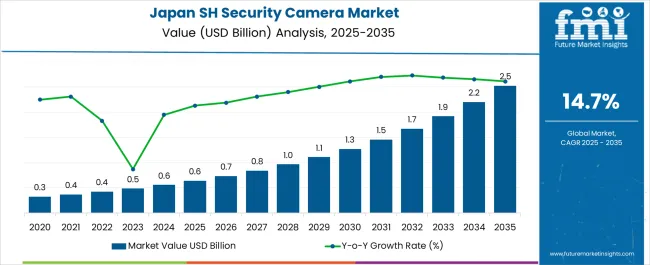

The Demand and Trends Analysis of Smart Home Security Camera in Japan is estimated to be valued at USD 0.6 billion in 2025 and is projected to reach USD 2.5 billion by 2035, registering a compound annual growth rate (CAGR) of 14.7% over the forecast period.

| Metric | Value |

|---|---|

| Demand and Trends Analysis of Smart Home Security Camera in Japan Estimated Value in (2025 E) | USD 0.6 billion |

| Demand and Trends Analysis of Smart Home Security Camera in Japan Forecast Value in (2035 F) | USD 2.5 billion |

| Forecast CAGR (2025 to 2035) | 14.7% |

The smart home security camera market in Japan is witnessing strong demand growth driven by rising urban security concerns, increasing smart home adoption, and rapid advancements in wireless connectivity. Consumer awareness regarding safety and surveillance has been expanding, with households prioritizing integrated security solutions that combine convenience with real-time monitoring. The market is also being supported by favorable infrastructure, high-speed internet penetration, and growing adoption of IoT-enabled devices.

Price competitiveness and product variety offered by manufacturers are further strengthening accessibility across different consumer income groups. Over the forecast period, demand is expected to be reinforced by technological innovations such as AI-enabled analytics, cloud storage, and seamless integration with broader smart home ecosystems.

Expansion of e-commerce platforms and aggressive online marketing campaigns are shaping purchasing behavior, ensuring steady market penetration Growth rationale is built on the intersection of technology adoption, consumer lifestyle changes, and strong retail distribution, which together position the market for sustained expansion in Japan.

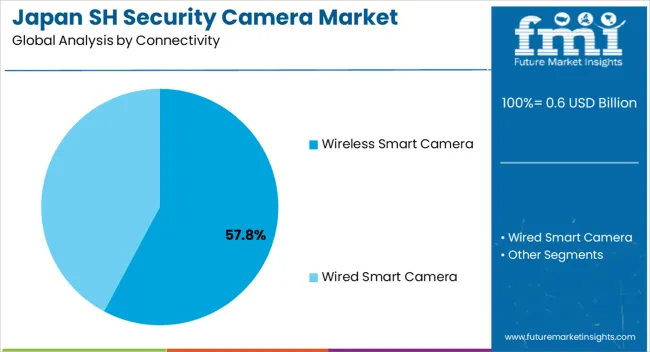

The wireless smart camera segment, accounting for 57.80% of the connectivity category, has established dominance due to its ease of installation, flexibility, and compatibility with modern smart home ecosystems. Demand has been accelerated by the increasing penetration of Wi-Fi networks and consumer preference for devices that do not require complex wiring.

The segment’s growth is also supported by advancements in wireless transmission quality, battery life, and integration with mobile applications that enable remote monitoring. Consumer adoption is further reinforced by the ability of wireless cameras to be easily relocated and upgraded, providing both cost efficiency and convenience.

Manufacturers are focusing on improving encryption standards and cybersecurity features, addressing consumer concerns around privacy and data protection With smart city initiatives and rising household digitalization in Japan, the wireless segment is expected to maintain its leadership and continue driving the market’s overall growth trajectory.

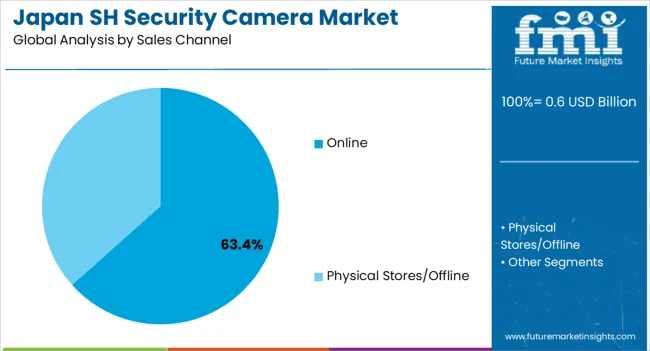

The online sales channel, holding 63.40% of the distribution category, has emerged as the leading mode of purchase, reflecting shifting consumer preferences toward digital shopping platforms. This dominance is supported by the availability of wide product assortments, competitive pricing, and promotional offers provided by leading e-commerce players. Online platforms are also enabling informed decision-making through reviews, detailed product descriptions, and comparison features, which are increasingly influencing consumer purchasing behavior.

Market penetration has been accelerated by the convenience of home delivery and integration of financing options, which have widened accessibility. For manufacturers, online sales channels provide the ability to reach a larger customer base while optimizing distribution costs.

Strategic partnerships between smart device brands and major e-commerce platforms in Japan have further reinforced this channel’s strength With continued growth in digital adoption and consumer reliance on online shopping, the online segment is anticipated to sustain its leadership in driving sales growth for smart home security cameras.

Wired smart camera have the edge over wireless smart camera in Japan. For 2025, the industry share by connectivity of wired smart camera is tipped to be 70.4% in Japan.

Wired smart camera have earned the trust of consumers in Japan. Although technologically advanced, wireless smart camera are also prone to hacking. Thus, wired smart camera are being relied upon by consumers in Japan.

| Demand for Smart Home Security Camera in Japan Based on Connectivity | Wired Smart Camera |

|---|---|

| Industry Share in 2025 | 70.4% |

People in Japan flock to physical stores to get hold of smart home security camera. For 2025, the industry share of physical stores/offline is predicted to be 70.9%.

While the eCommerce sector is growing, consumers in Japan still prefer the offline mode to buy smart home security camera. Physical stores allow for a closer inspection of the product before it is purchased. Thus, more confidence is placed in the offline mode by consumers in Japan.

| Demand for Smart Home Security Camera in Japan Based on Sales Channel | Physical Stores/Offline |

|---|---|

| Industry Share in 2025 | 70.9% |

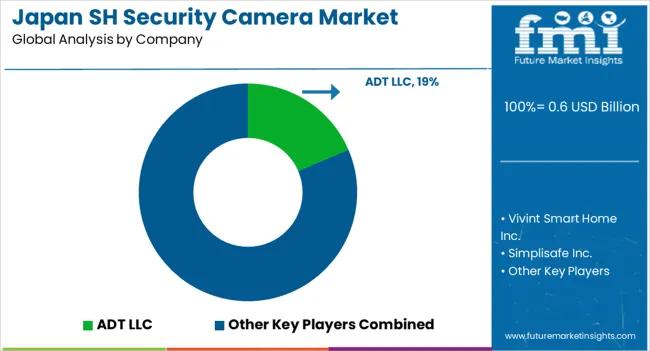

The landscape of smart home security camera in Japan is saturated with several local companies. Furthermore, multinational foreign giants have also made an impact in Japan, establishing a foothold in the country. Advancements in technology are considered a must by industry players to maintain strong positions. Japan-based industry players also focus on exports out of Japan.

Recent Developments Observed in Smart Home Security Camera in Japan

| Attribute | Details |

|---|---|

| Estimated Industry Size in 2025 | USD 0.6 billion |

| Projected Industry Size by 2035 | USD 2.5 billion |

| Anticipated CAGR between 2025 to 2035 | 14.7% CAGR |

| Historical Analysis of Demand for Smart Home Security Camera in Japan | 2020 to 2025 |

| Demand Forecast for Smart Home Security Camera in Japan | 2025 to 2035 |

| Report Coverage | Industry Size, Industry Trends, Key Insights for Smart Home Security Camera in Japan, Insights on Global Players and Leading Industry Strategy in Japan, Ecosystem Analysis of Local and Regional Japan Providers |

| Key Companies Profiled | Vivint Smart Home Inc.; ADT LLC; Simplisafe Inc.; Brinks Home Security; Skylinkhome; Samsung Electronics Co. Ltd.; Frontpoint Security Solutions LLC; Arlo Technologies Inc.; Wyze Labs Inc.; Blink; Ring LLC |

| Key Cities Analyzed | Kanto, Chubu, Kinki, Kyushu & Okinawa, Tohoku, Rest of Japan |

The global demand and trends analysis of smart home security camera in Japan is estimated to be valued at USD 0.6 billion in 2025.

The market size for the demand and trends analysis of smart home security camera in Japan is projected to reach USD 2.5 billion by 2035.

The demand and trends analysis of smart home security camera in Japan is expected to grow at a 14.7% CAGR between 2025 and 2035.

The key product types in demand and trends analysis of smart home security camera in Japan are wireless smart camera and wired smart camera.

In terms of sales channel, online segment to command 63.4% share in the demand and trends analysis of smart home security camera in Japan in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Demand Signal Repository Solutions Market Size and Share Forecast Outlook 2025 to 2035

Demand Side Management Market Size and Share Forecast Outlook 2025 to 2035

Demand Response Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Demand for Industrial Chocolate in EU Size and Share Forecast Outlook 2025 to 2035

Demand for Industrial & Institutional Cleaning Products in EU Size and Share Forecast Outlook 2025 to 2035

Demand for Joint Compound in EU Size and Share Forecast Outlook 2025 to 2035

Demand for Taurine in EU Size and Share Forecast Outlook 2025 to 2035

Demand for Kaolin in India Size and Share Forecast Outlook 2025 to 2035

Demand for DMPA in EU Size and Share Forecast Outlook 2025 to 2035

Demand for 3D Printing Materials in Middle East Size and Share Forecast Outlook 2025 to 2035

Demand for Protein-rich Shelf-stable UHT Oat Drinks in Latin America Size and Share Forecast Outlook 2025 to 2035

Demand for Yeast in EU Size and Share Forecast Outlook 2025 to 2035

Demand for Oat Drink in EU Size and Share Forecast Outlook 2025 to 2035

Demand for Vanillin in EU Size and Share Forecast Outlook 2025 to 2035

Demand for Spirulina Extract in EU Size and Share Forecast Outlook 2025 to 2035

Demand for Pulse Ingredients in EU Size and Share Forecast Outlook 2025 to 2035

Demand for Gypsum in EU Size and Share Forecast Outlook 2025 to 2035

Demand for Barite in EU Size and Share Forecast Outlook 2025 to 2035

Demand for Shrimp in the EU Size and Share Forecast Outlook 2025 to 2035

Demand for Mezcal in EU Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA