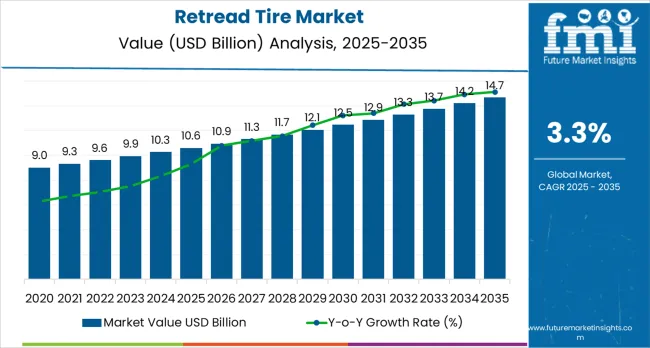

The global retread tire market is anticipated to grow from USD 10.6 billion in 2025 to approximately USD 14.7 billion by 2035, recording an absolute increase of USD 4.07 billion over the forecast period. This translates into a total growth of 38.1%, with the market forecast to expand at a CAGR of 3.3% between 2025 and 2035. The overall market size is expected to grow by nearly 1.38 times during the same period, supported by an increasing focus on initiatives, growing commercial fleet operations, and rising demand for cost-effective tire solutions across various vehicle categories and industrial applications.

Between 2025 and 2030, the global market is projected to expand from USD 10.6 billion to USD 12.5 billion, resulting in a value increase of USD 1.9 billion, which represents 45.2% of the total forecast growth for the decade. This phase of growth will be shaped by accelerating eco-friendly mandates across transportation sectors, increasing adoption of circular economy principles in tire manufacturing, and growing recognition of retreading as a viable solution for reducing carbon footprint. Commercial fleet operators are investing in comprehensive tire management programs that prioritize retreading to optimize operational costs while meeting environmental compliance requirements.

From 2030 to 2035, the market is forecast to grow from USD 12.5 billion to USD 14.7 billion, adding another USD 2.2 billion, which constitutes 54.8% of the overall ten-year expansion. This period is expected to be characterized by expansion of digital tire monitoring systems enabling predictive maintenance and optimal retreading decisions, integration of advanced materials improving retread durability and performance, and development of automated retreading processes enhancing quality consistency. The growing focus on total cost of ownership optimization and environmental will drive demand for premium retread solutions across passenger vehicle, commercial transport, and off-road equipment segments.

Technological advancements in retreading processes are also contributing to market growth. Innovations in tread materials, curing techniques, and tire casing inspection systems have improved the quality and safety of retread tires, making them more competitive with new tires. Modern retread tires are now capable of offering comparable performance to new tires in terms of durability, safety, and fuel efficiency. These advancements have increased consumer confidence in retread products, particularly in sectors such as aviation, mining, and agriculture, where tire performance is critical.

The expanding adoption of retread tires in emerging markets, where cost sensitivity and environmental concerns are growing, will further drive market expansion. Additionally, innovations in tire retreading technology and growing awareness about the benefits of retreading in terms of both cost and sustainability will continue to contribute to market growth in the coming years.

| Metric | Value |

|---|---|

| Market Value (2025) | USD 10.6 billion |

| Market Forecast Value (2035) | USD 14.7 billion |

| Forecast CAGR (2025-2035) | 3.3% |

Market expansion is being supported by the increasing focus on environmental across transportation sectors and the corresponding need for circular economy solutions that reduce raw material consumption and carbon emissions. Modern fleet operations require cost-effective tire management strategies that balance performance, safety, and environmental responsibility. The proven reliability and performance characteristics of quality retread tires make them essential components in comprehensive fleet management programs where operational efficiency and are critical priorities.

The growing recognition of total cost of ownership benefits is driving demand for retread tire solutions from certified manufacturers with proven track records of quality and performance. Fleet operators are increasingly investing in retreading programs that offer substantial cost savings compared to new tire procurement while delivering comparable performance and safety characteristics. Regulatory incentives and industry certifications are establishing quality benchmarks that favor professional retreading operations with advanced process controls and comprehensive quality assurance systems.

The expansion of commercial transportation and logistics sectors globally is creating steady demand for cost-effective tire solutions that can withstand demanding operational conditions. Long-haul trucking, regional delivery services, and industrial equipment operations generate substantial tire replacement requirements, making retreading an economically attractive option. Rising raw material costs and supply chain disruptions affecting new tire production are making retreaded alternatives increasingly competitive in terms of both cost and availability.

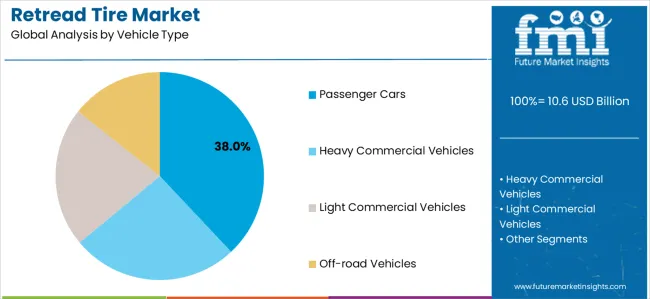

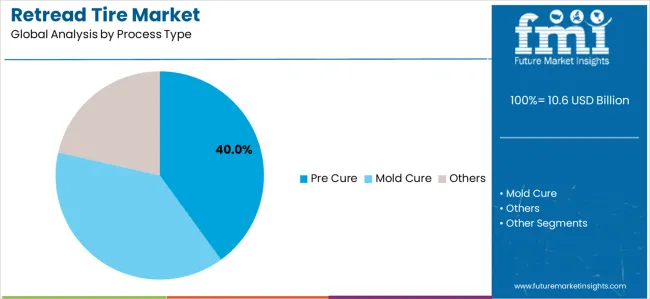

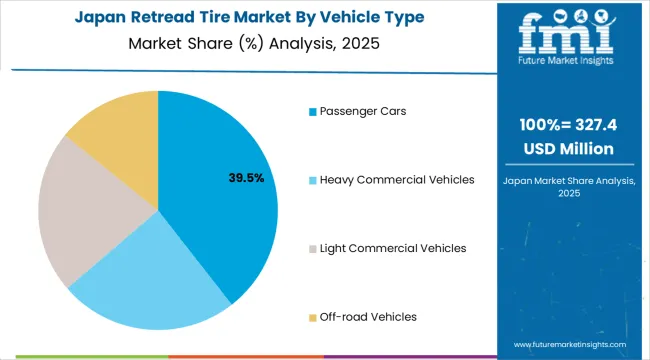

The market is segmented by vehicle type, process type, sales channel, and region. By vehicle type, the market is divided into Passenger Cars, Heavy Commercial Vehicles, Light Commercial Vehicles, and Off-road Vehicles. Based on process type, the market is categorized into Pre Cure, Mold Cure, and Others. By sales channel, the market is segmented into Independent Service Providers and Original Equipment Manufacturers (OEM). Regionally, the market is divided into North America, Europe, Asia-Pacific, Latin America, and Middle East &Africa.

Passenger Cars are projected to account for 38% of the global retread tire market in 2025. This leading share is supported by the large global passenger vehicle population and increasing consumer awareness of environmental benefits and cost savings associated with quality retread tires. The passenger car segment benefits from growing acceptance of retreading among environmentally conscious consumers and fleet operators managing taxi services, ride-sharing operations, and corporate vehicle fleets. Technological advancements in passenger car tire retreading have significantly improved performance characteristics, making retreaded tires increasingly comparable to new alternatives in terms of safety, durability, and ride quality.

Modern passenger car retreading processes incorporate advanced inspection technologies, precision manufacturing techniques, and high-quality materials that ensure consistent performance across diverse driving conditions. The segment particularly benefits from urban mobility trends and increasing vehicle utilization rates in car-sharing and mobility-as-a-service applications, where operational cost optimization is critical. Environmental regulations and initiatives in major markets are creating favorable conditions for passenger car retread adoption, as consumers and fleet operators seek to reduce their carbon footprint while maintaining safe and reliable transportation.

The growing focus on circular economy principles in automotive sectors is encouraging vehicle manufacturers and mobility service providers to incorporate retreading into their strategies. The segment also benefits from certification programs and quality standards that provide consumer confidence in retread tire performance and safety characteristics.

Pre Cure and Mold Cure processes collectively are projected to account for over 70% of the global retread tire market in 2025. Pre Cure retreading, which involves applying a pre-cured tread rubber to prepared tire casings, offers advantages in production flexibility, consistent quality, and wide applicability across different tire sizes and patterns. This process is particularly favored for commercial vehicle applications due to its ability to deliver consistent performance characteristics and efficient production throughput. The technology enables retreaders to maintain inventory of pre-cured treads in various patterns and compounds, facilitating rapid response to customer requirements.

Mold Cure retreading, where uncured rubber is applied to the tire casing and then cured in a mold, provides advantages in tread-to-casing adhesion and the ability to create custom tread designs. This process is often preferred for specialized applications including off-road equipment and specific commercial vehicle requirements where customized tread patterns enhance performance. Both processes benefit from ongoing technological improvements in rubber compounds, bonding systems, and curing technologies that enhance retread durability and performance.

The dominance of these established processes reflects their proven reliability, widespread industry adoption, and comprehensive quality control capabilities. Modern retreading facilities utilizing Pre Cure and Mold Cure technologies incorporate advanced inspection equipment, automated material application systems, and sophisticated quality assurance protocols that ensure consistent product quality. The segment benefits from continuous process improvements and material innovations that enhance retread performance characteristics and expand application possibilities.

The global retread tire market is advancing steadily due to increasing environmental priorities and growing recognition of retreading economic benefits in fleet operations. The market faces challenges including varying quality perceptions among consumers, competition from lower-cost new tire alternatives in certain markets, and limited retreading infrastructure in emerging economies. Industry certification programs and technological advancement continue to influence quality standards and market development patterns.

The growing deployment of tire pressure monitoring systems (TPMS), telematics solutions, and predictive maintenance platforms is enabling data-driven tire management decisions and optimal retreading timing. Digital technologies provide real-time monitoring of tire condition, tread wear patterns, and operational parameters, allowing fleet managers to maximize casing utilization and identify optimal retreading opportunities. These systems are particularly valuable for large commercial fleets seeking to optimize tire lifecycles while maintaining safety and performance standards.

Modern retreading operations are incorporating innovative rubber compounds, advanced adhesion systems, and precision manufacturing techniques that enhance retread performance and durability. Integration of automated inspection technologies, including shearography and X-ray systems, enables comprehensive casing evaluation and quality assurance. Advanced tread designs incorporating specialized compounds for fuel efficiency, wet traction, and extended wear life are expanding retread application possibilities across diverse operational requirements.

Increasing corporate commitments and regulatory support for circular economy principles are driving adoption of retreading as a key strategy for reducing environmental impact in transportation sectors. Life cycle assessment studies demonstrating significant carbon footprint reduction and resource conservation benefits of retreading are influencing procurement decisions. Industry collaborations focused on developing eco-friendly tire management systems and extended producer responsibility frameworks are creating favorable conditions for retread market expansion.

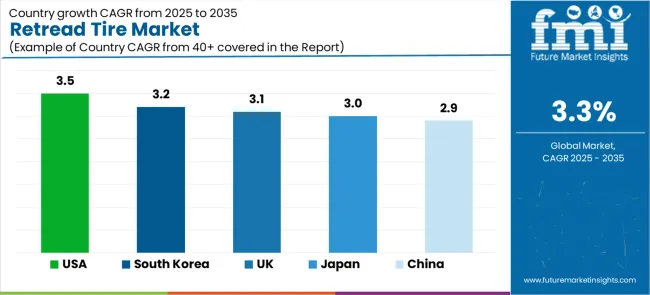

| Country | CAGR (2025-2035) |

|---|---|

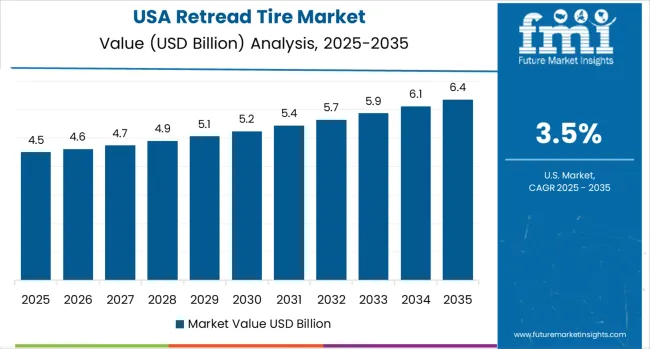

| United States | 3.5% |

| South Korea | 3.2% |

| United Kingdom | 3.1% |

| Japan | 3.0% |

| China | 2.9% |

The global market is growing steadily, with the United States leading at a 3.5% CAGR through 2035, driven by mature commercial trucking sector, established retreading infrastructure, and strong regulatory support for eco-friendly tire management South Korea records solid growth at 3.2%, focusing quality standards and technological innovation. The United Kingdom shows steady expansion at 3.1%, benefiting from established commercial fleet operations and initiatives. Japan demonstrates consistent growth at 3.0%, focusing quality control and precision manufacturing. China maintains 3.0% growth, driven by expanding logistics sector and increasing environmental awareness. India shows 2.9% expansion, supported by growing commercial vehicle population and cost-optimization priorities.

The report covers an in-depth analysis of 40+ countries, top-performing countries are highlighted below.

The United States is projected to exhibit the highest growth rate with a CAGR of 3.5% through 2035, driven by the country's extensive commercial trucking industry representing over 3.5 million Class 8 trucks and well-established retreading infrastructure spanning all major transportation corridors. The United States represents the world's largest retread tire market, supported by widespread industry acceptance, comprehensive quality standards developed over decades, and mature distribution networks connecting hundreds of retreading facilities with fleet operators nationwide. Major commercial fleet operators including long-haul trucking companies such as Schneider National, J.B. Hunt, and Swift Transportation, along with regional delivery services and third-party logistics providers routinely incorporate systematic retreading into comprehensive tire management strategies.

The market benefits from advanced retreading facilities operated by major tire manufacturers'divisions including Bridgestone's Bandag network, Michelin Retread Technologies, and Goodyear's retreading systems, alongside independent service providers utilizing state-of-the-art technologies including automated casing inspection systems, precision tread application equipment, and sophisticated quality control systems ensuring consistent performance. Industry organizations including the Tire Retread &Repair Information Bureau (TRIB) actively promote retreading benefits through educational programs, technical resources, and quality certification initiatives while maintaining comprehensive industry standards and performance specifications. Federal and state regulations supporting green practices including government fleet procurement preferences and total cost of ownership optimization in commercial operations create favorable market conditions that recognize retreading's proven economic and environmental benefits.

South Korea is projected to grow at a CAGR of 3.2%, supported by the country's well-established focus on precision quality manufacturing standards rooted in advanced industrial capabilities and systematic technological innovation in tire retreading operations incorporating cutting-edge automation and materials science. South Korean retreading industry combines world-class manufacturing capabilities derived from the country's broader industrial excellence with rigorous quality control systems implementing comprehensive testing protocols, delivering premium retread products serving demanding domestic commercial transportation markets and growing export opportunities across Asia-Pacific region. The country's well-developed automotive sector including major commercial vehicle manufacturers such as Hyundai Motor Company's truck division and sophisticated commercial transportation infrastructure supporting extensive logistics networks generate consistent demand for cost-effective tire solutions that simultaneously meet high-performance standards expected by quality-conscious fleet operators.

Korean tire manufacturers including industry leaders and specialized retreading companies invest substantially in cutting-edge technologies including fully automated casing inspection systems utilizing advanced imaging technologies, precision robotic material application systems ensuring consistent tread placement and optimal bonding, and sophisticated computer-controlled curing processes delivering uniform product characteristics across production batches. The market benefits significantly from strong government support for environmental initiatives aligned with Korea's ambitious carbon neutrality targets, growing corporate recognition of retreading's substantial economic benefits in competitive commercial transportation markets, and increasing awareness of environmental advantages including reduced carbon footprint and resource conservation supporting circular economy development.

The United Kingdom is projected to grow at a CAGR of 3.1%, supported by well-established commercial fleet operations spanning long-haul transport, regional distribution networks, and urban delivery services, combined with strong national environmental consciousness reflected in ambitious carbon reduction commitments and comprehensive industry quality standards maintained through decades of professional retreading practice. The United Kingdom maintains a mature and sophisticated retreading industry serving exceptionally diverse commercial transportation sectors including road haulage, public bus services, waste management operations, industrial equipment fleets, and specialized agricultural machinery applications. British commercial fleet operators, particularly major logistics companies, parcel delivery services, and public transportation authorities, have historically recognized and systematically captured retreading benefits, with professional trucking companies and bus operators routinely incorporating multiple planned retread cycles into comprehensive tire lifecycle management programs that balance cost optimization, operational performance, and environmental responsibility.

The market benefits substantially from sophisticated fleet management practices incorporating advanced tire pressure monitoring systems, comprehensive preventive maintenance programs, detailed performance tracking, and systematic tire lifecycle optimization that maximize casing quality and retreading potential. Industry organizations including the UK Tyre Manufacturers'Association promote retreading benefits through extensive certification programs, rigorous quality standards aligned with international best practices, and educational initiatives specifically targeting fleet procurement decision-makers, operations managers, and officers. The United Kingdom's firm commitment to achieving net-zero carbon emissions by 2050 and comprehensive circular economy principles embedded in national environmental strategy creates exceptionally supportive policy environment for systematic retreading adoption across commercial and public sectors.

Japan is expanding at a CAGR of 3.0%, driven by the country's deeply ingrained cultural focus on precision manufacturing excellence, systematic quality control methodologies, and continuous technological improvement philosophy (kaizen) systematically applied to tire retreading operations reflecting Japan's broader manufacturing excellence reputation. Japanese retreading industry embodies the nation's renowned manufacturing culture, systematically incorporating sophisticated automated inspection technologies including advanced shearography systems capable of detecting microscopic internal defects, precision computer-controlled material application systems ensuring optimal uniformity, and exceptionally rigorous quality assurance protocols implementing comprehensive testing at multiple production stages. The market serves diverse specialized applications including commercial trucking operations, industrial forklift and material handling equipment, construction machinery, and specialized vehicles requiring high-performance tire solutions capable of meeting demanding operational requirements in terms of durability, safety, and consistent performance.

Japanese companies including major tire manufacturers'retreading divisions and specialized independent operators have methodically developed proprietary retreading technologies incorporating decades of accumulated expertise, advanced rubber compound formulations utilizing cutting-edge materials science, and precision manufacturing processes that systematically deliver superior performance characteristics and extended tire service lifecycles. The country's mature commercial transportation sector, while experiencing modest growth, maintains consistent and stable retread demand driven by persistent operational cost pressures affecting profit margins, increasing fuel expenses, and gradually growing environmental awareness among corporate fleet operators and logistics companies seeking to demonstrate environmental responsibility to stakeholders.

China is projected to grow at a CAGR of 2.9%, supported by the country's massive commercial vehicle population exceeding 30 million units including trucks, buses, and specialized vehicles, combined with rapidly expanding logistics infrastructure development driven by e-commerce boom and domestic consumption growth generating unprecedented freight transportation volumes across extensive national highway networks and urban delivery systems. China's remarkable economic development trajectory and growing middle-class domestic consumption patterns are systematically driving substantial increases in road freight transportation volumes, parcel delivery services, and last-mile logistics operations, collectively creating significant and growing opportunities for commercial tire retreading services addressing massive tire replacement requirements. The Chinese government's increasingly prominent focus on environmental aligned with carbon neutrality commitments targeting 2060, comprehensive circular economy development policies promoting resource efficiency, and waste reduction initiatives is gradually creating more favorable policy environment for retreading industry expansion and modernization.

Domestic tire manufacturers including major players and specialized retreading companies, alongside international retreading service providers and equipment suppliers, are systematically establishing modern production operations in major industrial manufacturing hubs, strategic transportation corridors, and key logistics centers across China's vast geographic expanse. The market continues facing ongoing structural challenges related to quality perception issues among some customer segments, intense price competition from abundant supplies of lower-cost new tire alternatives, and varying standards across fragmented industry, but concerted industry efforts to systematically improve manufacturing standards, implement comprehensive quality assurance systems, and promote quality awareness through education are gradually strengthening overall market development trajectory and building consumer confidence.

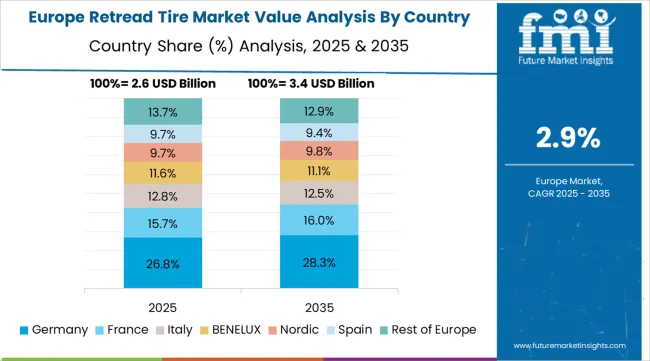

The retread tire market in Europe is projected to grow from USD 3.52 billion in 2025 to USD 4.73 billion by 2035, registering a CAGR of 3.0% over the forecast period. Germany is expected to maintain its leadership with a 26.5% share in 2025, supported by Europe's largest commercial vehicle fleet and advanced retreading infrastructure. France follows with 18.8% market share, driven by strong environmental policies and extensive commercial transportation sector. The United Kingdom holds 16.2% of the European market, benefiting from mature retreading industry and sophisticated fleet management practices. Italy and Spain collectively represent 20.3% of regional demand, with growing focus on initiatives and commercial fleet optimization. The Netherlands maintains 8.7% share, supported by advanced logistics sector and quality-focused retreading operations. The Rest of Europe region accounts for 9.5% of the market, including growing retreading sectors in Poland, Belgium, and Scandinavian countries where environmental consciousness and fleet efficiency priorities drive systematic retread adoption.

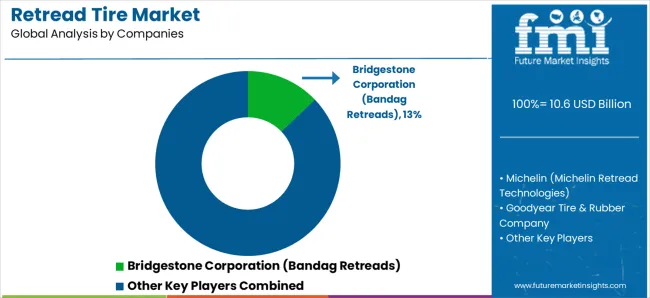

The retread tire market is composed of 12–15 key players, with the top five companies holding 55–60% of the global market share, driven by their technological expertise, vast distribution networks, and long-standing relationships with tire dealers, fleet owners, and distributors. Competition focuses on retread quality, durability, environmental sustainability, and cost-effectiveness, rather than just price. Bridgestone Corporation (Bandag Retreads) leads the market with an 13% share, benefiting from its strong reputation in tire technology, extensive retreading processes, and established relationships with commercial and industrial fleets.

Other major players such as Michelin (Michelin Retread Technologies), Goodyear Tire & Rubber Company, Continental AG (ContiLifeCycle), and Marangoni S.p.A. maintain their competitive edge through advanced retread processes, including hot and cold retreading methods, and a broad range of retreaded tires for commercial vehicles, heavy trucks, and off-the-road applications. Their focus on high-quality materials, tire longevity, and improved fuel efficiency makes them key players in the market.

Challengers like Tire Group International (TGI), Nokian Tyres, Oliver Rubber Company, and Kraiburg Austria GmbH & Co. KG differentiate by offering region-specific retread solutions, cost-effective products, and strong supply chains. Smaller players such as REMA TIP TOP AG, Vipal Rubber, and Hawkinson Tire & Retreading focus on regional markets and provide specialized retreading services with an emphasis on tire performance and customer service, securing a competitive position in emerging markets and specialized industries.

The global retread tire market underpins transportation cost optimization, environmental, resource conservation, and circular economy development. With increasing mandates, rising raw material costs, and demand for total cost of ownership optimization, the sector must balance quality consistency, performance reliability, and market confidence. Coordinated contributions from governments, industry associations, retreading companies, fleet operators, and tire manufacturers will accelerate the transition toward widespread retread adoption and eco-friendly tire lifecycle management.

| Item | Value |

|---|---|

| Quantitative Units | USD 10.6 billion |

| Vehicle Type | Passenger Cars, Heavy Commercial Vehicles, Light Commercial Vehicles, Off-road Vehicles |

| Process Type | Pre Cure, Mold Cure, Others |

| Sales Channel | Independent Service Providers, Original Equipment Manufacturers (OEM) |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East &Africa |

| Country Covered | United States, European Union (Germany, France, UK, Italy, Spain, Netherlands), South Korea, Japan, China, India, and other 40+ countries |

| Key Companies Profiled | Bridgestone Corporation (Bandag Retreads), Michelin (Michelin Retread Technologies), Goodyear Tire & Rubber Company, Continental AG (ContiLifeCycle), Marangoni S.p.A., Tire Group International (TGI), Nokian Tyres, Oliver Rubber Company, Kraiburg Austria GmbH & Co. KG, REMA TIP TOP AG, Vipal Rubber, and Hawkinson Tire & Retreading |

| Additional Attributes | Dollar sales by vehicle type and process type, regional demand trends across North America, Europe, and Asia-Pacific, competitive landscape with major tire manufacturers'retread divisions and independent retreading companies, fleet operator preferences for quality assurance versus cost optimization, integration with digital tire monitoring and fleet management systems, innovations in inspection technologies and retreading processes for enhanced performance and durability, and adoption of eco-friendly tire lifecycle management programs with environmental impact measurement and circular economy principles for improved resource efficiency. |

The global retread tire market is estimated to be valued at USD 10.6 billion in 2025.

The market size for the retread tire market is projected to reach USD 14.7 billion by 2035.

The retread tire market is expected to grow at a 3.3% CAGR between 2025 and 2035.

The key product types in retread tire market are passenger cars, heavy commercial vehicles, light commercial vehicles and off-road vehicles.

In terms of process type, pre cure segment to command 40.0% share in the retread tire market in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Tire Retreading Equipment Market Size and Share Forecast Outlook 2025 to 2035

Tire Marking Machine Market Size and Share Forecast Outlook 2025 to 2035

Tire Pressure Monitoring System Market Size and Share Forecast Outlook 2025 to 2035

Tire Cord Fabric Market Size and Share Forecast Outlook 2025 to 2035

Tire Cobalt Salt Adhesive Market Size and Share Forecast Outlook 2025 to 2035

Tire Curing Bladder Release Agent Market Size and Share Forecast Outlook 2025 to 2035

Tire and Wheel Handling Equipment Market Size and Share Forecast Outlook 2025 to 2035

Tire Changing Machines Market Size and Share Forecast Outlook 2025 to 2035

Tire Pyrolysis Oil Market Size and Share Forecast Outlook 2025 to 2035

Tire Cord and Tire Fabrics Market Size and Share Forecast Outlook 2025 to 2035

Tire Materials Market Insights – Size, Trends & Forecast 2025–2035

Tire Testing Machine Market Size and Share Forecast Outlook 2025 to 2035

Tire & Wheel Cleaners Market Size and Share Forecast Outlook 2025 to 2035

Tire Repair Patch Market Analysis By Type, Application, and Region Through 2035

Tire Inspection System Market - Outlook 2025 to 2035

Tire Curing Press Market Growth - Trends & Forecast 2025 to 2035

Tire Changers - Market Growth - 2025 to 2035,

Tire Cutting Machine Market Trends, Outlook & Forecast 2025 to 2035

Tire Storage Rack Market Growth - Trends & Forecast 2025 to 2035

Tire Cord Market

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA