The Demand and Trends Analysis of Smart Home Security Camera in Western Europe is estimated to be valued at USD 1.8 billion in 2025 and is projected to reach USD 5.9 billion by 2035, registering a compound annual growth rate (CAGR) of 12.3% over the forecast period.

| Metric | Value |

|---|---|

| Demand and Trends Analysis of Smart Home Security Camera in Western Europe Estimated Value in (2025 E) | USD 1.8 billion |

| Demand and Trends Analysis of Smart Home Security Camera in Western Europe Forecast Value in (2035 F) | USD 5.9 billion |

| Forecast CAGR (2025 to 2035) | 12.3% |

The smart home security camera market in Western Europe is expanding steadily. Demand is being driven by heightened consumer focus on home safety, rising smart home adoption, and the integration of advanced features such as AI-enabled motion detection and cloud-based storage. Current dynamics reflect strong competition among established electronics brands and emerging IoT players, while pricing strategies and product differentiation are shaping market positioning.

The influence of remote monitoring demand, accelerated by lifestyle shifts and digital adoption, has further reinforced growth momentum. Future expansion is expected to be supported by the rollout of high-speed connectivity infrastructure, increased interoperability across smart home ecosystems, and regulatory emphasis on data privacy and product safety.

Growth rationale lies in the ability of manufacturers to deliver user-friendly, secure, and cost-effective solutions that align with consumer expectations Continuous product innovation and expanding distribution networks are expected to underpin long-term adoption and sustain revenue growth across the region.

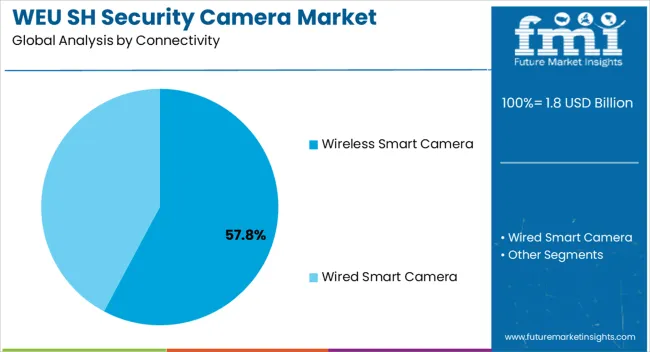

The wireless smart camera segment, accounting for 57.80% of the connectivity category, has emerged as the dominant choice due to its ease of installation, flexible placement, and compatibility with smart home platforms. Adoption has been reinforced by consumer preference for devices that avoid complex wiring and offer seamless integration with mobile applications.

Enhanced Wi-Fi coverage and improved battery performance have further strengthened the reliability and appeal of wireless solutions. The ability to scale installations across various property sizes without significant infrastructure modifications has driven mass-market penetration.

Ongoing advancements in data encryption and secure connectivity protocols are addressing privacy concerns, thereby boosting consumer trust The segment’s growth is expected to remain strong as demand for convenient and adaptable security solutions continues to expand across both urban and suburban households.

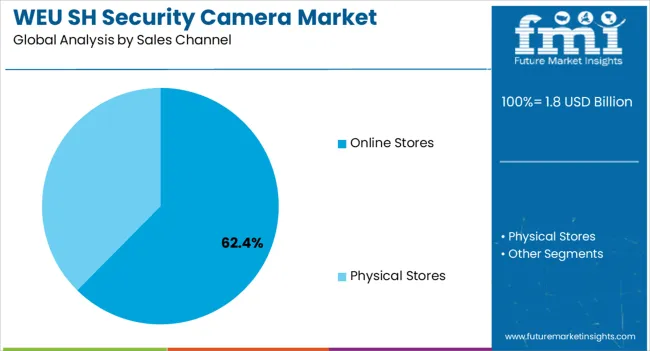

The online stores segment, representing 62.40% of the sales channel category, has maintained leadership owing to the increasing preference for e-commerce platforms that provide wide product availability, transparent pricing, and customer reviews to support purchasing decisions. Convenience of home delivery, bundled offers, and seasonal discounts have reinforced online dominance.

Market adoption has been accelerated by consumer comfort with digital transactions and the ability to compare specifications across multiple brands quickly. Direct-to-consumer strategies employed by manufacturers, combined with partnerships with leading e-commerce platforms, have further boosted sales volumes.

Enhanced logistics and return policies have improved consumer confidence, ensuring sustained reliance on online channels The segment is anticipated to remain dominant as digital penetration deepens and e-commerce platforms expand their presence across Western European markets.

| Segment | Industry Share in 2025 |

|---|---|

| Wired Smart Camera | 72.80% |

| Physical Stores | 71.70% |

Based on connectivity, the wired smart camera segment is likely to dominate by securing a share of 72.80% in 2025. The increased consumer demand for flexibility and reliability is driving the adoption of wired smart cameras for constant network and power. These cameras enhance security with continuous monitoring systems and stable connectivity.

Wired smart cameras are widely accepted in buildings, houses, flats, and bungalows to secure every movement, and footage in low light is fueling the Western European industry. These cameras are cost-effective and easy to set up at home with minimal maintenance compared to other cameras in the region.

Based on sales channels, the physical stores segment is estimated to lead by securing a share of 71.70% in 2025. Consumers prefer to visit physical stores to buy products, check the quality, and receive warranty cards to build trust. They can purchase their products without delay and avoid delivery times. On the other hand, consumers have the option to return products due to dissatisfaction with the rising Western European industry.

| Countries | Forecast CAGR through 2035 |

|---|---|

| United Kingdom | 8.60% |

| Germany | 8.90% |

| France | 7.70% |

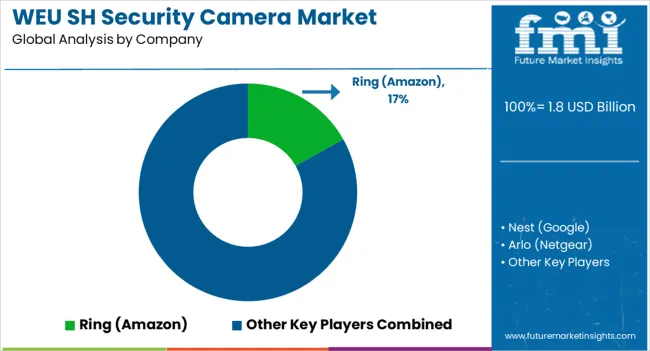

The United Kingdom is estimated to secure a CAGR of 8.60% in the Western European industry during the forecast period. Manufacturers have integrated the Internet of Things, automation, and remote monitoring technologies into smart home security camera to expand the United Kingdom industry. Key players, including Nest, Ring, and Arlo, are significantly increasing the demand for smart home security camera to fuel the country’s revenue.

Germany is estimated to secure a CAGR of 8.90% in Western Europe during the forecast period. Growing safety and security concerns among homeowners are increasing the demand for smart home security camera in Germany. These companies enhance quality, data, and security with innovative designs to fuel the German industry.

France is anticipated to capture a CAGR of 7.70% in Western Europe during the forecast period. Increasing innovative designs and advanced technologies are surging the demand for seamless smart home security camera in France. A few brands, such as Betatmo and Somfy, are popularly offering advanced products to capture revenue in the country.

Leading players in Western Europe are heavily investing in research and development activities to offer standardized and unique products to meet end users' desires. These players offer a variety of improved and flexible products with eco-friendly practices to reduce waste. A few marketing methodologies, including mergers, collaborations, and agreements, are bringing vast industry growth.

Recent Developments in the Smart Home Security Camera in Western Europe

| Attributes | Details |

|---|---|

| Estimated Industry Size in 2025 | USD 1.8 billion |

| Projected Industry Valuation by 2035 | USD 5.9 billion |

| Value-based CAGR 2025 to 2035 | 12.3% |

| Historical Analysis of Smart Home Security Camera in Western Europe | 2020 to 2025 |

| Demand Forecast for Smart Home Security Camera in Western Europe | 2025 to 2035 |

| Report Coverage | Industry Size, Industry Trends, Analysis of key factors influencing Smart Home Security Camera in Western Europe Insights on Global Players and their Industry Strategy in Western Europe, Ecosystem Analysis of Local and Regional Western Europe Providers |

| Key Countries Analyzed While Studying Opportunities in Smart Home Security Camera in Western Europe | United Kingdom, Germany, France, BENELUX, Sweden, Norway, Denmark, Italy, Spain |

| Key Companies Profiled | Nest (Google); Ring (Amazon); Arlo (Netgear); Netatmo; Hikvision; Eufy (Anker); Blink (Amazon); D-Link; Swann; Somfy; TP-Link; Logitech; Hive (Centrica); Xiaomi; Yale (Assa Abloy) |

The global demand and trends analysis of smart home security camera in Western Europe is estimated to be valued at USD 1.8 billion in 2025.

The market size for the demand and trends analysis of smart home security camera in Western Europe is projected to reach USD 5.9 billion by 2035.

The demand and trends analysis of smart home security camera in Western Europe is expected to grow at a 12.3% CAGR between 2025 and 2035.

The key product types in demand and trends analysis of smart home security camera in Western Europe are wireless smart camera and wired smart camera.

In terms of sales channel, online stores segment to command 62.4% share in the demand and trends analysis of smart home security camera in Western Europe in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Demand Signal Repository Solutions Market Size and Share Forecast Outlook 2025 to 2035

Demand Side Management Market Size and Share Forecast Outlook 2025 to 2035

Demand Response Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Demand for Industrial Chocolate in EU Size and Share Forecast Outlook 2025 to 2035

Demand for Industrial & Institutional Cleaning Products in EU Size and Share Forecast Outlook 2025 to 2035

Demand for Joint Compound in EU Size and Share Forecast Outlook 2025 to 2035

Demand for Taurine in EU Size and Share Forecast Outlook 2025 to 2035

Demand for Kaolin in India Size and Share Forecast Outlook 2025 to 2035

Demand for DMPA in EU Size and Share Forecast Outlook 2025 to 2035

Demand for 3D Printing Materials in Middle East Size and Share Forecast Outlook 2025 to 2035

Demand for Protein-rich Shelf-stable UHT Oat Drinks in Latin America Size and Share Forecast Outlook 2025 to 2035

Demand for Yeast in EU Size and Share Forecast Outlook 2025 to 2035

Demand for Oat Drink in EU Size and Share Forecast Outlook 2025 to 2035

Demand for Vanillin in EU Size and Share Forecast Outlook 2025 to 2035

Demand for Spirulina Extract in EU Size and Share Forecast Outlook 2025 to 2035

Demand for Pulse Ingredients in EU Size and Share Forecast Outlook 2025 to 2035

Demand for Gypsum in EU Size and Share Forecast Outlook 2025 to 2035

Demand for Barite in EU Size and Share Forecast Outlook 2025 to 2035

Demand for Shrimp in the EU Size and Share Forecast Outlook 2025 to 2035

Demand for Mezcal in EU Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA