The sorbitan oleate market is estimated to be valued at USD 644.0 million in 2025 and is projected to reach USD 990.6 million by 2035, registering a compound annual growth rate (CAGR) of 4.4% over the forecast period. The sorbitan oleate market is projected to add an absolute dollar opportunity of USD 346.6 million over the forecast period.

| Metric | Value |

|---|---|

| Estimated Value in (2025E) | USD 644.0 million |

| Forecast Value in (2035F) | USD 990.6 million |

| Forecast CAGR (2025 to 2035) | 4.4% |

This reflects a 1.50 times growth at a compound annual growth rate of 4.4%. The market's evolution is expected to be shaped by rising demand for natural emulsifiers in personal care, food processing, and pharmaceutical applications, particularly where stable emulsification and biocompatibility are required.

By 2030, the market is likely to reach approximately USD 754.2 million, accounting for USD 110.2 million in incremental value over the first half of the decade. The remaining USD 236.4 million is expected during the second half, suggesting a moderately back-loaded growth pattern. Product substitution for synthetic emulsifiers is gaining traction due to sorbitan oleate's natural origin and favorable safety profile.

Companies such as BASF and Croda International are advancing their competitive positions through investment in sustainable sourcing and specialized formulation technologies. Clean-label and natural ingredient procurement models are supporting expansion into cosmetics, food processing, and pharmaceutical applications. Market performance will remain anchored in regulatory compliance, emulsification efficiency, and sustainability benchmarks.

The sorbitan oleate market holds approximately 42% of the specialty emulsifiers market, driven by its versatility, natural origin, and compatibility with sensitive formulations. It accounts for around 35% of the food-grade emulsifiers market, supported by its GRAS status and effectiveness in bakery, dairy, and confectionery applications.

The market contributes nearly 28% to the cosmetic emulsifiers market, particularly for creams, lotions, and skincare formulations requiring mild, skin-compatible ingredients. It holds close to 22% of the pharmaceutical excipients market for topical applications, where sorbitan oleate enhances drug delivery and formulation stability. The share in the natural ingredient market reaches about 32%, reflecting its preference among manufacturers seeking plant-derived alternatives to synthetic emulsifiers.

The market is undergoing structural change driven by rising demand for natural and sustainable ingredients across industries. Advanced processing methods using sustainable sourcing and low-impact production have enhanced product purity, safety profiles, and environmental compliance, making sorbitan oleate a viable alternative to synthetic emulsifiers.

Manufacturers are introducing specialized grades and customized formulations tailored for specific applications in food, cosmetics, and pharmaceuticals, expanding their role beyond basic emulsification. Strategic collaborations between ingredient suppliers and end-user industries have accelerated adoption in clean-label and natural product formulations. Direct-to-manufacturer supply chains have improved access and quality control, reshaping traditional distribution models.

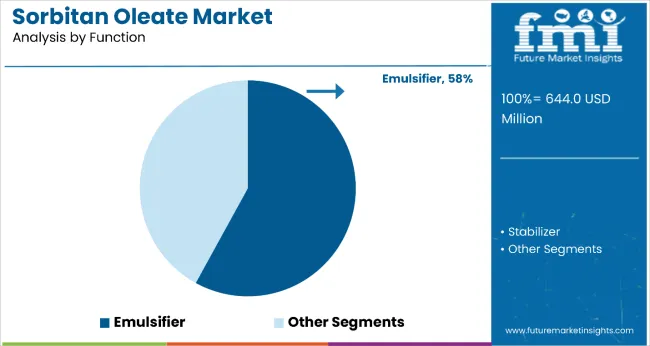

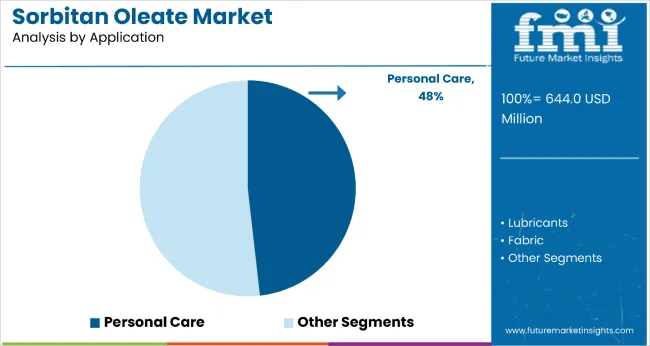

The market is segmented by function, application, distribution channel, and region. By function, the market is bifurcated into emulsifier and stabilizer. Based on application, the market is divided into lubricants, fabric, textile, solvents, surface active agents, leather products, greases, paper products, and personal care.

By distribution channel, the market is segmented into online and offline. Regionally, the market is analyzed across North America, Latin America, Western and Eastern Europe, Asia-Pacific, and Japan.

The emulsifier segment holds a leading 58% share in the function category, reflecting its primary role in creating stable oil-in-water and water-in-oil emulsions across multiple industries. Sorbitan oleate is increasingly preferred as an emulsifier due to its natural origin, mild action, and compatibility with sensitive formulations in cosmetics and food applications.

The segment benefits from rising demand for natural emulsifiers that can replace synthetic alternatives while maintaining product stability and performance. Its effectiveness in low concentrations and ability to work across various pH ranges make it suitable for diverse formulation requirements.

Manufacturers are focusing on developing specialized emulsifier grades with enhanced performance characteristics, including improved temperature stability and reduced dosage requirements. As clean-label trends intensify and regulatory standards favor natural ingredients, the emulsifier segment's role as the primary application for sorbitan oleate is expected to strengthen, supporting a steady growth trajectory.

The personal care segment dominates the application category with a 48% market share, driven by increasing consumer preference for natural and skin-compatible ingredients in daily-use products. Sorbitan oleate-based formulations are gaining popularity for their gentle emulsifying action and compatibility with sensitive skin types.

The segment's growth is supported by the expanding global cosmetics market and rising demand for premium, natural skincare products. Innovation in formulation technology has enabled the development of lightweight, non-greasy textures that appeal to modern consumers seeking effective yet comfortable skincare solutions.

The segment continues to benefit from regulatory support for natural ingredients and increasing investment in sustainable beauty product development. As consumer awareness of ingredient safety grows and demand for multifunctional cosmetic products increases, personal care & cosmetics applications are expected to maintain strong demand within the broader sorbitan oleate market landscape.

Sorbitan oleate's natural origin, excellent emulsification properties, and regulatory approval status make it an attractive alternative to synthetic emulsifiers across multiple industries. Growing consumer awareness of clean-label ingredients and natural formulations is driving adoption, especially in personal care and food applications where ingredient transparency is increasingly valued. Government regulations favoring natural ingredients, along with technological advances in sustainable production, are enhancing product quality and supply chain reliability.

As infrastructure development accelerates in emerging economies and consumer preferences shift toward natural products in mature markets, the market outlook remains favorable. With manufacturers and formulators prioritizing sustainability, safety, and functionality, sorbitan oleate is well-positioned to expand across various emulsification and stabilization applications in food, cosmetics, and pharmaceutical sectors.

In 2024, global sorbitan oleate adoption grew by 12% year-on-year, with North America taking a 49% share. Applications include stable emulsification in cosmetics, texture enhancement in food products, and solubilization in pharmaceutical formulations.

Manufacturers are introducing high-purity grades and specialized formulations that deliver superior stability and compatibility. Clean-label formats now support consumer transparency requirements. OEMs increasingly supply finished formulations with pre-optimized sorbitan oleate concentrations to reduce formulation complexity.

Natural Ingredient Preference Drives Market Adoption

Consumer and regulatory preference for natural ingredients has been identified as the primary catalyst driving growth in the sorbitan oleate market. In 2024, clean-label initiatives in the food and cosmetics industries prompted widespread adoption of plant-derived emulsifiers to replace synthetic alternatives.

By 2025, personal care brands were incorporating sorbitan oleate to meet consumer demands for transparent, natural ingredient lists. These trends demonstrate that natural ingredient preference rather than cost considerations is driving market adoption, with manufacturers of certified natural and organic sorbitan oleate positioned to capture sustained demand growth.

Regulatory Compliance Requirements Create Market Opportunities

In 2024, stringent regulatory requirements for cosmetic and food additives were implemented across multiple regions, requiring extensive safety documentation and compliance protocols. By 2025, manufacturers adopting sorbitan oleate benefited from its established GRAS status and extensive safety database, reducing regulatory approval timelines compared to newer synthetic alternatives.

These developments demonstrate that regulatory compliance capabilities can provide competitive advantages in ingredient selection. Manufacturers offering well-documented, pre-approved sorbitan oleate grades with comprehensive regulatory support are positioned to capture demand from companies seeking to streamline product development and regulatory approval processes.

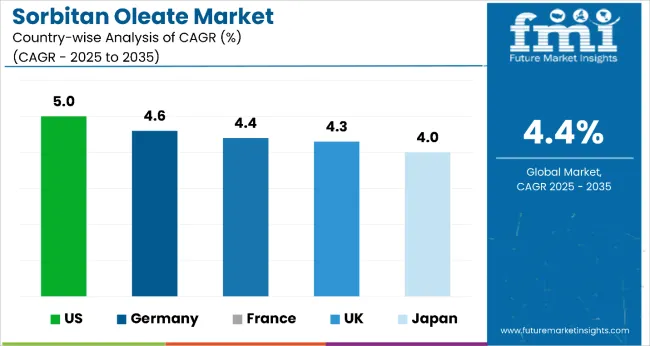

| Country | CAGR |

|---|---|

| USA | 5% |

| Germany | 4.6% |

| France | 4.4% |

| UK | 4.3% |

| Japan | 4% |

The sorbitan oleate market shows varied growth trajectories across key countries from 2025 to 2035. The United States leads with the highest CAGR of 5.0%, driven by strong demand in personal care, food, and pharmaceutical sectors and expanding export opportunities.

Germany follows at 4.6%, supported by pharmaceutical-grade production and EU sustainability mandates. France and the UK exhibit moderate growth rates of 4.4% and 4.3%, respectively, fueled by luxury cosmetics and niche clean-label food applications. Japan registers the slowest growth at 4.0%, reflecting its smaller domestic market but steady demand in high-precision emulsification for cosmetics and pharmaceuticals.

The report covers an in-depth analysis of 40+ countries; five top-performing OECD countries are highlighted below.

The sorbitan oleate market in the USA is projected to grow at a CAGR of 5.0% from 2025 to 2035, aligning closely with rising demand from natural and sustainable ingredient formulations in the personal care, food, and pharmaceutical sectors. Domestic production is being optimized for clean-label cosmetic formulations and FDA-compliant food-grade emulsifiers.

Major manufacturers are investing in high-purity sorbitan oleate production to meet demand from multinational brands focused on ingredient traceability and transparency. Export opportunities are also expanding, particularly to Latin America and Canada, where USA-origin materials are preferred due to regulatory harmonization and reliability.

The demand for sorbitan oleate in Germany is slated to rise at a CAGR of 4.6% from 2025 to 2035, reflecting stable demand from high-value pharmaceutical, cosmetic, and specialty food segments. Stringent EU sustainability mandates and clean-label consumer preferences are pushing manufacturers to adopt certified organic and RSPO-compliant sorbitan oleate grades.

Domestic production remains concentrated in pharmaceutical-grade output, supported by regulatory alignment and technical expertise. Import volumes from Asia continue to supplement demand for specialized applications, particularly in biotech and dermatological products.

The sales of sorbitan oleate in France are anticipated to flourish at a CAGR of 4.4% between 2025 and 2035, driven by its strong luxury cosmetics and fine foods sectors. Major French beauty conglomerates are increasingly sourcing naturally derived emulsifiers to align with eco-certification programs and EU regulations.

In food applications, sorbitan oleate is being integrated into gourmet and shelf-stable items requiring consistent emulsification without compromising clean-label requirements. High-end producers around Paris and Lyon continue to develop customized formulations for domestic and export use.

The revenue from sorbitan oleate in the UK is projected to expand at a CAGR of 4.3% from 2025 to 2035, reflecting steady growth across personal care and health-conscious food categories. Despite market maturity and Brexit-related uncertainties affecting imports, niche segments such as vegan skincare and allergen-free food items continue to show robust adoption of sorbitan oleate.

Local formulation houses in London and Manchester are prioritizing plant-derived emulsifiers to meet the demand for eco-label and organic certifications. Import substitution policies and sustainability goals are slowly encouraging domestic production enhancements.

The sorbitan oleate market in Japan is forecast to grow at a CAGR of 4.0% from 2025 to 2035, driven by high demand for multifunctional emulsifiers in both food and cosmetics. While domestic usage remains limited compared to Western countries, Japan's emphasis on ingredient precision and performance has made sorbitan oleate a preferred emulsifier in premium formulations.

Pharmaceutical and nutraceutical companies are also exploring sorbitan oleate in excipient roles where stability and bioavailability are critical. Imports dominate the supply chain, although a few domestic producers cater to high-spec, small-batch segments.

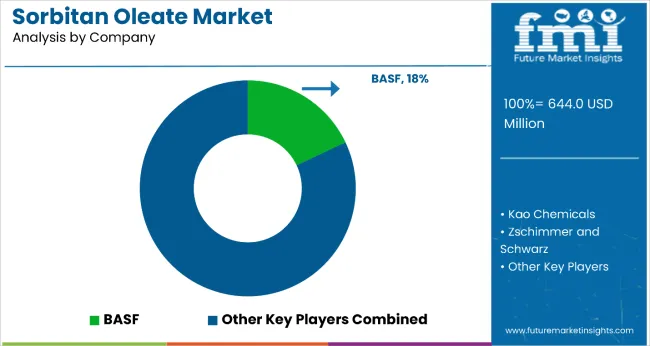

The sorbitan oleate market is moderately fragmented, led by BASF with a 18% market share. The company holds a leading position due to its comprehensive specialty chemicals portfolio, global production capabilities, and strong relationships with key end-user industries, including cosmetics, food, and pharmaceuticals.

Dominant player status is held exclusively by BASF. Key players include Burlington Chemical Company, Kao Chemicals, Jeen International, Kawaken Fine Chemicals, Zschimmer and Schwarz, The Herbarie, Sabo, Protameen Chemicals, Comercial Química Massó, Nikkol, Taiwan Surfactant, Lonza, ErcaWilmar, Vantage Specialty Ingredients, Italmatch Chemicals, Oxiteno, Reachin Chemical, and Anyo Chemical Industries, each offering specialized sorbitan oleate grades for emulsification, stabilization, and functional applications across diverse industries.

Emerging players face barriers due to regulatory requirements and established supplier relationships in key industries. Market demand is influenced by clean-label trends, natural ingredient preferences, and expanding applications in premium cosmetic and pharmaceutical formulations requiring specialized emulsifier properties.

| Item | Value |

|---|---|

| Quantitative Units | USD 644.0 Million |

| Function | Emulsifier and Stabilizer |

| Application | Lubricants, Fabric, Textile, Solvents, Surface Active Agents, Leather Products, Greases, Paper Products, Personal Care |

| Distribution Channel | Offline, Online |

| Regions Covered | North America, Latin America, Asia Pacific, Eastern Europe, Western Europe, Japan |

| Country Covered | United States, Canada, United Kingdom, Germany, France, China, Japan, South Korea, Brazil, Australia, and 40+ countries |

| Key Companies Profiled | Burlington Chemical Company, Kao Chemicals, BASF, Jeen International, Kawaken Fine Chemicals, Zschimmer and Schwarz, The Herbarie, Sabo, Protameen Chemicals, Comercial Química Massó, Nikkol, Taiwan Surfactant, Lonza, ErcaWilmar, Vantage Specialty Ingredients, Italmatch Chemicals, Oxiteno, Reachin Chemical, Anyo Chemical Industries |

| Additional Attributes | Dollar sales by function and application sector, growing usage in natural cosmetics and clean-label food products, stable demand in pharmaceutical excipients, innovations in sustainable sourcing and specialized formulations improve product quality, safety profiles, and environmental compliance. |

The global sorbitan oleate market is estimated to be valued at USD 644.0 million in 2025.

The market size for the sorbitan oleate market is projected to reach USD 990.6 million by 2035.

The sorbitan oleate market is expected to grow at a 4.4% CAGR between 2025 and 2035.

The key product types in sorbitan oleate market are emulsifier and stabilizer.

In terms of application, lubricants segment to command 47.6% share in the sorbitan oleate market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Sorbitan Esters Market Size and Share Forecast Outlook 2025 to 2035

Sorbitan Tristearate Market Size and Share Forecast Outlook 2025 to 2035

Sorbitan Laurate Market Growth - Trends & Forecast 2025 to 2035

Sorbitan Monolaurate Market

Polyoxyethylene Sorbitan Monostearate Market Size and Share Forecast Outlook 2025 to 2035

Polyoxyethylene Sorbitan Tristearate Market

Evaluating Oleate Esters Market Share & Provider Insights

Methyl Oleate Market – Trends & Forecast 2025 to 2035

Polyglycerol Polyricinoleate Market Analysis - Demand, Trends & Forecast 2025 to 2035

Demand for Polyglycerol Polyricinoleate (PGPR) in the EU Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA