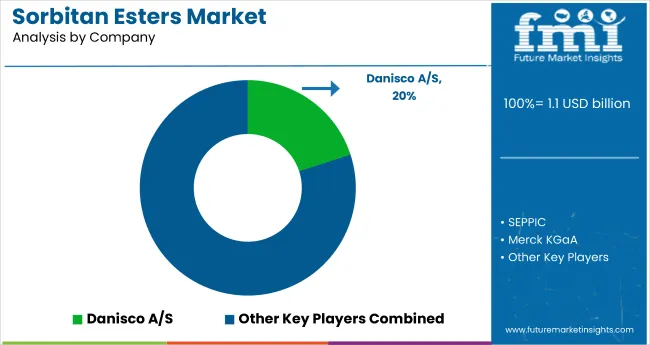

The global sorbitan esters market is projected to grow from USD 1.1 billion in 2025 to USD 1.9 billion by 2035, registering a CAGR of 5.6%. The market expansion is being driven by rising demand for emulsifiers and solubilizers across food, cosmetics, and pharmaceutical industries.

| Metric | Value |

|---|---|

| Industry Size (2025E) | USD 1.1 billion |

| Industry Value (2035F) | USD 1.9 billion |

| CAGR (2025 to 2035) | 5.6% |

The growing preference for plant-based and bio-derived ingredients is fueling interest in sorbitan esters, particularly in clean-label and organic product formulations. Product innovations, expanding application scope, and increased R&D investments by manufacturers are contributing to the widespread adoption of sorbitan esters in diverse industrial and consumer sectors.

The market holds a niche but impactful share across its parent markets. It accounts for 4.8% of the global emulsifiers market and around 6% within the food emulsifiers segment. In the pharmaceutical excipients market, its share is estimated at 3%, while it contributes nearly 2% to the cosmetic ingredients sector.

Within the functional food ingredients market, sorbitan esters hold a modest 1.5% share, reflecting selective applications. Its contribution to the broader specialty chemicals and surfactants markets is relatively minor, estimated at under 0.5%, due to the vastness of those sectors and wider competition.

Government regulations impacting the market focus on food safety, pharmaceutical quality, and cosmetic formulation standards. Agencies such as the USA Food and Drug Administration (FDA), the European Food Safety Authority (EFSA), and regulatory bodies in India and China have approved various sorbitan esters for use in food and personal care products.

These regulations mandate the use of safe, non-toxic, and biodegradable compounds, encouraging the shift toward naturally sourced sorbitan esters. Growing compliance needs are driving the adoption of high-purity food grade and pharmaceutical grade esters across global markets.

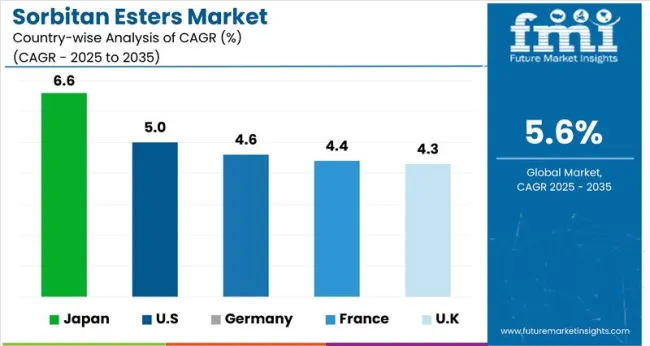

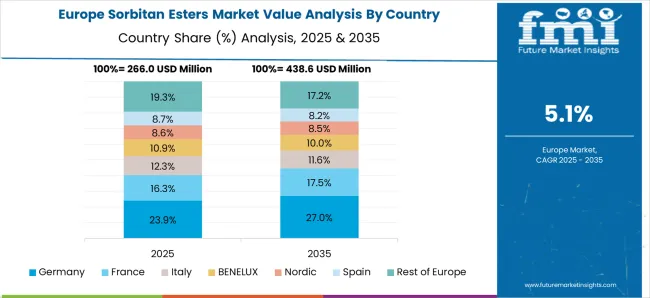

Japan is projected to be the fastest-growing market, expected to expand at a CAGR of 6.6% from 2025 to 2035. Liquid sorbitan esters will lead the form segment with a 47% share, while food grade sorbitan esters will dominate the grade segment with over 50% share. The USA and Germany markets are also expected to grow steadily at CAGRs of 5% and 4.6%, respectively. The UK and France will grow at CAGRs of 4.3% and 4.4%, respectively.

The global market is segmented by product type, application, form, grade, and region. By product type, the market includes sorbitantristearate, sorbitanmonostearate, sorbitan monooleate, sorbitantrioleate, sorbitanmonopalmitate, sorbitanmonolaurate, and sorbitansesquioleate.

In terms of application, the market covers cosmetics and personal care products (facial care, body care, and others), food and beverage processing (confectionery, bakery, oil and fats, non-alcoholic beverages, alcoholic beverages, soups, sauces and gravies), pharmaceuticals, lubricants and waxes, animal nutrition and pet food, industrial, and textiles.

By form, the market is categorized into liquid, solid/powder, and semisolid/paste. By grade, the market includes food grade, industrial grade, and pharmaceutical grade. Regionally, the market is segmented into North America, Latin America, Europe, East Asia, South Asia, Oceania, and the Middle East & Africa.

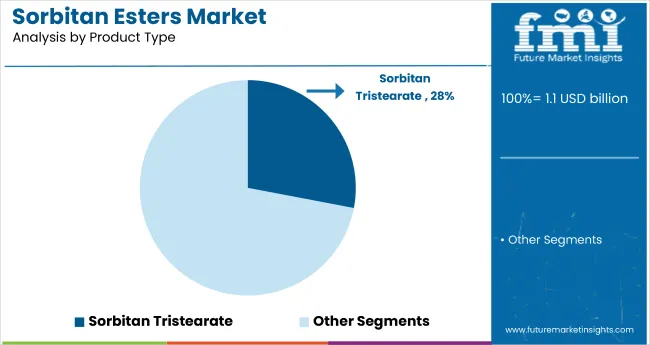

Sorbitan tristearate is projected to dominate the product type segment, accounting for 28% of the global market share by 2025. This ester is extensively used as an emulsifier and stabilizer in chocolate, confectionery, and bakery applications. It plays a key role in improving the texture, consistency, and shelf life of food products by enhancing fat dispersion and reducing stickiness.

In chocolate production, it helps control sugar crystallization and improves gloss and melt resistance. Its excellent compatibility with fats and oils also makes it ideal for use in spreads, coatings, and dessert fillings. Demand is driven by the growth of the processed food sector.

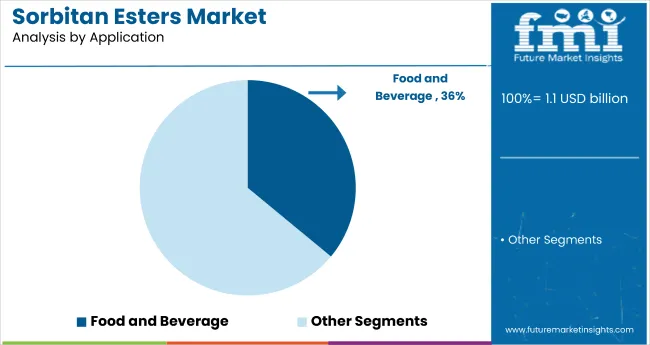

The food and beverage processing is anticipated to account for 36% of the global market share in 2025, emerging as the leading application area for sorbitan esters. These esters are widely used as emulsifiers, stabilizers, and dispersing agents in a range of food products, including bakery goods, confectionery, margarine, dairy products, and non-alcoholic beverages.

Their ability to maintain texture, extend shelf life, and enhance the appearance of processed foods makes them essential in large-scale manufacturing. Growing demand for packaged and ready-to-eat products, along with increasing preference for plant-based ingredients, continues to drive usage across the food sector.

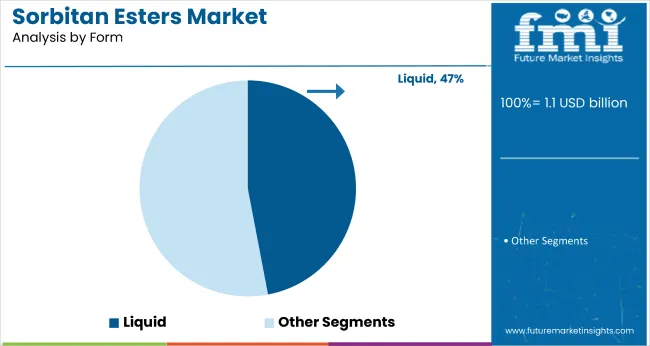

Liquid is projected to dominate the form segment, holding a 47% share of the market by 2025. Its popularity stems from ease of handling, superior solubility, and compatibility with various processing systems. Liquid forms are widely used in food processing, pharmaceuticals, and personal care applications due to their ability to blend uniformly with other ingredients.

They help improve the consistency and stability of emulsions in creams, sauces, and lotions. Manufacturers also prefer liquid esters for their reduced processing time and efficient incorporation into automated production lines. This versatility continues to drive strong demand across multiple industrial sectors.

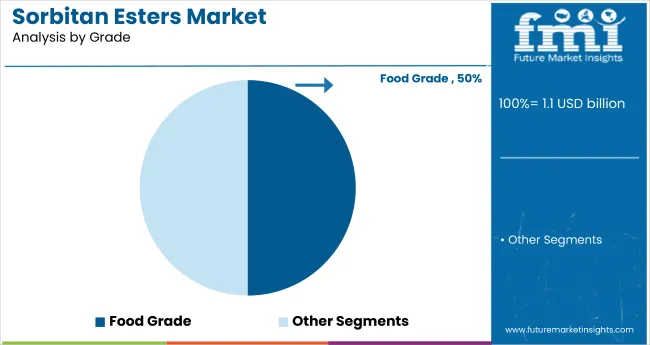

Food grade is expected to hold over 50% of the market share by 2025, making it the most dominant grade segment. These esters are extensively used as emulsifiers and stabilizers in processed foods such as baked goods, confectionery, margarine, spreads, and non-dairy creamers.

Their approval by regulatory bodies like the FDA and EFSA for use in food products enhances their reliability and widespread adoption. Food manufacturers prefer food grade esters for their safety profile, functional performance, and ability to improve product texture and shelf life. Rising demand for convenient and packaged foods continues to fuel segment growth.

The global market is experiencing consistent growth, driven by rising demand for emulsifiers and stabilizers in food, pharmaceuticals, and cosmetics. Sorbitan esters improve product texture, stability, and shelf life, making them essential in modern manufacturing. The growing preference for clean-label and plant-derived ingredients further supports market expansion.

Recent Trends in the Sorbitan Esters Market

Challenges in the Sorbitan Esters Market

Japan’s momentum in the market is anchored in its advanced pharmaceutical and cosmetics sectors, where demand for high-purity emulsifiers and solubilizers continues to rise. Germany and France maintain consistent demand, driven by EU food safety regulations and clean-label ingredient mandates. Developed economies such as the USA (5.0% CAGR), UK (4.3%), and Japan (6.6%) are expected to grow at a steady 0.91 to 1.18 times the global growth rate.

Japan is projected to witness the fastest growth in the market, driven by rising demand in pharmaceuticals, dermatology, and premium personal care products. The USA follows closely, supported by strong innovation in food-grade and pharmaceutical applications.

Germany and France show steady expansion due to widespread usage in bakery, margarine, and clean-label emulsifiers. The UK lags behind the other countries, with slower momentum attributed to cautious investment and post-Brexit regulatory transitions. However, its focus on organic and vegan formulations continues to sustain demand in the cosmetics and food sectors, maintaining a stable presence in the global market.

The report includes in-depth analysis of 40+ countries; five top-performing OECD countries are highlighted below.

The Japan sorbitan esters market is projected to grow at a CAGR of 6.6% from 2025 to 2035, outpacing the global average. Growth is supported by Japan’s focus on high-purity solubilizers for human and veterinary medicine.

Rapid innovation in dermatological applications and clean-label pharmaceuticals has increased the use of polysorbate 20 and polysorbate 80. In the cosmetics sector, demand for gentle, non-irritating emulsifiers continues to rise. Japan’s aging population and premium personal care industry further drive demand for functional and safe emulsification systems.

The Germany sorbitan esters revenue is projected to expand at a CAGR of 4.6% through 2035, slightly below the global average. Food-grade esters dominate due to widespread usage in baked goods, margarine, and confectionery.

Germany’s strict food ingredient labeling laws and sustainable sourcing requirements boost demand for clean-label emulsifiers. Additionally, high R&D intensity in pharmaceutical production supports the uptake of pharmaceutical-grade variants. The market is shifting toward sustainable and plant-based alternatives, in line with broader EU goals.

The French sorbitan esters market is anticipated to grow at a CAGR of 4.4% from 2025 to 2035, mirroring Germany. The market benefits from strong demand in processed foods, cosmetics, and emulsified pharmaceutical formulations. France’s clean ingredient policy encourages the use of sorbitan esters derived from natural fatty acids.

Applications in margarine, sauces, and bakery products are widespread. The cosmetics and luxury personal care sectors also favor multifunctional emulsifiers, further driving demand for sorbitan monooleate and sorbitan tristearate.

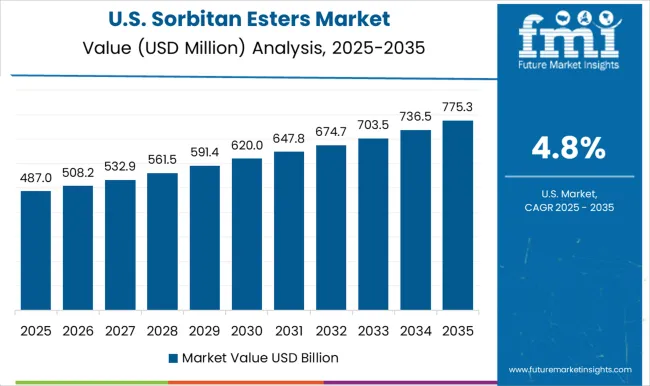

Sales of sorbitan esters in the USA are forecasted to expand at a CAGR of 5% from 2025 to 2035, representing 0.89 times the global average. The USA leads in product innovation, regulatory compliance, and pharmaceutical integration.

FDA approvals for food-grade and pharmaceutical-grade esters strengthen their position in both sectors. Growth is driven by functional food trends, specialty drug formulations, and R&D investment. High demand persists in margarine, frostings, dermal ointments, and parenteral formulations.

The UK sorbitan esters market is expected to grow at a CAGR of 4.3% from 2025 to 2035, reflecting the slowest growth among the top five OECD nations. Demand remains steady across bakery, confectionery, and cosmetic applications.

The UK market is gradually shifting to plant-derived sorbitan esters in response to consumer demand for sustainable and cruelty-free formulations. Regulatory transitions post-Brexit have led to cautious investment in new production facilities, yet adoption continues in the development of organic and clean-label products.

The global market is moderately consolidated, with key players such as LasenorEmul, Merck KGaA, Oleon N.V., Ivanhoe Industries Inc., and Vantage Specialty Chemicals leading the global landscape. These companies focus on high-quality emulsifiers used across food, pharmaceutical, and cosmetic industries.

LasenorEmul is recognized for its food-grade emulsifiers, while Merck KGaA delivers pharmaceutical-grade esters for high-purity applications. Oleon N.V. emphasizes sustainable, plant-based sourcing in its ester product lines. Ivanhoe Industries Inc. and Vantage Specialty Chemicals provide a wide range of tailored solutions for industrial and personal care formulations.

Other notable players include Vantage Leuna GmbH, Union Derivan, Sabo S.p.A., SEPPIC, Ethox Chemicals LLC, Mosselman, Lonza AG, Penta Manufacturing Company, and Danisco A/S, all contributing to product innovation and global supply through extensive R&D, strategic partnerships, and regional expansion.

Recent Sorbitan Esters Industry News

| Report Attributes | Details |

|---|---|

| Market Size (2025) | USD 1.1 billion |

| Projected Market Size (2035) | USD 1.9 billion |

| CAGR (2025 to 2035) | 5.6% |

| Base Year for Estimation | 2024 |

| Historical Period | 2020 to 2024 |

| Projections Period | 2025 to 2035 |

| Report Parameter | USD billion for value/volume in Metric Tons |

| Product Types Analyzed | Sorbitan Tristearate, Sorbitan Monostearate, Sorbitan Monooleate, Sorbitan Trioleate, Sorbitan Monopalmitate, Sorbitan Monolaurate, Sorbitan Sesquioleate |

| Applications Analyzed | Cosmetics and Personal Care (Facial Care, Body Care, Others), Food and Beverage Processing (Confectionery, Bakery, Oil and Fats, Non-alcoholic Beverages, Alcoholic Beverages, Soups, Sauces and Gravies), Pharmaceuticals, Lubricants and Waxes, Animal Nutrition and Pet Food, Industrial, Textiles |

| Form Analyzed | Liquid, Solid/Powder, Semisolid/Paste |

| Grade Analyzed | Food Grade, Industrial Grade, Pharmaceutical Grade |

| Regions Covered | North America, Latin America, Europe, East Asia, South Asia, Oceania, and the Middle East & Africa |

| Countries Covered | United States, United Kingdom, Germany, France, Japan, China, India, Brazil, South Korea, Australia and 40+ countries |

| Key Players Influencing the Market | Lasenor Emul, Merck KGaA, Oleon N.V., Ivanhoe Industries Inc., Vantage Specialty Chemicals, Vantage Leuna GmbH, Union Derivan, Sabo S.p.A., SEPPIC, Ethox Chemicals, LLC, Mosselman, Lonza AG, Penta Manufacturing Company, Danisco A/S. |

| Additional Attributes | Volume and value share by application, grade preference, regional production analysis, raw material sourcing trends, regulatory influence, market entry strategies |

The global sorbitan esters market is estimated to be valued at USD 1.1 billion in 2025.

The market size for the sorbitan esters market is projected to reach USD 1.9 billion by 2035.

The sorbitan esters market is expected to grow at a 5.6% CAGR between 2025 and 2035.

The key product types in sorbitan esters market are sorbitan tristearate, sorbitan monostearate, sorbitan monooleate, sorbitan trioleate, sorbitan monopalmitate, sorbitan monolaurate and sorbitan sesquioleate.

In terms of application, cosmetics and personal care products segment to command 37.9% share in the sorbitan esters market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Sorbitan Oleate Market Size and Share Forecast Outlook 2025 to 2035

Sorbitan Tristearate Market Size and Share Forecast Outlook 2025 to 2035

Sorbitan Laurate Market Growth - Trends & Forecast 2025 to 2035

Sorbitan Monolaurate Market

Polyoxyethylene Sorbitan Monostearate Market Size and Share Forecast Outlook 2025 to 2035

Polyoxyethylene Sorbitan Tristearate Market

Esters Market Trends & Outlook 2025 to 2035

Thioesters Market Growth & Trends 2025 to 2035

Pump Testers Market Size and Share Forecast Outlook 2025 to 2035

Fatty Esters Market Growth - Trends & Forecast 2025 to 2035

Cetyl Esters Market

Evaluating Oleate Esters Market Share & Provider Insights

Torque Testers Market

Tensile Testers Market Size and Share Forecast Outlook 2025 to 2035

Glycerol Esters Market Size and Share Forecast Outlook 2025 to 2035

Glycerol Esters Of Wood Rosins Market

Humidity Testers Market Size and Share Forecast Outlook 2025 to 2035

Cellulose Esters Market Size and Share Forecast Outlook 2025 to 2035

Concrete Testers Market Growth – Trends & Forecast 2025-2035

Phosphate Esters Market

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA