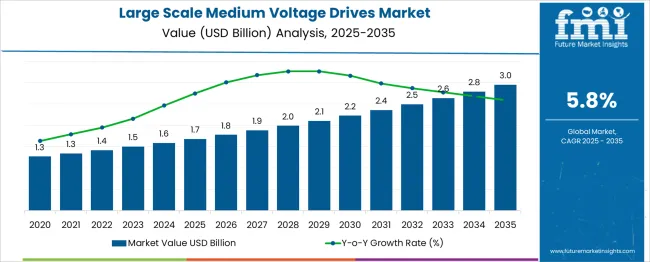

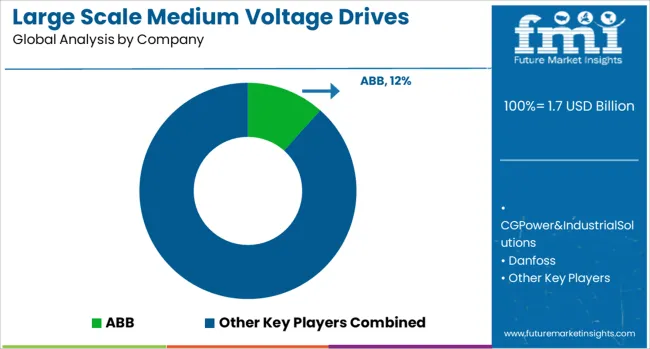

The large-scale medium-voltage drives market is projected to expand from USD 1.7 billion in 2025 to USD 3.0 billion by 2035, adding nearly USD 1.3 billion in absolute opportunity. During 2025 to 2030, the market rises to approx. USD 2.25 billion (nearly USD 0.55 billion gain, approximately 43% of incremental growth). From 2030 to 2035, it increases to approximately USD 3.0 billion (≈ USD 0.73 billion gain, nearly 57% of incremental growth) as industrial automation, energy-efficiency mandates, and power-electronics advances accelerate upgrades across pumps, compressors, fans, and conveyors

| Metric | Value |

|---|---|

| Large Scale Medium Voltage Drives Market Estimated Value in (2025 E) | USD 1.7 billion |

| Large Scale Medium Voltage Drives Market Forecast Value in (2035 F) | USD 3.0 billion |

| Forecast CAGR (2025 to 2035) | 5.8% |

The large scale medium voltage drives market is being shaped by global efforts to enhance energy efficiency and reduce carbon emissions in heavy duty industrial applications. Electrification of high capacity pumps compressors and fans is being prioritized across infrastructure sectors. Market momentum is being generated by government incentives for energy saving and emissions reduction as well as regulatory mandates on industrial energy performance.

Industry leaders are increasingly integrating advanced drive technologies offering variable speed control fault diagnostics and remote monitoring to improve operational uptime and process control. Investment in digitalization and smart grid compatibility is enabling predictive maintenance reducing downtime and lowering life cycle cost.

Growth opportunities are emerging in utilities water treatment and manufacturing where demand for flexible scalable drive systems is rising. Future expansion is expected to be supported by innovations in power semiconductors and integration with renewable power sources further enhancing efficiency reliability and grid compatibility.

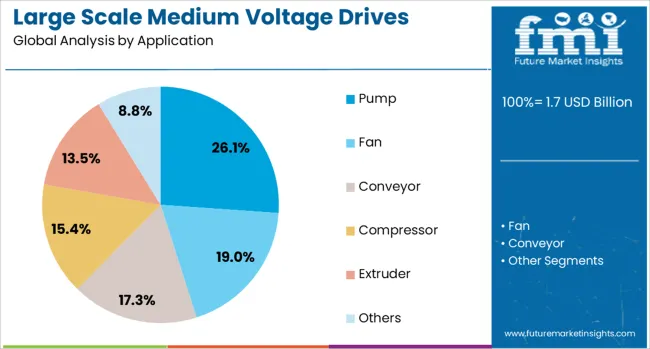

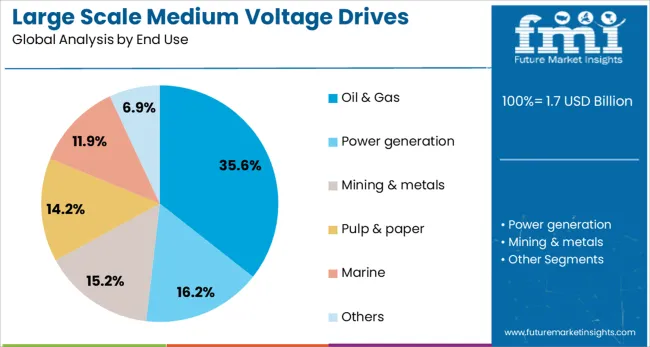

The large scale medium voltage drives market is segmented by application, end use, and geographic regions. By application of the large scale medium voltage drives market is divided into Pump, Fan, Conveyor, Compressor, Extruder, Others. In terms of end use of the large scale medium voltage drives market is classified into Oil & Gas, Power generation, Mining & metals, Pulp & paper, Marine, Others. Regionally, the large scale medium voltage drives industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The pump application segment is anticipated to account for 26.1% of the total revenue in the large scale medium voltage drives market by 2025, making it the leading application segment. This dominance is being driven by the growing use of medium voltage drives in centrifugal pump systems across critical sectors such as water and wastewater, oil and gas, chemical processing, and thermal power generation.

The ability of medium voltage drives to enhance energy efficiency in fluid handling operations has emerged as a key value proposition, especially where variable flow or pressure is required. Energy consumption reduction, reduced mechanical stress on pump components, and enhanced process control have become primary considerations for operators seeking cost optimization.

Moreover, increased infrastructure investment in water distribution and sewage treatment systems, particularly in developing economies, is further accelerating segment demand. Pump systems requiring high starting torque and precise speed control benefit significantly from the implementation of these drives, reinforcing their indispensable role in achieving operational reliability and long-term savings across fluid-intensive industries.

The oil and gas end use segment is expected to capture 35.6% of market revenue in 2025 establishing clear dominance. This trend has been driven by the critical need to control rotating equipment pressures and flow across upstream midstream and downstream operations. Medium voltage drives have been widely adopted for centrifugal compressors pumps and gas processing units enabling precise speed control improved process efficiency and reduced emissions.

The harsh operating environments and remote locations encountered in oil and gas have pushed demand for rugged reliable drive systems with embedded fault diagnostics and remote access. Moreover global investments in production and processing capacity are reinforcing this trend.

Pressure to improve energy efficiency meet sustainability benchmarks and increase throughput has made drives indispensable in facility modernization initiatives. This combination of operational control asset criticality and environmental goals continues to underpin growth in this key industrial segment.

Large scale medium voltage drives are advancing through energy efficiency gains, integration into mission-critical processes, contributions to power quality, and alignment with predictive maintenance strategies. These factors are reinforcing their role in industrial optimization worldwide.

The adoption of large scale medium voltage drives is being driven by the need for higher energy efficiency in industrial applications. These drives allow operators to match motor speed to actual load requirements, reducing energy consumption and operational costs. Industries such as mining, metals processing, water utilities, and oil and gas are increasingly upgrading legacy fixed-speed systems to variable frequency drives to improve productivity while cutting electricity bills. Energy efficiency regulations in many regions are further motivating investments in advanced drive systems. As electricity costs continue to rise, end-users are prioritizing equipment upgrades that deliver both immediate operational savings and long-term reductions in maintenance expenses.

Large scale medium voltage drives have become integral to mission-critical processes where uninterrupted operations are essential. In industries such as steel manufacturing, cement production, and offshore oil extraction, downtime can result in substantial financial losses. These drives offer precise torque and speed control, enabling consistent performance under demanding conditions. Their ability to handle heavy start-up loads, adapt to varying production needs, and protect motors from mechanical stress makes them indispensable in continuous production environments. This reliability factor is encouraging operators to prioritize quality and robustness in drive selection, often favoring suppliers with proven track records in high-demand industrial sectors.

Industrial operations are increasingly relying on large scale medium voltage drives to improve power quality and grid stability. These drives feature harmonic mitigation technologies, regenerative capabilities, and reactive power compensation that help facilities meet grid compliance requirements. In renewable energy applications such as wind farms and pumped hydro plants, they play a vital role in balancing variable energy inputs. Their contribution to reducing voltage fluctuations and improving overall electrical system stability is becoming a key selling point. For operators in regions with unstable power infrastructure, the integration of such drives is also seen as a measure to protect valuable equipment and ensure consistent output.

The adoption of large scale medium voltage drives is being accelerated by their compatibility with predictive maintenance programs. Modern systems can collect and transmit real-time performance data, enabling maintenance teams to identify wear patterns, detect anomalies, and plan interventions before failures occur. This reduces unplanned downtime and extends equipment lifespan, which is crucial for industries with high capital investments in machinery. Predictive capabilities are also improving inventory management for spare parts, ensuring that critical components are available when needed. As industrial facilities adopt more data-driven approaches to operations, the integration of monitoring-enabled drives is becoming a strategic priority.

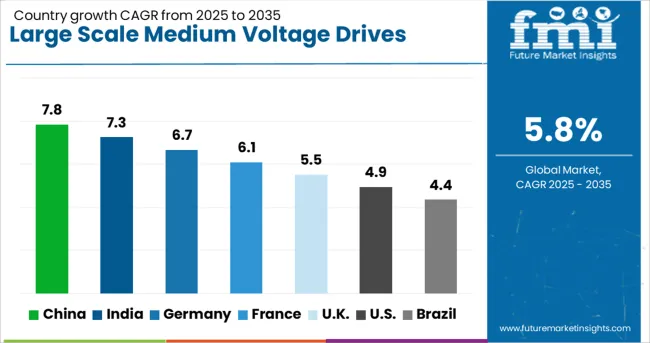

| Country | CAGR |

|---|---|

| China | 7.8% |

| India | 7.3% |

| Germany | 6.7% |

| France | 6.1% |

| UK | 5.5% |

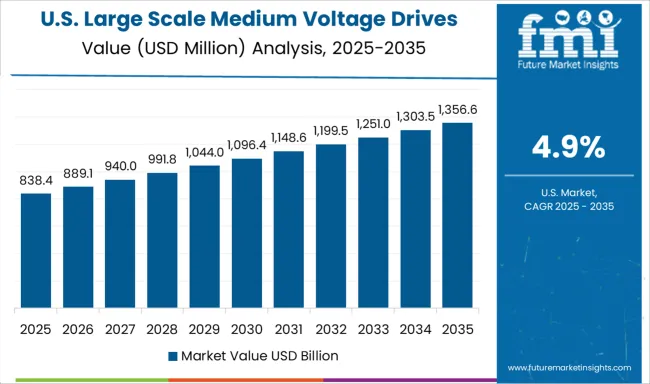

| USA | 4.9% |

| Brazil | 4.4% |

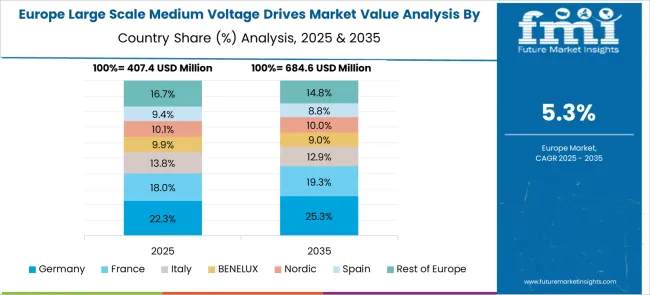

The large scale medium voltage drives sector is forecast to expand globally at a CAGR of 5.8% from 2025 to 2035, driven by rising industrial automation, increased energy efficiency requirements, and modernization of power infrastructure. China leads with a CAGR of 7.8%, propelled by large-scale industrial upgrades, renewable energy integration, and expanding manufacturing capacity. India follows at 7.3%, supported by rapid industrialization, infrastructure development, and strong demand in water treatment, cement, and steel sectors. France records 6.1%, benefitting from grid modernization projects, offshore wind developments, and industrial retrofitting initiatives. The United Kingdom grows at 5.5%, backed by oil & gas sector investments, smart grid deployment, and increased adoption in heavy manufacturing. The United States posts 4.9%, reflecting steady replacement demand, modernization of legacy systems, and expansion in mining and water utility segments. The report covers over 40 countries, with detailed insights into investment patterns, technological integration, and application-specific growth factors influencing large scale medium voltage drives adoption worldwide.

China is expected to grow at 7.8% CAGR during 2025–2035, outpacing the global average of 5.8%. From 2020–2024, the growth rate was about 6.5%, driven by expansion in renewable energy projects, rapid manufacturing capacity additions, and heavy investment in smart industrial facilities. The upward shift in CAGR is linked to accelerated adoption in offshore wind farms, large-scale mining projects, and advanced water treatment plants, coupled with domestic manufacturing of medium voltage drive components that reduces cost and lead times. Strategic government incentives for energy-efficient equipment are further bolstering adoption, especially in heavy industries where operational efficiency directly impacts profitability.

India is projected to register 7.3% CAGR during 2025–2035, compared with about 6.0% during 2020–2024. The earlier period benefited from large infrastructure projects, expansion of cement and steel plants, and upgrades in municipal water facilities. The rise in CAGR is attributed to ongoing industrial automation, expansion of metro rail networks, and capacity additions in the renewable sector, particularly solar and wind power integration requiring advanced drive systems. Growing local manufacturing capabilities are enabling cost-efficient production, while the Make in India initiative is encouraging OEM investments in localized assembly of MV drives. Water scarcity challenges are also fueling demand for high-efficiency pumping systems using MV drives.

France is forecasted to grow at 6.1% CAGR during 2025–2035, higher than the approximately 5.2% recorded during 2020–2024. The initial growth phase was sustained by nuclear power plant maintenance, upgrades in industrial machinery, and retrofitting of manufacturing lines for energy efficiency. The CAGR increase is supported by offshore wind farm deployments, modernization of heavy industrial equipment, and integration of smart grid systems. Strategic investments from both government and private sectors in decarbonizing heavy industry are pushing adoption of MV drives in steel, chemical, and marine sectors. Higher replacement cycles of legacy systems also contribute to steady growth in the forecast period.

The UK is estimated to grow at 5.5% CAGR during 2025–2035, compared to about 4.3% during 2020–2024. The earlier phase saw moderate growth from oil & gas applications, water utility upgrades, and selective investments in manufacturing. The increase in CAGR stems from accelerated offshore wind capacity installations, modernization of industrial plants, and greater adoption in marine propulsion systems. Decarbonization policies and electrification of transport infrastructure are creating new demand for MV drives in rail, port, and large-scale energy storage projects. Improved local service and maintenance capabilities are also supporting higher adoption rates across industries seeking uptime reliability.

The United States is projected at 4.9% CAGR for 2025–2035, compared with around 4.0% during 2020–2024. Earlier growth was anchored by mining, water treatment facilities, and oil & gas sector upgrades. The increase in CAGR is linked to rising investments in renewable integration, modern manufacturing facilities, and large-scale water infrastructure improvements. Replacement of outdated drive systems with energy-efficient solutions is also contributing to market expansion. Growing focus on grid stability and industrial process optimization is expected to sustain demand, particularly in sectors where downtime has high operational costs.

The large scale medium voltage drives industry is characterized by a mix of global industrial giants and specialized power electronics manufacturers, each competing to deliver high-efficiency solutions for critical applications in energy, manufacturing, and infrastructure. ABB maintains leadership through a diverse MV drive portfolio covering mining, marine, and renewables, supported by strong global service networks. Siemens focuses on integrated drive systems, offering advanced control, diagnostics, and energy optimization tailored to heavy industry needs. Schneider Electric emphasizes modular MV drive platforms with strong grid compatibility and industrial automation integration. GE Vernova leverages expertise in renewable energy and grid systems to deliver drives optimized for wind, hydro, and industrial processes.

Fuji Electric stands out with compact, high-reliability MV drives targeting water treatment and steel sectors, while Eaton integrates its power management capabilities into medium voltage drive systems with a focus on safety and grid stability. Rockwell Automation applies its industrial automation expertise to process-specific MV drive solutions, particularly in oil & gas and food processing. Nidec Corporation continues to expand with high-power drive systems aimed at large-scale pumping and marine propulsion. Other players such as WEG, TMEIC, and Yaskawa Electric Corporation invest in R&D for higher energy efficiency, extended service life, and digital monitoring. Strategies include localized production, application-specific customization, and lifecycle service support to strengthen competitiveness in demanding industrial sectors.

| Item | Value |

|---|---|

| Quantitative Units | USD Billion |

| Application | Pump, Fan, Conveyor, Compressor, Extruder, and Others |

| End Use | Oil & Gas, Power generation, Mining & metals, Pulp & paper, Marine, and Others |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | ABB, CGPower&IndustrialSolutions, Danfoss, Eaton, FujiElectric, GeneralAtomics, GEVernova, HiconicsEco-energyTechnology, IngeteamPowerTechnology, NidecCorporation, RockwellAutomation, SchneiderElectric, Siemens, TMEIC, TriolCorporation, VEM, WEG, and YaskawaElectricCorporation |

| Additional Attributes | Dollar sales, share, regional demand trends, competitive positioning, regulatory shifts, technology adoption rates, end-user investment patterns, and long-term capacity expansion forecasts. |

The global large scale medium voltage drives market is estimated to be valued at USD 1.7 billion in 2025.

The market size for the large scale medium voltage drives market is projected to reach USD 3.0 billion by 2035.

The large scale medium voltage drives market is expected to grow at a 5.8% CAGR between 2025 and 2035.

The key product types in large scale medium voltage drives market are pump, fan, conveyor, compressor, extruder and others.

In terms of end use, oil & gas segment to command 35.6% share in the large scale medium voltage drives market in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Large-flow Horizontal Sand Mill Market Size and Share Forecast Outlook 2025 to 2035

Large Synchronous Motor Market Size and Share Forecast Outlook 2025 to 2035

Large Mining Shovel Market Size and Share Forecast Outlook 2025 to 2035

Large Spot Fiber Collimator Market Size and Share Forecast Outlook 2025 to 2035

Large Capacity Stationary Fuel Cell Market Size and Share Forecast Outlook 2025 to 2035

Large Industrial Displays Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Large Volume Wearable Injectors Market Growth - Trends & Forecast 2025 to 2035

Large Granular Lymphocytic Leukemia (LGLL) Therapeutics Market - Growth, Demand & Outlook 2025 to 2035

Large Molecule Bioanalytical Testing Services Market - Growth & Demand 2025 to 2035

Large Diameter Steel Pipes Market Growth - Trends & Forecast 2025 to 2035

Large Format Display Market Report – Growth & Trends through 2034

Large Character Printers Market

Large Breed Dog Food Market

Large Scale Bearing Market Size and Share Forecast Outlook 2025 to 2035

Large Scale Natural Refrigerant Heat Pump Market Growth – Trends & Forecast (2024-2034)

Large Scale Variable Frequency Drives Market Size and Share Forecast Outlook 2025 to 2035

Built-in Large Cooking Appliance Market Insights – Growth & Forecast 2025 to 2035

Anaplastic Large Cell Lymphoma (ALCL) Therapeutics Market Size and Share Forecast Outlook 2025 to 2035

Freestanding Large Cooking Appliance Market Trends - Growth & Forecast 2025 to 2035

Descaler Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA