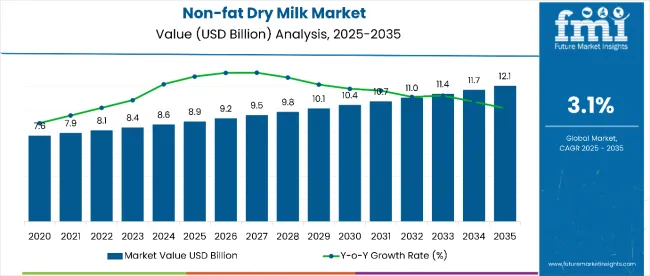

The global non-fat dry milk market is estimated to be valued at USD 8.9 billion in 2025 and is projected to reach USD 12.1 billion by 2035, registering a compound annual growth rate (CAGR) of 3.1% over the forecast period.

| Metric | Value |

|---|---|

| Market Estimated Value in (2025E) | USD 8.9 billion |

| Market Forecast Value in (2035F) | USD 12.1 billion |

| Forecast CAGR (2025 to 2035) | 3.1% |

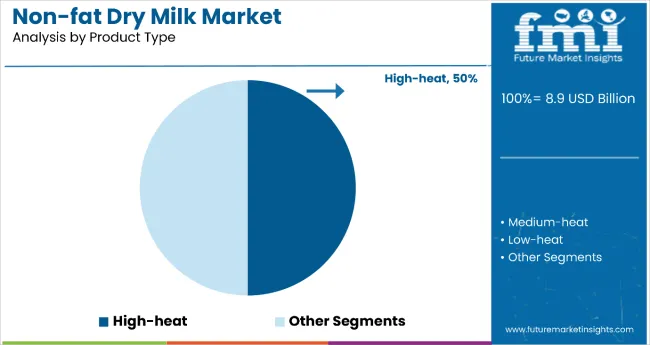

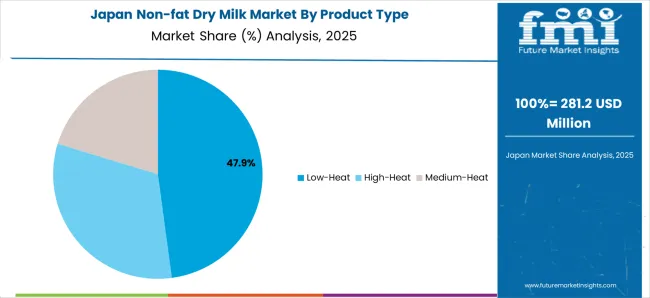

The market is expected to add an absolute dollar opportunity of USD 3.2 billion during this time, reflecting steady growth driven by rising demand for fortified dairy ingredients, extended shelf-life convenience, and expanding applications in bakery, confectionery, and nutritional supplements. The high-heat segment is anticipated to lead with a 50% share, supported by strong demand in baked goods and processed food production.

By 2030, the market is likely to reach approximately USD 10.4 billion, representing USD 1.5 billion in incremental value over the first half of the decade and USD 1.7 billion in the latter half, indicating a moderately balanced growth trajectory. Non-fat dry milk’s appeal is underpinned by its long shelf life, nutrient density, and ease of transportation, offering a cost-effective source of protein, calcium, potassium, and vitamins. Growing health awareness and popularity of nutritional supplements are boosting adoption, while expansion of e-commerce and modern trade channels enhances accessibility. The high-heat segment, favored for industrial food processing, will maintain demand momentum throughout the forecast period due to its versatility.

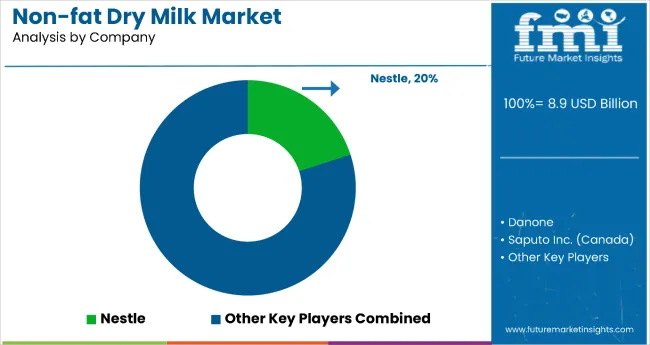

Key players such as Nestlé S.A., holding the largest market share at 20%, are strengthening their positions through innovation in fortified products and research into animal-free dairy proteins. Arla Foods leverages its farmer-owned model to emphasize value and sustainability, while Amul dominates the Indian market via its extensive cooperative network. HOCHDORF Holding and Dairy America reinforce their presence with specialized dairy ingredients and strong export capabilities. Competitive strategies across the market include capacity expansions, e-commerce channel development, and strategic partnerships with functional food manufacturers, ensuring continued market evolution driven by innovation and consumer demand.

The market holds approximately 46% of the global powdered milk market, driven by its extended shelf life, cost efficiency, and wide application across bakery, confectionery, and nutritional supplements. It accounts for around 40% of the fortified dairy ingredients segment, supported by its role in protein-rich formulations and calcium-enriched products. The market contributes nearly 35% to the high-heat dairy ingredient category, particularly for baked goods, processed foods, and high-mix formulations. It holds close to 32% of the global dairy nutritional supplement market, where non-fat dry milk is valued for its protein, potassium, and vitamin content. Its share in the e-commerce dairy products segment reaches about 28%, reflecting growing demand through online channels for shelf-stable, nutrient-rich options.

The market is undergoing structural change driven by rising demand for fortified, functional dairy products and increased adoption in emerging economies. Advancements in spray-drying and heat-treatment technologies have improved product solubility, nutritional retention, and shelf stability. Manufacturers are introducing organic-certified, high-heat, and value-added formulations tailored for sports nutrition, infant formula, and functional food applications, expanding non-fat dry milk’s role beyond traditional home reconstitution and institutional catering.

Non-fat dry milk’s long shelf life, cost-effectiveness, and rich nutrient profile high in protein, calcium, potassium, and vitamins make it highly attractive to health-conscious consumers and food manufacturers seeking versatile dairy ingredients. Its ability to be fortified with additional nutrients and flavors supports demand in bakery, confectionery, nutritional supplements, and functional beverages.

Rising health awareness, growing urbanization, and increasing preference for shelf-stable, easy-to-transport dairy products are further propelling adoption. With expanding applications in sports nutrition, infant formula, and fortified food products, and with advances in spray-drying technology improving quality and solubility, non-fat dry milk is well-positioned to capture sustained global demand.

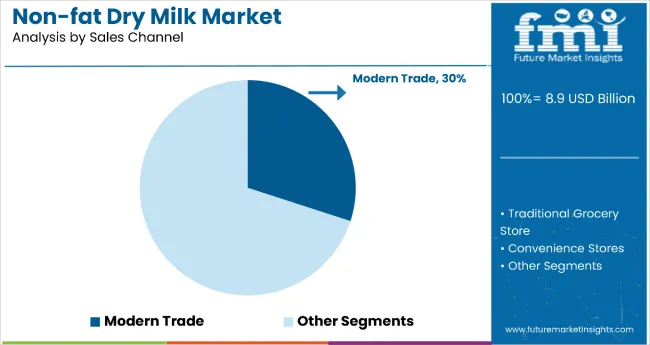

The market is segmented by product type, sales channel, application, and region. By product type, the market is classified into high-heat, medium-heat, and low-heat. Based on sales channel, the market is divided into modern trade, traditional grocery store, convenience stores, online channels, direct sales. In terms of application, the market is segmented into home reconstitutions, dairy whiteners, bakery and confectionery, desserts, ice-cream, dairy blends, snacks, nutritional supplements. Regionally, the market is categorized into North America, Latin America, Western Europe, Eastern Europe, South Asia and Pacific, East Asia, and the Middle East & Africa.

High-heat non-fat dry milk is the most lucrative segment, commanding 50% market share in 2025 due to its tailored functionality for industrial baking and processed foods. High-heat powders deliver improved heat stability, promote browning and loaf volume in breads, and contribute desirable structure and mouthfeel in doughs and dry mixes attributes that make them the ingredient of choice for large-scale bakers, pancake/waffle mixes, and savory formulations.

From a depth perspective, high-heat’s lower solubility is actually a benefit in cooked systems (it resists rehydration during processing), enabling formulators to replace liquid milk without compromising texture. This drives steady institutional and industrial demand, bulk purchase patterns, and long-term supply contracts that support higher margins and stable volume growth versus medium/low-heat types.

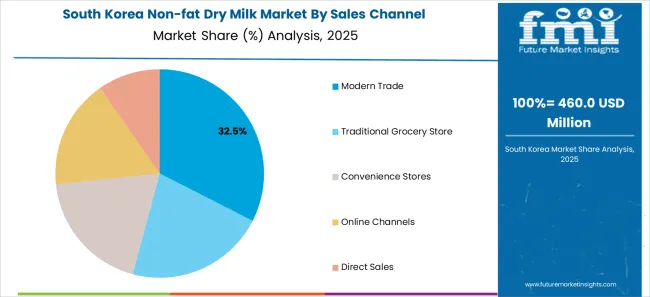

Modern trade is the leading sales channel for non-fat dry milk, holding 30% market share in 2025, supported by the rapid expansion of supermarkets, hypermarkets, and organized dairy retail chains. These outlets offer consistent product availability, a wide range of SKUs, and competitive pricing through bulk purchasing and promotional campaigns. They also provide an ideal platform for high-heat and fortified variants, enabling manufacturers to educate consumers through in-store displays and sampling programs.

Modern trade’s structured supply chain ensures better inventory management, minimized wastage, and fresher stock rotation, which is critical for maintaining the quality of dry dairy powders. The segment benefits from rising urbanization and changing consumer habits, with more shoppers preferring one-stop retail solutions. Strategic collaborations between dairy producers and large retail groups are facilitating bundled offers with complementary products like bakery mixes and nutritional beverages.

From 2025 to 2035, growing demand for shelf-stable, protein-rich dairy ingredients is driving non-fat dry milk (NFDM) adoption across bakery, confectionery, nutritional supplements, and dairy blend applications. Health-conscious consumers seeking high-protein, low-fat dairy options, coupled with rising demand in emerging economies, are reinforcing the market’s steady expansion. Manufacturers offering high-heat variants for industrial applications and fortified formulations for nutritional use are expected to benefit most.

Nutritional Versatility and Shelf-life Stability Drive Non-fat Dry Milk Market Growth

The high protein content, low fat levels, and extended shelf life of NFDM have made it an essential ingredient for both foodservice and industrial processing. In 2024, demand surged in bakery, confectionery, and sports nutrition segments, where NFDM’s functional properties such as improved texture, browning, and stability add value to formulations. By 2025, nutritional supplement manufacturers were increasingly incorporating NFDM into powders and bars to meet the clean-label, high-protein trend.

Value-added Formulations and Processing Innovation Create Opportunities

Advancements in spray-drying technology, heat-treatment precision, and fortification processes are enabling producers to develop high-heat and nutrient-enriched NFDM variants tailored for specific applications. In 2024, innovations included blending with whey proteins for sports nutrition and creating instantized powders for home reconstitution. By 2025, expanded applications in ready-to-drink beverages, bakery mixes, and fortified snack products were opening new revenue streams.

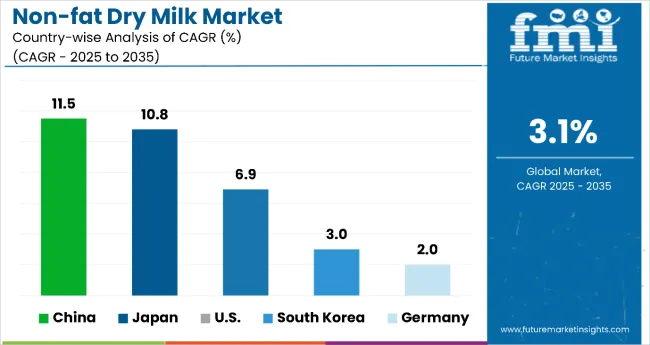

| Countries | CAGR |

|---|---|

| China | 11.5% |

| Japan | 10.8% |

| USA | 6.9% |

| South Korea | 3.0% |

| Germany | 2.0% |

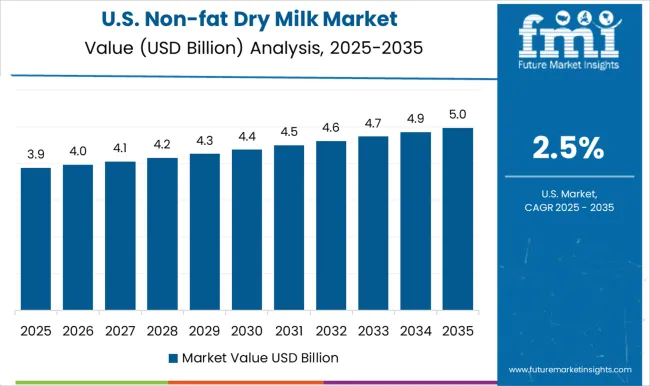

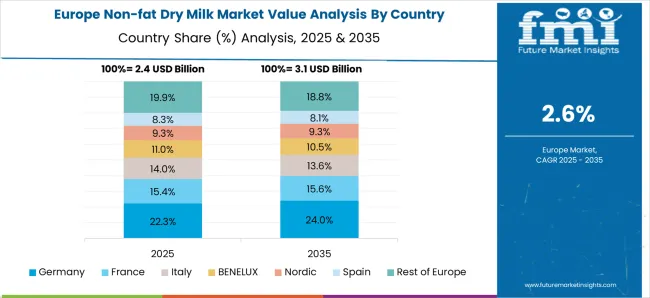

China leads growth with a projected CAGR of 11.5% from 2025 to 2035, fueled by rapid food processing industrialization, expanding bakery and snack sectors, and strong government support for dairy self-sufficiency. Japan follows with 10.8% CAGR, driven by premiumization, functional fortification for an aging population, and export-oriented specialty production. The USA maintains steady momentum at 6.9% CAGR, leveraging advanced processing technology, diversified applications, and strong cooperative-led manufacturing. South Korea, with a modest 3.0% CAGR, benefits from e-commerce penetration, convenience foods, and growing wellness demand. Germany posts the slowest growth at 2.0% CAGR, reflecting a mature, value-driven market focused on organic and certified products.

The report covers an in-depth analysis of 40+ countries; five top-performing OECD countries are highlighted below.

The non-fat dry milk market in China is witnessing robust expansion at a CAGR of 11.5% from 2025, underpinned by rapid industrialization of food processing, growing bakery and snack production, and increasing consumer preference for fortified dairy-based products. Modern trade and e-commerce are boosting penetration into urban and semi-urban areas, while government-backed investments in processing facilities strengthen domestic supply.

Imports remain vital for specialty high-heat powders demanded by industrial bakers. Strategic partnerships between global dairy giants and local processors are enhancing technical know-how, quality consistency, and brand recognition. Additionally, China’s shift toward self-sufficiency in dairy ingredients aligns with broader food security goals, further accelerating NFDM adoption across applications from bakery to ready-to-drink beverages. The increasing use of NFDM in fortified beverages and sports nutrition blends adds a new revenue layer for manufacturers.

Revenue from non-fat dry milk in Japan is driven by a CAGR of 10.8%, preference for premium, high-quality dairy ingredients and the integration of fortified powders into functional foods targeting its aging population. The country’s strong processed food culture sustains high-heat NFDM demand, especially in institutional baking and confectionery.

Stringent regulatory frameworks ensure only certified suppliers thrive, favoring established brands with traceable supply chains. Innovative instantized NFDM products enriched with calcium, vitamins, and protein blends are increasingly tailored for elderly nutrition and convenience-based applications. Export-oriented production of specialty Japanese formulations further enhances the country’s reputation for quality, opening opportunities in regional premium markets. With rising health consciousness, Japanese consumers are also driving growth in lactose-free and low-fat fortified NFDM variants.

Sales of non-fat dry milk in the USA are expected to grow at a CAGR of 6.9%, maintaining steady growth through a combination of industrial demand, strong dairy infrastructure, and innovation in product formulations. Major cooperatives and private labels dominate production, supplying to both domestic and export markets. NFDM is integral to bakery, confectionery, sports nutrition, and ready-to-mix beverages, benefiting from a well-developed distribution network across modern trade and online channels.

Technological advancements in instantization, protein enrichment, and blending with plant-based ingredients have expanded product versatility. Exports help balance production surpluses, while niche opportunities emerge in high-protein, low-fat dairy blends for the wellness market. Rising demand for clean-label NFDM and fortified blends continues to shape manufacturing strategies.

Demand for non-fat dry milk in South Korea is growing at a CAGR of 3.0% modest but consistent, with demand driven by urban lifestyles, convenience foods, and rising interest in functional nutrition. Modern retail and advanced e-commerce platforms are the primary sales channels, often catering to consumers seeking premium instantized and fortified variants.

Foodservice and snack manufacturers prefer NFDM for its versatility and shelf stability, particularly in ready-to-drink and bakery applications. Imports are crucial to meeting specialized industrial-grade requirements, while domestic producers focus on flavor innovation and packaging formats suited for smaller households. Increasing emphasis on high-protein, low-sugar dairy blends is creating opportunities in the fitness and wellness segments.

Non-fat dry milk revenue in Germany is forecasted at a CAGR of 2.0%, demonstrates steady growth, shaped by strict regulatory standards, high consumer awareness, and a strong inclination toward organic and sustainably sourced dairy products. Industrial demand remains concentrated in the bakery, confectionery, and dairy blend sectors, where quality certifications are critical for supplier selection. Growth is largely value-driven, with consumers paying premiums for traceable, pesticide-free, and animal welfare-compliant products.

Domestic production emphasizes quality consistency and environmental responsibility, aligning with Germany’s broader environmental objectives. While volume expansion is limited, opportunities lie in premium fortified blends and niche exports to other European countries demanding certified products. Rising consumer demand for organic, high-protein NFDM blends is boosting supplier differentiation in this mature market.

The market is moderately fragmented, with Nestlé S.A. leading at 20% market share, followed by Dairy Farmers of America (DFA) with 11.2%. The cooperative’s dominance stems from its vast production capacity, vertically integrated supply chain, and strong global export presence, supplying both industrial and consumer-grade NFDM.

Leading player status is held by Dairy Farmers of America. Other key players include Fonterra Co-operative Group, Nestlé S.A., Arla Foods amba, Saputo Inc., Lactalis Ingredients, Glanbia plc, FrieslandCampina, California Dairies Inc., Murray Goulburn Co-operative, and Hoogwegt Group, each offering diverse NFDM variants such as high-heat, medium-heat, and low-heat powders, tailored for applications in bakery, confectionery, beverages, and nutritional products. Many of these players emphasize functional enrichment, instantization technology, and clean-label certifications to meet evolving consumer preferences.

Emerging players are entering through specialized fortified formulations, lactose-free variants, and regional supply agreements, yet established manufacturers hold competitive advantages through economies of scale, advanced processing facilities, and long-standing relationships with multinational food and beverage companies. Market growth is further fueled by rising protein supplementation trends, increasing demand from developing markets, and innovation in packaging formats for both industrial and retail buyers.

| Item | Value |

|---|---|

| Quantitative Units | USD 8.9 Billion |

| Product Type | High-heat, Medium-heat, Low-heat |

| Sales Channel | Modern Trade, Traditional Grocery Store, Convenience Stores, Online Channels, Direct Sales |

| Application | Home Reconstitutions, Dairy Whiteners, Bakery and Confectionery, Desserts, Ice-cream, Dairy Blends, Snacks, Nutritional Supplements |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Countries Covered | United States, Canada, United Kingdom, Germany, France, China, Japan, South Korea, Brazil, Australia and 40+ countries |

| Key Companies Profiled | HOCHDORF Holding Ltd., The St. Albans Cooperative Creamery, American Dairy Products Institute, Bob’s Red Mill Natural Foods, Nestle S.A., All American Foods, Inc., Arla Foods, DairyAmerica, Inc., Amul NOW Foods, Earth’s Own Food Company Inc., The Hain Celestial Group |

| Additional Attributes | Dollar sales by product type and sales channel, growing usage in bakery, confectionery, beverages, and sports nutrition applications, stable demand in institutional and industrial processing, innovations in spray-drying, instantization, and blending technology improve solubility, shelf life, and functionality. |

The global non-fat dry milk market is estimated to be valued at USD 9.5 billion in 2025.

The market size for the non-fat dry milk market is projected to reach USD 12.7 billion by 2035.

The non-fat dry milk market is expected to grow at a 3.0% CAGR between 2025 and 2035.

The key product types in non-fat dry milk market are low-heat, high-heat and medium-heat.

In terms of sales channel, modern trade segment to command 34.2% share in the non-fat dry milk market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Dry Powder Inhaler Market Size and Share Forecast Outlook 2025 to 2035

Dry Vacuum Pumps Market Size and Share Forecast Outlook 2025 to 2035

Dry Cleaning Solvents Market Size and Share Forecast Outlook 2025 to 2035

Dry Block Heaters Market Size and Share Forecast Outlook 2025 to 2035

Dry Fog Dust Suppression Equipment Market Size and Share Forecast Outlook 2025 to 2035

Dry Scalp Treatment Market Size and Share Forecast Outlook 2025 to 2035

Dry Type Distribution Transformer Market Size and Share Forecast Outlook 2025 to 2035

Dry Type Current Transformer Market Size and Share Forecast Outlook 2025 to 2035

Dry Eye Syndrome Treatment Market Size and Share Forecast Outlook 2025 to 2035

Dry Type Automated Solar Panel Cleaning Market Size and Share Forecast Outlook 2025 to 2035

Dry Electrostatic Precipitator Market Size and Share Forecast Outlook 2025 to 2035

Dry Herb Cannabis Vaporizers Market Size and Share Forecast Outlook 2025 to 2035

Dry Type Transformer Market Size and Share Forecast Outlook 2025 to 2035

Dry Gas Coupling Market Analysis Size and Share Forecast Outlook 2025 to 2035

Dry Mixes Market Analysis - Size, Share and Forecast Outlook 2025 to 2035

Dryer Sheets Market Size and Share Forecast Outlook 2025 to 2035

Dry Electrostatic Wipes Market Size and Share Forecast Outlook 2025 to 2035

Drylab Photo Printing Market Size and Share Forecast Outlook 2025 to 2035

Dry and Wet Wipes Market Size and Share Forecast Outlook 2025 to 2035

Dry Yeast Market Report - Size, Demand & Forecast 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA