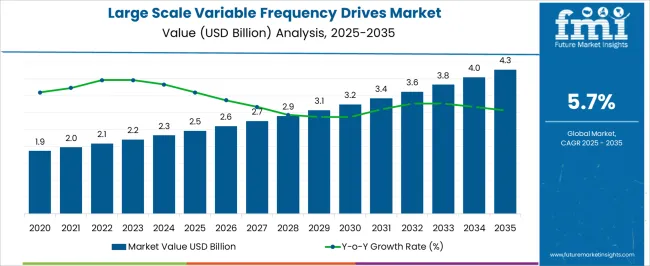

The large scale variable frequency drives market is projected to reach 2.5 billion dollars in 2025 and 4.3 billion dollars in 2035, growing at a CAGR of 5.7% between 2025 and 2035. In the early adoption phase from 2020 to 2024, growth was driven by selective use in heavy industries such as steel, cement, and chemicals, where energy efficiency and motor control were tested in large-scale operations.

As the scaling phase begins in 2025, adoption expands across power generation, water treatment, oil and gas, and large manufacturing facilities. Broader integration into industrial processes, combined with long-term cost savings, encourages greater market penetration. Between 2030 and 2035, the market advances to the consolidation phase, expected to reach 4.3 billion dollars by 2035 while maintaining a CAGR of 5.7%. Leading manufacturers strengthen market presence through partnerships, lifecycle service agreements, and expansion into emerging economies. Smaller suppliers either narrow their focus on specific applications or exit the market. By this stage, most heavy industries adopt VFDs as a standard part of operations, and market growth stabilizes. Companies emphasize reliability, large-scale operational efficiency, and cost competitiveness, shaping a mature, stable, and structured industrial market landscape.

| Metric | Value |

|---|---|

| Large Scale Variable Frequency Drives Market Estimated Value in (2025 E) | USD 2.5 billion |

| Large Scale Variable Frequency Drives Market Forecast Value in (2035 F) | USD 4.3 billion |

| Forecast CAGR (2025 to 2035) | 5.7% |

The large scale variable frequency drives market is supported by a diverse set of parent industries that drive adoption. Heavy Manufacturing leads with around 25% share, including steel, cement, and pulp & paper industries, where precise motor control and energy optimization are critical. Power Generation contributes 20%, with VFDs used for pumps, fans, and auxiliary equipment in thermal and hydroelectric plants. Oil & Gas accounts for 15%, which drives support for drilling rigs, compressors, and refining operations. Water and Wastewater Treatment make up 12%, deploying VFDs for pumps and blowers to ensure stable and efficient operation. Mining and Metals contribute 10%, driven by conveyors, crushers, and ventilation systems in large-scale operations. Chemical and Petrochemical Facilities represent 7%, requiring VFDs for process pumps, mixers, and cooling systems.

Marine and Shipbuilding hold 5%, where drives optimize propulsion and auxiliary machinery. Transportation Infrastructure accounts for 4%, including metro systems and tunnel ventilation. The remaining 2% is spread across specialized industrial applications and R&D projects. Revenue growth reflects sector adoption, expanding from 1.9 billion dollars in 2020 to 2.5 billion in 2025 and projected to reach 4.3 billion by 2035, at a CAGR of 5.7%. Heavy manufacturing, power, and oil & gas remain core demand drivers, while water treatment and infrastructure steadily expand their role.

The large scale variable frequency drives market is expanding steadily, driven by the growing need for energy efficiency, process optimization, and operational cost reduction across heavy industries. Rising electricity costs and stringent environmental regulations are prompting industries to adopt drives that enable precise motor control and significant power savings.

Advancements in power electronics, digital control systems, and predictive maintenance capabilities have further enhanced the performance and reliability of these solutions. Global infrastructure development, especially in oil and gas, water treatment, and manufacturing sectors, is also increasing the demand for high capacity drives.

The outlook remains positive as industrial operators continue to modernize their equipment to meet regulatory requirements, improve productivity, and integrate with Industry 4.0 automation frameworks.

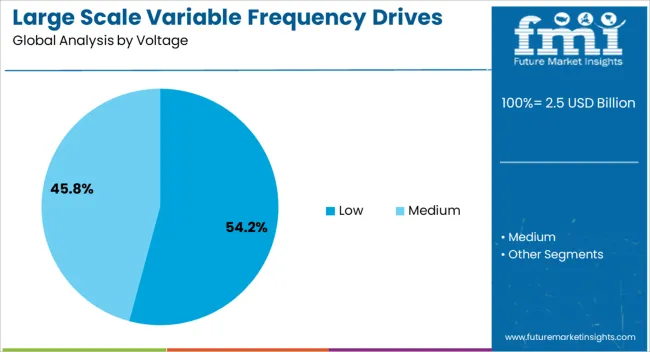

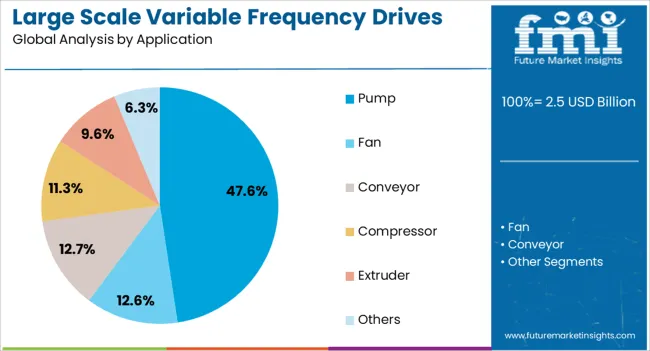

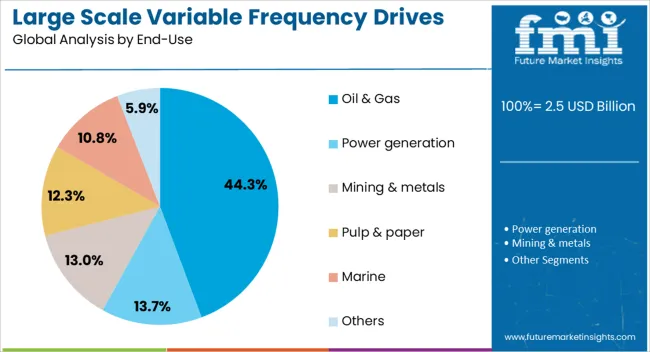

The large scale variable frequency drives market is segmented by voltage, application, end-use, and geographic regions. By voltage, large scale variable frequency drives market is divided into Low and Medium. In terms of application, large scale variable frequency drives market is classified into Pump, Fan, Conveyor, Compressor, Extruder, and Others. Based on end-use, large scale variable frequency drives market is segmented into Oil & Gas, Power generation, Mining & metals, Pulp & paper, Marine, and Others.

Regionally, the large scale variable frequency drives industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The low voltage segment is projected to account for 54.20% of total market revenue by 2025 within the voltage category, making it the leading segment. This dominance is attributed to its widespread adoption in applications where energy savings, precise motor control, and compact design are critical.

Low voltage drives offer cost efficiency, ease of installation, and compatibility with a wide range of motors, making them suitable for various industrial and infrastructure projects.

Their flexibility in retrofitting existing systems and ability to integrate with modern automation solutions have strengthened their market position.

The pump application segment is expected to represent 47.60% of the total market revenue by 2025 within the application category, positioning it as the dominant segment. This growth is driven by the extensive use of pumps in water supply, wastewater treatment, oil and gas processing, and industrial fluid handling.

Variable frequency drives in pump systems allow for precise flow and pressure control, reducing energy consumption and equipment wear.

The increasing global demand for efficient water management and process optimization has reinforced the preference for VFD integration in pump operations.

The oil and gas segment is anticipated to hold 44.30% of total market revenue by 2025 within the end use category, making it the top contributor. The sector’s reliance on heavy duty equipment, coupled with the need to optimize operations in drilling, extraction, and refining, has accelerated the adoption of variable frequency drives.

These drives enhance operational reliability, reduce energy consumption, and enable better process control in harsh environments.

With fluctuating energy prices and a strong focus on sustainability, oil and gas operators are increasingly investing in VFD technology to improve efficiency and reduce operational costs.

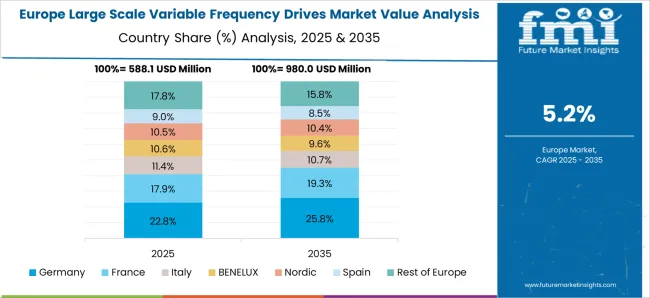

The large scale variable frequency drives (VFD) market is expanding due to rising demand for energy-efficient motor control in heavy industries, power generation, and large-scale infrastructure. North America and Europe lead adoption with advanced, high-voltage VFDs integrated into smart grids, oil & gas, and water treatment plants. Asia-Pacific shows rapid growth driven by manufacturing expansion, urban electrification, and renewable integration.

Manufacturers differentiate through drive capacity, harmonic mitigation, and digital monitoring features. Regional variations in industrialization, regulatory standards, and grid infrastructure shape market adoption.

Adoption of large scale VFDs is strongly influenced by the demand for energy efficiency and reduced operational costs in industries. North America and Europe prioritize drives that optimize motor speed control, reduce energy wastage, and comply with strict efficiency regulations in power plants, refineries, and water networks. Asia-Pacific markets emphasize cost-effective yet efficient drives for expanding manufacturing, steel, and cement industries. Differences in energy efficiency standards, electricity pricing, and industry requirements affect adoption pace and product specification. Leading suppliers offer high-efficiency, digitally monitored VFDs, while regional players focus on practical, affordable solutions. Energy efficiency contrasts shape adoption, cost optimization, and market competitiveness globally.

Demand for high-voltage and large-capacity VFDs significantly drives market growth. North America and Europe emphasize drives capable of managing high-power applications such as offshore platforms, hydroelectric plants, and grid-integrated renewables. Asia-Pacific markets adopt large-capacity drives for heavy manufacturing, mining, and large-scale infrastructure projects. Differences in voltage requirements, application load, and system complexity influence drive design, cooling systems, and integration methods. Leading suppliers deliver advanced drives with harmonic filters, modular construction, and fault-tolerant capabilities, while regional manufacturers provide cost-effective drives with simpler configurations. Voltage and capacity contrasts shape adoption, operational flexibility, and competitive positioning in the global large scale VFD market.

Digital monitoring and integration with smart grid or industrial automation systems are reshaping VFD adoption. North America and Europe prioritize drives with IoT-enabled diagnostics, predictive maintenance, and advanced communication protocols for seamless integration into automated operations. Asia-Pacific markets adopt drives with selective digital features, balancing affordability with connectivity. Differences in digital infrastructure, automation maturity, and data management capabilities affect deployment strategies and adoption. Leading suppliers invest in cloud-enabled VFD platforms with real-time monitoring and predictive fault detection, while regional players focus on practical drives with basic digital tools. Smart integration contrasts shape adoption, operational intelligence, and competitiveness globally.

Regulatory compliance and safety standards are critical in large scale VFD deployment. North America and Europe enforce IEC, IEEE, and industry-specific standards on efficiency, harmonic distortion, and safety in high-voltage operations. Asia-Pacific regulations vary; developed economies enforce international standards, while emerging regions adopt flexible guidelines prioritizing cost and reliability. Differences in compliance requirements, certification processes, and enforcement affect product acceptance, procurement cycles, and user confidence. Leading suppliers provide fully certified, safety-compliant VFDs with extensive testing, while regional manufacturers deliver practical, regulation-aligned alternatives. Regulatory and safety contrasts shape adoption, credibility, and competitiveness in the global market.

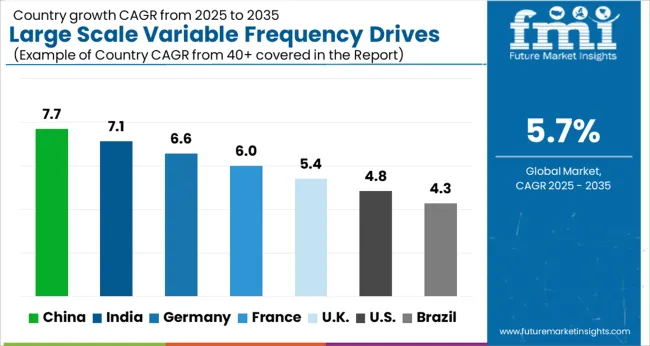

| Country | CAGR |

|---|---|

| China | 7.7% |

| India | 7.1% |

| Germany | 6.6% |

| France | 6.0% |

| UK | 5.4% |

| USA | 4.8% |

| Brazil | 4.3% |

The global large scale variable frequency drives market is projected to expand at a 5.7% CAGR through 2035, driven by applications in power management, industrial automation, and utility operations. Among BRICS nations, China led with 7.7% growth as large-scale production and deployment across manufacturing and energy sectors were undertaken, while India at 7.1% growth broadened installations to support industrial and infrastructure needs. In the OECD region, Germany at 6.6% maintained robust deployment supported by compliance with efficiency standards, while the United Kingdom at 5.4% adopted these systems across commercial and industrial projects. The USA, at 4.8% growth, advanced installations across power distribution and heavy industries under strict operational and safety guidelines. This report includes insights on 40+ countries; the top five markets are shown here for reference.

The large scale variable frequency drives market in China is expected to advance at a CAGR of 7.7%, driven by industrial expansion and rising electricity consumption. Adoption is being strengthened by drives that enhance motor efficiency, lower energy costs, and ensure reliable performance in heavy duty applications. Manufacturers are being encouraged to provide high capacity systems designed for industries such as steel, cement, and chemicals. Distribution is being broadened through partnerships with engineering contractors, system integrators, and utility providers. Research efforts in improved heat dissipation, compact design, and digital control integration are being emphasized. Rapid urban growth, demand for power optimization, and modernization of industrial processes are key contributors to the large scale variable frequency drives market in China.

In India, the large scale variable frequency drives market is projected to grow at a CAGR of 7.1%, supported by industrial modernization and demand for energy efficient motor control systems. Adoption is being accelerated by solutions that regulate motor speed, reduce operational costs, and improve power quality. Manufacturers are being encouraged to supply cost effective and robust systems tailored to Indian industrial requirements. Distribution channels are being expanded through collaborations with electrical contractors, equipment distributors, and large infrastructure projects. Training workshops and awareness campaigns are being promoted to improve knowledge of advanced drive technologies. Rising energy costs, government initiatives to enhance efficiency, and growth of heavy industries are recognized as major drivers of the large scale variable frequency drives market in India.

Germany is experiencing steady growth in the large scale variable frequency drives market at a CAGR of 6.6%, supported by demand for precision control in manufacturing and energy optimization in industrial processes. Adoption is being encouraged by drives that ensure operational stability, lower energy losses, and provide flexible motor control. Manufacturers are being urged to innovate in efficiency, digital monitoring, and remote control features. Distribution through industrial suppliers, automation companies, and authorized dealers is being maintained. Research in advanced cooling systems, compact designs, and intelligent software integration is being pursued. Increasing focus on production efficiency, reduction of electricity consumption, and adoption of smart factory solutions are driving the large scale variable frequency drives market in Germany.

The large scale variable frequency drives market in the United Kingdom is expected to grow at a CAGR of 5.4%, driven by adoption in power distribution, manufacturing, and utility sectors. Adoption is being supported by drives that improve energy efficiency, reduce operating costs, and ensure reliable performance under varying loads. Manufacturers are being encouraged to deliver compact, efficient, and advanced control systems. Distribution channels include authorized suppliers, industrial contractors, and system integration firms. Training sessions and technical workshops are being promoted to improve awareness among plant managers and engineers. Expansion of power distribution networks, rising electricity demand, and modernization of industries are considered important factors for the growth of the large scale variable frequency drives market in the United Kingdom.

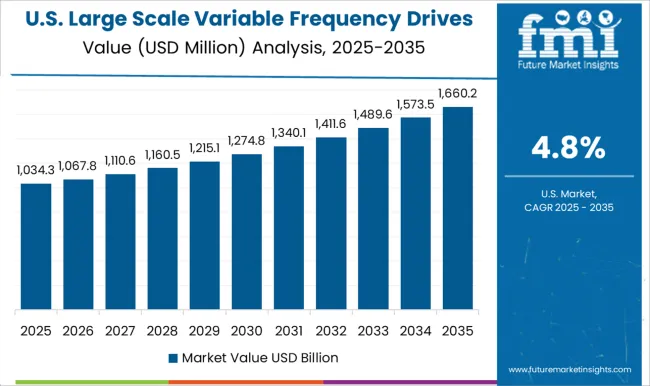

The large scale variable frequency drives market in the United States is projected to expand at a CAGR of 4.8%, supported by rising demand for motor efficiency and reliable power management in industries. Adoption is being encouraged by solutions that lower maintenance needs, improve operational performance, and support flexible speed control. Manufacturers are being urged to provide high performance, durable, and digitally integrated drives. Distribution through authorized suppliers, utilities, and engineering firms is being strengthened. Research in enhanced control algorithms, cloud connectivity, and real time monitoring is being pursued. Expansion of power intensive industries, increasing electricity costs, and modernization of automation processes are recognized as major factors fueling the large scale variable frequency drives market in the United States.

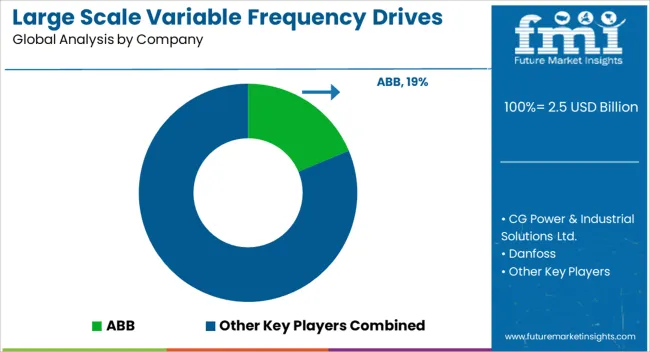

The large scale variable frequency drives (VFD) market is shaped by a mix of global industrial automation leaders, regional drive manufacturers, and specialized solution providers for heavy industries. Leading players such as Siemens, ABB, Schneider Electric, and Rockwell Automation maintain strong market positions by offering a diversified portfolio of high-capacity VFDs for applications in oil & gas, mining, water treatment, power generation, and manufacturing sectors. Competitive differentiation is largely driven by energy efficiency, drive reliability, scalability, advanced motor control features, and integration capabilities with industrial IoT and automation platforms. Regional manufacturers, particularly in Asia-Pacific, compete by providing cost-effective solutions, localized technical support, and customized drives for specific industrial requirements.

Strategic partnerships with system integrators, EPC contractors, and industrial end-users enhance market reach and adoption. Innovation in digital monitoring, predictive maintenance, and high-performance cooling technologies further strengthens competitive positioning. Companies focusing on regulatory compliance, energy-saving certifications, and robust after-sales service networks are poised to capture significant market share.

| Item | Value |

|---|---|

| Quantitative Units | USD 2.5 Billion |

| Voltage | Low and Medium |

| Application | Pump, Fan, Conveyor, Compressor, Extruder, and Others |

| End-Use | Oil & Gas, Power generation, Mining & metals, Pulp & paper, Marine, and Others |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | ABB, CG Power & Industrial Solutions Ltd., Danfoss, Eaton, Fuji Electric Co., Ltd., General Atomics, GE Vernova, Hiconics Eco-energy Technology Co., Ltd., Ingeteam Power Technology, S.A, NIDEC CORPORATION, PARKER HANNIFIN CORP, Rockwell Automation, Schneider Electric, Siemens, TMEIC, TRIOL Corporation, VEM GmbH, WEG, and YASKAWA ELECTRIC CORPORATION |

| Additional Attributes | Dollar sales vary by drive type, including AC, DC, and servo drives; by power rating, spanning medium voltage to high voltage systems; by application, such as pumps, compressors, conveyors, and HVAC; by end-use industry, covering oil & gas, power generation, mining, and manufacturing; by region, led by Asia-Pacific, North America, and Europe. Growth is driven by energy efficiency mandates, industrial automation, and renewable energy integration. |

The global large scale variable frequency drives market is estimated to be valued at USD 2.5 billion in 2025.

The market size for the large scale variable frequency drives market is projected to reach USD 4.3 billion by 2035.

The large scale variable frequency drives market is expected to grow at a 5.7% CAGR between 2025 and 2035.

The key product types in large scale variable frequency drives market are low and medium.

In terms of application, pump segment to command 47.6% share in the large scale variable frequency drives market in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Large-flow Horizontal Sand Mill Market Size and Share Forecast Outlook 2025 to 2035

Large Synchronous Motor Market Size and Share Forecast Outlook 2025 to 2035

Large Mining Shovel Market Size and Share Forecast Outlook 2025 to 2035

Large Spot Fiber Collimator Market Size and Share Forecast Outlook 2025 to 2035

Large Capacity Stationary Fuel Cell Market Size and Share Forecast Outlook 2025 to 2035

Large Industrial Displays Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Large Volume Wearable Injectors Market Growth - Trends & Forecast 2025 to 2035

Large Granular Lymphocytic Leukemia (LGLL) Therapeutics Market - Growth, Demand & Outlook 2025 to 2035

Large Molecule Bioanalytical Testing Services Market - Growth & Demand 2025 to 2035

Large Diameter Steel Pipes Market Growth - Trends & Forecast 2025 to 2035

Large Format Display Market Report – Growth & Trends through 2034

Large Character Printers Market

Large Breed Dog Food Market

Large Scale Bearing Market Size and Share Forecast Outlook 2025 to 2035

Large Scale Natural Refrigerant Heat Pump Market Growth – Trends & Forecast (2024-2034)

Large Scale Medium Voltage Drives Market Size and Share Forecast Outlook 2025 to 2035

Built-in Large Cooking Appliance Market Insights – Growth & Forecast 2025 to 2035

Anaplastic Large Cell Lymphoma (ALCL) Therapeutics Market Size and Share Forecast Outlook 2025 to 2035

Freestanding Large Cooking Appliance Market Trends - Growth & Forecast 2025 to 2035

Descaler Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA