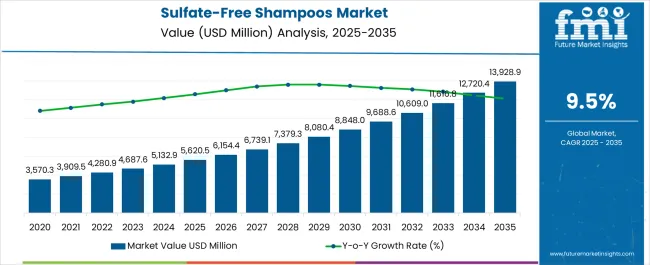

The global sulfate-free shampoos market is projected to grow from USD 5,608.1 million in 2025 to approximately USD 13,950.4 million by 2035, recording an absolute increase of USD 8,342.3 million over the forecast period. This translates into a total growth of 148.8%, with the market forecast to expand at a compound annual growth rate (CAGR) of 9.5% between 2025 and 2035. The overall market size is expected to grow by nearly 2.49X during the same period, supported by rising consumer awareness about hair health, increasing demand for gentle hair care products, and growing preference for natural and organic beauty solutions.

Between 2025 and 2030, the sulfate-free shampoos market is projected to expand from USD 5,608.1 million to USD 8,854.8 million, resulting in a value increase of USD 3,246.7 million, which represents 38.9% of the total forecast growth for the decade. This phase of growth will be shaped by rising consumer preference for gentle hair care solutions, increasing awareness about sulfate-related hair damage, and growing demand for products suitable for color-treated and chemically processed hair. Manufacturers are expanding their sulfate-free product portfolios to meet the diverse needs and preferences of consumers.

From 2030 to 2035, the market is forecast to grow from USD 8,854.8 million to USD 13,950.4 million, adding another USD 5,095.6 million, which constitutes 61.1% of the overall ten-year expansion. This period is expected to be characterized by expansion of natural and organic sulfate-free formulations, integration of advanced botanical ingredients, and development of specialized products for specific hair types and concerns. The growing adoption of clean beauty trends and sustainability-focused consumer behavior will drive demand for environmentally friendly sulfate-free shampoo solutions.

Between 2020 and 2025, the sulfate-free shampoos market experienced rapid expansion, driven by increasing consumer education about harsh chemical effects and growing preference for mild, gentle hair care products. The market developed as beauty retailers recognized consumer demand for sulfate-free alternatives and premium hair care brands began reformulating their products. Social media influence and beauty expert recommendations significantly contributed to market awareness and adoption rates.

| Metric | Value |

|---|---|

| Estimated Value in (2025E) | USD 5,608.1 million |

| Forecast Value in (2035F) | USD 13,950.4 million |

| Forecast CAGR (2025 to 2035) | 9.5% |

Market expansion is being supported by the increasing consumer awareness about the potentially damaging effects of sulfates on hair and scalp health, particularly for individuals with sensitive skin, color-treated hair, and curly or textured hair types. Modern consumers are seeking gentle cleansing solutions that maintain natural oils and moisture balance while effectively cleaning hair. The growing preference for clean beauty and natural ingredients is driving demand for sulfate-free formulations that align with health-conscious lifestyle choices.

The rising popularity of professional salon treatments and color protection needs are creating sustained demand for sulfate-free products that preserve hair treatments and extend color vibrancy. Beauty influencers and hair care professionals are increasingly recommending sulfate-free alternatives, contributing to market education and consumer adoption. E-commerce growth and direct-to-consumer brands are making specialized sulfate-free products more accessible to diverse consumer segments worldwide.

The market is segmented by function, ingredient base, product type, claim, channel, and region. By function, the market is divided into cleansing for sensitive scalp, color protection, moisturizing & hydration, and anti-dandruff. Based on ingredient base, the market is categorized into cocamidopropyl betaine, decyl glucoside, sodium cocoyl isethionate, plant-derived surfactants, and others.

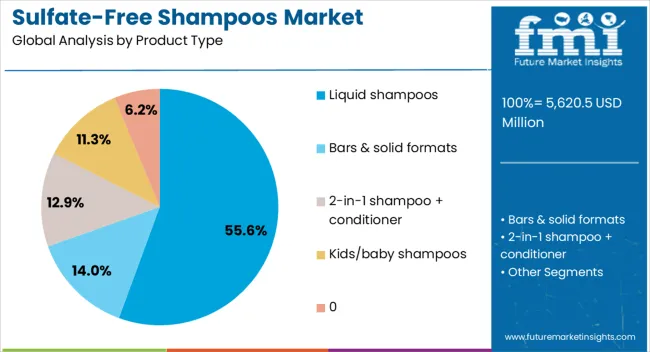

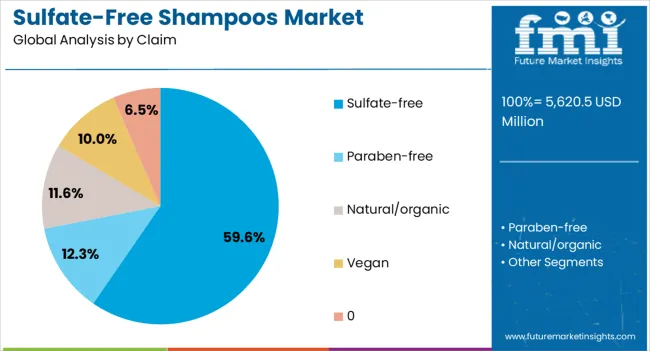

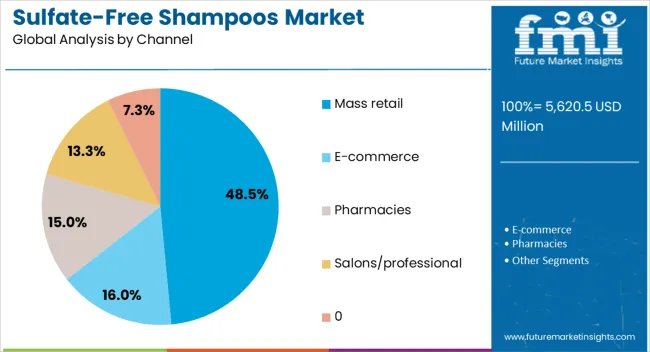

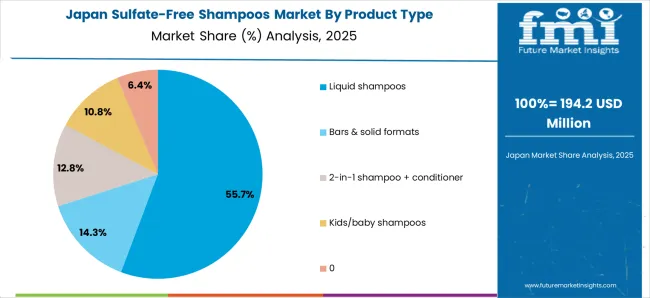

In terms of product type, the market is segmented into liquid shampoos, bars & solid formats, 2-in-1 shampoo + conditioner, and kids/baby shampoos. By claim, the market is classified into sulfate-free, paraben-free, natural/organic, and vegan. By channel, the market includes e-commerce, mass retail, pharmacies, and salons/professional. Regionally, the market is divided into North America, Europe, East Asia, South Asia & Pacific, Latin America, and Middle East & Africa.

The liquid shampoos segment is expected to represent 55.6% of sulfate-free shampoo sales in 2025. This dominance reflects long-standing consumer familiarity with liquid shampoo formats, which remain the most widely recognized and trusted form of hair cleansing. Liquid formulations allow for extensive versatility, enabling brands to incorporate botanical extracts, proteins, vitamins, and other active ingredients tailored to diverse hair types and scalp conditions.

This adaptability makes liquid sulfate-free shampoos appealing across both mass-market and premium segments. Established distribution networks, particularly through supermarkets, drugstores, and specialty beauty retailers, also reinforce the accessibility of this format. Additionally, liquid shampoos are often marketed with added claims such as color protection, hydration, or scalp care, increasing their perceived value. With their balance of performance, convenience, and variety, liquid shampoos will continue to anchor sulfate-free product adoption globally.

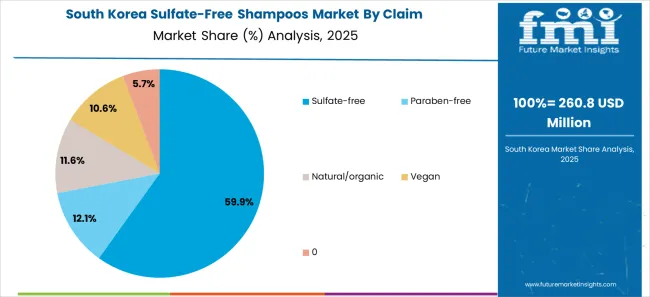

Products specifically marketed with sulfate-free claims are projected to contribute 59.6% of the market in 2025. This leadership underscores how sulfate elimination has become the defining message of the category, resonating with consumers concerned about harsh detergents that strip natural oils, cause scalp irritation, or fade hair color. The sulfate-free claim has transitioned from niche positioning to a mainstream expectation, serving as the entry point for broader claims such as “clean beauty” and “gentle care.”

Brands capitalize on this by using clear front-of-pack messaging that highlights the absence of sulfates while pairing with secondary benefits like hydration, frizz control, or strengthening. Consumer awareness campaigns and influencer-driven education have further deepened understanding of sulfate-related concerns. This segment benefits from strong differentiation, credibility, and alignment with wellness-driven lifestyles, ensuring that sulfate-free positioning remains the cornerstone of haircare innovation.

The mass retail channel is projected to represent 48.5% of sulfate-free shampoo sales in 2025. This leading share reflects the accessibility and affordability offered by supermarkets, drugstores, and big-box retailers, which make sulfate-free shampoos widely available to mainstream consumers. Mass retail platforms provide competitive pricing, frequent promotions, and wide assortments, encouraging trial and adoption among budget-conscious shoppers who may be new to sulfate-free formulations.

Educational in-store displays and sampling campaigns further support consumer awareness and trust. While premium and e-commerce channels are growing, mass retail continues to dominate due to convenience and established shopping behaviors. Its ability to reach large, diverse demographics ensures sustained demand, positioning it as a critical driver of sulfate-free shampoo expansion and a gateway channel for consumers transitioning from conventional to gentle haircare solutions.

The sulfate-free shampoos market is advancing rapidly due to increasing consumer health consciousness and growing preference for gentle beauty products. However, the market faces challenges including higher production costs compared to conventional shampoos, consumer education needs about product benefits, and varying performance expectations. Clean beauty trends and sustainability concerns continue to influence product development and consumer purchasing decisions.

The growing integration of natural and organic ingredients in sulfate-free shampoo formulations is meeting consumer demand for clean beauty products that align with environmental and health values. Manufacturers are incorporating botanical extracts, essential oils, and plant-based surfactants that provide effective cleansing while supporting scalp and hair health. These formulations appeal to eco-conscious consumers seeking products with transparent ingredient lists and sustainable sourcing practices.

Modern sulfate-free shampoo brands are creating targeted formulations for specific hair types, textures, and concerns including curly hair, color-treated hair, fine hair, and damaged hair. Customized solutions address unique cleansing and care needs while maintaining the gentle benefits of sulfate-free formulations. Advanced ingredient technologies enable precise formulation that delivers optimal performance for diverse hair characteristics and styling preferences.

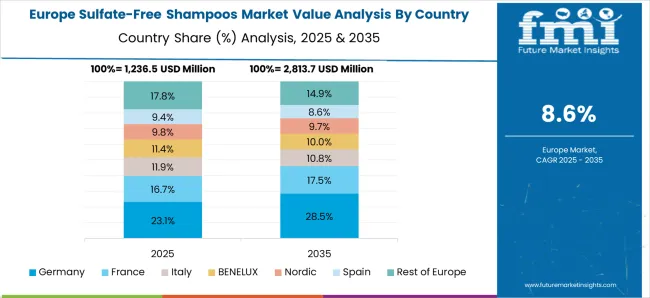

The sulfate-free shampoos market in Europe demonstrates robust growth across major economies with Germany showing strong presence through its advanced chemical formulation expertise and consumer preference for gentle, scientifically-backed hair care solutions, supported by companies like Beiersdorf leveraging dermatological research to develop effective sulfate-free cleansing systems that maintain hair health while addressing scalp sensitivity concerns.

France represents a significant market driven by its luxury beauty heritage and sophisticated understanding of hair care science, with companies like L'Oréal pioneering premium sulfate-free formulations that combine French cosmetic artistry with advanced surfactant technologies for gentle yet effective cleansing performance.

The UK exhibits considerable growth through its embrace of clean beauty trends and natural hair care solutions, with brands like The Body Shop and Aveda leading the development of plant-based sulfate alternatives that align with environmental consciousness and hair wellness principles.

Italy, Spain, and other European regions show expanding interest in gentle hair care formulations, particularly among consumers with color-treated, chemically processed, or naturally curly hair types that benefit from sulfate-free cleansing. BENELUX countries contribute through their focus on sustainable and ethical beauty products, while Eastern Europe and Nordic regions display growing potential, driven by increasing awareness of sulfate sensitivity and expanding access to premium gentle hair care products across diverse retail channels.

South Korea represents an emerging innovation center for sulfate-free shampoos, positioning as a growing global market with health-conscious consumers increasingly embracing gentle hair care solutions and scalp wellness approaches that align with traditional Korean beauty philosophies of nurturing and protecting natural hair texture and scalp health.

The market benefits from extensive research capabilities in cosmetic science and fermentation technologies, creating natural advantages for developing innovative sulfate-free cleansing systems that incorporate traditional Korean botanicals and modern surfactant science for optimal hair and scalp care results. Strong domestic cosmetics manufacturing infrastructure supports both local consumption and significant export opportunities to global markets, particularly in Asia-Pacific regions where Korean beauty expertise is highly valued and trusted.

The integration of sulfate-free technology with Korean expertise in gentle yet effective formulations, combined with consumer sophistication in understanding ingredient benefits and long-term hair health strategies, positions the market as both an important consumer base and emerging innovation catalyst for sulfate-free shampoo applications. Growing influence of K-beauty principles on global hair care trends, emphasizing scalp health and gentle care routines, supports continued market expansion and innovation development in sulfate-free hair cleansing solutions worldwide.

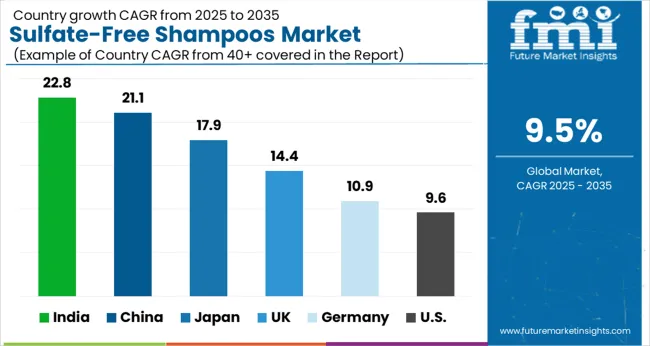

| Country | CAGR (2025 to 2035) |

|---|---|

| China | 21.1% |

| India | 22.8% |

| USA | 9.6% |

| UK | 14.4% |

| Germany | 10.9% |

| Japan | 17.9% |

The sulfate-free shampoos market demonstrates varied regional growth patterns, with India leading at a 22.8% CAGR through 2035, driven by rising disposable income, increasing beauty consciousness, and growing availability of international brands. China follows closely at 21.1%, supported by strong e-commerce adoption, premium beauty product demand, and expanding urban consumer base. Japan records 17.9% growth, emphasizing quality, innovation, and specialized formulations for Asian hair types. The USA shows steady growth at 9.6%, focusing on market maturity, brand diversification, and clean beauty trends. Overall, Asian markets emerge as the primary drivers of global sulfate-free shampoos market expansion.

The report covers an in-depth analysis of 40+ countries; six top-performing regions are highlighted below.

Revenue from sulfate-free shampoos in China is projected to exhibit the highest growth rate with a CAGR of 21.1% through 2035, driven by rapid adoption of international beauty standards and increasing consumer preference for premium hair care products. The country's expanding middle class and growing beauty consciousness are creating significant demand for sulfate-free solutions. Major beauty brands and domestic manufacturers are establishing comprehensive product lines to serve diverse consumer needs across tier-1 and tier-2 cities.

Revenue from sulfate-free shampoos in India is expanding at a CAGR of 22.8%, supported by increasing disposable income, growing urban population, and rising awareness about hair care health. The country's diverse hair types and traditional beauty practices create opportunities for specialized sulfate-free formulations that combine modern science with traditional ingredients. International brands and local manufacturers are developing products that address specific needs of Indian consumers while maintaining cultural relevance.

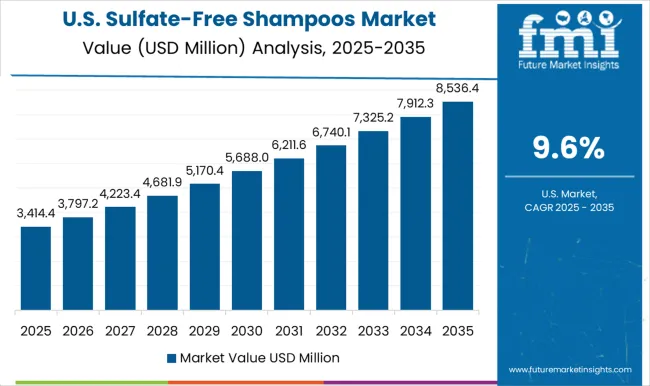

Revenue from sulfate-free shampoos in the USA is growing at a CAGR of 9.6%, driven by mature consumer awareness of clean beauty trends and established demand for sulfate-free alternatives. The country's diverse consumer base and strong retail infrastructure support comprehensive product availability across price points and distribution channels. Professional recommendations and beauty expert endorsements continue to influence consumer adoption and brand loyalty.

In Japan, sulfate-free shampoos demonstrate strong performance in the liquid format segment, which accounts for 57.6% of total market sales. The emphasis on quality, gentle formulations, and specialized ingredients for Asian hair types drives premium product adoption. Japanese consumers prioritize hair health and are willing to invest in sulfate-free solutions that provide superior care and styling benefits.

Revenue from sulfate-free shampoos in the UK is projected to grow at a CAGR of 14.4% through 2035, driven by rising consumer demand for premium and clean-label haircare solutions. British consumers are increasingly aware of scalp health, ingredient safety, and environmental sustainability, positioning sulfate-free shampoos as a preferred choice in both mass-market and luxury haircare segments.

Revenue from sulfate-free shampoos in Germany is projected to grow at a CAGR of 10.9% through 2035, supported by strong consumer emphasis on dermatological validation, product safety, and natural ingredient sourcing. German consumers prioritize high-quality, clinically tested formulations, making sulfate-free shampoos a central part of the premium haircare landscape.

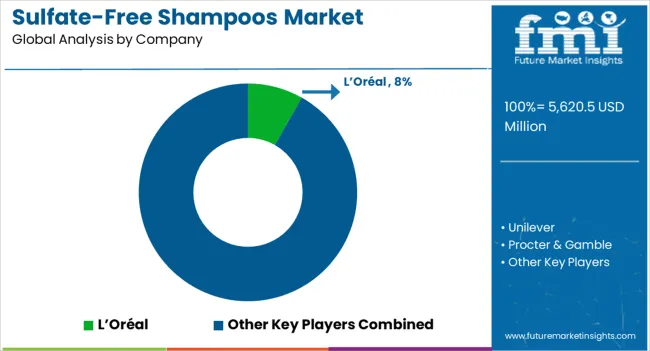

The sulfate-free shampoos market is characterized by competition among established beauty conglomerates, specialized natural brands, and emerging direct-to-consumer companies. Companies are investing in research and development, natural ingredient sourcing, sustainable packaging, and targeted marketing to deliver effective, appealing, and environmentally responsible sulfate-free solutions. Brand positioning, product innovation, and distribution expansion are central to strengthening market presence and consumer loyalty.

L'Oréal leads the market with an 8.2% global value share in 2025, leveraging its extensive brand portfolio and research capabilities to offer diverse sulfate-free formulations across mass market and professional segments. Unilever provides comprehensive sulfate-free solutions through multiple brand platforms that address various consumer needs and price points. Procter & Gamble emphasizes innovation and brand strength to maintain competitive positioning in the growing sulfate-free segment.

Beiersdorf focuses on gentle, dermatologist-tested formulations that appeal to sensitive scalp consumers. Herbal Essences and OGX offer natural ingredient-focused products that combine sulfate-free benefits with botanical extracts and essential oils. Aveda provides premium, salon-quality sulfate-free solutions with emphasis on natural ingredients and environmental responsibility. SheaMoisture targets textured and curly hair consumers with specialized formulations. Function of Beauty and The Body Shop represent personalized and ethical beauty approaches respectively, offering unique value propositions in the sulfate-free market segment.

| Items | Values |

|---|---|

| Quantitative Units (2025) | USD 5,608.1 Million |

| Function | Cleansing for Sensitive Scalp, Color Protection, Moisturizing & Hydration, Anti-dandruff |

| Product Type | Liquid Shampoos, Bars & Solid Formats, 2-in-1 Shampoo + Conditioner, Kids/Baby Shampoos |

| Ingredient Base | Cocamidopropyl Betaine, Decyl Glucoside, Sodium Cocoyl Isethionate, Plant-derived Surfactants, Others |

| Claim | Sulfate-free, Paraben-free, Natural/Organic, Vegan |

| Channel | E-commerce, Mass Retail, Pharmacies, Salons/Professional |

| Regions Covered | North America, Europe, East Asia, South Asia & Pacific, Latin America, Middle East & Africa |

| Countries Covered | United States, Canada, United Kingdom, Germany, France, China, Japan, South Korea, India, Brazil, Australia and 40+ countries |

| Key Companies Profiled | L'Oréal, Unilever, Procter & Gamble, Beiersdorf, Herbal Essences, OGX, Aveda, SheaMoisture, Function of Beauty, and The Body Shop |

| Additional Attributes | Dollar sales by surfactant type and formulation, regional demand trends, competitive landscape, buyer preferences for natural versus synthetic alternatives, integration with clean-label/dermatologist-tested positioning, innovations in gentle cleansing systems, scalp microbiome care, and sustainable packaging solutions |

The global sulfate-free shampoos market is estimated to be valued at USD 5,620.5 million in 2025.

The market size for the sulfate-free shampoos market is projected to reach USD 13,928.9 million by 2035.

The sulfate-free shampoos market is expected to grow at a 9.5% CAGR between 2025 and 2035.

The key product types in sulfate-free shampoos market are liquid shampoos , bars & solid formats, 2-in-1 shampoo + conditioner, kids/baby shampoos and .

In terms of claim , sulfate-free segment to command 59.6% share in the sulfate-free shampoos market in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Anti-Dandruff Shampoos Market Analysis - Size and Share Forecast Outlook 2025 to 2035

Dandruff Control Shampoos Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA