The global Glaucoma Treatment Market is estimated to be valued at USD 6,200.0 million in 2025 and is projected to reach USD 8,495.4 million by 2035, registering a compound annual growth rate of 3.2% over the forecast period.

| Metric | Value |

|---|---|

| Market Size (2025E) | USD 6,200.0 million |

| Market Value (2035F) | USD 8,495.4 million |

| CAGR (2025 to 2035) | 3.2% |

The glaucoma treatment market is experiencing robust growth in 2025, propelled by rising disease prevalence, aging populations, and innovation in therapies. Key growth drivers include advancements in minimally invasive surgeries, sustained-release drug delivery systems, and early diagnosis tools. Open-angle glaucoma dominates due to its widespread occurrence and late symptom onset, necessitating long-term management.

Prostaglandin analogs lead the drug class segment owing to superior efficacy in lowering intraocular pressure. Hospital pharmacies remain the primary distribution route due to integrated care and access to specialists. Future growth is expected from AI-based diagnostic tools, long-acting therapeutics, and increased public-private investments in ophthalmology. The market’s trajectory underscores a clear shift toward precision medicine and patient-centric glaucoma care.

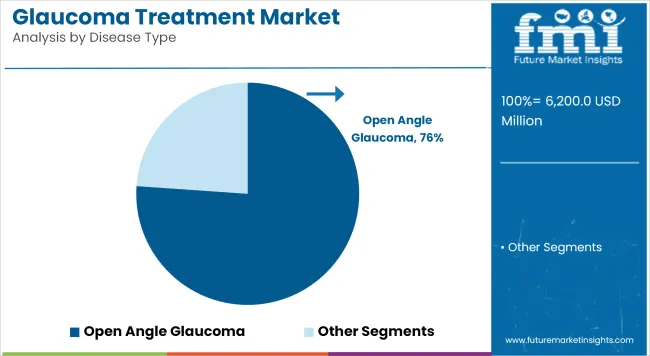

The Open-Angle Glaucoma segment has been identified as the leading contributor to market revenue, holding approximately 76.1% share in 2025. This dominance has been attributed to the high prevalence of this form of glaucoma globally, particularly among aging populations. The disease progresses slowly and often remain asymptomatic until significant optic nerve damage occurs.

Consequently, treatment demand has been driven by the need for early intervention and long-term management. It has been observed that patient adherence to treatment regimens is higher in this segment due to the chronic nature of the disease. Additionally, open-angle glaucoma has been widely studied in clinical settings, leading to more targeted therapeutics and improved diagnostic technologies. Healthcare systems in developed nations have integrated regular screening protocols, which has facilitated early detection and increased treatment uptake.

Prostaglandin Analogs are projected to maintain their leadership position within the drug class segment by contributing 41.8% to the glaucoma treatment market in 2025. Their dominance has been reinforced by their high efficacy in reducing intraocular pressure (IOP), which is a critical clinical objective in glaucoma management. These medications require only once-daily dosing, which significantly enhances patient compliance compared to other drug classes.

The mechanism of action, which facilitates increased aqueous humor outflow, has been clinically validated and preferred by ophthalmologists. Furthermore, the side-effect profile of prostaglandin analogs has been considered relatively manageable, increasing physician confidence in prescribing them as first-line therapy. The segment has also benefited from the availability of both branded and generic formulations, making it accessible across diverse economic settings.

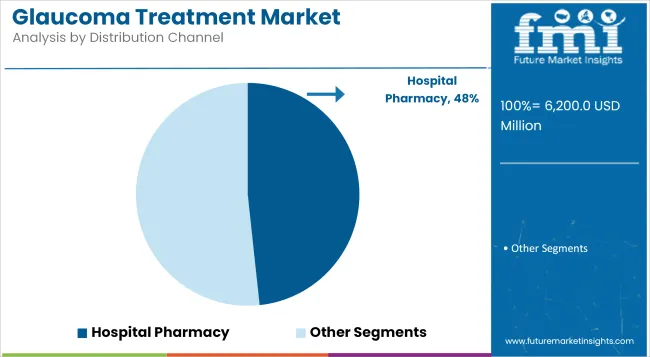

Hospital Pharmacies has emerged as the leading segment, securing 48.3% of the glaucoma treatment market in 2025. This has been primarily driven by the presence of specialized ophthalmologists and access to advanced diagnostic facilities in hospital settings. It has been observed that initial glaucoma diagnoses and the commencement of treatment typically occur in hospitals, especially for patients with co-existing chronic conditions.

The availability of combination therapies, customized dosage adjustments, and emergency care under one roof has encouraged treatment adherence. Hospital pharmacies often maintain a robust inventory of both branded and high-value glaucoma drugs, thereby offering a wider therapeutic choice to physicians. In addition, institutional tie-ups and reimbursements are more streamlined in hospital environments, promoting efficient drug dispensation

Limited Patient Compliance and Adherence to Treatment

Enhancing long-term adherence to prescribed therapies can be one of the most challenging aspects of glaucoma management. And a lot of patients, specifically in the early phases, don’t have chapter symptoms and will not take or they will not abide by their drugs.

Eye drops, the most common treatment option, require consistent application but poor compliance is common due to forgetfulness, difficulty with administering drops, and side effects including eye irritation. The failure to follow this regimen raises the likelihood of disease to develop and vision to diminish, posing a significant challenge for healthcare providers and pharmaceutical companies.

Advancements in Sustained-Release Drug Delivery and Minimally Invasive Treatments

Sustained release drug delivery systems including intracerebral implants and biodegradable drugs eluting inserts are shaping the future of glaucoma management. These new treatments remove reliance on daily eye drops, thus increasing patient compliance and achieving more stable intraocular pressure (IOP) control.

Furthermore, minimally invasive glaucoma surgeries (MIGS) are trending in recent years as their complication rates are lower, recovery is faster, and they are safer than standard operative procedures. With the aging population and the increase in the prevalence of glaucoma, the demand for long-acting treatments is always increasing, making companies investing in such products and next-generation surgical methods to become more successful.

North America commands the global glaucoma treatment industry sera, with high prevalence of glaucoma, strong healthcare infrastructure and rising awareness of early diagnosis and treatment. The growth of the market is driven by new medical research and availability of new treatment options like minimally invasive glaucoma surgeries (MIGS). And the increased geriatric population and increasing government initiatives for eye health awareness are soliciting the market growth.

| Country | CAGR (2025 to 2035) |

|---|---|

| United States | 3.1% |

The UK is showing modest growth in the glaucoma treatment market, which line of action is aided by government health care measures, an aging population, and an ever-growing implementation of proficient diagnostic or header methodologies. The presence of optimal ophthalmology research institutions and better support for innovative treatment methods including laser therapies and sustained drug delivery systems are propelling the market growth.

| Country | CAGR (2025 to 2035) |

|---|---|

| United Kingdom | 2.7% |

The glaucoma treatment market in Europe is growing at a steady pace, propelled by rising healthcare expenditure and strong regulatory policies promoting early glaucoma detection, as well as adoption of advanced eye care technologies. Germany, France and Italy are among the other large contributors along with increased demand for combination therapies and surgeries.

| Country | CAGR (2025 to 2035) |

|---|---|

| European Union | 2.8% |

Japan is a key market for glaucoma treatment (its usage will be increasing in the future) due to the aging population and high chronic eye disease prevalence. A well-developed healthcare infrastructure, thriving pharmaceutical industry, and emphasis on research and development have further aided the integration of novel glaucoma therapies in the nation. Telemedicine and artificial intelligence-assisted diagnosis are also becoming more widely available, and helping improve patients’ outcomes.

| Country | CAGR (2025 to 2035) |

|---|---|

| Japan | 2.9% |

In South Korea, the growing awareness of eye health, increased healthcare investment, and availability of advanced computer-aided diagnostic tools. Some factors that make the country an attractive market for glaucoma treatment. Market growth is supported by government initiatives for improving ocular care. Demand for prescription eye drops and surgical procedures is also increasing.

| Country | CAGR (2025 to 2035) |

|---|---|

| South Korea | 3.0% |

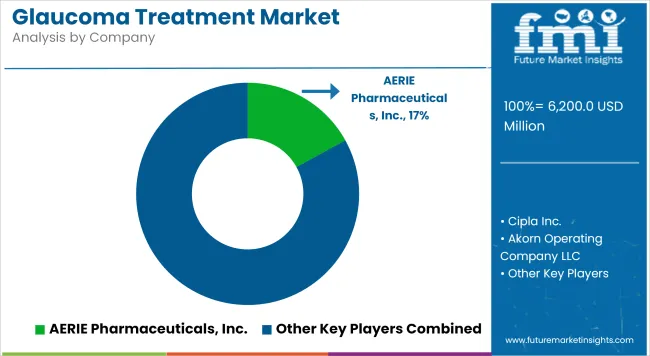

The glaucoma treatment market is witnessing intense competition, primarily driven by a surge in innovation, strategic licensing agreements, and the expansion of global ophthalmology portfolios. Key players are increasingly investing in R&D to develop advanced formulations with longer dosing intervals and improved safety profiles, addressing compliance issues commonly associated with daily regimens.

Biosimilar and fixed-dose combination therapies are being actively explored to enhance treatment efficacy while reducing costs. Partnerships between biotech firms and large pharmaceutical companies are accelerating the commercialization of novel therapeutics, including neuroprotective agents and sustained-release implants. Moreover, a strong focus on regulatory approvals and geographic expansion is shaping the competitive landscape, as companies strive to capture emerging markets with unmet clinical needs.

Key Development

The overall market size for the glaucoma treatment market was USD 6,200.0 million in 2025.

The glaucoma treatment market is expected to reach USD 8,495.4 million in 2035.

The demand for glaucoma treatment is expected to rise due to the increasing prevalence of glaucoma, advancements in treatment options, and rising awareness about early diagnosis.

The top five countries driving the development of the glaucoma treatment market are the USA, Germany, China, Japan, and India.

Open-angle glaucoma are expected to command a significant share over the assessment period.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Treatment-Resistant Hypertension Management Market Size and Share Forecast Outlook 2025 to 2035

Treatment-Resistant Depression Treatment Market Size and Share Forecast Outlook 2025 to 2035

Glaucoma Therapeutics Market Size and Share Forecast Outlook 2025 to 2035

Treatment Pumps Market Insights Growth & Demand Forecast 2025 to 2035

Pretreatment Coatings Market Size and Share Forecast Outlook 2025 to 2035

Air Treatment Ozone Generator Market Size and Share Forecast Outlook 2025 to 2035

CNS Treatment and Therapy Market Insights - Trends & Growth Forecast 2025 to 2035

Seed Treatment Materials Market Size and Share Forecast Outlook 2025 to 2035

Acne Treatment Solutions Market Size and Share Forecast Outlook 2025 to 2035

Scar Treatment Market Overview - Growth & Demand Forecast 2025 to 2035

Soil Treatment Chemicals Market

Water Treatment System Market Size and Share Forecast Outlook 2025 to 2035

Water Treatment Chemical Market Size and Share Forecast Outlook 2025 to 2035

Algae Treatment Chemical Market Forecast and Outlook 2025 to 2035

Water Treatment Market Size and Share Forecast Outlook 2025 to 2035

Water Treatment Ozone Generator Market Size and Share Forecast Outlook 2025 to 2035

Water Treatment Equipment Market Size and Share Forecast Outlook 2025 to 2035

Burns Treatment Market Overview – Growth, Demand & Forecast 2025 to 2035

CRBSI Treatment Market Insights - Growth, Trends & Forecast 2025 to 2035

Water Treatment Polymers Market Growth & Demand 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA