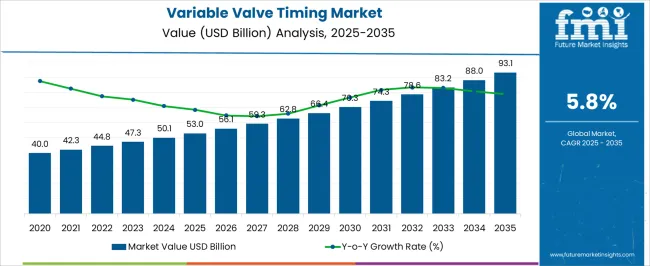

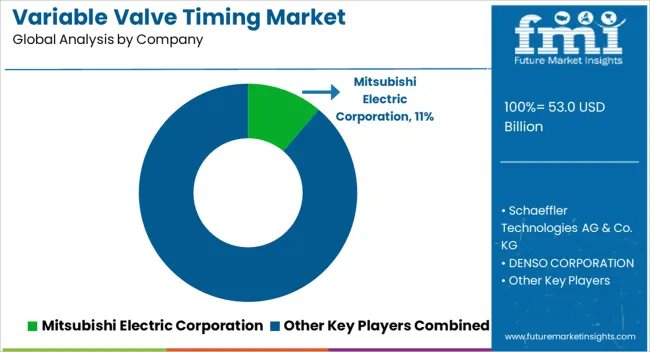

The Variable Valve Timing Market is estimated to be valued at USD 53.0 billion in 2025 and is projected to reach USD 93.1 billion by 2035, registering a compound annual growth rate (CAGR) of 5.8% over the forecast period.

| Metric | Value |

|---|---|

| Variable Valve Timing Market Estimated Value in (2025 E) | USD 53.0 billion |

| Variable Valve Timing Market Forecast Value in (2035 F) | USD 93.1 billion |

| Forecast CAGR (2025 to 2035) | 5.8% |

The variable valve timing market is experiencing significant growth, driven by the increasing demand for enhanced engine performance, fuel efficiency, and emission reduction across the automotive industry. Rising adoption of advanced powertrain technologies and stricter environmental regulations are encouraging manufacturers to integrate variable valve timing solutions in internal combustion engines. The market is being influenced by technological advancements that optimize valve timing dynamically, thereby improving engine torque, reducing fuel consumption, and lowering harmful emissions.

Growing awareness among automakers regarding regulatory compliance and the need to meet corporate average fuel economy targets is further accelerating market adoption. Consumer preference for vehicles that provide superior performance without sacrificing fuel efficiency is also contributing to growth.

Continuous investment in research and development, alongside the expansion of production capacity for automotive powertrain components, is enabling the deployment of innovative variable valve timing technologies across passenger cars, commercial vehicles, and high-performance engines The increasing focus on sustainable mobility solutions ensures the market is positioned for robust expansion over the next decade.

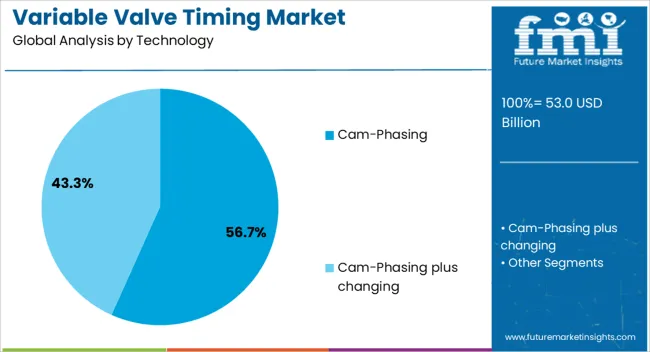

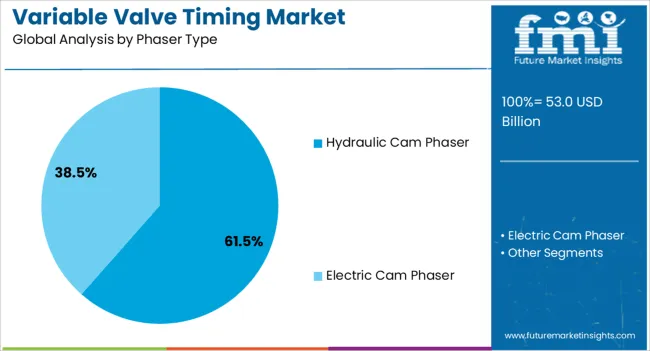

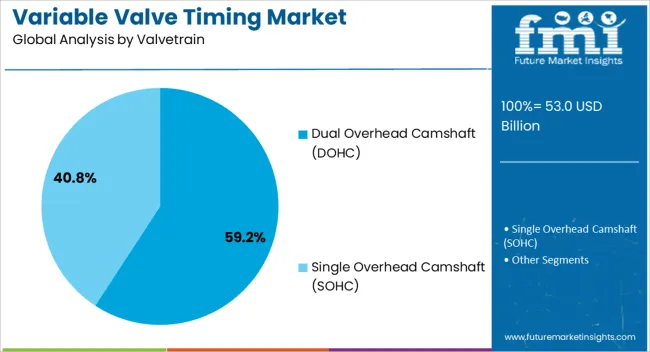

The variable valve timing market is segmented by technology, phaser type, valvetrain, fuel type, vehicle type, and geographic regions. By technology, variable valve timing market is divided into Cam-Phasing and Cam-Phasing plus changing. In terms of phaser type, variable valve timing market is classified into Hydraulic Cam Phaser and Electric Cam Phaser. Based on valvetrain, variable valve timing market is segmented into Dual Overhead Camshaft (DOHC) and Single Overhead Camshaft (SOHC). By fuel type, variable valve timing market is segmented into Gasoline and Diesel. By vehicle type, variable valve timing market is segmented into Passenger Vehicle and Commercial Vehicle. Regionally, the variable valve timing industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The cam-phasing technology segment is projected to hold 56.7% of the variable valve timing market revenue share in 2025, establishing it as the leading technology type. This segment’s leadership is being driven by its ability to adjust valve timing continuously, which enhances engine efficiency and performance across varying speed and load conditions. Cam-phasing provides significant improvements in torque delivery, fuel economy, and emission control, making it the preferred choice for passenger vehicles and commercial engines.

Adoption is further supported by its relative simplicity in design, reliability, and compatibility with multiple engine configurations, including dual overhead camshaft systems. Manufacturers are increasingly leveraging cam-phasing technology to meet stricter fuel efficiency standards and emission norms globally.

Continuous advancements in electronic control mechanisms and precision hydraulic actuation have improved response times and accuracy, enhancing its effectiveness across engine operating conditions As engine manufacturers prioritize balancing performance with environmental compliance, cam-phasing technology is expected to maintain its dominant position in the market.

The hydraulic cam phaser segment is anticipated to represent 61.5% of the variable valve timing market revenue share in 2025, making it the leading phaser type. Its dominance is being reinforced by its high reliability, durability, and precise control over valve timing adjustments under varying engine speeds and loads. Hydraulic cam phasers optimize engine performance by dynamically controlling valve overlap, thereby reducing fuel consumption and emissions while improving power output.

The widespread adoption of hydraulic systems is supported by their ability to integrate with existing internal combustion engine designs without significant structural modifications. Growth is further driven by increasing vehicle production and the demand for engines that meet stringent emission regulations in North America, Europe, and Asia-Pacific regions.

Continuous improvements in hydraulic actuator technology, including faster response times and reduced friction losses, are enhancing the efficiency and effectiveness of this segment As the automotive industry continues to prioritize performance, efficiency, and regulatory compliance, hydraulic cam phasers are expected to remain the preferred solution for variable valve timing applications globally.

The dual overhead camshaft valvetrain segment is expected to hold 59.2% of the variable valve timing market revenue share in 2025, establishing it as the leading valvetrain configuration. Its growth is being driven by the ability to optimize valve timing across multiple intake and exhaust valves, improving airflow, engine efficiency, and combustion performance. DOHC valvetrains provide greater flexibility for variable valve timing technologies, enabling manufacturers to meet the increasing demands for higher power output, reduced emissions, and improved fuel economy.

Adoption is further supported by compatibility with cam-phasing technology and advanced hydraulic systems, allowing precise valve actuation without compromising engine reliability. Growing consumer preference for high-performance vehicles and commercial engines that deliver superior acceleration and efficiency is reinforcing segment growth.

The capability to support multiple valves per cylinder, coupled with advances in lightweight materials and precision machining, enhances performance while reducing engine weight As automotive manufacturers continue to innovate and meet global emission and efficiency standards, the dual overhead camshaft valvetrain is expected to retain its dominant position in the variable valve timing market.

Analysis of the market for variable valve timing from 2025 to 2025 revealed a historical growth rate of less than 5.1% CAGR, with the market expansion being driven by the general expansion of the automotive industry as customers increased spending due to rising disposable incomes.

Initial recessionary downturns brought on by the COVID-19 pandemic resulted in dilation in the supply chain, reduced demand and sales, and production stops or delayed deliveries, shattering growth expectations in the automotive sector. All these are the factors that hampered the automotive market, and also the variable valve market in the pandemic.

However, after the reduced percentage of COVID spread and flattening of infection curves in 2025, the production activities and supply chain resumed with strong demand. As a result of this, FMI’s variable valve timing market demand projection predicts a CAGR of 5.8% by 2035.

The market is growing as a result of a number of factors, including rising hybridization rates, stricter pollution standards in developed and developing nations, and consumer demand for better fuel economy and vehicle performance. A vehicle's variable valve timing system prolongs the life of the engine while advancely enhancing discharges, efficacy, or execution.

Customers want vehicles that are more fuel efficient and have higher overall performance. The engine is the primary factor that affects a vehicle's performance, and the VVT system is utilised to improve this aspect. It has better motor force, a better burn, uses less fuel, emits less pollution, and optimises the motor cycle. Due to these factors, the market is driven by increased demand for VVT systems in the automotive industry.

Additionally, the variable valve timing system aids in adjusting the valve timing in accordance with the IC engine cycle, consequently reducing carbon emissions and ultimately promoting the expansion of the global variable valve timing (VVT) market.

However, it will be harder for a traditional VVT system to provide the necessary level of performance and economy on a stand-alone basis as the fuel economy standards and pollution laws are expected to get substantially stricter. When examining the future of variable valve timing in automobiles, a great desire for new and advanced technology is noticeable.

Although innovative and new technologies have been developed, they must first undergo extensive testing before being used in the regular market. For instance, cam-less Variable Valve Actuation (VVA) systems give the engine's valve train flexibility by providing variable valve event timing, duration, and lift. The market for traditional VVT systems may become constrained in the future due to the emergence of such cutting-edge technologies.

In addition, the increasing use of electric vehicles (EVs) might be seen as the biggest hindrance to the expansion of the global market. Government officials have been particularly concerned about the rising vehicle emissions produced by conventional fuel-based vehicles. Governments are providing financial rewards in the form of subsidies or tax exemptions to individuals buying EVs due to rising global pollution levels.

The market for variable valves is expected to rise due to China's and India's developing automotive industries. Due to the maturity of the automotive sector in Japan and South Korea, the market for VVT is anticipated to expand at a moderate rate.

The Asia Pacific market will rule the sector and experience the highest growth over the coming years. This is because the region's automobile industry includes constantly growing markets including China, Japan, South Korea, and India.

Additionally, rising nations in South Asia and the ASEAN region have a significant demand for VVT systems. The global automotive VVT market in the region is anticipated to experience growth over the forecast period, as a result of rising consumer per capita income, customised financing plans, and decreasing vehicle loan interest rates.

Key players operating in the Variable Valve Timing market include Mitsubishi Electric Corporation, Schaeffler Technologies AG & Co. KG, DENSO CORPORATION, BorgWarner Inc., Hitachi Automotive Systems, Eaton, Hilite International, Mikuni American Corporation, TOYOTA MOTOR CORPORATION, Camcraft, Aisin Seiki Co. Ltd, Continental AG, HUSCO International, Robert Bosch GmbH, Delphi Automotive System Inc, Metaldyne Performance Group Inc., Johnson Controls Inc., Perodua.

The Variable Valve Timing market is highly consolidated as a result of the presence of OEM’s in automotive sector. Key market players are enhancing their regional and worldwide product networks through the introduction of new products, joint ventures, and partnerships with significant industry players.

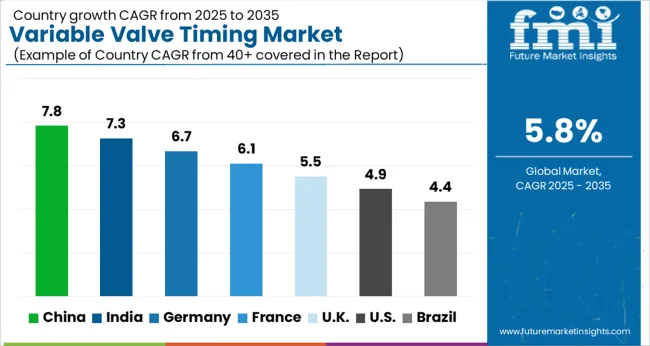

| Country | CAGR |

|---|---|

| China | 7.8% |

| India | 7.3% |

| Germany | 6.7% |

| France | 6.1% |

| UK | 5.5% |

| USA | 4.9% |

| Brazil | 4.4% |

The Variable Valve Timing Market is expected to register a CAGR of 5.8% during the forecast period, exhibiting varied country level momentum. China leads with the highest CAGR of 7.8%, followed by India at 7.3%. Developed markets such as Germany, France, and the UK continue to expand steadily, while the USA is likely to grow at consistent rates. Brazil posts the lowest CAGR at 4.4%, yet still underscores a broadly positive trajectory for the global Variable Valve Timing Market. In 2024, Germany held a dominant revenue in the Western Europe market and is expected to grow with a CAGR of 6.7%. The USA Variable Valve Timing Market is estimated to be valued at USD 19.4 billion in 2025 and is anticipated to reach a valuation of USD 31.4 billion by 2035. Sales are projected to rise at a CAGR of 4.9% over the forecast period between 2025 and 2035. While Japan and South Korea markets are estimated to be valued at USD 2.7 billion and USD 1.4 billion respectively in 2025.

| Item | Value |

|---|---|

| Quantitative Units | USD 53.0 Billion |

| Technology | Cam-Phasing and Cam-Phasing plus changing |

| Phaser Type | Hydraulic Cam Phaser and Electric Cam Phaser |

| Valvetrain | Dual Overhead Camshaft (DOHC) and Single Overhead Camshaft (SOHC) |

| Fuel Type | Gasoline and Diesel |

| Vehicle Type | Passenger Vehicle and Commercial Vehicle |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | Mitsubishi Electric Corporation, Schaeffler Technologies AG & Co. KG, DENSO CORPORATION, BorgWarner Inc., Hitachi Automotive Systems, Eaton, Hilite International, Mikuni American Corporation, TOYOTA MOTOR CORPORATION, Camcraft, Aisin Seiki Co. Ltd, Continental AG, HUSCO International, Robert Bosch GmbH, Delphi Automotive System Inc, Metaldyne Performance Group Inc., Johnson Controls Inc., and Perodua |

The global variable valve timing market is estimated to be valued at USD 53.0 billion in 2025.

The market size for the variable valve timing market is projected to reach USD 93.1 billion by 2035.

The variable valve timing market is expected to grow at a 5.8% CAGR between 2025 and 2035.

The key product types in variable valve timing market are cam-phasing and cam-phasing plus changing.

In terms of phaser type, hydraulic cam phaser segment to command 61.5% share in the variable valve timing market in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Variable Frequency Drive Market Size and Share Forecast Outlook 2025 to 2035

Variable Air Volume System Market Size and Share Forecast Outlook 2025 to 2035

Valve Grinder Market Size and Share Forecast Outlook 2025 to 2035

Valve Seat Inserts Market Size and Share Forecast Outlook 2025 to 2035

Variable Shunt Reactor Market Size and Share Forecast Outlook 2025 to 2035

Timing Gear Market Size and Share Forecast Outlook 2025 to 2035

Variable Displacement Compressor Market Size and Share Forecast Outlook 2025 to 2035

Valve Driver Market Size and Share Forecast Outlook 2025 to 2035

Timing Devices Market Analysis - Size, Growth, & Forecast Outlook 2025 to 2035

Variable Reluctance Sensor Market Size and Share Forecast Outlook 2025 to 2035

Variable Speed Generators Market Analysis & Forecast by Technology, End Use and Region through 2035

Valve Remote Control Systems Market Analysis by Type, Application and Region - Forecast for 2025 to 2035

Variable Data Printing Market Analysis – Growth & Forecast through 2034

Valve Positioner Market Growth – Trends & Forecast (2024-2034)

Valve Cover Gasket Market

Valve Sack Market

ESD Valve Market Forecast and Outlook 2025 to 2035

EGR Valve Market

HVAC Valve Market Size and Share Forecast Outlook 2025 to 2035

Flat Valve Caps And Closures Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA