The global smart pump market is projected to grow steadily, fueled by rising demand for energy-efficient, automated, and digitally connected pumping solutions. Smart pumps, which integrate advanced sensors, controls, and IoT capabilities, enable real-time monitoring, predictive maintenance, and improved performance efficiency. They are increasingly used in sectors such as water and wastewater management, oil and gas, chemical processing, and HVAC systems.

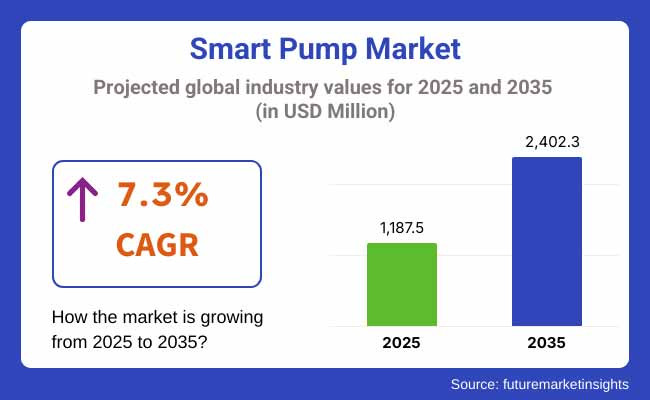

The shift toward more sustainable, efficient infrastructure and the growing adoption of digital technologies in industrial processes are driving demand. As businesses and municipalities strive to reduce operational costs, minimize downtime, and achieve greater system reliability, the market for smart pumps is expected to expand consistently through 2035. In 2025, the global smart pump market is estimated at approximately USD 1,187.5 Million. By 2035, it is projected to grow to around USD 2,402.3 Million, reflecting a compound annual growth rate (CAGR) of 7.3%.

North America continues to be a significant market for smart pumps, driven by substantial infrastructure investments, stringent energy efficiency regulations, and widespread adoption of advanced automation technologies. Authorities in Canada, as well as the United States, have shape up great belletristic for smart pumps for an array of applications include water treatment precincts, HVAC systems, and oil and gas entrances. In addition, the market growth is supported by region's emphasis on digital transformation and sustainability.

Europe is another big market, with high energy-saving awareness, strict environment rules and hard industrial base. Smart pumps are widely adopted across regions according to the industries' dominant players, with Germany, the United Kingdom, and France leading the way across Europe. The region’s focus on smart city initiatives and green infrastructure development is further driving market expansion as well.

Smart pumps market is rapidly growing in Asia-Pacific, because of rapid urbanization, industrialization, and development of infrastructures. Usage of energy and energy efficient pumps is increasing in different manufacturing and processing industries, thus creating opportunity for this market.

Challenges

High Initial Costs, Integration Complexity, and Cybersecurity Risks

However, the smart pump market also present a number of challenges, especially because of the high initial investment needed for the implementation of advanced sensor technology, IoT connectivity, and AI-driven automation. Smart pumps provide smart flows, reduce energy consumption, and increase on-site diagnostics, but the cost in comparison to traditional pumps hinders adoption, particularly within cost-sensitive industries.

Integration complexity is another hurdle as industries like oil & gas, water treatment, and pharmaceuticals require seamless interoperability with existing SCADA (Supervisory Control and Data Acquisition) systems and used their own industrial IoT (IIoT) platforms, making implementation cumbersome and time-consuming.

Also, there are cybersecurity risks as well, as IoT-connected smart pumps are susceptible to being hacked, and there are also possibilities of data breaches and disruptions in operations which require strong encryption as well as cybersecurity measures.

Opportunities

Growth in Industrial Automation, AI-Driven Predictive Maintenance, and Sustainable Water Management

In spite of these challenges, the smart pump market is primed for growth which is being fueled by industrial automation expansion, surge in the adoption of artificial intelligence driven predictive maintenance, and sustainable water management initiatives.

Growing demand for a real-time performance monitoring, energy efficiency, and remote diagnostics is one of the factors pushing the adoption of smart pumps in manufacturing, HVAC (heating, ventilation, and air conditioning), and water treatment plants. Moreover, the demand for sustainable water management and smart irrigation systems also opens avenues for smart pumps in agriculture, municipal water supply, and wastewater treatment.

| Market Shift | 2020 to 2024 Trends |

|---|---|

| Regulatory Landscape | Compliance with energy efficiency regulations, industrial automation standards, and IoT security protocols. |

| Consumer Trends | Demand for remote monitoring, energy-efficient pumps, and IoT-enabled fluid management. |

| Industry Adoption | High use in industrial processing, oil & gas, water treatment, and HVAC systems. |

| Supply Chain and Sourcing | Dependence on sensor-based control units, high-efficiency motors, and proprietary software systems. |

| Market Competition | Dominated by traditional pump manufacturers, industrial automation firms, and IoT solution providers. |

| Market Growth Drivers | Growth fueled by industrial automation, energy conservation initiatives, and demand for real-time performance tracking. |

| Sustainability and Environmental Impact | Moderate adoption of low-energy consumption motors and water conservation technologies. |

| Integration of Smart Technologies | Early adoption of IoT-enabled pump monitoring, cloud-based analytics, and AI-powered maintenance alerts. |

| Advancements in Smart Pump Design | Development of high-efficiency pumps with remote monitoring and automated diagnostics. |

| Market Shift | 2025 to 2035 Projections |

|---|---|

| Regulatory Landscape | Stricter AI-based operational safety laws, smart water conservation policies, and cybersecurity mandates for IIoT devices. |

| Consumer Trends | Growth in AI-driven predictive analytics, blockchain-based pump security, and smart city water infrastructure integration. |

| Industry Adoption | Expansion into smart irrigation, AI-powered chemical dosing, and fully autonomous industrial fluid handling systems. |

| Supply Chain and Sourcing | Shift toward AI-assisted supply chain tracking, blockchain-enabled sourcing verification, and nanotechnology-infused pump coatings. |

| Market Competition | Entry of AI-powered fluid control startups, sustainable energy pump innovators, and cybersecurity-focused smart pump manufacturers. |

| Market Growth Drivers | Accelerated by AI-driven self-optimizing pumps, carbon-neutral fluid handling solutions, and fully integrated IIoT industrial platforms. |

| Sustainability and Environmental Impact | Large-scale shift toward zero-emission smart pumps, self-cleaning filtration systems, and AI-optimized resource allocation. |

| Integration of Smart Technologies | Expansion into autonomous self-learning pumps, real-time vibration and pressure analytics, and smart leak detection systems. |

| Advancements in Smart Pump Design | Evolution toward quantum computing-assisted flow optimization, ultra-low friction pump materials, and next-gen AI-powered predictive maintenance solutions. |

Energy efficient pumps, industrial automation and demand for IoT-enabled monitoring solutions is driving the smart pump market in the USA. Municipal and commercial applications are catching on to the smart water management system, and the need for predictive maintenance and remote control feature is driving revenue growth. Moreover, government initiatives that promote smart infrastructure and water conservation are also further bolstering industry growth.

| Country | CAGR (2025 to 2035) |

|---|---|

| USA | 7.4% |

The smart pump market in the United Kingdom is growing due to increasing investment in smart building technologies, industrial automation, and energy-efficient water systems. Industries with AI-powered and cloud-connected pump systems increase is HVAC, water treatment, and oil & gas. And strict government regulations fostering low energy consumption, sustainability, etc., are establishing market trends.

| Country | CAGR (2025 to 2035) |

|---|---|

| UK | 7.2% |

In the European Union, the smart pump market is experiencing regular growth owing to better emphasis on smart factory prefab, energy optimization, and predictive preservation expectancies. The demand is driven by the increasing adoption of these IoT-enabled pumps in private utilities, water utilities, manufacturing and building automation. Market development is being driven by EU policies that promote renewable energy and smart water management solutions.

| Region | CAGR (2025 to 2035) |

|---|---|

| European Union (EU) | 7.3% |

Advancements in precision engineering, smart industrial automation, and sustainable water management initiatives are propelling the growth of Japan's smart pump market at a moderate rate. Demand is driven by the increasing adoption of digital twin technology in smart pumps and AI-based diagnostics in manufacturing and wastewater treatment. Moreover, government initiatives promoting energy-efficient industrial equipment are shaping market trends.

| Country | CAGR (2025 to 2035) |

|---|---|

| Japan | 7.2% |

This growth is attributed to rapid industrialization, rising implementation of smart manufacturing, and growing need for real-time monitoring in fluid handling systems in South Korea. Increase in usage in semiconductor cooling and chemical industries and the integration of 5G connectivity in IoT based smart pumps would boost the market growth. Further, the growth of industry is also accelerated by government-backed digital transformation initiatives for various industrial automation.

| Country | CAGR (2025 to 2035) |

|---|---|

| South Korea | 7.4% |

The smart pump market is witnessing real-time performance tracking, and variable speed control have all defined a new era for pumps across sectors like water treatment, oil & gas, HVAC, manufacturing, and pharmaceuticals all in the wake of smart technology.

The growing need for smart industrial automation, strict energy efficiency compliance regulations, and the development of sensor-based monitoring technology are calling for high-performing, self-regulating smart pump technologies from manufacturers. By Pump Type: Centrifugal, Positive Displacement by Power: Upto 30, 30-90, 90-180, 180-360, Above 360.

Centrifugal pumps to dominate the market owing to their widespread usage in water supply systems, industrial fluid handling, HVAC systems, and oil & gas operations. Large-volume routine fluid movement can benefit from the real-time flow adjustment, variable speed control, and automated diagnostics that centrifugal smart pumps can provide, making sure their energy consumption is always at its best and they minimize operating costs.

Rising investment toward smart water management solutions, renewable energy-driven pumps, and demand for predictive maintenance solutions are becoming key growth factors that are driving manufacturers toward application of IoT-enabled sensors, cloud based analytics, and AI powered performance tracking system in centrifugal smart pumps.

Positive displacement pump sector is also experiencing high demand primarily in oil & gas, chemical processing, and pharmaceutical industries due to its requirement for precise fluid metering and high-pressure pumping. These pumps are specifically built for critical industrial applications and feature a predictable flow rate, automatic flow control, and better handling on fluid viscosity.

Demand for positive displacement smart pumps will be on the rise in specific, high-precision fluid handling industries, aided by smart pressure monitoring, automatic leak detection and wireless connectivity in industrial fluid systems.

Among these, the 30-90 capacity segment is the largest sub-segment in the Smart Pump Market, as this smart pump range proves to be beneficial in commercial and industrial applications that need flow from moderate flow rates with smart automation features. However, they are more commonly utilized within water supply networks, commercial buildings, and mid-scale industrial processes where their flexibility can deliver on-demand energy savings, real-time digital performance insight, and adaptive pressure control.

Demand for smart pumps in the 30-90 capacity range is expected to surge across the municipal water distribution, mid-sized industrial automation, and energy efficient HVAC applications due to the increasing adoption of smart pumping systems.

This demand is also especially in the 90-180 segment, large-scale plants, oil refineries, and high-performance cooling systems. These pumps offer much higher flow capacity and, with built-in real-time diagnostics and automatic fault detection, allow for maximum operational efficiency in heavy-duty fluid transport applications.

Also, the rising trends towards industrial automation, surging emphasis on reducing energy consumption, and increasing adoption of predictive maintenance in large-scale pumping systems are widening the market expansion of high-capacity smart pumps for critical infrastructure and process-intensive industries.

The smart pump market is expected to witness significant growth as the demand for energy-efficient, Internet of Things (IoT)-enabled, and AI-based fluid management systems rises in water treatment, HVAC, pharmaceuticals, oil and gas, and several other end users.

The growth of the market can be attributed to the growing adoption of predictive maintenance, remote monitoring capabilities, and advanced automation in industrial pumping systems. While companies are embedding AI in pump diagnostics, real-time performance monitoring, and sustainability-driven smart pump innovations to optimize efficiencies, reduce costs, and meet environmental goals.

Market Share Analysis by Key Players & Smart Pump Manufacturers

| Company Name | Estimated Market Share (%) |

|---|---|

| Grundfos Holding A/S | 18-22% |

| Xylem Inc. | 12-16% |

| Flowserve Corporation | 10-14% |

| ITT Inc. | 8-12% |

| Sulzer Ltd. | 5-9% |

| Other Smart Pump Providers (combined) | 30-40% |

| Company Name | Key Offerings/Activities |

|---|---|

| Grundfos Holding A/S | Develops AI-enhanced smart pumps with real-time diagnostics, remote monitoring, and energy-efficient water management systems. |

| Xylem Inc. | Specializes in IoT-enabled smart pumps, AI-driven predictive maintenance, and smart water infrastructure solutions. |

| Flowserve Corporation | Provides AI-powered industrial smart pumps, vibration monitoring, and real-time efficiency optimization. |

| ITT Inc. | Focuses on high-performance smart pumps for HVAC and industrial applications, AI-enhanced process control, and automated flow regulation. |

| Sulzer Ltd. | Offers AI-assisted pump monitoring solutions, cloud-connected predictive analytics, and intelligent fluid handling systems. |

Key Market Insights

Grundfos Holding A/S (18-22%)

Grundfos leads the smart pump market, offering AI-powered diagnostics, sustainable water solutions, and next-generation IoT-connected pumps.

Xylem Inc. (12-16%)

Xylem specializes in smart water infrastructure solutions, ensuring AI-enhanced predictive maintenance and real-time pump performance monitoring.

Flowserve Corporation (10-14%)

Flowserve provides industrial smart pumping systems, optimizing AI-driven vibration detection and cloud-integrated process automation.

ITT Inc. (8-12%)

ITT focuses on smart HVAC and industrial fluid pumps, integrating AI-assisted flow control and energy-efficient automation.

Sulzer Ltd. (5-9%)

Sulzer develops smart pumps with IoT-based monitoring, ensuring AI-powered fault detection and remote control capabilities.

Other Key Players (30-40% Combined)

Several smart pump manufacturers, industrial automation firms, and fluid management solution providers contribute to next-generation pump innovations, AI-powered performance optimization, and sustainability-driven automation. These include:

The overall market size for the smart pump market was USD 1,187.5 Million in 2025.

The smart pump market is expected to reach USD 2,402.3 Million in 2035.

Growth is driven by the increasing adoption of energy-efficient pumping systems, rising demand for IoT-enabled monitoring and automation, and expanding applications in water management, HVAC, and industrial processes.

The top 5 countries driving the development of the smart pump market are the USA, China, Germany, Japan, and India.

Centrifugal Pumps and 30-90 Capacity Segment are expected to command a significant share over the assessment period.

Table 1: Global Market Value (US$ Million) Forecast by Region, 2018 to 2033

Table 2: Global Market Volume (Units) Forecast by Region, 2018 to 2033

Table 3: Global Market Value (US$ Million) Forecast by Pump Type, 2018 to 2033

Table 4: Global Market Volume (Units) Forecast by Pump Type, 2018 to 2033

Table 5: Global Market Value (US$ Million) Forecast by Capacity, 2018 to 2033

Table 6: Global Market Volume (Units) Forecast by Capacity, 2018 to 2033

Table 7: Global Market Value (US$ Million) Forecast by End-User, 2018 to 2033

Table 8: Global Market Volume (Units) Forecast by End-User, 2018 to 2033

Table 9: North America Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 10: North America Market Volume (Units) Forecast by Country, 2018 to 2033

Table 11: North America Market Value (US$ Million) Forecast by Pump Type, 2018 to 2033

Table 12: North America Market Volume (Units) Forecast by Pump Type, 2018 to 2033

Table 13: North America Market Value (US$ Million) Forecast by Capacity, 2018 to 2033

Table 14: North America Market Volume (Units) Forecast by Capacity, 2018 to 2033

Table 15: North America Market Value (US$ Million) Forecast by End-User, 2018 to 2033

Table 16: North America Market Volume (Units) Forecast by End-User, 2018 to 2033

Table 17: Latin America Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 18: Latin America Market Volume (Units) Forecast by Country, 2018 to 2033

Table 19: Latin America Market Value (US$ Million) Forecast by Pump Type, 2018 to 2033

Table 20: Latin America Market Volume (Units) Forecast by Pump Type, 2018 to 2033

Table 21: Latin America Market Value (US$ Million) Forecast by Capacity, 2018 to 2033

Table 22: Latin America Market Volume (Units) Forecast by Capacity, 2018 to 2033

Table 23: Latin America Market Value (US$ Million) Forecast by End-User, 2018 to 2033

Table 24: Latin America Market Volume (Units) Forecast by End-User, 2018 to 2033

Table 25: Western Europe Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 26: Western Europe Market Volume (Units) Forecast by Country, 2018 to 2033

Table 27: Western Europe Market Value (US$ Million) Forecast by Pump Type, 2018 to 2033

Table 28: Western Europe Market Volume (Units) Forecast by Pump Type, 2018 to 2033

Table 29: Western Europe Market Value (US$ Million) Forecast by Capacity, 2018 to 2033

Table 30: Western Europe Market Volume (Units) Forecast by Capacity, 2018 to 2033

Table 31: Western Europe Market Value (US$ Million) Forecast by End-User, 2018 to 2033

Table 32: Western Europe Market Volume (Units) Forecast by End-User, 2018 to 2033

Table 33: Eastern Europe Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 34: Eastern Europe Market Volume (Units) Forecast by Country, 2018 to 2033

Table 35: Eastern Europe Market Value (US$ Million) Forecast by Pump Type, 2018 to 2033

Table 36: Eastern Europe Market Volume (Units) Forecast by Pump Type, 2018 to 2033

Table 37: Eastern Europe Market Value (US$ Million) Forecast by Capacity, 2018 to 2033

Table 38: Eastern Europe Market Volume (Units) Forecast by Capacity, 2018 to 2033

Table 39: Eastern Europe Market Value (US$ Million) Forecast by End-User, 2018 to 2033

Table 40: Eastern Europe Market Volume (Units) Forecast by End-User, 2018 to 2033

Table 41: South Asia and Pacific Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 42: South Asia and Pacific Market Volume (Units) Forecast by Country, 2018 to 2033

Table 43: South Asia and Pacific Market Value (US$ Million) Forecast by Pump Type, 2018 to 2033

Table 44: South Asia and Pacific Market Volume (Units) Forecast by Pump Type, 2018 to 2033

Table 45: South Asia and Pacific Market Value (US$ Million) Forecast by Capacity, 2018 to 2033

Table 46: South Asia and Pacific Market Volume (Units) Forecast by Capacity, 2018 to 2033

Table 47: South Asia and Pacific Market Value (US$ Million) Forecast by End-User, 2018 to 2033

Table 48: South Asia and Pacific Market Volume (Units) Forecast by End-User, 2018 to 2033

Table 49: East Asia Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 50: East Asia Market Volume (Units) Forecast by Country, 2018 to 2033

Table 51: East Asia Market Value (US$ Million) Forecast by Pump Type, 2018 to 2033

Table 52: East Asia Market Volume (Units) Forecast by Pump Type, 2018 to 2033

Table 53: East Asia Market Value (US$ Million) Forecast by Capacity, 2018 to 2033

Table 54: East Asia Market Volume (Units) Forecast by Capacity, 2018 to 2033

Table 55: East Asia Market Value (US$ Million) Forecast by End-User, 2018 to 2033

Table 56: East Asia Market Volume (Units) Forecast by End-User, 2018 to 2033

Table 57: Middle East and Africa Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 58: Middle East and Africa Market Volume (Units) Forecast by Country, 2018 to 2033

Table 59: Middle East and Africa Market Value (US$ Million) Forecast by Pump Type, 2018 to 2033

Table 60: Middle East and Africa Market Volume (Units) Forecast by Pump Type, 2018 to 2033

Table 61: Middle East and Africa Market Value (US$ Million) Forecast by Capacity, 2018 to 2033

Table 62: Middle East and Africa Market Volume (Units) Forecast by Capacity, 2018 to 2033

Table 63: Middle East and Africa Market Value (US$ Million) Forecast by End-User, 2018 to 2033

Table 64: Middle East and Africa Market Volume (Units) Forecast by End-User, 2018 to 2033

Figure 1: Global Market Value (US$ Million) by Pump Type, 2023 to 2033

Figure 2: Global Market Value (US$ Million) by Capacity, 2023 to 2033

Figure 3: Global Market Value (US$ Million) by End-User, 2023 to 2033

Figure 4: Global Market Value (US$ Million) by Region, 2023 to 2033

Figure 5: Global Market Value (US$ Million) Analysis by Region, 2018 to 2033

Figure 6: Global Market Volume (Units) Analysis by Region, 2018 to 2033

Figure 7: Global Market Value Share (%) and BPS Analysis by Region, 2023 to 2033

Figure 8: Global Market Y-o-Y Growth (%) Projections by Region, 2023 to 2033

Figure 9: Global Market Value (US$ Million) Analysis by Pump Type, 2018 to 2033

Figure 10: Global Market Volume (Units) Analysis by Pump Type, 2018 to 2033

Figure 11: Global Market Value Share (%) and BPS Analysis by Pump Type, 2023 to 2033

Figure 12: Global Market Y-o-Y Growth (%) Projections by Pump Type, 2023 to 2033

Figure 13: Global Market Value (US$ Million) Analysis by Capacity, 2018 to 2033

Figure 14: Global Market Volume (Units) Analysis by Capacity, 2018 to 2033

Figure 15: Global Market Value Share (%) and BPS Analysis by Capacity, 2023 to 2033

Figure 16: Global Market Y-o-Y Growth (%) Projections by Capacity, 2023 to 2033

Figure 17: Global Market Value (US$ Million) Analysis by End-User, 2018 to 2033

Figure 18: Global Market Volume (Units) Analysis by End-User, 2018 to 2033

Figure 19: Global Market Value Share (%) and BPS Analysis by End-User, 2023 to 2033

Figure 20: Global Market Y-o-Y Growth (%) Projections by End-User, 2023 to 2033

Figure 21: Global Market Attractiveness by Pump Type, 2023 to 2033

Figure 22: Global Market Attractiveness by Capacity, 2023 to 2033

Figure 23: Global Market Attractiveness by End-User, 2023 to 2033

Figure 24: Global Market Attractiveness by Region, 2023 to 2033

Figure 25: North America Market Value (US$ Million) by Pump Type, 2023 to 2033

Figure 26: North America Market Value (US$ Million) by Capacity, 2023 to 2033

Figure 27: North America Market Value (US$ Million) by End-User, 2023 to 2033

Figure 28: North America Market Value (US$ Million) by Country, 2023 to 2033

Figure 29: North America Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 30: North America Market Volume (Units) Analysis by Country, 2018 to 2033

Figure 31: North America Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 32: North America Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 33: North America Market Value (US$ Million) Analysis by Pump Type, 2018 to 2033

Figure 34: North America Market Volume (Units) Analysis by Pump Type, 2018 to 2033

Figure 35: North America Market Value Share (%) and BPS Analysis by Pump Type, 2023 to 2033

Figure 36: North America Market Y-o-Y Growth (%) Projections by Pump Type, 2023 to 2033

Figure 37: North America Market Value (US$ Million) Analysis by Capacity, 2018 to 2033

Figure 38: North America Market Volume (Units) Analysis by Capacity, 2018 to 2033

Figure 39: North America Market Value Share (%) and BPS Analysis by Capacity, 2023 to 2033

Figure 40: North America Market Y-o-Y Growth (%) Projections by Capacity, 2023 to 2033

Figure 41: North America Market Value (US$ Million) Analysis by End-User, 2018 to 2033

Figure 42: North America Market Volume (Units) Analysis by End-User, 2018 to 2033

Figure 43: North America Market Value Share (%) and BPS Analysis by End-User, 2023 to 2033

Figure 44: North America Market Y-o-Y Growth (%) Projections by End-User, 2023 to 2033

Figure 45: North America Market Attractiveness by Pump Type, 2023 to 2033

Figure 46: North America Market Attractiveness by Capacity, 2023 to 2033

Figure 47: North America Market Attractiveness by End-User, 2023 to 2033

Figure 48: North America Market Attractiveness by Country, 2023 to 2033

Figure 49: Latin America Market Value (US$ Million) by Pump Type, 2023 to 2033

Figure 50: Latin America Market Value (US$ Million) by Capacity, 2023 to 2033

Figure 51: Latin America Market Value (US$ Million) by End-User, 2023 to 2033

Figure 52: Latin America Market Value (US$ Million) by Country, 2023 to 2033

Figure 53: Latin America Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 54: Latin America Market Volume (Units) Analysis by Country, 2018 to 2033

Figure 55: Latin America Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 56: Latin America Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 57: Latin America Market Value (US$ Million) Analysis by Pump Type, 2018 to 2033

Figure 58: Latin America Market Volume (Units) Analysis by Pump Type, 2018 to 2033

Figure 59: Latin America Market Value Share (%) and BPS Analysis by Pump Type, 2023 to 2033

Figure 60: Latin America Market Y-o-Y Growth (%) Projections by Pump Type, 2023 to 2033

Figure 61: Latin America Market Value (US$ Million) Analysis by Capacity, 2018 to 2033

Figure 62: Latin America Market Volume (Units) Analysis by Capacity, 2018 to 2033

Figure 63: Latin America Market Value Share (%) and BPS Analysis by Capacity, 2023 to 2033

Figure 64: Latin America Market Y-o-Y Growth (%) Projections by Capacity, 2023 to 2033

Figure 65: Latin America Market Value (US$ Million) Analysis by End-User, 2018 to 2033

Figure 66: Latin America Market Volume (Units) Analysis by End-User, 2018 to 2033

Figure 67: Latin America Market Value Share (%) and BPS Analysis by End-User, 2023 to 2033

Figure 68: Latin America Market Y-o-Y Growth (%) Projections by End-User, 2023 to 2033

Figure 69: Latin America Market Attractiveness by Pump Type, 2023 to 2033

Figure 70: Latin America Market Attractiveness by Capacity, 2023 to 2033

Figure 71: Latin America Market Attractiveness by End-User, 2023 to 2033

Figure 72: Latin America Market Attractiveness by Country, 2023 to 2033

Figure 73: Western Europe Market Value (US$ Million) by Pump Type, 2023 to 2033

Figure 74: Western Europe Market Value (US$ Million) by Capacity, 2023 to 2033

Figure 75: Western Europe Market Value (US$ Million) by End-User, 2023 to 2033

Figure 76: Western Europe Market Value (US$ Million) by Country, 2023 to 2033

Figure 77: Western Europe Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 78: Western Europe Market Volume (Units) Analysis by Country, 2018 to 2033

Figure 79: Western Europe Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 80: Western Europe Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 81: Western Europe Market Value (US$ Million) Analysis by Pump Type, 2018 to 2033

Figure 82: Western Europe Market Volume (Units) Analysis by Pump Type, 2018 to 2033

Figure 83: Western Europe Market Value Share (%) and BPS Analysis by Pump Type, 2023 to 2033

Figure 84: Western Europe Market Y-o-Y Growth (%) Projections by Pump Type, 2023 to 2033

Figure 85: Western Europe Market Value (US$ Million) Analysis by Capacity, 2018 to 2033

Figure 86: Western Europe Market Volume (Units) Analysis by Capacity, 2018 to 2033

Figure 87: Western Europe Market Value Share (%) and BPS Analysis by Capacity, 2023 to 2033

Figure 88: Western Europe Market Y-o-Y Growth (%) Projections by Capacity, 2023 to 2033

Figure 89: Western Europe Market Value (US$ Million) Analysis by End-User, 2018 to 2033

Figure 90: Western Europe Market Volume (Units) Analysis by End-User, 2018 to 2033

Figure 91: Western Europe Market Value Share (%) and BPS Analysis by End-User, 2023 to 2033

Figure 92: Western Europe Market Y-o-Y Growth (%) Projections by End-User, 2023 to 2033

Figure 93: Western Europe Market Attractiveness by Pump Type, 2023 to 2033

Figure 94: Western Europe Market Attractiveness by Capacity, 2023 to 2033

Figure 95: Western Europe Market Attractiveness by End-User, 2023 to 2033

Figure 96: Western Europe Market Attractiveness by Country, 2023 to 2033

Figure 97: Eastern Europe Market Value (US$ Million) by Pump Type, 2023 to 2033

Figure 98: Eastern Europe Market Value (US$ Million) by Capacity, 2023 to 2033

Figure 99: Eastern Europe Market Value (US$ Million) by End-User, 2023 to 2033

Figure 100: Eastern Europe Market Value (US$ Million) by Country, 2023 to 2033

Figure 101: Eastern Europe Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 102: Eastern Europe Market Volume (Units) Analysis by Country, 2018 to 2033

Figure 103: Eastern Europe Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 104: Eastern Europe Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 105: Eastern Europe Market Value (US$ Million) Analysis by Pump Type, 2018 to 2033

Figure 106: Eastern Europe Market Volume (Units) Analysis by Pump Type, 2018 to 2033

Figure 107: Eastern Europe Market Value Share (%) and BPS Analysis by Pump Type, 2023 to 2033

Figure 108: Eastern Europe Market Y-o-Y Growth (%) Projections by Pump Type, 2023 to 2033

Figure 109: Eastern Europe Market Value (US$ Million) Analysis by Capacity, 2018 to 2033

Figure 110: Eastern Europe Market Volume (Units) Analysis by Capacity, 2018 to 2033

Figure 111: Eastern Europe Market Value Share (%) and BPS Analysis by Capacity, 2023 to 2033

Figure 112: Eastern Europe Market Y-o-Y Growth (%) Projections by Capacity, 2023 to 2033

Figure 113: Eastern Europe Market Value (US$ Million) Analysis by End-User, 2018 to 2033

Figure 114: Eastern Europe Market Volume (Units) Analysis by End-User, 2018 to 2033

Figure 115: Eastern Europe Market Value Share (%) and BPS Analysis by End-User, 2023 to 2033

Figure 116: Eastern Europe Market Y-o-Y Growth (%) Projections by End-User, 2023 to 2033

Figure 117: Eastern Europe Market Attractiveness by Pump Type, 2023 to 2033

Figure 118: Eastern Europe Market Attractiveness by Capacity, 2023 to 2033

Figure 119: Eastern Europe Market Attractiveness by End-User, 2023 to 2033

Figure 120: Eastern Europe Market Attractiveness by Country, 2023 to 2033

Figure 121: South Asia and Pacific Market Value (US$ Million) by Pump Type, 2023 to 2033

Figure 122: South Asia and Pacific Market Value (US$ Million) by Capacity, 2023 to 2033

Figure 123: South Asia and Pacific Market Value (US$ Million) by End-User, 2023 to 2033

Figure 124: South Asia and Pacific Market Value (US$ Million) by Country, 2023 to 2033

Figure 125: South Asia and Pacific Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 126: South Asia and Pacific Market Volume (Units) Analysis by Country, 2018 to 2033

Figure 127: South Asia and Pacific Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 128: South Asia and Pacific Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 129: South Asia and Pacific Market Value (US$ Million) Analysis by Pump Type, 2018 to 2033

Figure 130: South Asia and Pacific Market Volume (Units) Analysis by Pump Type, 2018 to 2033

Figure 131: South Asia and Pacific Market Value Share (%) and BPS Analysis by Pump Type, 2023 to 2033

Figure 132: South Asia and Pacific Market Y-o-Y Growth (%) Projections by Pump Type, 2023 to 2033

Figure 133: South Asia and Pacific Market Value (US$ Million) Analysis by Capacity, 2018 to 2033

Figure 134: South Asia and Pacific Market Volume (Units) Analysis by Capacity, 2018 to 2033

Figure 135: South Asia and Pacific Market Value Share (%) and BPS Analysis by Capacity, 2023 to 2033

Figure 136: South Asia and Pacific Market Y-o-Y Growth (%) Projections by Capacity, 2023 to 2033

Figure 137: South Asia and Pacific Market Value (US$ Million) Analysis by End-User, 2018 to 2033

Figure 138: South Asia and Pacific Market Volume (Units) Analysis by End-User, 2018 to 2033

Figure 139: South Asia and Pacific Market Value Share (%) and BPS Analysis by End-User, 2023 to 2033

Figure 140: South Asia and Pacific Market Y-o-Y Growth (%) Projections by End-User, 2023 to 2033

Figure 141: South Asia and Pacific Market Attractiveness by Pump Type, 2023 to 2033

Figure 142: South Asia and Pacific Market Attractiveness by Capacity, 2023 to 2033

Figure 143: South Asia and Pacific Market Attractiveness by End-User, 2023 to 2033

Figure 144: South Asia and Pacific Market Attractiveness by Country, 2023 to 2033

Figure 145: East Asia Market Value (US$ Million) by Pump Type, 2023 to 2033

Figure 146: East Asia Market Value (US$ Million) by Capacity, 2023 to 2033

Figure 147: East Asia Market Value (US$ Million) by End-User, 2023 to 2033

Figure 148: East Asia Market Value (US$ Million) by Country, 2023 to 2033

Figure 149: East Asia Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 150: East Asia Market Volume (Units) Analysis by Country, 2018 to 2033

Figure 151: East Asia Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 152: East Asia Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 153: East Asia Market Value (US$ Million) Analysis by Pump Type, 2018 to 2033

Figure 154: East Asia Market Volume (Units) Analysis by Pump Type, 2018 to 2033

Figure 155: East Asia Market Value Share (%) and BPS Analysis by Pump Type, 2023 to 2033

Figure 156: East Asia Market Y-o-Y Growth (%) Projections by Pump Type, 2023 to 2033

Figure 157: East Asia Market Value (US$ Million) Analysis by Capacity, 2018 to 2033

Figure 158: East Asia Market Volume (Units) Analysis by Capacity, 2018 to 2033

Figure 159: East Asia Market Value Share (%) and BPS Analysis by Capacity, 2023 to 2033

Figure 160: East Asia Market Y-o-Y Growth (%) Projections by Capacity, 2023 to 2033

Figure 161: East Asia Market Value (US$ Million) Analysis by End-User, 2018 to 2033

Figure 162: East Asia Market Volume (Units) Analysis by End-User, 2018 to 2033

Figure 163: East Asia Market Value Share (%) and BPS Analysis by End-User, 2023 to 2033

Figure 164: East Asia Market Y-o-Y Growth (%) Projections by End-User, 2023 to 2033

Figure 165: East Asia Market Attractiveness by Pump Type, 2023 to 2033

Figure 166: East Asia Market Attractiveness by Capacity, 2023 to 2033

Figure 167: East Asia Market Attractiveness by End-User, 2023 to 2033

Figure 168: East Asia Market Attractiveness by Country, 2023 to 2033

Figure 169: Middle East and Africa Market Value (US$ Million) by Pump Type, 2023 to 2033

Figure 170: Middle East and Africa Market Value (US$ Million) by Capacity, 2023 to 2033

Figure 171: Middle East and Africa Market Value (US$ Million) by End-User, 2023 to 2033

Figure 172: Middle East and Africa Market Value (US$ Million) by Country, 2023 to 2033

Figure 173: Middle East and Africa Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 174: Middle East and Africa Market Volume (Units) Analysis by Country, 2018 to 2033

Figure 175: Middle East and Africa Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 176: Middle East and Africa Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 177: Middle East and Africa Market Value (US$ Million) Analysis by Pump Type, 2018 to 2033

Figure 178: Middle East and Africa Market Volume (Units) Analysis by Pump Type, 2018 to 2033

Figure 179: Middle East and Africa Market Value Share (%) and BPS Analysis by Pump Type, 2023 to 2033

Figure 180: Middle East and Africa Market Y-o-Y Growth (%) Projections by Pump Type, 2023 to 2033

Figure 181: Middle East and Africa Market Value (US$ Million) Analysis by Capacity, 2018 to 2033

Figure 182: Middle East and Africa Market Volume (Units) Analysis by Capacity, 2018 to 2033

Figure 183: Middle East and Africa Market Value Share (%) and BPS Analysis by Capacity, 2023 to 2033

Figure 184: Middle East and Africa Market Y-o-Y Growth (%) Projections by Capacity, 2023 to 2033

Figure 185: Middle East and Africa Market Value (US$ Million) Analysis by End-User, 2018 to 2033

Figure 186: Middle East and Africa Market Volume (Units) Analysis by End-User, 2018 to 2033

Figure 187: Middle East and Africa Market Value Share (%) and BPS Analysis by End-User, 2023 to 2033

Figure 188: Middle East and Africa Market Y-o-Y Growth (%) Projections by End-User, 2023 to 2033

Figure 189: Middle East and Africa Market Attractiveness by Pump Type, 2023 to 2033

Figure 190: Middle East and Africa Market Attractiveness by Capacity, 2023 to 2033

Figure 191: Middle East and Africa Market Attractiveness by End-User, 2023 to 2033

Figure 192: Middle East and Africa Market Attractiveness by Country, 2023 to 2033

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Smart IoT Pumps Market Analysis - Size, Share, and Forecast Outlook (2025 to 2035)

Smart Wheelchair Market Forecast and Outlook 2025 to 2035

Smart TV Market Forecast and Outlook 2025 to 2035

Smart/AI Toy Market Size and Share Forecast Outlook 2025 to 2035

Smart Locks Market Size and Share Forecast Outlook 2025 to 2035

Smart Sprinkler Controller Market Size and Share Forecast Outlook 2025 to 2035

Smart Indoor Gardening System Market Size and Share Forecast Outlook 2025 to 2035

Smart Building Delivery Robot Market Size and Share Forecast Outlook 2025 to 2035

Smart Watch Market Size and Share Forecast Outlook 2025 to 2035

Smart Label Market Size and Share Forecast Outlook 2025 to 2035

Smart Mat Market Size and Share Forecast Outlook 2025 to 2035

Smart Water Management Market Size and Share Forecast Outlook 2025 to 2035

Smart Built-In Kitchen Appliance Market Size and Share Forecast Outlook 2025 to 2035

Smart Cold Therapy Machine Market Size and Share Forecast Outlook 2025 to 2035

Smart Personal Assistance Devices Market Size and Share Forecast Outlook 2025 to 2035

Smart Speaker Market Size and Share Forecast Outlook 2025 to 2035

Smart Vehicle Architecture Market Size and Share Forecast Outlook 2025 to 2035

Smart City Platforms Market Size and Share Forecast Outlook 2025 to 2035

Smart Doorbell Market Size and Share Forecast Outlook 2025 to 2035

Smart Water Monitoring Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA