The global network equipment market is showcased at valuation of USD 34,239.7 million in 2025. According to the analysis, the industry is projected to grow at a CAGR of 8.3% from 2025 to 2035. The industry is foreseen to surpass USD 75,990.4 million wide adoption of this technology in varied sector through 2035.

The network equipment industry is an essential part of the global technology infrastructure, providing the hardware and tools needed to allow data communication between devices. This market includes products such as routers, switches, firewalls and access points that accomplish, direct and secure data traffic.

With the fast growth of cloud computing, IoT (Internet of Things), 5G networks and growing internet penetration, the demand for effective and high-speed networking equipment continues to grow. These tools are important in both enterprise and consumer settings, powering everything from corporate data centers to home Wi-Fi systems.

Global Network Equipment Market Assessment

| Attributes | Description |

|---|---|

| Historical Size, 2024 | USD 31,827.9 million |

| Estimated Size, 2025 | USD 34,239.7 million |

| Projected Size, 2035 | USD 75,990.4 million |

| Value-based CAGR (2025 to 2035) | 8.3% CAGR |

The prominence of the network equipment industry lies in its capability to guarantee fast, secure and dependable data transfer. Businesses rely on this equipment to support their operations, allowing employees to collaborate, store and access data seamlessly. As digital transformation accelerates across industries, network equipment is vital for continuing operational efficiency and competitiveness.

The growing number of connected devices and the shift towards remote work has enlarged the need for robust networking infrastructure. Also, cybersecurity concerns have determined demand for equipment that includes built-in security landscapes to safeguard sensitive data from breaches and attacks. This industry is expected to continue increasing as technology grows and global connectivity requirements grow.

The below table presents the expected CAGR for the global network equipment market over several semi-annual periods spanning from 2025 to 2035. This assessment outlines changes in the memory interconnect industry and identify revenue trends, offering key decision makers an understanding about market performance throughout the year.

H1 represents first half of the year from January to June, H2 spans from July to December, which is the second half. In the first half (H1) of the year from 2024 to 2034, the business is predicted to surge at a CAGR of 8.1%, followed by a slightly higher growth rate of 8.2% in the second half (H2) of the same decade.

| Particular | Value CAGR |

|---|---|

| H1 | 8.1% (2024 to 2034) |

| H2 | 8.2% (2024 to 2034) |

| H1 | 7.7% (2025 to 2035) |

| H2 | 8.5% (2025 to 2035) |

Moving into the subsequent period, from H1 2025 to H2 2035, the CAGR is projected to increase slightly to 7.7% in the first half and remain higher at 8.5% in the second half. In the first half (H1) the market witnessed a decrease of 40 BPS while in the second half (H2), the market witnessed an increase of 30 BPS.

Surging Demand for High-Speed Internet Drives Innovation in Network Equipment Market

Growing web and broadband requirement is the primary factor driving the network equipment market. With increasing number of people relying on internet for remote work, entertainment and online shopping, the need for faster and reliable connections has grown manifold.

Internet speeds need to be faster still to support high definition video streaming services provided by Netflix or YouTube that have become increasingly popular. Internet protocol (IP) traffic has been forecast to reach beyond 4.8 ZB per year in 2023 due to heavy consumption of streaming, gaming and video conferencing.

To cater this demand crucial network equipment like routers, switches and fiber optic systems need continuous upgrades as they act as bridges for data travel from one end-point to another. For instance, age old copper wires are being replaced with fiber optic wires which are capable of delivering gigabit speed connection.

Countries like the United States have enlarged investments in broadband infrastructure, with the goal of providing high-speed internet to rural and underserved areas. This shove for better connectivity energies constant demand for advanced network equipment to support growing data needs.

Shift toward AI-driven Network Management and Automation is an Escalating Trend

The shift toward AI-driven network management and automation is renovating the network equipment industry, letting companies to streamline operations and recover efficiency. As networks become more complex with the adding of cloud services, IoT devices and remote work environments, physically managing these systems is gradually challenging.

AI-driven tools can monitor network performance, predict failures and repeatedly adjust resources to ensure smooth operation. For example, AT&T has combined AI to achieve its network, handling billions of network interactions daily. AI recognizes patterns in data traffic, letting the network to self-optimize and decrease latency, enlightening the user experience.

AI-based network automation also helps reduce downtime by detecting potential issues before they occur. A study by Juniper Networks showed that AI could decrease network troubleshooting time by up to 70%, saving both time and costs for initiatives.

By using machine learning algorithms, these systems learn from preceding data to recover performance, making AI-driven network management a key tendency for improving scalability and reliability in the growing digital landscape.

Secure Networking Solutions Drive Innovation for Remote Workforce Connectivity

The development of secure networking solutions for remote workforce’s boons a important opportunity in the network equipment industry. With remote work becoming a enduring feature for many organizations, ensuring secure access to company data from various locations has become vital.

Companies need vigorous solutions to protect sensitive information while upholding productivity. Virtual private networks (VPNs), multi-factor authentication (MFA) and zero-trust security models are progressively being combined into network gear to secure remote connections.

For example, Zoom Video Communications upgraded its network to offer end-to-end encryption for all users in 2020, after undergoing an massive rise in demand from remote workers. The company’s investment in boosted security protocols not only improved user trust but also boosted its service reliability for millions of global users.

Similarly, enterprises are looking for network equipment that can support secure, encrypted communication for their remote employees. As more organizations hold hybrid work environments, demand for network equipment with progressive security features is predictable to grow, opening new opportunities for providers of protected networking solutions.

High Costs of Upgrading Legacy Infrastructure Challenge Network Modernization Efforts

Many organizations still rely on outdated systems that can delay performance and security. Upgrading these legacy systems can require considerable investment in both hardware and software, often surpassing budget constraints.

For example, a mid-sized company might have to replace older routers and switches, which can cost tens of thousands of dollars. Additionally, training staff to operate new tackle and systems can advance expand costs, complicating the upgrade process.

A applied example is seen in the healthcare sector, where hospitals often work on legacy systems that are critical for patient care. When a hospital resolves to revolutionize its network, it may face a bill of hundreds of thousands of dollars to replace outdated equipment and ensure compliance with regulatory standards.

These monetary hurdles can lead to delays in essential upgrades, leaving organizations susceptible to security breaches and preventive their ability to adopt new technologies. As a result, many businesses contend with the decision to invest in transformation versus upholding their existing systems.

From 2020 to 2024, the global network equipment industry experienced stable growth due to growing internet usage, improved cloud adoption and the growth of remote work. Companies invested heavily in advancement their infrastructure to meet the demand for faster and more dependable connectivity.

For example, many businesses substituted outdated routers and switches to support the outpouring in data traffic from video conferencing and online services. This period saw a noteworthy boost in sales, as organizations renowned the importance of robust network solutions to stay competitive.

Looking ahead to 2025 through 2035, demand for network equipment is likely to endure increasing, driven by trends like the growth of 5G technology, the Internet of Things (IoT) and smart city initiatives. As more devices become interrelated, the need for advanced networking solutions will rise.

Companies will likely arrange investments in automation and security landscapes to improve efficiency and protect data, foremost to a vibrant industry with many opportunities for novelty and development.

Tier 1 vendors dominates the network equipment industry with a high level of share which contributes to the higher level of concentration and significant market share of 50% to 55%. Tier 1 vendor such as Cisco Systems, Huawei Technologies, and Juniper Networks are known for extensive product portfolios, global reach and strong brand recognition.

These vendors are leading the industry in innovation and have a presence across multiple regions and contributing a major portion of the market's total sales.

Tier 2 vendors hold a moderate market share around 15% to 20%. Vendors such as Arista Networks, Extreme Networks and Nokia offer specialized network equipment solutions and have a solid market presence. They focus on specific applications or industries, providing competitive alternatives to the dominant players.

Tier 3 vendors represent smaller market players with niche offerings or regional focus. Tier 3 typically serves specific markets or regions and have lower market concentration compared to Tier 1 and Tier 2 and it hold around 25% to 30%. Vendors are contributing to the market for addressing unique needs and providing cost-effective solutions for targeted applications.

The section highlights the CAGRs of countries experiencing growth in the Network Equipment market along with the latest advancements contributing to overall market development. Based on current estimations China, India and Germany are expected to see steady growth during the forecast period.

| Countries | CAGR from 2025 to 2035 |

|---|---|

| India | 7.1% |

| China | 8.2% |

| Germany | 6.6% |

| Japan | 7.8% |

| United States | 7.0% |

The United States is experiencing a movement in demand for network equipment, mainly driven by the quick adoption of 5G technology and keen cybersecurity concerns. In 2023, the USA government owed approximately USD 65 billion to improve broadband infrastructure, pointing to link the digital divide and support rural connectivity. This subvention is part of the Infrastructure Investment and Jobs Act, which highlights improving network reliability and speed.

Also, main telecommunications companies like Verizon and AT&T have copied partnerships with vendors such as Cisco and Nokia to grow and deploy progressive networking solutions. These partnerships emphasis on improving 5G networks and growing capacity, allowing faster internet access for consumers and businesses alike.

The continuing threat of cyberattacks has also led organizations to capitalize heavily in healthy security measures, with outlay on cybersecurity solutions projected to exceed USD 200 billion by 2025. As a result, companies are gradually looking for advanced network equipment that offers integrated security features making the USA market a vibrant hub for innovation and growth in network technology.

In India, the demand for network equipment is hastening due to swift digital transformation powered by government initiatives like Digital India. This program purposes to improve digital infrastructure across the country, with the government allocating over USD 10 billion for projects to advance broadband connectivity, mainly in rural areas. Moreover, the rollout of 5G technology is set to advance boost this demand.

By 2024, the Indian government plans to auction 5G spectrum, which is likely to attract significant investment from private telecom operators. Companies like Reliance Jio and Bharti Airtel are affiliating with global vendors such as Ericsson and Nokia to advancement their networks and present 5G services. These partnerships focus on organizing cutting-edge equipment that can upkeep higher data speeds and increased connectivity.

Furthermore, the National Policy on Electronics aims to make India a global manufacturing hub for electronic components, which will probable improve the local production of network equipment. With these initiatives, India is located for substantial growth in the network equipment industry, making it an striking landscape for both domestic and international players.

In China, the demand for progressive networking solutions is quickly snowballing, powered by significant investments in smart city projects and the Internet of Things (IoT). The Chinese government has committed over USD 150 billion to develop smart cities across the country, aiming on refining urban infrastructure, traffic management and public services. This investment is part of a broader initiative to improve urban living through technology.

For example, cities like Shanghai and Beijing are executing IoT solutions to connect various city services, such as public transport and waste management, needing robust networking equipment to guarantee seamless communication. Also, major technology companies like Huawei and Alibaba are creating partnerships with local governments to position cutting-edge IoT platforms that assimilate smart devices. In 2023, Huawei propelled a new series of networking products precisely designed for smart city applications, facilitating cities to manage resources more efficiently.

These developments highlight China’s commitment to leveraging technology to recover urban life, making it a key player in the global network equipment market. As a result, the demand for erudite networking solutions remains to grow, making opportunities for both domestic and international suppliers.

The section summarizes leading segment in the industry.

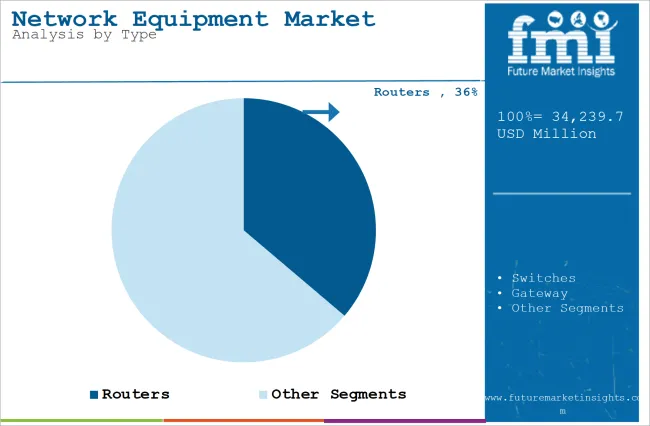

Routers are the mainstay of the network equipment industry, liable for data traffic management between devices and networks. Need for high speed internet has been growing at an unprecedented pace across claims such as remote working, online gaming and video streaming. Rapidly increasing number of connected devices has created a need for routers with large data handling capacity.

Moreover, smart homes and IoTs require routers to support multiple concurrent connections without compromising on speed or security. Improvement in router technology through Wi-Fi 6 and mesh networking have unlocked higher performances and resiliency from routers that corporate users and home users cannot afford to lag behind due to constraints imposed by their existing low-performance routers.

| Segment | Routers (Type) |

|---|---|

| Value Share ( 2025) | 36.2% |

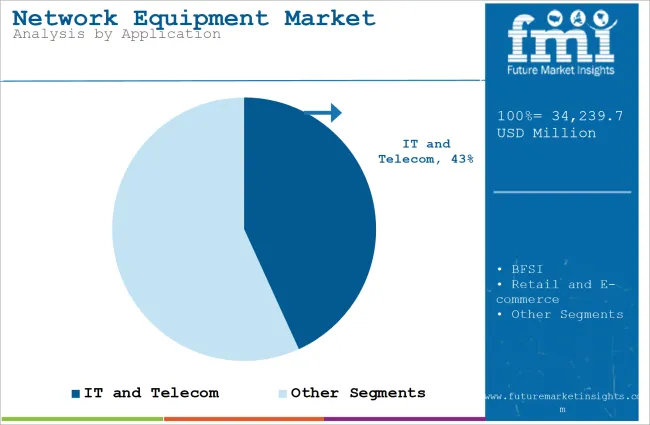

IT and Telecom sector comprises a wide range of doings such as internet service providers, telecommunications companies and cloud service providers. The demand for robust networking infrastructure is determined by the speedy growth of data consumption, the rollout of 5G technology and the growing need for progressive security solutions.

In 2023, IT and Telecom accounted for roughly 35% of the general network equipment industry, as companies invest heavily in development their networks to support high-speed connectivity and a increasing number of devices. The constant digital transformation and the alteration toward remote work have advance amplified the need for consistent network equipment within this sector.

| Segment | IT and Telecom (Application) |

|---|---|

| Value Share ( 2025) | 43.2% |

The market for network equipment is highly competitive as there are many players trying to win over each other in terms of product innovation and advancement technologically. There are some old players and many new vendors also emerging in the industry giving a tough competition to others. The competition is really high in cloud networking, cybersecurity solutions etc., among others.

Different geography has different requirements and hence some may need advances faster than others. Cost efficiency along with performance plays an important role for any client while choosing products as well as vendor so companies have to keep on innovating or advancing their products continuously to not lose the customer traction.

Industry Update

In April 2023, Arista Networks, a leading provider of cloud networking solutions, launched the AI-driven network identity service for enterprise security and IT operations. Based on Arista's flagship CloudVision platform, Arista Guardian for Network Identity (CV AGNI.) CV AGNI helps to secure IT operations with simplified deployment and cloud scale for all enterprise network users, their associated endpoints, and Internet of Things (IoT) devices.

In terms of type, the segment is divided into switches, routers, gateway, fiber optic equipment and others.

In terms of enterprise size, the industry is segregated into Small and Mid-Sized Enterprises (SMEs) and Large Enterprises.

In terms of application, the industry is segregated IT and Telecom, BFSI, retail and e-commerce, government and defense, manufacturing and others application.

A regional analysis has been carried out in key countries of North America, Latin America, Asia Pacific, Middle East and Africa (MEA) and Europe.

The Global Network Equipment industry is projected to witness CAGR of 8.3% between 2025 and 2035.

The Global Network Equipment industry stood at USD 31,827.9 million in 2024.

The Global Network Equipment industry is anticipated to reach USD 75,990.4 million by 2035 end.

East Asia is set to record the highest CAGR of 8.2% in the assessment period.

The key players operating in the Global Network Equipment Cisco Systems, Huawei Technologies, Juniper Networks, Arista Networks, Nokia (including Alcatel-Lucent), Ericsson, Dell Technologies among others.

Table 1: Global Market Value (US$ Mn) Forecast by Region, 2017-2032

Table 2: Global Market Volume (Units) Forecast by Region, 2017-2032

Table 3: Global Market Value (US$ Mn) Forecast by Type, 2017-2032

Table 4: Global Market Volume (Units) Forecast by Type, 2017-2032

Table 5: Global Market Value (US$ Mn) Forecast by Application, 2017-2032

Table 6: Global Market Volume (Units) Forecast by Application, 2017-2032

Table 7: Global Market Value (US$ Mn) Forecast by End User, 2017-2032

Table 8: Global Market Volume (Units) Forecast by End User, 2017-2032

Table 9: North America Market Value (US$ Mn) Forecast by Country, 2017-2032

Table 10: North America Market Volume (Units) Forecast by Country, 2017-2032

Table 11: North America Market Value (US$ Mn) Forecast by Type, 2017-2032

Table 12: North America Market Volume (Units) Forecast by Type, 2017-2032

Table 13: North America Market Value (US$ Mn) Forecast by Application, 2017-2032

Table 14: North America Market Volume (Units) Forecast by Application, 2017-2032

Table 15: North America Market Value (US$ Mn) Forecast by End User, 2017-2032

Table 16: North America Market Volume (Units) Forecast by End User, 2017-2032

Table 17: Latin America Market Value (US$ Mn) Forecast by Country, 2017-2032

Table 18: Latin America Market Volume (Units) Forecast by Country, 2017-2032

Table 19: Latin America Market Value (US$ Mn) Forecast by Type, 2017-2032

Table 20: Latin America Market Volume (Units) Forecast by Type, 2017-2032

Table 21: Latin America Market Value (US$ Mn) Forecast by Application, 2017-2032

Table 22: Latin America Market Volume (Units) Forecast by Application, 2017-2032

Table 23: Latin America Market Value (US$ Mn) Forecast by End User, 2017-2032

Table 24: Latin America Market Volume (Units) Forecast by End User, 2017-2032

Table 25: Europe Market Value (US$ Mn) Forecast by Country, 2017-2032

Table 26: Europe Market Volume (Units) Forecast by Country, 2017-2032

Table 27: Europe Market Value (US$ Mn) Forecast by Type, 2017-2032

Table 28: Europe Market Volume (Units) Forecast by Type, 2017-2032

Table 29: Europe Market Value (US$ Mn) Forecast by Application, 2017-2032

Table 30: Europe Market Volume (Units) Forecast by Application, 2017-2032

Table 31: Europe Market Value (US$ Mn) Forecast by End User, 2017-2032

Table 32: Europe Market Volume (Units) Forecast by End User, 2017-2032

Table 33: Asia Pacific Market Value (US$ Mn) Forecast by Country, 2017-2032

Table 34: Asia Pacific Market Volume (Units) Forecast by Country, 2017-2032

Table 35: Asia Pacific Market Value (US$ Mn) Forecast by Type, 2017-2032

Table 36: Asia Pacific Market Volume (Units) Forecast by Type, 2017-2032

Table 37: Asia Pacific Market Value (US$ Mn) Forecast by Application, 2017-2032

Table 38: Asia Pacific Market Volume (Units) Forecast by Application, 2017-2032

Table 39: Asia Pacific Market Value (US$ Mn) Forecast by End User, 2017-2032

Table 40: Asia Pacific Market Volume (Units) Forecast by End User, 2017-2032

Table 41: MEA Market Value (US$ Mn) Forecast by Country, 2017-2032

Table 42: MEA Market Volume (Units) Forecast by Country, 2017-2032

Table 43: MEA Market Value (US$ Mn) Forecast by Type, 2017-2032

Table 44: MEA Market Volume (Units) Forecast by Type, 2017-2032

Table 45: MEA Market Value (US$ Mn) Forecast by Application, 2017-2032

Table 46: MEA Market Volume (Units) Forecast by Application, 2017-2032

Table 47: MEA Market Value (US$ Mn) Forecast by End User, 2017-2032

Table 48: MEA Market Volume (Units) Forecast by End User, 2017-2032

Figure 1: Global Market Value (US$ Mn) by Type, 2022-2032

Figure 2: Global Market Value (US$ Mn) by Application, 2022-2032

Figure 3: Global Market Value (US$ Mn) by End User, 2022-2032

Figure 4: Global Market Value (US$ Mn) by Region, 2022-2032

Figure 5: Global Market Value (US$ Mn) Analysis by Region, 2017-2032

Figure 6: Global Market Volume (Units) Analysis by Region, 2017-2032

Figure 7: Global Market Value Share (%) and BPS Analysis by Region, 2022-2032

Figure 8: Global Market Y-o-Y Growth (%) Projections by Region, 2022-2032

Figure 9: Global Market Value (US$ Mn) Analysis by Type, 2017-2032

Figure 10: Global Market Volume (Units) Analysis by Type, 2017-2032

Figure 11: Global Market Value Share (%) and BPS Analysis by Type, 2022-2032

Figure 12: Global Market Y-o-Y Growth (%) Projections by Type, 2022-2032

Figure 13: Global Market Value (US$ Mn) Analysis by Application, 2017-2032

Figure 14: Global Market Volume (Units) Analysis by Application, 2017-2032

Figure 15: Global Market Value Share (%) and BPS Analysis by Application, 2022-2032

Figure 16: Global Market Y-o-Y Growth (%) Projections by Application, 2022-2032

Figure 17: Global Market Value (US$ Mn) Analysis by End User, 2017-2032

Figure 18: Global Market Volume (Units) Analysis by End User, 2017-2032

Figure 19: Global Market Value Share (%) and BPS Analysis by End User, 2022-2032

Figure 20: Global Market Y-o-Y Growth (%) Projections by End User, 2022-2032

Figure 21: Global Market Attractiveness by Type, 2022-2032

Figure 22: Global Market Attractiveness by Application, 2022-2032

Figure 23: Global Market Attractiveness by End User, 2022-2032

Figure 24: Global Market Attractiveness by Region, 2022-2032

Figure 25: North America Market Value (US$ Mn) by Type, 2022-2032

Figure 26: North America Market Value (US$ Mn) by Application, 2022-2032

Figure 27: North America Market Value (US$ Mn) by End User, 2022-2032

Figure 28: North America Market Value (US$ Mn) by Country, 2022-2032

Figure 29: North America Market Value (US$ Mn) Analysis by Country, 2017-2032

Figure 30: North America Market Volume (Units) Analysis by Country, 2017-2032

Figure 31: North America Market Value Share (%) and BPS Analysis by Country, 2022-2032

Figure 32: North America Market Y-o-Y Growth (%) Projections by Country, 2022-2032

Figure 33: North America Market Value (US$ Mn) Analysis by Type, 2017-2032

Figure 34: North America Market Volume (Units) Analysis by Type, 2017-2032

Figure 35: North America Market Value Share (%) and BPS Analysis by Type, 2022-2032

Figure 36: North America Market Y-o-Y Growth (%) Projections by Type, 2022-2032

Figure 37: North America Market Value (US$ Mn) Analysis by Application, 2017-2032

Figure 38: North America Market Volume (Units) Analysis by Application, 2017-2032

Figure 39: North America Market Value Share (%) and BPS Analysis by Application, 2022-2032

Figure 40: North America Market Y-o-Y Growth (%) Projections by Application, 2022-2032

Figure 41: North America Market Value (US$ Mn) Analysis by End User, 2017-2032

Figure 42: North America Market Volume (Units) Analysis by End User, 2017-2032

Figure 43: North America Market Value Share (%) and BPS Analysis by End User, 2022-2032

Figure 44: North America Market Y-o-Y Growth (%) Projections by End User, 2022-2032

Figure 45: North America Market Attractiveness by Type, 2022-2032

Figure 46: North America Market Attractiveness by Application, 2022-2032

Figure 47: North America Market Attractiveness by End User, 2022-2032

Figure 48: North America Market Attractiveness by Country, 2022-2032

Figure 49: Latin America Market Value (US$ Mn) by Type, 2022-2032

Figure 50: Latin America Market Value (US$ Mn) by Application, 2022-2032

Figure 51: Latin America Market Value (US$ Mn) by End User, 2022-2032

Figure 52: Latin America Market Value (US$ Mn) by Country, 2022-2032

Figure 53: Latin America Market Value (US$ Mn) Analysis by Country, 2017-2032

Figure 54: Latin America Market Volume (Units) Analysis by Country, 2017-2032

Figure 55: Latin America Market Value Share (%) and BPS Analysis by Country, 2022-2032

Figure 56: Latin America Market Y-o-Y Growth (%) Projections by Country, 2022-2032

Figure 57: Latin America Market Value (US$ Mn) Analysis by Type, 2017-2032

Figure 58: Latin America Market Volume (Units) Analysis by Type, 2017-2032

Figure 59: Latin America Market Value Share (%) and BPS Analysis by Type, 2022-2032

Figure 60: Latin America Market Y-o-Y Growth (%) Projections by Type, 2022-2032

Figure 61: Latin America Market Value (US$ Mn) Analysis by Application, 2017-2032

Figure 62: Latin America Market Volume (Units) Analysis by Application, 2017-2032

Figure 63: Latin America Market Value Share (%) and BPS Analysis by Application, 2022-2032

Figure 64: Latin America Market Y-o-Y Growth (%) Projections by Application, 2022-2032

Figure 65: Latin America Market Value (US$ Mn) Analysis by End User, 2017-2032

Figure 66: Latin America Market Volume (Units) Analysis by End User, 2017-2032

Figure 67: Latin America Market Value Share (%) and BPS Analysis by End User, 2022-2032

Figure 68: Latin America Market Y-o-Y Growth (%) Projections by End User, 2022-2032

Figure 69: Latin America Market Attractiveness by Type, 2022-2032

Figure 70: Latin America Market Attractiveness by Application, 2022-2032

Figure 71: Latin America Market Attractiveness by End User, 2022-2032

Figure 72: Latin America Market Attractiveness by Country, 2022-2032

Figure 73: Europe Market Value (US$ Mn) by Type, 2022-2032

Figure 74: Europe Market Value (US$ Mn) by Application, 2022-2032

Figure 75: Europe Market Value (US$ Mn) by End User, 2022-2032

Figure 76: Europe Market Value (US$ Mn) by Country, 2022-2032

Figure 77: Europe Market Value (US$ Mn) Analysis by Country, 2017-2032

Figure 78: Europe Market Volume (Units) Analysis by Country, 2017-2032

Figure 79: Europe Market Value Share (%) and BPS Analysis by Country, 2022-2032

Figure 80: Europe Market Y-o-Y Growth (%) Projections by Country, 2022-2032

Figure 81: Europe Market Value (US$ Mn) Analysis by Type, 2017-2032

Figure 82: Europe Market Volume (Units) Analysis by Type, 2017-2032

Figure 83: Europe Market Value Share (%) and BPS Analysis by Type, 2022-2032

Figure 84: Europe Market Y-o-Y Growth (%) Projections by Type, 2022-2032

Figure 85: Europe Market Value (US$ Mn) Analysis by Application, 2017-2032

Figure 86: Europe Market Volume (Units) Analysis by Application, 2017-2032

Figure 87: Europe Market Value Share (%) and BPS Analysis by Application, 2022-2032

Figure 88: Europe Market Y-o-Y Growth (%) Projections by Application, 2022-2032

Figure 89: Europe Market Value (US$ Mn) Analysis by End User, 2017-2032

Figure 90: Europe Market Volume (Units) Analysis by End User, 2017-2032

Figure 91: Europe Market Value Share (%) and BPS Analysis by End User, 2022-2032

Figure 92: Europe Market Y-o-Y Growth (%) Projections by End User, 2022-2032

Figure 93: Europe Market Attractiveness by Type, 2022-2032

Figure 94: Europe Market Attractiveness by Application, 2022-2032

Figure 95: Europe Market Attractiveness by End User, 2022-2032

Figure 96: Europe Market Attractiveness by Country, 2022-2032

Figure 97: Asia Pacific Market Value (US$ Mn) by Type, 2022-2032

Figure 98: Asia Pacific Market Value (US$ Mn) by Application, 2022-2032

Figure 99: Asia Pacific Market Value (US$ Mn) by End User, 2022-2032

Figure 100: Asia Pacific Market Value (US$ Mn) by Country, 2022-2032

Figure 101: Asia Pacific Market Value (US$ Mn) Analysis by Country, 2017-2032

Figure 102: Asia Pacific Market Volume (Units) Analysis by Country, 2017-2032

Figure 103: Asia Pacific Market Value Share (%) and BPS Analysis by Country, 2022-2032

Figure 104: Asia Pacific Market Y-o-Y Growth (%) Projections by Country, 2022-2032

Figure 105: Asia Pacific Market Value (US$ Mn) Analysis by Type, 2017-2032

Figure 106: Asia Pacific Market Volume (Units) Analysis by Type, 2017-2032

Figure 107: Asia Pacific Market Value Share (%) and BPS Analysis by Type, 2022-2032

Figure 108: Asia Pacific Market Y-o-Y Growth (%) Projections by Type, 2022-2032

Figure 109: Asia Pacific Market Value (US$ Mn) Analysis by Application, 2017-2032

Figure 110: Asia Pacific Market Volume (Units) Analysis by Application, 2017-2032

Figure 111: Asia Pacific Market Value Share (%) and BPS Analysis by Application, 2022-2032

Figure 112: Asia Pacific Market Y-o-Y Growth (%) Projections by Application, 2022-2032

Figure 113: Asia Pacific Market Value (US$ Mn) Analysis by End User, 2017-2032

Figure 114: Asia Pacific Market Volume (Units) Analysis by End User, 2017-2032

Figure 115: Asia Pacific Market Value Share (%) and BPS Analysis by End User, 2022-2032

Figure 116: Asia Pacific Market Y-o-Y Growth (%) Projections by End User, 2022-2032

Figure 117: Asia Pacific Market Attractiveness by Type, 2022-2032

Figure 118: Asia Pacific Market Attractiveness by Application, 2022-2032

Figure 119: Asia Pacific Market Attractiveness by End User, 2022-2032

Figure 120: Asia Pacific Market Attractiveness by Country, 2022-2032

Figure 121: MEA Market Value (US$ Mn) by Type, 2022-2032

Figure 122: MEA Market Value (US$ Mn) by Application, 2022-2032

Figure 123: MEA Market Value (US$ Mn) by End User, 2022-2032

Figure 124: MEA Market Value (US$ Mn) by Country, 2022-2032

Figure 125: MEA Market Value (US$ Mn) Analysis by Country, 2017-2032

Figure 126: MEA Market Volume (Units) Analysis by Country, 2017-2032

Figure 127: MEA Market Value Share (%) and BPS Analysis by Country, 2022-2032

Figure 128: MEA Market Y-o-Y Growth (%) Projections by Country, 2022-2032

Figure 129: MEA Market Value (US$ Mn) Analysis by Type, 2017-2032

Figure 130: MEA Market Volume (Units) Analysis by Type, 2017-2032

Figure 131: MEA Market Value Share (%) and BPS Analysis by Type, 2022-2032

Figure 132: MEA Market Y-o-Y Growth (%) Projections by Type, 2022-2032

Figure 133: MEA Market Value (US$ Mn) Analysis by Application, 2017-2032

Figure 134: MEA Market Volume (Units) Analysis by Application, 2017-2032

Figure 135: MEA Market Value Share (%) and BPS Analysis by Application, 2022-2032

Figure 136: MEA Market Y-o-Y Growth (%) Projections by Application, 2022-2032

Figure 137: MEA Market Value (US$ Mn) Analysis by End User, 2017-2032

Figure 138: MEA Market Volume (Units) Analysis by End User, 2017-2032

Figure 139: MEA Market Value Share (%) and BPS Analysis by End User, 2022-2032

Figure 140: MEA Market Y-o-Y Growth (%) Projections by End User, 2022-2032

Figure 141: MEA Market Attractiveness by Type, 2022-2032

Figure 142: MEA Market Attractiveness by Application, 2022-2032

Figure 143: MEA Market Attractiveness by End User, 2022-2032

Figure 144: MEA Market Attractiveness by Country, 2022-2032

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Wireless Network Test Equipment Market Report – Growth & Forecast 2025 to 2035

Enterprise Network Equipment Market Size and Share Forecast Outlook 2025 to 2035

Next Generation Network (NGN) Equipment Market Size and Share Forecast Outlook 2025 to 2035

Optical Transport Network Equipment Market Size and Share Forecast Outlook 2025 to 2035

Gigabit Passive Optical Network Equipment Market Size and Share Forecast Outlook 2025 to 2035

Network Simulator Software Market Size and Share Forecast Outlook 2025 to 2035

Network Connectivity Tester Market Size and Share Forecast Outlook 2025 to 2035

Network Analyzers Market Size and Share Forecast Outlook 2025 to 2035

Network as a Service (NaaS) Market Size and Share Forecast Outlook 2025 to 2035

Network Analytics Market Size and Share Forecast Outlook 2025 to 2035

Network Devices Market Size and Share Forecast Outlook 2025 to 2035

Network Sandboxing Market Size and Share Forecast Outlook 2025 to 2035

Network Access Control (NAC) Market Size and Share Forecast Outlook 2025 to 2035

Network Monitoring Market Size and Share Forecast Outlook 2025 to 2035

Network Encryption Market Size and Share Forecast Outlook 2025 to 2035

Network Packet Broker Market Size and Share Forecast Outlook 2025 to 2035

Network Traffic Analytics Market Size and Share Forecast Outlook 2025 to 2035

Network Function Virtualization (NFV) Market Size and Share Forecast Outlook 2025 to 2035

Network Cable Tester Market Size and Share Forecast Outlook 2025 to 2035

Network Point-of-Care Glucose Testing Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA