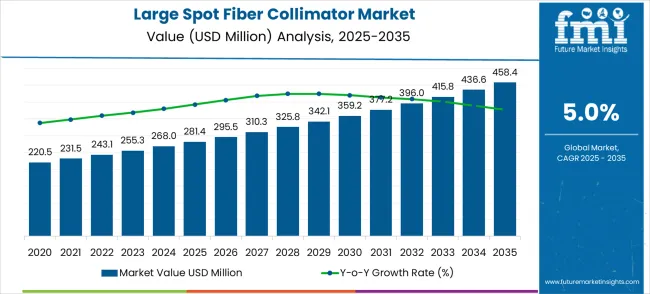

The large spot fiber collimator market is expected to grow from USD 281.4 million in 2025 to USD 458.4 million by 2035, with a compound annual growth rate (CAGR) of 5%. This growth is largely driven by increasing demand for high-precision optical devices in telecommunications, aerospace, and industrial sectors. The steady YoY growth spikes in this market are closely tied to advancements in fiber optic technology, where the demand for more efficient and precise collimation of light signals has surged. As the reliance on fiber-optic networks increases, especially in high-demand applications like 5G rollout and satellite communications, the need for accurate fiber collimators to maintain signal integrity is more critical than ever. Policy changes supporting the expansion of high-speed internet infrastructure, coupled with increasing government investments in communication technologies, are driving the market’s upward trajectory. These shifts provide a clear correlation between market growth and the rising demand for high-quality fiber optics equipment.

A closer look at YoY spikes in the large spot fiber collimator market reveals that consumer trends in advanced telecommunications, coupled with rising demand from the aerospace sector, are contributing factors. As more industries adopt fiber optics for applications such as data transmission and sensor networks, demand for precision instruments like fiber collimators continues to grow. In the aerospace industry, the increasing focus on satellite and communications technology has also been a key driver of growth. As the need for reliable and efficient optical systems becomes even more pressing, both policy shifts and market demands are ensuring that fiber collimators remain a central component of modern optical systems. Thus, the market is positioned to expand consistently over the coming decade, spurred by ongoing technological and consumer demand for higher-performance solutions.

| Metric | Value |

|---|---|

| Estimated Value in (2025E) | USD 281.4 million |

| Forecast Value in (2035F) | USD 458.4 million |

| Forecast CAGR (2025 to 2035) | 5.0% |

The large spot fiber collimator market captures a small share within its parent markets. In the fiber optics market, it accounts for roughly 2.3%, as it plays a crucial role in coupling light between fiber optic systems. Within the optical components market, the share rises to approximately 3.8%, driven by demand for high-precision optical instruments. In the laser equipment market, the collimator holds a modest 1.6%, as it complements laser systems in research and industrial applications. The photonics market, broader in scope, sees the collimator’s share around 1.9%, reflecting its importance in precision optical systems. Lastly, the telecommunications equipment market shows a 2.2% share, as the collimators enable high-quality optical communication. Despite being a niche product, the large spot fiber collimator’s role in these sectors demonstrates its specialized and growing demand in optical applications.

The large spot fiber collimator market is set for steady growth, projected to rise from USD 281.4 million in 2025 to USD 458.4 million by 2035 at a CAGR of 5.0%, driven by advancements in laser processing, precision manufacturing, and medical applications. By 2035, these pathways together represent USD 140–200 million in incremental revenue opportunities.

Pathway A – Continuous Laser Processing. Single-mode fiber collimators are increasingly adopted in precision laser systems for material processing and optical testing, unlocking USD 40–60 million in near-term revenue.

Pathway B – Laser Marking. Multi-mode collimators enable high-speed marking on metals, plastics, and electronics, supporting industrial automation and traceability needs, representing USD 30–50 million.

Pathway C – Laser Cleaning. Fiber collimators for laser cleaning systems reduce surface contamination and enhance industrial maintenance efficiency, creating a revenue pool of USD 20–35 million.

Pathway D – Medical Beauty Applications. Fiber collimators are integral to cosmetic and dermatological laser systems for skin treatment, hair removal, and rejuvenation, offering USD 15–25 million in growth potential.

Pathway E – Emerging Market Adoption. Rapid industrialization in Asia, Latin America, and the Middle East is boosting demand for laser processing technologies, contributing USD 15–20 million.

Pathway F – Custom & High-Power Collimators. Specialized collimators for high-power lasers, telecom, and scientific research create niche opportunities, expected to add USD 10–15 million.

Pathway G – Technology Upgrades & Integration. Smart fiber collimators with adjustable focus, higher stability, and integration with automated laser systems enhance precision and reduce downtime, contributing USD 5–10 million.

Pathway H – OEM & Turnkey Solutions. Offering tailored fiber collimators for OEMs in industrial, medical, and scientific sectors provides incremental growth of USD 5–10 million.

Market expansion is being supported by the rapid increase in high-power laser applications worldwide and the corresponding need for specialized fiber collimators that ensure optimal beam quality and system performance. Modern laser processing operations rely on precise beam collimation and optical alignment to ensure proper execution of cutting, welding, marking, and surface treatment applications. Even minor beam quality degradation can significantly impact processing efficiency and require comprehensive system optimization to maintain optimal performance and application results.

The growing complexity of laser processing applications and increasing demand for higher beam quality are driving demand for professional optical components from established manufacturers with appropriate expertise and quality certifications. Industrial laser users and system integrators are increasingly emphasizing proper beam shaping following application success metrics and customer satisfaction requirements. Performance specifications and beam quality standards are establishing higher requirements for optical components that demand advanced coating technologies and precision manufacturing capabilities.

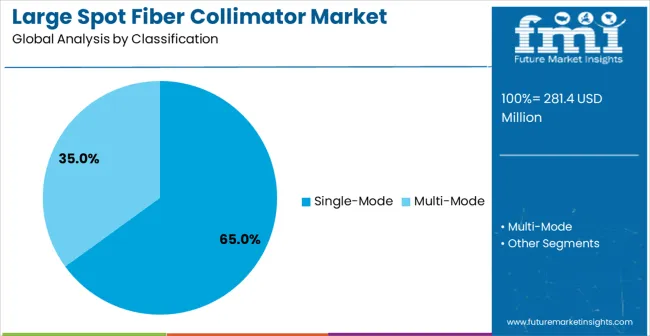

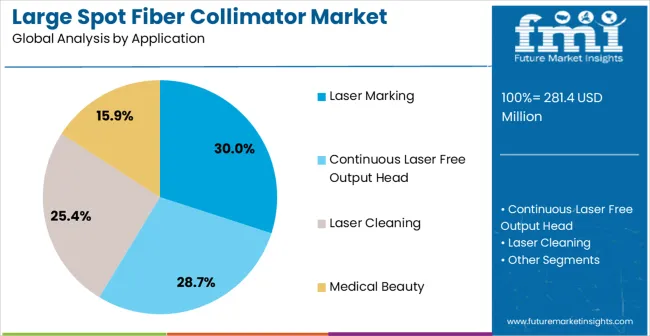

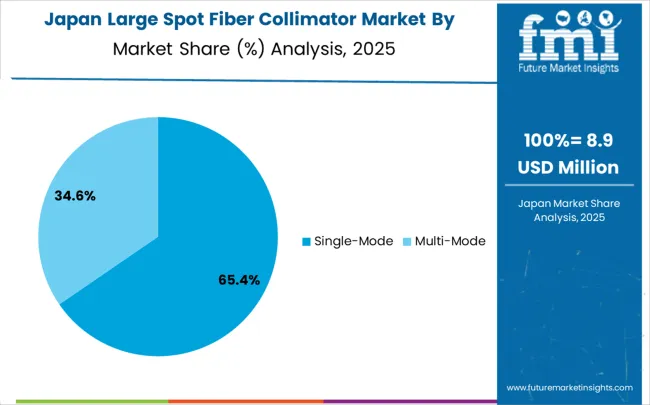

The market is segmented by fiber type, end-use, and region. Single-mode fiber collimators are expected to capture 65% of the market in 2025, driven by their precision in laser applications. The laser marking segment will hold 30% share, fueled by demand for high-quality, permanent markings in industries like automotive and electronics. Regionally, the market is divided into North America, Europe, East Asia, South Asia & Pacific, Latin America, and Middle East & Africa.

Single-mode fiber collimators are projected to account for 65% of the large spot fiber collimator market in 2025. This leading share is supported by the widespread adoption of single-mode fiber systems for high-precision laser applications, which represent the majority of current industrial laser processing operations. Single-mode collimators provide superior beam quality and precise spatial mode control using advanced optical designs and precision manufacturing techniques, making them the preferred solution for most demanding laser processing applications including cutting, welding, and micro-machining. The segment benefits from established optical design principles and comprehensive product availability from multiple specialized manufacturers.

The dominance of single-mode systems reflects their critical importance in maintaining excellent beam quality throughout fiber-coupled laser delivery systems. These collimators excel at preserving the fundamental mode characteristics of single-mode fiber sources, ensuring optimal beam propagation and focus quality for precision processing applications. Their ability to maintain low beam parameter product values makes them essential for applications requiring tight focus spots and high power density.

The laser marking segment is projected to account for 30% of the large spot fiber collimator market in 2025, maintaining a strong position. This significant market share is driven by the increasing adoption of fiber collimators in laser marking applications, especially in manufacturing and industrial sectors. Fiber collimators offer high precision and versatility in laser marking processes, allowing for high-quality, permanent markings on a wide variety of materials. The demand for precise and efficient marking systems across industries such as automotive, electronics, and packaging is expected to continue driving growth in this segment. As laser marking technologies evolve and become more accessible, this segment is poised to maintain its leading role in the market.

The large spot fiber collimator market is expanding due to the increasing demand for high-precision optical devices used in telecommunications, laser systems, and industrial applications. These collimators are essential for ensuring accurate beam alignment and minimizing signal loss. Opportunities are emerging with growing advancements in fiber optic networks and applications in medical lasers. However, challenges remain due to high production costs, complexities in manufacturing, and competition from alternative beam-shaping devices that may provide similar results with less cost.

A significant trend in the large spot fiber collimator market is the increasing demand for customized solutions and advanced coatings. In opinion, manufacturers are focusing on providing collimators with tailored specifications to meet the unique requirements of different applications, such as specific beam diameters, wavelengths, and power levels. Additionally, advanced coatings that enhance performance by reducing surface reflections and improving durability are becoming more common. This trend toward customization ensures that collimators can be effectively used in specialized settings such as laser material processing, medical applications, and research, driving the market’s evolution towards more versatile and high-performance solutions.

The large spot fiber collimator market faces challenges, particularly from high production costs and competition from alternative technologies. In opinion, the precision required in manufacturing these collimators often leads to higher costs, which can limit their accessibility, especially for smaller businesses and emerging markets. Additionally, competing beam-shaping technologies, such as micro-optics and diffractive optical elements, provide similar performance at potentially lower costs. These alternatives are presenting price pressures on the market. Overcoming these challenges will require manufacturers to focus on reducing production costs, optimizing manufacturing processes, and offering a broader range of solutions to meet various customer needs.

| Country | CAGR (2025-2035) |

|---|---|

| China | 6.8% |

| India | 6.3% |

| Germany | 5.8% |

| Brazil | 5.3% |

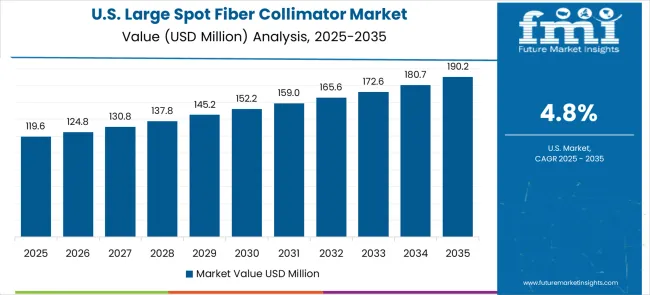

| United States | 4.8% |

| United Kingdom | 4.3% |

| Japan | 3.8% |

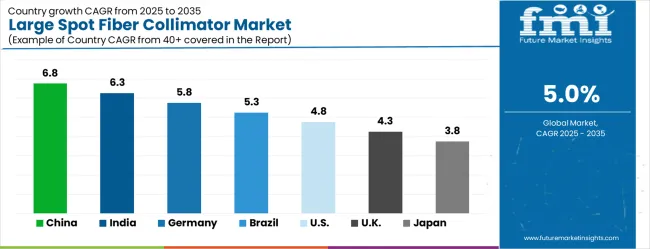

The large spot fiber collimator market is growing rapidly, with China leading at a 6.8% CAGR through 2035, driven by expanding laser manufacturing industry, growing industrial processing adoption, and increasing optical component production capabilities. India follows at 6.3%, supported by rising laser technology investments and increasing precision manufacturing requirements. Germany grows steadily at 5.8%, emphasizing optical engineering excellence, quality standards, and advanced laser system expertise. Brazil records 5.3%, integrating fiber collimator technology into its expanding industrial laser applications. The United States shows growth at 4.8%, focusing on research and development advancement and high-technology manufacturing. The United Kingdom demonstrates growth at 4.3%, supported by photonics research leadership and precision optical manufacturing. Japan maintains expansion at 3.8%, driven by precision manufacturing requirements and optical technology excellence. Overall, China and India emerge as the leading drivers of global Large Spot Fiber Collimator market expansion.

The report covers an in-depth analysis of 40+ countries, the top-performing countries are highlighted below.

The large spot fiber collimator market in China is projected to grow at a CAGR of 6.8%, driven by the country’s strong telecommunications industry and increasing demand for high-performance optical devices. China’s rapid advancements in optical networking, industrial automation, and research activities are fueling the adoption of fiber collimators. The country's focus on improving infrastructure in the communications sector, combined with an expanding R&D base, is expected to continue supporting the growth of the large spot fiber collimator market.

The large spot fiber collimator market in India is growing at a CAGR of 6.3%, supported by the rapid expansion of the telecommunications and electronics industries. As India continues to invest heavily in optical fiber networks, the demand for precision optical components like large spot fiber collimators is increasing. The country’s growing focus on industrial automation, research, and development further strengthens market growth. The increasing number of startups and manufacturers in India focusing on fiber optic technologies is also contributing to the rise in demand for these components.

The large spot fiber collimator market in Germany is expected to grow at a CAGR of 5.8%, driven by the country’s well-established optical technology sector. Germany’s strong presence in industrial automation, telecommunications, and research activities is fueling the adoption of advanced optical components. The demand for large spot fiber collimators is growing in various applications such as fiber optic communication, laser systems, and medical equipment, as industries continue to integrate high-performance optical solutions into their operations.

The large spot fiber collimator market in Brazil is growing at a CAGR of 5.3%, supported by increasing investments in telecommunications infrastructure and industrial automation. As Brazil continues to develop its optical networking capabilities, the demand for high-precision optical components such as fiber collimators is on the rise. The market is further strengthened by the growing use of fiber optics in research and development, and the rise in industries requiring laser-based technologies.

The large spot fiber collimator market in the United States is expected to grow at a CAGR of 4.8%, driven by the country’s robust optical technology and telecommunications sectors. The adoption of fiber optics in industrial automation, research, and medical applications is contributing to the growing demand for fiber collimators. In addition, continued advancements in fiber optic technology and increasing investments in communications infrastructure are expected to further propel the market forward.

The large spot fiber collimator market in the United Kingdom is projected to grow at a CAGR of 4.3%, driven by the increasing adoption of fiber optic technologies in communications and research. The UK's well-established manufacturing and industrial sectors are increasingly integrating high-performance optical components into their operations. The rise of fiber optic communication networks, coupled with advancements in laser technologies, is also contributing to the demand for large spot fiber collimators in the country.

The large spot fiber collimator market in Japan is expected to grow at a CAGR of 3.8%, driven by the country’s emphasis on high-precision optical components in telecommunications and laser systems. Japan’s strong focus on research and development in fiber optics, coupled with the growing adoption of automation and robotics, is driving the demand for fiber collimators. The continued integration of advanced optical technologies in various industries is expected to sustain market growth in Japan.

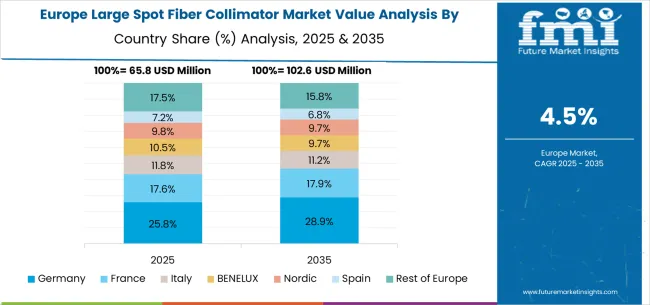

The large spot fiber collimator market in Europe is projected to grow from USD 65.8 million in 2025 to USD 102.6 million by 2035, registering a CAGR of 4.5% over the forecast period. Germany will remain the largest market, expanding from 25.8% in 2025 to 28.9% by 2035, supported by its strong laser technology industry, precision optics leadership, and advanced optical manufacturing ecosystem.

France is expected to contribute 17.6% in 2025, rising to 17.9% by 2035, reflecting stable growth from optical R&D and precision engineering industries. Italy will hold 12.8% in 2025, easing slightly to 12.3% by 2035, showing consistent though slower adoption in industrial and academic optics markets.

The BENELUX region will account for 10.5% in 2025, declining to 9.7% by 2035, reflecting gradual consolidation in specialized optics suppliers. The Nordic countries will represent 9.8% in 2025, decreasing to 9.1% by 2035, reflecting moderate growth despite strong industrial adoption.

Spain is forecast to hold 7.2% in 2025, softening to 6.8% by 2035, reflecting limited expansion in optical manufacturing hubs. Meanwhile, the Rest of Europe will decline from 17.5% in 2025 to 15.8% by 2035, as investment in laser and optical technology remains concentrated in Western Europe.

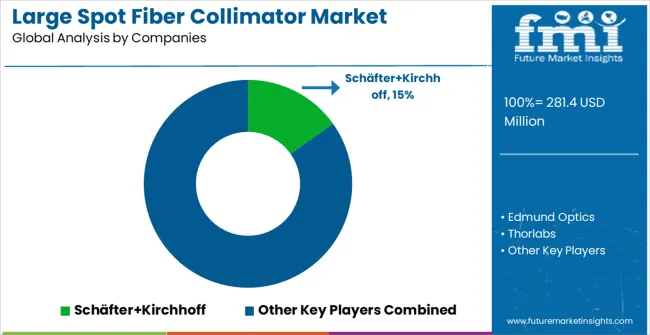

The large spot fiber collimator market is defined by competition among specialized optical component manufacturers, photonics technology companies, and precision engineering providers. Companies are investing in advanced optical design capabilities, precision manufacturing technologies, custom coating development, and comprehensive technical support services to deliver high-performance, reliable, and application-optimized collimation solutions. Strategic partnerships, technological innovation, and global market expansion are central to strengthening product portfolios and market presence.

Schäfter+Kirchhoff provides precision optical components with German engineering excellence and comprehensive technical support. Edmund Optics emphasizes broad product availability, competitive pricing, and extensive global distribution networks. Thorlabs delivers comprehensive photonics solutions with proven reliability and extensive product ecosystems.

IPG Photonics offers integrated optical solutions with advanced fiber laser compatibility and high-power capabilities. OZ Optics provides specialized fiber optic components with technical innovation and custom solutions. Meet Optics, Lumiworks, and Optical Surface deliver precision optical components with specialized applications and regional market expertise. Optikos, LBTEK, Silicon Lightwave, Hobbite, Changchun Sunday Optics, Optizone Technology, CNI Laser, Daheng Optics, Huirui Optics, Castech, OPTO Wide, C.F. Technology, Dimension Labs, and Shanghai Optics offer diverse optical solutions, competitive technologies, and comprehensive market coverage across global and specialized optical component segments.

| Items | Values |

|---|---|

| Quantitative Units | USD 458.4 million |

| Fiber Type | Single-Mode Fiber Collimators and Multi-Mode Fiber Solutions |

| End-Use | Continuous Laser Processing, Laser Marking Systems, Laser Cleaning Applications, and Medical Beauty |

| Regions Covered | North America, Europe, East Asia, South Asia & Pacific, Latin America, Middle East & Africa |

| Countries Covered | United States, Canada, United Kingdom, Germany, France, China, Japan, South Korea, India, Brazil, Australia and 40+ countries |

| Key Companies Profiled | Schäfter+Kirchhoff, Edmund Optics, Thorlabs, IPG Photonics, OZ Optics, Meet Optics, Lumiworks, Optical Surface, Optikos, LBTEK, Silicon Lightwave, Hobbite, Changchun Sunday Optics, Optizone Technology, CNI Laser, Daheng Optics, Huirui Optics, Castech, OPTO Wide, C.F. Technology, Dimension Labs, Shanghai Optics |

| Additional Attributes | Dollar sales by fiber type, end-use application, and wavelength range, regional demand trends across North America, Europe, and Asia-Pacific, competitive landscape with established optical manufacturers and emerging technology providers, buyer preferences for standard versus custom optical solutions, integration with advanced laser systems and beam quality monitoring platforms, and innovations in optical coating technologies |

The global large spot fiber collimator market is estimated to be valued at USD 281.4 million in 2025.

The market size for the large spot fiber collimator market is projected to reach USD 458.4 million by 2035.

The large spot fiber collimator market is expected to grow at a 5.0% CAGR between 2025 and 2035.

The key product types in large spot fiber collimator market are single-mode and multi-mode.

In terms of application, laser marking segment to command 30.0% share in the large spot fiber collimator market in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Large-flow Horizontal Sand Mill Market Size and Share Forecast Outlook 2025 to 2035

Large Synchronous Motor Market Size and Share Forecast Outlook 2025 to 2035

Large Mining Shovel Market Size and Share Forecast Outlook 2025 to 2035

Large Scale Bearing Market Size and Share Forecast Outlook 2025 to 2035

Large Scale Variable Frequency Drives Market Size and Share Forecast Outlook 2025 to 2035

Large Capacity Stationary Fuel Cell Market Size and Share Forecast Outlook 2025 to 2035

Large Scale Medium Voltage Drives Market Size and Share Forecast Outlook 2025 to 2035

Large Industrial Displays Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Large Volume Wearable Injectors Market Growth - Trends & Forecast 2025 to 2035

Large Granular Lymphocytic Leukemia (LGLL) Therapeutics Market - Growth, Demand & Outlook 2025 to 2035

Large Molecule Bioanalytical Testing Services Market - Growth & Demand 2025 to 2035

Large Diameter Steel Pipes Market Growth - Trends & Forecast 2025 to 2035

Large Format Display Market Report – Growth & Trends through 2034

Large Scale Natural Refrigerant Heat Pump Market Growth – Trends & Forecast (2024-2034)

Large Character Printers Market

Large Breed Dog Food Market

Built-in Large Cooking Appliance Market Insights – Growth & Forecast 2025 to 2035

Anaplastic Large Cell Lymphoma (ALCL) Therapeutics Market Size and Share Forecast Outlook 2025 to 2035

Freestanding Large Cooking Appliance Market Trends - Growth & Forecast 2025 to 2035

Blind Spot Monitor Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA