has further enhanced patient safety, reduced hospitalization time, and improved post-operative recovery rates. Hospitals and ambulatory surgical centers have prioritized discectomy due to its cost-effectiveness and established treatment protocols.

With a consistently high volume of cases and demonstrated clinical success, discectomy is expected to continue as the most commonly performed spine pain procedure, underpinning its leading position within the market.

| Historical CAGR 2020 to 2025 | 5.3% |

|---|---|

| Forecast CAGR 2025 to 2035 | 5% |

The historical CAGR underscores the steady expansion of the spine pain industry, reflecting the boom in prevalence and demand for effective treatments.

Such kind of trajectory has positioned the industry as a focal point for innovation and investment, with advancements in medical technology and therapies driving growth.

Looking ahead to the forecast CAGR of 5% from 2025 to 2035, while marginally lower, indicates continued momentum and sustained demand. This trajectory suggests a maturing market that, while still exhibiting growth, may face challenges such as regulatory hurdles, healthcare system constraints, and evolving consumer preferences.

Opportunities for disruption remain abundant, with the potential to impact not only the healthcare sector but also intersecting industries like pharmaceuticals, medical devices, and construction as the need for specialized infrastructure and equipment to accommodate spine-related conditions grows.

Healthcare providers and manufacturers stand to benefit from ongoing innovation in treatments, diagnostics, and medical devices tailored to spine care.

Pharmaceutical companies may explore novel therapies targeting spine-related ailments, while medical device manufacturers can develop advanced implants and instrumentation for surgical interventions.

The below section shows the leading segment. Based on the product, the fusion devices segment is accounted to hold a market share of 39.8% in 2025. Based on treatment, the minimally invasive surgeries segment is accounted to hold a market share of 43.8% in 2025.

| Categories | Market Share in 2025 |

|---|---|

| Fusion Devices | 39.8% |

| Minimally Invasive Surgeries | 43.8% |

Based on product, the fusion devices segment is accounted to hold a market share of 39.8% in 2025. Fusion devices, including spinal implants, plates, and screws, are instrumental in stabilizing and fusing vertebrae, particularly in cases of degenerative disc disease, spinal stenosis, and spondylolisthesis.

The significant market share of the segment underscores the enduring demand for surgical solutions in managing complex spine conditions, driven by factors such as aging populations and a boom in the prevalence of spinal disorders worldwide.

Ongoing advancements in fusion device technologies, including improved materials, designs, and surgical techniques, continue to enhance patient outcomes, augmenting adoption and growth.

Based on treatment, the minimally invasive surgeries segment is accounted to hold a market share of 43.8% in 2025. The prominence of the segment reflects a paradigm shift towards less invasive approaches in spine pain management, driven by advantages such as reduced tissue trauma, shorter hospital stays, and faster recovery times compared to traditional open surgeries.

Minimally invasive techniques encompass a range of procedures, including endoscopic discectomy, percutaneous vertebroplasty, and minimally invasive lumbar fusion, offering patients less invasive alternatives with comparable efficacy to conventional surgical approaches.

The substantial market share underscores growing patient and physician preference for MIS procedures, fueled by advancements in surgical instrumentation, imaging technologies, and surgeon expertise.

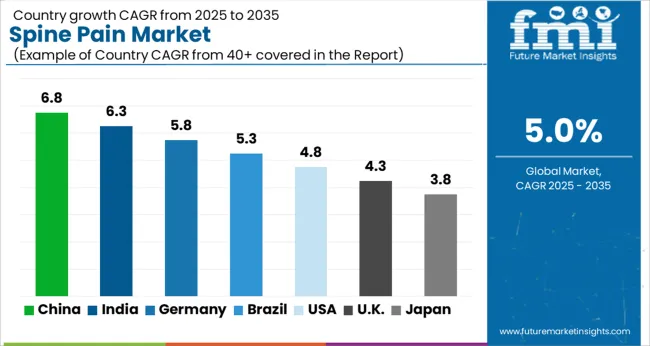

The graph below describes the top five countries ranked by revenue, with India holding the top position. India dominates the spine pain industry through a blend of factors like skilled medical professionals, advanced technology, and cost-effective treatments.

Renowned hospitals, specialized clinics, and medical tourism bolster its position. The pharmaceutical industry of the country offers a range of medications catering to various spine conditions, further solidifying its dominance.

The industry is led significantly by spine pain market sales channel in India, Canada, and China. Asia Pacific emerges as a key industry at a global level. Followed by North America sees demand rising at an impressive pace.

| Countries | Forecast CAGRs from 2025 to 2035 |

|---|---|

| The United States | 4.8% |

| The United Kingdom | 4.4% |

| Canada | 5.4% |

| India | 5.7% |

| China | 5.1% |

In the United States, the spine pain industry is extensively utilized due to several factors. The country has a large aging population, which contributes to a higher prevalence of spine-related conditions such as degenerative disc disease and spinal stenosis.

The advanced healthcare infrastructure and high levels of healthcare spending facilitate widespread access to spine pain treatments, including surgical interventions, physical therapy, and pain management services.

Technological advancements in diagnostic imaging, minimally invasive surgical techniques, and biologics further augment growth, with a focus on improving patient outcomes and reducing healthcare costs.

In the United Kingdom, the utilization of the spine pain industry is influenced by factors such as the aging population, lifestyle factors, and healthcare system dynamics. While the country has a comprehensive public healthcare system, access to spine pain treatments may be subject to waiting times and resource constraints.

Private healthcare options supplement the public system, offering faster access to specialized spine care services for those who can afford them.

Budgetary constraints within the National Health Service (NHS) may limit the adoption of advanced technologies and innovative treatments, impacting growth compared to countries with higher healthcare spending.

Similar factors drive utilization of the spine pain industry in Canada, just like in the United States, including an aging population and advanced healthcare infrastructure.

The publicly funded healthcare system of Canada provides universal access to essential medical services. Access to specialized spine care services and elective procedures may vary by province.

Private healthcare options exist, particularly in urban centers, offering alternative avenues for accessing spine pain treatments.

Technological advancements and research initiatives in spine care contribute to economic growth, with a focus on optimizing patient outcomes and reducing healthcare disparities.

In India, the utilization of the spine pain sector is influenced by factors such as the large population, increasing urbanization, and rising disposable incomes. The country has a growing middle class with greater awareness of healthcare options and a willingness to seek treatment for spine-related conditions.

Access to specialized spine care services may be limited in rural areas, leading to disparities in healthcare access. The spine pain industry in India is characterized by a mix of public and private healthcare providers, with a focus on affordability and accessibility.

Technological advancements in telemedicine, minimally invasive surgery, and regenerative medicine hold promise for expanding access to spine pain treatments and improving patient outcomes.

The utilization of the spine pain industry in China is driven by factors such as urbanization, the aging population, and healthcare system reforms. The country has experienced rapid economic growth, leading to lifestyle changes and a surge in chronic diseases, including spine-related conditions.

The healthcare system is undergoing reforms to improve access to healthcare services and promote innovation in medical technologies. The spine pain industry is characterized by a growing demand for advanced treatments, including minimally invasive surgery, biologics, and non-fusion spinal devices.

Public and private healthcare providers are expanding their offerings to meet the needs of a growing patient population, with a focus on quality of care and cost-effectiveness.

The competitive landscape of the spine pain industry is characterized by intense rivalry among key players striving to innovate and differentiate their products and services. Established companies leverage their extensive product portfolios, strong distribution networks, and brand recognition to maintain market dominance.

Emerging players focusing on niche segments and disruptive technologies challenge incumbents, propelling competition and fostering innovation. Strategic collaborations, mergers, and acquisitions are common strategies employed to expand market presence and capitalize on emerging opportunities.

Regulatory compliance, quality assurance, and patient outcomes increasingly shape competitive strategies, highlighting the importance of delivering value-driven solutions in this dynamic market.

Some of the key developments are

| Attributes | Details |

|---|---|

| Estimated Market Size in 2025 | USD 8.03 billion |

| Projected Market Valuation in 2035 | USD 13.08 billion |

| Value-based CAGR 2025 to 2035 | 5% |

| Forecast Period | 2025 to 2035 |

| Historical Data Available for | 2020 to 2025 |

| Market Analysis | Value in USD billion |

| Key Regions Covered |

North America; Latin America; Western Europe; Eastern Europe; South Asia and Pacific; East Asia; The Middle East and Africa |

| Key Market Segments Covered |

Product Type, Treatment, Procedure, Region |

| Key Countries Profiled |

The United States, Canada, Brazil, Mexico, Germany, The United Kingdom, France, Spain, Italy, Russia, Poland, Czech Republic, Romania, India, Bangladesh, Australia, New, Zealand, China, Japan, South Korea, GCC countries, South Africa, Israel |

| Key Companies Profiled |

Medtronic Plc.; DePuy Synthes Inc.; Stryker Corporation; NuVasive Inc.; Zimmer Biomet Holdings Inc.; Globus Medical Inc.; Alphatec Spine Inc.; Orthofix International N.V.; Difusion Technologies, Inc.; ZimVie Inc. |

The market is classified into Fusion Devices, Non-Fusion Devices, and Stimulation Devices

The report consists of key sourcing, such as Open Surgery, Minimally Invasive Surgery, and Others

The industrial insights of Discectomy, Laminotomy, Foraminotomy, Corpectomy, and Facetectomy

Analysis of the market has been carried out in key countries of North America, Latin America, Western Europe, South Asia, East Asia, Eastern Europe, and the Middle East and Africa.

The global spine pain market is estimated to be valued at USD 8.4 billion in 2025.

The market size for the spine pain market is projected to reach USD 13.7 billion by 2035.

The spine pain market is expected to grow at a 5.0% CAGR between 2025 and 2035.

The key product types in spine pain market are fusion devices, non-fusion devices and stimulation devices.

In terms of treatment, minimally invasive surgery segment to command 43.8% share in the spine pain market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

United States Spine Pain Market Trend Analysis Based on Product, Pain, End-User, and Regions 2025 to 2035

Spine Biologics Market Size and Share Forecast Outlook 2025 to 2035

Spine Positioning Devices Market

Cervical Spine System Market – Innovations, Trends & Forecast 2025 to 2035

Non-Operative Spine Care Market

Minimally Invasive Spine Technologies Market Size and Share Forecast Outlook 2025 to 2035

Paint Cans Market Size and Share Forecast Outlook 2025 to 2035

Painting Robots Market Size and Share Forecast Outlook 2025 to 2035

Pain Monitoring Devices Market Size and Share Forecast Outlook 2025 to 2035

Paint Curing Lamp Market Size and Share Forecast Outlook 2025 to 2035

Paint Booth Market Size and Share Forecast Outlook 2025 to 2035

Pain Therapeutic Injectables Market Size and Share Forecast Outlook 2025 to 2035

Painkillers Market Size and Share Forecast Outlook 2025 to 2035

Painting Tool Market Size and Share Forecast Outlook 2025 to 2035

Pain Therapeutic Solutions Market Size and Share Forecast Outlook 2025 to 2035

Paint Rollers Market Size and Share Forecast Outlook 2025 to 2035

Paint Ingredient Market Size and Share Forecast Outlook 2025 to 2035

Paint Tester Market Size and Share Forecast Outlook 2025 to 2035

Paint Knife Market Size and Share Forecast Outlook 2025 to 2035

Paint Buckets Market Size, Share & Forecast 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA