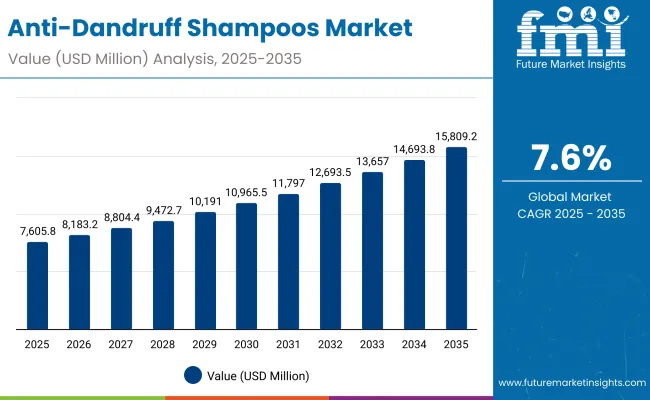

The Anti-Dandruff Shampoos Market is expected to record a valuation of USD 7,605.8 million in 2025 and USD 15,809.2 million in 2035, with an increase of USD 8,203.4 million, which equals a growth of 107.8% over the decade. The overall expansion represents a CAGR of 7.6% and more than a 2X increase in market size.

Anti-Dandruff Shampoos Market Key Takeaways

| Metric | Value |

|---|---|

| Anti-Dandruff Shampoos Market Estimated Value (2025E) | USD 7,605.8 million |

| Anti-Dandruff Shampoos Market Forecast Value (2035F) | USD 15,809.2 million |

| Forecast CAGR (2025 to 2035) | 7.6% |

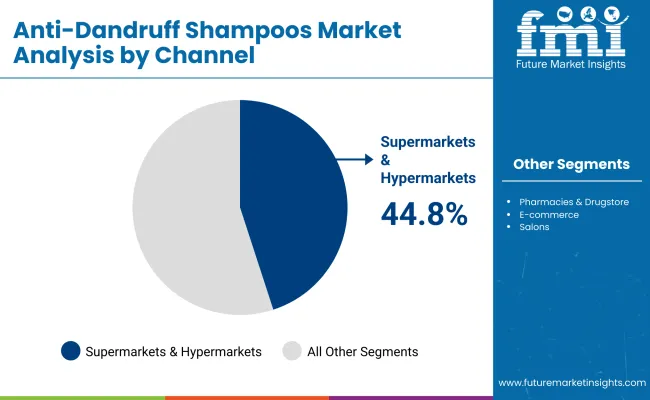

During the first five-year period from 2025 to 2030, the market increases from USD 7,605.8 million to USD 10,965.5 million, adding USD 3,359.7 million, which accounts for 41% of the total decade growth. This phase records steady adoption across both men’s and women’s grooming segments, with zinc pyrithione shampoos remaining the backbone of anti-dandruff solutions. Growing demand for scalp health and dermatology-backed formulations, particularly in pharmacies and drugstores, is a major driver. Supermarkets and hypermarkets dominate this period as they cater to over 44% of consumer purchases, offering strong distribution penetration and wide product visibility.

The second half from 2030 to 2035 contributes USD 4,843.7 million, equal to 59% of total growth, as the market jumps from USD 10,965.5 million to USD 15,809.2 million. This acceleration is powered by premiumization trends, with increased adoption of e-commerce and salon-exclusive products. Consumers shift towards ketoconazole and selenium sulfide shampoos, supported by clinical efficacy claims. Digital channels expand rapidly, with online subscription models and dermatologist-recommended D2C products gaining traction. Unisex-targeted formulations and color-treated hair-specific variants show notable growth in this phase.

From 2020 to 2024, the Anti-Dandruff Shampoos Market grew from USD 6,210.0 million to USD 7,320.0 million, driven by hardware-style mass adoption through supermarket and hypermarket shelves. During this period, the competitive landscape was dominated by mass-market leaders like Head & Shoulders (P&G), Dove, and Selsun Blue, controlling nearly 50% of organized retail shelves worldwide. Competitive differentiation relied on affordability, accessibility, and dermatologist-backed claims, while salon-exclusive and e-commerce-focused brands remained niche. Premiumization had minimal traction, contributing less than 15% of the total market value.

Demand for anti-dandruff shampoos will expand further to USD 7,605.8 million in 2025, and the revenue mix will shift as e-commerce and salon channels grow to over 35% share. Traditional FMCG leaders face rising competition from dermatology-based specialist brands such as Nizoral and Scalpe, which emphasize clinical credibility and physician recommendations. Major consumer goods vendors are pivoting to hybrid models, integrating both mass-market retail and digital subscription strategies. Emerging entrants specializing in botanical formulations, sulfate-free ranges, and AI-personalized hair care are gaining share. The competitive advantage is moving away from price leadership alone to brand equity, consumer trust, and innovation-driven scalp care ecosystems.

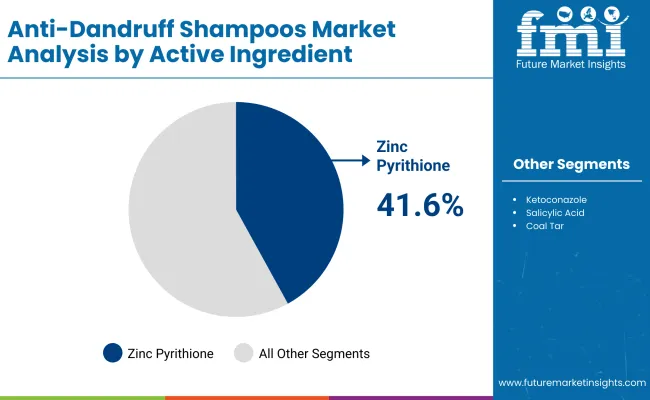

Advances in dermatology research and the rising prevalence of scalp-related issues such as dandruff, seborrheic dermatitis, and dry & flaky scalp conditions have significantly boosted demand. Zinc pyrithione, the leading active ingredient, has remained the most trusted due to its antimicrobial properties, followed closely by ketoconazole-based shampoos for their targeted antifungal benefits.

Supermarkets and hypermarkets have strengthened their position by offering wide assortments at competitive prices, allowing leading FMCG players to scale rapidly across both developed and emerging markets. Meanwhile, e-commerce channels are accelerating growth through convenience, wider brand visibility, and direct-to-consumer subscription offerings.

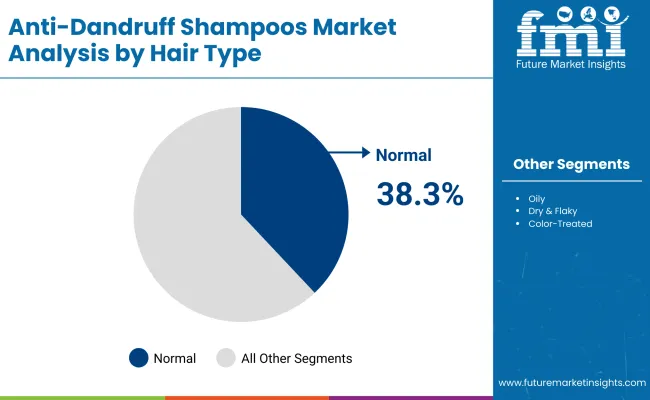

Consumer preferences are shifting towards personalized scalp care, with growing traction for shampoos suitable for oily, dry & flaky, and color-treated hair. This demand is further fueled by premium salon partnerships, dermatology clinic recommendations, and influencer-led marketing on digital platforms.

Segment growth is expected to be led by zinc pyrithione-based formulations, normal hair variants, and supermarkets & hypermarkets in the near term, while e-commerce and specialty products for women and color-treated hair will gain significant traction by 2030-2035.

The market is segmented by active ingredient, hair type, channel, end user, and region. Active ingredients include zinc pyrithione, ketoconazole, salicylic acid, coal tar, and selenium sulfide, highlighting the core elements driving product efficacy. Hair type classification covers normal, oily, dry & flaky, and color-treated hair to cater to diverse consumer needs. Based on channel, the segmentation includes supermarkets & hypermarkets, pharmacies & drugstores, e-commerce, and salons, reflecting the distribution mix. In terms of end users, categories encompass men, women, and unisex as targeted demographics. Regionally, the scope spans North America, Europe, East Asia, South Asia & Pacific, Latin America, and the Middle East & Africa.

| Active Ingredient Segment | Market Value Share, 2025 |

|---|---|

| Zinc pyrithione | 41.6% |

| Others | 58.4% |

The zinc pyrithione segment is projected to contribute 41.6% of the Anti-Dandruff Shampoos Market revenue in 2025, maintaining its lead as the dominant active ingredient category. This dominance is driven by zinc pyrithione’s proven antifungal and antibacterial properties, making it the most widely trusted ingredient for controlling dandruff and seborrheic dermatitis. Consumers consistently associate zinc pyrithione shampoos with faster relief, better scalp comfort, and dermatologist-recommended efficacy.

The segment’s growth is also supported by its integration across both premium and mass-market brands. Leading players such as Head & Shoulders, Dove, and Neutrogena T/Gel continue to anchor their anti-dandruff lines with zinc pyrithione formulations, ensuring mass adoption across supermarkets, pharmacies, and online retail platforms. In parallel, product innovations are introducing zinc pyrithione in combination with moisturizers, botanical extracts, and sulfate-free bases, allowing the ingredient to penetrate the evolving clean-label and sensitive-skin consumer segment.

As newer actives like ketoconazole and selenium sulfide gain traction in niche therapeutic or prescription-backed shampoos, zinc pyrithione remains the backbone of the category, retaining its leadership due to broad consumer trust, clinical validation, and multi-channel accessibility.

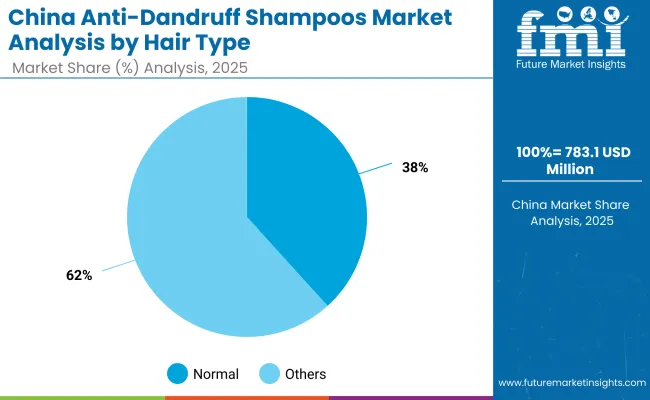

| Hair Type Segment | Market Value Share, 2025 |

|---|---|

| Normal | 38.3% |

| Others | 61.7% |

The normal hair segment is forecasted to hold 38.3% of the market share in 2025, led by its universal application and suitability for a broad base of consumers. Anti-dandruff shampoos formulated for normal hair are widely marketed as all-in-one solutions that balance cleansing with scalp treatment, appealing to both men and women across age groups.

These shampoos are favored because they provide effective dandruff control without over-drying or over-conditioning, making them versatile for households where multiple family members share the same product. Their accessible positioning in supermarkets, pharmacies, and even online bundles has strengthened their reach across urban and semi-urban markets. The segment’s growth is further bolstered by expanding middle-class consumption in emerging regions such as India and China, where normal hair-positioned shampoos act as the entry point into premium scalp care.

As consumers increasingly seek preventive scalp health products and simple, everyday-use formulas, normal hair variants are expected to maintain their dominance. However, specialized demand from oily, dry & flaky, and color-treated hair users will gradually rise, pushing manufacturers to diversify offerings while keeping normal hair as the largest single contributor to market growth.

| Channel Segment | Market Value Share, 2025 |

|---|---|

| Supermarkets & hypermarkets | 44.8% |

| Others | 55.2% |

The supermarkets & hypermarkets segment is projected to account for 44.8% of the Anti-Dandruff Shampoos Market revenue in 2025, establishing itself as the leading distribution channel. Large-format retail chains remain the first point of purchase for consumers worldwide due to convenience, variety, and frequent promotions. Supermarkets drive higher volumes by combining mass-market brands like Head & Shoulders and Dove with mid-tier and specialty options, enabling cross-segmentation of consumer spending.

Prominent retail strategies, including shelf placements, combo packs, and loyalty program tie-ins, have supported the continued dominance of this channel. In addition, partnerships between FMCG giants and global retailers such as Walmart, Carrefour, and Tesco have reinforced supermarket penetration across North America and Europe, while expanding regional chains in Asia-Pacific are driving faster growth in emerging economies.

Despite the rise of e-commerce and pharmacy-driven credibility in scalp care, supermarkets remain central to brand visibility and impulse purchases, particularly in middle-income economies. This segment will continue to dominate through 2030, even as digital and salon-exclusive channels accelerate their penetration in the latter half of the decade.

Rising Scalp Health Awareness and Dermatology-backed Adoption

One of the strongest drivers of the Anti-Dandruff Shampoos Market is the rising consumer awareness of scalp health as a key element of personal grooming and overall wellness. Dermatologists and trichologists are increasingly recommending anti-dandruff shampoos not just for treatment of visible flakes, but also as part of long-term preventive scalp care. This shift is especially strong in developed markets like the USA and UK, where pharmacy and drugstore sales account for a growing share, and in emerging economies such as India and China, where dermatology-endorsed brands like Scalpe and Nizoral are gaining consumer trust.

In addition, increased cases of dandruff linked to urban pollution, stress, and lifestyle-driven scalp issues have amplified demand for medically proven actives such as zinc pyrithione and ketoconazole. This credibility-driven adoption ensures sustained growth for both premium therapeutic lines and mainstream FMCG-backed shampoos.

Channel Diversification with Supermarkets Driving Volume and E-commerce Accelerating Premium Sales

The distribution channel mix is another major driver, with supermarkets & hypermarkets commanding 44.8% of sales in 2025 due to visibility, promotions, and multipack strategies. These retail giants have created consistent consumer access to mass brands like Head & Shoulders and Dove, pushing volume growth. However, the driver that ensures future acceleration is the rapid expansion of e-commerce platforms, especially in Asia-Pacific markets such as China and India.

Online platforms not only support premium niche players like Paul Mitchell and Nizoral but also enable direct-to-consumer subscription models, which are reshaping how consumers repurchase anti-dandruff shampoos. This dual-channel strength mass visibility in supermarkets and premium credibility through e-commerce creates a layered driver that is expanding both value and volume across regions.

Regulatory Bans and Ingredient Safety Concerns

A major restraint for the Anti-Dandruff Shampoos Market is the increasing scrutiny around active ingredients such as zinc pyrithione. The European Union banned zinc pyrithione in 2022 under cosmetic regulations due to potential carcinogenicity concerns, forcing brands operating in Europe to reformulate their best-selling anti-dandruff lines. This has disrupted supply chains and reduced consumer confidence in certain regions, creating uncertainty for brands overly dependent on zinc pyrithione. Reformulation costs and re-approval delays have acted as barriers to maintaining growth momentum in Europe, where anti-dandruff shampoos account for a significant share of the haircare market.

Consumer Fatigue from Overuse and Side Effects

Another restraint is consumer fatigue and side-effect driven drop-offs. Frequent users of anti-dandruff shampoos often report scalp dryness, hair breakage, or color fading (especially in color-treated hair), which discourages long-term consistent use. This issue is especially acute in mature markets like the USA, where anti-dandruff shampoo penetration is already high, and consumers are shifting towards botanical, sulfate-free, or "mild" alternatives that are positioned as safer for daily use. Such perception gaps reduce repurchase rates for conventional anti-dandruff shampoos and challenge brands to re-engineer formulations that combine efficacy with cosmetic appeal.

Premiumization and Specialized Formulations for Targeted Hair Types

A clear trend shaping the market is premiumization, where shampoos are no longer sold as one-size-fits-all products but are segmented by hair type and lifestyle needs. The dataset shows normal hair accounted for 38.3% of market share in 2025, but growth is accelerating fastest in oily, dry & flaky, and color-treated segments, where consumers are seeking targeted scalp care solutions. Premium brands are responding with specialized claims such as "anti-dandruff + color protection" or "anti-dandruff + hydration." This allows companies to charge higher price points and capture consumers who view scalp care as part of an overall hair wellness routine. Premiumization is particularly strong in Asia-Pacific and European markets, where fashion-driven and dermatology-focused consumers are willing to invest in specialized care.

Digital and Subscription-led E-commerce Growth

The second key trend is the digital-first transformation of sales and engagement. In markets like China and India, e-commerce already represents the fastest-growing distribution channel, supported by platforms like Tmall, Amazon, and Flipkart. Anti-dandruff shampoos are being bundled into subscription programs and promoted through AI-driven product recommendation engines. Consumers are increasingly exposed to dermatologist-led live streaming, influencer campaigns, and salon-based product endorsements online. This not only boosts brand visibility but also sustains recurring sales cycles through subscription renewals. The trend of direct-to-consumer refill models and eco-conscious packaging tied to online retail is further amplifying digital adoption, making e-commerce a structural driver of future market share redistribution.

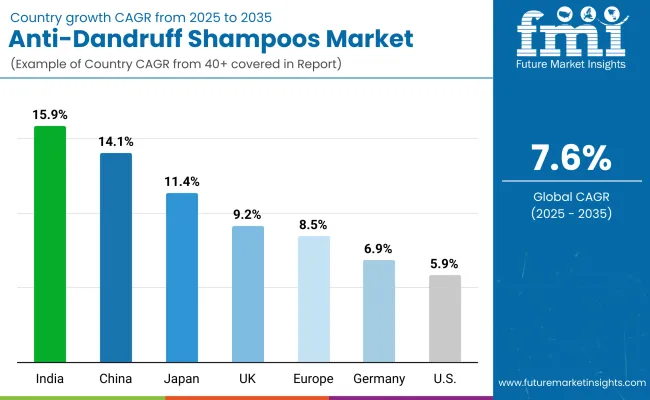

| Countries | Estimated CAGR (2025 to 2035) |

|---|---|

| China | 14.1% |

| USA | 5.9% |

| India | 15.9% |

| UK | 9.2% |

| Germany | 6.9% |

| Japan | 11.4% |

| Europe | 8.5% |

China and India stand out as the fastest-growing markets, with CAGRs of 14.1% and 15.9%, respectively. Growth in these countries is fueled by rapid urbanization, rising disposable incomes, and increasing consumer awareness of scalp health as part of holistic grooming. India’s expansion is particularly sharp due to strong adoption among younger demographics and high exposure to humid climatic conditions, which amplify dandruff prevalence.

Pharmacies, local retailers, and e-commerce platforms are emerging as key channels, while international brands like Head & Shoulders and Dove are competing with domestic players that emphasize affordability. In China, e-commerce platforms such as Tmall and JD.com are accelerating premium shampoo sales, with consumers showing strong preference for dermatologist-backed and specialized formulations that target oily and color-treated hair.

In contrast, developed markets such as the USA, UK, Germany, and Japan are recording more moderate growth trajectories, with CAGRs of 5.9%, 9.2%, 6.9%, and 11.4%, respectively. In these regions, the market is already highly penetrated, and growth is being driven less by volume expansion and more by premiumization and product diversification. In the USA, dermatologist-endorsed products like Nizoral maintain steady demand through pharmacies and drugstores, while subscription-based e-commerce sales are rising among urban consumers.

In Europe, stricter regulatory oversight, including restrictions on zinc pyrithione, has slowed momentum, prompting companies to reformulate with safer alternatives such as salicylic acid or selenium sulfide. Japan shows stronger growth potential at 11.4% CAGR, supported by consumers’ affinity for high-quality, functional shampoos that integrate scalp care with broader haircare routines. Overall, these variations highlight the dual nature of the market: volume-driven acceleration in emerging Asia and premium-led stability in mature Western economies.

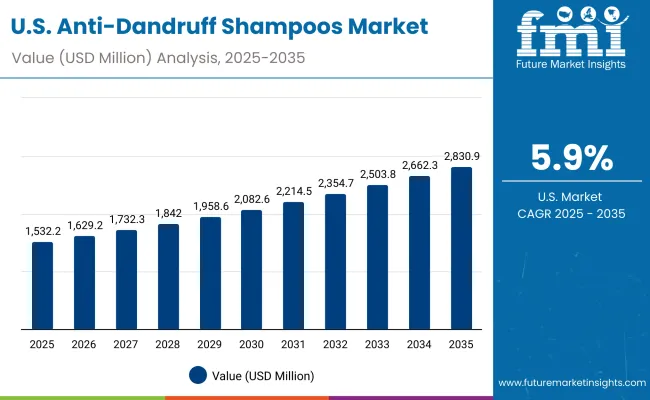

| Year | USA Anti-Dandruff Shampoos Market (USD Million) |

|---|---|

| 2025 | 1532.2 |

| 2026 | 1629.2 |

| 2027 | 1732.4 |

| 2028 | 1842.0 |

| 2029 | 1958.7 |

| 2030 | 2082.7 |

| 2031 | 2214.5 |

| 2032 | 2354.7 |

| 2033 | 2503.8 |

| 2034 | 2662.4 |

| 2035 | 2830.9 |

The Anti-Dandruff Shampoos Market in the United States is projected to grow at a CAGR of 5.9%, led by stable demand across both pharmacy and supermarket channels. Zinc pyrithione-based shampoos remain the most widely used, with USA consumers showing strong loyalty to Head & Shoulders and Nizoral. Growth is further supported by premium segments, particularly dermatologist-recommended products marketed through drugstores. E-commerce is expanding as consumers shift toward subscription models and personalized scalp-care solutions, although offline retail remains the backbone of volume sales.

The Anti-Dandruff Shampoos Market in the United Kingdom is expected to grow at a CAGR of 9.2%, supported by innovation in premium formulations and expanding consumer focus on scalp wellness. Local growth is tied to rising adoption of salon-exclusive and e-commerce-led offerings, with brands like Dove and Paul Mitchell increasing their presence in specialist retail. Heritage drugstore chains such as Boots and Superdrug continue to stock mainstream leaders, while niche botanical and sulfate-free shampoos are carving out new premium segments. Government-backed consumer safety regulations are pushing reformulations, especially with the zinc pyrithione ban in Europe, encouraging uptake of salicylic acid and selenium sulfide shampoos.

India is witnessing rapid growth in the Anti-Dandruff Shampoos Market, which is forecast to expand at a CAGR of 15.9% through 2035, the highest among major countries. Demand is being driven by high dandruff prevalence due to tropical climates, rising awareness among urban millennials, and expanding reach of FMCG distribution networks into tier-2 and tier-3 cities. Affordable zinc pyrithione shampoos dominate mass sales, while premium segments such as ketoconazole-based therapeutic shampoos are growing strongly in pharmacies. E-commerce adoption is fast, with Flipkart and Amazon becoming key platforms for younger consumers seeking premium and international brands.

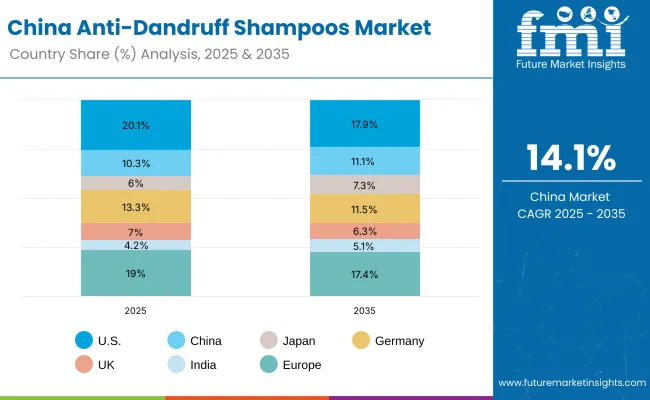

| Countries | 2025 Share (%) |

|---|---|

| USA | 20.1% |

| China | 10.3% |

| Japan | 6.0% |

| Germany | 13.3% |

| UK | 7.0% |

| India | 4.2% |

| Europe | 19.0% |

| Countries | 2035 Share (%) |

|---|---|

| USA | 17.9% |

| China | 11.1% |

| Japan | 7.3% |

| Germany | 11.5% |

| UK | 6.3% |

| India | 5.1% |

| Europe | 17.4% |

The Anti-Dandruff Shampoos Market in China is expected to grow at a CAGR of 14.1%, making it one of the fastest-growing regions globally. Growth is powered by digital-first consumer behavior, strong adoption of scalp health solutions in urban centers, and the rapid rise of e-commerce channels like Tmall, JD.com, and Douyin. Normal hair anti-dandruff shampoos dominate with 38.3% share in 2025, but specialized offerings for oily and color-treated hair are recording sharp growth. Domestic and international brands are competing aggressively, with Head & Shoulders maintaining mass-market leadership while Chinese brands are gaining share by offering botanical, sulfate-free, and dermatologist-endorsed alternatives at competitive prices.

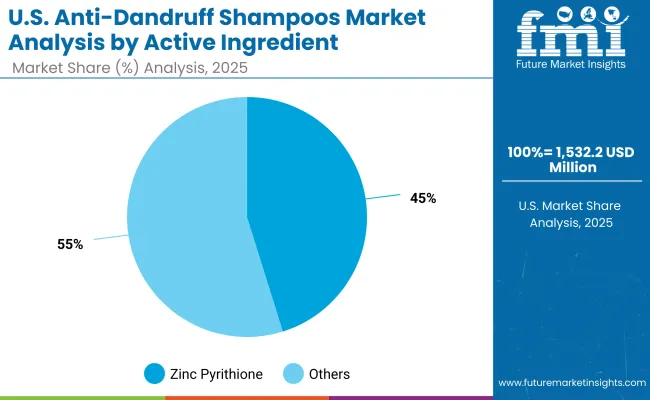

| Active Ingredient Segment | Market Value Share, 2025 |

|---|---|

| Zinc pyrithione | 45.2% |

| Others | 54.8% |

The Anti-Dandruff Shampoos Market in the United States is projected at USD 1,532.2 million in 2025. Zinc pyrithione contributes 45.2%, while other ingredients such as ketoconazole, selenium sulfide, and coal tar collectively hold 54.8%, which shows a gradual transition toward broader active ingredient portfolios. This reflects USA consumer demand for clinically validated and dermatologist-recommended alternatives, particularly in pharmacies and drugstores. Unlike zinc pyrithione, ketoconazole and selenium sulfide are often marketed as higher-strength solutions, appealing to consumers facing chronic dandruff or seborrheic dermatitis.

The growing role of e-commerce subscriptions and D2C platforms has created recurring revenue streams, in contrast to the one-time purchase model common in mass retail. Leading brands such as Nizoral, Neutrogena T/Gel, and Scalpe have gained traction by emphasizing credibility and therapeutic positioning. At the same time, mainstream FMCG players like Head & Shoulders and Dove continue to dominate supermarkets and hypermarkets, leveraging brand equity and large-scale promotional reach. This dual channel dynamic, with mass-market hardware-style dominance complemented by specialist therapeutic adoption, positions the USA market for steady, long-term expansion.

| Hair Type Segment | Market Value Share, 2025 |

|---|---|

| Normal | 38.3% |

| Others | 61.7% |

The Anti-Dandruff Shampoos Market in China is valued at USD 783.1 million equivalent in 2025, with normal hair formulations leading at 38.3%, followed by specialized shampoos for oily, dry & flaky, and color-treated hair at 61.7%. The dominance of normal hair shampoos reflects consumer preference for multi-purpose, affordable solutions in mass retail and e-commerce, while premium growth is being fueled by specialized categories. Chinese consumers are increasingly opting for salon-exclusive lines, botanical ingredients, and sulfate-free shampoos, especially those designed for oily scalp types, which are more prevalent due to environmental and climatic factors.

This advantage positions specialized hair-type shampoos as an essential premium growth lever, supported by e-commerce platforms such as Tmall, JD.com, and Douyin that amplify brand discovery and influencer-led adoption. International players like Head & Shoulders and Dove dominate volume sales, while domestic competitors are gaining ground through localized pricing, herbal claims, and dermatologist endorsements. As digital-first consumers increasingly demand personalization and rapid delivery, online-exclusive bundles and subscription-based scalp care kits are becoming mainstream growth drivers in China.

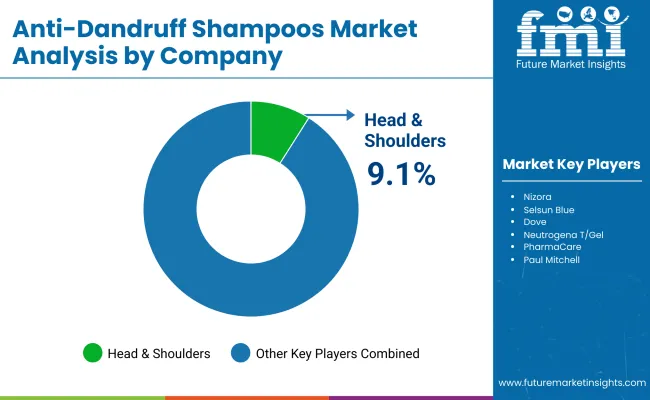

The Anti-Dandruff Shampoos Market is moderately fragmented, with global leaders, FMCG multinationals, and dermatology-focused specialist brands competing across diverse consumer segments. Head & Shoulders (P&G) holds the largest single global share at 9.1% in 2025, driven by its unmatched distribution network, strong brand recall, and continued investment in zinc pyrithione-based mass-market solutions. Its strategy emphasizes multipack promotions in supermarkets, combined with digital campaigns targeting younger demographics.

Other major FMCG players, including Dove (Unilever) and Neutrogena (Johnson & Johnson), are leveraging brand trust to capture mid-premium consumers. Their focus is on sulfate-free, dermatologist-tested, and multipurpose scalp care lines, appealing to health-conscious and premium buyers. Specialist therapeutic brands such as Nizoral and Scalpe are strengthening their foothold in pharmacies and online retail by emphasizing medical efficacy and clinical positioning. Meanwhile, salon-oriented players like Redken and Paul Mitchell are gaining visibility through premium haircare partnerships and e-commerce channels targeting professional users.

Competitive differentiation is shifting away from single-ingredient mass-market dominance toward integrated ecosystems of dermatologist endorsement, clean-label claims, subscription-based online models, and salon partnerships. The battleground is increasingly being defined by the ability to balance mass accessibility with premium credibility, as consumers worldwide demand both efficacy and personalization in anti-dandruff care.

Key Developments in Anti-Dandruff Shampoos Market

| Item | Value |

|---|---|

| Quantitative Units | USD Million |

| Active Ingredient | Zinc pyrithione, Ketoconazole, Salicylic acid, Coal tar, Selenium sulfide |

| Hair Type | Normal, Oily, Dry & flaky, Color-treated |

| Channel | Supermarkets & hypermarkets, Pharmacies & drugstores, E-commerce, Salons |

| End User | Men, Women, Unisex |

| Regions Covered | North America, Europe, East Asia, South Asia & Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | Head & Shoulders (P&G), Nizoral, Selsun Blue, Dove, Neutrogena T/Gel, The Body Shop, PharmaCare (Alpecin), Scalpe, Redken, Paul Mitchell |

| Additional Attributes | Dollar sales by active ingredient and hair type, adoption trends in e-commerce and subscription-based sales, rising demand for scalp-health-focused and sulfate-free formulations, sector-specific growth in men’s grooming, women’s premium care, and unisex daily-use categories, revenue segmentation by mass-market vs premium shampoos, integration with digital-first retail platforms, regional trends influenced by dermatology recommendations and regulatory bans, and innovations in zinc pyrithione alternatives, botanical blends, and salon-grade formulations. |

The Anti-Dandruff Shampoos Market is estimated to be valued at USD 7,605.8 million in 2025.

The market size for the Anti-Dandruff Shampoos Market is projected to reach USD 15,809.2 million by 2035.

The Anti-Dandruff Shampoos Market is expected to grow at a 7.6% CAGR between 2025 and 2035.

The key product types in the Anti-Dandruff Shampoos Market are shampoos based on zinc pyrithione, ketoconazole, salicylic acid, coal tar, and selenium sulfide.

In terms of active ingredient, the zinc pyrithione segment is expected to command 41.6% share in the Anti-Dandruff Shampoos Market in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Sulfate-Free Shampoos Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Dandruff Control Shampoos Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA