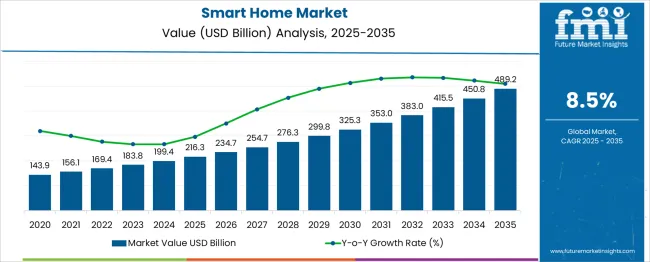

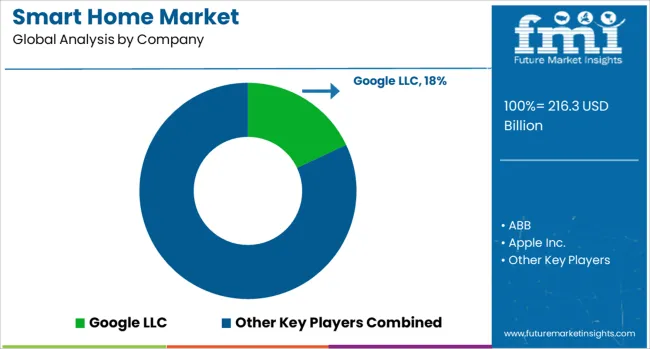

The Smart Home Market is estimated to be valued at USD 216.3 billion in 2025 and is projected to reach USD 489.2 billion by 2035, registering a compound annual growth rate (CAGR) of 8.5% over the forecast period. From 2020 to 2024, the market is in the early adoption phase, growing from USD 143.9 to 199.4 billion. Early adopters include tech-savvy homeowners and pilot commercial installations, with basic automation solutions, lighting controls, and connected security systems dominating.

Analogous to “Hydraulic” in other sectors, these mature technologies see selective adoption, while advanced solutions like AI-driven energy management or fully integrated home ecosystems (similar to Electric Hydraulic and EPS) remain niche. From 2025 to 2030, the market enters the scaling phase, expanding from USD 216.3-325.3 billion. Adoption accelerates as smart devices become more affordable, interoperable, and integrated into mainstream housing and commercial buildings.

Electric, Hydraulic-like innovations, such as connected HVAC and energy optimization systems, gain traction, while EPS-like solutions, fully integrated, AI-enabled smart homes, begin broader deployment in premium segments. Between 2030 and 2035, the market transitions to consolidation, reaching USD 489.2 billion. Growth moderates as most urban and suburban households adopt smart technologies. Mature segments stabilize, while advanced solutions dominate premium and innovative applications. The overall maturity curve is sigmoid-shaped, with segments mapped by adoption readiness, cost, and complexity.

| Metric | Value |

|---|---|

| Smart Home Market Estimated Value in (2025 E) | USD 216.3 billion |

| Smart Home Market Forecast Value in (2035 F) | USD 489.2 billion |

| Forecast CAGR (2025 to 2035) | 8.5% |

The Smart Home market is witnessing significant growth, propelled by increasing consumer demand for connected living environments and enhanced home automation solutions. The current market scenario is shaped by rising awareness of energy efficiency, convenience, and safety among homeowners, as highlighted in corporate announcements, industry journals, and technology news articles.

Advancements in wireless communication standards and integration of artificial intelligence into home devices have further enhanced the appeal of smart homes, fostering wider adoption. The future outlook remains positive as manufacturers continue to innovate and develop open platforms that support interoperability across devices.

Investor presentations and press releases point to growing investments in infrastructure upgrades and consumer education campaigns that are expanding the addressable market. These factors, along with favorable government initiatives promoting sustainable and secure housing, are expected to sustain momentum and create further opportunities for market expansion globally.

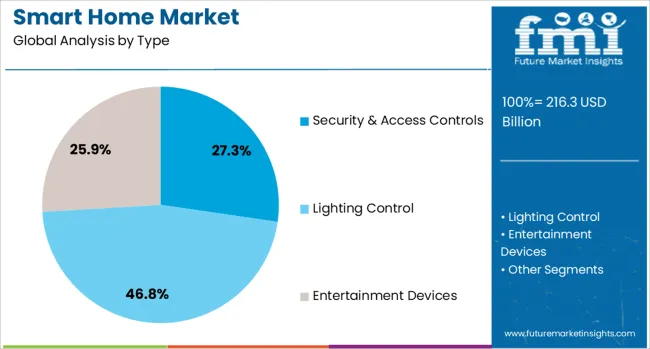

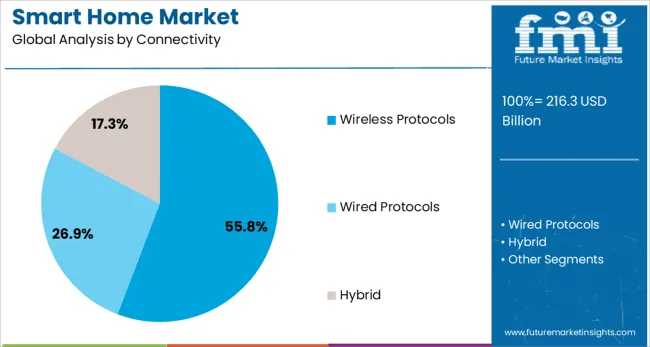

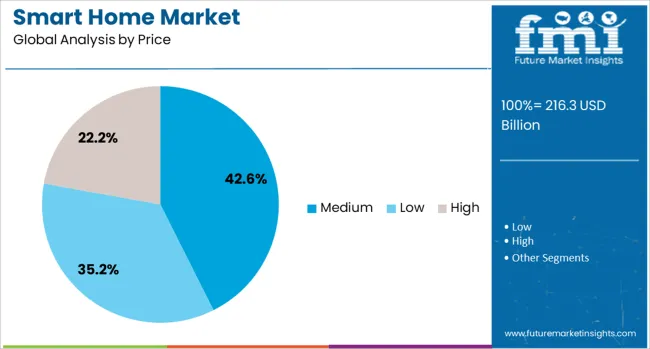

The smart home market is segmented by type, connectivity, price, application, distribution channel, and geographic regions. The smart home market is divided into Security & Access Controls, Lighting Control, Entertainment Devices, HVAC, Smart Kitchen Appliances, Home Appliances, Smart Furniture, Home Healthcare, and Other Devices. In terms of connectivity, the smart home market is classified into Wireless Protocols, Wired Protocols, and Hybrid. Based on the price, the smart home market is segmented into Medium, Low, and High.

The smart home market is segmented into Retrofit and New Construction. The distribution channel of the smart home market is segmented into Online and Offline. Regionally, the smart home industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The security and access controls segment is projected to hold 27.3% of the Smart Home market revenue share in 2025, establishing it as the leading type segment. This leadership is attributed to growing consumer emphasis on personal and property safety as highlighted in product announcements and industry publications. The segment has been supported by advancements in software defined monitoring systems and cloud based surveillance solutions that enhance security effectiveness.

Corporate statements have also pointed to rising urbanization and the need for real time access management as key drivers of adoption. The ability of these systems to integrate seamlessly with broader home automation platforms has increased their relevance in the connected home ecosystem.

Additionally, the introduction of user friendly mobile applications and biometric authentication features has strengthened consumer confidence in adopting such solutions. These factors combined have reinforced the segment’s dominant position in the Smart Home market in 2025.

The wireless protocols segment is anticipated to account for 55.8% of the Smart Home market revenue share in 2025, making it the most significant connectivity segment. This prominence has been driven by the increasing preference for flexible, scalable, and cost efficient solutions that eliminate the need for extensive cabling, as cited in technology whitepapers and corporate disclosures.

The segment’s growth has been fueled by improvements in communication standards that ensure reliable performance and interoperability among diverse smart home devices. Industry news has reported that the proliferation of Wi Fi, Zigbee, Z Wave, and emerging low power wireless technologies has enabled easier installation and broader device compatibility.

Companies have also highlighted that wireless connectivity aligns with consumer demand for mobility and rapid upgrades without structural modifications. These benefits have encouraged widespread adoption of wireless protocols, ensuring their leadership within the market’s connectivity segment in 2025.

The medium price segment is forecasted to contribute 42.6% of the Smart Home market revenue share in 2025, securing its position as the largest price segment. This leadership has been shaped by growing consumer preference for solutions that balance affordability and advanced functionality, as reported in technology product launches and corporate briefings.

Industry publications have highlighted that medium priced offerings are appealing to a broader customer base by delivering reliable performance at competitive costs. Companies have emphasized that economies of scale and technological maturation have enabled manufacturers to offer feature rich products within this price range, enhancing value for money.

The segment has also benefited from its accessibility to middle income households and its compatibility with existing infrastructure without requiring premium investments. These factors together have sustained the dominance of the medium price segment in the Smart Home market in 2025.

The smart home market is expanding rapidly as consumers increasingly adopt connected devices for convenience, security, and energy management. Products such as smart lighting, thermostats, security systems, and voice-controlled assistants are gaining traction across residential spaces. North America and Europe lead due to high adoption rates and mature infrastructure, while Asia-Pacific shows strong growth driven by urban development and rising disposable incomes. Integration with mobile apps, AI-assisted automation, and remote monitoring is enhancing user experience, fueling broader adoption of smart home solutions globally.

Smart home devices are increasingly used for automation, security, and energy efficiency. Homeowners seek systems that allow remote control of lighting, heating, security cameras, and appliances via smartphones or voice commands. Convenience, personalized experiences, and time-saving features drive adoption. Integration with IoT platforms enables seamless coordination between devices, enhancing overall functionality. Consumers are also drawn to energy monitoring and cost-saving benefits offered by connected devices. As awareness of smart home benefits grows, adoption expands across urban and semi-urban households, contributing to consistent market growth globally.

Manufacturers are focusing on seamless integration of devices into centralized platforms. Smart hubs, AI assistants, and cross-device compatibility allow coordinated operation, simplifying user interaction. Enhanced connectivity ensures devices respond intelligently to environmental changes, user preferences, and occupancy patterns. Real-time notifications and remote access improve security and control. Interoperability standards and open protocols make it easier to expand home automation systems with additional devices. As solutions become more intuitive and reliable, consumer confidence increases, supporting widespread adoption of smart home technologies in residential spaces.

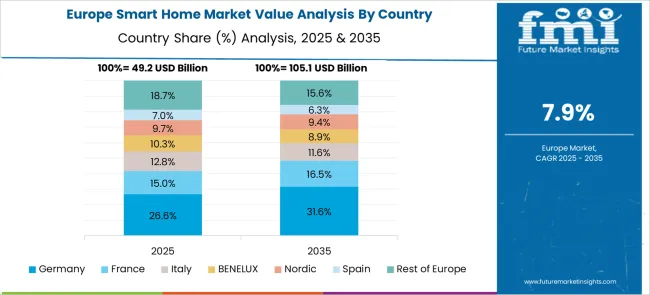

North America and Europe maintain high market penetration due to established infrastructure, awareness, and high disposable incomes. Asia-Pacific shows rapid growth driven by expanding urban housing projects, rising middle-class populations, and tech-savvy consumers. Local governments are promoting energy-efficient and connected housing initiatives, further driving adoption. Regional variations in network coverage, electricity reliability, and consumer purchasing behavior influence the types of smart home devices adopted. Urban development patterns and increasing home automation awareness in emerging economies contribute to sustained regional growth, creating a balanced global market landscape.

Key players are collaborating with technology providers, homebuilders, and service companies to enhance device functionality and reach. Partnerships enable integration with emerging AI platforms, voice assistants, and IoT ecosystems, providing added value to consumers. Collaborating with distributors and retailers ensures wide availability and after-sales support. Co-development agreements allow tailored solutions for regional preferences, including language, energy systems, and regulatory compliance. These alliances help companies strengthen brand recognition, expand market presence, and deliver comprehensive smart home experiences, driving further adoption and long-term market growth.

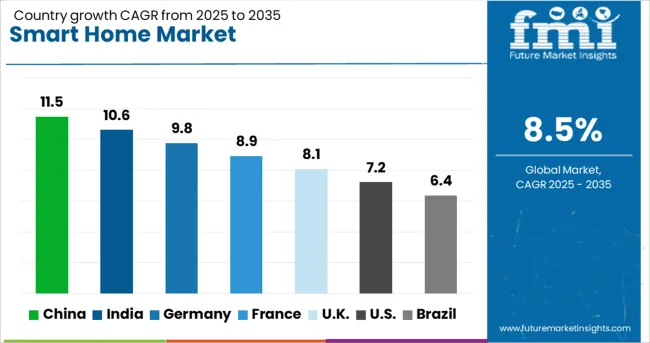

| Country | CAGR |

|---|---|

| China | 11.5% |

| India | 10.6% |

| Germany | 9.8% |

| France | 8.9% |

| UK | 8.1% |

| USA | 7.2% |

| Brazil | 6.4% |

The smart home market is anticipated to grow at a CAGR of 8.5%, reflecting increased adoption of connected devices for lighting, security, energy management, and entertainment. China leads with an 11.5% growth rate, driven by large-scale urban installations and extensive smart device manufacturing. India follows at 10.6%, supported by growing middle-class demand and rising awareness of home automation benefits. Germany, at 9.8% growth, leverages strong engineering expertise and high-quality smart solutions for both residential and commercial applications. The UK, with 8.1% growth, emphasizes advanced distribution networks and user-friendly systems, while the USA, at 7.2%, sustains market growth through integration of IoT platforms and home automation services. This report includes insights on 40+ countries; the top countries are shown here for reference. Expansion is driven by increasing consumer demand for convenience, safety, and energy efficiency in homes.

China leads the smart home market with 11.5% growth, driven by increasing consumer adoption of IoT-enabled devices, home automation, and energy management solutions. Compared to India, China benefits from a large urban population, high smartphone penetration, and strong technology infrastructure. Government initiatives promoting smart cities and energy efficiency further boost demand for connected devices. Leading manufacturers focus on AI-based systems, voice-controlled appliances, and integrated security solutions. Investments in R&D enhance device compatibility, interoperability, and user-friendly interfaces. Rapid urbanization and rising disposable incomes encourage households to adopt smart lighting, HVAC systems, and home security solutions. The market is also supported by a growing e-commerce ecosystem for smart home product distribution. Overall, China maintains a leading position due to technological innovation, urbanization, and consumer readiness to adopt smart home solutions.

India’s smart home market grows at 10.6%, fueled by increasing internet penetration, smartphone usage, and middle-class disposable income. Compared to Germany, India emphasizes cost-effective solutions tailored for local consumers. Rising awareness of energy management, home security, and automation drives adoption. Companies focus on smart lighting, smart plugs, connected HVAC, and voice-controlled devices. Government programs supporting digital infrastructure and smart cities promote wider integration of smart home technologies. Urban households show higher adoption rates, while tier-2 and tier-3 cities are gradually expanding market potential. E-commerce platforms and local retail chains enhance product accessibility. Technological innovation and affordable pricing ensure steady market growth. The combination of rising consumer interest, digital adoption, and infrastructure support positions India as a fast-growing smart home market.

Germany grows at 9.8%, driven by demand for energy-efficient and secure home automation systems. Compared to the UK, Germany emphasizes sustainability, high-quality engineering, and regulatory compliance. Smart home adoption includes connected lighting, heating, ventilation, security, and entertainment systems. Technological advancements focus on AI, IoT, and cloud-based integration for seamless user experience. Residential smart home solutions are supported by government incentives for energy efficiency and sustainable building initiatives. High consumer awareness, urbanization, and willingness to invest in technology maintain steady growth. Export opportunities and collaboration with international smart device providers strengthen Germany’s market. Overall, the German smart home market thrives on technological sophistication, regulatory compliance, and energy-efficient solutions.

The commercial gas fired boiler market in the United Kingdom is growing steadily at 7.3%, driven by increasing regulatory pressure on emissions and a focus on energy cost reduction. Compared to the United States, the UK market prioritizes cleaner heating technologies and smart energy management solutions. Demand is boosted by upgrades in commercial properties and new constructions adopting modern boilers. Energy service companies offer maintenance and upgrade packages to improve system performance. The retail and education sectors are prominent users of gas fired boilers.

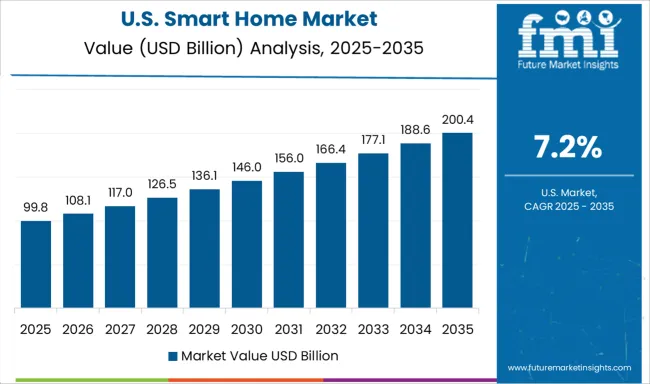

The USA smart home market grows at 7.2%, driven by consumer demand for connected devices, security systems, and energy management solutions. Compared to China, the USA emphasizes interoperability, privacy, and AI-enabled automation. High adoption rates in residential and multi-family housing promote market expansion. Manufacturers focus on smart lighting, smart thermostats, security cameras, and integrated home systems. Technological innovation, cloud-based control, and voice-enabled assistants enhance user convenience. E-commerce distribution channels facilitate product reach and adoption. Urbanization, rising disposable income, and interest in sustainable living support growth. Overall, the US market shows steady expansion, driven by technological advancements, consumer awareness, and smart home lifestyle trends.

The smart home market is experiencing rapid growth, driven by increasing consumer demand for connected, energy-efficient, and secure home environments. Smart home solutions include automation systems, lighting controls, security systems, HVAC management, and home entertainment integration. Google LLC and Apple Inc. are prominent technology leaders offering smart home ecosystems, Google through its Nest platform and Apple through HomeKit, enabling seamless connectivity across devices. Samsung also plays a key role with its SmartThings ecosystem, providing extensive device compatibility and automation capabilities.

Traditional electronics and appliance manufacturers have entered the market with smart solutions: Panasonic Corporation, Haier Group, and Robert Bosch Smart Home GmbH offer appliances and home systems integrated with IoT technology. Honeywell International Inc. and Johnson Controls focus on security, climate control, and energy management systems for residential and commercial applications.

European automation and electrical solution providers, including ABB, Schneider Electric, Crestron Electronics, Inc., Emerson Electric Co., Gira, and Nice Polska Sp. z o.o., specialize in smart lighting, access control, and building automation solutions tailored for energy efficiency and user convenience. Xiaomi has also gained traction by providing affordable and scalable smart home devices, appealing to budget-conscious consumers and expanding global adoption.

The smart home market continues to evolve with AI integration, voice control, energy management, and interoperability standards. Companies focusing on ecosystem expansion, innovative device integration, and user-friendly interfaces are positioned to drive the next phase of growth in this dynamic market.

In August 2024, LG unveiled its ThinQ ON smart home hub at IFA Berlin. This Matter-certified device integrates LG's Affectionate Intelligence AI voice assistant, enabling natural language control and learning user preferences. It supports Thread, Zigbee, and Wi-Fi protocols, aiming to compete with platforms like Samsung SmartThings and Apple Home. LG's acquisition of Dutch platform Athom in 2024 enhances its ecosystem capabilities.

| Item | Value |

|---|---|

| Quantitative Units | USD 216.3 Billion |

| Type | Security & Access Controls, Lighting Control, Entertainment Devices, HVAC, Smart Kitchen Appliances, Home Appliances, Smart Furniture, Home Healthcare, and Others Device |

| Connectivity | Wireless Protocols, Wired Protocols, and Hybrid |

| Price | Medium, Low, and High |

| Application | Retrofit and New Construction |

| Distribution Channel | Online and Offline |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | Google LLC, ABB, Apple Inc., Crestron Electronics, Inc., Emerson Electric Co., Gira, Haier Group, Honeywell International Inc., Johnson Control, Nice Polska Sp. z o.o., Panasonic Corporation, Robert Bosch Smart Home GmbH, Samsung, Schneider Electric, and Xiaomi |

| Additional Attributes | Dollar sales in the smart home market vary by product type including smart lighting, security systems, thermostats, and appliances, application across residential and multi-dwelling units, and region covering North America, Europe, and Asia-Pacific. Growth is driven by increasing adoption of IoT devices, rising consumer demand for convenience and energy efficiency, and advancements in home automation technologies. |

The global smart home market is estimated to be valued at USD 216.3 billion in 2025.

The market size for the smart home market is projected to reach USD 489.2 billion by 2035.

The smart home market is expected to grow at a 8.5% CAGR between 2025 and 2035.

The key product types in smart home market are security & access controls, _security cameras, _video door phones, _smart locks, _remote monitoring software & services, _others, lighting control, _smart lights, _relays & switches, _occupancy sensors, _dimmers, _other products, entertainment devices, _smart displays/tv, _streaming devices, _sound bars & speakers, hvac, _smart thermostats, _sensors, _smart vents, _others, smart kitchen appliances, _refrigerators, _dish washers, _cooktops, _microwave/ovens, _others, home appliances, _smart washing machines, _smart water heaters, _smart vacuum cleaners, _others, smart furniture, _table, _chair, _others, home healthcare and others device.

In terms of connectivity, wireless protocols segment to command 55.8% share in the smart home market in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Smart Home Wireless Smoke Detector Market Size and Share Forecast Outlook 2025 to 2035

Smart Home Devices Market Size and Share Forecast Outlook 2025 to 2035

Smart Home Gym Equipment Market Size and Share Forecast Outlook 2025 to 2035

Smart Home Service Market Size and Share Forecast Outlook 2025 to 2035

Smart Home Automation Technology Market Size and Share Forecast Outlook 2025 to 2035

Smart Home Security Camera Market Analysis - Size, Share, and Forecast 2025 to 2035

Smart Home-Based Beverage Machine Market Size and Share Forecast Outlook 2025 to 2035

Smart Home Payments Market Size and Share Forecast Outlook 2025 to 2035

Smart Home Automation Market Size and Share Forecast Outlook 2025 to 2035

Smart Home Solutions Market Size and Share Forecast Outlook 2025 to 2035

Smart Home Appliances Market Growth – Trends & Forecast 2025 to 2035

Smart Home Water Sensors & Controllers Market Trends & Forecast 2025 to 2035

Smart Home Platforms Market Growth – Trends & Forecast through 2034

Smart Home Automation in India – IoT & AI-Driven Growth

Smart Home Hub Market

Smart Grid Home Area Network (HAN) Market Size and Share Forecast Outlook 2025 to 2035

Korea Smart Home Security Camera Market Size and Share Forecast Outlook 2025 to 2035

Demand and Trends Analysis of Smart Home Security Camera in Western Europe Size and Share Forecast Outlook 2025 to 2035

Demand and Trends Analysis of Smart Home Security Camera in Japan Size and Share Forecast Outlook 2025 to 2035

Smart Meeting Pod Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA